Dell Technologies Bundle

Can Dell Technologies Thrive in the AI Era?

The tech world is rapidly evolving, with Artificial Intelligence reshaping everything. Dell Technologies, a prominent Dell Technologies SWOT Analysis, is at the forefront of this transformation, aiming to capitalize on the opportunities presented by AI and digital infrastructure. This analysis dives deep into Dell's Growth Strategy and examines its Future Prospects in this dynamic environment.

From its origins as a PC innovator, Dell has become a global leader in IT solutions, and its Business Strategy now centers on high-growth sectors. This article explores how Dell Technologies plans to navigate the challenges in the mature PC market and seize the opportunities in AI-powered infrastructure. We'll examine its strategic initiatives, financial outlook, and potential obstacles to understand its long-term goals and investment opportunities in the competitive landscape.

How Is Dell Technologies Expanding Its Reach?

The Owners & Shareholders of Dell Technologies are seeing the company aggressively pursue several expansion initiatives to drive future growth. These initiatives focus on new market opportunities, product innovation, and strategic partnerships. A significant area of focus is the company's intensified efforts in AI-powered servers and infrastructure.

Dell has strategically positioned itself to meet the increasing demand for powerful, specialized hardware needed for AI model training and inference. This has resulted in substantial orders and benefits from this trend. The company is also diversifying its revenue streams by expanding into high-growth sectors.

Strategic partnerships are another critical component of Dell's expansion. The company is actively strengthening collaborations to secure large-scale revenue streams and provide foundational infrastructure for cutting-edge AI research and deployment. Dell's 2025 Partner Program emphasizes growth and modernization of the core business and new market opportunities.

Dell is experiencing significant growth in its AI server business. AI server orders for Q1 fiscal year 2025 increased sequentially to $2.6 billion. Shipments were up more than 100% to $1.7 billion. The backlog grew over 30% to $3.8 billion.

Dell is expanding into the smart projector market, which is projected to grow significantly. This market is expected to have a compound annual growth rate (CAGR) of 17.70% from 2024 to 2032. This presents a promising avenue for Dell's diversification efforts.

Dell is focused on incorporating on-device AI features into its PC portfolio. This aims to boost creativity and productivity for both consumers and businesses. This strategic move also capitalizes on the upcoming refresh cycle for Windows 10.

Dell is strengthening its collaborations to drive growth. Emerging discussions include a deal with Elon Musk's xAI. Dell is also co-engineering an open AI ecosystem with strategic partners.

Dell's expansion strategy focuses on several key areas to ensure future growth. These initiatives are designed to capitalize on emerging market trends and technological advancements. The company is also focused on enhancing its partner ecosystem.

- AI-Powered Servers and Infrastructure: Meeting the growing demand for AI hardware.

- Smart Projectors and Digital Transformation Services: Diversifying into high-growth sectors.

- AI-Enhanced PCs: Capitalizing on the Windows 10 refresh cycle.

- Strategic Partnerships: Collaborating to secure revenue and drive innovation.

