Bank Negara Indonesia Bundle

How is Bank Negara Indonesia Dominating the Indonesian Market?

Bank Negara Indonesia (BNI), a cornerstone of Indonesia's financial landscape, is undergoing a remarkable transformation. From its roots as a state-owned bank, BNI has evolved into a digital-first powerhouse, aggressively pursuing market share through innovative sales and marketing strategies. This article unveils the secrets behind BNI's success in a rapidly evolving financial ecosystem.

This deep dive explores BNI's Bank Negara Indonesia SWOT Analysis, examining how it leverages its extensive physical presence alongside cutting-edge digital solutions like 'wondr by BNI' and 'BNIdirect'. We'll analyze the BNI marketing strategy, including its customer acquisition tactics and brand awareness campaigns, and how it navigates the competitive Indonesian market. Understanding BNI's strategic approach provides valuable insights for financial professionals and business strategists alike, offering a clear view of BNI's sales strategy and its impact on the BNI financial services sector.

How Does Bank Negara Indonesia Reach Its Customers?

The sales strategy of Bank Negara Indonesia (BNI) leverages a multi-channel approach, integrating both traditional and digital platforms to reach a diverse customer base. BNI's strategy focuses on providing seamless customer experiences across various touchpoints, from physical branches to digital applications. This comprehensive approach supports BNI's customer acquisition efforts and enhances its market share in the competitive Indonesian financial services landscape.

BNI's marketing strategy emphasizes digital transformation, strategic partnerships, and direct sales to enhance its market presence. The bank's commitment to technological advancements and customer-centric solutions underpins its sales and marketing initiatives. By focusing on innovation and collaboration, BNI aims to strengthen its position in the financial sector and drive sustainable growth.

BNI's approach to sales channels is a key component of its overall strategy, designed to meet the evolving needs of its customers. The bank's ability to adapt and innovate in its sales and marketing efforts is critical to its continued success. For more insights, see the Growth Strategy of Bank Negara Indonesia.

BNI maintains a substantial network of physical branch locations and ATMs, which remain a crucial sales channel, especially for customers preferring in-person interactions. BNI's branches provide essential services and support complex financial advisory needs. The bank's ongoing transformation of its branch office network across Indonesia further supports this channel.

Digital transformation is a significant driver of BNI's sales channels. 'wondr by BNI,' launched in July 2024, had 6.8 million users by March 2025, facilitating 218 million transactions valued at IDR 212 trillion. 'BNIdirect,' the integrated corporate portal, processed transactions worth Rp 7,931 trillion in 2024, a 23.3% year-on-year increase, with transaction volume up 36.5% year-on-year. BNIdirect users reached 173,000 by the end of 2024, a 15% year-on-year increase.

BNI utilizes direct sales teams to engage with corporate and institutional clients. This approach allows for personalized service and tailored financial solutions. The direct sales teams focus on building strong customer relationships and driving sales growth.

BNI expands its reach through strategic collaborations and distribution deals. Partnerships include Indoglobal Nusa Persada (Pintro), Teknologi Kartu Indonesia (TKI), and Rizki Tujuhbelas Kelola (R17) for the Campus Financial Ecosystem (CFEST). Other partnerships are with Jasa Medika Transmedic (Jasamedika Transmedic) and Jejaring Tiga Artha (ZiCare) for Smart Healthcare, and Krakatau Information Technology (KIT) and Realta Chakra Dharma (Realta) for Smart Tenant ecosystems.

In November 2024, BNI partnered with fintech lending platform Batumbu, providing a loan channeling facility of IDR 1.2 trillion to enhance financing access for Micro, Small, and Medium Enterprises (MSMEs) using a supply chain financing model. These strategic alliances and digital adoption efforts have significantly contributed to BNI's growth and market share.

- BNI's credit growth in 2024 outpaced the banking sector's average, reaching 11.62% year-on-year for total loans disbursed compared to the industry average of 10.39%.

- The bank's multi-channel strategy includes physical branches, ATMs, digital platforms like 'wondr by BNI' and 'BNIdirect', direct sales teams, and strategic partnerships.

- These channels are designed to improve BNI's customer acquisition, customer relationship management, and overall market share.

