Chewy Bundle

How Does the Chewy Company Thrive in the Pet Care Market?

Chewy, Inc. has rapidly become a dominant force in the online pet retail space. With impressive financial results, including $11.86 billion in net sales for fiscal year 2024, the Chewy SWOT Analysis can help you understand the company's strengths and weaknesses. This performance highlights Chewy's strong market position and ability to adapt within the ever-changing industry.

This in-depth analysis explores how Chewy works, from its extensive selection of pet supplies and pet food delivery to its innovative customer service. Discover how this online pet store leverages its Autoship program and veterinary services to drive growth and maintain its competitive edge. Investors and pet parents alike will gain valuable insights into Chewy's operational model and its strategies for long-term success, including understanding details like Chewy customer service phone number and Chewy return policy.

What Are the Key Operations Driving Chewy’s Success?

The Chewy company creates value by providing a comprehensive online platform for pet products and services. It caters to a broad spectrum of pet owners, offering a vast selection of pet food, treats, toys, health supplies, and medications. The company also provides services like Chewy Pharmacy and Connect with a Vet telehealth to build brand loyalty and encourage repeat purchases.

How Chewy works involves meticulously designed operational processes to ensure efficient delivery and customer satisfaction. A highly efficient distribution network is central to its ability to provide fast and reliable delivery. The company leverages its proprietary technology platform for seamless customer experiences, from managing pet health and wellness needs to convenient shopping. Supply chain optimization, personalized product recommendations, and enhanced customer service are also key operational focuses, contributing to improved efficiency and reduced costs.

Chewy partners with approximately 3,200 trusted brands in the pet industry and also offers its own private label brands, further expanding its product assortment. Its subscription-driven sales model, primarily through its Autoship program, forms a significant portion of its revenue and fosters strong customer retention. This recurring revenue model, coupled with a high-touch service model, differentiates Chewy from competitors. Continuous investment in technology, including AI-powered chatbots and self-service tools, further enhances its customer experience and operational effectiveness.

Chewy offers a wide range of products including pet food, treats, toys, health supplies, and medications. It also provides services like Chewy Pharmacy and telehealth services. This diverse offering aims to meet all the needs of pet owners, making it a one-stop shop for pet supplies.

Chewy focuses on providing exceptional customer service and personalized support. It uses technology, including AI-powered chatbots, to enhance the customer experience. The company aims to build strong relationships with its customers, fostering loyalty and repeat purchases.

Chewy has a highly efficient distribution network and leverages its proprietary technology platform. Supply chain optimization and personalized product recommendations are key. These efforts contribute to improved efficiency and reduced costs.

The Autoship program is a significant part of Chewy's business model, fostering strong customer retention. This recurring revenue model, combined with high-touch service, sets Chewy apart. This approach ensures a steady stream of revenue and encourages customer loyalty.

Chewy's success is built on several key differentiators. These include a wide selection of products, competitive pricing, and personalized customer support. The subscription-based model and investment in technology further enhance its market position. For more insights, check out the Competitors Landscape of Chewy.

- Wide product selection, including private label brands.

- Subscription-driven Autoship program for recurring revenue.

- Focus on customer service and personalized support.

- Investment in technology, including AI and self-service tools.

