Darling Ingredients Bundle

Can Darling Ingredients Continue to Thrive in the Circular Economy?

Darling Ingredients (NYSE: DAR) has carved a unique niche as a global leader in transforming waste into valuable resources. From its origins in 1882, the company has evolved from a rendering firm to a powerhouse in sustainable ingredients. This analysis explores Darling Ingredients' Darling Ingredients SWOT Analysis, growth trajectory, and future potential.

This deep dive into Darling Ingredients' business development will examine its strategic initiatives for future growth, including expansion plans and technological advancements. We'll dissect the company's financial performance analysis, assessing its revenue growth and market share within the context of evolving market trends. Understanding Darling Ingredients' competitive landscape and sustainability initiatives is crucial for evaluating its long-term growth strategy and investment potential.

How Is Darling Ingredients Expanding Its Reach?

The expansion initiatives of Darling Ingredients are central to its growth strategy, focusing on both market diversification and geographical expansion. These moves are designed to strengthen its position in existing markets and capitalize on emerging opportunities, particularly in the renewable energy and sustainable ingredients sectors. The company's approach combines organic growth with strategic acquisitions and partnerships to achieve its objectives.

A key element of Darling Ingredients' strategy involves entering new markets, especially within the sustainable aviation fuel (SAF) sector. This move aligns with the increasing global demand for low-carbon aviation fuel and positions the company to capitalize on this emerging market. The company's expansion efforts are driven by a commitment to diversify revenue streams, access new customer bases, and stay ahead of industry changes.

Darling Ingredients is actively pursuing a multi-faceted expansion strategy to solidify its market leadership and tap into new growth avenues. This strategy includes entering new markets and product categories, particularly within the rapidly expanding sustainable aviation fuel (SAF) sector. The company is also expanding its global footprint and product offerings through strategic partnerships and acquisitions.

Darling Ingredients has made significant strides in the SAF sector. The company started up one of the world's largest SAF units in Port Arthur, Texas, in the fourth quarter of 2024. This initiative is expected to significantly enhance profitability.

Darling Ingredients is expanding its global footprint and product offerings through strategic partnerships and acquisitions. A notable recent development is the agreement with Tessenderlo Group to form a new joint venture called Nextida™, which will combine their collagen and gelatin businesses.

This non-cash transaction, expected to close in 2026, aims to accelerate growth in the fast-growing collagen-based health, wellness, and nutrition sectors. The joint venture is expected to generate annual revenue of $1.5 billion and have a total production capacity of 200,000 metric tons across 23 global facilities.

Darling Ingredients has already secured three-year offtake agreements for its initial SAF production at a premium of over $2 per gallon. These expansion initiatives are driven by the company's commitment to diversify revenue streams, access new customer bases, and stay ahead of industry changes.

Darling Ingredients' expansion strategy is focused on entering new markets, particularly SAF, and expanding its global footprint through partnerships and acquisitions. The company is also focused on integrating acquisitions worldwide to position itself for future growth and adapt to global market dynamics.

- Start-up of one of the world's largest SAF units in Port Arthur, Texas in Q4 2024.

- Agreement with Tessenderlo Group to form the Nextida™ joint venture.

- Secured three-year offtake agreements for SAF production at a premium.

- Focus on integrating acquisitions to adapt to global market dynamics.

