CHC Group Ltd Bundle

Who Flies with CHC Group Ltd?

In the high-stakes world of aerospace, understanding the CHC Group Ltd SWOT Analysis is crucial. CHC Group Ltd, a leader in helicopter services, has navigated significant market shifts, requiring a deep understanding of its customer demographics and target market. From its origins in the offshore oil and gas industry to its expansion into vital services, CHC's evolution offers valuable insights.

This exploration into CHC Group's customer base will reveal the company's strategic adaptations. We'll delve into CHC Group Ltd target audience analysis, examining the consumer profile and how CHC Group identifies its ideal customer. This analysis will provide a comprehensive understanding of CHC Group Ltd customer segmentation and its impact on the company's market position, including CHC Group Ltd market share and CHC Group Ltd customer acquisition strategy.

Who Are CHC Group Ltd’s Main Customers?

Understanding the customer base is crucial for analyzing the business strategy of companies like CHC Group Ltd. The primary customer segments for CHC Group Ltd are diverse, spanning several sectors, with a strong focus on business-to-business (B2B) operations. This diversification highlights the company's ability to serve various needs within the aviation and support services industries. The company's services are critical for infrastructure upkeep of offshore operations.

The customer demographics of CHC Group Ltd are primarily composed of large corporations and governmental entities. These clients rely on CHC Group Ltd for essential services, including transportation, search and rescue, and maintenance. Analyzing the target market reveals a strategic approach to serving both established and emerging sectors.

The company's ability to adapt and expand its services to meet the evolving needs of its clients is a key factor in its market position. The following sections will provide a detailed look at the primary customer segments and their specific requirements.

The initial and historically significant customer base for CHC Group Ltd consists of blue-chip oil and gas companies. These companies require crew change and transportation services to offshore platforms and rigs. In fiscal year 2013, key customers such as Statoil and Petrobras each accounted for approximately 14% of CHC's revenues. The global offshore helicopter market was valued at approximately $2.5 billion in 2024, indicating the scale of this sector.

CHC Group Ltd has expanded its services to government agencies, focusing on search and rescue (SAR) and emergency medical services (EMS). In 2024, CHC's SAR operations supported over 1,000 missions. SAR and EMS activities accounted for approximately 10% of total revenue in fiscal year 2013. The global air ambulance market, a segment of EMS, was valued at $4.95 billion in 2023 and is projected to reach $7.33 billion by 2028.

Heli-One, CHC's maintenance, repair, and overhaul (MRO) division, is a significant customer segment, providing services to various rotor-wing helicopters. Heli-One holds an estimated 15% market share in the helicopter MRO sector in 2024. This segment's revenue growth for CHC Group increased by 10% in 2024, driven by strong MRO services, and Heli-One expanded its service capacity by 12% in 2024 by opening new facilities.

CHC Group Ltd also serves commercial operators, offering helicopter support services and leasing. While the specific revenue contribution from this segment is not detailed in the provided data, it represents a component of the company's diversified customer base. This segment contributes to the overall market share and revenue streams of CHC Group Ltd.

The primary customer segments of CHC Group Ltd include oil and gas companies, government agencies, the MRO division (Heli-One), and commercial operators. These segments reflect a strategic diversification that mitigates risk and expands market reach. Understanding the customer demographics of CHC Group Ltd is essential for evaluating its business model and market position.

- Oil and Gas Companies: Key clients for transportation services.

- Government Agencies: Primarily for SAR and EMS operations.

- Heli-One (MRO): Provides maintenance and repair services, contributing significantly to profitability.

- Commercial Operators: Offers helicopter support and leasing services.