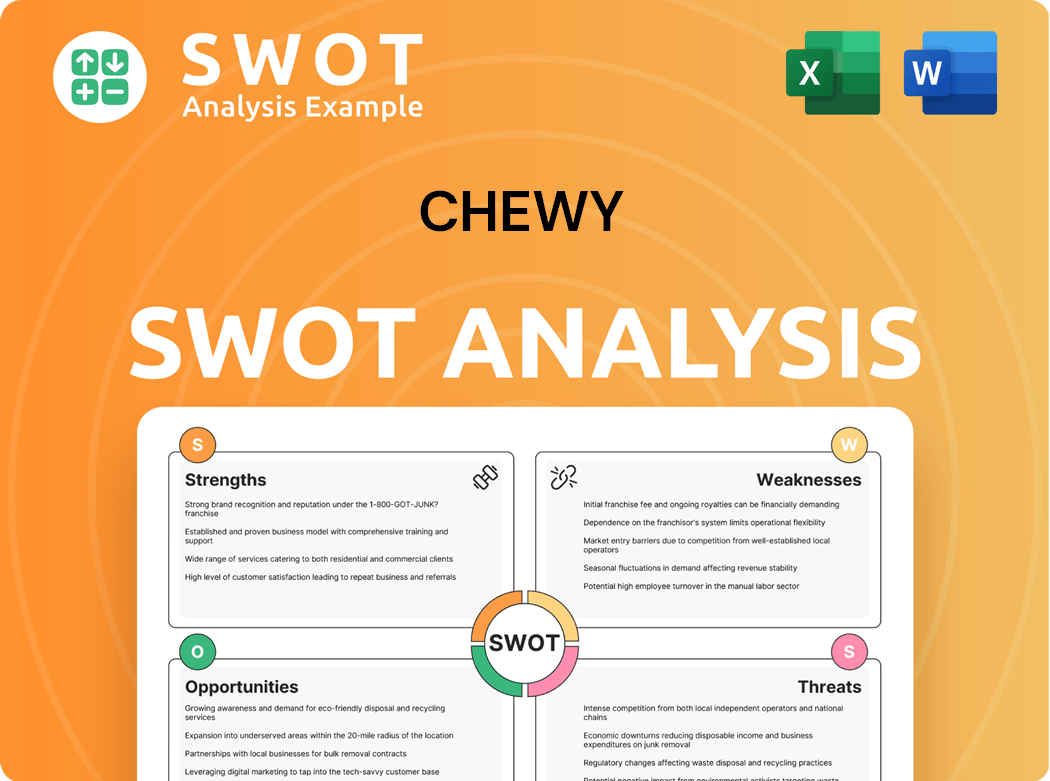

Chewy SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Chewy Make Money?

The Chewy company generates revenue primarily through the sale of pet products and services. It utilizes a multi-faceted approach to generate income, focusing on product sales, subscription services, and expanding into the pet healthcare market. This strategy allows the company to capture a significant share of the pet industry's overall spending.

The company's financial performance is driven by a combination of product sales, subscription programs, and strategic initiatives. A significant portion of its revenue comes from its Autoship subscription program, which provides a predictable and recurring revenue stream. Chewy also focuses on innovative monetization strategies beyond direct product sales, such as advertising and veterinary services, to enhance its value proposition and drive growth.

Understanding how Chewy works involves looking at its revenue streams and how it monetizes its services. The company has successfully built a strong customer base and continues to expand its offerings to meet the diverse needs of pet owners. This approach has enabled Chewy to maintain a competitive edge in the online pet store market.

The core of Chewy's revenue model is the sale of pet products, including food, treats, toys, and supplies. A significant portion of these sales comes from its Autoship subscription program. This program offers convenience and discounts, encouraging repeat purchases and customer loyalty. For the fourth quarter of fiscal year 2024, Autoship sales grew by 21.2% to $2.62 billion, representing 80.6% of Chewy's net sales for that quarter and 79.2% for the full fiscal year 2024. For the full fiscal year 2024, Chewy's net sales reached $11.86 billion, growing 6.4% year-over-year.

- Autoship provides a predictable and recurring revenue stream.

- Customers tend to spend more after their first year, contributing to a stable revenue base.

- The program enhances customer retention and reduces customer acquisition costs.

Chewy is expanding into veterinary services, aiming to capture a portion of the pet healthcare market. This includes Chewy Vet Care clinics, Chewy Pharmacy, and telehealth services like Connect with a Vet. These services enhance the company's value proposition and provide new revenue avenues. As of fiscal year 2024, Chewy operated eight veterinary clinics, with plans to open an additional 8 to 10 in fiscal year 2025. This expansion allows Chewy to offer a more comprehensive suite of services, increasing customer engagement and lifetime value.

