CHC Group Ltd Bundle

Can CHC Group Ltd. Soar to New Heights?

CHC Group Ltd., a pillar in the aviation industry since 1947, provides essential helicopter services globally, supporting offshore oil and gas operations and critical search and rescue missions. From its Canadian roots, the company has evolved into a major player, offering specialized aviation solutions across diverse international regions. Understanding the CHC Group Ltd SWOT Analysis is key to grasping its potential.

CHC Group Ltd.'s future prospects are intricately linked to its growth strategy, encompassing aggressive expansion and continuous innovation within the helicopter services sector. This analysis delves into CHC Group Ltd.'s market analysis, exploring its strategic initiatives and future revenue projections. The company's ability to navigate the challenges and opportunities within the aviation industry, particularly the impact of oil prices, will be crucial for its long-term success.

How Is CHC Group Ltd Expanding Its Reach?

CHC Group Ltd is implementing several strategic expansion initiatives to strengthen its market position and drive future growth. These initiatives focus on geographical expansion, diversification of service offerings, and fleet modernization. The company aims to capitalize on emerging opportunities within the aviation industry and the offshore oil and gas sector.

A key element of CHC Group Ltd's growth strategy involves expanding its geographical footprint, particularly in regions with increasing demand for its services. This includes a focus on emerging energy markets and areas where search and rescue capabilities are in high demand. The company is also looking to diversify its service offerings beyond its traditional oil and gas clientele.

To support these expansion efforts, CHC is investing in modern, fuel-efficient helicopters and exploring partnerships and acquisitions. These strategies are designed to access new customer segments, mitigate market volatility, and maintain a competitive edge in a dynamic global environment. The company's commitment to these initiatives reflects its long-term vision for sustainable growth within the aviation industry.

CHC Group Ltd is focusing on expanding its presence in key regions. This includes exploring opportunities in the Asia-Pacific region, driven by growing offshore energy exploration and production activities. The company is also targeting emerging energy markets to capitalize on increasing demand for its services.

CHC is diversifying its service offerings beyond its traditional oil and gas clientele. This includes strengthening its government services division, focusing on long-term contracts for critical services such as emergency medical services (EMS) and disaster relief operations. The company aims to broaden its revenue streams and reduce reliance on any single sector.

CHC continues to invest in modern, fuel-efficient helicopters to meet anticipated demand and enhance operational capabilities. Recent reports indicate continued investment in newer generation aircraft that offer improved range and payload capacity, essential for supporting remote offshore operations. This ensures the company can meet the evolving needs of its customers.

To support its growth strategy, CHC is actively pursuing partnerships and potential acquisitions. These strategic moves align with the company's diversification goals, allowing it to broaden its service offerings and expand its market reach. These initiatives are designed to access new customer segments and mitigate market volatility.

CHC Group Ltd's strategic initiatives position it for future growth in the aviation industry. The company's focus on geographical expansion, service diversification, and fleet modernization are key to its long-term success. These efforts are designed to enhance operational efficiency and capitalize on emerging market opportunities, as discussed in detail in the Marketing Strategy of CHC Group Ltd article.

- The global helicopter services market is projected to reach \$17.5 billion by 2027, with a CAGR of 4.2% from 2020 to 2027.

- The Asia-Pacific region is expected to experience significant growth in offshore oil and gas exploration, creating opportunities for helicopter services.

- CHC's focus on government services, such as EMS and disaster relief, provides a stable revenue stream and reduces reliance on the volatile oil and gas sector.

- Investing in modern, fuel-efficient helicopters helps CHC reduce operational costs and meet environmental standards.

