Designer Brands Bundle

Who Really Owns Designer Brands Company?

Ever wondered who's truly calling the shots at Designer Brands Company, the powerhouse behind DSW Designer Shoe Warehouse? With a market cap of around $170.11 million as of May 30, 2025, understanding Designer Brands ownership is crucial for any investor or business strategist. This article peels back the layers to reveal the key players and their influence.

From its humble beginnings in 1969 to its current status, Designer Brands Company's journey has been shaped by significant shifts in its ownership structure. This analysis explores the evolution of DBI ownership, examining the impact of the 2005 IPO and the 2018 rebranding. Understanding the major stakeholders and board composition provides critical insights into the company's strategic direction. For those seeking a deeper dive, consider exploring a Designer Brands SWOT Analysis to gain a comprehensive understanding of its market position.

Who Founded Designer Brands?

The story of Designer Brands Inc. (DBI) begins in 1969 with the establishment of Shonac Corporation in Columbus, Ohio. This initial venture was the brainchild of Harry Kanfer, who partnered with members of the Schottenstein family (Saul, Alvin, Jerome, and Leon) and George and Steve Nacht. The company started with a foundational investment of $7.8 million.

Shonac Corporation's early operations focused on managing leased shoe departments for Value City and other retailers. This model persisted for over two decades before a significant transformation occurred. The opening of the first DSW Designer Shoe Warehouse store in Dublin, Ohio, in July 1991 marked a pivotal shift, introducing a new retail concept that would define the company's future.

In 1998, the company saw a major change in ownership. Value City Department Stores, Inc., which later became a wholly-owned subsidiary of Retail Ventures, Inc., acquired DSW and its affiliated shoe businesses from Schottenstein Stores Corporation (SSC) and Nacht Management, Inc. This acquisition highlighted the expanding retail influence of the Schottenstein family, spearheaded by Jerome M. Schottenstein, who played a crucial role in growing these business interests.

The evolution of Designer Brands ownership reflects strategic shifts and expansions within the retail landscape. Understanding the foundational ownership is crucial for investors and stakeholders interested in the company's trajectory. For more information about the Target Market of Designer Brands, you can read this article.

- 1969: Shonac Corporation founded by Harry Kanfer, the Schottenstein family, and partners.

- 1991: First DSW Designer Shoe Warehouse store opens, marking a shift in retail strategy.

- 1998: Value City Department Stores, Inc. acquired DSW from Schottenstein Stores Corporation and Nacht Management, Inc.

- 1999: DSW expands to 48 stores, showcasing early growth post-acquisition.