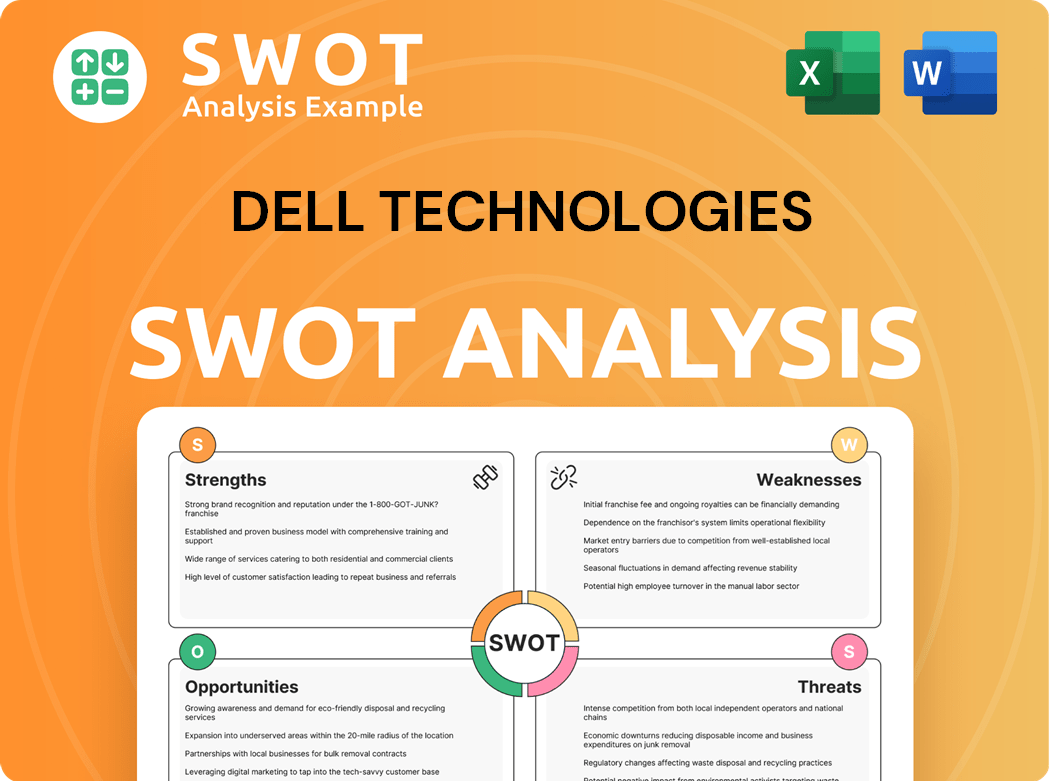

Dell Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Dell Technologies Invest in Innovation?

The Mission, Vision & Core Values of Dell Technologies company is strategically focused on innovation and technological advancements to drive its growth. This approach is particularly evident in its increasing investments in research and development (R&D), which are crucial for maintaining a competitive edge in the rapidly evolving tech landscape. The company's commitment to AI and enterprise IT infrastructure is a key element of its business strategy.

Dell Technologies' growth strategy is heavily influenced by its ability to adapt to the evolving needs of its customers and the broader market. This includes a focus on developing and integrating cutting-edge technologies like AI, which are designed to deliver significant returns on investment (ROI) for its customers. The company's strategic initiatives are geared towards addressing the growing demand for advanced IT solutions.

By concentrating on AI and edge computing, Dell aims to provide comprehensive solutions that meet the demands of modern businesses. This focus allows Dell to differentiate itself by offering optimized solutions for AI workloads, including specialized storage, networking, and management software. This approach is designed to ensure the company's long-term success.

Dell Technologies significantly increased its R&D spending to $3.061 billion in fiscal year 2025, a 9.28% increase from 2024. This investment highlights the company's dedication to innovation.

The 'Dell AI Factory' approach simplifies AI deployment. It uses automation, streamlined operations, hybrid cloud orchestration, and zero-trust security to support diverse AI workloads.

Dell collaborates with Intel, AMD, and Qualcomm to optimize its PCs for AI. Partnerships with NVIDIA are crucial for providing solutions that support AI workloads.

Dell focuses on integrating generative AI (GenAI) into daily workflows. 2025 is seen as a pivotal year for deliberate GenAI integration.

Dell is pioneering edge AI, bringing real-time intelligence to where data lives. Over 75% of enterprise data is expected to be created and processed at the edge soon.

Dell's leadership believes AI will deliver meaningful ROI to enterprises. A significant portion of customers are already seeing positive returns from their GenAI solutions.

Dell Technologies' strategic initiatives are centered around AI, edge computing, and infrastructure solutions. These initiatives are designed to meet the growing demand for advanced IT solutions and drive revenue growth.

- AI Infrastructure: Providing specialized storage, networking, and management software optimized for AI workloads.

