CHC Group Ltd Bundle

Who Truly Owns CHC Group Ltd?

Unraveling the CHC Group Ltd SWOT Analysis is just the beginning; understanding its ownership structure is key to grasping its future. From its founding in 1987 to its emergence from Chapter 11 bankruptcy in 2017, CHC Helicopter's journey has been marked by significant shifts in ownership. Knowing who owns CHC Group Ltd is critical for anyone seeking to understand its strategic direction and market influence.

The evolution of CHC Group Ltd's ownership, including its CHC Group Ltd SWOT Analysis, reflects its resilience in a dynamic industry. This exploration will delve into the key investors and stakeholders, examining how the company's restructuring efforts shaped its current ownership profile. Understanding the CHC Group parent company and its shareholders is crucial for investors, analysts, and anyone interested in the financial health and strategic direction of this global leader in helicopter services.

Who Founded CHC Group Ltd?

The origins of CHC Helicopter, now known as CHC Group Ltd, are rooted in the 1987 merger of Sealand Helicopters and Okanagan Helicopters. This consolidation marked a significant step in the helicopter services industry, creating a stronger entity designed to meet the growing demands of the offshore oil and gas sector. It is important to understand the foundational ownership structure of the company to fully grasp its evolution.

Sealand Helicopters was founded by Carl Agar and Alf Stringer, while Okanagan Helicopters was also founded by Carl Agar. Although specific equity splits from the initial merger are not publicly documented, the merger itself was a pivotal moment. The combined expertise and assets of these two companies allowed for expansion and enhanced service capabilities, especially in the challenging environments of offshore operations.

The early ownership of CHC Group Ltd would have primarily involved the shareholders of Sealand and Okanagan Helicopters at the time of the merger. The focus was on integrating the assets, operational frameworks, and strategic direction of the combined entity. The vision was to provide reliable and safe helicopter transportation, which shaped the initial distribution of control, ensuring operational expertise remained central to the company's leadership.

Sealand Helicopters and Okanagan Helicopters merged in 1987.

Carl Agar founded both Sealand Helicopters and Okanagan Helicopters.

The company aimed to provide air support, especially in the offshore oil and gas sector.

Early ownership involved shareholders from both Sealand and Okanagan.

Operational expertise was central to the leadership of the new company.

The merger aimed to create a stronger market presence.

Understanding the initial ownership is crucial for tracing the evolution of the company. For more details, you can read a Brief History of CHC Group Ltd. The early agreements likely focused on integrating assets and setting the strategic direction. While specific ownership details from this period are not readily available in public records, the emphasis was on creating a strong, reliable helicopter service provider.

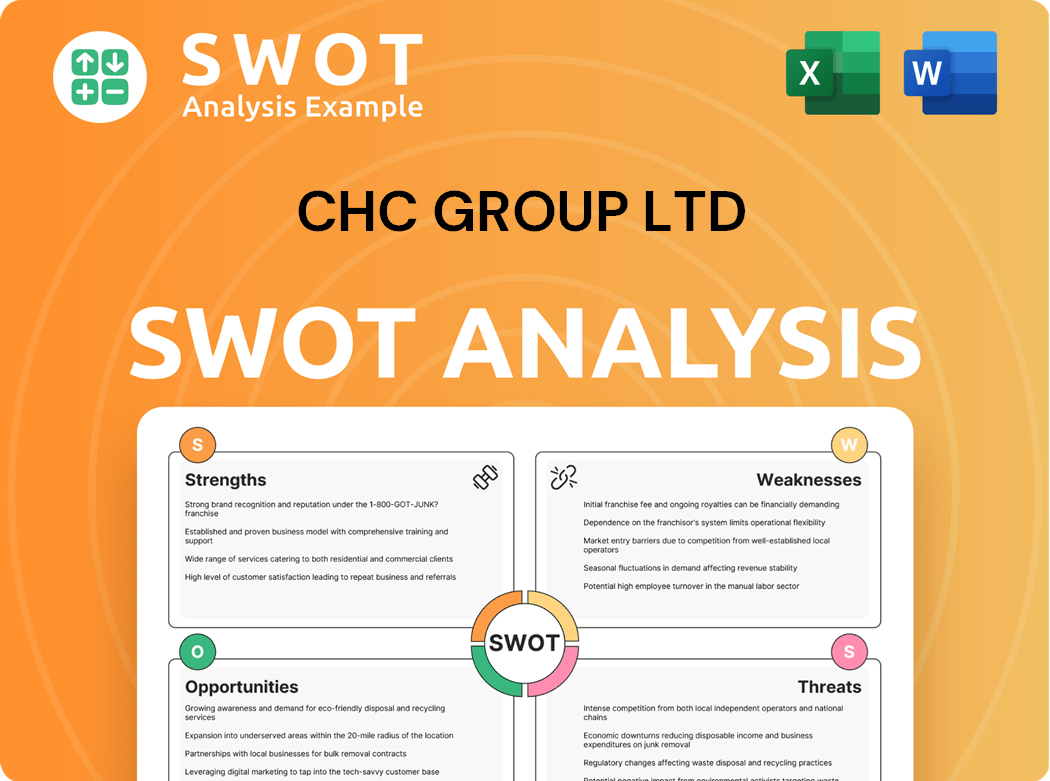

CHC Group Ltd SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has CHC Group Ltd’s Ownership Changed Over Time?

