Chewy Bundle

Can Chewy Continue to Dominate the Online Pet Market?

Chewy, the online retail giant for pet supplies, has revolutionized the pet industry with its customer-centric approach and vast product selection. From its humble beginnings to its current status as a publicly traded company, Chewy's journey is a testament to the power of a strong Chewy SWOT Analysis and strategic execution. This analysis dives deep into Chewy's business model, market share, and future prospects.

This comprehensive Chewy company analysis explores the e-commerce pet industry, examining Chewy's competitive advantages and how it acquires customers. We'll delve into Chewy's financial performance review, its expansion plans, and the impact of COVID-19. Furthermore, we will explore Chewy's long-term growth forecast, subscription service details, and sustainability initiatives.

How Is Chewy Expanding Its Reach?

The core of the Chewy growth strategy involves aggressive expansion across several key areas. This includes venturing into new markets, launching innovative products and services, and forming strategic partnerships. The company is focused on broadening its reach within the substantial online pet supplies market.

A significant aspect of this strategy is the expansion into pet healthcare services. This move is designed to capture a larger share of the customer's spending and to integrate them more deeply into the ecosystem. The company's future prospects are closely tied to these initiatives.

The company is also leveraging its established customer base through its Autoship program. This program is a critical driver for predictable, recurring revenue and customer retention.

The launch of Chewy Vet Care clinics is a key expansion initiative. The company plans to open an additional 8 to 10 clinics in fiscal year 2025. This expansion taps into a $25 billion total addressable market in veterinary services.

The company is focused on growing its private brands like Frisco, American Journey, and Tylee's. These brands, launched starting in 2016, have been adopted by millions of customers. This strategy enhances customer loyalty and provides higher profit margins.

International expansion is another avenue for growth. The company plans to increase its presence in Canada and explore other regions. This strategy aims to capture a larger share of the global pet supplies market.

The company aims to broaden its selection of products and services. This includes pharmacy offerings and pet insurance to capture a larger share of its existing customers' spending. This diversification strategy enhances customer lifetime value.

The Autoship program is a critical driver for predictable, recurring revenue and customer retention. In Q4 2024, the Autoship program generated $2.62 billion in sales, representing 80.6% of total net sales. The company also intends to increase brand awareness and acquire new customers by investing in advertising and marketing.

- The Autoship program ensures a steady stream of revenue.

- Marketing investments aim to attract new customers.

- Focus on customer retention through subscription services.

- Expansion into new services like pet healthcare.

Chewy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Chewy Invest in Innovation?

The company significantly relies on innovation and technology as a cornerstone of its Chewy growth strategy. This focus is aimed at enhancing the customer experience and improving operational efficiency. Continuous investment in its technology platform is designed to scale with increasing sales volume and active customers, while also aiming to reduce transaction and operational costs.

Chewy's future prospects are closely tied to its ability to leverage technology. This includes substantial investments in research and development, in-house development, and strategic collaborations. The goal is to continually find innovative ways to engage with customers and maintain a competitive edge in the e-commerce pet industry.

A key part of the company's strategy involves using AI and data analytics. This is done to provide personalized recommendations, optimize inventory management, and streamline logistics and supply chain operations. This approach enables more efficient and cost-effective operations, contributing to competitive pricing and high customer satisfaction within the pet food market.

AI and data analytics are central to the company's operations. They enable personalized recommendations and optimized inventory management. These tools also streamline logistics and supply chain operations, leading to cost savings.

The smart reordering system uses data analytics to predict customer needs. This feature enhances convenience by ensuring timely deliveries. It's a key element in retaining customers and driving repeat business.

The company has expanded its digital offerings with telehealth services. 'Connect With a Vet,' launched in 2020, allows online veterinary consultations. This adds value to the customer experience.

Improvements to the e-commerce platform and mobile applications are ongoing. These enhancements allow pet parents to manage their pets' health, wellness, and merchandise needs conveniently. This improves user experience.

Efforts to automate fulfillment centers are underway. Nearly half of order volume already benefits from automation. The long-term goal is 70% automation to reduce labor costs and improve efficiency.

The company consistently invests in its technology platform. This platform is designed to be scalable. This allows for increased sales volume and active customers while aiming to reduce marginal transaction and operational costs.

The company's commitment to digital transformation is evident through its continuous improvements to its e-commerce platform and mobile applications. These platforms allow pet parents to manage their pets' health, wellness, and merchandise needs conveniently. Furthermore, the automation of fulfillment centers is a key focus, with nearly half of its order volume already benefiting from automation. The long-term goal of 70% automation underscores the company's commitment to reducing labor costs and improving overall efficiency. For more insights into their target market, consider reading about the Target Market of Chewy.