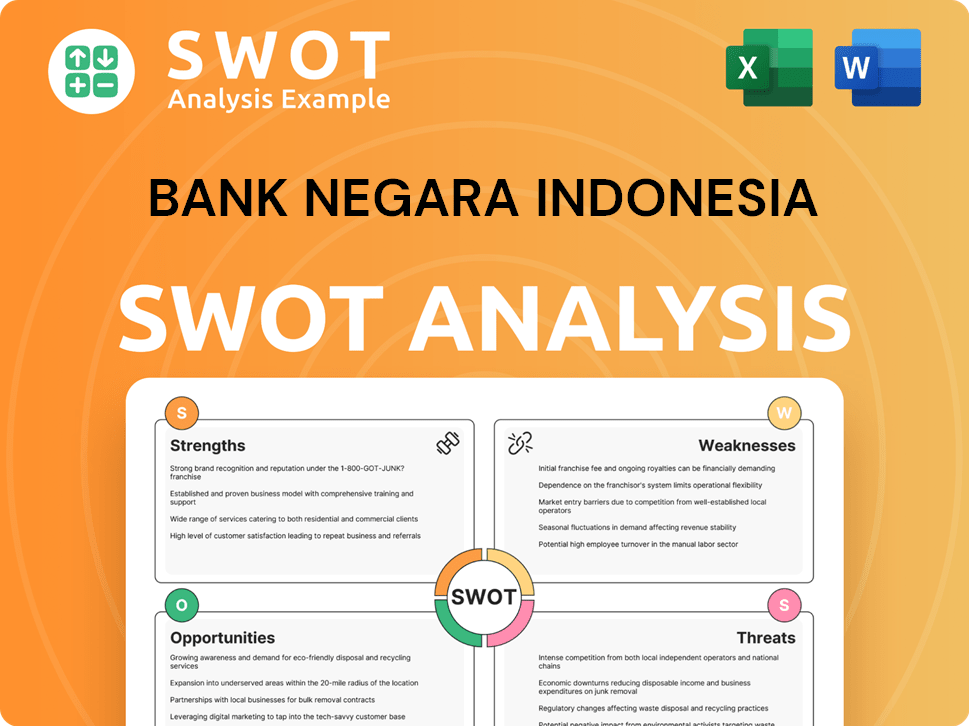

Bank Negara Indonesia SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Bank Negara Indonesia Use?

The sales and marketing strategy of Bank Negara Indonesia (BNI) is a comprehensive approach that blends digital and traditional marketing tactics. This strategy aims to boost brand awareness, generate leads, and increase sales across its various financial services. BNI's focus on customer segmentation and data-driven insights is central to its marketing efforts.

BNI's marketing tactics leverage both digital and traditional channels to reach a broad audience. Digital initiatives, such as the launch of 'wondr by BNI' and 'BNIdirect,' are key components of its digital marketing strategy. Traditional media, including TV, radio, and print, are also utilized for broader brand-building campaigns.

The bank's approach to customer acquisition and retention is heavily influenced by data analytics and technological advancements. BNI's strategic partnerships and investments in digital platforms reflect its commitment to innovation and enhancing customer experience.

BNI's digital marketing strategy includes content marketing, SEO, paid advertising, email marketing, and social media. The bank uses platforms like 'wondr by BNI' and 'BNIdirect' to streamline processes.

BNI leverages AI for conversational banking, hyper-personalization, and fraud detection. The Digital Contact Center Application, launched in October 2024, uses AI and NLP for faster customer interactions.

Traditional media, such as TV, radio, and print, are used for brand-building campaigns and public announcements. Events like BNI EXPO 2024 are also significant marketing tactics.

BNI segments its customers, with 'wondr by BNI' for retail and 'BNIdirect' for wholesale and international banking. This allows for tailored marketing efforts.

BNI uses data to understand user behavior and optimize platforms. For example, only 17% of BNIDirect users were active between December 2023 and May 2024, informing platform improvements.

BNI collaborates with fintech companies to expand financial access for MSMEs. BNI Ventures, a subsidiary, supports innovation within the financial services industry.

BNI's marketing strategy is designed to enhance its market share and improve customer relationship management. This involves a blend of digital and traditional methods, with a strong emphasis on data analytics and customer-centric approaches. The bank's focus on innovation and strategic partnerships is crucial for its long-term growth.

- Digital Marketing: Content marketing, SEO, paid advertising, email marketing, and social media are key.

- AI Integration: Utilizes AI for conversational banking, personalization, and fraud detection.