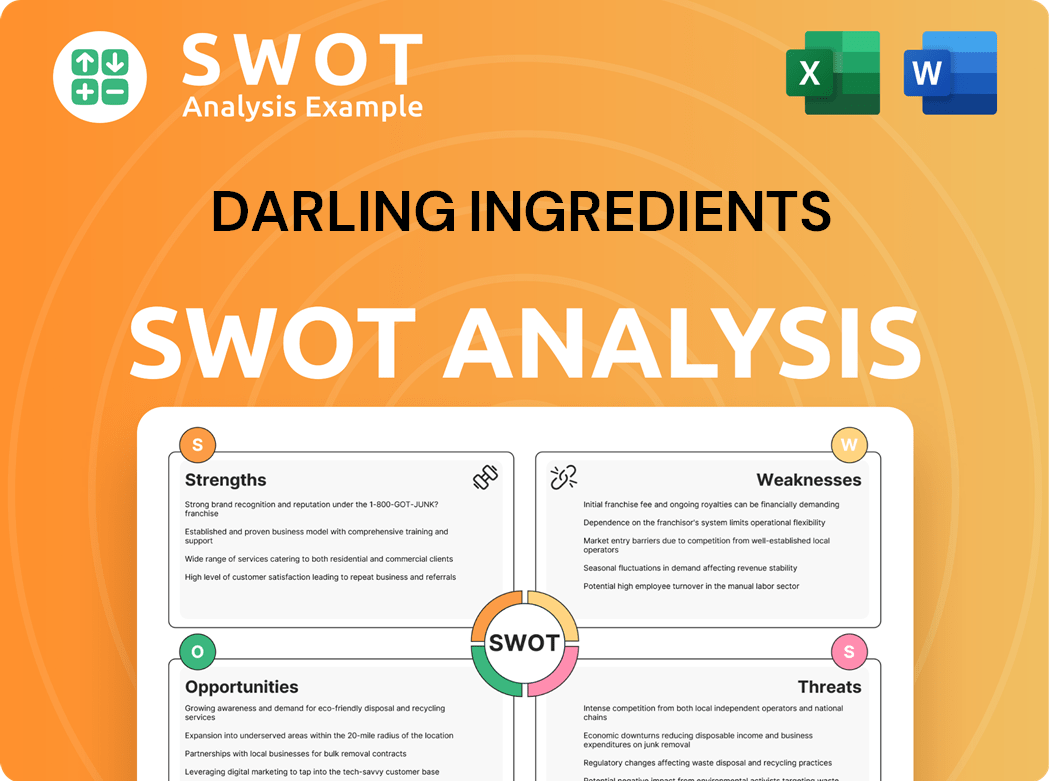

Darling Ingredients SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Darling Ingredients Invest in Innovation?

Darling Ingredients' Growth Strategy hinges significantly on innovation and technology, driving its Future Prospects through strategic investments and collaborations. The company's core business model is inherently innovative, focused on transforming by-products from the animal agriculture and food industries into valuable ingredients. This approach not only adds value but also promotes sustainability by repurposing materials that might otherwise be waste.

The company's commitment to innovation is evident in its continuous investment in research and development. This includes in-house development initiatives and strategic partnerships aimed at enhancing its operational efficiency and expanding its product offerings. Darling Ingredients' ability to adapt and integrate new technologies is crucial for maintaining a competitive edge in the market.

A key area of technological advancement is the renewable fuels sector, particularly through its joint venture, Diamond Green Diesel (DGD). DGD focuses on converting various feedstocks, including animal fats and used cooking oil, into renewable fuels like renewable diesel and sustainable aviation fuel (SAF). The company is also exploring technologies to reduce its environmental footprint, such as producing renewable natural gas (RNG) from wastewater.

DGD's capacity is expanding, with a focus on renewable diesel and SAF. This expansion is critical for meeting the growing demand for sustainable fuels and reducing carbon emissions. The Port Arthur, Texas, SAF unit, which started in Q4 2024, is a significant step in this direction.

Darling Ingredients is implementing technologies to minimize its environmental impact. The production of RNG from wastewater at its Dublin, Georgia, facility is a prime example. This reduces Scope 1 emissions and creates a new revenue stream.

The company is focused on digital transformation to enhance efficiency. This includes improving the management of its nationwide transportation network for feedstocks, particularly for low-carbon intensity markets. This helps improve the efficiency of the supply chain.

Darling Ingredients prioritizes cybersecurity. Its cyber program is recognized as being in the top 10% of the Energy/Resource Industry, as highlighted in its Annual ESG Report. This demonstrates a commitment to protecting its assets and data.

Continuous investment in research and development is a core part of Darling Ingredients' strategy. These investments support the development of new products and technologies. This helps maintain a competitive edge.

