Campbell Soup Bundle

Can Campbell Soup Company Thrive in the Modern Food Market?

For over 150 years, Campbell Soup Company has been a culinary cornerstone, evolving from a purveyor of canned goods to a global food powerhouse. From its humble beginnings in 1869, the company has consistently adapted, innovating with products like condensed soup and iconic branding. Today, with a portfolio boasting brands like Pepperidge Farm and Goldfish, Campbell's faces new challenges and opportunities in the ever-changing food industry.

This exploration delves into the Campbell Soup SWOT Analysis, dissecting its strategies for future growth and market dominance. We'll examine how Campbell Soup Company plans to navigate the soup market trends and the broader food industry outlook, analyzing its expansion plans, innovation strategy, and adaptation to shifting consumer preferences. Understanding Campbell Soup Company's growth strategy and its future prospects in 2024 is crucial for investors and industry watchers alike, as the company continues to shape the consumer packaged goods landscape.

How Is Campbell Soup Expanding Its Reach?

The Campbell Soup Company growth strategy centers on strategic acquisitions and investments to bolster its market position and expand its product offerings. A key element of this strategy involves optimizing its portfolio through both acquisitions and divestitures to ensure sustained, profitable growth within the food industry outlook.

The company is also focused on enhancing its operational capabilities through investments in new production facilities and capacity expansions. These initiatives are designed to improve efficiency and meet the evolving demands of consumers. This strategic approach is crucial for navigating the soup market trends and the broader consumer packaged goods landscape.

A significant move in Campbell Soup Company's expansion plans was the acquisition of Sovos Brands, Inc., completed on March 12, 2024, for approximately $2.7 billion. This acquisition added a variety of premium brands, including Rao's pasta sauces, to Campbell's portfolio. The integration of Rao's is expected to drive net sales growth of +9% to 11% in fiscal year 2025.

The acquisition of Sovos Brands, including Rao's, is a pivotal move to diversify the product portfolio. This strategic acquisition enhances Campbell's presence in the premium food category. It is expected to significantly boost the company's revenue.

Campbell's has divested certain businesses, such as Pop Secret and noosa yogurt, to streamline its focus. These divestitures, combined with acquisitions, aim at optimizing the portfolio for sustained growth. This approach supports the company's long-term financial goals.

Investments in new production facilities are key to improving operational efficiency. A $150 million investment in a new aseptic soup production line in Maxton, North Carolina, is a prime example. These investments are designed to meet increasing consumer demand.

The company anticipates organic net sales growth of approximately 2% to 3%. The Snacks business is expected to grow at 3-4%, while Meals & Beverages is projected at 1-2%, supported by the Sovos Brands acquisition. These projections highlight the company's financial outlook.

Campbell's expansion strategy involves strategic acquisitions, portfolio optimization, and investments in production capabilities. The acquisition of Sovos Brands is a major step towards diversification. These initiatives aim to enhance the company's market position and drive future growth.

- Acquisition of Sovos Brands for approximately $2.7 billion.

- Divestiture of Pop Secret and noosa yogurt businesses.

- Investment in new production facilities, such as the Maxton, North Carolina, soup line.

- Anticipated organic net sales growth of approximately 2% to 3%.

Campbell Soup SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Campbell Soup Invest in Innovation?

The Campbell Soup Company growth strategy is heavily influenced by evolving consumer needs and preferences within the food industry. Consumers are increasingly seeking healthier, more convenient food options, which drives the company's innovation efforts. The company actively adapts to these trends to maintain its market position and drive future growth.

Understanding these shifts is crucial for Campbell Soup Company's future prospects. The company's ability to innovate and meet these demands directly impacts its financial performance and market share. This focus on consumer preferences is a core element of the company's strategic planning.

The company's strategic initiatives emphasize new product offerings and continuous improvement. This commitment to innovation is essential for navigating the dynamic soup market trends and the broader food industry outlook.

Product innovation contributed to 3% of net sales in fiscal 2024. This highlights the importance of new product development in driving revenue growth.