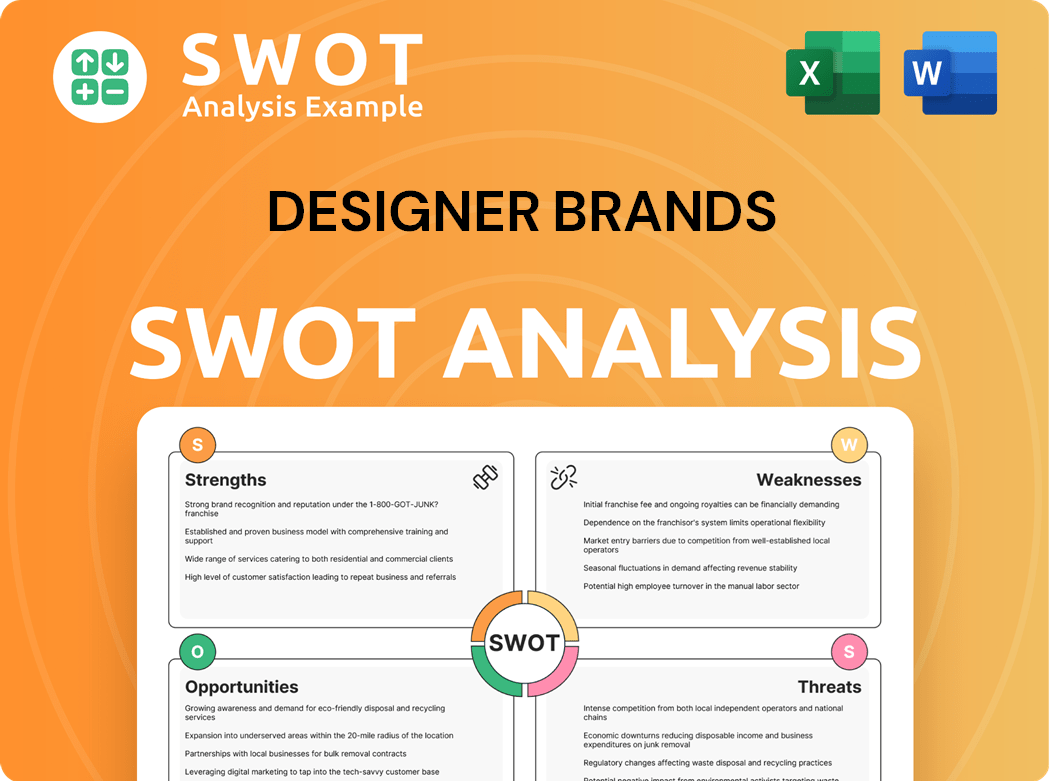

Designer Brands SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Designer Brands’s Ownership Changed Over Time?

The ownership of Designer Brands Company, now known as DBI, has evolved significantly since its inception. Initially, Retail Ventures, an affiliate of the Schottenstein family, held a controlling stake. A crucial step was the Initial Public Offering (IPO) in July 2005, which provided capital for expansion. Later, in 2011, DSW Inc. acquired Retail Ventures, consolidating ownership further. The company rebranded to Designer Brands Inc. in 2018, reflecting a strategic shift.

The company's structure is defined by two classes of common stock as of February 20, 2025. Class A shares provide economic interest with one vote per share, while Class B shares offer eight votes per share. This dual-class structure gives Schottenstein Affiliates significant control, holding 31% of the outstanding shares and 67% of the voting power. The evolution of Designer Brands ownership reflects strategic decisions aimed at growth and market positioning.

| Key Dates | Event | Impact on Ownership |

|---|---|---|

| December 2004 | Retail Ventures acquires the company | Schottenstein family affiliate gains control. |

| July 2005 | Initial Public Offering (IPO) | DSW Inc. (later DBI) raises capital and goes public. |

| 2011 | DSW Inc. acquires Retail Ventures | Ownership consolidated under DSW Inc. |

| 2018 | Rebranding to Designer Brands Inc. (DBI) | Reflects broader brand focus. |

As of March 31, 2025, major institutional shareholders include Stone House Capital Management, LLC, BlackRock, Inc., Dimensional Fund Advisors LP, and The Vanguard Group, Inc. Institutional investors hold approximately 36.18% of the stock, while insiders own 38.94%. Jay Schottenstein remains the largest individual shareholder. For more insights, you can explore the Competitors Landscape of Designer Brands.

Designer Brands ownership is primarily influenced by the Schottenstein family and institutional investors.

- Schottenstein Affiliates control 67% of the voting power.

- Institutional investors hold about 36.18% of the company's stock.

- Jay Schottenstein is the largest individual shareholder.