The ownership of CHC Group Ltd has seen substantial shifts, particularly influenced by private equity involvement and a significant restructuring. A pivotal moment was the acquisition by First Reserve Corporation, a private equity firm specializing in energy, in 2008 for approximately $3.7 billion. This move privatized the company, transitioning ownership from public shareholders to a private equity model. Understanding the Target Market of CHC Group Ltd helps to understand the company's operations.

The most impactful change occurred with CHC's Chapter 11 bankruptcy filing in 2016 and its subsequent emergence in 2017. This restructuring fundamentally altered the ownership structure. Upon exiting bankruptcy, CHC's ownership largely transferred to its former creditors, mainly a group of senior secured noteholders. These noteholders exchanged their debt for equity, becoming the new major stakeholders. This shift from private equity to creditor-led ownership enabled CHC to significantly reduce its debt and stabilize its finances.

| Event | Date | Impact on Ownership |

|---|---|---|

| Acquisition by First Reserve Corporation | 2008 | Privatization; Shift to private equity ownership. |

| Chapter 11 Bankruptcy Filing | 2016 | Restructuring; Transfer of ownership to creditors. |

| Emergence from Bankruptcy | 2017 | Creditors become primary stakeholders; Debt reduction. |

As of 2024-2025, CHC Group Ltd remains privately held, primarily owned by institutional investors who were its former creditors. These include various investment funds and financial institutions. While specific shareholder details aren't publicly disclosed, the ownership structure is characterized by a concentrated group of institutional holders who gained control through the bankruptcy reorganization. This structure allows the company to concentrate on operational improvements and strategic growth, though it is still accountable to its institutional investors. The company's focus remains on providing helicopter services, with its ownership structure designed to support long-term stability and strategic execution.

CHC Group Ltd's ownership has evolved significantly, marked by private equity involvement and a major restructuring through bankruptcy.

- First Reserve Corporation's acquisition in 2008 privatized the company.

- The 2016 bankruptcy led to creditors becoming the primary owners.

- As of 2024-2025, institutional investors hold the majority of the shares.

- The current structure supports operational improvements and strategic growth.

CHC Group Ltd PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on CHC Group Ltd’s Board?

The Board of Directors of CHC Group Ltd. currently reflects its ownership structure, primarily consisting of representatives from its major institutional shareholders and independent directors. These board members are crucial in guiding the company's strategic decisions, capital allocation, and overall governance. The exact composition can change, but it typically includes individuals appointed by the key investment funds that hold significant equity stakes. Understanding the dynamics of the board is key to grasping the Growth Strategy of CHC Group Ltd.

Given that CHC Group Ltd. is privately held, the voting structure aligns with equity ownership. Major institutional shareholders, having converted debt to equity during restructuring, hold substantial voting rights. There are no publicly reported instances of dual-class shares or special voting rights that would grant disproportionate control outside of their equity stake. The board's focus is on ensuring the company's long-term financial health and operational efficiency, reflecting the investment objectives of its primary stakeholders. The company's structure and the influence of its shareholders are central to understanding who owns CHC Group.

| Board Member | Role | Affiliation |

|---|---|---|

| [Name - Placeholder] | Chairman | [Institutional Investor - Placeholder] |

| [Name - Placeholder] | Director | [Institutional Investor - Placeholder] |

| [Name - Placeholder] | Director | Independent |

The board is composed of representatives from major shareholders and independent directors. Voting power aligns with equity ownership, reflecting the influence of institutional investors. This structure impacts strategic decisions and operational efficiency.

- Ownership is primarily held by institutional investors.

- Voting rights are proportional to shareholdings.

- The board focuses on long-term financial health.

