Bank Negara Indonesia Bundle

Can Bank Negara Indonesia Maintain Its Dominance in the Indonesian Banking Sector?

Bank Negara Indonesia (BNI), a pillar of the Indonesian financial system, is aggressively enhancing its digital banking platform, BNI Mobile Banking, signaling a pivotal shift in its growth strategy. This strategic move is crucial for BNI as it aims to capitalize on Indonesia's booming digital economy and cement its position in the competitive financial services landscape. Understanding BNI's future prospects requires a deep dive into its strategic initiatives and adaptation to evolving market dynamics.

From its inception as Indonesia's first state-owned bank, BNI has continuously evolved, adapting to the changing needs of its diverse clientele. To understand the intricacies of BNI's strategic approach, one can explore its strengths, weaknesses, opportunities, and threats through a comprehensive Bank Negara Indonesia SWOT Analysis. This article delves into BNI's expansion plans, digital transformation strategy, and long-term growth potential, offering insights into BNI's journey in the Indonesian banking sector and its future prospects.

How Is Bank Negara Indonesia Expanding Its Reach?

Bank Negara Indonesia (BNI) is actively pursuing a multi-pronged expansion strategy to bolster its market position and capitalize on growth opportunities. This involves a dual approach: strengthening its presence in the domestic market and strategically expanding its international footprint. The core of BNI's strategy focuses on sustainable growth and enhanced shareholder value.

Domestically, BNI is concentrating on deepening its engagement within key sectors, particularly retail and small and medium-sized enterprises (SMEs). This involves tailoring product offerings and improving digital accessibility to cater to the specific needs of these customer segments. The bank's commitment to digital transformation, including the continuous enhancement of its BNI Mobile Banking platform, is crucial for attracting new customers and increasing transaction volumes. This focus aligns with the broader trends in the Indonesian banking sector, where digital banking is rapidly gaining prominence.

Internationally, BNI is strategically expanding its global presence to support Indonesian businesses and individuals abroad, as well as to capitalize on opportunities in key economic corridors. This includes strengthening its presence in regions with significant Indonesian diaspora or strong trade ties, such as through its existing branches and representative offices in various global financial hubs. The bank's international expansion is driven by the need to diversify revenue streams and provide comprehensive banking solutions for cross-border transactions and investments. BNI has also been exploring partnerships with fintech companies and other financial institutions to broaden its service offerings and reach new customer bases, particularly in areas like remittances and trade finance.

BNI aims to deepen its presence in the retail and SME sectors. This is achieved through tailored product offerings and enhanced digital accessibility. The bank's digital transformation efforts, including BNI Mobile Banking, are key to reaching new customers. For example, BNI's Q1 2024 results showed a significant increase in digital transaction volumes, indicating the success of these initiatives.

BNI is expanding its global footprint to support Indonesian businesses and individuals abroad. This includes strengthening its presence in regions with significant Indonesian diaspora or strong trade ties. The expansion aims to diversify revenue streams and offer comprehensive banking solutions. Partnerships with fintech companies are also being explored to broaden service offerings.

Digital transformation is central to BNI's strategy, particularly through the continuous improvement of BNI Mobile Banking. This focus helps in reaching new customer segments and increasing transaction volumes. The bank is investing in technology to enhance user experience and expand its digital service offerings. This approach aligns with the growing trend of digital banking in Indonesia.

BNI is exploring partnerships with fintech companies and other financial institutions. These collaborations are aimed at broadening service offerings and reaching new customer bases. The focus is on areas like remittances and trade finance to enhance customer value. Strategic alliances are a key component of BNI's expansion strategy.

BNI's expansion strategy involves domestic market penetration and strategic international ventures. The focus is on retail and SME sectors, digital transformation, and global footprint enhancement. These initiatives are designed to drive sustainable growth and improve financial performance.

- Deepening presence in retail and SME sectors through tailored products.

- Continuous improvement of BNI Mobile Banking to boost digital transactions.

- Expanding international operations to support Indonesian businesses abroad.

- Exploring partnerships with fintech companies for broader service offerings.