Collaborations are essential for driving innovation and expanding market reach. These partnerships enable the company to leverage external expertise and resources. This helps accelerate the development of new technologies.

Darling Ingredients' Growth Strategy is significantly shaped by its innovation and technology initiatives. The company focuses on converting waste streams into valuable products, particularly in the renewable fuels sector. This approach is supported by investments in R&D, in-house development, and strategic collaborations.

- Renewable Fuels Expansion: The expansion of DGD's capacity to produce renewable diesel and SAF, with the SAF unit in Port Arthur, Texas, operational in Q4 2024.

- Sustainability Initiatives: Implementation of technologies to reduce environmental impact, such as producing RNG from wastewater, which reduces emissions and generates new revenue.

- Digital Transformation: Enhancing operational efficiency through digital solutions, including optimizing the transportation of feedstocks.

- Cybersecurity: Maintaining a robust cybersecurity program to protect assets and data, with the program ranked in the top 10% of the Energy/Resource Industry.

- R&D Investments: Continuous investment in research and development to support the development of new products and technologies.

- Strategic Partnerships: Collaborations to drive innovation and expand market reach, leveraging external expertise and resources.

For a deeper understanding of how Darling Ingredients approaches its Marketing Strategy, you can explore more details in the Marketing Strategy of Darling Ingredients.

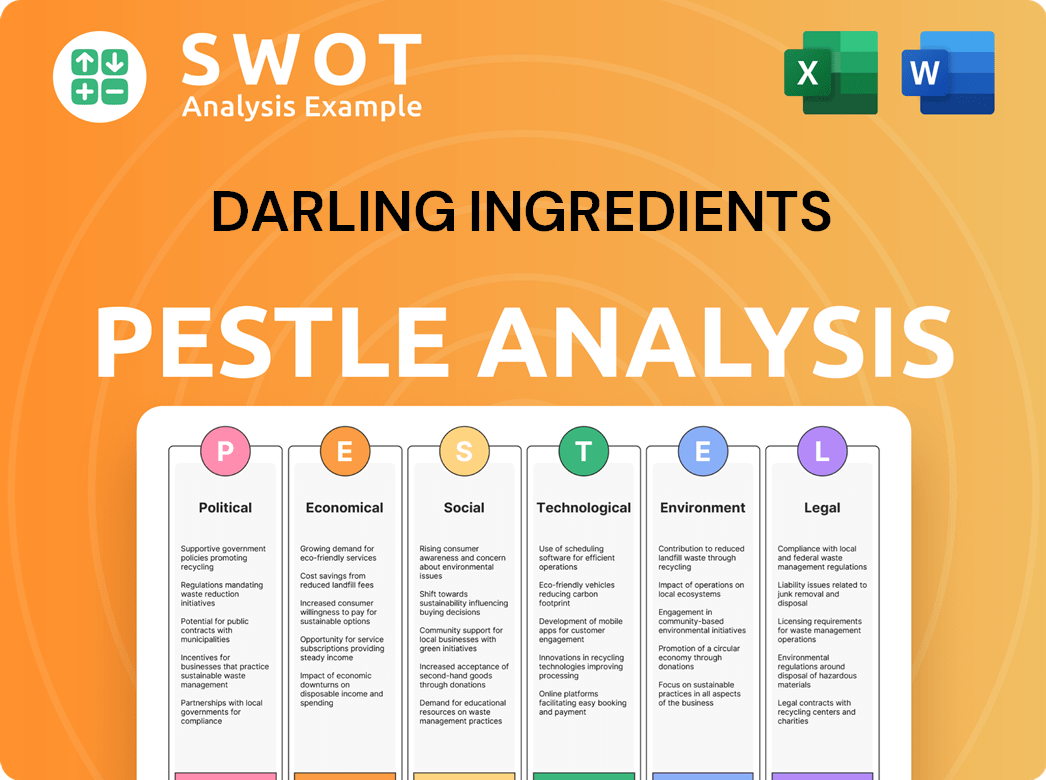

Darling Ingredients PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Darling Ingredients’s Growth Forecast?

