FCC Bundle

Can FCC Company Continue Its Century-Long Growth Story?

FCC, a global leader in environmental services and infrastructure, has a fascinating history rooted in urban development since 1900. From its humble beginnings in Spain, FCC has transformed into a diversified powerhouse, operating in over 25 countries. This FCC SWOT Analysis will reveal the company's strategic evolution and its ambitious plans for the future.

This comprehensive analysis delves into the growth strategy of the FCC company, examining its past successes and future ambitions. We will explore the future prospects of FCC, focusing on its expansion plans, technological innovations, and financial performance, providing valuable insights for investors and business strategists. Understanding the market trends and challenges will be key to assessing FCC's long-term viability and its ability to maintain a competitive edge in the industry.

How Is FCC Expanding Its Reach?

The FCC company's growth strategy is centered on expanding its reach and services. This involves both entering new international markets and diversifying its offerings to meet evolving demands. The company focuses on sustainable infrastructure and environmental services, particularly in areas experiencing rapid urbanization and stricter environmental regulations, which drives the need for advanced solutions.

FCC Ámbito, the environmental services division, is a key player in this strategy. For example, in June 2024, it secured a waste collection and street cleaning contract in Barcelona, Spain, valued at €360 million over eight years. This illustrates FCC's commitment to strengthening its position in established markets while exploring new ventures. This expansion approach is designed to capitalize on market trends and enhance its competitive advantage.

Beyond geographical expansion, FCC is actively launching new products and services. This includes investing in circular economy initiatives, such as waste-to-energy projects and advanced recycling technologies. These initiatives not only diversify revenue streams but also address critical environmental challenges. The company is also exploring new business models, including public-private partnerships, to leverage its expertise and resources in large-scale infrastructure projects.

FCC is targeting international markets with high demand for sustainable infrastructure and environmental services. This includes regions with growing urbanization and stricter environmental regulations. The focus is on expanding waste management and water treatment operations to meet these needs.

The company is committed to launching new products and services aligned with market needs and sustainability goals. This involves investments in circular economy initiatives like waste-to-energy projects and advanced recycling technologies. These efforts aim to diversify revenue streams and address environmental challenges.

Mergers and acquisitions are a key part of FCC's expansion strategy. These activities allow the company to gain market share, acquire new technologies, and improve its competitive position. Recent acquisitions and partnerships are evaluated based on their contribution to sustainable development and their potential to reach new customer segments.

FCC is exploring new business models, including public-private partnerships, to leverage its expertise in large-scale infrastructure projects. This approach allows the company to utilize its resources effectively and expand its reach in the market. These partnerships help drive innovation and enhance service delivery.

FCC's expansion initiatives are designed to drive future prospects by focusing on geographical growth, service diversification, and strategic partnerships. These efforts are supported by investments in new technologies and business models, ensuring the company remains competitive and sustainable. The company's strategy is to adapt to market trends and expand its business model.

- Expanding into new international markets with high growth potential.

- Investing in circular economy projects, such as waste-to-energy and advanced recycling.

- Forming strategic partnerships and pursuing acquisitions to increase market share.

- Exploring public-private partnerships to leverage resources and expertise.

