Ciena Bundle

Can Ciena Conquer the Future of Connectivity?

Ciena Corporation, a titan in the networking arena, stands at a critical juncture. With the explosion of data and the rise of AI, the demand for high-bandwidth services is soaring, presenting both immense opportunities and complex challenges. Founded in 1992, Ciena has evolved from its early days of wavelength division multiplexing to become a global force in telecommunications.

This deep dive into Ciena SWOT Analysis will explore the Ciena Growth Strategy, examining its Ciena Future Prospects within the dynamic telecommunications landscape. We'll dissect Ciena's Market Share, Financial Performance, and strategic initiatives, including its innovation in optical networking and its impact on 5G deployment. This Ciena Company Analysis will provide actionable insights for investors and stakeholders alike, assessing Ciena's long-term investment potential and navigating its challenges and opportunities within the competitive landscape.

How Is Ciena Expanding Its Reach?

Ciena's expansion initiatives are primarily fueled by the increasing need for high-speed connectivity. This demand is especially strong from cloud providers and the growing use of AI workloads. The company is actively working to enter new markets and broaden its existing presence, focusing on its leadership in optical technology.

A key aspect of Ciena's Ciena Growth Strategy involves leveraging its optical expertise to grow into adjacent markets. These include core networking applications, Data Center Interconnect (DCI) solutions, and pluggable devices. Management anticipates that hyperscalers will contribute over 30% of fiscal 2025 revenues. Additionally, indirect exposure through Managed Optical Fiber Network (MOFN) and submarine applications is expected to generate another 10%-15% of revenue.

MOFN, currently representing 5% of revenue, is poised for significant growth in the coming year. This growth is driven by service providers building capacity to support cloud providers. Ciena's focus on innovation and expansion is crucial for its Ciena Future Prospects and overall Ciena Company Analysis.

Ciena is expanding its share of the optical networking market outside of China. This strategic move is part of the company's broader growth strategy. This expansion is crucial for maintaining and increasing its Ciena Market Share.

The Blue Planet platform is a key component of Ciena's software and services business. Sales surged 87% year-over-year in Q1 2025, emphasizing its importance in network automation and orchestration. This growth highlights Ciena's focus on software and services revenue streams.

Ciena's collaboration with Lumen Technologies showcases its commitment to addressing the growing demand for high-speed, low-latency connectivity. They achieved a 1.2 terabit wavelength over 1,800 miles using Ciena's WaveLogic 6 Extreme technology. This partnership is vital for supporting AI and cloud applications.

Ciena's focus on high-speed connectivity is crucial for supporting AI and cloud applications. Their technology and partnerships are designed to meet the increasing demands of these sectors. This commitment is key for future growth and success in the Telecommunications industry.

Ciena's expansion strategy includes entering new markets and leveraging its optical leadership. The company is focused on growth in core networking, DCI solutions, and pluggable devices. These initiatives are designed to drive Ciena's revenue growth drivers.

- Focus on Hyperscalers: Targeting hyperscalers for over 30% of fiscal 2025 revenues.

- MOFN Growth: Anticipating significant growth in Managed Optical Fiber Network.

- Blue Planet Platform: Expanding software and services with an 87% year-over-year sales surge.

- Strategic Partnerships: Collaborating with Lumen Technologies for advanced connectivity solutions.

For a deeper understanding of Ciena's customer base and market positioning, consider exploring the Target Market of Ciena. This analysis provides valuable insights into the company's strategic direction and its ability to capitalize on emerging opportunities in the telecommunications sector.