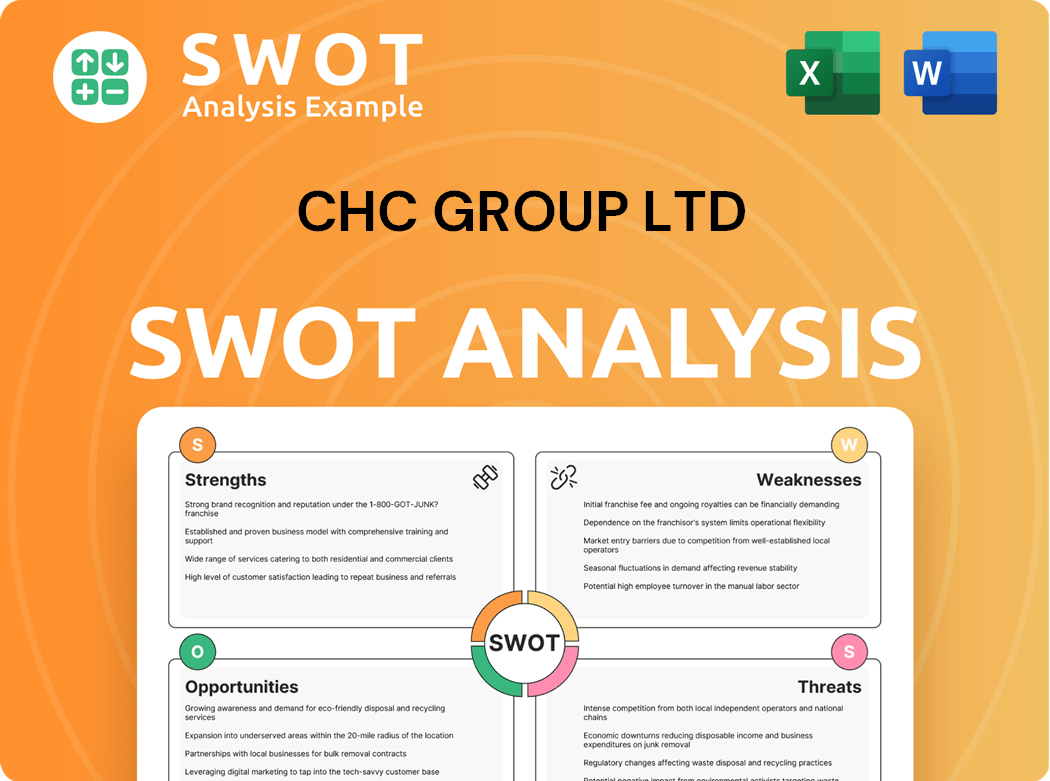

CHC Group Ltd SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do CHC Group Ltd’s Customers Want?

Understanding the customer needs and preferences is crucial for any business. For CHC Group Ltd, a deep dive into their customer base reveals a focus on safety, reliability, and efficiency, which drives their service offerings. This is particularly evident in their B2B relationships within the offshore energy and government sectors, where these factors are paramount.

The primary customer base for CHC Group Ltd consists of entities in the offshore energy and government sectors. These customers have specific needs that CHC Group Ltd aims to fulfill. The company's success hinges on meeting these demands, which are essential for maintaining and growing their market share.

CHC Group Ltd's customer demographics are primarily B2B clients, including offshore oil and gas companies and government agencies. Their target market is defined by the need for specialized aviation services, such as crew transportation, Search and Rescue (SAR), and Emergency Medical Services (EMS). The company's ability to meet these needs directly impacts its market position and customer satisfaction.

Offshore oil and gas companies require safe, efficient crew change and transportation services. This includes reliable access to remote offshore platforms and rigs. CHC Group Ltd's contracts, like the one with DNO signed in August 2024, highlight this need.

Government agencies and clients in SAR and EMS prioritize rapid response and specialized capabilities. They need life-saving medical care in critical situations. CHC Group Ltd's long-term contracts across Norway, Ireland, and Australia demonstrate their commitment to these urgent requirements.

Customers also value operational excellence to minimize downtime. Heli-One, CHC's MRO division, provides comprehensive maintenance services. In 2023, Heli-One performed over 250,000 maintenance man-hours.

CHC Group Ltd tailors services through strategic alliances and collaborative development. ClearSkies flight planning software, developed with customer input, improves flight sustainability. This feedback-driven approach ensures customer satisfaction.

CHC Group Ltd invests in new technologies and enhanced capabilities, such as AI-powered engine diagnostics, adopted in February 2025. This reflects the company's responsiveness to evolving customer requirements and dedication to safety and efficiency.

CHC Group Ltd's customers, including those in the offshore energy sector and government agencies, have specific preferences that drive their choices. These preferences influence the company's strategies for customer acquisition and market share. Understanding these preferences is critical for CHC Group's success.

- Safety: The primary concern for all customers, especially in crew transportation and SAR operations.

- Reliability: Consistent service delivery is crucial, particularly in remote and challenging environments.

- Efficiency: Minimizing downtime and ensuring smooth operations are essential for cost-effectiveness.

- Rapid Response: For SAR and EMS clients, quick and effective responses are critical.

- Specialized Capabilities: Customers require services tailored to their specific needs, such as offshore operations and medical transport.

CHC Group Ltd PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does CHC Group Ltd operate?

CHC Group Ltd operates globally, with a significant presence in over 30 countries. The company's geographical diversity is a key aspect of its business model, allowing it to serve a wide range of customers in the offshore oil and gas industry. Its main operations are strategically based in key regions to maximize market penetration and operational efficiency.

The company's major operating units are strategically located in the United Kingdom, Norway, the Netherlands, South Africa, Brazil, Nigeria, Australia, and Canada. These locations are critical for serving major offshore oil and gas producing regions worldwide. This broad geographical footprint is essential for supporting the company's diverse customer base and maintaining its competitive advantage in the helicopter services market.