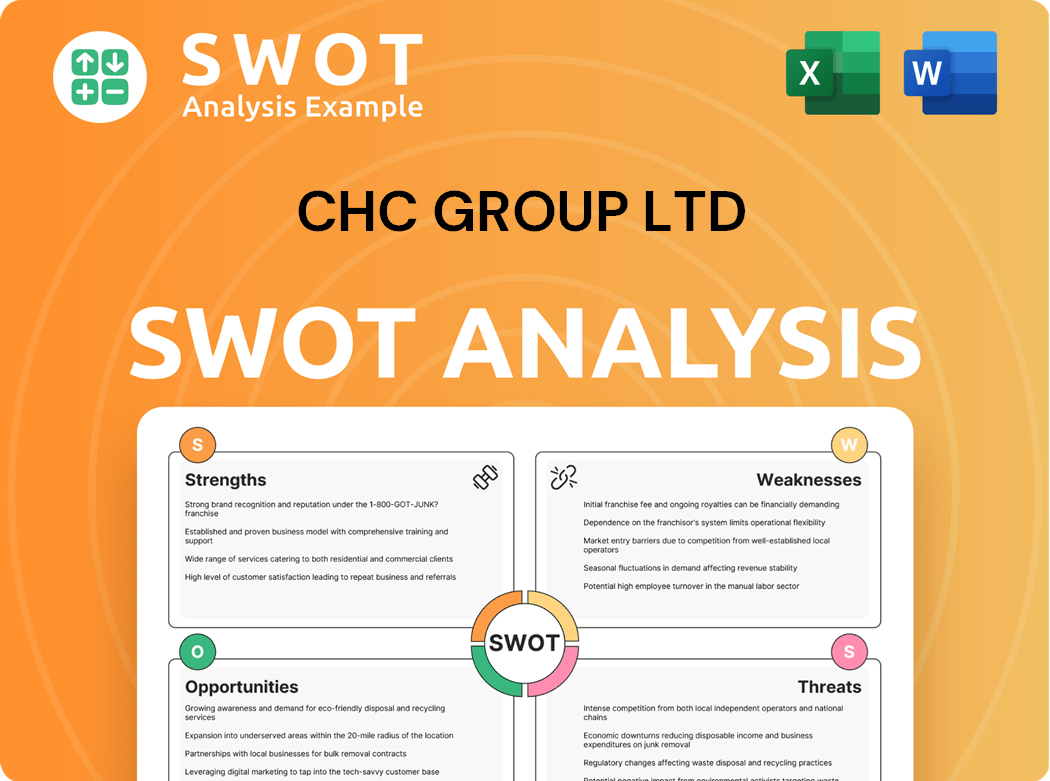

CHC Group Ltd SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does CHC Group Ltd Invest in Innovation?

CHC Group Ltd. prioritizes innovation and technology to fuel its Growth Strategy and secure its Future Prospects. The company invests heavily in research and development to enhance helicopter performance, maintenance protocols, and digital operational platforms. This commitment positions CHC Group Ltd. as a leader in the Aviation Industry.

A core focus is digital transformation, including predictive maintenance and advanced data analytics. This approach allows CHC to optimize maintenance schedules, minimize downtime, and extend aircraft lifespan, thereby boosting Operational Efficiency. Real-time data from its fleet is crucial for proactive interventions, moving away from reactive repairs.

Furthermore, CHC Group Ltd. is exploring the integration of Artificial Intelligence (AI) and the Internet of Things (IoT) to improve flight safety and operational decision-making. The company is developing AI-powered tools for route optimization and risk assessment, and using IoT sensors for environmental monitoring during missions. These advancements contribute to superior services and support its growth objectives.

CHC Group Ltd. allocates significant resources to research and development, focusing on helicopter performance and maintenance. These investments are crucial for enhancing Helicopter Services and maintaining a competitive edge. This commitment to innovation is central to its long-term strategy.

Digital transformation is a key initiative, with a focus on predictive maintenance and advanced data analytics. This approach allows for proactive maintenance, reducing downtime and improving aircraft longevity. The use of real-time data is critical for optimizing operations.

CHC Group Ltd. is exploring AI and IoT to enhance flight safety and operational decision-making. This includes AI-powered route optimization and risk assessment tools, and IoT sensors for environmental monitoring. These technologies are expected to improve efficiency and safety.

The company is committed to sustainability through the use of Sustainable Aviation Fuels (SAF) and fuel-efficient flight procedures. These initiatives aim to reduce the carbon footprint and align with environmental goals. This commitment enhances its reputation.

Technological advancements contribute significantly to operational excellence, ensuring superior services. This includes optimized maintenance, reduced downtime, and improved safety protocols. These improvements directly support the company's growth objectives.

CHC Group Ltd. aims to be a leader in safety and environmental responsibility within the aviation industry. This commitment is reflected in its technological advancements and sustainable practices. These efforts enhance the company's brand image.

CHC Group Ltd. is focused on several key technological advancements to drive its Growth Strategy. These advancements are designed to improve operational efficiency, enhance safety, and reduce environmental impact. These initiatives are vital for the company's Future Prospects.

- Predictive Maintenance: Implementing sensor technology to monitor critical components, enabling proactive maintenance and reducing downtime.

- AI-Powered Tools: Developing AI for route optimization and risk assessment to improve flight safety and operational decision-making.

- IoT Integration: Utilizing IoT sensors for comprehensive environmental monitoring during missions.

- Sustainable Aviation Fuels (SAF): Exploring the use of SAF and fuel-efficient flight procedures to reduce the carbon footprint.

- Data Analytics: Leveraging advanced data analytics to optimize maintenance schedules and improve aircraft longevity.

