Designer Brands Bundle

Can Designer Brands Inc. Maintain Its Momentum in the Competitive Retail Landscape?

Designer Brands Inc. has impressively rebounded, showcasing a robust growth strategy in the fourth quarter of fiscal year 2024, marking a significant turnaround after nine challenging quarters. This resurgence highlights the crucial role of strategic planning within the dynamic fashion industry. From its origins as a shoe licensee to its current status as a major footwear and accessories retailer, the company's evolution is a testament to its adaptability and vision.

This analysis delves into the Designer Brands SWOT Analysis, exploring its growth strategy and future prospects within the luxury market. We will examine how Designer Brands Inc. plans to leverage brand expansion, innovation, and strategic financial planning to navigate the evolving market trends of 2024 and beyond. Understanding the challenges and opportunities facing Designer Brands Inc. offers valuable insights for investors and strategists alike, providing a comprehensive market analysis of the company's long-term growth plans and competitive landscape.

How Is Designer Brands Expanding Its Reach?

Designer Brands Inc. is implementing several expansion initiatives to fuel future growth. These initiatives focus on geographical expansion, product category diversification, and strategic acquisitions. The company's strategic moves aim to drive consistent top and bottom-line growth, adapting to industry changes and accessing new customer segments.

A key element of their strategy involves evolving the omnichannel customer experience. This includes improving inventory, productivity, and assortment strategies. Optimizing marketing efforts to boost DSW awareness is also a priority. These efforts are designed to enhance value for consumers and improve financial results.

The company's approach is data-driven, aiming for sustainable growth. The initiatives are designed to strengthen its market position and capitalize on emerging opportunities within the fashion retail sector. This includes leveraging private label brands and expanding into new markets.

The Canadian market is a significant focus for geographical expansion. The company anticipates mid to high single-digit growth in 2025 for its Canada Retail segment. This growth is supported by the acquisition of Rubino in June 2024, web enhancements, and initiatives to grow the existing Canadian business, including The Shoe Co. and Shoe Warehouse.

Designer Brands is revitalizing its product assortment, with a focus on athleisure. Athleisure penetration increased by five percentage points in 2024, leading to market share gains. Private label brands like Kelly & Katie and Crown Vintage are being reestablished as margin drivers, offering significant expansion opportunities.

The brand portfolio segment, including Topo Athletic, Keds, Jessica Simpson, Vince Camuto, and Lucky Brand, is a key growth driver. Topo Athletic saw over 70% growth in 2024, representing over 10% of total brand portfolio sales. Jessica Simpson's wholesale sales grew over 20% in 2024. The company plans to continue investing in Topo and Keds.

The company is focused on evolving the omnichannel customer experience. This includes improving inventory availability, productivity, and assortment strategy. Marketing optimization aims to drive DSW awareness. These initiatives are designed to drive consistent top and bottom-line growth over the long term, as discussed in Revenue Streams & Business Model of Designer Brands.

The growth strategy of Designer Brands includes geographical expansion, particularly in Canada, and product category diversification, with a focus on athleisure and private label brands. The brand portfolio, featuring brands like Topo Athletic and Jessica Simpson, is a significant growth driver, with investments planned for continued expansion.

- Geographical Expansion: Focusing on the Canadian market with the Rubino acquisition and other initiatives.

- Product Diversification: Increasing athleisure penetration and reestablishing private label brands.

- Brand Portfolio: Investing in high-growth brands like Topo Athletic and Keds.

- Omnichannel Experience: Improving inventory, marketing, and customer experience.