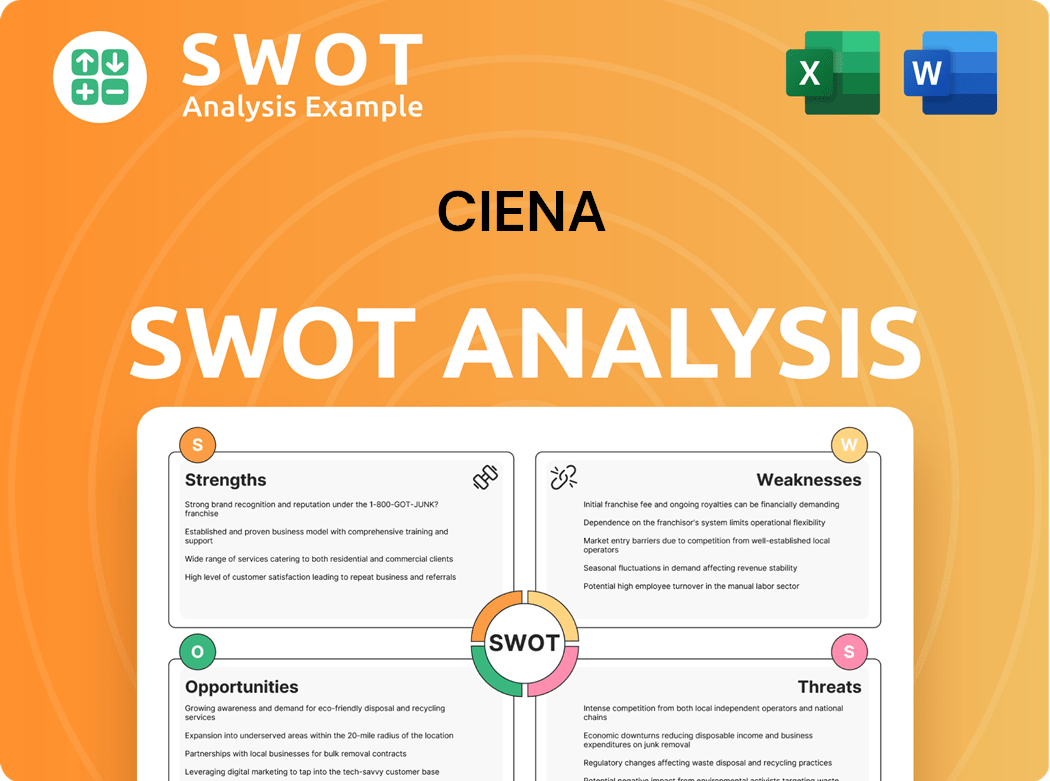

Ciena SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ciena Invest in Innovation?

The growth strategy of the company is heavily reliant on its dedication to innovation and technological leadership. This focus has positioned the company as a key player in the optical networking sector, with substantial investments in research and development to drive advancements in high-speed connectivity. The company's ongoing efforts in this area are crucial for maintaining its competitive edge and capitalizing on emerging market opportunities.

The company's approach to digital transformation is evident through its emphasis on network automation and orchestration, particularly with its Blue Planet platform. The company is also actively leveraging technologies like AI to boost demand for core networking applications, DCI solutions, and pluggable devices. These initiatives are designed to meet the evolving needs of its customers and the growing demands of the telecommunications industry.

As of 2025, the company is the sole provider of 1.6 Tbps single-lambda coherent optics, a significant technological breakthrough. This innovation reduces the number of components, lowers electricity consumption, and minimizes infrastructure needs while maintaining the same power footprint as previous generations. This positions the company to effectively cater to the surging demands of AI workloads and other data-intensive applications.

The company's leadership in optical networking is a cornerstone of its growth strategy. It is consistently at the forefront of developing high-speed connectivity solutions.

The company is actively investing in network automation and orchestration, particularly through its Blue Planet platform. This helps in streamlining network operations and enhancing efficiency.

The company is leveraging AI to boost demand for core networking applications, DCI solutions, and pluggable devices. This integration is crucial for meeting the evolving needs of its customers.

The company is the only supplier of 1.6 Tbps single-lambda coherent optics as of 2025. This is a significant technological advancement.

The company has unveiled groundbreaking coherent optical and IMDD technologies for data center connectivity. These innovations are designed to meet the increasing bandwidth demands driven by AI.

The company holds an extensive patent portfolio, with over 1,800 active patents in networking technologies as of 2024. This demonstrates its commitment to innovation and protecting its intellectual property.

The company's commitment to innovation is reflected in its significant R&D investments and technological breakthroughs. These advancements are crucial for its Ciena Growth Strategy and future prospects.

- WaveLogic 6 Extreme Technology: This technology added 20 new customers in Q1 2025, indicating strong market adoption and product innovation.

- R&D Expenditure: The company invested $686.4 million in research and development in fiscal year 2023, demonstrating a strong commitment to future technological advancements.

- Pluggable Devices: Record orders for pluggable devices highlight the company's leadership in product innovation and its ability to meet market demands.

- Impact on 5G Deployment: The company's technologies play a crucial role in supporting 5G deployment, enabling faster and more reliable network connectivity.

- Data Center Interconnect (DCI) Solutions: The company's DCI solutions are essential for high-speed data transfer between data centers, supporting the growth of cloud infrastructure.