For more insights into the company's values, consider reading Mission, Vision & Core Values of CHC Group Ltd.

CHC Group Ltd PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is CHC Group Ltd’s Growth Forecast?

The financial outlook for CHC Group Ltd is shaped by its strategic focus on maintaining revenue stability, improving operational efficiency, and making targeted investments to support its growth. While specific financial projections for 2025 are not publicly available in detail, the company's financial strategy is built on its long-term contracts within the offshore oil and gas sector and its expanding government services. Recent performance indicates a resilient financial structure, with efforts to optimize fleet utilization and control operating costs.

Investment levels are expected to remain strong, particularly in fleet modernization and technological upgrades, which aligns with the company’s innovation strategy. For instance, capital expenditure is likely to be directed towards acquiring new generation helicopters that offer improved fuel efficiency and operational capabilities, potentially leading to better profit margins. The company's financial ambitions are also supported by its ability to secure and renew significant contracts with major energy companies and government entities, providing a stable revenue base.

The company's commitment to enhancing its operational efficiency is a key aspect of its financial strategy. This includes measures to optimize fleet management, reduce operational costs, and improve overall productivity. These efforts are intended to contribute to sustainable financial performance and support the company’s ability to invest in future growth. While specific revenue targets or profit margins for 2025 are not publicly available, the company's consistent operational performance and strategic investments suggest a stable financial trajectory aimed at supporting its expansion and innovation efforts.

The company's financial health is closely tied to the performance of the aviation industry and the offshore oil and gas market. Strategic initiatives are designed to provide a stable financial foundation. The company's ability to secure and renew contracts with major energy companies and government entities supports a stable revenue base.

CHC Group Ltd. is expected to continue investing in fleet modernization and technological upgrades. These investments are critical for maintaining a competitive edge. Capital expenditure will likely focus on acquiring new generation helicopters. This focus on innovation and efficiency is expected to enhance profitability.

The company's long-term contracts in the offshore oil and gas sector provide a solid revenue base. Expanding government services also contribute to revenue stability. Efforts to optimize fleet utilization and control operating costs are crucial for financial stability. These factors are key to the company's growth strategy.

CHC Group Ltd. focuses on optimizing fleet management to reduce costs. Improving overall productivity is a key objective. These measures contribute to sustainable financial performance. The company aims to enhance operational efficiency to support future growth.

While specific revenue targets for 2025 are not publicly available, the company's financial trajectory appears stable. The consistent operational performance and strategic investments suggest a positive outlook. The company's ability to secure and renew contracts with major energy companies and government entities provides a stable revenue base. The Growth Strategy of the company is focused on sustainable financial performance and expansion.

- The company's focus on innovation and efficiency is expected to enhance profitability.

- Strategic initiatives are designed to provide a stable financial foundation.

- The company's financial health is closely tied to the performance of the Aviation Industry.

- Investment in new generation helicopters is a key component of the Future Prospects.

