Dell Technologies Bundle

Who Really Owns Dell Technologies?

Unraveling the ownership of Dell Technologies is key to understanding its trajectory in the ever-evolving tech landscape. From its humble beginnings as PC's Limited to its current status as a global IT powerhouse, Dell's ownership structure has undergone significant transformations. This deep dive explores the key players who shape Dell's strategic decisions and influence its market performance.

Understanding the Dell Technologies SWOT Analysis begins with knowing who controls the company's reins. Dell Technologies, a publicly traded company, has a complex ownership structure that involves multiple stakeholders, including its founder, institutional investors, and the broader market. This article will examine the history of Dell Technologies ownership, its current Dell Company Owner structure, and the influence of Dell Executives on its strategic direction. Discover how Who owns Dell impacts its future.

Who Founded Dell Technologies?

The journey of Dell Technologies began in 1984, when Michael Dell, a student at the University of Texas at Austin, founded the company. Initially named PC's Limited, it operated out of his dormitory room. Dell's vision was to sell IBM PC compatible computers directly to consumers, a strategy that aimed to reduce costs and offer effective computing solutions.

This direct-to-consumer model quickly proved successful. In its first year, the company achieved gross sales exceeding $73 million. As the business expanded and evolved, the name was changed to Dell Computer Corporation in 1987 to better reflect its market presence and to align with naming conventions globally.

A significant milestone in the company's history was its initial public offering (IPO) in June 1988. The IPO involved the sale of 3.5 million shares at $8.50 per share, raising $30 million and increasing the market capitalization to $80 million. This event marked a transition in the company's ownership structure, opening it up to public shareholders.

The early ownership of Dell Technologies, starting with Michael Dell's vision, evolved significantly over time. The IPO in 1988 was a pivotal moment, transforming the company's ownership landscape. Over the years, the ownership structure has continued to shift, influenced by market dynamics and strategic decisions. For a deeper understanding of the company's financial strategies, consider exploring the Revenue Streams & Business Model of Dell Technologies.

- 1984: Michael Dell founds PC's Limited.

- 1987: The company is renamed Dell Computer Corporation.

- June 1988: Dell Computer Corporation goes public with an IPO.

- Ownership Structure: Initially private, transitioning to public with the IPO.