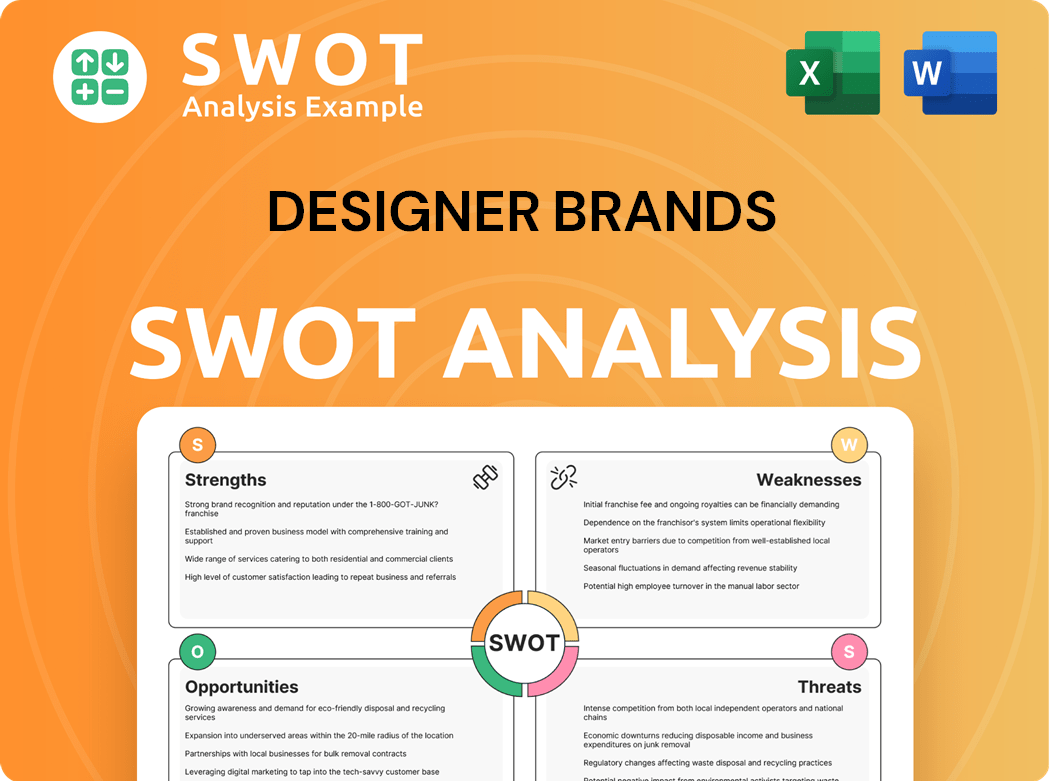

Designer Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Designer Brands Invest in Innovation?

The company is implementing innovation and technology to support its growth strategy and enhance its market position. A key element of this involves a 'customer-first and product-obsessed' approach, which aims to deepen customer understanding and strengthen product offerings through data-driven insights. This data-driven approach is crucial for optimizing inventory allocation and digital order management, which are expected to improve in-stock rates, enhance conversion on store traffic, and lower fulfillment costs for digital orders.

The focus on 'revitalizing and modernizing our assortment' and 'refining our marketing strategies' suggests a commitment to product innovation and digital engagement. The emphasis on evolving the omnichannel customer experience and web enhancements, particularly in the Canada Retail segment, indicates continued investment in digital transformation. This aligns with the goal of profitable growth by improving omnichannel experiences and expanding store presence. The company's approach is designed to adapt to the evolving needs of the luxury market and the changing preferences of its customers.

The company aims to differentiate itself in the retail market through cost management, innovation, digital transformation, and sustainability. While the direct application of cutting-edge technologies such as AI or IoT is not explicitly detailed in recent financial reports, the broad commitment to digital transformation and data-driven strategies suggests an openness to leveraging such advancements to improve operational efficiency and customer engagement. The company's goal to 'continuously improve our customers' omni-channel experience' highlights its ongoing digital efforts.

The company's focus on data-driven insights is critical for optimizing inventory allocation and digital order management. This is expected to enhance conversion on store traffic and lower fulfillment costs for digital orders. These efficiencies are anticipated to build throughout 2025. Marketing Strategy of Designer Brands underscores the importance of adapting to the evolving digital landscape.

- Data-Driven Decision Making: Utilizing customer data to inform product development, marketing, and inventory management.

- Omnichannel Experience: Improving the integrated experience across all channels, including online and in-store.

- Digital Transformation: Embracing digital technologies to enhance operational efficiency and customer engagement.

- Cost Management: Implementing strategies to control and reduce operational costs, improving profitability.

