Dell Technologies Bundle

How Does Dell Technologies Thrive in the Tech World?

Dell Technologies, a titan in the tech industry, boasts a vast array of computers, products, and services that power businesses and individuals worldwide. In fiscal year 2025, the company demonstrated its strength with a remarkable $95.6 billion in revenue, showcasing an 8% year-over-year increase. This impressive financial performance highlights Dell's significant impact and crucial role in the ever-evolving IT landscape.

This deep dive into Dell Technologies SWOT Analysis will explore the core of this tech giant. We'll uncover its operational structure, revenue streams, and strategic initiatives, providing a comprehensive understanding of how Dell Company operates and maintains its competitive edge. Whether you're an investor, customer, or industry enthusiast, understanding How Dell Works is key to navigating the future of technology, especially considering its influence in areas like data storage solutions and cloud computing services.

What Are the Key Operations Driving Dell Technologies’s Success?

The core of how Dell Technologies operates revolves around two main segments: the Client Solutions Group (CSG) and the Infrastructure Solutions Group (ISG). The CSG focuses on end-user computing, offering desktops, notebooks, and workstations to both commercial and consumer markets. The ISG provides enterprise-grade IT infrastructure, including servers, networking, and storage solutions, catering to large organizations.

Operational processes are characterized by a direct sales model, robust supply chain management, and significant investment in technology development. This approach allows for greater control over the supply chain, cost efficiency, and responsiveness to market demands. The company’s global supply chain includes manufacturing facilities in the US, India, Poland, China, Brazil, Malaysia, and Ireland.

A key aspect of the Dell Company's value proposition is its ability to offer customized IT solutions, especially within the ISG segment. This includes high-performance, scalable, and reliable PowerEdge servers and PowerStore storage platforms. Dell's strong positioning in the AI server market, providing end-to-end solutions, further differentiates it from competitors.

Dell offers a wide range of products, including desktops, laptops, servers, storage solutions, and networking equipment. The company also provides various services, such as IT consulting, deployment, and support. These offerings are designed to meet the diverse needs of both individual consumers and large enterprises.

The Dell business model is primarily direct-to-customer, allowing for personalized sales and support. This model enables the company to gather valuable customer feedback and tailor its offerings. The company also utilizes a channel partner program to expand its reach and provide local support.

In fiscal year 2024, Dell Technologies reported revenue of approximately $88.4 billion. The company's focus on high-growth areas like AI servers and data storage has been a key driver of its financial performance. Dell continues to invest in research and development to stay competitive in the rapidly evolving technology market.

Dell holds a significant market share in various segments, including servers and storage. The company's strong presence in the enterprise IT infrastructure market contributes to its overall market share. Dell's competitive pricing and innovative solutions help it maintain a strong position against competitors.

Dell Technologies is guided by core values that emphasize customer satisfaction, innovation, and ethical conduct. These values shape the company's culture and influence its decision-making processes. The company is committed to providing value to its customers, partners, and employees.

- Customer Focus: Prioritizing customer needs and delivering exceptional experiences.

- Innovation: Constantly seeking new and improved solutions.

- Integrity: Operating with honesty and transparency.

- Teamwork: Collaborating effectively to achieve common goals.