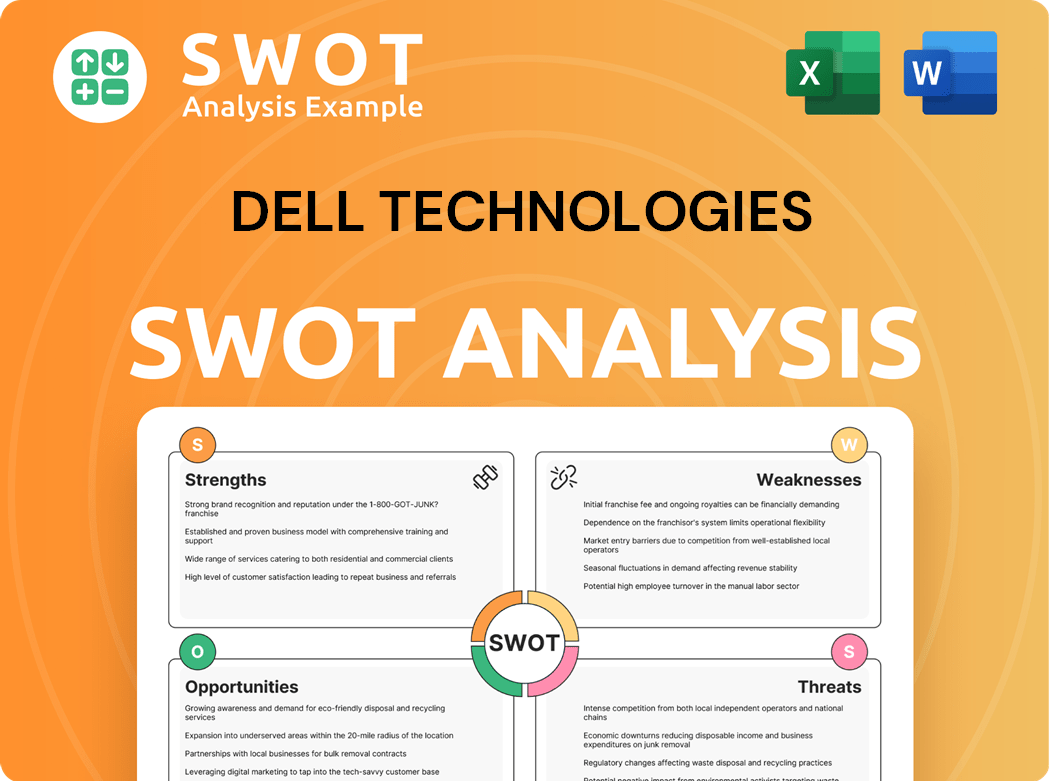

Dell Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Dell Technologies’s Ownership Changed Over Time?

The ownership structure of Dell Technologies has seen significant shifts since its initial public offering in 1988. A pivotal moment occurred in 2013 when Michael Dell, in partnership with Silver Lake Partners, took the company private in a $24.9 billion deal. This strategic move aimed to provide the flexibility to focus on long-term objectives, away from the pressures of the public market. The merger with EMC Corporation in September 2016, valued at $67 billion, further reshaped the ownership landscape, creating substantial debt but also broadening Dell's portfolio.

In December 2018, returned to the public markets via the New York Stock Exchange (NYSE) under the ticker symbol 'DELL.' This was accomplished through a share buyback of a tracking stock linked to Dell's stake in VMware. This maneuver allowed the company to regain a public presence while maintaining significant control by Michael Dell and related stockholders. As of February 2, 2024, Michael Dell holds a 58.9% ownership stake in Dell Technologies. As of March 29, 2024, Michael Dell remains the largest shareholder with a 51% stake.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering | 1988 | Dell becomes a publicly traded company. |

| Going Private | 2013 | Michael Dell and Silver Lake Partners acquire Dell, taking it private. |

| Merger with EMC Corporation | September 2016 | Creates Dell Technologies Inc., significant debt incurred. |

| Return to Public Markets | December 2018 | Dell Technologies lists on NYSE via VMware tracking stock buyback. |

Beyond Michael Dell, the major shareholders of Dell include institutional investors such as Vanguard Investments Australia Ltd. (6.71%), Fidelity Management & Research Co. LLC (4.17%), Boston Partners Global Investors, Inc. (3.65%), BlackRock Advisors LLC (3.64%), and Arrowstreet Capital LP (3.21%). Silver Lake Partners also remains a significant institutional shareholder. According to the latest TipRanks data, institutional investors own approximately 28.81% of Dell Technologies stock, while insiders hold 49.49%, and public companies and individual investors account for 18.29%. These shifts have enabled major acquisitions and a strategic pivot towards a broader IT solutions portfolio. To understand more about the company's evolution, consider reading this detailed analysis of the ownership structure of Dell Technologies.

The ownership of Dell Technologies has evolved significantly since its IPO.

- Michael Dell remains the largest shareholder, maintaining significant control.

- Institutional investors hold a substantial portion of the stock.

- Strategic decisions, such as going private and mergers, have reshaped the ownership landscape.

- Understanding the ownership structure is crucial for assessing the company's strategic direction.

