BurgerFi Bundle

How Does the BurgerFi Company Thrive in the Fast-Casual Arena?

BurgerFi International Inc. has established itself as a significant player in the competitive fast-casual dining sector, distinguishing itself with a commitment to high-quality, sustainably sourced ingredients and a modern, eco-friendly restaurant concept. Operating and franchising numerous BurgerFi SWOT Analysis locations across the United States, the company's focus on premium burgers, fries, hot dogs, and frozen custard, all prepared with natural ingredients, makes it a compelling alternative to traditional fast-food chains.

Understanding the BurgerFi business model is essential for anyone looking to understand the restaurant chain's operations. From investors seeking to gauge its financial health to customers curious about the value proposition, the inner workings of BurgerFi, including its menu, franchise, and locations, offer a wealth of insight. This exploration will delve into how BurgerFi makes money, its sustainability practices, and its expansion strategy, providing a comprehensive overview of the company's success.

What Are the Key Operations Driving BurgerFi’s Success?

The core of the BurgerFi company's operations centers on delivering a 'better burger' experience. This involves a focus on fresh, natural ingredients, and an eco-friendly approach. The company's value proposition is centered around providing a higher-quality fast-casual dining option compared to traditional fast-food establishments.

BurgerFi offers gourmet burgers made from 100% American Angus beef, along with natural-cut fries, hot dogs, and frozen custard. They cater to a customer base that seeks a more upscale and health-conscious experience. The company's operational strategy includes a streamlined kitchen process to ensure efficiency while maintaining product quality.

Sourcing plays a crucial role in BurgerFi's operations. They partner with suppliers committed to natural and sustainable practices, such as hormone-free and antibiotic-free beef. The business model combines company-owned and franchised restaurants, facilitating direct control over brand standards and accelerated expansion through franchisee investment. Logistics and distribution networks are designed for the timely delivery of fresh ingredients to all locations.

BurgerFi offers a 'better burger' experience, emphasizing fresh, natural ingredients. Their menu features gourmet burgers, natural-cut fries, and frozen custard. They aim to provide a higher-quality, health-conscious fast-casual dining option.

BurgerFi focuses on a streamlined kitchen process for efficiency and quality. Sourcing is critical, with an emphasis on natural and sustainable practices. They use a mix of company-owned and franchised restaurants for expansion.

The company uses 100% American Angus beef. They prioritize fresh, natural ingredients and sustainable sourcing. This commitment to quality differentiates them from competitors.

BurgerFi uses a combination of company-owned and franchised locations. This strategy allows for direct control over brand standards. It also accelerates expansion through franchisee investment.

BurgerFi's blend of fast-casual efficiency with a strong commitment to premium ingredients and environmental responsibility sets it apart. This approach leads to customer benefits such as a perceived healthier and more flavorful meal. This aligns with current consumer trends toward transparency and ethical sourcing.

- Focus on high-quality, fresh ingredients.

- Commitment to sustainability and ethical sourcing.

- Combination of company-owned and franchised locations.

- Streamlined kitchen processes for efficiency.