- Edge Computing: Focusing on bringing real-time intelligence to where data is created and processed.

- Partnerships: Collaborating with industry leaders like Intel, AMD, Qualcomm, and NVIDIA to enhance its offerings.

- Generative AI: Integrating GenAI into workflows to deliver meaningful ROI for enterprises.

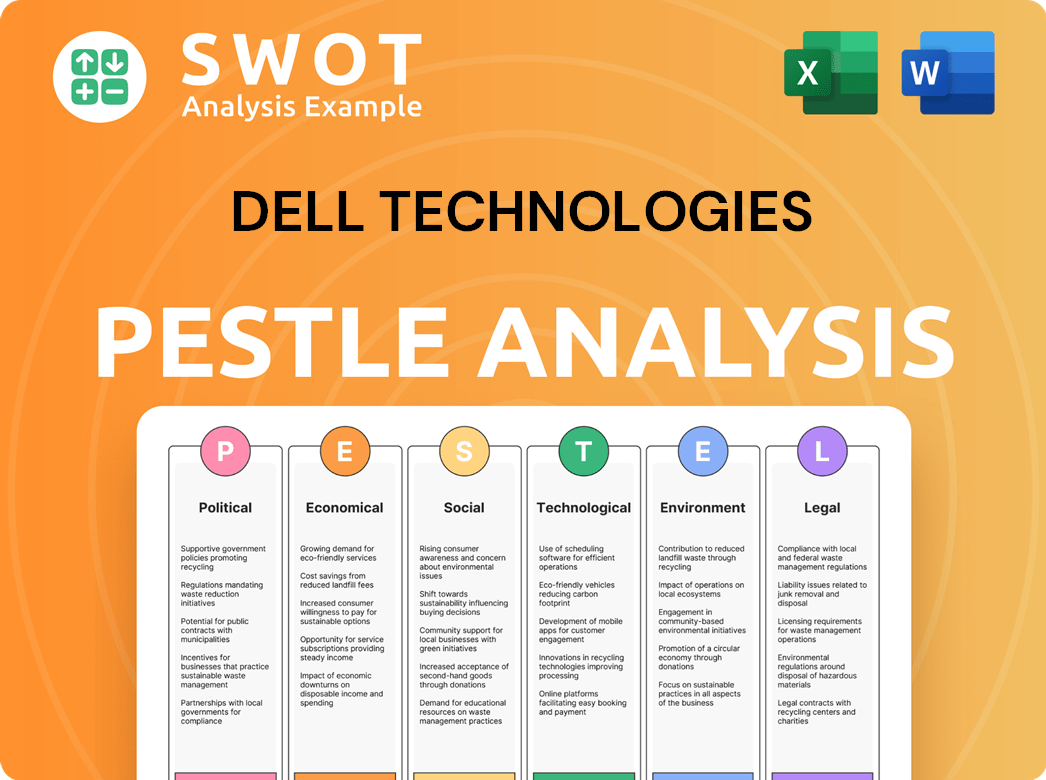

Dell Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Dell Technologies’s Growth Forecast?

The financial outlook for Dell Technologies is largely shaped by its strategic pivot towards high-margin AI infrastructure, even as it navigates the complexities of the traditional PC market. The company's performance in fiscal year 2025, ending January 31, 2025, highlights this transition, with substantial revenue and profit increases. This shift is critical for understanding the Growth Strategy and the Future Prospects of the company.

In the competitive landscape of the Technology Company, Dell is focusing on areas like AI servers to drive growth. This focus is reflected in the strong performance of its Infrastructure Solutions Group (ISG), particularly in AI-optimized servers. Despite some short-term challenges, the overall trajectory suggests a positive outlook, supported by strategic investments and a solid financial foundation.

The company's financial results for fiscal year 2025 demonstrate a robust performance. The total revenue reached $95.57 billion, marking an 8.08% increase from the $88.42 billion reported in fiscal year 2024. Net income also saw a significant rise, increasing by 43.01% year-over-year. Operating income improved to 6.53% in FY2025 from 5.89% in FY2024, and net income margin increased to 4.81% in FY2025 from 3.63% in FY2024, indicating improved profitability.