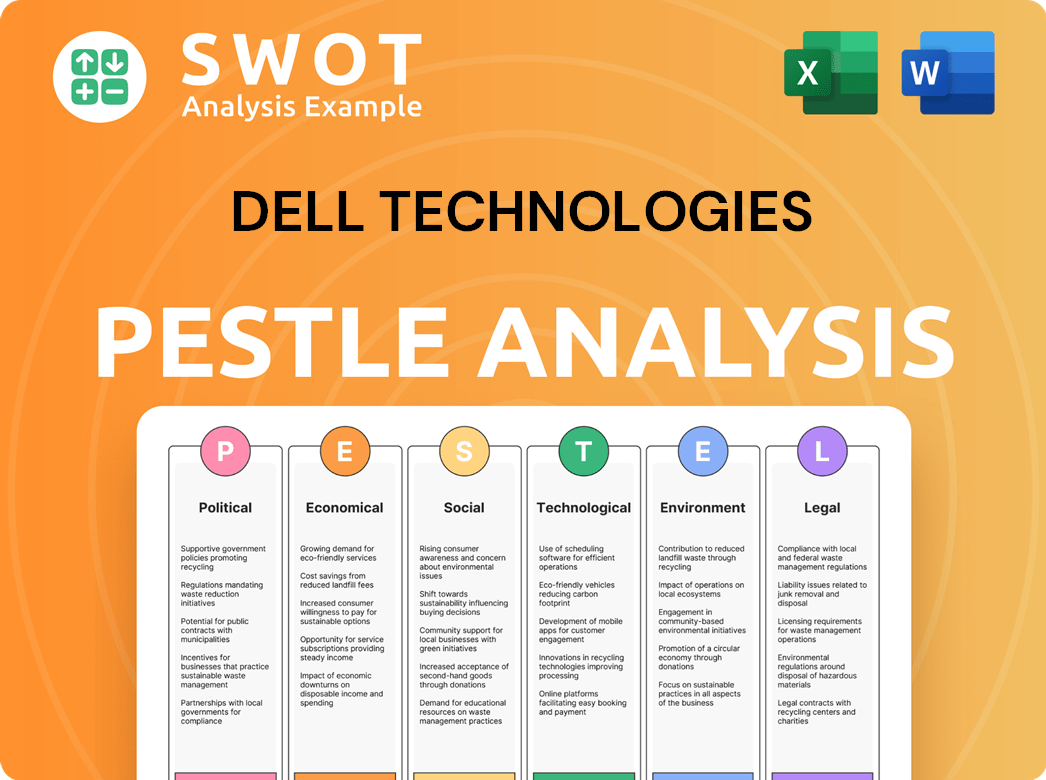

Dell Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Dell Technologies’s Board?

The Board of Directors at Dell Technologies significantly influences the company's governance and is closely linked to its ownership structure. Michael Dell, serving as Chairman and CEO, holds a substantial stake, ensuring his vision continues to guide the company. Understanding the board's composition is key to grasping the dynamics of Dell Technologies Ownership.

The company's structure, particularly its dual-class share system, concentrates voting power. This setup allows certain individuals or entities to have significant control. The board's composition and the influence of major shareholders are detailed in the company's annual proxy statements, such as DEF 14A filings. This structure impacts how decisions are made and how the company responds to market changes. For a broader view, consider the Competitors Landscape of Dell Technologies.

| Board Member | Title | Key Role |

|---|---|---|

| Michael Dell | Chairman and CEO | Oversees the company's strategic direction and operations. |

| Egon Durban | Director | Provides strategic guidance and insights. |

| William D. Green | Lead Independent Director | Ensures independent oversight and governance. |

As of December 31, 2023, Michael Dell owned 58.9% of all Class C DELL stock, including Class A holdings convertible to Class C. This ownership structure, combined with the dual-class shares, gives Michael Dell substantial control. This concentration of power can affect the company's strategic decisions and its response to shareholder actions. The influence of Dell Executives, coupled with the board's structure, highlights the internal dynamics of Dell Technologies Parent Company.

Michael Dell's significant ownership and role as Chairman and CEO are central to the company's governance.

- Dual-class shares provide concentrated voting power.

- The board's composition and the influence of major shareholders are crucial.

- Understanding the ownership structure is key to evaluating the company's strategic direction.