CHC Group Ltd's market presence is particularly strong in the North Sea, where it holds a dominant position. In 2006, the company had approximately a 64% market share, compared to Bristow's 30%. Recent contracts in this region include a new crew change and transportation contract with DNO, set to commence in August 2024, and a 12-month contract with Shell for offshore transportation services from the Deepsea Yantai rig, signed in May 2024. Additionally, CHC Helikopter Service, the Norwegian division, entered a $500 million strategic partnership with Aker BP in January 2025 to support offshore helicopter activity in Norway.

CHC Group Ltd maintains a strong presence in the North Sea, holding a significant market share. This dominance is supported by long-standing contracts and strategic partnerships. The North Sea remains a vital market for the company's helicopter services.

CHC is expanding its operations in Brazil, with new contracts signed with Petrobras. The company anticipates a significant increase in its operations in Brazil by the end of 2025. This expansion is part of CHC's broader strategy to tap into high-growth markets.

The company is forming strategic partnerships to enhance its market presence. The partnership with Aker BP in Norway and the MoU with Court Helicopters in Namibia are examples of this strategy. These partnerships help CHC to leverage local knowledge and operational capabilities.

CHC is entering emerging markets, such as Namibia, to diversify its geographical footprint. This expansion strategy involves adapting offerings to meet diverse market needs. This approach positions CHC for future growth in high-potential regions.

CHC Group Ltd's competitive advantage is supported by its strong market share in key regions and its ability to adapt to different market needs. The company faces competition from rivals like Bristow, but its strategic partnerships and geographical diversity help it maintain a strong position. For more details on the company's strategy, see Marketing Strategy of CHC Group Ltd.

Latin America is projected to experience the highest CAGR in the helicopter services market between 2025 and 2030. CHC's expansion in Brazil positions it to capitalize on this growth. This strategic focus highlights the company's commitment to high-growth markets.