- Chewy Vet Care clinics provide in-person veterinary services.

- Chewy Pharmacy offers prescription medications and other healthcare products.

- Telehealth services connect pet owners with veterinarians remotely.

Chewy is developing its sponsored ads business, Chewy Ads, to generate additional revenue. This retail media network allows brands to reach targeted pet owners through various onsite and offsite channels. The company aims for sponsored ads to contribute up to 3% of total enterprise net sales in the long term. Additionally, Chewy is increasing sales of higher-margin private label products, which contribute to improved profitability and margin expansion. This diversification strategy helps Chewy to increase its profitability and strengthen its market position. For more details, you can read about the Growth Strategy of Chewy.

- Chewy Ads provides a platform for brands to advertise to pet owners.

- Private label products offer higher profit margins.

- These initiatives contribute to overall revenue growth and profitability.

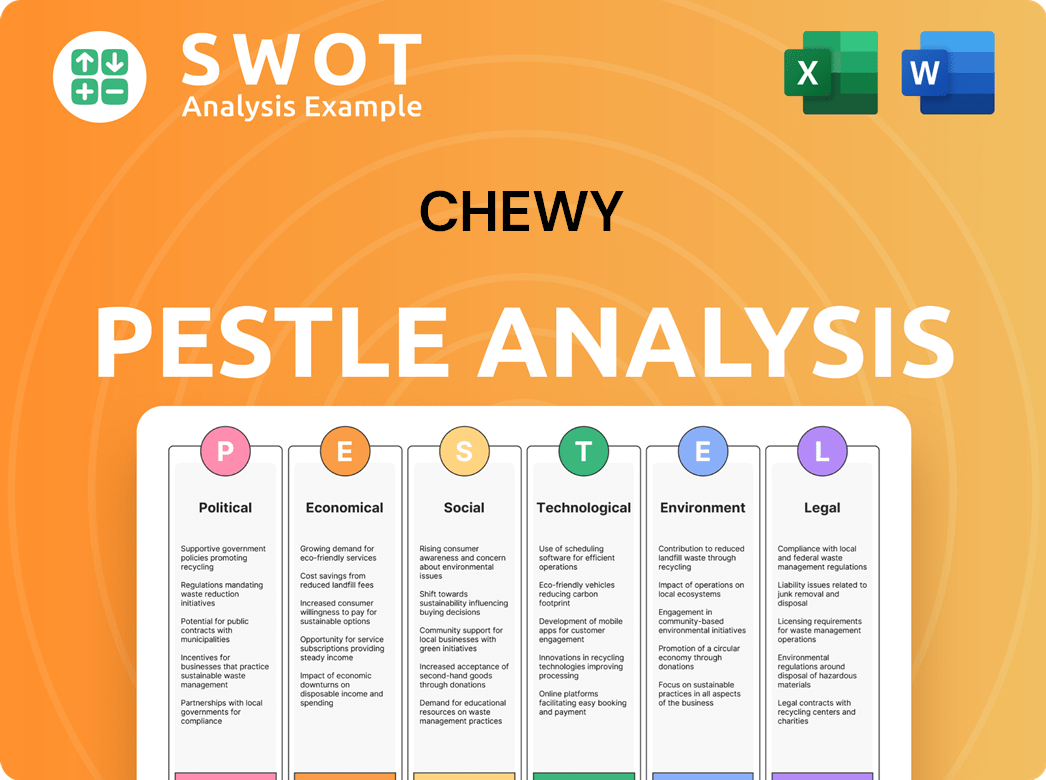

Chewy PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Chewy’s Business Model?

