BurgerFi Bundle

Can BurgerFi Rebound? A Look at Its Future.

BurgerFi, a fast-casual burger chain, has faced significant challenges, including a Chapter 11 bankruptcy. This BurgerFi SWOT Analysis will help us understand the company's position. With a focus on quality ingredients and sustainable practices, BurgerFi aims to offer a 'better burger' experience. But can it overcome recent setbacks and achieve sustainable growth?

This analysis delves into BurgerFi's BurgerFi growth strategy and BurgerFi future prospects, examining its BurgerFi company analysis in detail. We'll explore its expansion plans, potential for BurgerFi market share gains, and the factors influencing its financial performance. Understanding these elements is crucial for assessing BurgerFi investment potential and its ability to compete in the fast-casual dining landscape, especially considering the impact of inflation and evolving consumer preferences.

How Is BurgerFi Expanding Its Reach?

The BurgerFi growth strategy in 2024 and 2025 has been marked by a dual approach: strategic expansion and operational refinement. The company has actively pursued new restaurant openings while simultaneously streamlining its existing portfolio. This strategy is designed to enhance BurgerFi market share and improve overall financial performance.

A key aspect of BurgerFi's expansion plans involves exploring non-traditional locations and co-branded units. These initiatives aim to increase customer reach and diversify revenue streams. Despite these efforts, the company has also focused on closing underperforming locations to improve profitability and cash flow.

BurgerFi company analysis reveals a focus on adapting to changing consumer preferences, including the relaunch of 'The Chicken Wars' as ChickenFi. This move aims to capture a larger share of the fast-casual market by expanding its chicken offerings.

BurgerFi has been opening new locations, including a franchised unit and a corporate-owned flagship restaurant in New York City in Q1 2024. They are also exploring non-traditional spaces, such as the licensing agreement with Apple Cinemas in Rochester, New York, which opened in December 2023. This involves in-theater service via QR codes.

The company has opened its first co-branded BurgerFi and Anthony's location. To adapt to changing consumer trends, BurgerFi relaunched 'The Chicken Wars' in May 2024 as ChickenFi, expanding its chicken offerings by 50%. This diversification aims to capture a larger share of the fast-casual market.

BurgerFi has been actively refining its restaurant portfolio. This includes closing underperforming locations throughout 2023 and 2024. The goal is to focus on cash flow and profitability. The company planned to open between 10-15 new restaurants in fiscal year 2024, with 9-14 being franchised locations.

These strategic decisions are crucial for the BurgerFi future prospects. The company's ability to adapt to market changes, optimize its operations, and expand strategically will significantly influence its long-term success. For more details on the business model, see Revenue Streams & Business Model of BurgerFi.

BurgerFi's expansion strategy in 2024 and 2025 includes several key initiatives aimed at driving growth and improving profitability. These initiatives focus on strategic location choices, menu diversification, and operational efficiency.

- Opening new franchised and corporate-owned locations.

- Exploring non-traditional locations like cinemas.

- Launching co-branded units to expand market reach.

- Rebranding and expanding menu offerings, such as the ChickenFi initiative.

- Refining the restaurant portfolio by closing underperforming locations.