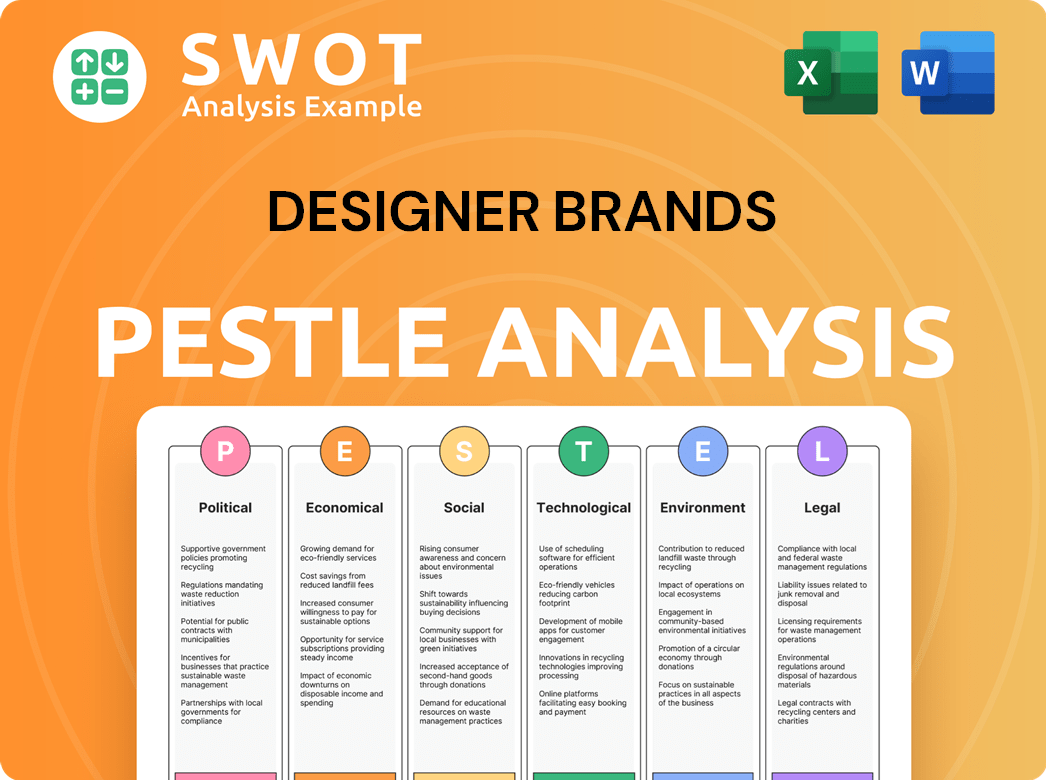

Designer Brands PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Designer Brands’s Board?

The current Board of Directors of Designer Brands Company comprises eleven members, each serving staggered three-year terms. As of June 2025, the board includes key figures such as Jay Schottenstein as Executive Chairman, and Douglas M. Howe as CEO and Director. Other board members include independent directors Peter S. Cobb, Elaine J. Eisenman, Joanna T. Lau, John W. Atkinson, Harvey L. Sonnenberg, Allan J. Tanenbaum, Joanne Zaiac, and Rich Paul. Joseph A. Schottenstein also serves as an Inside Director. John W. Atkinson, appointed to the Board on August 1, 2024, also participates in the Audit Committee and the Nominating and Corporate Governance Committee.

The board's composition reflects a mix of experience and expertise, guiding the strategic direction of the company. The presence of independent directors ensures a degree of oversight and diverse perspectives in decision-making processes. The structure of the board is designed to align with the company's goals and maintain effective governance.

| Board Member | Title | Appointment Date |

|---|---|---|

| Jay Schottenstein | Executive Chairman | N/A |

| Douglas M. Howe | CEO and Director | N/A |

| Peter S. Cobb | Independent Director | N/A |

| Elaine J. Eisenman | Independent Director | N/A |

| Joanna T. Lau | Independent Director | N/A |

| John W. Atkinson | Independent Director | August 1, 2024 |

| Harvey L. Sonnenberg | Independent Director | N/A |

| Allan J. Tanenbaum | Independent Director | N/A |

| Joanne Zaiac | Independent Director | N/A |

| Rich Paul | Independent Director | N/A |

| Joseph A. Schottenstein | Inside Director | N/A |

The voting structure at Designer Brands Company is based on a dual-class share system. Class A Common Shares grant one vote per share, while the privately held Class B Common Shares provide eight votes per share. This structure significantly concentrates voting power. The Schottenstein Affiliates, despite owning approximately 31% of the outstanding shares, control about 67% of the voting power because of their holdings of Class B shares. Jay Schottenstein's substantial ownership of Class A Common Shares, including shares held directly and through various trusts, further strengthens the family's influence. This arrangement allows the Schottenstein family to have considerable control over the company's strategic decisions and governance.

The ownership structure of Designer Brands Company is characterized by a dual-class share system, concentrating voting power within the Schottenstein family. This structure impacts the company's governance and strategic direction.

- The Schottenstein Affiliates hold a significant portion of the voting power.

- Class B shares provide eight votes per share.

- Jay Schottenstein has substantial ownership through various holdings.

- This structure allows the family to maintain control over strategic decisions.