The financial outlook for Darling Ingredients suggests a positive trajectory, particularly in 2025. The company anticipates a stronger financial performance, driven by strategic initiatives and market dynamics. This positive outlook is supported by specific financial targets and strategic actions.

In fiscal year 2024, the company reported net sales of $5.7 billion, a decrease from $6.8 billion in 2023. Net income for 2024 was $278.9 million, or $1.73 per diluted share, a decrease from $647.7 million, or $3.99 per diluted share, in 2023. Combined Adjusted EBITDA for fiscal year 2024 totaled $1.08 billion, compared to $1.61 billion in 2023. A detailed Brief History of Darling Ingredients can provide additional context.

Looking ahead, the company projects a Combined Adjusted EBITDA of $1.25 billion to $1.30 billion for fiscal year 2025. This forecast is based on several key factors, including improved fat prices, the completion of DGD turnarounds, and an increasing percentage of Sustainable Aviation Fuel (SAF) sales. The core business is expected to contribute approximately $950 million to $1 billion in EBITDA for fiscal year 2025.

Despite a net loss of $(26.2) million, or $(0.16) per diluted share, in Q1 2025, the core business showed resilience. The company's overall positive cash flow indicates a stable operational foundation. Darling Ingredients also received $129.5 million in cash dividends from DGD during this quarter.

In Q1 2025, the company repurchased approximately 1 million shares of its common stock for about $35 million. Additionally, Darling Ingredients reduced its debt by $146.2 million, demonstrating a commitment to financial discipline. These actions reflect a proactive approach to capital allocation and debt management.

As of March 29, 2025, Darling Ingredients held $81.5 million in cash and cash equivalents. The company also had $1.27 billion available under its revolving credit agreement. Total debt outstanding stood at $3.9 billion. The company is focused on reducing its financial leverage to 2.5x.

Capital expenditures for fiscal year 2024 were $332.5 million. The company plans to increase these expenditures to approximately $400 million in 2025, contingent on market conditions. This increase reflects ongoing investments in infrastructure and future growth initiatives.