The company's technological strategies are multifaceted, focusing on customer experience, operational efficiency, and digital transformation. These strategies are crucial for maintaining a competitive edge in the online pet supplies market and ensuring sustainable growth.

- AI-Driven Personalization: Using AI to offer personalized product recommendations and improve the overall customer experience.

- Data-Driven Inventory Management: Optimizing inventory levels through data analytics to reduce costs and improve order fulfillment times.

- Supply Chain Optimization: Streamlining logistics and supply chain operations to enhance efficiency and reduce expenses.

- Telehealth Services: Providing online veterinary consultations through services like 'Connect With a Vet' to add value to customer offerings.

- E-commerce Platform Enhancements: Continuously improving the e-commerce platform and mobile applications to offer a seamless shopping experience.

- Fulfillment Center Automation: Automating fulfillment processes to reduce labor costs and increase operational efficiency, with a goal of 70% automation.

Chewy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Chewy’s Growth Forecast?

The financial outlook for Chewy in 2025 projects continued expansion and improved margins, underscoring a robust Chewy growth strategy. The company's performance in fiscal year 2024 demonstrated solid financial health, setting a positive trajectory for future growth. This positive trend is supported by strategic initiatives and a strong market position within the e-commerce pet industry.

For fiscal year 2024, the company achieved net sales of $11.86 billion, marking a 6.4% increase year-over-year. Gross margin expanded to 29.2%, an 80 basis point improvement, reflecting operational efficiencies. Net income reached $392.7 million, resulting in a net margin of 3.3%. Adjusted EBITDA for the full year 2024 was $570.5 million, which represents a 4.8% margin. These results are a testament to Chewy's ability to navigate the competitive pet food market and grow its customer base.

Looking ahead, Chewy anticipates net sales between $12.30 billion and $12.45 billion in fiscal year 2025, indicating a 6% to 7% year-over-year growth. The adjusted EBITDA margin is expected to further expand, projected to be between 5.4% and 5.7% in 2025, with a long-term target of 10%. Analysts forecast a 6.1% earnings growth for FY2025, compared to 5.5% in FY2024. This positive outlook supports the Chewy future prospects, driven by its strong financial performance and strategic initiatives.

Chewy's projected net sales for fiscal year 2025 are between $12.30 billion and $12.45 billion. This represents a 6% to 7% year-over-year growth, demonstrating continued expansion in the online pet supplies market. The company's consistent growth is a key indicator of its success in the e-commerce sector.

The adjusted EBITDA margin is expected to increase to between 5.4% and 5.7% in 2025. This expansion reflects improved operational efficiency and cost management. Chewy's long-term target for the adjusted EBITDA margin is 10%, indicating significant potential for further profitability.

Analysts anticipate a 6.1% earnings growth for fiscal year 2025, up from 5.5% in fiscal year 2024. This growth is supported by increased sales and margin expansion. The positive earnings forecast underscores Chewy's financial strength and future potential.

Net sales per active customer are forecast to rise from $554 to $586.50. This increase is driven by an expanding product portfolio, including pharmacy and pet health services. Chewy's ability to increase revenue per customer indicates strong customer loyalty and successful cross-selling strategies.

Chewy's strong financial position is bolstered by record free cash flow of $452.5 million in fiscal year 2024. The company has no long-term debt, allowing for significant share repurchases. This financial health provides flexibility for future investments and growth initiatives.

Chewy's success is supported by strategic initiatives, including an expanding product portfolio and enhanced pet health services. These initiatives contribute to increased sales and customer loyalty. For more insights into the company's values, you can read about the Mission, Vision & Core Values of Chewy.

Chewy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Chewy’s Growth?

The growth trajectory of Chewy faces several potential risks and obstacles. These challenges range from intense competition in the e-commerce pet industry to supply chain vulnerabilities, regulatory changes, and economic factors. Understanding these risks is crucial for a comprehensive Chewy company analysis and assessing its future prospects.

One of the primary hurdles is the competitive landscape. Chewy operates in a market dominated by giants like Amazon and Walmart, as well as established players such as Petco and PetSmart. This competition can lead to pricing pressures and increased marketing expenses, which might affect profit margins. Furthermore, factors like fluctuations in consumer spending and potential economic downturns could lead to reduced spending on premium pet products.

Supply chain disruptions pose another significant risk, especially given Chewy's reliance on a limited number of suppliers. Such disruptions could result in product shortages and higher costs, which would negatively affect revenue and profitability. Additionally, regulatory changes could impact the company's marketing and growth strategies.

