Darling Ingredients Bundle

How Does Darling Ingredients Thrive in the Sustainable Ingredients Market?

Darling Ingredients Company is a global leader, transforming waste into valuable resources across vital industries. From pharmaceuticals to renewable energy, its impact is far-reaching, solidifying its role in the circular economy. With impressive financial results, including approximately $6.7 billion in net sales for 2023, Darling Ingredients showcases its robust market position and operational excellence.

This Darling Ingredients SWOT Analysis can help investors understand the company's strengths, weaknesses, opportunities, and threats. Darling International's core business focuses on collecting and repurposing animal by-products, converting them into essential ingredients. Furthermore, Darling Ingredients offers sustainable solutions, including renewable diesel, making it a key player in the shift toward eco-friendly practices and food waste recycling.

What Are the Key Operations Driving Darling Ingredients’s Success?

Darling Ingredients Company, a leading global player, excels in transforming bio-nutrients into a diverse range of sustainable ingredients and specialty solutions. The company focuses on converting animal by-products into valuable resources, contributing significantly to the circular economy. This approach not only generates revenue but also addresses environmental concerns related to food waste recycling.

The core of Darling Ingredients' operations involves sourcing, processing, and distributing these transformed materials. They provide ingredients for various sectors, including pharmaceuticals, food manufacturing, pet food, and renewable energy. The company's commitment to innovation and sustainability positions it as a key player in the evolving landscape of sustainable solutions.

Darling Ingredients' value proposition centers on its ability to create sustainable and traceable ingredients while offering cost-effective waste management solutions. This is achieved through a vertically integrated business model, allowing control over the entire value chain. The company's operations are supported by a vast global network, including over 270 facilities across more than 17 countries, highlighting its extensive reach and operational efficiency.

Darling Ingredients offers a variety of products, including collagen, tallow, and proteins. These products cater to various industries, such as pharmaceuticals, food, and pet food. Additionally, the company is a significant producer of renewable diesel through its Diamond Green Diesel joint venture.

The operational processes begin with sourcing animal by-products and involve advanced processing technologies. A global logistics network ensures efficient transportation and distribution. The company's commitment to research and development drives continuous innovation in product development and processing efficiency.

Darling Ingredients serves a wide range of customers, including pharmaceutical companies, food manufacturers, and pet food producers. Agricultural businesses and the bio-energy sector are also key customer segments. This diverse customer base highlights the broad applicability of the company's products.

The company provides sustainable and traceable ingredients, offering cost-effective waste management solutions. Darling Ingredients contributes to the circular economy by converting waste into valuable resources. This approach aligns with global sustainability trends and regulatory pressures, setting it apart in the market.

Darling Ingredients' unique capabilities stem from its scale, technological expertise, and vertically integrated model. This allows the company to control the entire value chain, ensuring efficiency and quality. The company's focus on food waste recycling and sustainable solutions positions it favorably in the market. For more insights, you can explore the Competitors Landscape of Darling Ingredients.

- Unparalleled scale of operations.

- Technological expertise in rendering and processing.

- Vertically integrated business model for complete control.

- Commitment to sustainability and the circular economy.