The journey of the Chewy company has been marked by significant milestones and strategic initiatives that have shaped its operations and financial performance. A key strategy is the expansion into veterinary services with Chewy Vet Care, with eight clinics opened in fiscal year 2024 and plans for 8-10 more in fiscal year 2025. This move is aimed at diversifying revenue streams and increasing customer loyalty by tapping into the large pet healthcare market. Another crucial strategic development is the continued enhancement of its retail media network, Chewy Ads, which is becoming a notable revenue contributor.

The company has navigated operational and market challenges, including intense competition from major retailers like Amazon and Walmart, potential supply chain disruptions, and the need to manage high customer acquisition costs. Chewy has responded by focusing on efficient marketing channels, optimizing its supply chain, and investing in technology to improve operational efficiency and customer satisfaction. For instance, automation in its distribution centers is already delivering a 30% productivity boost per square foot. To understand more about their customer base, you can explore the Target Market of Chewy.

Chewy's competitive advantages are multifaceted. Its strong brand reputation, loyal customer base, and comprehensive product range are key strengths. The Autoship program stands out as a significant competitive edge, driving recurring revenue and fostering strong customer loyalty, with Autoship sales accounting for over 80% of net sales in Q4 2024. The company's emphasis on exceptional customer service, fast shipping, and a personalized shopping experience further differentiates it. Chewy also leverages data analytics and artificial intelligence to provide tailored product recommendations, enhancing customer engagement and driving sales. The expansion into higher-margin private label products and pet pharmacy services also contributes to its competitive moat. Chewy continues to adapt to new trends and competitive threats by consistently innovating its product offerings, improving its mobile app experience, and refining its customer segmentation strategies.

Chewy has achieved significant growth since its founding, marked by strategic acquisitions and expansions. The company went public in 2019, which fueled further growth and investment in its infrastructure. Continuous innovation in its services and product offerings has been a consistent theme.

The launch of Chewy Vet Care and the expansion of Chewy Ads are key strategic moves. Investments in automation and supply chain optimization are ongoing. These moves aim to enhance customer loyalty and diversify revenue streams.

Chewy's strong brand reputation, Autoship program, and focus on customer service are key differentiators. Data analytics and AI-driven personalization enhance the customer experience. The expansion into private label products and pet pharmacy services also provides a competitive advantage.

Chewy has shown robust financial performance, with Autoship sales contributing significantly to net sales. The company is investing in growth initiatives, including expanding its vet care services. The focus on operational efficiency and customer satisfaction supports its financial health.

Chewy distinguishes itself through several key advantages, including its strong brand reputation and a loyal customer base. Its comprehensive product range and commitment to customer service further enhance its position in the market. The Autoship program is a significant driver of recurring revenue and customer loyalty.

- Autoship Program: Drives recurring revenue, with over 80% of sales in Q4 2024.

- Customer Service: Exceptional customer service and personalized shopping experiences.

- Data Analytics: Leverages data and AI for tailored product recommendations.

- Expansion: Expanding into private label products and pet pharmacy services.