In Q1 FY25, Dell reported revenue of $23.38 billion, a 5% year-over-year increase. This growth was driven by a surge in AI server orders and shipments. The company's strategic focus on AI infrastructure is clearly paying off, as evidenced by these strong results.

The Infrastructure Solutions Group (ISG) saw a remarkable 22% year-over-year revenue growth in Q1 FY25. Servers and networking revenue hit a record $5.5 billion, up 42%. This segment's performance is a key driver of Dell's overall growth strategy.

AI server orders exceeded $12 billion, with shipments reaching $1.8 billion in Q1 FY25. The AI server backlog reached approximately $9 billion as of February 2025, indicating strong future demand. This highlights the company's strong position in the AI market.

Dell returned $1.1 billion to shareholders through share repurchases and dividends in Q1 FY25. The company ended the quarter with $7.3 billion in cash and investments. This demonstrates Dell's commitment to returning value to shareholders.

Despite the strong revenue figures, Dell's Q1 FY25 diluted earnings per share (EPS) of $1.55 fell short of the forecasted $1.69. Operating income in Q1 FY25 declined by 14% year-over-year to $920 million, and non-GAAP operating income was down 8% to $1.5 billion. For the full fiscal year 2026, Dell anticipates an 8% revenue growth, 23% diluted EPS growth, and 14% non-GAAP diluted EPS growth. This suggests that while there are short-term challenges, the company is positioned for sustained growth.

Analysts generally hold a positive outlook on Dell's stock.

- The average analyst rating is 'Strong Buy.'

- The average 12-month price target for Dell Technologies stock ranges from $120 to $155.

- The average price target is $139.76, forecasting a 24.90% increase in the stock price.

- This indicates strong confidence in the company's future performance.