The company focuses on its 16 'leadership brands,' which accounted for 84% of enterprise sales and approximately 95% of segment operating earnings in fiscal 2024. These brands are key to the company's growth strategy.

Through the second quarter of fiscal 2025, the company achieved approximately $65 million in savings from a new $250 million cost savings program announced in September 2024. This indicates a focus on operational efficiency.

Investments in new production facilities, such as an aseptic soup production line and expanded tortilla chip capacity, show a commitment to modernizing manufacturing processes.

The company is committed to a healthier environment, which may involve sustainable manufacturing practices and related technologies. This reflects a broader trend towards corporate social responsibility.

While specific details on AI or IoT are not extensively detailed, the strategic direction toward optimizing supply chain productivity and cost savings suggests an underlying embrace of technological advancements.

The company's strategy emphasizes 'Best Portfolio' and 'Winning Execution,' indicating a focus on product development and efficient operations. Modernizing manufacturing processes, potentially integrating automation, and embracing technological advancements are key components of the Campbell Soup Company's innovation strategy. Further insights into the company's target market can be found in this analysis of the Target Market of Campbell Soup.

The company is focusing on several key areas to drive growth and efficiency.

- New Product Development: Continuous introduction of new products to meet evolving consumer preferences.

- Operational Efficiency: Modernizing manufacturing processes and leveraging technology to reduce costs and improve productivity.

- Supply Chain Optimization: Utilizing technology to streamline the supply chain and enhance operational efficiency.

- Sustainability Initiatives: Implementing sustainable manufacturing practices to align with environmental goals.

- Cost Savings Programs: Implementing cost-saving measures to improve financial performance.

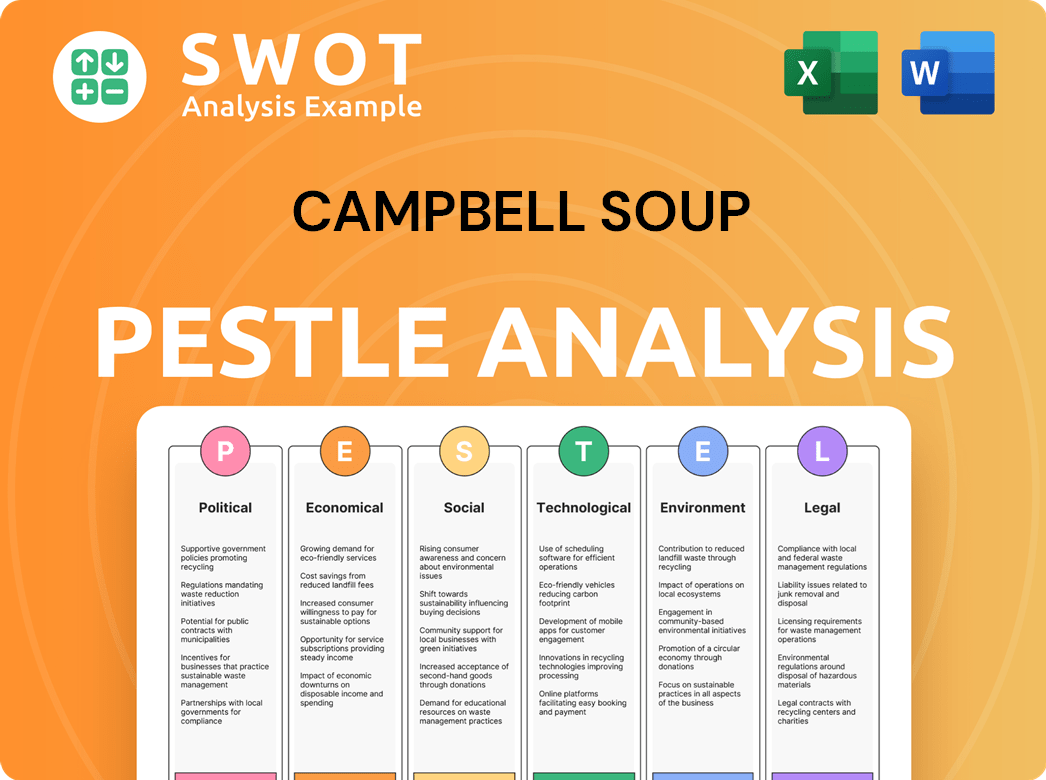

Campbell Soup PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Campbell Soup’s Growth Forecast?