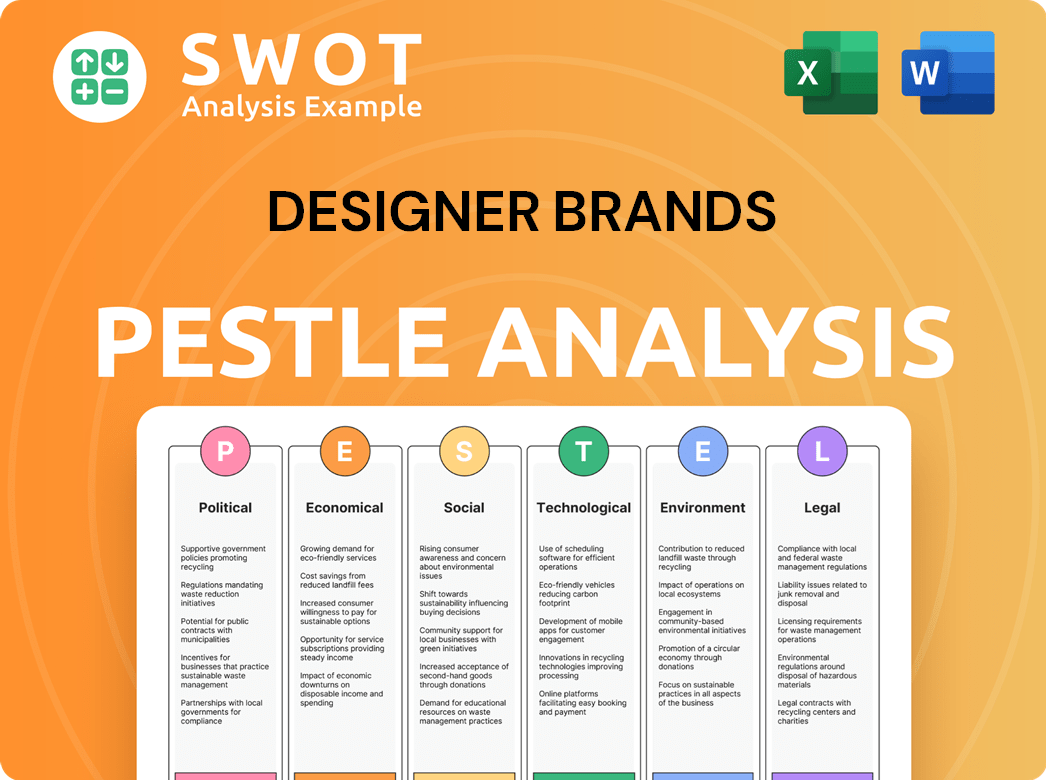

Designer Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Designer Brands’s Growth Forecast?

The financial outlook for Designer Brands Inc. indicates a strategic focus on achieving consistent growth in both revenue and profitability. The company's plans for fiscal year 2025 highlight a commitment to sustainable expansion within the competitive luxury market. This includes targeted investments and strategic initiatives designed to enhance market share and drive long-term value.

Designer Brands Inc. anticipates a return to more consistent top and bottom-line growth in the long term. The company's financial guidance for 2025 reflects this strategic direction. The company's growth strategy is designed to capitalize on emerging opportunities and navigate the challenges within the dynamic retail landscape.

The company's financial performance in 2024 and projections for 2025 provide insights into its strategies and future prospects. For a deeper understanding of the company's origins and evolution, you can explore the Brief History of Designer Brands.

For fiscal year 2025, the company projects consolidated net sales growth in the low single digits. Diluted Earnings Per Share (EPS) are expected to be in the range of $0.30 to $0.50. Capital expenditures are planned between $45 million and $55 million.

The U.S. Retail segment anticipates low single-digit net sales and comparable sales growth. Canada Retail is projected to achieve mid to high single-digit growth. The Brand Portfolio segment is expected to increase sales mid-single digits.

Total comparable sales increased by 0.5% in Q4 2024, marking positive comparable sales. Net sales decreased by 5.4% to $713.6 million. Gross margin for Q4 2024 was 39.6%.

Net sales for the full year 2024 decreased by 2.1% to $3.0 billion. The reported net loss was $10.5 million, or $0.20 loss per diluted share, with adjusted net income of $15.0 million, or $0.27 adjusted diluted EPS.

The company's financial health is supported by a solid cash position and available credit. The company returned $79 million to shareholders in 2024. While the first quarter of 2025 may underperform, gradual performance improvements are expected throughout the year, indicating a strategic focus on long-term growth plans for designer brands.

- Cash and cash equivalents at the end of 2024: $44.8 million.

- Available borrowings under the revolving credit facility: $127.3 million.

- Debt totaled $491.0 million at the end of 2024.

- Dividend declared for April 2025: $0.05 per share.