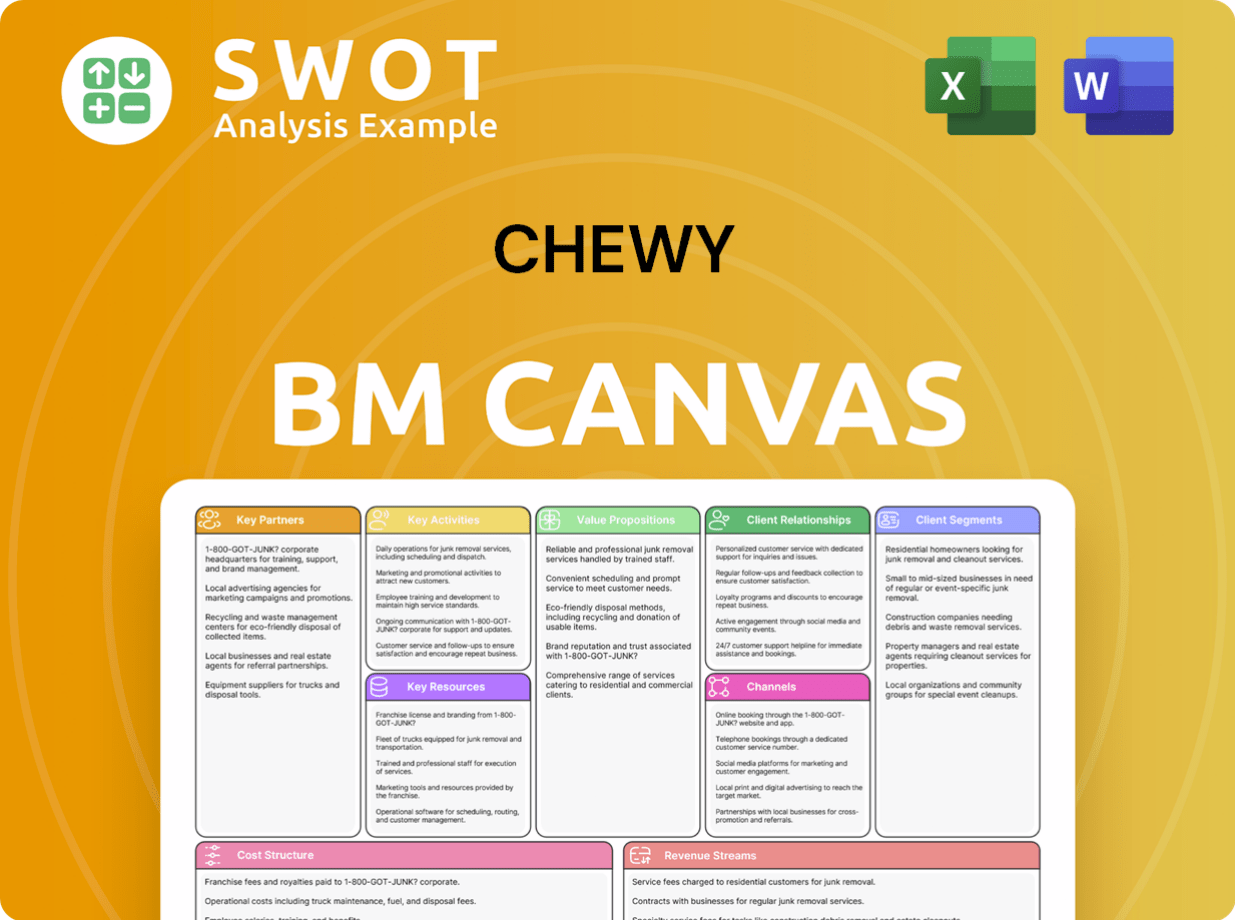

Chewy Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Chewy Positioning Itself for Continued Success?

The Chewy company has established itself as a leading player in the online pet retail sector, often compared to the 'Amazon for pet products.' The Chewy company ended fiscal year 2024 with 20.5 million active customers, showing a return to year-over-year growth. The company's Autoship program drives customer loyalty and recurring revenue, with approximately 80% of sales coming from this subscription-based service.

Despite its strong market position, Chewy faces challenges. Competition from major retailers like Amazon and Walmart is a significant concern. Economic factors, including inflation and rising operational costs, could affect profitability. Changes in consumer spending habits and potential supply chain disruptions also present risks. Read a Brief History of Chewy for more background.

As of 2023, Chewy held around 51% of the online pet supplies market share, showing its dominance in the industry. Its focus is primarily on the US market, although it is expanding globally. The company's strong customer base and subscription model contribute to its robust market position within the online pet store industry.

Key risks include intense competition from larger retailers with vast resources. Economic pressures, such as inflation and higher operational costs, pose challenges. Changes in consumer behavior and potential supply chain issues also represent risks. The departure of the CFO adds uncertainty regarding financial strategy.