The financial outlook for the Owners & Shareholders of Campbell Soup is shaped by strategic moves and cost management. The company's performance in 2024 and its projections for 2025 provide insights into its growth strategy and future prospects. Understanding these financial aspects is crucial for assessing the company's position within the food industry outlook and the broader consumer packaged goods sector.

In fiscal year 2024, the company reported net sales of roughly $9.1 billion, with some sources indicating $9.6 billion. This increase, mainly due to acquisitions like Sovos Brands and favorable pricing, highlights the company's approach to growth. Analyzing these figures helps in understanding the soup market trends and the company's ability to navigate the complexities of the food industry.

The company's revenue over the past 12 months stands at $10.23 billion, with net sales increasing 3% in 2024. In Q1 2025, revenue saw a 4.5% increase, reaching $2.48 billion, exceeding expectations. This demonstrates the company's resilience and ability to adapt to market dynamics, which is key to its long term investment potential.

Net sales increased 3% in 2024, primarily due to the acquisition of Sovos Brands and positive net price realization. In Q1 2025, revenue increased by 4.5%, reaching $2.48 billion. This growth reflects the company's strategic initiatives and market adaptability.

The gross profit margin averaged 32.2% from August 2020 to 2024. Adjusted gross profit margin increased in Q2 2024 but declined in Q2 2025 due to cost inflation. These fluctuations impact the company's financial health and its response to inflation.

The average net profit margin for 2024 was 6.89%, with a decline of 21.35% from 2023. The company expects adjusted EPS in the range of $2.95 to $3.05 for fiscal year 2025. These figures are crucial for understanding the company's profitability.

Campbell's has increased its cost savings target for fiscal year 2025 to $120 million. Capital expenditures in 2024 were $517 million, with an estimated $530 million planned for 2025. These investments support the company's growth and operational efficiency.

For fiscal year 2025, the company expects adjusted EBIT growth between 3% and 5%. The company's growth strategy includes cost savings and strategic investments.

- Adjusted EPS projected in the range of $2.95 to $3.05.

- Increased cost savings target for fiscal year 2025 to $120 million.

- Capital expenditures planned at approximately $530 million in 2025.

- Analysts' consensus as of November 2024 is 'Hold,' with a price target of $48.33.