- Traditional Media: TV, radio, and print are used for brand building.

- Events: BNI EXPO 2024 promoted the 'wondr by BNI' application.

- Customer Segmentation: Tailored platforms like 'wondr by BNI' and 'BNIdirect' cater to different customer segments.

- Data Analytics: Uses data to understand user behavior and optimize platforms.

- Strategic Partnerships: Collaborates with fintech companies and fosters innovation through BNI Ventures.

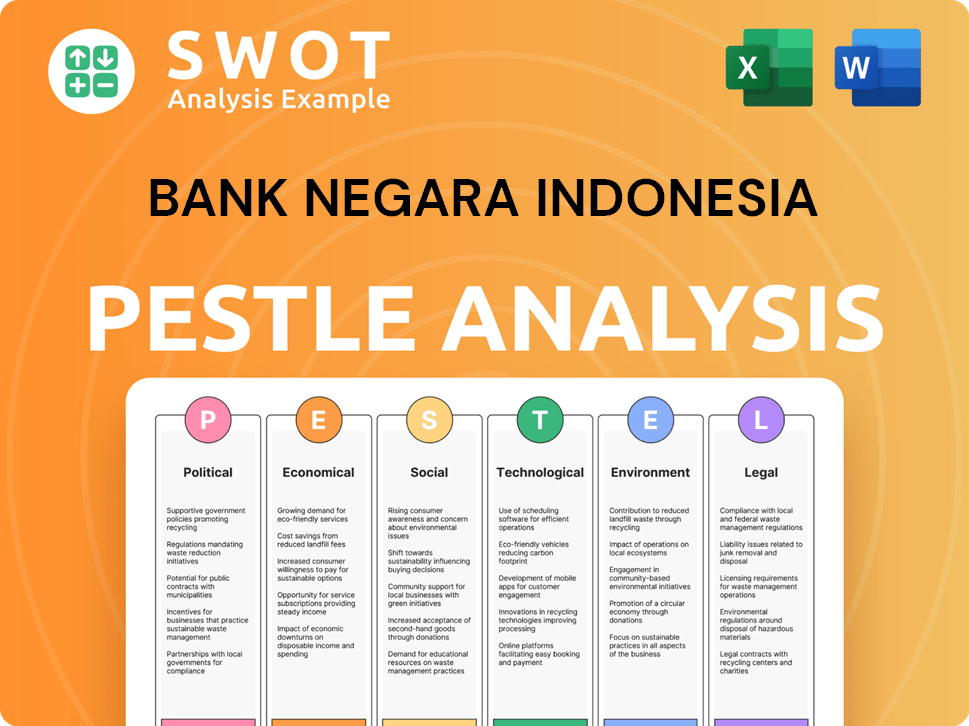

Bank Negara Indonesia PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Bank Negara Indonesia Positioned in the Market?

Bank Negara Indonesia (BNI) positions itself as a leading state-owned commercial bank, emphasizing continuous digital transformation to serve a broad customer base. Its core message focuses on providing comprehensive BNI financial services, with a growing emphasis on digital convenience and innovation. This approach is central to the BNI strategy, aiming to be a 'transaction bank of choice'.

The bank differentiates itself through digital innovation, customer-centricity, and its role as an 'Agent of Development,' supporting Indonesia's economic growth, particularly through empowering MSMEs. BNI's visual identity and tone of voice reflect a modern, reliable, and accessible financial partner. This is key to the BNI marketing strategy, ensuring it appeals to its target audience.

BNI's commitment to sustainability is evident in its sustainable finance initiatives and its target of achieving Net Zero Emission (NZE) for operational activities by 2028 and for financing by 2060. This commitment to ESG principles strengthens its brand appeal. By the end of 2024, BNI's total sustainable financing reached IDR 190.5 trillion, with a target to grow to IDR 199.67 trillion by the end of 2025, showcasing its dedication to responsible banking practices.

BNI emphasizes digital innovation to enhance customer experience and operational efficiency. This includes the development of digital platforms such as 'wondr by BNI' and 'BNIdirect', catering to retail and corporate clients, respectively. This focus is crucial for the Bank Negara Indonesia sales strategy.

The bank prioritizes customer needs by continuously improving its digital platforms based on feedback and market trends. This customer-centric approach aims to improve customer satisfaction and loyalty, a key component of BNI customer acquisition.