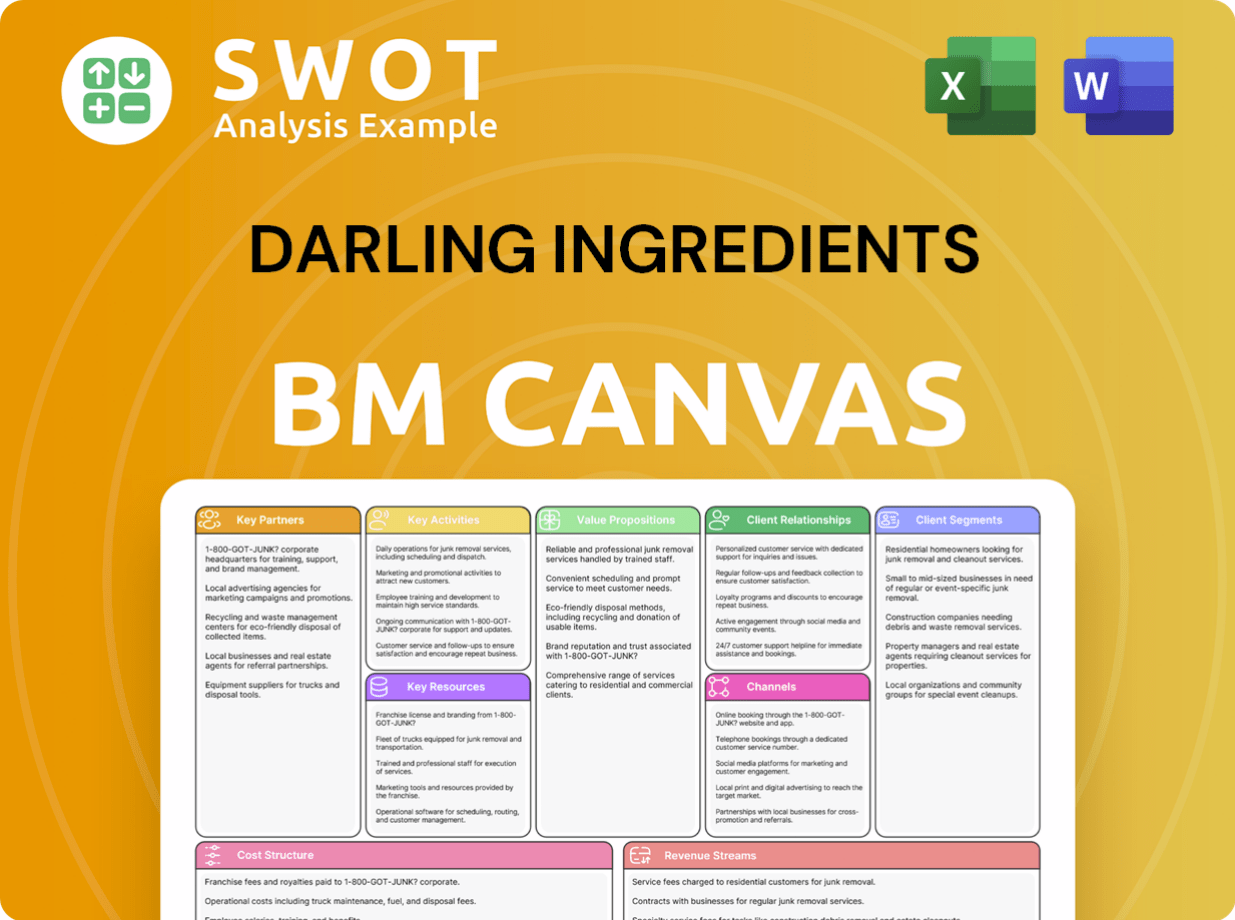

Darling Ingredients Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Darling Ingredients’s Growth?

Analyzing the potential risks and obstacles is crucial for understanding the Darling Ingredients' future prospects and growth strategy. The company operates in dynamic markets, facing competition, regulatory changes, and supply chain vulnerabilities. Understanding these challenges is key to evaluating the Darling Ingredients stock forecast and its long-term investment potential.

Market competition, especially in renewable fuels and ingredients, presents a significant hurdle. Regulatory shifts, particularly in biofuel policies, add another layer of complexity. Furthermore, supply chain issues and the impact of climate change pose operational risks that the company must navigate to maintain its revenue growth and market position.

Darling Ingredients must proactively manage these risks to capitalize on its expansion plans. Strategic responses, such as diversification and operational excellence, are essential for mitigating challenges and ensuring sustained success. A comprehensive company analysis is needed to assess the impact of these factors on the company's financial performance.

Darling Ingredients faces intense competition, especially in renewable fuels and ingredients. The global renewable fuel market reached $202.7 billion in 2024. Darling Ingredients held a 4.3% market share, highlighting the competitive intensity. The company also faces competition from alternative protein sources in animal feed markets.

Regulatory changes, especially those related to biofuel policies, pose a significant risk. The anticipated shift from a blenders tax credit to a producers tax credit in 2025 is crucial. Environmental regulations, including EPA Scope 3 emissions reporting, add further compliance costs. Navigating these changes is vital for the company's business development.

Supply chain vulnerabilities, including feedstock fluctuations, can impact operations. The rendering industry is concentrated, with a limited number of providers. Climate change impacts on agricultural production could disrupt operations, such as a projected 7.2% reduction in livestock feed availability. These factors are essential for understanding the Darling Ingredients industry outlook.

Technological disruption from new protein sources or processing methods could emerge. The insect protein market is projected to reach $4.09 billion by 2032, growing at a CAGR of 16% between 2024 and 2032. This potential disruption impacts the company's long term growth strategy.

Darling Ingredients manages risks through diversification across feed, food, and fuel ingredients. A broad geographical presence helps mitigate market volatility and regulatory changes. Focus on operational excellence and margin management also contributes to its resilience. This approach is key to analyzing Darling Ingredients' market share.