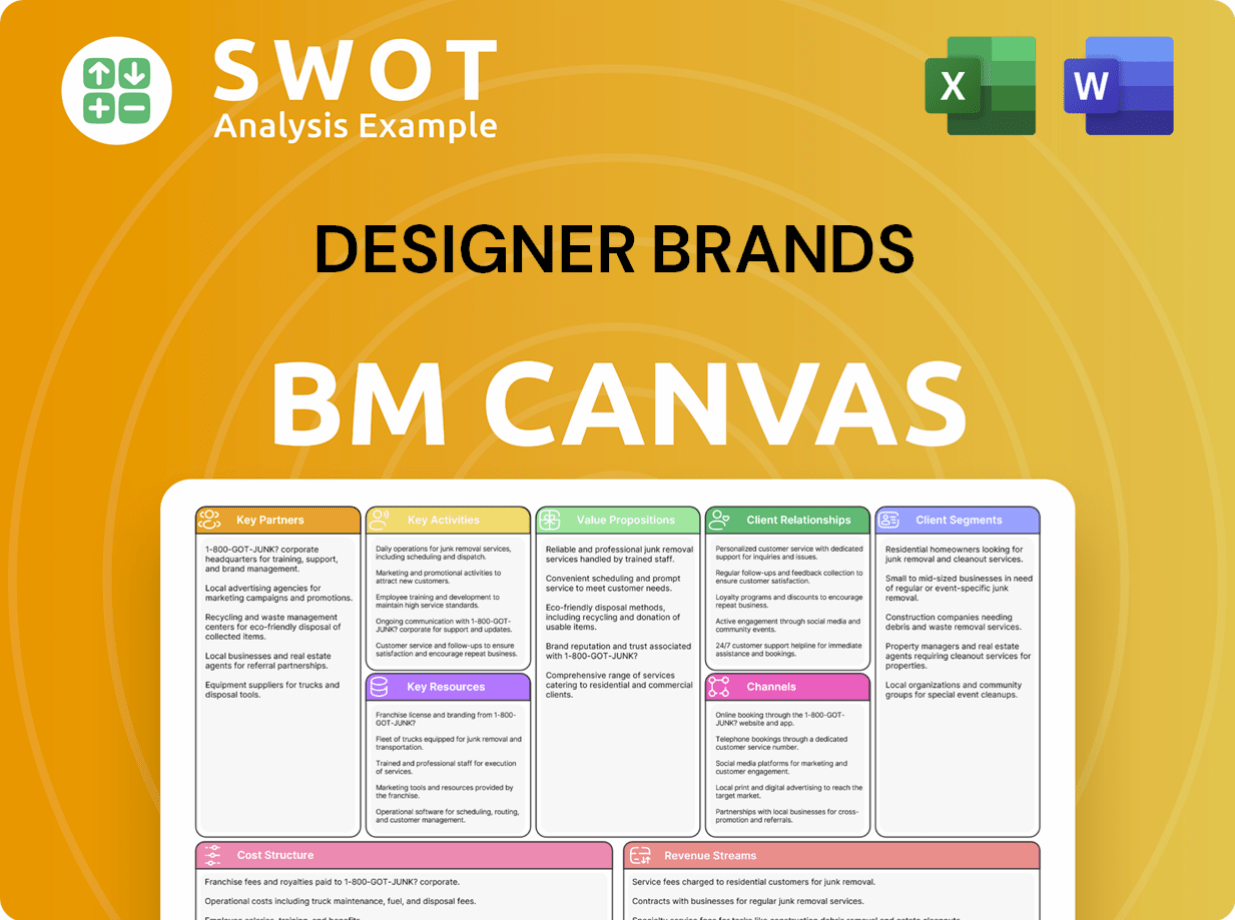

Designer Brands Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Designer Brands’s Ownership Landscape?

In the past few years, several developments have shaped the ownership and strategic direction of the Designer Brands Company. A significant move was the April 2024 acquisition of Rubino Shoes Inc. for $18.15 million, expanding its footprint into Quebec, Canada, with the addition of 28 stores. This brand acquisition highlights the company's strategy of broadening its brand portfolio and market presence.