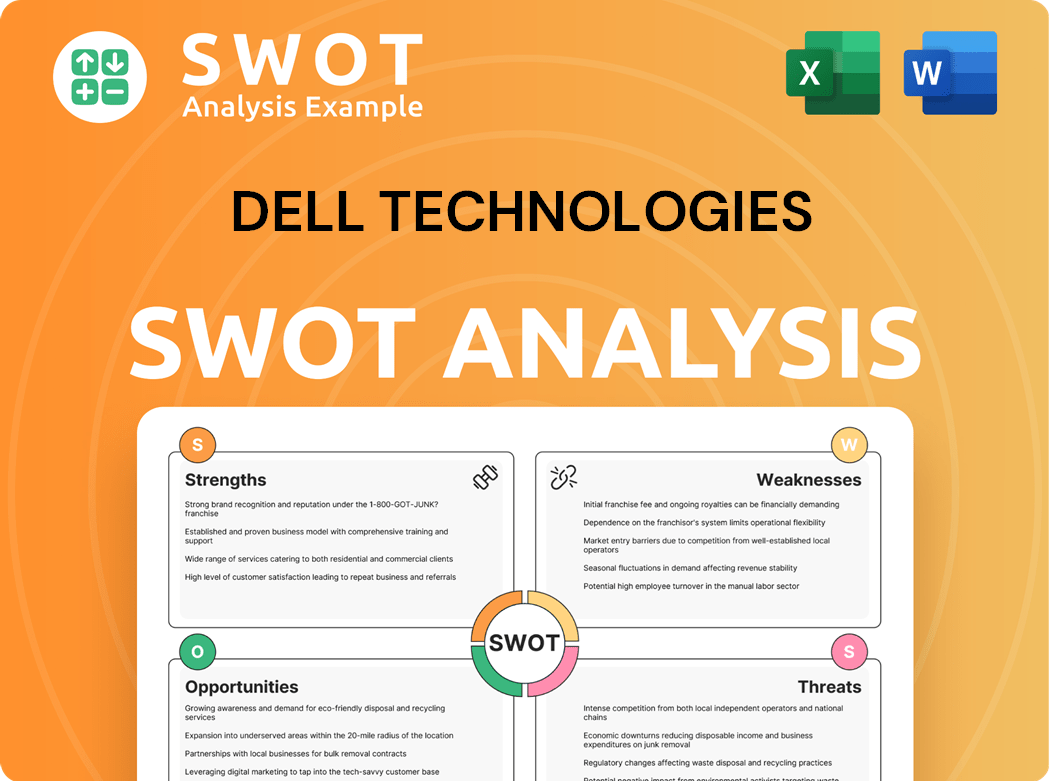

Dell Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Dell Technologies Make Money?

The revenue streams and monetization strategies of the company are primarily centered around the sale of hardware products and services. The company is structured into two main segments: the Client Solutions Group (CSG) and the Infrastructure Solutions Group (ISG).

In fiscal year 2025, the company's total revenue reached a substantial $95.6 billion. This financial performance highlights the company's significant presence in the technology market and its ability to generate substantial income through its diverse product and service offerings.

The Client Solutions Group (CSG) was the largest segment, contributing $48.39 billion to total revenue, representing 52.61% of the company's overall revenue in fiscal year 2025. The Infrastructure Solutions Group (ISG) demonstrated significant growth, with full-year revenue of $43.6 billion, marking a substantial 29% increase year-over-year in fiscal year 2025.

The company's monetization strategies involve a combination of hardware sales, services, and solutions. It is also capitalizing on the upcoming Windows 10 refresh cycle by offering AI-enabled PCs. Furthermore, the company is expanding its services and enterprise solutions divisions, including cloud services, security, and infrastructure, to ensure long-term success and healthy profit margins. To learn more about the company's comprehensive approach, consider reading this detailed overview of the company's operations.

- Client Solutions Group (CSG): This segment includes the sales of desktops, notebooks, and other client-related hardware. In the fourth quarter of fiscal 2025, CSG revenue was $11.9 billion, with commercial client revenue up 5% to $10.0 billion.

- Infrastructure Solutions Group (ISG): This segment focuses on servers, storage, and networking solutions. ISG revenue grew by 22% to $11.4 billion in the fourth quarter of fiscal 2025, driven by a 37% increase in servers and networking revenue.

- Services and Enterprise Solutions: The company is expanding its services, including cloud services, security, and infrastructure, to ensure long-term success and healthy profit margins.

- AI-Enabled Architecture: The company provides AI-enabled architecture like the Dell AI Factory to partners, facilitating repeatable and scalable AI deployments.

