BurgerFi Bundle

Who Really Owns BurgerFi?

Understanding the BurgerFi SWOT Analysis is just the beginning; the true power lies in knowing who steers the ship. BurgerFi, a fast-casual darling, has seen its ownership evolve dramatically since its inception. This evolution offers a fascinating look at how a company's trajectory is shaped by its stakeholders and strategic decisions.

From its early days to its current status as a publicly traded entity, the BurgerFi company has undergone significant shifts in its ownership structure. This exploration into BurgerFi ownership will reveal the key players, from the original founders to the current major shareholders. Whether you're curious about BurgerFi franchise opportunities or simply want to understand the BurgerFi history, this deep dive offers valuable insights.

Who Founded BurgerFi?

The fast-casual restaurant chain, was established in 2011. The founders, John Rosatti and David Manero, were the driving forces behind the initial development of the company. Their vision focused on providing a 'better burger' experience, emphasizing high-quality ingredients and environmental sustainability.

John Rosatti, a prominent figure in the restaurant industry, played a key role in shaping the brand and its operational framework. While the exact equity distribution at the company's inception isn't publicly available, Rosatti's extensive experience was crucial. Early financial backing likely came from a combination of the founders' personal investments and potentially angel investors or private funding rounds, typical for emerging restaurant concepts.

The early phase of the company was characterized by a close-knit team focused on rapid expansion and brand building in the competitive fast-casual market. Early agreements would have included standard provisions for a startup, such as vesting schedules for equity and potential buy-sell clauses to manage founder exits or disputes, though the specifics are not publicly disclosed. The founding team's vision for a high-quality, eco-conscious burger chain was deeply embedded in the early operational and branding strategies.

Understanding the initial ownership structure of the company provides insight into its early strategies and growth trajectory. The founders' commitment to quality and sustainability set the tone for the brand. The early focus was on establishing a strong brand identity and expanding its footprint in the fast-casual market.

- Founders: John Rosatti and David Manero.

- Initial Vision: To create a 'better burger' concept.

- Focus: Fresh ingredients and environmental sustainability.

- Early Funding: Founders' capital and potentially angel investors.

- Early Strategy: Rapid expansion and brand building.