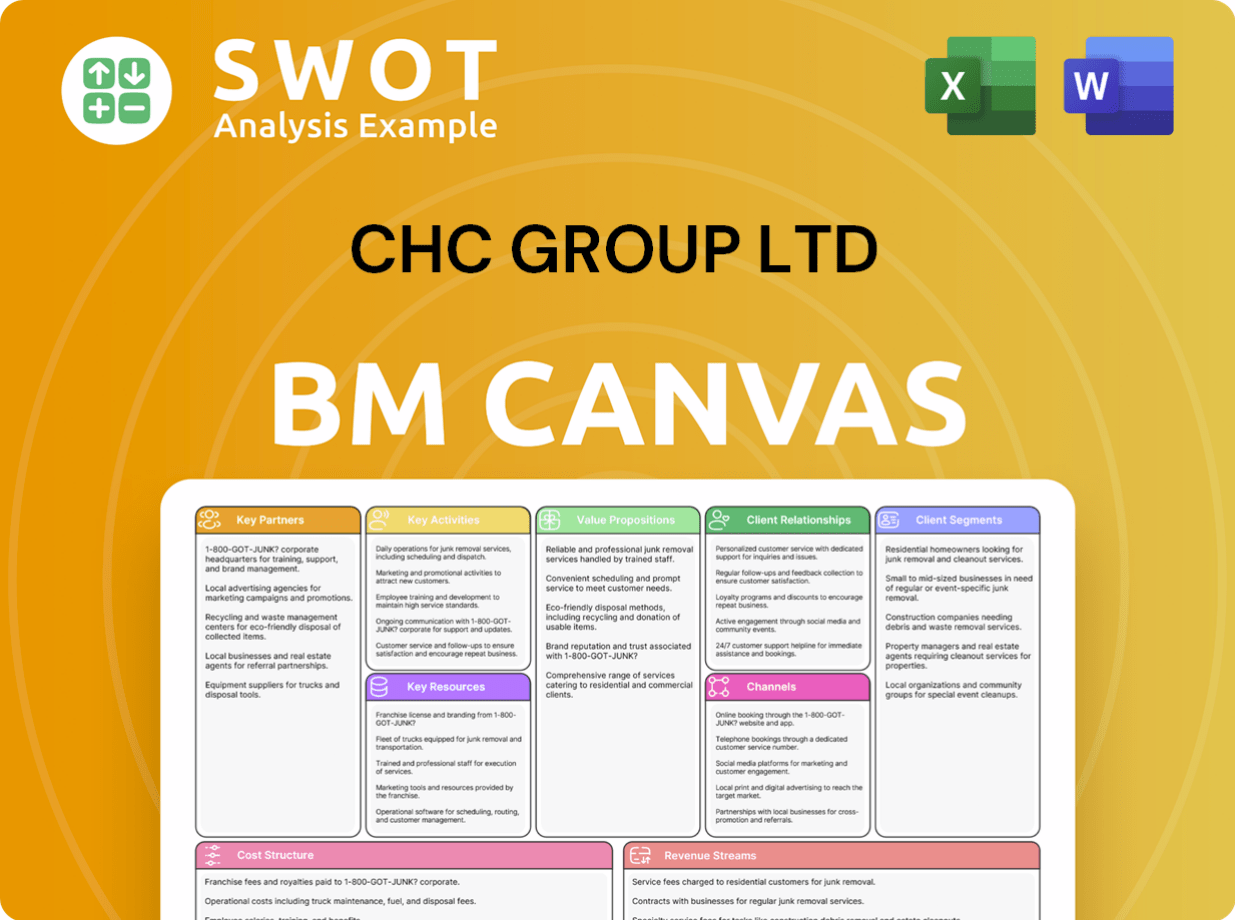

CHC Group Ltd Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does CHC Group Ltd Win & Keep Customers?

The customer acquisition and retention strategies of CHC Group Ltd (referred to as the 'company') are centered around long-term contracts, service diversification, and a customer-centric approach. The company's primary focus is on securing and renewing contracts with major clients in the offshore oil and gas industry and government sectors. This strategy is complemented by expanding service offerings and continuous operational improvements to maintain and enhance customer relationships. These strategies are vital for achieving sustainable growth and maintaining a strong market position.

The company's approach to customer acquisition and retention emphasizes safety, reliability, and long-term strategic partnerships. A core strategy involves securing and renewing long-term contracts with major clients in the offshore oil and gas industry and government sectors. The company also focuses on expanding its service offerings to attract new customers and diversify its revenue. For retention, the company prioritizes continuous improvement and customer-centricity, aiming to meet evolving customer requirements with enhanced safety standards.

The company's strategy includes a significant expansion into Search and Rescue (SAR) and Emergency Medical Services (HEMS) missions globally, with projects in Norway, Australia, Brazil, the United Kingdom, and the Netherlands. This expansion, along with the Memorandum of Understanding (MoU) with Court Helicopters in Namibia in April 2025 to explore SAR and crew change solutions, is a strategic move to acquire new customers and enter new markets. The company also aims to serve customers by meeting their changing requirements with ever-higher levels of safety.

Securing long-term contracts with key clients is a cornerstone of the company's acquisition strategy. For example, the new North Sea crew change and transportation contract with DNO secured in August 2024 demonstrates this approach. The $500 million strategic partnership with Aker BP in Norway, signed in January 2025, is a five-year agreement with options to extend for up to 15 additional years, showcasing a commitment to sustainable relationships.

The company is actively expanding its service offerings, particularly in Search and Rescue (SAR) and Emergency Medical Services (HEMS). The MoU with Court Helicopters in Namibia in April 2025 exemplifies this strategic market entry. This diversification helps attract new customers and reduces dependency on a single revenue stream. This expansion is part of the company's strategy to attract new customers and diversify its revenue.

The company focuses on continuous improvement and customer-centricity to retain customers. Developing proprietary flight planning software like ClearSkies, in close collaboration with core customers, highlights how feedback influences product development and fosters loyalty. This approach ensures that the company meets the evolving needs of its clients and maintains high levels of customer satisfaction.

Heli-One, the company's Maintenance, Repair, and Overhaul (MRO) division, plays a crucial role in retention by ensuring fleet mission readiness and optimizing aircraft performance. Heli-One's revenue growth of 10% in 2024, driven by strong MRO services, indicates the success of this retention-focused strategy. The agreement with ITP Aero in February 2025 to implement AI-powered engine diagnostics further enhances reliability and potentially improves customer lifetime value.

The company's customer acquisition and retention strategies are multifaceted, focusing on long-term contracts, service diversification, and operational excellence. These strategies are crucial for maintaining a competitive edge and ensuring sustainable growth. For more insights, explore the Competitors Landscape of CHC Group Ltd.

- Securing and renewing long-term contracts with key clients.

- Expanding service offerings, particularly in SAR and HEMS.

- Prioritizing continuous improvement and customer-centricity.

- Leveraging Heli-One's MRO services for fleet readiness.

- Embracing new technologies like AI-powered engine diagnostics.

CHC Group Ltd Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CHC Group Ltd Company?

- What is Competitive Landscape of CHC Group Ltd Company?

- What is Growth Strategy and Future Prospects of CHC Group Ltd Company?

- How Does CHC Group Ltd Company Work?

- What is Sales and Marketing Strategy of CHC Group Ltd Company?

- What is Brief History of CHC Group Ltd Company?

- Who Owns CHC Group Ltd Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.