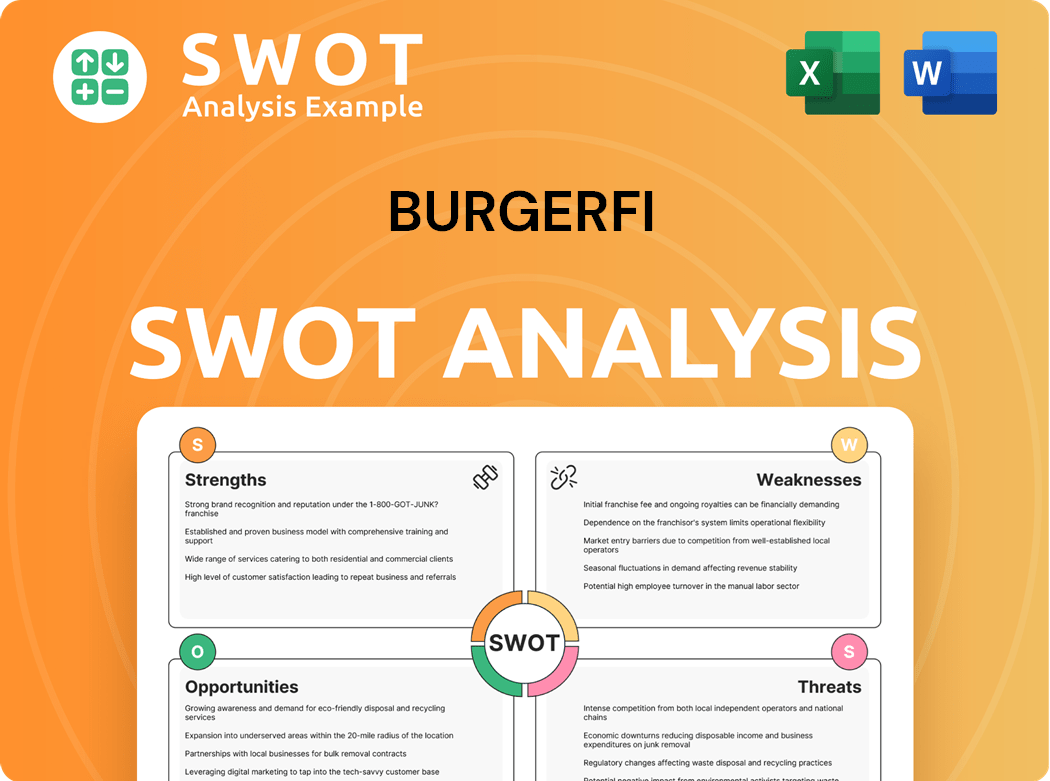

BurgerFi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BurgerFi Invest in Innovation?

In 2024, the company has been actively leveraging technology and innovation to drive growth and enhance operational efficiency. This focus includes digital transformation and infrastructure improvements, aiming to streamline operations and improve the customer experience. The company is also exploring new technologies to optimize kitchen operations and reduce employee turnover, indicating a forward-looking approach to technological adoption within the restaurant industry.

The company's strategy involves integrating technology to improve both the customer experience and internal operations. This includes rolling out new inventory control systems and point-of-sale (POS) platforms. Furthermore, the introduction of innovative features like the Heinz Remix Machine and the 'Better Burger Lab' demonstrates a commitment to staying ahead of consumer trends and providing unique dining experiences.

The company's approach to innovation is multifaceted, encompassing digital transformation, customer experience enhancements, and operational efficiency improvements. By focusing on technology and menu innovations, the company aims to strengthen its market position and adapt to changing consumer preferences. This strategic focus is crucial for the company's future prospects and overall growth.

The company is implementing new inventory control systems for both its own brand and Anthony's Coal Fired Pizza & Wings. The rollout of the Toast POS system at Anthony's is expected to streamline operations. These initiatives are designed to improve efficiency and support recovery from sales slumps.

The company became the first adopter of the Heinz Remix Machine in April 2024, offering customized condiment options. The introduction of the 'Better Burger Lab' in New York City serves as an innovation hub for limited-edition menu items. These innovations aim to enhance the customer experience and drive traffic.

The launch of jumbo chicken wings as a permanent menu item in late 2023 aimed to increase the chicken sales mix. The goal was to reach a chicken sales mix of 10-15 percent. Menu enhancements are a key part of the company's strategy to attract customers.

The collaboration with MERGE in 2024 focused on accelerating digital transformation and boosting brand awareness. This partnership aims to increase traffic and sales. Digital marketing is a key component of the company's growth strategy.

The company is exploring the use of AI and robotics to optimize kitchen operations. This includes efforts to reduce employee turnover. This forward-looking approach highlights the company's commitment to innovation.

These technological and menu innovations provide the company with competitive advantages. By enhancing the customer experience and streamlining operations, the company aims to improve its market share. The company's focus on innovation is crucial for its long-term success.