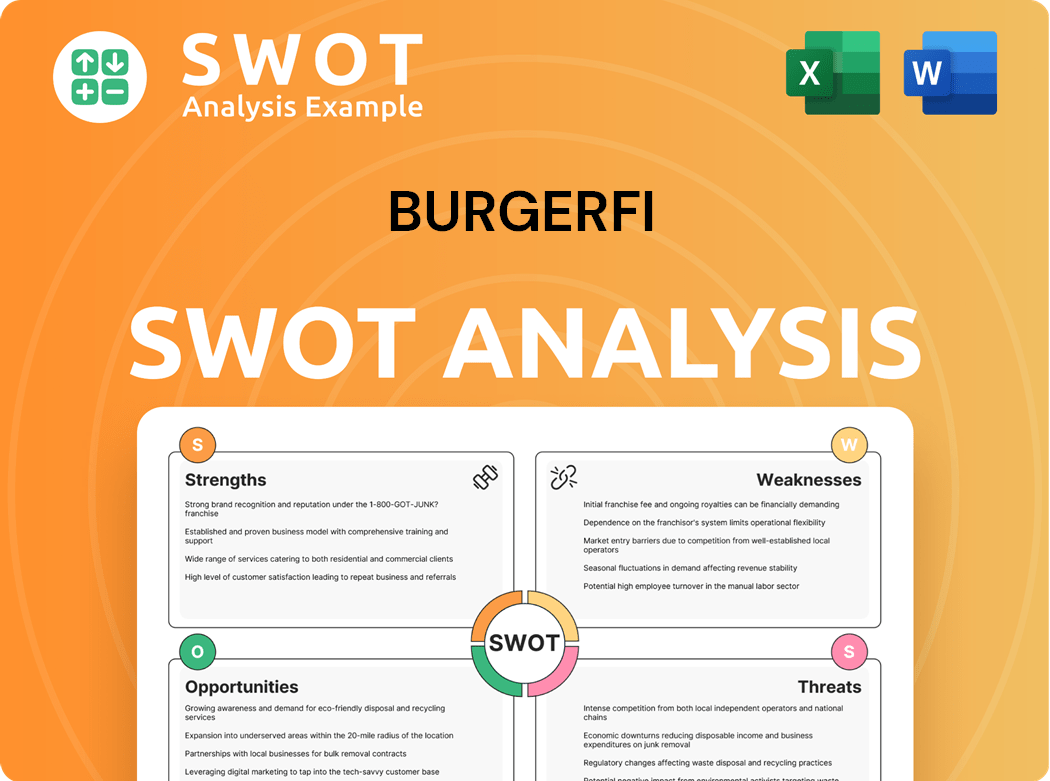

BurgerFi SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has BurgerFi’s Ownership Changed Over Time?

The evolution of BurgerFi's ownership structure is marked by a key transition. This change occurred when the company merged with Opes Acquisition Corp., a special purpose acquisition company (SPAC), in December 2020. This merger was a pivotal event, transforming BurgerFi into a publicly traded entity. Following the merger, BurgerFi International Inc. began trading on the Nasdaq Stock Market under the ticker BFI.

Post-IPO, the ownership of the BurgerFi company diversified significantly. Institutional investors, mutual funds, and individual shareholders now hold a substantial portion of the company's shares. As of early 2025, major institutional holders include firms like Vanguard Group Inc. and BlackRock Inc., which hold significant stakes. The ownership structure has shifted from a concentrated private ownership to a more dispersed public one, influencing governance and increasing the impact of public market dynamics.

| Ownership Phase | Key Event | Impact |

|---|---|---|

| Pre-IPO | Private Ownership | Concentrated ownership; strategic decisions made by a smaller group. |

| December 2020 | Merger with Opes Acquisition Corp. (SPAC) | BurgerFi becomes a publicly traded company; increased access to capital. |

| Post-IPO (Early 2025) | Institutional Investment | Diversified ownership; increased influence of institutional investors like Vanguard and BlackRock; greater focus on shareholder value. |

The shift to public ownership has led to a more dispersed shareholder base. This change has increased the importance of franchise growth and operational efficiency. The executive team and board members also maintain a notable stake, aligning their interests with long-term shareholder value. The company's strategy now focuses on appealing to its diverse shareholder base.

BurgerFi's ownership structure has evolved significantly since its IPO. The company is now publicly traded, with a diverse shareholder base. Institutional investors and individual shareholders hold substantial stakes in the company.

- The merger with a SPAC in 2020 was a key event.

- Major institutional holders include Vanguard and BlackRock.

- The ownership structure has shifted from private to public.

- The company focuses on franchise growth and operational efficiency.