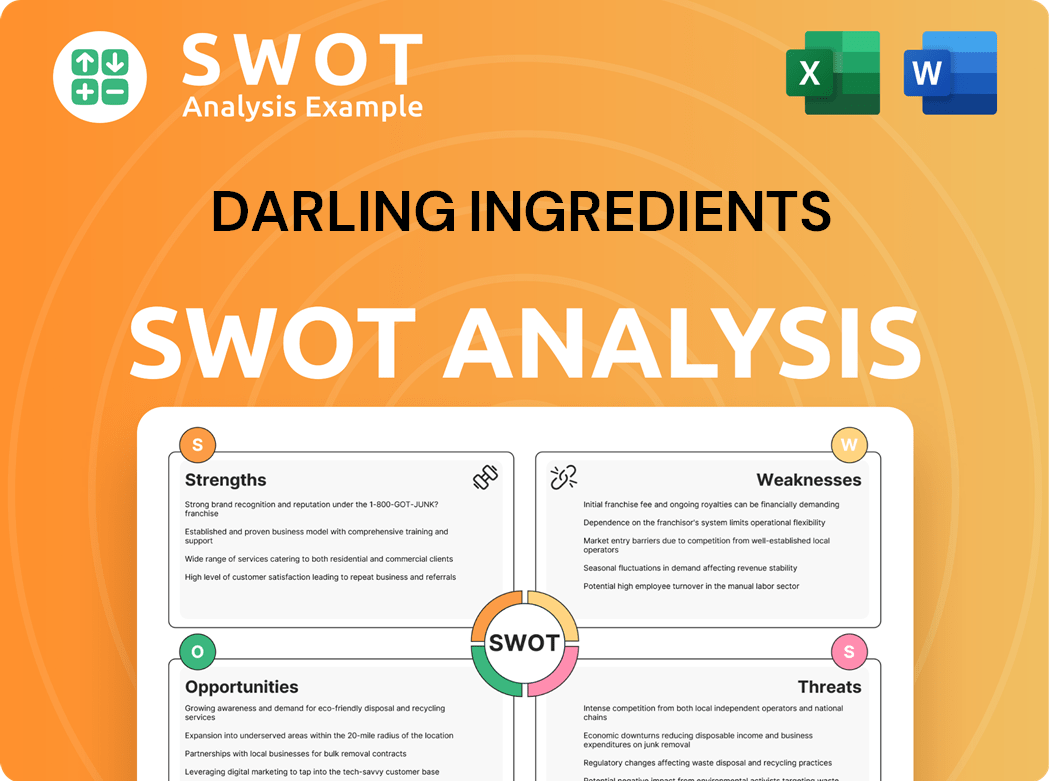

Darling Ingredients SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Darling Ingredients Make Money?

The Darling Ingredients Company generates revenue through a diverse set of streams, primarily centered on its product offerings and services. The company's core revenue drivers include the sale of specialty ingredients, feed ingredients, and renewable fuels. For the fiscal year ending December 30, 2023, Darling Ingredients reported total net sales of roughly $6.7 billion.

Product sales form the bulk of the company's revenue. Key segments contribute significantly to this, including food ingredients like collagen and gelatin, feed ingredients derived from animal by-products, and fuel and bio-energy, which is anchored by the production of renewable diesel. The company's strategic approach to monetization involves direct sales to industrial customers, a global distribution network, and a focus on high-value specialty ingredients.

The company's investment in renewable fuels represents a strategic expansion into a high-growth sector. This expansion is driven by environmental regulations and sustainability mandates. The company's diversified revenue mix, spanning food, feed, and fuel, provides resilience against market fluctuations. Over time, Darling Ingredients has expanded its revenue sources through acquisitions and joint ventures, such as Rousselot and Diamond Green Diesel, to bolster its capabilities in renewable energy and specialty ingredients.

The main revenue streams of Darling Ingredients are categorized into food ingredients, feed ingredients, and fuel and bio-energy. The company's focus on sustainable solutions and food waste recycling contributes to its diverse revenue model.

- Food Ingredients: This segment includes products like collagen, gelatin, and edible fats used in various food applications.

- Feed Ingredients: These are derived from animal by-products, including proteins and fats essential for pet food and animal feed.

- Fuel and Bio-energy: This stream is anchored by the production and distribution of renewable diesel through the Diamond Green Diesel joint venture. Diamond Green Diesel's Port Arthur facility is expected to increase total annual production capacity to approximately 1.2 billion gallons by the end of 2025.

- The company's financial performance in 2023 showed a strong revenue base, reflecting its ability to capitalize on market opportunities. For more insights, explore the Growth Strategy of Darling Ingredients.