The company's innovation strategy encompasses digital transformation, customer experience enhancements, and operational efficiency improvements. By focusing on technology and menu innovations, the company aims to strengthen its market position and adapt to changing consumer preferences. The company's commitment to innovation is evident in its adoption of new technologies and menu items.

- Digital transformation through new POS systems and inventory controls.

- Customer experience enhancements with the Heinz Remix Machine and the 'Better Burger Lab'.

- Menu innovations, such as jumbo chicken wings, to increase sales mix.

- Collaboration with MERGE to boost digital marketing and brand awareness.

- Exploration of AI and robotics for kitchen optimization and reduced turnover.

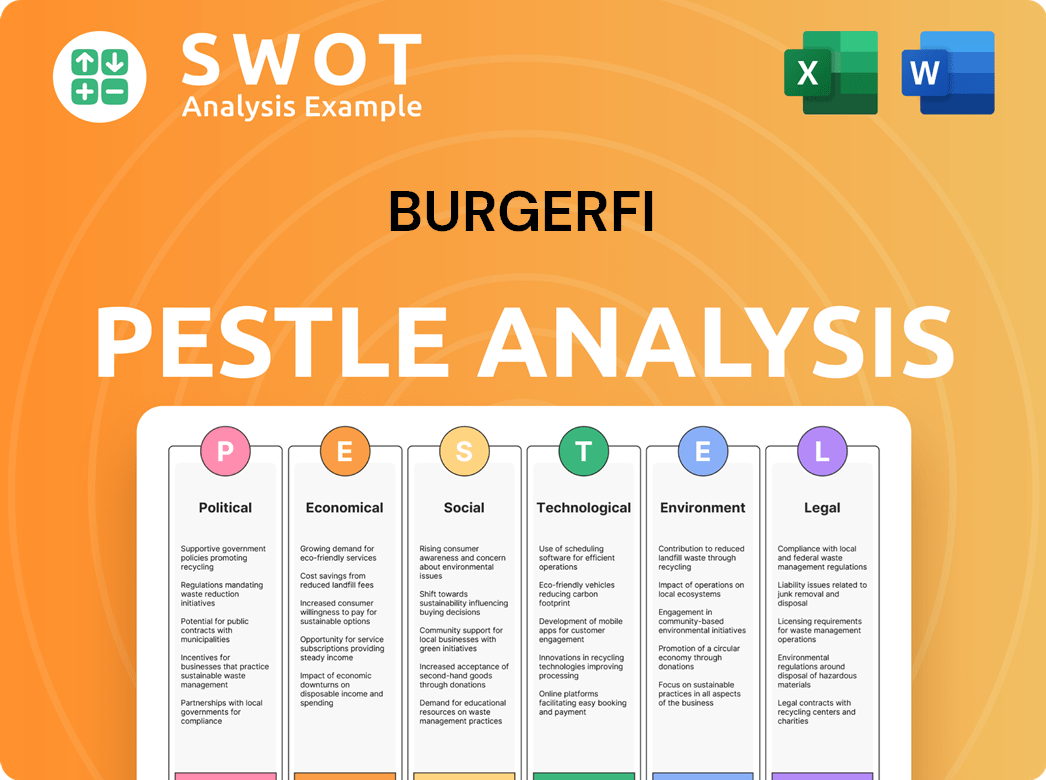

BurgerFi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BurgerFi’s Growth Forecast?

The financial outlook for the company in 2024 presented a mix of challenges and cautious optimism. Despite facing headwinds, the management maintained its revenue projections for the year, aiming for between $170 million and $180 million. This forecast aligns with the company's recent revenue performance, which saw $170.1 million in 2023, a slight decrease from $178.7 million in 2022. The company also anticipated modest same-store sales growth for its corporate-owned locations.

However, the early part of 2024 proved difficult, with a 6% decrease in total revenue to $42.9 million in the first quarter compared to the prior year. Systemwide sales also declined, and same-store sales for the company experienced a significant decrease. The company reported a net loss of $6.5 million in the first quarter of 2024, an improvement compared to the previous year's net loss. Adjusted EBITDA was $0.3 million, down from $2.6 million in the prior period.