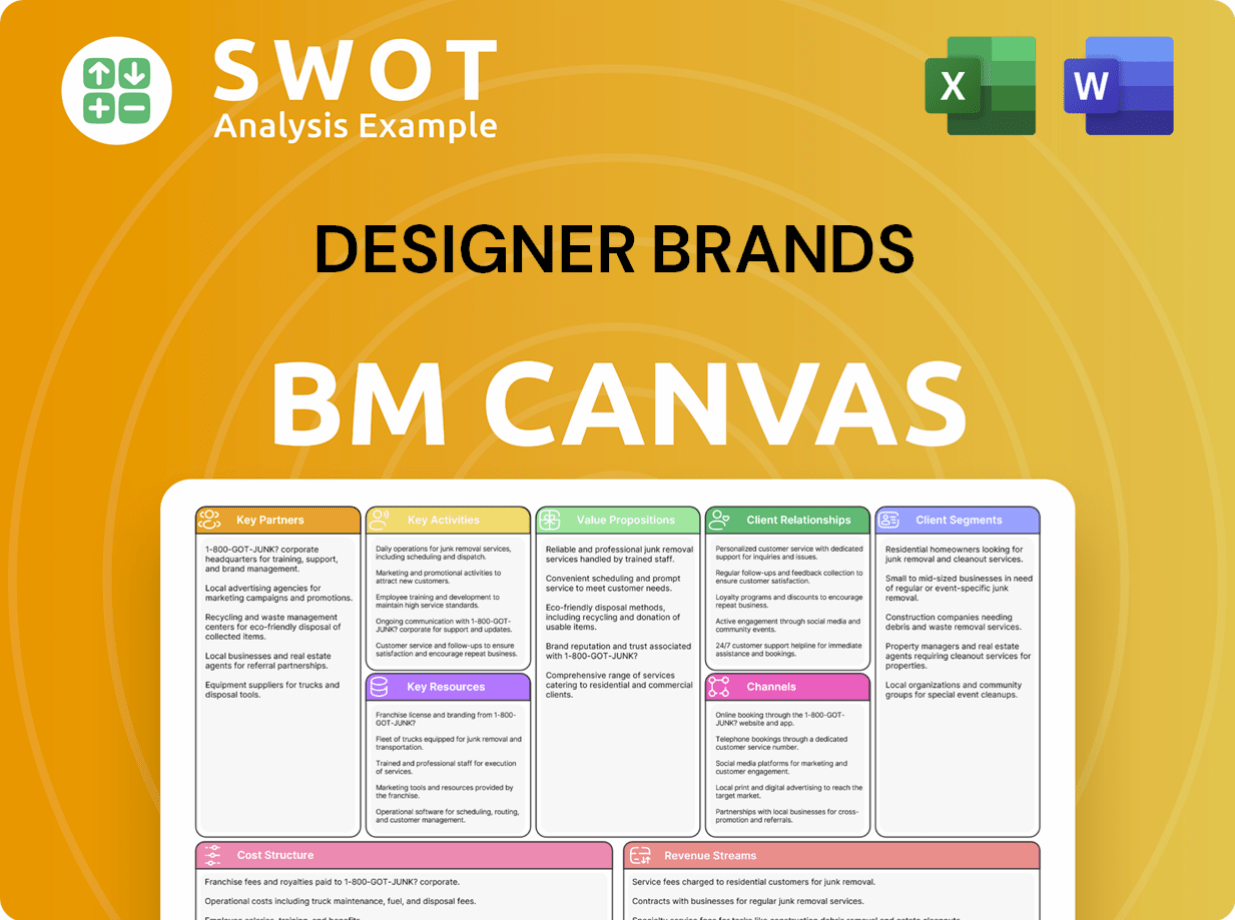

Designer Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Designer Brands’s Growth?

The path forward for Designer Brands Inc. faces several potential risks and obstacles. The fashion retail industry is intensely competitive, which can squeeze profit margins. Economic fluctuations and shifts in consumer spending present significant challenges to their Growth strategy.

Economic uncertainties, such as inflation, directly affect DBI's pricing strategies. In December 2023, the U.S. inflation rate of 3.4% influenced the company's decisions. The company increased prices by an average of 4.2% to 5.7% across different footwear categories. Furthermore, the company's reliance on physical stores and the sensitivity to changing consumer preferences, also pose significant risks.

Supply chain issues and seasonal declines, such as drops in boot sales, add to the hurdles. The company's response includes focusing on controllable factors and incorporating macroeconomic uncertainties into their 2025 guidance. This involves managing inventory, refining promotional strategies, and rationalizing underperforming products.

The Designer brands industry is highly competitive, with numerous players vying for market share. This competition can lead to price wars and reduced margins. Understanding the Designer brand market trends 2024 is crucial for maintaining a competitive edge.