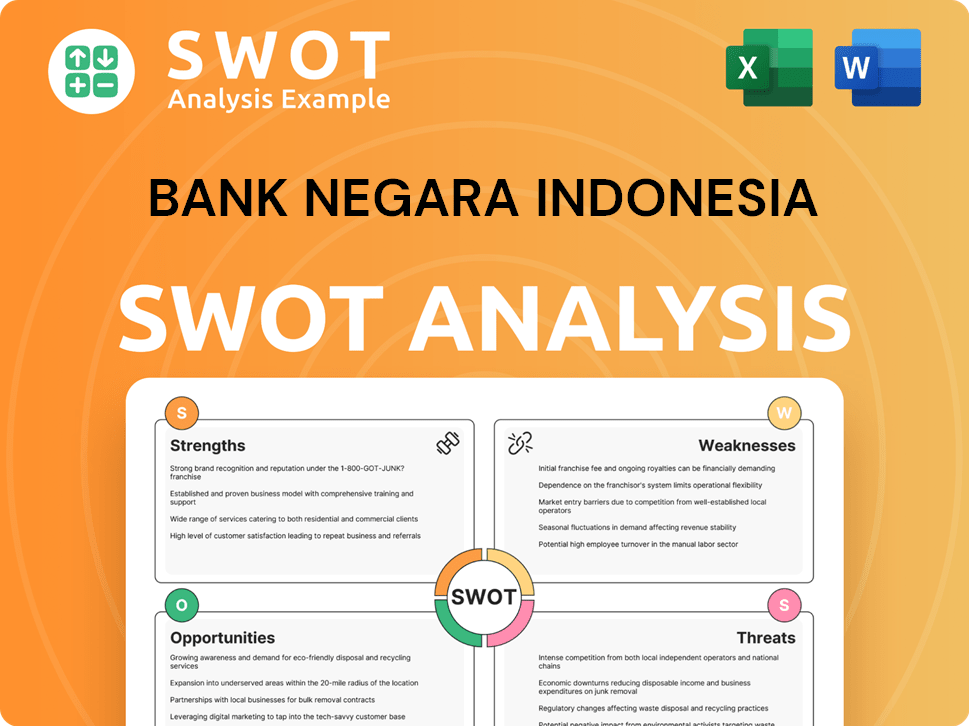

Bank Negara Indonesia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bank Negara Indonesia Invest in Innovation?

The growth trajectory of Bank Negara Indonesia (BNI) is significantly shaped by its innovation and technology strategies. The bank is strategically investing in research and development to enhance its digital platforms and introduce new customer-centric products. This approach is crucial for navigating the evolving landscape of Indonesian banking and financial services.

A core element of BNI's strategy involves a continuous digital transformation. This encompasses automating core banking processes, improving data analytics capabilities, and fortifying cybersecurity measures. The focus on digital channels, particularly BNI Mobile Banking, underscores this commitment, driving substantial increases in user engagement and transaction volumes.

BNI's proactive stance in adopting cutting-edge technologies, such as artificial intelligence (AI) and blockchain, further positions it at the forefront of financial innovation. These initiatives are designed to improve operational efficiency, reduce costs, and offer customers a seamless and secure banking experience, crucial for the future of banking in Indonesia.

BNI is actively automating core banking processes to enhance efficiency. Data analytics capabilities are being improved to gain deeper customer insights. Cybersecurity measures are constantly being upgraded to protect customer data.

The BNI Mobile Banking platform has been continuously upgraded. New features like QRIS payments and wealth management tools have been added. Enhanced user interfaces have improved the overall customer experience.

BNI is exploring AI for personalized banking experiences. AI is also being used for enhanced fraud detection. Blockchain technology is being considered for more secure cross-border transactions.

BNI actively participates in industry-wide digital initiatives. The bank is collaborating with fintech startups. These collaborations position BNI as a leader in the digital financial landscape.

BNI Mobile Banking recorded 767 million transactions in Q1 2024. This represents a 16.9% year-on-year increase. Transaction value reached Rp 1,224 trillion, up 17.1% year-on-year.

The bank aims to improve operational efficiency. It seeks to reduce costs through technological advancements. The ultimate goal is to deliver a seamless and secure banking experience.

BNI's strategic initiatives in 2024 focus on leveraging technology to drive growth and enhance customer experience. These initiatives are vital for BNI's long-term growth potential and its ability to compete in the dynamic Indonesian banking sector. For more insights, see the Marketing Strategy of Bank Negara Indonesia.

- Investment in AI for personalized banking and fraud detection.