The company's financial stability was further strained by a default on its credit agreement due to non-compliance with a minimum liquidity requirement. This led to the filing for Chapter 11 bankruptcy on September 11, 2024. The company's assets were later acquired by TREW Capital Management in November 2024, with the sale of its assets closing on November 27, 2024. For more insights into the company's approach, you can read about the Marketing Strategy of BurgerFi.

The company's market share has been impacted by the recent financial struggles and bankruptcy filing. The competitive landscape includes major players like McDonald's and Five Guys. The company's ability to regain market share will depend on its restructuring efforts and expansion plans.

The company's expansion plans are likely to be reassessed following the bankruptcy and acquisition. Franchise opportunities near me may be affected by the restructuring. Future expansion will likely focus on sustainable growth and adapting to changing consumer trends.

The financial performance in 2024 has been challenging, with declining revenues and systemwide sales in the first quarter. The impact of inflation on profitability is a key concern. The company's success will depend on its ability to improve same store sales growth.

The stock price forecast is uncertain due to the recent bankruptcy and acquisition. Investors should assess the company's restructuring plan and future prospects. The investment potential will depend on the successful execution of the new strategy.

The company's competitive advantages include its focus on high-quality ingredients and a commitment to sustainability. The company's new menu items 2024 may help to attract customers. These factors could help it to differentiate itself from competitors like Five Guys.

A SWOT analysis reveals the company's strengths, weaknesses, opportunities, and threats. Strengths may include brand recognition and customer loyalty. Weaknesses include financial instability and high debt. Opportunities include expanding its franchise network. Threats include increased competition and economic downturns.

The company's revenue growth over the last five years has been inconsistent, with recent declines. The company reported $178.7 million in fiscal year 2022 and $170.1 million in fiscal year 2023. The focus is now on stabilizing and growing revenue.

The company's international expansion strategy may be reviewed as part of the restructuring process. The focus will likely be on identifying key markets and establishing strategic partnerships. The company may consider adapting its menu to local tastes.

The company's sustainability initiatives include sourcing sustainable ingredients and reducing waste. The company is committed to environmental responsibility. These initiatives align with changing consumer preferences.

The company's digital marketing strategy includes online ordering, loyalty programs, and social media engagement. The goal is to enhance customer experience and drive sales. The company may use data analytics to optimize its marketing efforts.