Economic downturns and shifts in consumer spending habits directly impact sales. Inflation, as seen with the 3.4% rate in December 2023, affects pricing and consumer behavior. These factors influence the Future prospects of the company.

Disruptions in the supply chain can affect inventory management and overall operations. Delays in receiving goods can lead to lost sales and higher costs. Effective supply chain management is key to the Brand expansion.

Consumer tastes are always evolving, and shifts in trends can lead to increased inventory risks. Adapting to these changes requires agility and responsiveness in product offerings. This is important for the Luxury market.

Despite a strong online presence, a significant portion of sales comes from physical stores. Setbacks in foot traffic can directly affect sales. The Market analysis must include both online and offline performance.

Seasonal fluctuations, like drops in boot sales, can present challenges. Managing inventory and promotions to mitigate these declines is essential. For more insights, see Owners & Shareholders of Designer Brands.

Effective inventory management is crucial to mitigate risks. Strategies include rationalizing underperforming products and optimizing inventory allocation. This aims to improve product availability and reduce holding costs. The company is also focusing on promotional strategies.

Maintaining a flat gross profit rate is a key goal, offsetting pressures from athletic and national brand growth. SG&A expenses are expected to increase by approximately $50 million due to new logistics infrastructure, management incentives, and the Rubino acquisition. These factors impact the Designer brand future outlook.

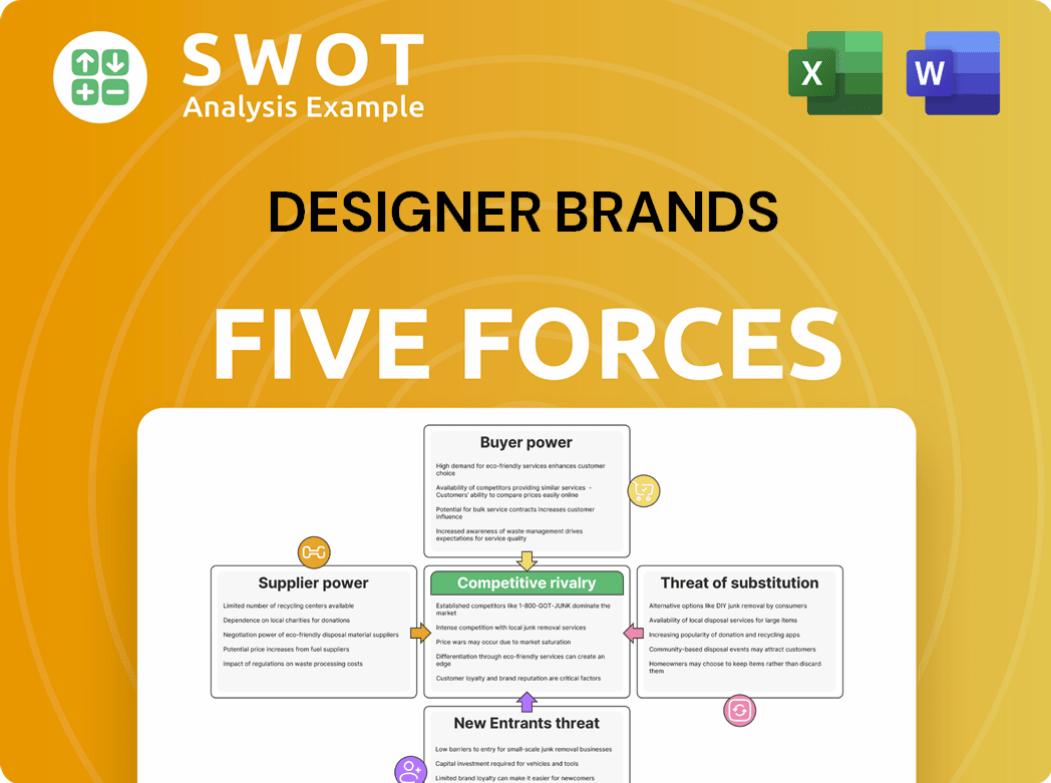

Designer Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Designer Brands Company?

- What is Competitive Landscape of Designer Brands Company?

- How Does Designer Brands Company Work?

- What is Sales and Marketing Strategy of Designer Brands Company?

- What is Brief History of Designer Brands Company?

- Who Owns Designer Brands Company?

- What is Customer Demographics and Target Market of Designer Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.