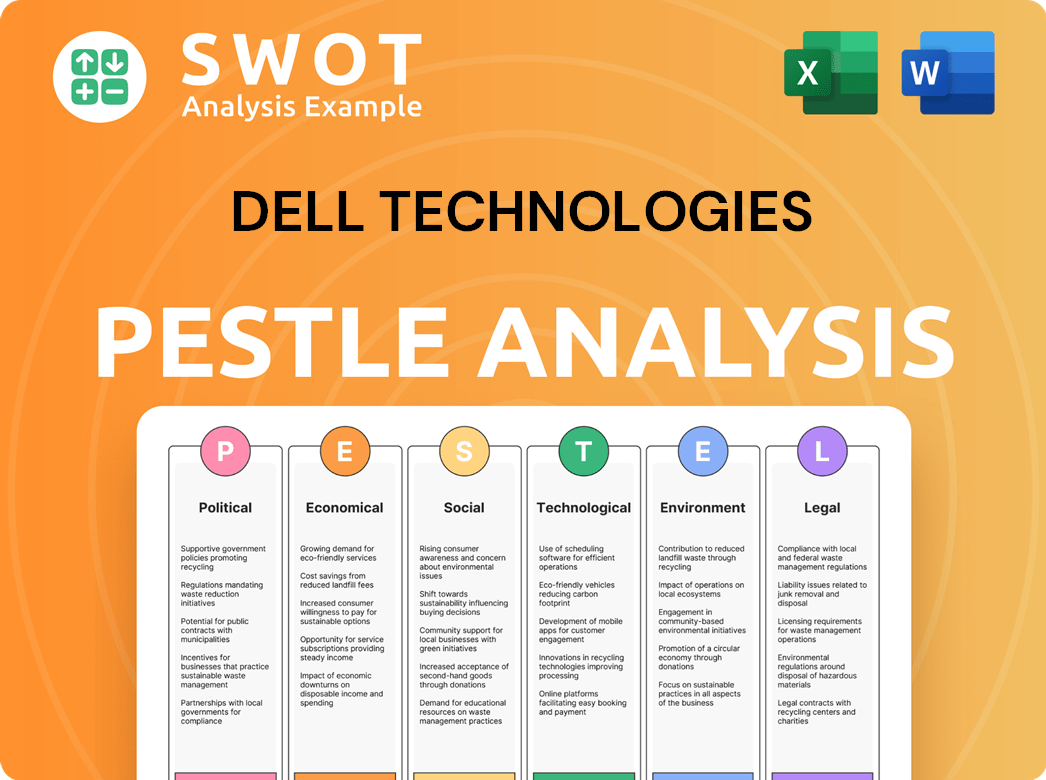

Dell Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Dell Technologies’s Business Model?

Dell Technologies has strategically navigated the ever-changing tech landscape, with significant moves centered around Artificial Intelligence (AI). A key focus has been its aggressive push into the AI server market. The company's ability to adapt and innovate has been crucial in maintaining its competitive edge.

The company has been actively integrating AI into its products and services. This includes streamlining its PC portfolio with on-device AI capabilities, aiming to enhance user productivity and creativity. This focus on innovation is a key factor in its ongoing success.

Dell's strategic moves and operational adjustments have been instrumental in its ability to meet the growing demand for AI solutions. The company's ability to adapt and innovate is a key factor in its ongoing success, especially in the rapidly evolving AI sector.

Dell's AI server backlog reached approximately $9 billion by February 2025, fueled by deals with entities like xAI. Analysts project a substantial increase in AI server sales, from $1.3 billion in fiscal year 2024 to over $10.5 billion in fiscal year 2025. This growth highlights its strong position in the AI server market.

Dell has faced supply chain bottlenecks and production constraints, particularly in meeting the surging demand for AI servers. These challenges include component shortages, especially high-performance GPUs from suppliers like NVIDIA and AMD. Dell has instructed semiconductor suppliers to diversify their fabrication and backend facilities by the end of 2024 to enhance supply chain resilience.

Dell's competitive advantages include strong brand recognition and a global presence with over 30,000 stores worldwide. Its commitment to innovation is reflected in substantial R&D investments, exceeding $8.2 billion from FY22 through FY2024. Dell's customer-centric approach, offering customized laptops and computers, also sets it apart.

Dell's leadership in the global server market, holding a 19.3% market share in 2025, driven by innovation in AI-powered servers, further solidifies its competitive edge. The company is co-engineering an open AI ecosystem with strategic partners to ensure repeatable and scalable deployments. Learn more about the Growth Strategy of Dell Technologies.