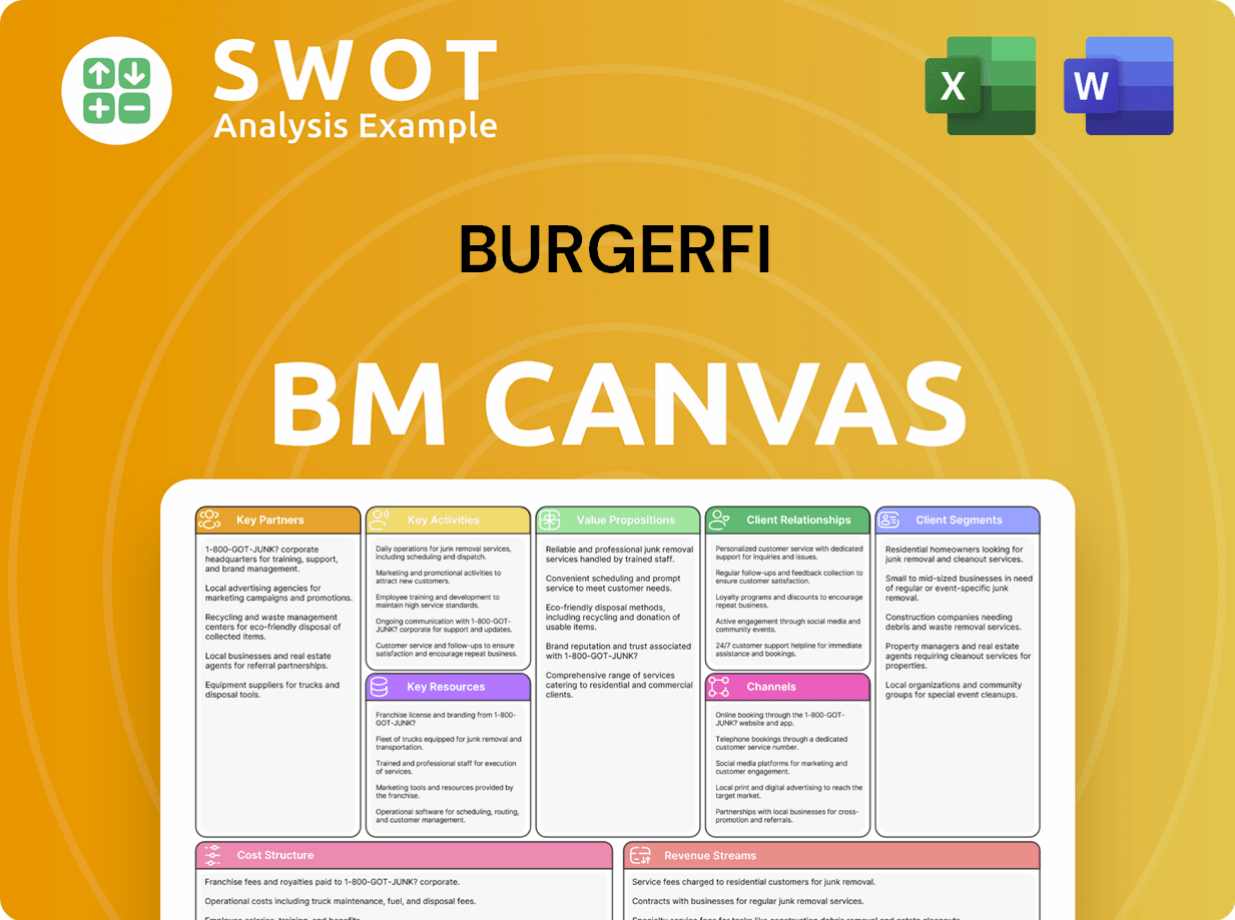

BurgerFi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BurgerFi’s Growth?

The path for the company, including its growth strategy, has been fraught with significant risks and obstacles. The fast-casual dining sector is highly competitive, forcing it to compete with numerous alternatives, which impacts its pricing strategies and overall profitability. This landscape presents persistent challenges to the company's expansion plans and market share.

Financial distress has been a major hurdle. The company's Chapter 11 bankruptcy filing on September 11, 2024, and the subsequent acquisition of its assets in November 2024 by TREW Capital Management underscore the severity of these issues. This financial strain is a critical factor affecting the company's future prospects.

Regulatory compliance and operational inefficiencies also pose risks. Deficiency notices from Nasdaq in August 2024, due to delayed filings and board committee non-compliance, highlight potential delisting threats. Addressing these issues is crucial for its long-term viability. The company analysis reveals the need for strategic adjustments.

The fast-casual dining sector is crowded, with numerous competitors vying for market share. This intense competition impacts pricing strategies and profit margins. The company must continuously innovate and differentiate itself to succeed.

The Chapter 11 bankruptcy filing in September 2024 and subsequent acquisition by TREW Capital Management highlight significant financial challenges. The company's ability to recover and grow depends on successful restructuring efforts and securing additional financing. Read more about the Owners & Shareholders of BurgerFi.

Deficiency notices from Nasdaq due to delayed filings and board compliance issues pose delisting risks. Maintaining compliance with regulatory requirements is essential for its future prospects. Failure to meet these requirements could severely impact its ability to raise capital and operate.

Supply chain vulnerabilities, rising food and labor costs, and the need for operational improvements strain operations. Implementing new inventory control systems, a new point-of-sale platform, and enhanced employee training are critical. These improvements are essential for improving efficiency and reducing turnover.