- Exploration of blockchain for secure and efficient cross-border transactions.

- Continuous upgrades to BNI Mobile Banking with new features and improved user interfaces.

- Collaboration with fintech startups to foster innovation and expand service offerings.

- Focus on digital transformation to automate processes and improve data analytics.

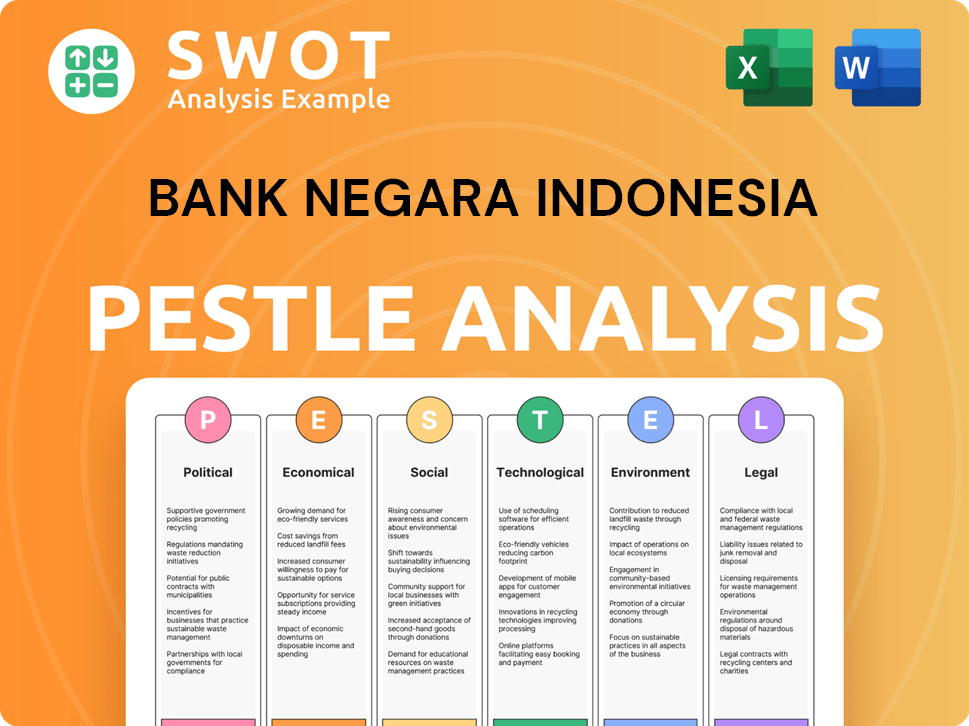

Bank Negara Indonesia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bank Negara Indonesia’s Growth Forecast?

The financial outlook for Bank Negara Indonesia (BNI) appears promising, supported by strategic initiatives and the resilience of the Indonesian economy. BNI is targeting significant revenue growth and profitability, aiming to capitalize on increased digital adoption and a recovering credit demand within the Indonesian banking sector. BNI's target market is key to understanding its financial trajectory.

In Q1 2024, BNI reported a consolidated net profit of Rp 5.33 trillion, reflecting a 2.7% year-on-year increase, which demonstrates stable financial performance. This positive trend indicates the effectiveness of BNI's corporate strategy and its ability to navigate the financial services landscape.

The bank's loan growth also shows a healthy trend, with consolidated loans reaching Rp 695.16 trillion, marking a 9.6% year-on-year increase. This growth is a key indicator of BNI's future prospects and its ability to expand its market share analysis within the Indonesian banking sector.

BNI is concentrating on high-yield segments such as consumer loans and small and medium-sized enterprises (SMEs). This strategic focus is expected to drive net interest income and contribute to overall BNI growth strategy.

The bank is actively managing its cost of funds and improving asset quality. These measures are crucial for maintaining healthy profit margins and ensuring sustainable banking practices.

Investment levels are projected to remain robust, particularly in technology infrastructure and digital product development. This investment supports BNI's digital transformation strategy and long-term growth potential.

BNI's capital adequacy ratio (CAR) stood at a strong 22.3% as of Q1 2024. This strong capital position indicates ample capacity for future expansion and risk absorption, supporting BNI's expansion plans.

Analyst forecasts generally align with BNI's positive outlook. Key drivers of future financial performance include the bank's strong capital position and its strategic shift towards digital services. The bank's focus on innovation in financial technology and its customer acquisition strategies are also expected to contribute to its long-term growth potential.