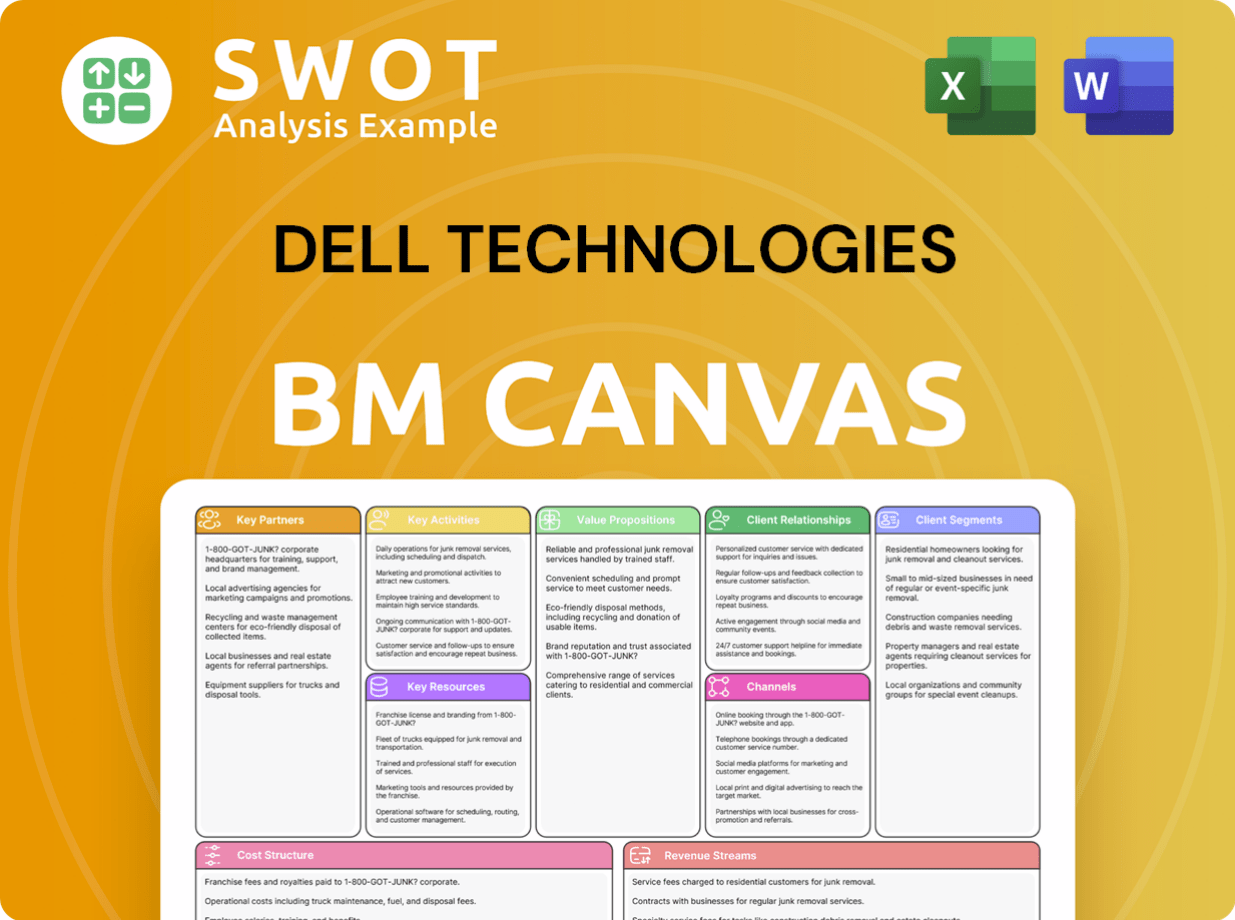

Dell Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Dell Technologies Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook of Dell Technologies. The company holds a strong position in the global server market, and it continues to be a major player in the PC market. However, like any major tech company, Dell faces various challenges and opportunities as it navigates the evolving technology landscape.

This analysis will delve into Dell's current market standing, the potential risks it faces, and its strategic plans for future growth, especially in the rapidly expanding field of artificial intelligence. For more information, you can read about Owners & Shareholders of Dell Technologies.

Dell Technologies is a leader in the global server market, holding a significant market share. In the first quarter of 2025, Dell maintained a strong position in the PC market. This strong market presence is supported by brand recognition and customer loyalty.