Chewy projects net sales for fiscal year 2025 to be between $12.3 billion and $12.45 billion, indicating 6% to 7% year-over-year growth. The company anticipates further adjusted EBITDA margin expansion to between 5.4% and 5.7% for fiscal year 2025. They aim to accelerate active customer growth in 2025 and 2026.

The company plans to expand its Chewy Vet Care clinics and develop its sponsored ads business. They will continue investing in technology and automation to enhance operational efficiency. Refining subscription offerings will also be a focus to sustain growth and customer loyalty.

In fiscal year 2025, Chewy expects to achieve significant financial milestones. These projections reflect the company's strategic initiatives and its commitment to growth and profitability. The company is focused on expanding its services and customer base.

- Net Sales: $12.3 billion to $12.45 billion (6% to 7% growth)

- Adjusted EBITDA Margin: 5.4% to 5.7%

- Long-Term EBITDA Target: 10%

- Focus on active customer growth in 2025 and 2026

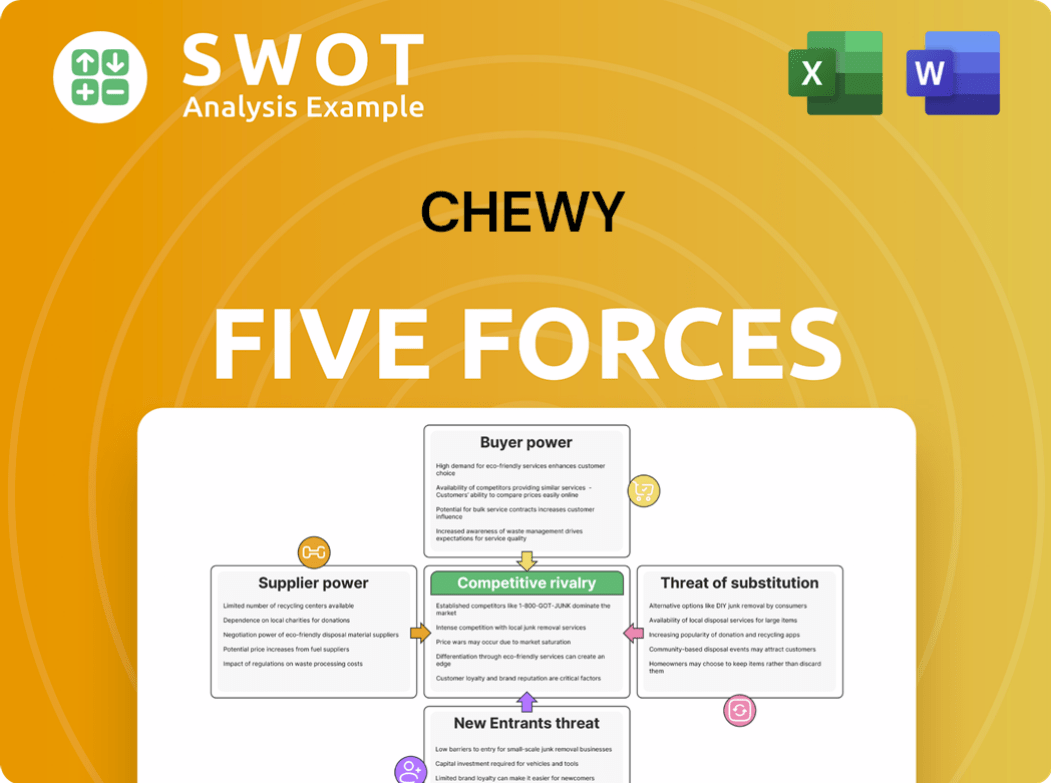

Chewy Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Chewy Company?

- What is Competitive Landscape of Chewy Company?

- What is Growth Strategy and Future Prospects of Chewy Company?

- What is Sales and Marketing Strategy of Chewy Company?

- What is Brief History of Chewy Company?

- Who Owns Chewy Company?

- What is Customer Demographics and Target Market of Chewy Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.