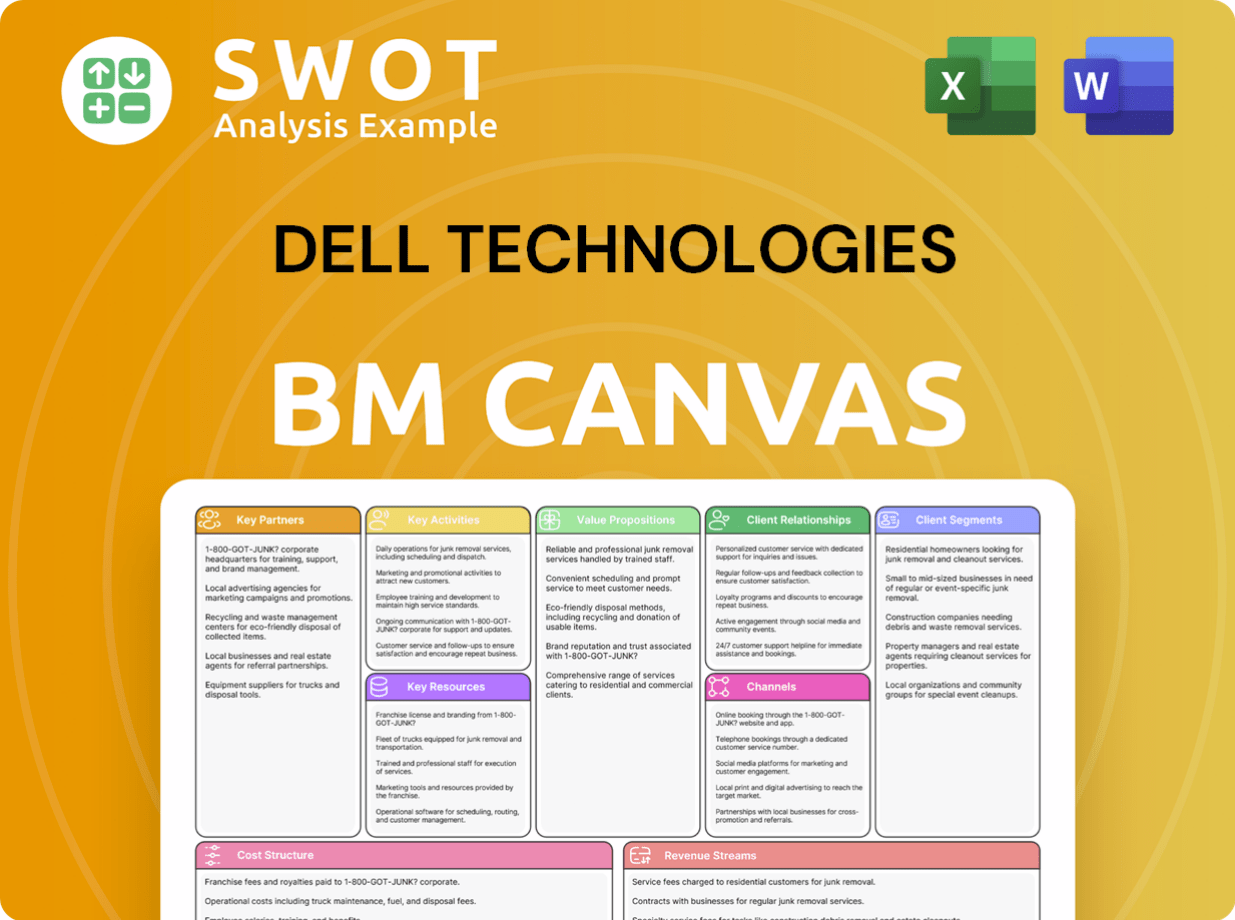

Dell Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Dell Technologies’s Ownership Landscape?

In recent years, the ownership structure of Dell Technologies has seen notable shifts. Michael Dell, the company's founder, has engaged in share sales, including selling shares for over $1.2 billion in September 2024. Despite these sales, Michael Dell remains a significant stakeholder, holding a substantial number of shares directly and indirectly. As of December 31, 2023, he owned 58.9% of all Class C DELL stock. These sales are often viewed as part of personal financial planning rather than a change in the company's direction.