The company has also been active in returning capital to shareholders. In 2024, Designer Brands returned $79 million through dividends and buybacks. Furthermore, during 2024, the company repurchased 10.3 million Class A common shares for $68.6 million. As of February 1, 2025, $19.7 million of Class A common shares were available for future repurchase. The company also announced a dividend of $0.05 per share of Class A and Class B common shares, payable on April 11, 2025. The company is focused on cost control, aiming for $20 million to $30 million in savings over 2025, and is accelerating efforts to diversify sourcing.

| Metric | Value | Year |

|---|---|---|

| Net Sales | $686.9 million | Q1 2025 |

| Net Loss | $17.4 million | Q1 2025 |

| Shares Repurchased | 10.3 million | 2024 |

| Sourcing from China | Less than 50% target | End of 2025 |

Recent financial results, as of the first quarter ended May 3, 2025, show a challenging macroeconomic environment, with net sales decreasing by 8.0% to $686.9 million and a reported net loss of $17.4 million. Despite these headwinds, the company is focused on cost control and strategic initiatives to ensure stability and growth. Industry trends, such as increased institutional ownership, are evident in Designer Brands, with major institutional investors holding significant stakes. To learn more about the company's business model, you can read this article about Revenue Streams & Business Model of Designer Brands.

Institutional ownership plays a significant role in the DBI ownership structure. Major institutional investors hold substantial stakes, influencing the company's direction.

Designer Brands is focused on private label growth and investing in key brands. The company is committed to long-term growth through strategic brand investments.

Q1 2025 showed a decrease in net sales and a reported net loss. The company is implementing cost-saving measures to mitigate these challenges.

While full-year 2025 guidance was withdrawn due to market volatility, Designer Brands remains confident. The company is focused on strategies to ensure continued stability.

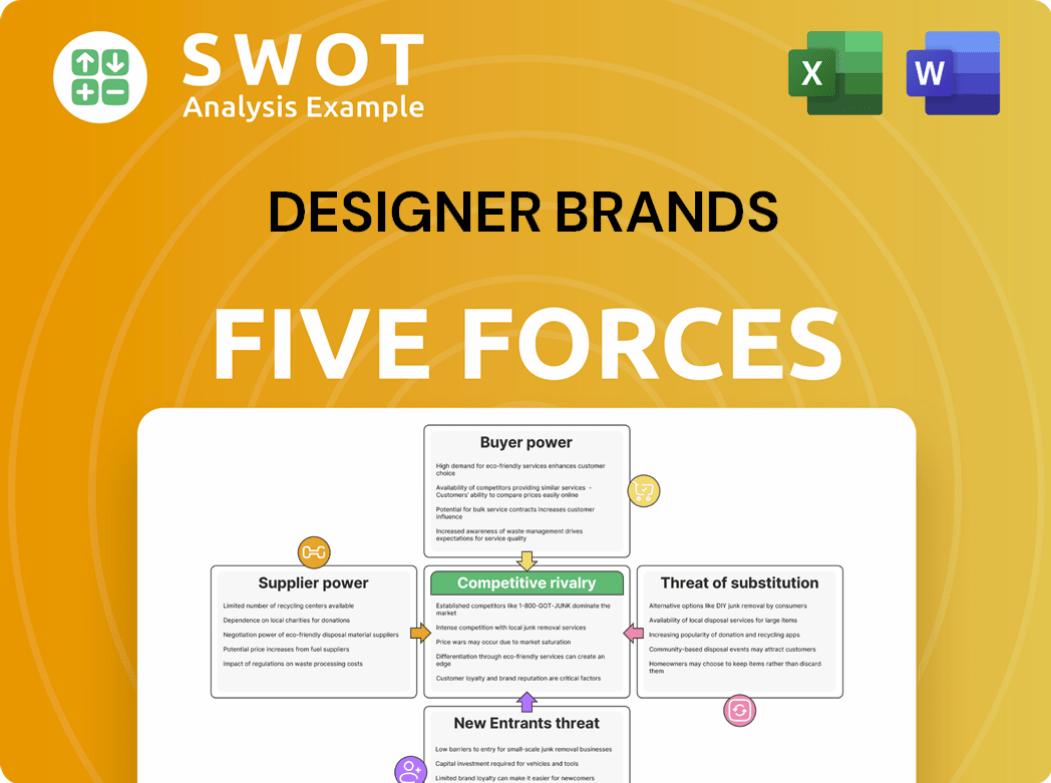

Designer Brands Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Designer Brands Company?

- What is Competitive Landscape of Designer Brands Company?

- What is Growth Strategy and Future Prospects of Designer Brands Company?

- How Does Designer Brands Company Work?

- What is Sales and Marketing Strategy of Designer Brands Company?

- What is Brief History of Designer Brands Company?

- What is Customer Demographics and Target Market of Designer Brands Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.