Chewy faces strong competition from major e-commerce and traditional retailers. This competitive pressure can lead to pricing wars and increased marketing costs. These factors can impact Chewy's profitability and market share.

Reliance on a limited number of suppliers makes Chewy vulnerable to supply chain disruptions. Such disruptions can cause product shortages and increase costs. These issues can negatively affect revenue and profitability, hindering Chewy's growth.

Economic downturns and changes in consumer spending can affect Chewy. Reduced consumer spending on premium pet products and increased customer acquisition costs are potential risks. These economic shifts can impact Chewy’s financial performance.

Regulatory changes can impact Chewy's marketing strategies and overall growth plans. New regulations can create uncertainty and require adjustments to business operations. These changes can affect Chewy's ability to compete effectively.

Chewy's expansion into veterinary clinics is modest, with only a few new clinics planned. Scaling these initiatives to significantly contribute to overall performance may take time. This slow expansion could limit Chewy's revenue diversification.

Increasing customer acquisition costs pose a challenge for Chewy. High marketing expenses are needed to attract and retain customers. This can impact profit margins and overall financial performance.

To mitigate these risks, Chewy focuses on diversifying revenue streams. They aim to improve operational efficiencies and continue emphasizing customer loyalty and innovation. Chewy's strong subscription service, Autoship, drives recurring revenue.

Chewy's strong Autoship program provides a defensible edge against broader market challenges. Their niche focus on pet care is also a key advantage. These strategies help Chewy maintain customer loyalty and drive recurring revenue.

For a deeper dive into how Chewy generates revenue, consider exploring the Revenue Streams & Business Model of Chewy.

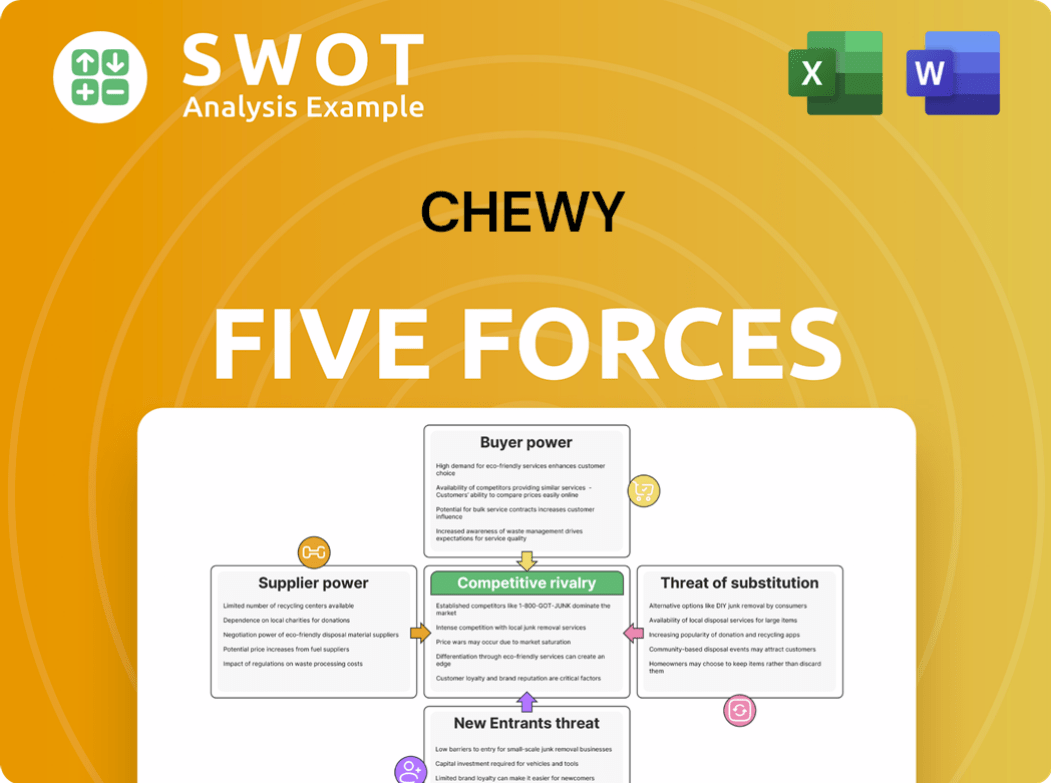

Chewy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Chewy Company?

- What is Competitive Landscape of Chewy Company?

- How Does Chewy Company Work?

- What is Sales and Marketing Strategy of Chewy Company?

- What is Brief History of Chewy Company?

- Who Owns Chewy Company?

- What is Customer Demographics and Target Market of Chewy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.