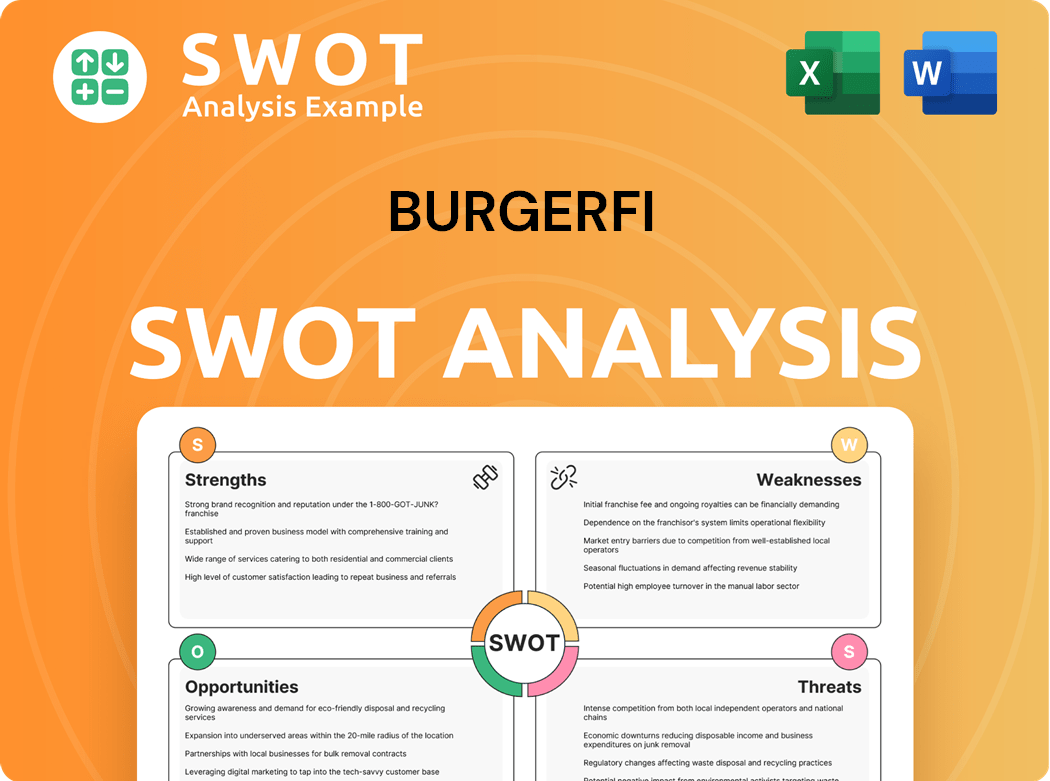

BurgerFi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BurgerFi Make Money?

The restaurant chain, generates revenue through a dual-pronged approach. This includes direct sales from its company-owned restaurants and through franchise fees and royalties from its franchised locations. This structure allows for diversified revenue streams and supports expansion efforts.

The primary revenue stream for the restaurant chain comes from the direct sales of food and beverages at its corporate-owned locations. This encompasses a variety of menu items, including burgers, fries, and frozen custard. The franchise model also provides a recurring revenue stream.

The franchise model provides a stable, recurring revenue base with lower operational overhead compared to company-owned stores. This contributes to overall profitability and expansion. The company also explores strategies like tiered pricing and cross-selling opportunities to maximize per-customer spending.

Direct sales from company-owned restaurants form a significant portion of revenue, driven by the sale of its menu items. This includes burgers, fries, hot dogs, frozen custard, and other items. These sales are crucial for the restaurant chain's financial performance.

The franchise model contributes significantly to the revenue through initial franchise fees and ongoing royalties. Franchisees pay initial fees to open a location, and ongoing royalties, typically a percentage of gross sales. This model provides a recurring revenue stream.

The company utilizes tiered pricing strategies for different menu items. It also explores cross-selling opportunities with beverages and desserts to increase per-customer spending. These strategies are designed to enhance revenue generation.

The company has explored ghost kitchens and virtual brands to expand its reach and diversify revenue streams. This allows the company to adapt to evolving consumer dining habits. These initiatives contribute to revenue diversification.

The company's expansion strategy is supported by a combination of company-owned and franchised locations. The franchise model is a key component. This approach allows for rapid growth and market penetration.

The financial performance of the restaurant chain is influenced by both direct sales and franchise revenues. The franchise model contributes to a stable revenue base. The company's financial health reflects its revenue diversification.

The restaurant chain employs various strategies to maximize revenue. These include direct sales, franchise fees, royalties, tiered pricing, and cross-selling. The company also explores ghost kitchens and virtual brands to adapt to changing consumer behaviors. For more details on how the company grows, you can read about the Growth Strategy of BurgerFi.

- Direct Sales: Revenue from food and beverage sales at company-owned locations.

- Franchise Fees: Initial fees paid by franchisees.

- Royalties: Ongoing percentage of gross sales from franchised restaurants.

- Tiered Pricing: Pricing strategies for different menu items.

- Cross-Selling: Opportunities with beverages and desserts.

- Ghost Kitchens: Expanding reach through virtual brands.