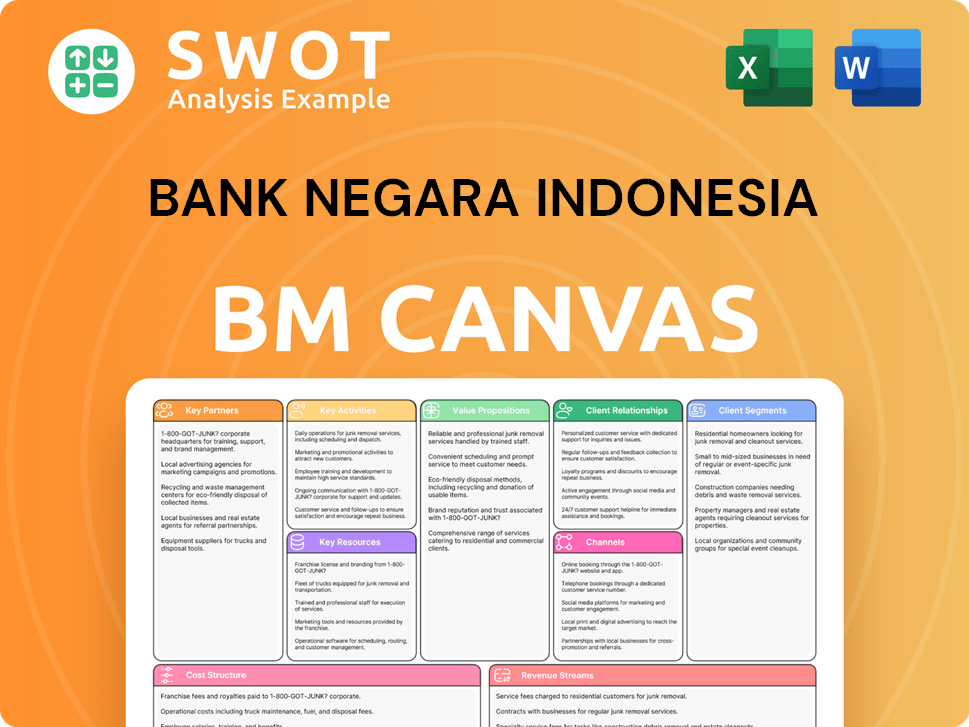

Bank Negara Indonesia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bank Negara Indonesia’s Growth?

Despite its promising outlook, Bank Negara Indonesia (BNI) faces several potential risks and obstacles that could impact its BNI growth strategy and BNI future prospects. These challenges range from intense market competition to the ever-evolving landscape of financial regulations and technological advancements. Understanding these risks is crucial for assessing BNI's long-term viability and investment potential within the Indonesian banking sector.

The competitive environment presents a significant hurdle. BNI competes not only with established traditional banks but also with a growing number of fintech companies. These fintech firms often offer innovative services and can quickly gain market share, especially among younger demographics. Furthermore, the global economic climate and domestic economic conditions, including inflation, can influence loan demand and asset quality, requiring BNI to adapt its strategies accordingly.

Regulatory changes, particularly those related to data privacy, digital banking, and financial technology, can also pose challenges. BNI must continuously adapt its operations and compliance frameworks to meet these evolving requirements. Cybersecurity threats represent a significant and evolving risk, necessitating continuous investment in robust security infrastructure and protocols. The rapid pace of technological disruption also requires BNI to stay agile and continuously innovate to avoid obsolescence.

Intense competition from both traditional banks and fintech companies could erode BNI's market share. Fintech firms are rapidly gaining traction by offering innovative financial solutions, potentially impacting BNI's customer base and profitability. This competitive pressure necessitates continuous innovation and strategic adaptation to maintain a strong market position.

Changes in regulations related to data privacy, digital banking, and financial technology pose challenges. BNI must invest in compliance and adapt its operations to meet new standards. These regulatory shifts can increase operational costs and require ongoing adjustments to maintain compliance and avoid penalties.

Global economic slowdowns or domestic inflationary pressures could impact loan demand and asset quality. Economic downturns can lead to increased loan defaults and reduced profitability. BNI must proactively manage its loan portfolio and risk exposure to mitigate these economic impacts.