The PC market faces challenges, including fluctuating consumer demand and increased competition. Higher U.S. tariffs and potential recessionary risks are also concerns. Supply chain bottlenecks and cybersecurity threats pose additional risks.

Dell is focused on capitalizing on the potential of artificial intelligence. The company is investing in AI and cloud solutions, expanding in high-growth sectors. Dell's financial guidance for fiscal year 2026 indicates continued growth.

Dell holds a 19.3% market share in the global server market in 2025. In Q1 2025, Dell had a 15.1% market share in the PC market, with shipments growing 3% year-over-year. The company's fiscal year 2026 guidance includes 8% revenue growth and 23% diluted EPS growth.

Dell's strategic focus includes leveraging AI and expanding its market presence. The 'AI Factory' concept aims to provide scalable AI infrastructure to enterprises. The company is also committed to returning capital to shareholders through dividends and share repurchases.

- Investing in research and development for next-generation AI and cloud solutions.

- Expanding its market presence in high-growth sectors like AI-powered servers.

- Increasing its annual cash dividend by 18% to an expected $2.10 per common share.

- Approving a $10 billion increase in its share repurchase authorization.

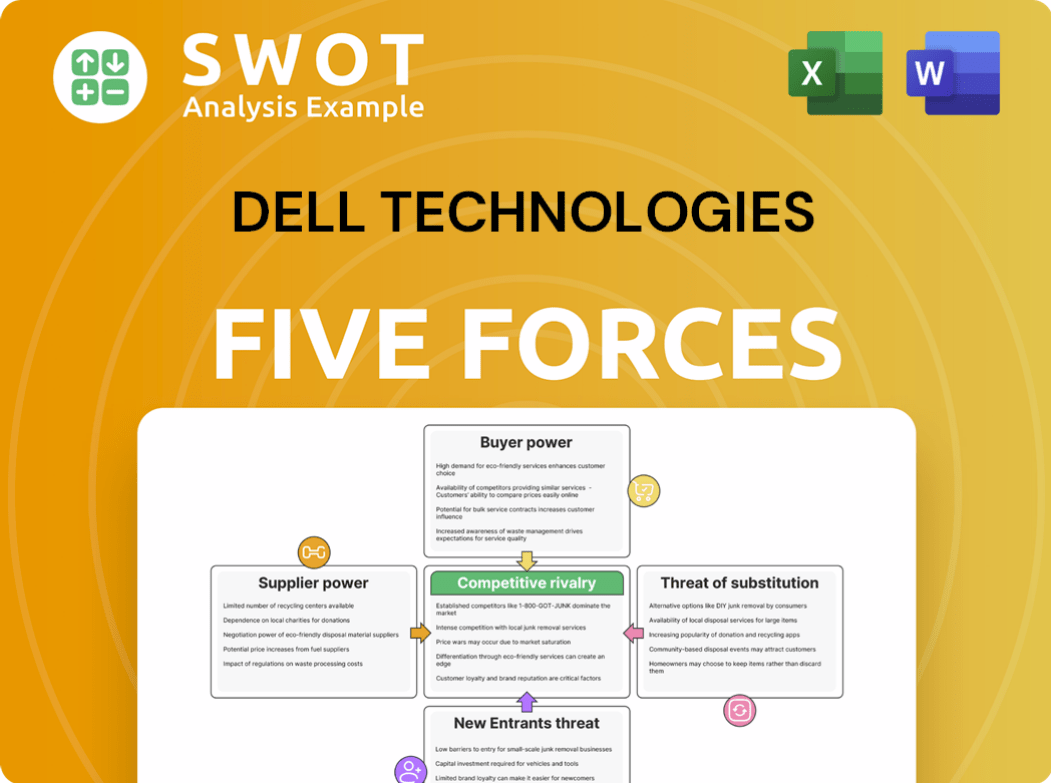

Dell Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Dell Technologies Company?

- What is Competitive Landscape of Dell Technologies Company?

- What is Growth Strategy and Future Prospects of Dell Technologies Company?

- What is Sales and Marketing Strategy of Dell Technologies Company?

- What is Brief History of Dell Technologies Company?

- Who Owns Dell Technologies Company?

- What is Customer Demographics and Target Market of Dell Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.