The company's innovation strategy, combined with its strong financial performance and market position, positions it well for long-term growth. The company's focus on technological advancements and strategic partnerships will be key to its success in the competitive telecommunications landscape. For more information on the company's core values, you can read about the Mission, Vision & Core Values of Ciena.

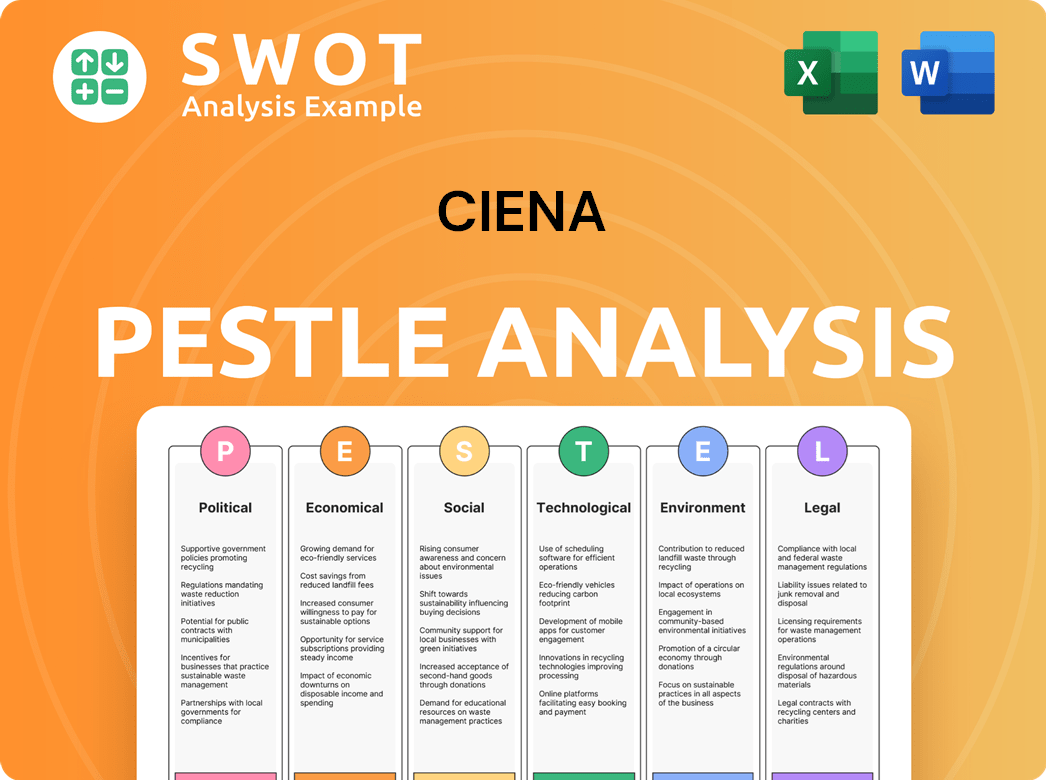

Ciena PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ciena’s Growth Forecast?

The financial outlook for Ciena appears promising, with the company targeting revenue growth at the high end of an 8% to 11% guidance range for fiscal year 2025. This positive forecast follows a challenging fiscal year 2024, where revenue decreased by 8.47%, dropping from $4.39 billion in 2023 to $4.01 billion. Despite a slight dip in GAAP net income in Q1 2025, the company demonstrated strong performance in adjusted (non-GAAP) net income, exceeding analyst expectations.

For the first quarter of fiscal year 2025, Ciena reported revenue of $1.07 billion, representing a 3.3% increase year-over-year. This growth was primarily fueled by the Networking Platforms segment, particularly in optical networking. The Americas region played a significant role, contributing $795.7 million to the overall revenue.

Analysts are projecting substantial earnings growth for Ciena in the coming year, with an estimated increase of 59.38%, from $1.60 to $2.55 per share. This follows a 33% decline in fiscal 2024, where earnings were $1.82 per share. Ciena's adjusted gross margin improved to 44.7% in Q1 2025, up from 41.6% in Q4 2024. The company also generated $104 million in cash from operations during Q1 2025 and maintained a robust cash and investments position of approximately $1.3 billion. Furthermore, Ciena's share repurchase program, with approximately 1.0 million shares repurchased for $79.2 million in Q1 2025, reflects confidence in its strategic direction.

Ciena's revenue growth in Q1 2025 was primarily driven by its Networking Platforms segment, especially optical networking. This indicates a strong demand for its core products and services within the telecommunications sector. The Americas region's significant contribution also highlights the importance of geographical market presence.