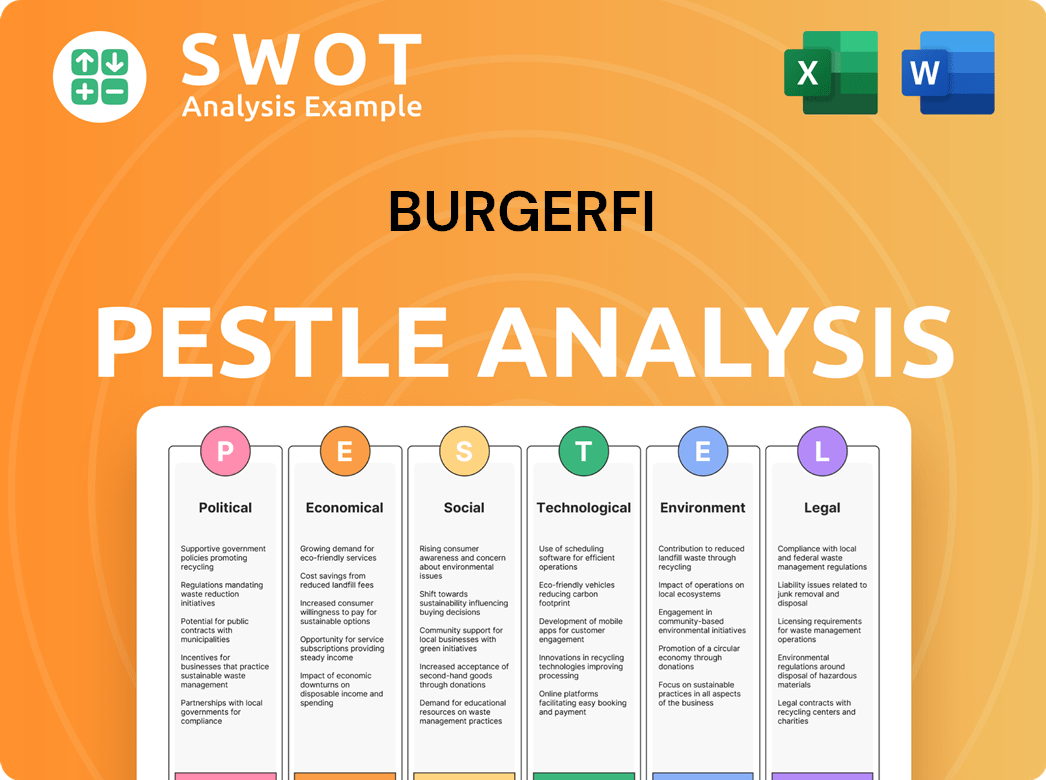

BurgerFi PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on BurgerFi’s Board?

The current Board of Directors of BurgerFi International Inc. includes a blend of individuals, representing major shareholders, industry experts, and independent directors. This composition is critical for understanding the company's governance and decision-making processes. As of early 2025, the board members bring expertise in finance, restaurant operations, and corporate strategy, reflecting the diverse skills needed to lead a public company in the fast-casual sector. While specific board members representing major shareholders aren't always explicitly stated, institutional investors frequently engage with management and the board, and some may have board representation or significant influence on the company's direction. Independent directors are essential for providing oversight and ensuring the board acts in the best interests of all shareholders.

The board's decisions are influenced by the need to deliver shareholder value and respond to market expectations, with independent directors providing a check on management and major shareholder interests. The Marketing Strategy of BurgerFi is also influenced by the board's decisions. The board's role in guiding the company's strategy is crucial, especially in a competitive market. The board's commitment to shareholder value is central to its operations.

| Board Member | Title | Background |

|---|---|---|

| Oren Heichal | Chairman of the Board | Extensive experience in finance and investments. |

| Ian Baines | Chief Executive Officer | Restaurant industry veteran with a focus on growth. |

| Michael J. Kulp | Independent Director | Expertise in corporate strategy and financial management. |

The voting structure for BurgerFi International Inc. generally follows a one-share-one-vote principle, common for publicly traded companies on major exchanges like Nasdaq. Each share of common stock typically entitles its holder to one vote on matters brought before shareholders, such as the election of directors or approval of corporate actions. There are no publicly disclosed details indicating a dual-class share structure, special voting rights, or golden shares that would grant outsized control to specific individuals or entities. This structure ensures shareholder democracy is maintained, and significant decisions require broad shareholder approval. The board's decisions are influenced by the need to deliver shareholder value and respond to market expectations.

Understanding who owns BurgerFi is crucial for investors and stakeholders. The company's ownership structure is designed to ensure fair voting rights for all shareholders.

- The board of directors includes a mix of independent directors, industry experts, and representatives of major shareholders.

- The voting structure follows a one-share-one-vote principle, ensuring that all shareholders have equal voting power.

- The company is publicly traded, offering opportunities for investment and participation in its growth.

- Institutional investors and major shareholders can significantly influence company decisions.