Despite challenges, such as lower earnings at Diamond Green Diesel in Q1 2025, Darling Ingredients' core business has demonstrated stability and positive cash flow. This allows the company to continue deleveraging its balance sheet and opportunistically repurchase shares. For more details, explore the Competitors Landscape of Darling Ingredients.

The primary challenges include intense market competition, especially in the renewable fuels sector. Regulatory changes, particularly in biofuel policies, pose significant risks. Supply chain vulnerabilities, including feedstock fluctuations, also present operational challenges. Understanding these challenges is essential for Darling Ingredients' financial performance analysis.

Darling Ingredients mitigates risks through diversification and a broad geographical presence. Focusing on operational excellence and margin management is crucial. The company's proactive approach to managing these challenges is key to its strategic partnerships and long-term success. These strategies influence the company's investment potential.

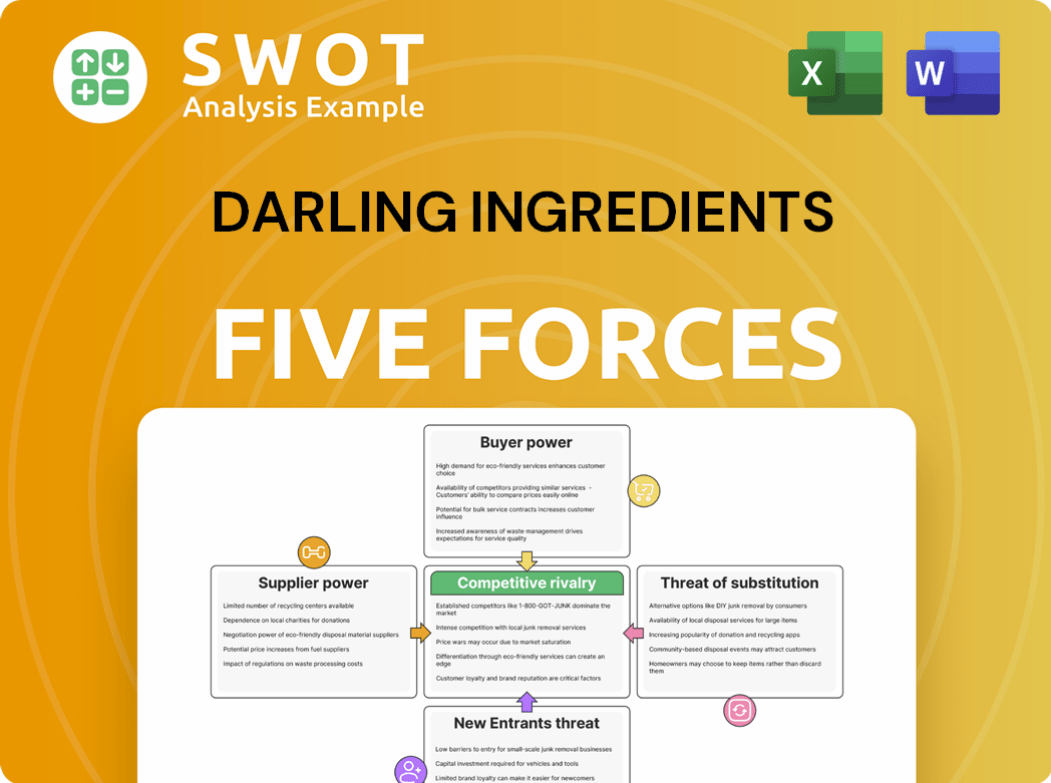

Darling Ingredients Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Darling Ingredients Company?

- What is Competitive Landscape of Darling Ingredients Company?

- How Does Darling Ingredients Company Work?

- What is Sales and Marketing Strategy of Darling Ingredients Company?

- What is Brief History of Darling Ingredients Company?

- Who Owns Darling Ingredients Company?

- What is Customer Demographics and Target Market of Darling Ingredients Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.