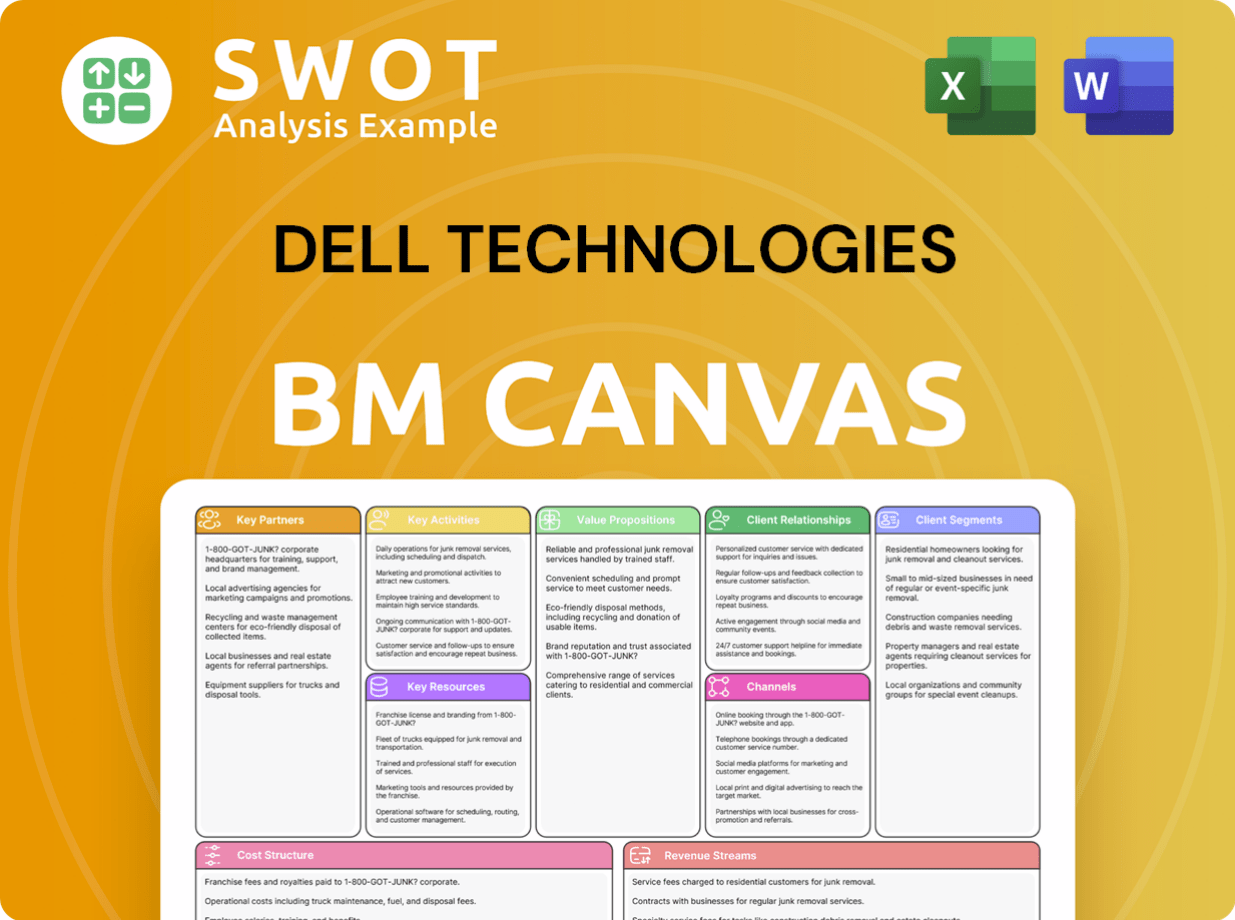

Dell Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Dell Technologies’s Growth?

The path to growth for Dell Technologies involves navigating several potential pitfalls. The company's Growth Strategy and overall Future Prospects are closely tied to its ability to mitigate these risks effectively. Understanding these challenges is crucial for assessing the long-term viability of the Technology Company's strategic initiatives.

One of the most significant hurdles for Dell is the intense competition in its core markets. The PC and storage sectors, in particular, are highly competitive, requiring continuous innovation and strategic maneuvering to maintain market share. Furthermore, the rapid evolution of technology, especially in areas like AI, necessitates substantial investment and adaptation to stay ahead of the curve.

External factors, such as economic fluctuations and supply chain disruptions, also pose threats to Dell Technologies. These issues can impact revenue, profitability, and the company's ability to execute its Business Strategy. Moreover, internal challenges, like maintaining robust internal controls and managing resources effectively, are critical for sustained success.

The PC and storage markets are fiercely competitive, posing a constant challenge to Dell. Competitors like HP, Lenovo, and HPE are significant players, requiring Dell to differentiate its offerings. The company must continuously innovate and adapt to maintain its market position, which is a key aspect of its Dell Technologies growth strategy analysis.

The rapid advancement of AI presents both opportunities and risks for Dell. While the company is investing heavily in AI, it must ensure its strategies are robust to avoid falling behind. The slower-than-expected adoption of AI PCs could also negatively impact Dell Technologies' performance, influencing the future of Dell Technologies stock.

Supply chain vulnerabilities and internal resource constraints could hinder Dell's ability to meet demand. Meeting the increasing demand for AI-optimized servers and other cutting-edge products is essential. These constraints could affect Dell Technologies market share and its ability to execute its Dell Technologies strategic initiatives.

Internal issues, such as the overstatement of costs, highlight the importance of strong internal controls. These challenges can affect investor confidence and the overall financial health of the company. Maintaining transparency and operational efficiency is crucial for Dell Technologies financial performance.

The cyclical nature of the hardware market and broader macroeconomic conditions can lead to revenue volatility. Economic downturns or shifts in consumer spending can significantly impact Dell's sales. These factors influence the company's ability to achieve its Dell Technologies long-term goals.