BNI integrates sustainability principles into its operations and financing activities. This includes sustainable finance initiatives and targets for achieving Net Zero Emission (NZE), aligning with ESG principles. This commitment enhances BNI's brand appeal to environmentally and socially conscious customers.

As a state-owned bank, BNI leverages its established trust and reliability to attract and retain customers. This strong foundation is complemented by a forward-looking approach driven by technology and innovation. For more information about BNI, you can read about the Owners & Shareholders of Bank Negara Indonesia.

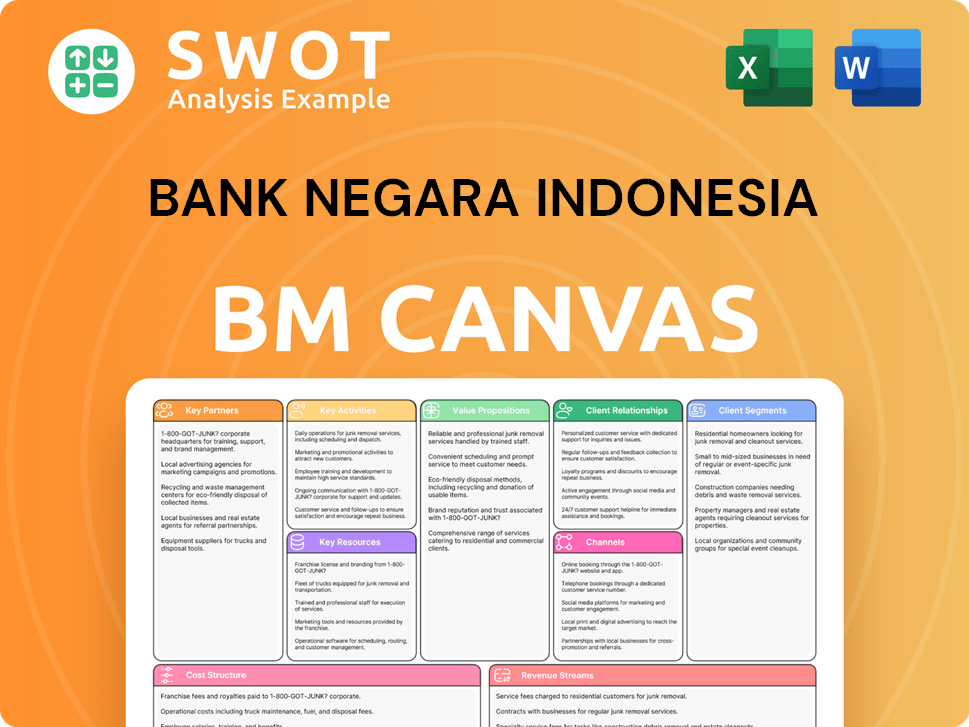

Bank Negara Indonesia Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Bank Negara Indonesia’s Most Notable Campaigns?

The sales and marketing strategy of Bank Negara Indonesia (BNI) is significantly shaped by key campaigns focused on digital transformation, ecosystem development, and sustainable finance. These campaigns aim to enhance BNI's market share and customer acquisition by leveraging digital platforms and strategic partnerships. The bank's approach is data-driven, using customer insights to tailor its product promotion strategies and improve customer relationship management.

BNI's strategy involves continuous innovation in its financial services, targeting various segments, including SMEs, through digital channels and strategic partnerships. This approach is supported by robust marketing budgets and sales performance analysis to ensure effectiveness. The bank's efforts also focus on building brand awareness through targeted campaigns and social media marketing, along with customer retention strategies designed to foster long-term relationships. For a more in-depth look at the bank's origins, you can explore the Brief History of Bank Negara Indonesia.

These initiatives collectively address the sales and marketing challenges BNI faces in a competitive market while driving growth and reinforcing its position as a leading financial institution.

Launched on July 5, 2024, 'wondr by BNI' is a 'super apps' experience designed to offer financial services across three dimensions: Insight, Transaction, and Growth. Digital marketing, in-app promotions, and events like BNI EXPO 2024 were key channels. By the end of December 2024, users reached 5.3 million, and transactions reached IDR 191 trillion with 195 million transactions.

Positioned as a one-stop transactional platform for multi-segment customers, 'BNIdirect' focuses on cash management solutions. Marketing efforts emphasize its single sign-on functionality and integrated services. By the end of 2024, the value of transactions increased 23.3% year-on-year to IDR 7,931 trillion, with a 36.5% increase in the number of transactions to 1.2 billion.