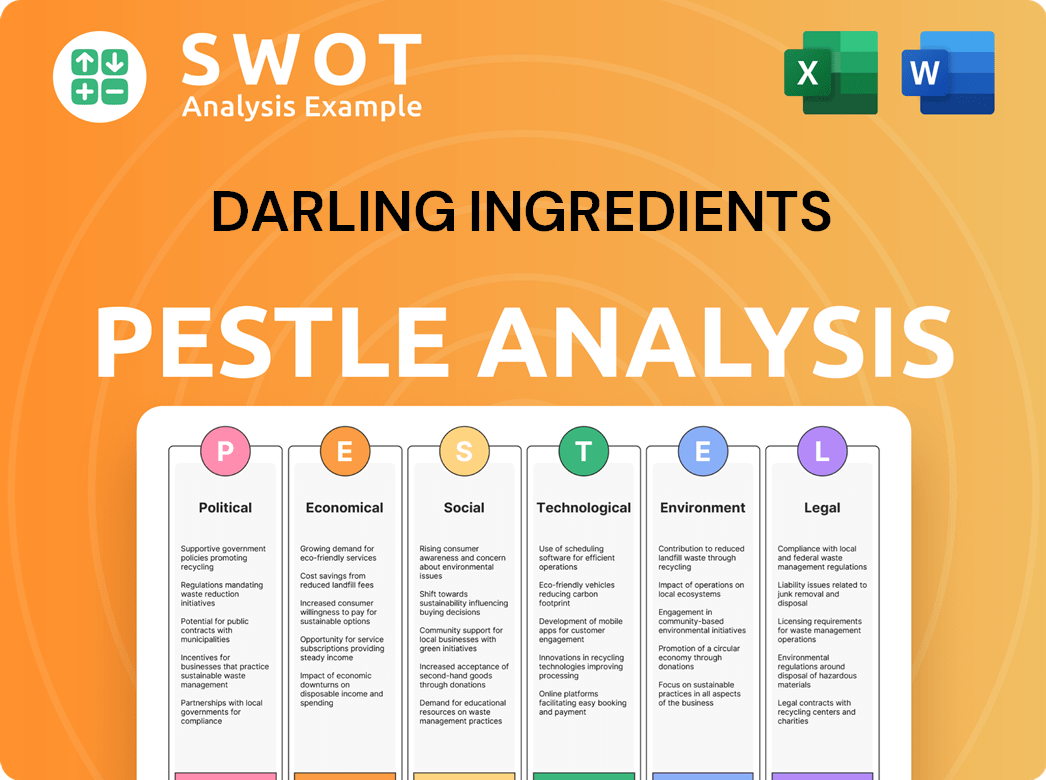

Darling Ingredients PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Darling Ingredients’s Business Model?

Darling Ingredients Company has significantly shaped its trajectory through strategic moves and key milestones. A pivotal move has been the company's substantial investment and expansion in renewable diesel, particularly through its Diamond Green Diesel (DGD) joint venture with Valero Energy Corporation. This strategic focus has diversified revenue streams and positioned the company at the forefront of the sustainable energy transition.

Another notable milestone was the acquisition of Rousselot, which strengthened Darling Ingredients' position in the high-value collagen and gelatin markets. These products are critical for the pharmaceutical and food industries. The company has also navigated operational and market challenges, including fluctuations in commodity prices and evolving regulatory landscapes.

Darling Ingredients has responded to these challenges through operational efficiencies, supply chain optimization, and strategic investments in advanced processing technologies. The company's integrated approach allows it to adapt to changing market demands by diverting materials to different product lines, such as converting fats into renewable diesel or specialty oleochemicals.

The Diamond Green Diesel (DGD) joint venture with Valero Energy Corporation is a key milestone, with production capacity expanding to approximately 1.2 billion gallons annually by the end of 2025. The acquisition of Rousselot further solidified its market position in collagen and gelatin.

Investing in renewable diesel production has been a core strategic move, aligning with the growing demand for sustainable solutions. The company focuses on operational efficiencies and supply chain optimization to maximize value from its inputs, adapting to market demands.

Darling Ingredients operates a vast network of over 270 facilities across more than 17 countries, providing significant economies of scale. Technology leadership in rendering and bio-energy conversion is another differentiator. Strong relationships with suppliers and a diverse customer base contribute to market resilience.

The company's financial performance reflects its strategic moves and operational efficiencies. For detailed insights into the company's financial health, you can explore official financial reports.

Darling Ingredients' competitive advantages include extensive economies of scale, a global network, and technological leadership. These factors enable efficient processing and distribution of bio-nutrients and sustainable solutions.

- Extensive global network of over 270 facilities.

- Technological leadership in rendering and bio-energy conversion.

- Strong supplier relationships and a diverse customer base.

- Focus on sustainable solutions and renewable energy.