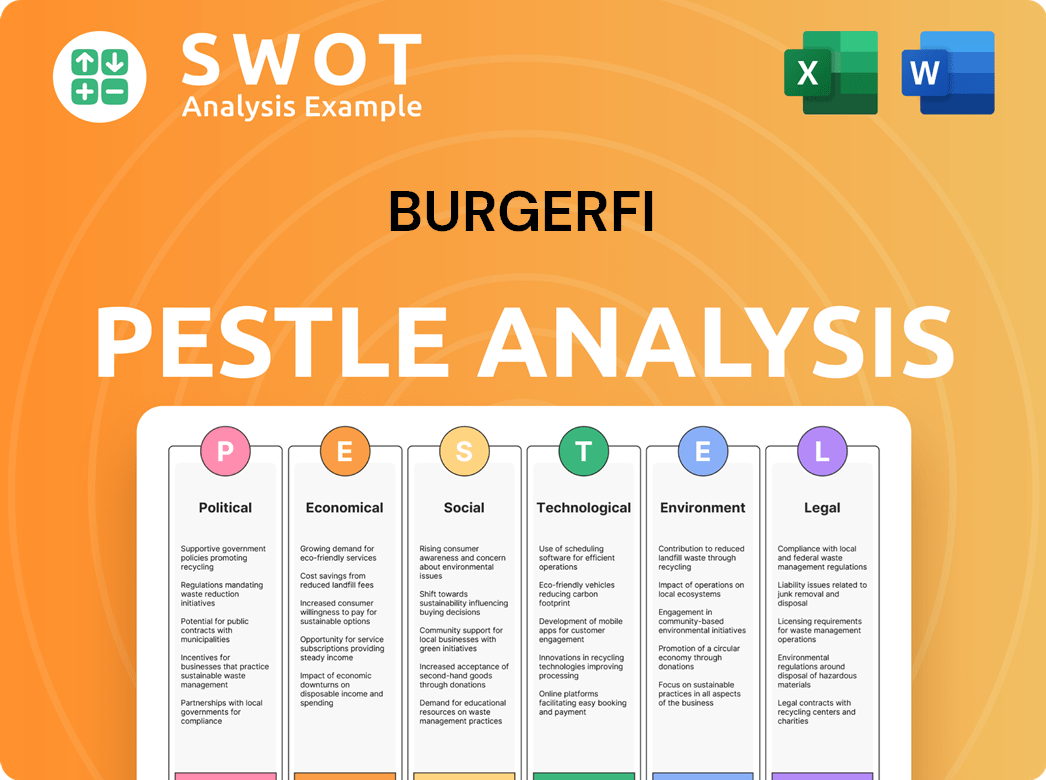

BurgerFi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BurgerFi’s Business Model?

The evolution of the BurgerFi company showcases significant milestones, strategic decisions, and competitive advantages. A key strategic move was its public listing, which provided capital for expansion and increased brand visibility. Operational challenges, such as supply chain disruptions, have been addressed through optimized procurement and stronger supplier relationships. The company's commitment to quality ingredients and eco-friendly practices has fostered a loyal customer base.

Strategic acquisitions, like the 2021 purchase of Anthony's Coal Fired Pizza & Wings, expanded its market reach and diversified its offerings. This move aimed to leverage operational efficiencies and cross-promote brands. The company continues to adapt to market trends by exploring digital ordering platforms and loyalty programs. These initiatives are designed to maintain relevance in the fast-casual sector.

The BurgerFi business model is built on a foundation of quality and sustainability. The company's focus on 'better burgers' and commitment to high-quality, natural ingredients has built a strong brand reputation. This, along with a loyal customer base, supports its competitive edge. The company continues to adapt to new trends by exploring digital ordering platforms, loyalty programs, and potential menu innovations.

The company's public listing was a pivotal moment, providing capital for expansion. The acquisition of Anthony's Coal Fired Pizza & Wings in 2021 was a strategic move to diversify its portfolio. These actions have shaped the company's growth trajectory and market position.

Acquisitions and public listings have been key strategic moves for BurgerFi. These moves have provided capital for expansion and increased brand visibility. The company has also focused on operational efficiencies to navigate challenges.

A strong brand reputation built on high-quality ingredients and eco-friendly practices is a key advantage. This reputation, combined with a loyal customer base, helps sustain the business model. The company's adaptation to digital trends also supports its competitive position.

Supply chain disruptions have presented operational challenges. The company has responded by optimizing procurement and strengthening supplier relationships. These efforts aim to ensure consistency and manage costs effectively.

The company's expansion strategy includes both organic growth and strategic acquisitions. The focus is on maintaining its brand reputation while adapting to changing consumer preferences. For insights into the BurgerFi's expansion strategy, consider reading Growth Strategy of BurgerFi.

- The company is exploring digital ordering and loyalty programs to enhance customer experience.

- Menu innovations and sustainability practices are key to maintaining relevance.

- Franchising continues to be a significant part of their growth strategy.

- The company aims to balance growth with maintaining its brand identity.