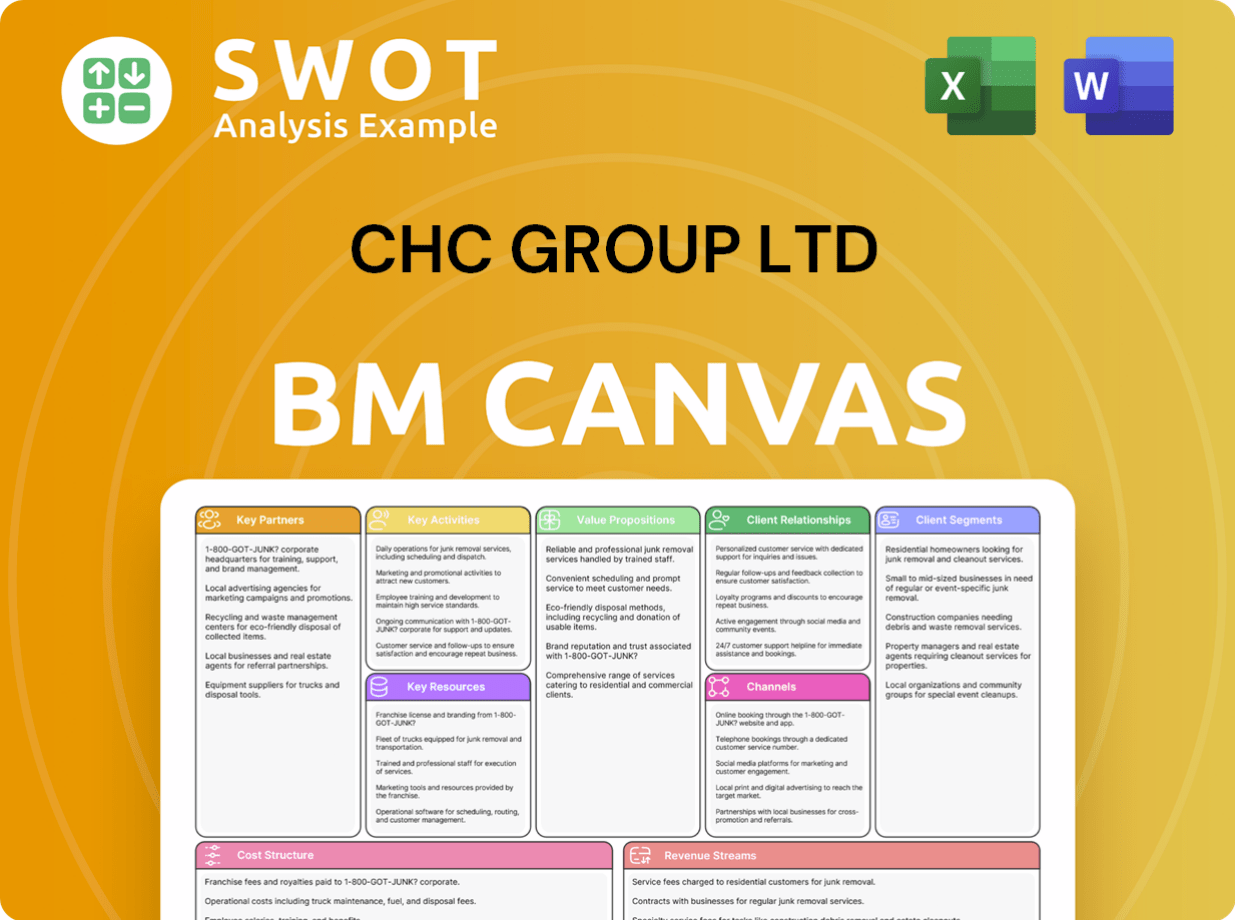

CHC Group Ltd Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped CHC Group Ltd’s Ownership Landscape?

Over the past three to five years (2022-2025), CHC Group Ltd has focused on stabilizing its operations and market position following its financial restructuring. The ownership structure has largely remained consistent, with institutional investors who gained control after the bankruptcy maintaining their stakes. There have been no major shifts in ownership reported, such as new strategic investors or significant share buybacks, as the company has prioritized optimizing its fleet and service offerings. This strategic direction reflects a move towards sustained profitability and strengthening existing partnerships within its current ownership framework.

Industry trends, including consolidation and evolving demands from the offshore oil and gas sector, continue to affect CHC. The broader trend of increased institutional ownership in essential service providers is evident. The company's focus remains on delivering critical services globally, adapting to energy market fluctuations, and leveraging its established infrastructure and expertise. Public statements about planned succession in terms of ownership or potential re-listing on a public exchange have not been made. The emphasis is on operational profitability and strategic partnerships.

| Metric | Value | Year |

|---|---|---|

| Revenue (approx.) | $1.2 billion | 2023 |

| Fleet Size (approx.) | 200+ helicopters | 2024 |

| Employees (approx.) | 2,000+ | 2024 |

The current ownership of CHC Group Ltd primarily consists of institutional investors. The restructuring efforts post-bankruptcy have resulted in a stable ownership structure focused on operational efficiency and market adaptation. The company continues to navigate the helicopter services sector, emphasizing its global presence and expertise in critical services.

The ownership structure has remained largely consistent, with institutional investors maintaining their stakes post-restructuring. This stability supports long-term strategic planning and operational improvements. It reflects a focus on sustained profitability and strategic partnerships.

The company adapts to industry trends, including consolidation and evolving demands from the offshore oil and gas sector. This includes optimizing the fleet and service offerings. The focus is on delivering critical services globally and leveraging existing infrastructure.

Recent financial reports show a focus on improving operational profitability. Revenue figures and fleet size indicate a stable market position. The company leverages its expertise in critical services to maintain its market presence.

The company's strategic focus is on sustained operational profitability and strategic partnerships. This approach supports its ability to adapt to market changes. The emphasis is on delivering essential services globally.

CHC Group Ltd Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of CHC Group Ltd Company?

- What is Competitive Landscape of CHC Group Ltd Company?

- What is Growth Strategy and Future Prospects of CHC Group Ltd Company?

- How Does CHC Group Ltd Company Work?

- What is Sales and Marketing Strategy of CHC Group Ltd Company?

- What is Brief History of CHC Group Ltd Company?

- What is Customer Demographics and Target Market of CHC Group Ltd Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.