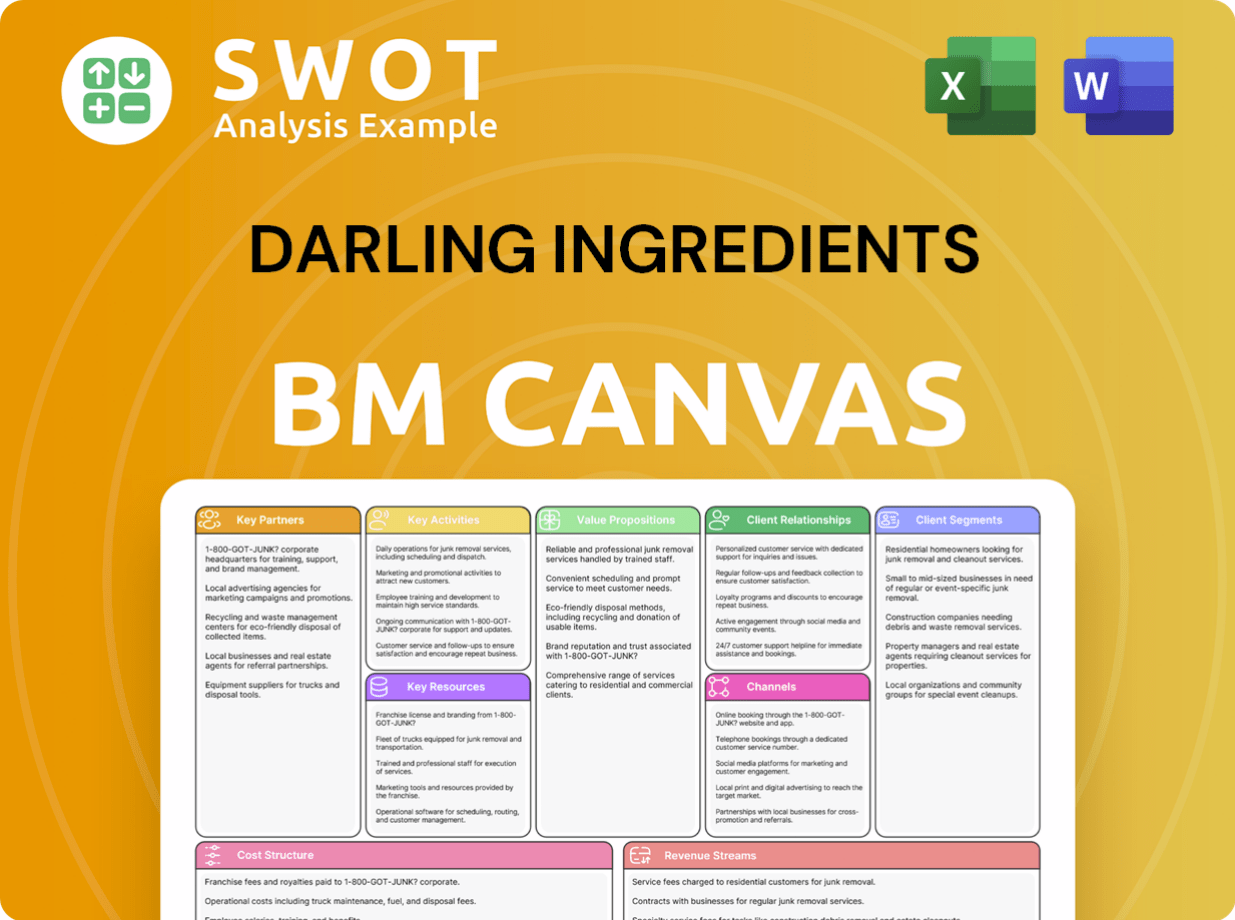

Darling Ingredients Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Darling Ingredients Positioning Itself for Continued Success?

Within the sustainable ingredients and bio-energy sectors, Darling Ingredients Company holds a leading market position. The company demonstrates significant market share and global reach, with facilities spanning over 17 countries. Its strategic joint venture, Diamond Green Diesel, solidifies its status as a major renewable diesel producer in North America. Its consistent supply of high-quality ingredients fosters customer loyalty, alongside its role in providing sustainable solutions for waste streams.

Despite its strong position, Darling Ingredients faces several risks. Fluctuations in commodity prices for animal by-products and finished goods can impact profitability. Regulatory changes related to environmental standards and renewable fuel mandates could also affect operations. The emergence of new competitors or disruptive technologies in bio-nutrient processing poses potential threats. Furthermore, global economic downturns or supply chain disruptions could impact raw material availability or demand for its products.