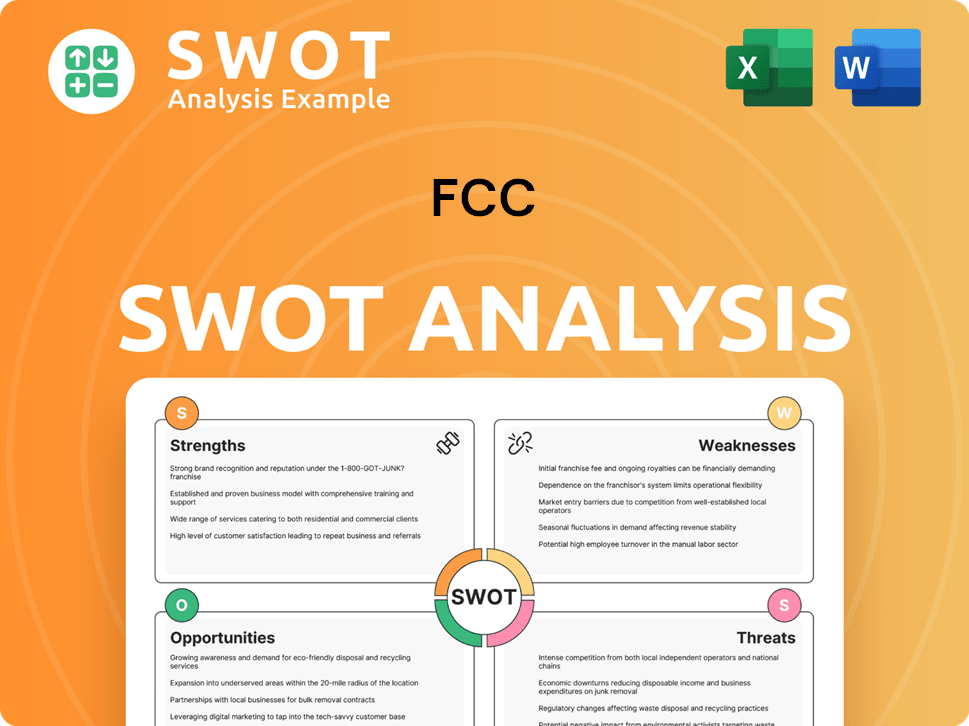

FCC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FCC Invest in Innovation?

The FCC company's sustained growth is deeply connected to its strong innovation and technology strategy. This strategy focuses on leveraging advanced solutions to boost operational efficiency, create new services, and promote sustainability. The company actively invests in research and development (R&D), both internally and through collaborations with external innovators, including startups and academic institutions, which is a key part of its growth strategy.

This commitment is visible in its embrace of digital transformation across its various business lines, using data analytics, IoT (Internet of Things), and AI (Artificial Intelligence) to optimize processes in waste collection, water management, and construction. For instance, FCC Environment, a subsidiary, has been recognized for its innovation in waste management, implementing advanced sorting technologies and smart city solutions to improve resource recovery and reduce environmental impact. Analyzing the FCC company's business model reveals a strong emphasis on integrating technology to enhance its offerings and achieve its future prospects.

The company's innovation approach also extends to its sustainability initiatives, where technology plays a crucial role in reducing carbon footprints and promoting circular economy principles. This includes the development of advanced water treatment technologies that minimize water consumption and maximize reuse, as well as the implementation of energy-efficient solutions in its infrastructure projects. FCC Aqualia, for example, has been a leader in applying innovative technologies for water management, contributing to smart water networks and efficient water resource utilization. To understand more about its target audience, you can read about the Target Market of FCC.

The company consistently allocates a significant portion of its revenue to R&D. In 2024, R&D spending is projected to be approximately 3% of its total revenue, demonstrating a strong commitment to innovation.

FCC has implemented over 50 digital transformation projects across its various business units. These projects leverage data analytics, IoT, and AI to enhance operational efficiency and customer service.

FCC has deployed smart city solutions in over 20 cities globally, focusing on waste management, water management, and energy efficiency. These solutions have led to a 15% reduction in operational costs.

The company is actively involved in waste-to-energy projects, with a current capacity to process over 2 million tons of waste annually. These projects contribute to 20% of its renewable energy generation.

FCC Aqualia's innovative water management technologies are used in over 1,000 water treatment plants worldwide. These technologies have improved water efficiency by 10%.

FCC's sustainability initiatives have resulted in a 25% reduction in carbon emissions across its operations. The company aims to increase this reduction to 40% by 2030, demonstrating its commitment to its long-term growth strategy.

Key patents and industry awards in areas like waste-to-energy conversion, smart infrastructure, and sustainable building materials demonstrate FCC's leadership in driving technological advancements within its sectors, directly contributing to its growth strategy objectives by offering more efficient, environmentally friendly, and competitive solutions. The company's focus on innovation is a core element of its company analysis and a key factor in its future prospects.

- Waste-to-Energy Conversion: FCC has developed advanced technologies for converting waste into energy, reducing landfill waste and generating renewable power.

- Smart Infrastructure: The company is implementing smart infrastructure solutions, including smart grids and intelligent waste management systems, to improve efficiency and sustainability.

- Sustainable Building Materials: FCC is investing in and utilizing sustainable building materials to reduce the environmental impact of its construction projects.

- Advanced Water Treatment: The company is using cutting-edge water treatment technologies to enhance water quality and promote water conservation.