Regulatory changes pose an ongoing concern for any global technology company. Adapting to new regulations and ensuring compliance across different regions require significant resources. These factors can influence Dell Technologies investment opportunities and Dell Technologies expansion plans.

To mitigate these risks, Dell employs several strategies. A key focus is diversification, particularly emphasizing the higher-margin Infrastructure Solutions Group (ISG). The company's integrated approach, which provides end-to-end solutions optimized for AI workloads, offers a competitive advantage. Furthermore, Dell is working to increase partner incentives to navigate market dynamics and drive profitable growth, influencing Dell Technologies revenue growth.

The competitive landscape includes strong players like HP, Lenovo, and HPE. In 2025, Dell held a 19.3% market share in the global server market. However, the PC market presents challenges, with the Client Solutions Group (CSG) experiencing revenue declines, such as a 12% year-over-year decrease in Q4 FY24. For more insights into the competitive environment, you can explore the Competitors Landscape of Dell Technologies.

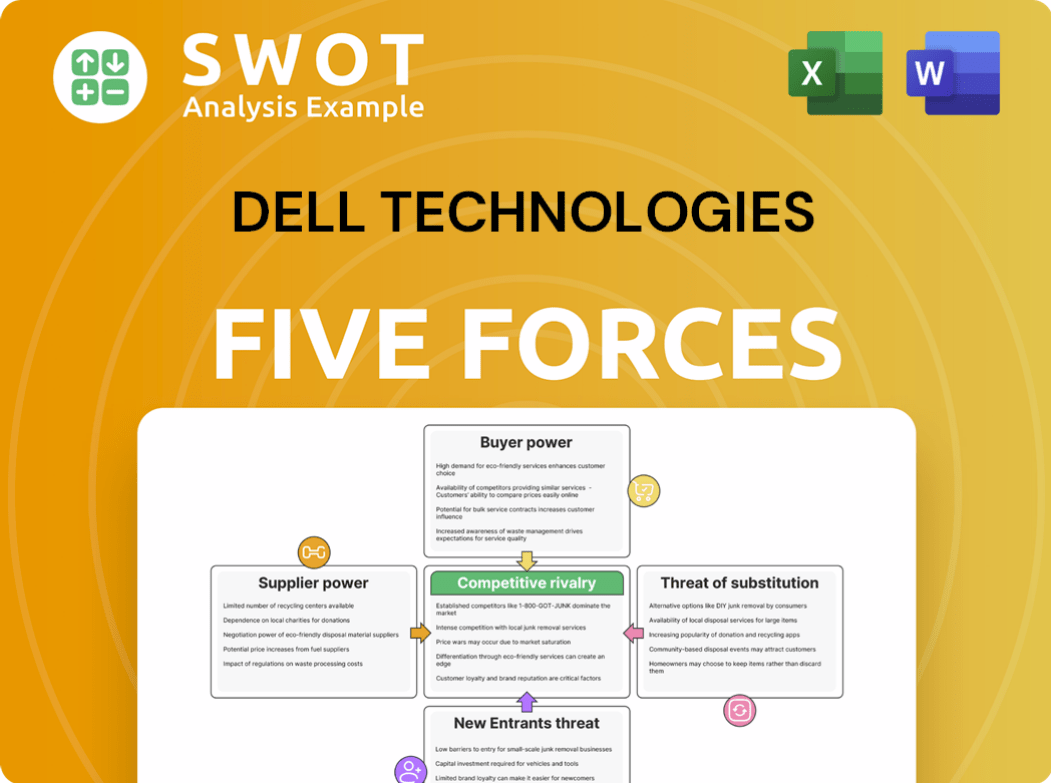

Dell Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dell Technologies Company?

- What is Competitive Landscape of Dell Technologies Company?

- How Does Dell Technologies Company Work?

- What is Sales and Marketing Strategy of Dell Technologies Company?

- What is Brief History of Dell Technologies Company?

- Who Owns Dell Technologies Company?

- What is Customer Demographics and Target Market of Dell Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.