As a leading rendering company, the company has a vast global presence. It is a major player in the rendering and protein conversion industries. The company's strategic ventures further strengthen its position in the sustainable fuels market.

Fluctuations in commodity prices and regulatory changes pose risks. The emergence of new competitors and disruptions to the supply chain also threaten the company. Global economic downturns may impact raw material availability.

The company is focused on expanding renewable diesel production. They are also committed to enhancing their portfolio of specialty ingredients. The company plans to sustain and expand its profitability through continued operational efficiency.

Expansion of renewable diesel production capacity is a core focus. The company is committed to enhancing high-value specialty ingredients. The company prioritizes sustainability and circular economy principles, aligning with global environmental goals.

The company is expanding its renewable diesel production capacity. They are also committed to enhancing their high-value specialty ingredients. The company's diversified business model and dedication to sustainable solutions position it for continued growth in the evolving bio-economy. For more insights into the company's ownership and shareholder structure, you can explore Owners & Shareholders of Darling Ingredients.

- Expansion of renewable diesel production through Diamond Green Diesel.

- Enhancement of specialty ingredients portfolio, such as collagen and gelatin.

- Operational efficiency, strategic acquisitions, and R&D investments.

- Commitment to sustainability and circular economy principles.

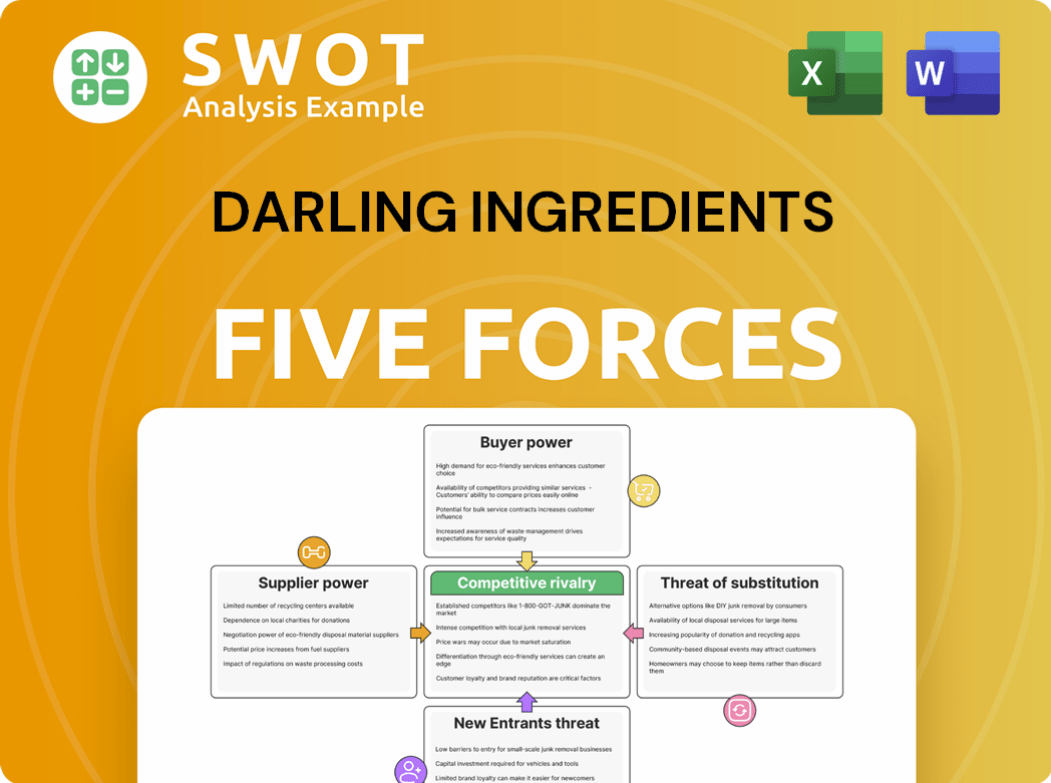

Darling Ingredients Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Darling Ingredients Company?

- What is Competitive Landscape of Darling Ingredients Company?

- What is Growth Strategy and Future Prospects of Darling Ingredients Company?

- What is Sales and Marketing Strategy of Darling Ingredients Company?

- What is Brief History of Darling Ingredients Company?

- Who Owns Darling Ingredients Company?

- What is Customer Demographics and Target Market of Darling Ingredients Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.