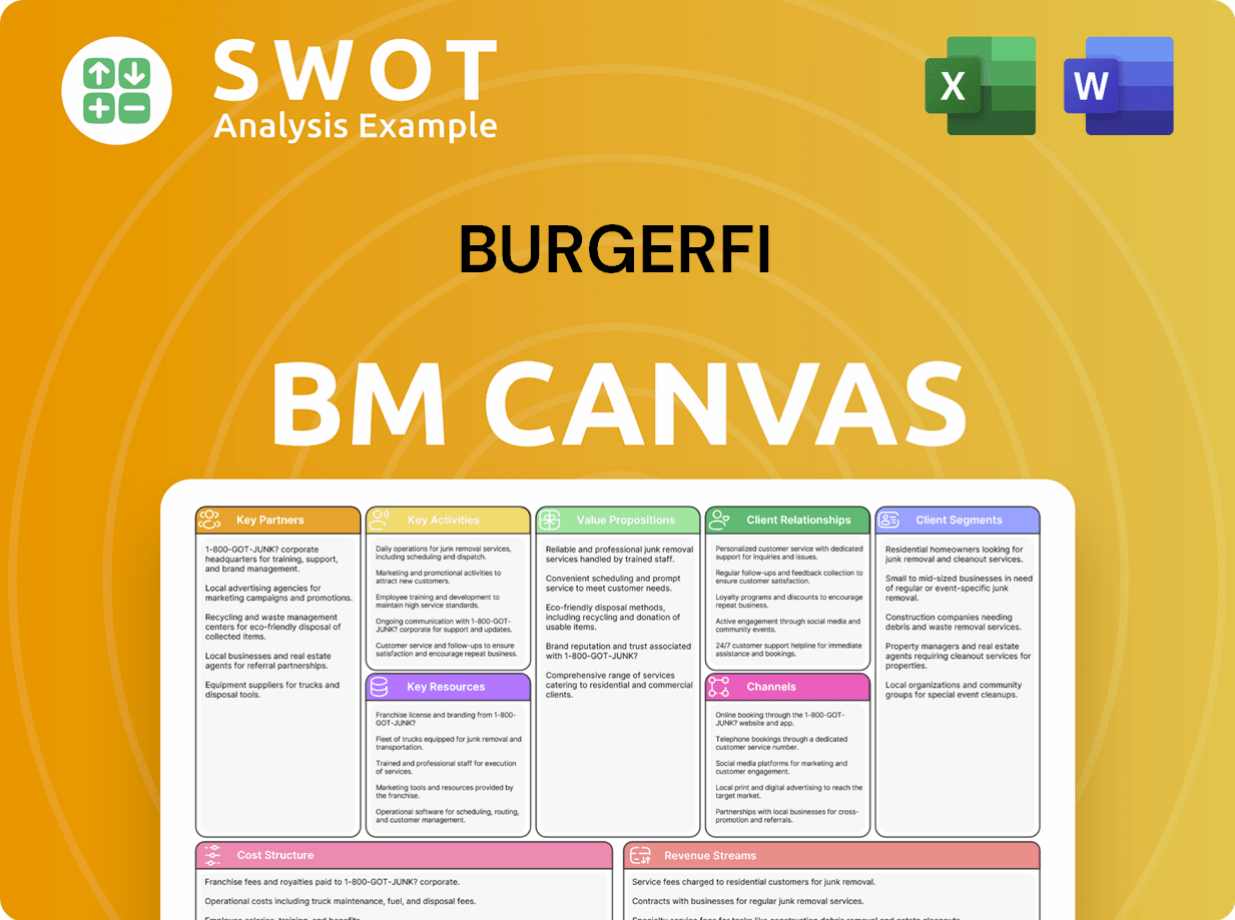

BurgerFi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BurgerFi Positioning Itself for Continued Success?

The BurgerFi company carves out its niche in the fast-casual dining sector, setting itself apart through a focus on premium ingredients and a modern brand identity. While it may not boast the largest market share compared to industry giants, BurgerFi has cultivated a loyal customer base, primarily across the U.S. and select international locations. Understanding the competitive landscape is key to assessing the BurgerFi business model and its potential for future growth.

The BurgerFi restaurant chain faces several challenges, including fluctuating ingredient costs and intense competition. Consumer preferences are also shifting, with a growing interest in plant-based options. Regulatory changes and the need for menu diversification are also important considerations. The BurgerFi franchise model, expansion plans, and technological advancements play a crucial role in its ability to adapt and thrive.