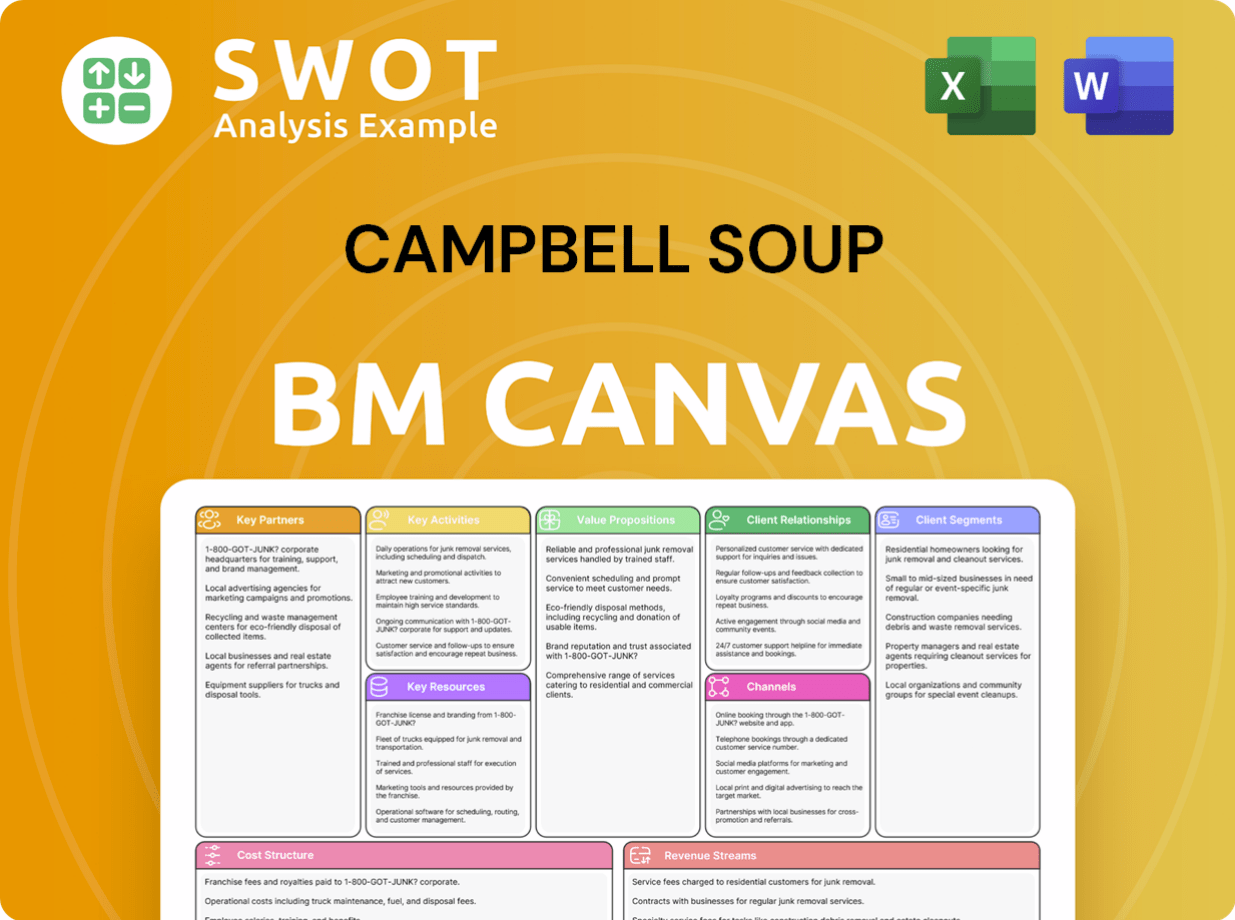

Campbell Soup Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Campbell Soup’s Growth?

The Campbell Soup Company growth strategy faces several challenges that could affect its future. The company operates in a highly competitive market, with rivals constantly vying for market share. Additionally, changing consumer preferences and economic factors pose significant hurdles.

Regulatory changes and supply chain vulnerabilities also present risks. These factors, combined with the need for continuous innovation, require the company to adapt and implement effective strategies. Understanding these challenges is crucial for assessing the Campbell Soup Company future prospects.

The food industry outlook and soup market trends are key factors influencing the company's performance. Inflation and rising costs of raw materials continue to impact profitability. Therefore, managing these risks is essential for sustaining growth.

The Campbell Soup Company faces intense competition from major players such as General Mills and Kraft Heinz. This competition can lead to increased promotional activities. These activities put pressure on profit margins, especially in key segments like crackers and salty snacks.

New food safety regulations and labeling requirements increase compliance costs. Potential tariffs, like those on imported tomato sauce, could negatively impact earnings per share (EPS). Exposure to steel costs, potentially influenced by tariffs, is another concern.

Disruptions to the supply chain, whether due to natural disasters or geopolitical events, can disrupt operations. These disruptions can lead to increased costs and reduced efficiency. The company needs to build a resilient supply chain to mitigate these risks.

Inflationary pressures and rising raw material costs continue to affect profitability. While the company has implemented cost management programs, mitigating these impacts remains a challenge. Price increases and productivity initiatives are critical.