Dell Technologies has also been active in share buybacks, which averaged 4.6% for the fiscal year ending January 2025. The company's board approved a $10 billion increase in its share repurchase authorization in February 2025. These actions reflect the company's commitment to returning value to shareholders. The company's strategic focus has increasingly shifted towards artificial intelligence (AI) and cloud-based solutions, with a reported AI server backlog of approximately $9 billion as of February 2025. Dell has publicly stated its commitment to increasing its annual cash dividend by 18% to an expected $2.10 per common share for fiscal year 2026.

| Ownership Aspect | Details | Data |

|---|---|---|

| Michael Dell's Direct Holdings (Sept 2024) | Shares of Class C Common Stock | 16,912,241 |

| Share Buyback Yield (Fiscal Year Ending Jan 2025) | Average | 4.6% |

| AI Server Backlog (Feb 2025) | Approximate Value | $9 billion |

The evolution of Dell Technologies' ownership reflects broader industry trends, including the influence of institutional investors and the ongoing role of its founder. The company's focus on AI and cloud solutions is a key strategic move. For more information on the company's growth strategy, see Dell Technologies' growth initiatives.

The current CEO is Michael Dell, who has been at the helm for many years.

Yes, Dell Technologies is a publicly traded company, listed on the stock exchange.

Michael Dell is a major shareholder, and institutional investors also hold significant stakes.

Market capitalization fluctuates, but it's in the billions of dollars, reflecting its large size.

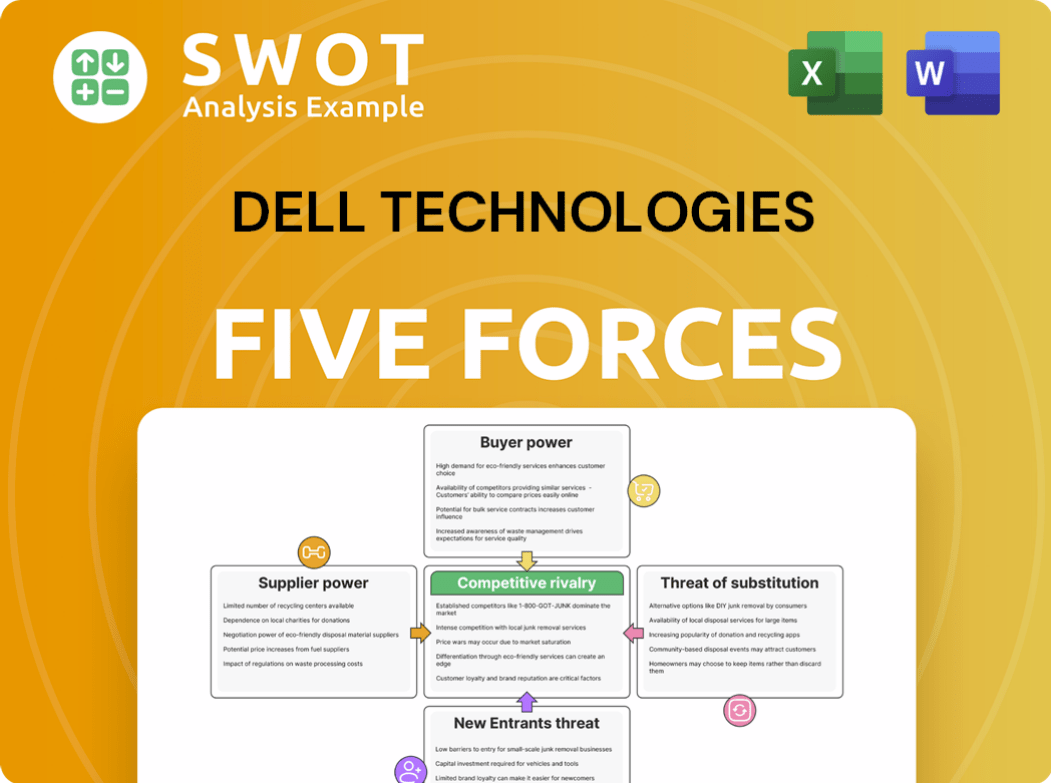

Dell Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dell Technologies Company?

- What is Competitive Landscape of Dell Technologies Company?

- What is Growth Strategy and Future Prospects of Dell Technologies Company?

- How Does Dell Technologies Company Work?

- What is Sales and Marketing Strategy of Dell Technologies Company?

- What is Brief History of Dell Technologies Company?

- What is Customer Demographics and Target Market of Dell Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.