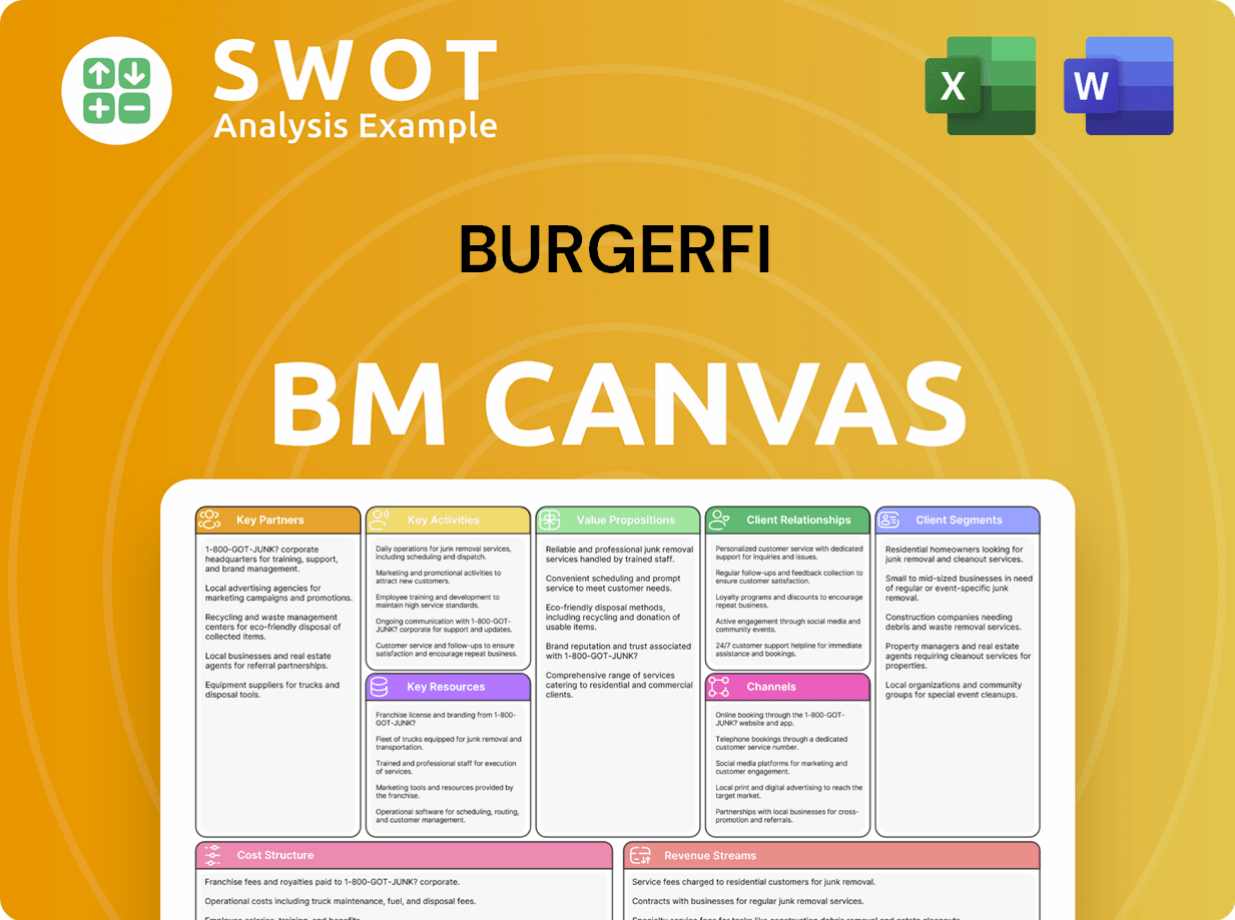

BurgerFi Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped BurgerFi’s Ownership Landscape?

The ownership landscape of the BurgerFi company has evolved significantly in the past few years. A pivotal moment was the merger with Opes Acquisition Corp. in December 2020, which transitioned BurgerFi into a publicly traded entity. This move opened the door for changes in the ownership structure, influenced by market activities and strategic decisions. Further shifts occurred in late 2021 when BurgerFi International Inc. acquired Anthony’s Coal Fired Pizza & Wings. This acquisition, financed through cash and stock, diluted existing shareholders and introduced new ones, altering the ownership percentages.

The restaurant industry, including BurgerFi, has seen a rise in institutional ownership. Large asset managers and index funds now hold considerable stakes, leading to increased scrutiny of financial performance and adherence to environmental, social, and governance (ESG) standards. Founder dilution is a natural outcome of public listings and subsequent financial actions. While there have been no recent announcements of privatization or significant founder departures, the company’s focus on growth and profitability could attract further investment or partnerships. For a deeper dive into the company's origins, check out the Brief History of BurgerFi.