BNI expanded its end-to-end banking services through CFEST, Smart Healthcare, and Smart Tenant. Collaborations with partners like Indoglobal Nusa Persada (Pintro) and Teknologi Kartu Indonesia (TKI) in December 2024 boosted brand visibility. These campaigns aim to enhance BNI's BNI customer acquisition and market share by integrating banking services into various ecosystems.

BNI's commitment to ESG principles included channeling IDR 190.5 trillion in sustainable financing by the end of 2024. The collaboration with fintech lending platform Batumbu in November 2024 provided a IDR 1.2 trillion loan facility for MSMEs. This campaign positions BNI as a responsible financial institution.

These campaigns have significantly influenced BNI's sales strategy, driving digital transformation and expanding its reach. BNI's marketing plan focuses on enhancing customer experience and providing comprehensive financial solutions. The bank's approach to BNI customer relationship management strategy is data-driven, improving customer retention strategies.

- Digital Transformation: The 'wondr by BNI' and 'BNIdirect' campaigns have increased digital platform adoption, boosting transactional Current Account Saving Account (CASA).

- Ecosystem Development: Partnerships and ecosystem solutions expand BNI's service offerings, enhancing customer acquisition.

- Sustainable Finance: Initiatives like the 'Go-Green Movement' and MSME financing support ESG goals and position BNI as a responsible financial institution.

- Market Share: Through strategic partnerships and targeted campaigns, BNI aims to increase its market share and strengthen its competitive position in Indonesia.

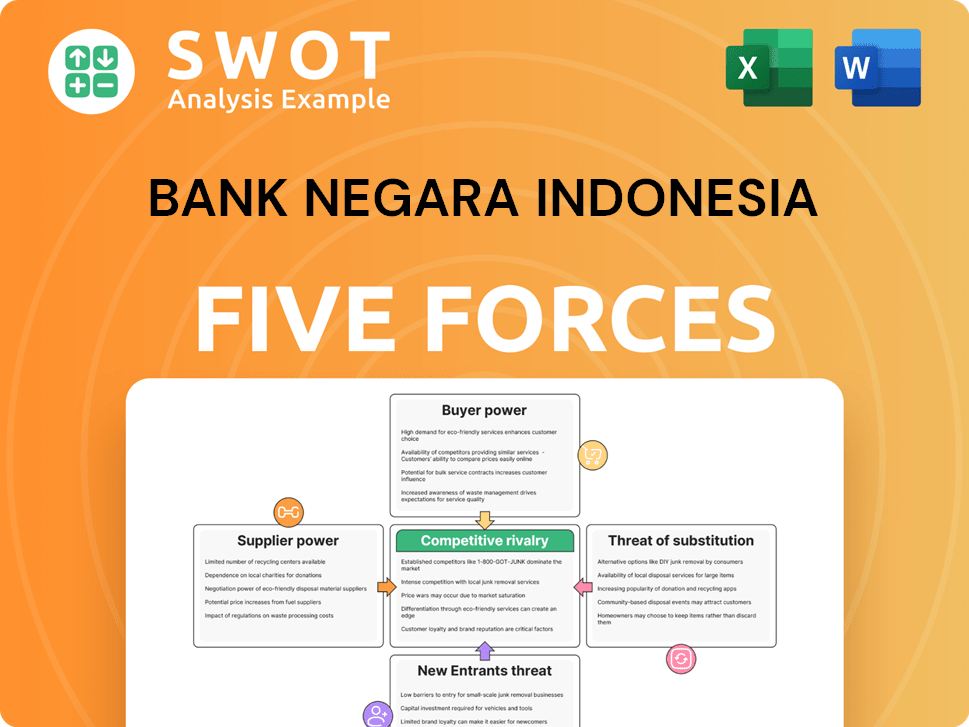

Bank Negara Indonesia Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bank Negara Indonesia Company?

- What is Competitive Landscape of Bank Negara Indonesia Company?

- What is Growth Strategy and Future Prospects of Bank Negara Indonesia Company?

- How Does Bank Negara Indonesia Company Work?

- What is Brief History of Bank Negara Indonesia Company?

- Who Owns Bank Negara Indonesia Company?

- What is Customer Demographics and Target Market of Bank Negara Indonesia Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.