The company's financial performance in Q1 2025 showed resilience. While GAAP net income saw a slight decrease, adjusted net income exceeded expectations, demonstrating effective cost management and operational efficiency. The increase in adjusted gross margin also points to improved profitability.

The projected earnings growth of 59.38% next year suggests a positive outlook for Ciena's stock performance. The share repurchase program further indicates the company's confidence in its future, which could positively impact investor sentiment and stock valuation. For further insights, you can read more about Ciena's strategic initiatives in this detailed article Ciena Company Analysis.

Ciena operates in a competitive landscape within the telecommunications industry. Its ability to maintain and improve gross margins, along with strong revenue growth in key segments, is crucial for its competitive positioning. The company's focus on innovation in optical networking is a key differentiator.

Ciena's long-term investment potential appears promising, supported by its revenue growth projections and strategic initiatives. The company's strong financial position, including its cash reserves and share repurchase program, provides flexibility for future investments and expansion. The ability to maintain a strong market share is critical.

Ciena faces challenges such as market competition and the need for continuous innovation. However, opportunities exist in the growing demand for high-speed internet and 5G deployment, which could drive further growth. Strategic partnerships and expansion into new markets can also create opportunities.

Ciena Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ciena’s Growth?

The path to growth for Ciena, like any major player in the telecommunications sector, is fraught with risks and obstacles. The company operates within a highly competitive landscape, facing challenges from established rivals and emerging technologies. Understanding these potential pitfalls is crucial for assessing Owners & Shareholders of Ciena and making informed decisions about its future.

Several factors could impact Ciena's financial performance and strategic goals. These include the evolving nature of the market, regulatory changes, and the need to continuously innovate to stay ahead of the curve. Analyzing these challenges provides a clearer picture of the environment in which Ciena operates.

Ciena's growth strategy also faces risks related to its customer concentration and supply chain dependencies. Any disruptions in these areas could significantly affect the company's ability to meet its financial targets and maintain its market position. The company's ability to mitigate these risks is a key factor in its long-term success.

The telecommunications equipment market is intensely competitive. Major players like Cisco, Ericsson, and Nokia, along with software vendors such as Amdocs and Oracle, constantly vie for market share. This competition directly impacts Ciena's ability to secure new contracts and maintain profit margins.

Changes in regulations, including tariffs and trade policies, can disrupt supply chains and impact macroeconomic conditions. These factors can lead to increased costs and delays, affecting Ciena's financial performance and its ability to meet customer demands.

Ciena's reliance on a few key customers poses a concentration risk. In fiscal year 2024, two customers accounted for over 10% of the company's revenue. Any significant shifts in spending patterns or relationship changes with these major customers could significantly impact Ciena's revenue and profitability.

The networking industry is subject to rapid technological advancements, especially in areas such as AI and cloud technologies. Ciena must continually invest in research and development to remain competitive. Failure to innovate could result in a loss of market share and reduced profitability.

Disruptions in the supply chain can lead to delays in production and increased costs. Geopolitical events, natural disasters, and other unforeseen circumstances can exacerbate these vulnerabilities. Effective supply chain management is essential to mitigate these risks.

Managing internal resources, including skilled personnel and financial capital, is crucial for supporting growth. Limited resources can hinder Ciena's ability to pursue new opportunities and maintain its competitive edge. Efficient resource allocation is vital for sustainable growth.

Ciena addresses these risks through various strategies. Diversifying its customer base, as it has done since its early reliance on Sprint and WorldCom, helps to reduce concentration risk. The company's strong backlog, which reached approximately $2.1 billion at the end of fiscal year 2024, provides a buffer against short-term fluctuations, offering some stability. Ciena also focuses on operational efficiency, as demonstrated by its stable pretax profit margin of 7.9% and a current ratio of 3.7, indicating its ability to manage operational commitments effectively.

The competitive landscape impacts Ciena's ability to maintain and grow its Ciena market share. While Ciena held a 19% market share in the optical transport equipment market in 2024, continuous innovation and strategic partnerships are essential to staying ahead. The intensity of competition requires constant vigilance and adaptation to maintain its position.

Ciena Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ciena Company?

- What is Competitive Landscape of Ciena Company?

- How Does Ciena Company Work?

- What is Sales and Marketing Strategy of Ciena Company?

- What is Brief History of Ciena Company?

- Who Owns Ciena Company?

- What is Customer Demographics and Target Market of Ciena Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.