Cybersecurity threats represent a significant and evolving risk. The increasing sophistication of cyberattacks requires continuous investment in robust security measures. Data breaches and cyberattacks can damage BNI's reputation, cause financial losses, and undermine customer trust.

The rapid pace of technological disruption requires BNI to stay agile and continuously innovate. Failure to adapt to new technologies could lead to obsolescence. BNI must invest in research and development and embrace digital transformation to remain competitive in the financial services sector.

Maintaining operational efficiency and managing costs are ongoing challenges. BNI must streamline its processes and optimize its resources. Effective cost management is crucial for maintaining profitability and competitiveness in the face of rising operational expenses.

To mitigate these risks, BNI employs a comprehensive risk management framework. This includes diversifying its loan portfolio to reduce exposure to specific sectors or borrowers. Robust credit risk assessment is essential for identifying and managing potential loan defaults. Proactive monitoring of market and regulatory developments allows BNI to anticipate and respond to changes effectively. Furthermore, BNI's strong capital base provides a buffer against unexpected shocks, ensuring financial stability. For further insights into BNI's financial structure, consider exploring the Revenue Streams & Business Model of Bank Negara Indonesia.

In recent financial reports, BNI has demonstrated resilience, even during past economic downturns. This resilience is a result of prudent lending practices and the strengthening of its digital channels to maintain customer engagement. BNI's ability to adapt and innovate is critical for its long-term growth. The bank's focus on digital transformation and customer-centric services has been key to navigating market challenges. For instance, BNI's digital banking initiatives have seen a significant increase in user engagement, reflecting the success of its customer acquisition strategies.

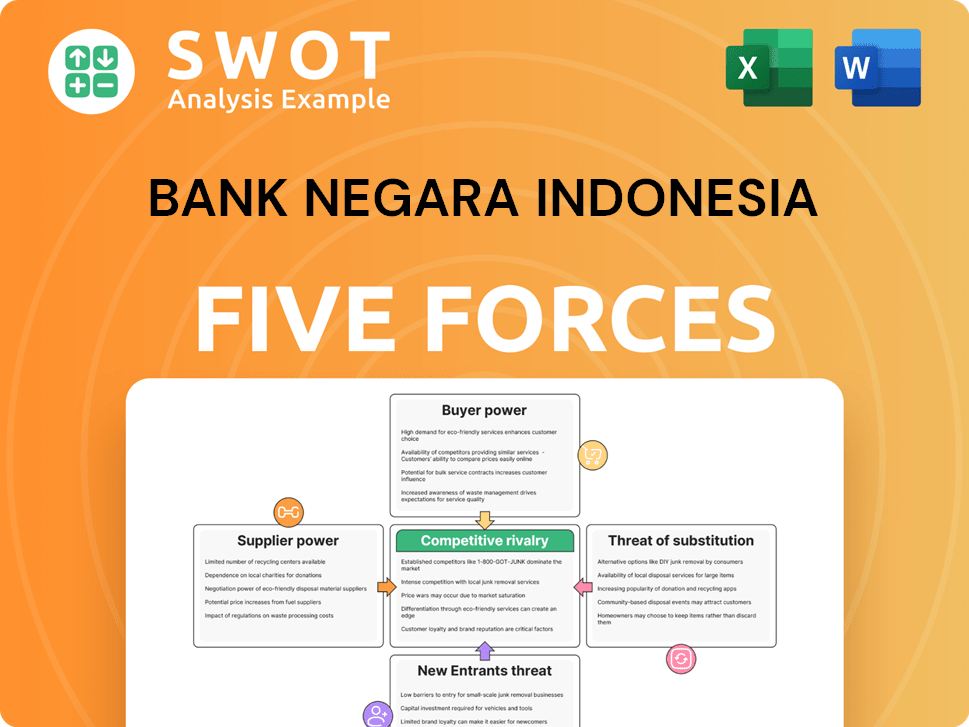

Bank Negara Indonesia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank Negara Indonesia Company?

- What is Competitive Landscape of Bank Negara Indonesia Company?

- How Does Bank Negara Indonesia Company Work?

- What is Sales and Marketing Strategy of Bank Negara Indonesia Company?

- What is Brief History of Bank Negara Indonesia Company?

- Who Owns Bank Negara Indonesia Company?

- What is Customer Demographics and Target Market of Bank Negara Indonesia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.