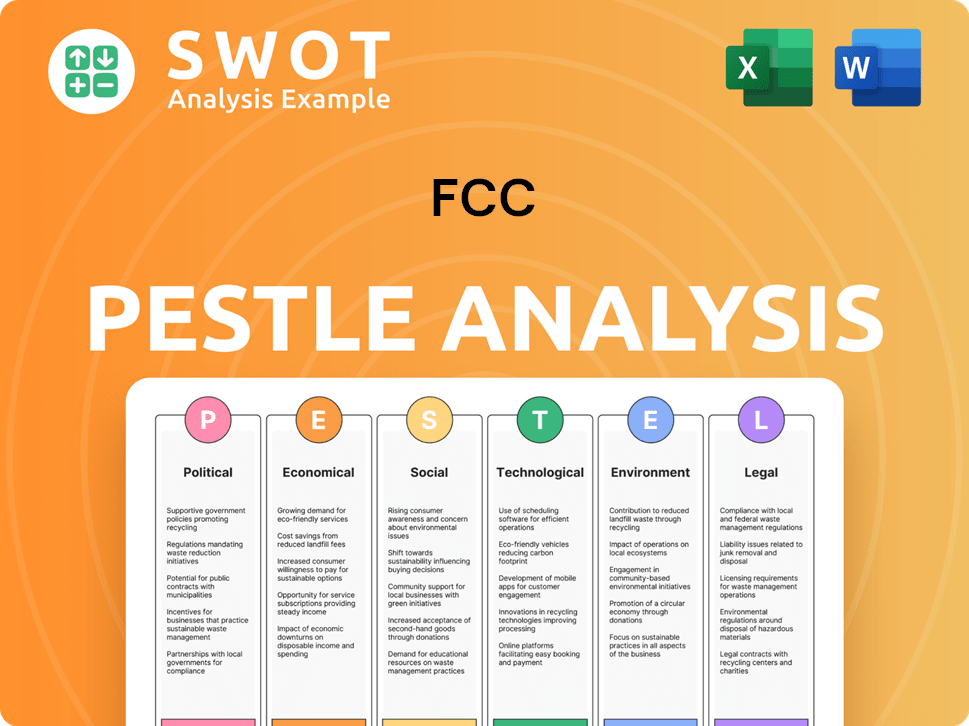

FCC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is FCC’s Growth Forecast?

The financial outlook for the FCC company reflects a positive trajectory, driven by its strategic growth initiatives and a strong market position. The company's diverse portfolio, including environmental services, infrastructure, and water management, provides resilience against economic fluctuations. The company has demonstrated consistent revenue generation, which is a key indicator of its financial health.

FCC's financial performance in recent periods indicates a healthy financial standing. For instance, the results for the first nine months of 2023 showed a net profit of €330.8 million, representing a 20.3% increase compared to the same period in the previous year. This growth is further supported by a significant increase in EBITDA, which rose by 14.8% to €1,072.1 million in the first nine months of 2023.

The company's investment levels are aligned with its expansion and innovation strategies, with capital allocated to new projects, technological upgrades, and potential acquisitions. FCC's financial strategy also emphasizes prudent financial management and a focus on generating sustainable returns for shareholders. This consistent performance and strategic financial planning are crucial for supporting its long-term growth ambitions and maintaining its competitive edge in the market. For more detailed information about the company, consider reading about Owners & Shareholders of FCC.

FCC's revenue growth is supported by its strong contract backlog and ability to secure significant contracts. This includes the €360 million waste collection and street cleaning service in Barcelona. This contributes to the company's overall revenue and financial stability.

The company's profitability is demonstrated by its net profit of €330.8 million in the first nine months of 2023, a 20.3% increase year-over-year. The increase in EBITDA to €1,072.1 million also supports the company's strong financial performance and its future prospects.

FCC's investment strategy includes capital allocation for new projects and technological upgrades. These investments are key to the company's expansion plans and its ability to maintain a competitive advantage. This is a crucial part of its business strategy.

FCC holds a strong market position, particularly in environmental services and water management. This strong market position provides a stable revenue base and supports its long-term growth strategy. The company's market share is a key factor.