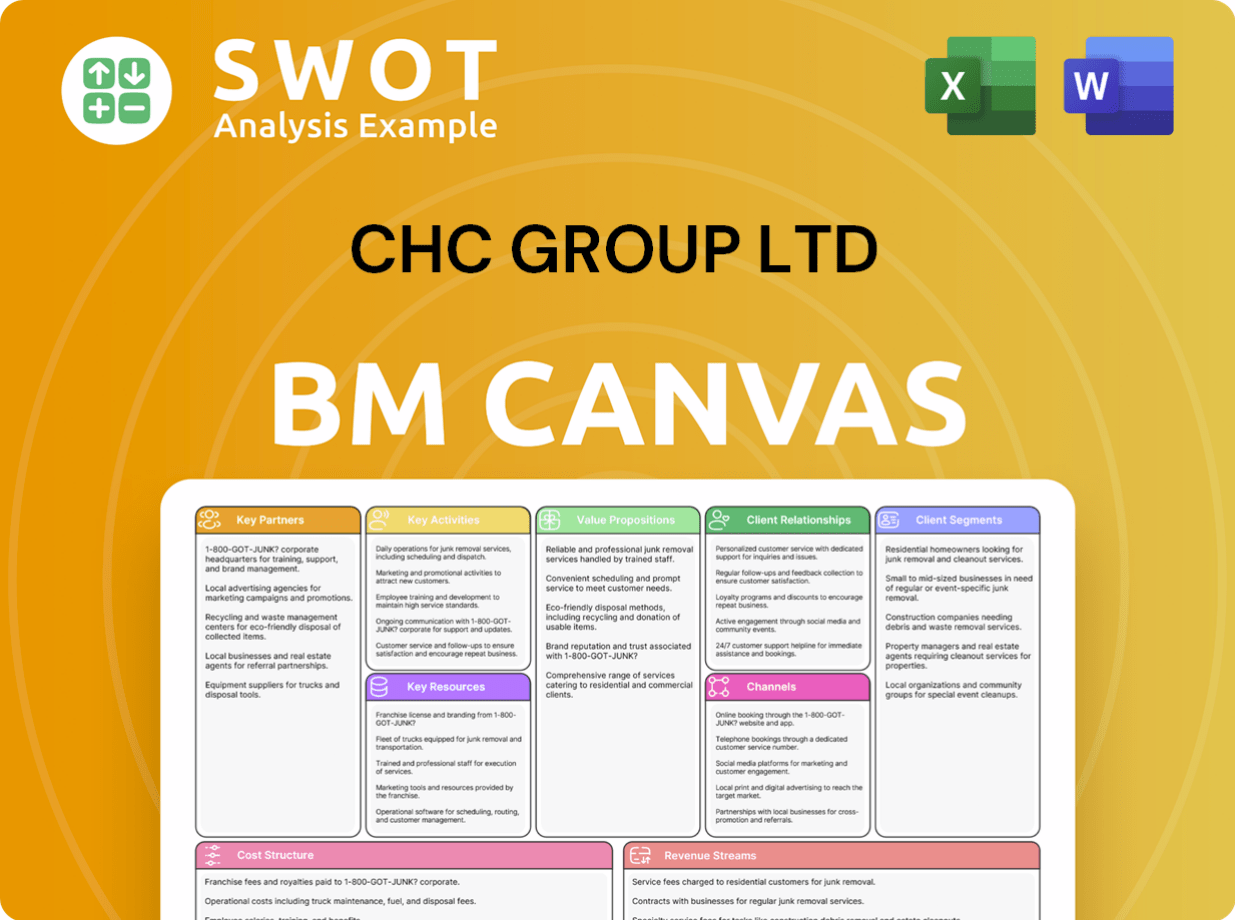

CHC Group Ltd Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow CHC Group Ltd’s Growth?

The success of Owners & Shareholders of CHC Group Ltd, and its future growth strategy, faces several potential risks and obstacles. These challenges range from industry-specific volatility to broader economic and operational hurdles. Understanding these risks is crucial for assessing the company's long-term prospects.

One of the primary concerns is the cyclical nature of the offshore oil and gas market, a significant driver for helicopter services. Market fluctuations can impact demand for CHC's services. Furthermore, regulatory changes and safety standards in the aviation industry present ongoing challenges, potentially increasing operational costs.

Supply chain disruptions, geopolitical risks, and currency fluctuations also pose threats. Intense competition from other helicopter operators can pressure pricing and contract terms. CHC must navigate these complexities to maintain its market position and achieve its growth ambitions.

The offshore oil and gas sector's cyclical nature can cause fluctuations in demand for helicopter services. This volatility directly impacts CHC Group Ltd's revenue streams and financial performance. Economic downturns can lead to reduced exploration and production activities, affecting demand.

Changes in aviation safety standards and environmental regulations can lead to increased operational costs. Compliance with new regulations may require significant investments in fleet upgrades or new technologies. Environmental concerns are becoming increasingly important.

Disruptions in the supply chain for critical aircraft components and specialized maintenance services can cause operational delays. Delays can affect contract fulfillment and impact profitability. The availability and cost of parts are crucial.

CHC Group Ltd's global operations expose it to geopolitical risks and currency fluctuations. Political instability in operating regions can disrupt services. Currency exchange rate volatility can affect financial results and profitability.

Intense market competition from other helicopter operators can put pressure on pricing and contract terms. This pressure can reduce profit margins and impact market share. The competitive landscape is dynamic.

The increasing focus on decarbonization in the aviation industry may require significant investments. New technologies or alternative fuels are needed. This transition could impact CHC's capital expenditure and operational strategies.

CHC Group Ltd employs a comprehensive risk management framework. This includes rigorous safety protocols and proactive engagement with regulatory bodies. The company diversifies its client base and geographical presence to reduce risk exposure.

CHC has actively pursued long-term contracts with government agencies to create a more stable revenue stream. Diversification into search and rescue services and other sectors helps reduce reliance on the volatile offshore oil and gas market. These contracts provide revenue stability.

CHC Group Ltd Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CHC Group Ltd Company?

- What is Competitive Landscape of CHC Group Ltd Company?

- How Does CHC Group Ltd Company Work?

- What is Sales and Marketing Strategy of CHC Group Ltd Company?

- What is Brief History of CHC Group Ltd Company?

- Who Owns CHC Group Ltd Company?

- What is Customer Demographics and Target Market of CHC Group Ltd Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.