BurgerFi competes in the fast-casual restaurant segment, emphasizing quality and sustainability. The company differentiates itself through its commitment to fresh, responsibly sourced ingredients. Its focus on a premium experience helps it attract customers seeking a higher-quality burger option.

Key risks include fluctuating commodity prices, particularly for beef. Competition from established and emerging chains poses a constant challenge. Consumer preferences, such as the rising demand for plant-based alternatives, require menu adaptability. Regulatory changes could also impact operational costs.

The company's strategy involves franchise network expansion and supply chain optimization. Technology will be leveraged to enhance the customer experience and operational efficiency. The goal is to sustain and expand revenue by delivering on its promise of a premium dining experience. The company's Marketing Strategy of BurgerFi plays a key role in its future success.

Financial data for BurgerFi shows the importance of understanding its revenue streams. The company's ability to manage costs, particularly food and labor, will be critical. Investors should monitor same-store sales growth and franchise expansion metrics.

Analyzing BurgerFi's position requires understanding its competitive advantages and vulnerabilities. The company's success depends on its ability to adapt to market changes and maintain customer loyalty. Key factors include menu innovation, operational efficiency, and franchise support.

- Monitor commodity price fluctuations, especially for beef.

- Assess the impact of new competitors and changing consumer preferences.

- Evaluate the effectiveness of the franchise expansion strategy.

- Track the company's investments in technology and customer experience.

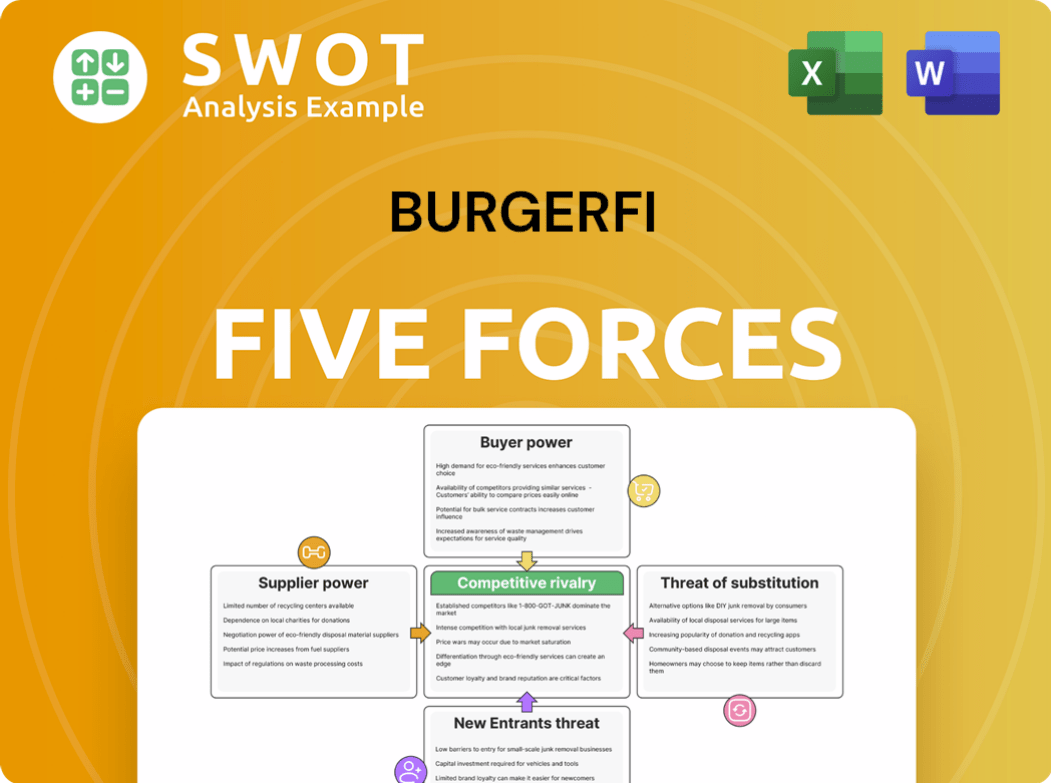

BurgerFi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BurgerFi Company?

- What is Competitive Landscape of BurgerFi Company?

- What is Growth Strategy and Future Prospects of BurgerFi Company?

- What is Sales and Marketing Strategy of BurgerFi Company?

- What is Brief History of BurgerFi Company?

- Who Owns BurgerFi Company?

- What is Customer Demographics and Target Market of BurgerFi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.