Economic downturns and shifts in consumer preferences, such as the demand for healthier options, can affect financial performance. Failure to innovate and meet these changing needs can lead to a decline in market share. This requires a proactive approach to product development.

Risks associated with integrating acquired businesses, including cultural differences and operational challenges, are present. The acquisition of Sovos Brands presents integration challenges. Careful management is required to ensure a smooth transition and realize the expected benefits.

Campbell Soup Company is actively managing these risks through various strategies. These include diversifying its product portfolio to reduce reliance on specific categories. Investment in research and development is also crucial for innovation and adapting to consumer preferences. Improving supply chain resilience is another key focus.

The company has implemented significant cost-saving programs. Approximately $65 million in savings were delivered through Q2 2025 as part of a larger $250 million program. These initiatives aim to improve operational efficiency and reduce expenses. This is important for maintaining profitability.

For a deeper understanding of the competitive landscape, consider reading about the Competitors Landscape of Campbell Soup.

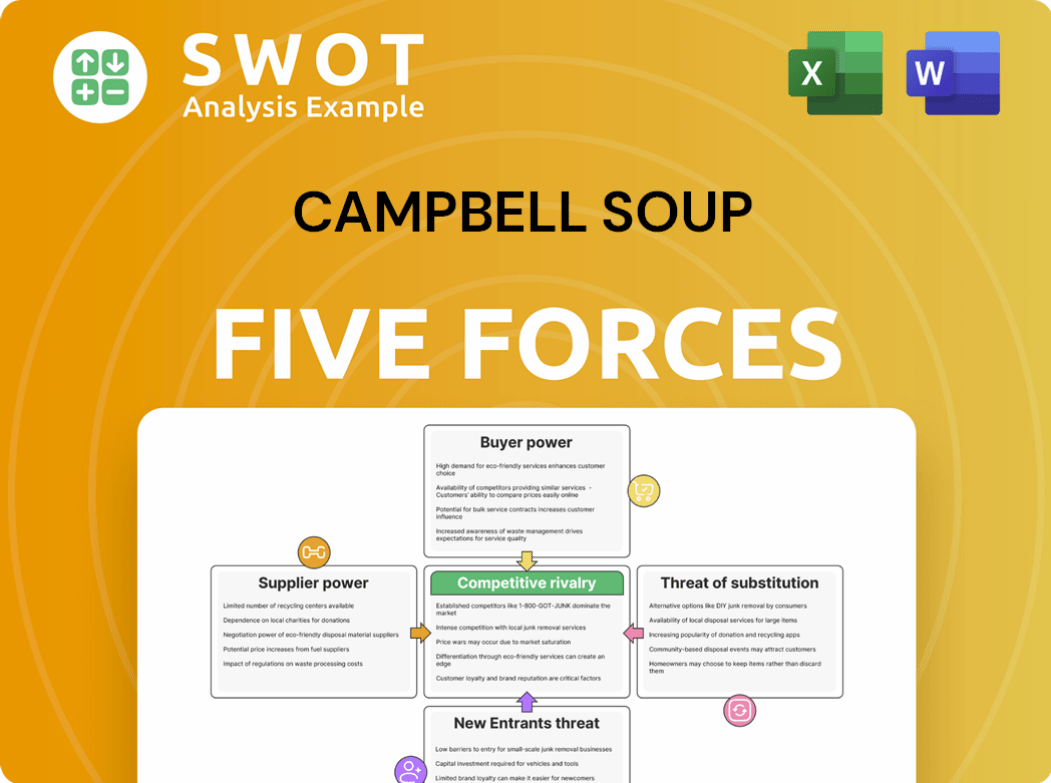

Campbell Soup Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Campbell Soup Company?

- What is Competitive Landscape of Campbell Soup Company?

- How Does Campbell Soup Company Work?

- What is Sales and Marketing Strategy of Campbell Soup Company?

- What is Brief History of Campbell Soup Company?

- Who Owns Campbell Soup Company?

- What is Customer Demographics and Target Market of Campbell Soup Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.