The impact of inflation on profitability is a significant concern. Rising costs for food and labor can squeeze profit margins. The company needs to effectively manage costs and adjust pricing strategies to mitigate these effects. This is one of the critical factors in the company analysis.

Exploring strategic alternatives, such as additional financing or asset sales, requires careful execution. The success of these strategies will significantly impact the company's future prospects. The ability to adapt to changing consumer trends is also crucial.

The company faced significant financial challenges, as indicated by its Q1 2024 results. Systemwide sales decreased by 17%, and same-store sales declined by 13%. The company reported a net loss of $6.5 million in Q1 2024 and an estimated net loss of $18.4 million for Q2 2024. These figures highlight the pressing need for strategic improvements.

Since May 2024, the company has been exploring strategic alternatives to address its financial difficulties. Management has focused on operational improvements, including new inventory control systems and a new point-of-sale platform. Employee training has also been enhanced to improve efficiency and reduce turnover. These efforts are crucial for improving the company's competitive advantages.

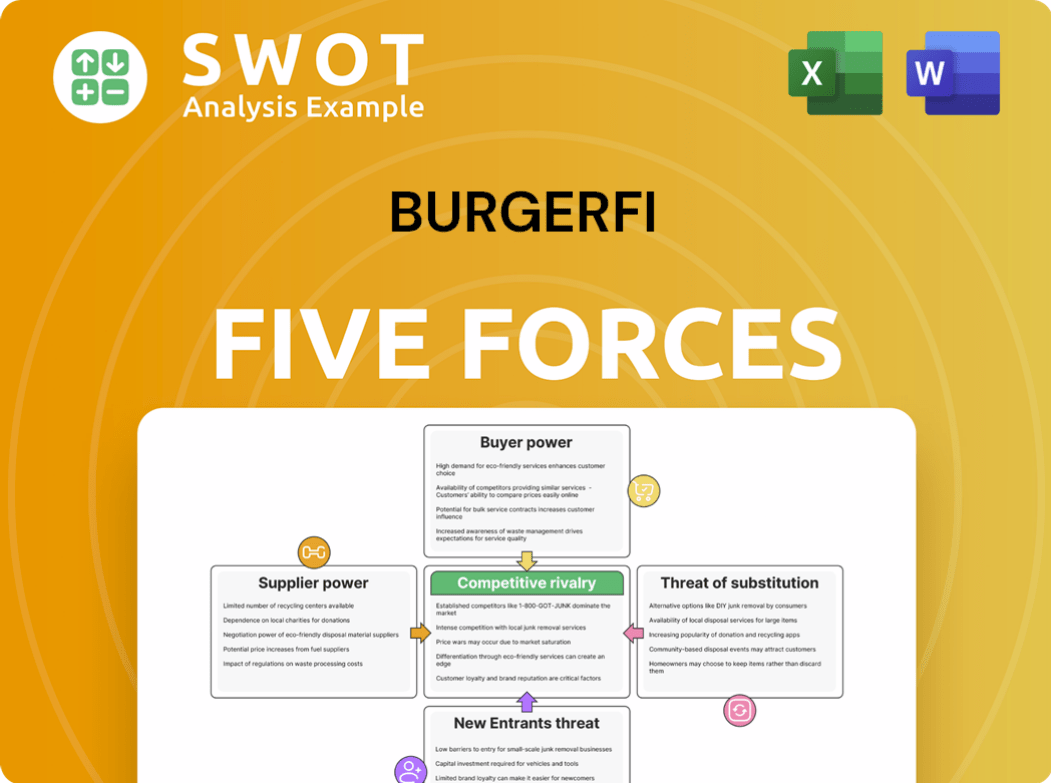

BurgerFi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BurgerFi Company?

- What is Competitive Landscape of BurgerFi Company?

- How Does BurgerFi Company Work?

- What is Sales and Marketing Strategy of BurgerFi Company?

- What is Brief History of BurgerFi Company?

- Who Owns BurgerFi Company?

- What is Customer Demographics and Target Market of BurgerFi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.