As of the latest available data, BurgerFi continues to concentrate on operational improvements and expansion. The company's leadership and analysts focus on these areas to drive long-term shareholder value. The exact ownership percentages and major shareholders are subject to change, and the latest information can be found in recent financial reports and investor relations materials.

The merger with Opes Acquisition Corp. marked a significant shift. The acquisition of Anthony’s Coal Fired Pizza & Wings in late 2021 also impacted ownership. Institutional investors now play a larger role in BurgerFi's ownership structure.

The public listing resulted in founder dilution. It also opened the door for increased institutional investment. The company's focus remains on growth and profitability.

Operational improvements and expansion are key for shareholder value. The company is focused on attracting further investment. Recent financial reports provide the latest data on the company.

Increased institutional ownership is a trend in the restaurant sector. Large asset managers hold substantial stakes. ESG factors are becoming more important.

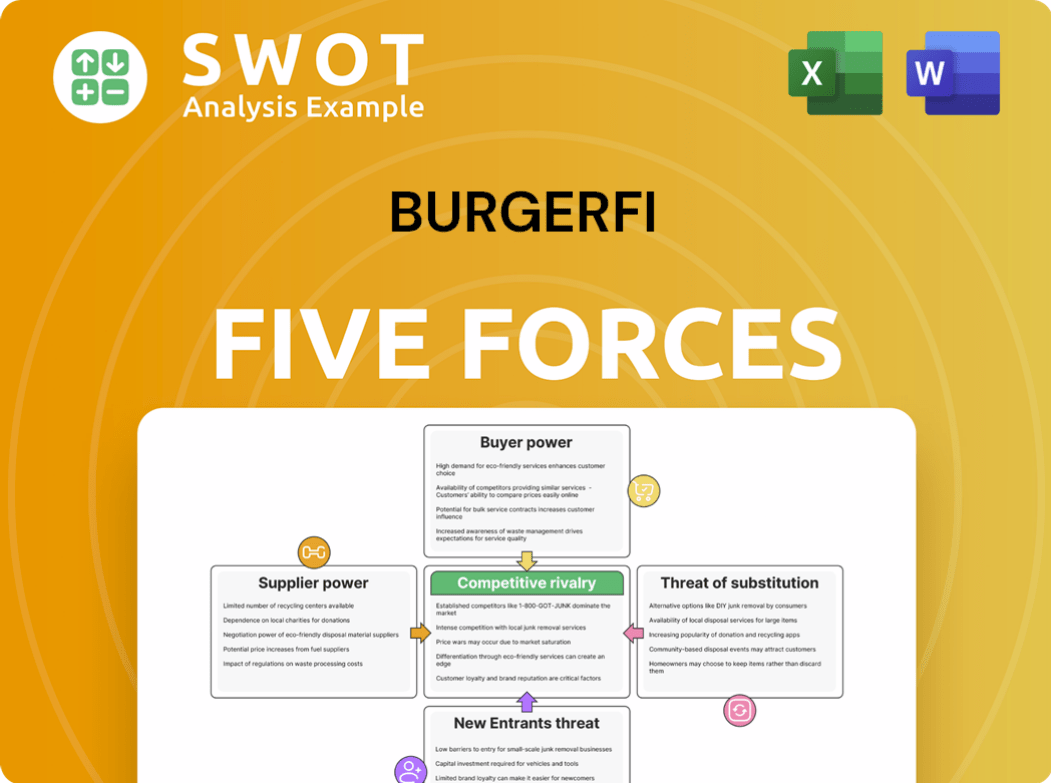

BurgerFi Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BurgerFi Company?

- What is Competitive Landscape of BurgerFi Company?

- What is Growth Strategy and Future Prospects of BurgerFi Company?

- How Does BurgerFi Company Work?

- What is Sales and Marketing Strategy of BurgerFi Company?

- What is Brief History of BurgerFi Company?

- What is Customer Demographics and Target Market of BurgerFi Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.