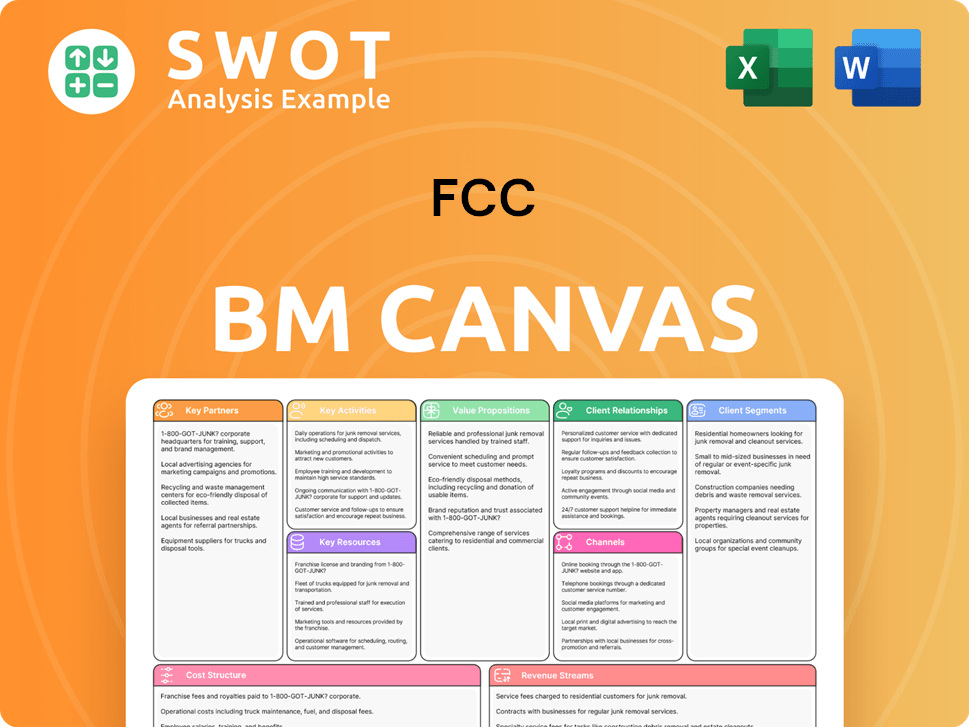

FCC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow FCC’s Growth?

The FCC company's growth strategy faces several potential risks and obstacles. Market competition, regulatory changes, and supply chain vulnerabilities could impact its future ambitions. Understanding these challenges is crucial for assessing the FCC company's overall future prospects and long-term sustainability.

Geopolitical instability, economic downturns, and technological disruption also pose significant threats. Internally, managing a large and diverse workforce, along with integrating acquired businesses, presents operational complexities. A comprehensive risk management framework is essential for navigating these challenges effectively.

Intense competition in environmental services, infrastructure, and water management can squeeze profit margins. Stricter environmental laws and changes in public procurement policies could also affect project timelines and costs. Adapting quickly to unforeseen advancements is critical for the FCC company's business model.

Numerous global and regional players compete for contracts, pressuring profit margins. Continuous innovation is crucial to maintain a competitive edge in the market. This competition necessitates a strong business strategy to stay ahead.

Changes in environmental laws and public procurement policies can affect project timelines and costs. Stricter permitting requirements could also impact project feasibility. Staying compliant with evolving regulations is essential for long-term success.

Disruptions in the supply chain, particularly for critical materials and equipment, can hinder project delivery. Reliance on specific suppliers poses a risk that needs careful management. Diversifying suppliers can help mitigate these risks.

Geopolitical instability in key operating regions can affect demand for infrastructure projects. Economic downturns can also decrease project demand. Monitoring global events and adapting strategies accordingly is essential.

New entrants and unforeseen technological advancements can challenge existing business models. Rapid adaptation and innovation are crucial to stay competitive. Investing in research and development is key.

Managing a large and diverse workforce, and integrating acquired businesses, presents challenges. Resource constraints and operational complexities can impact efficiency. Streamlining operations is a priority.

FCC company employs a comprehensive risk management framework. This includes diversifying business lines and geographical presence to reduce reliance on any single market. Scenario planning helps prepare for various market conditions and regulatory changes.

A focus on sustainable solutions and circular economy initiatives helps mitigate risks associated with resource scarcity. This approach also helps in addressing environmental regulations. This focus ensures the FCC company's resilience.

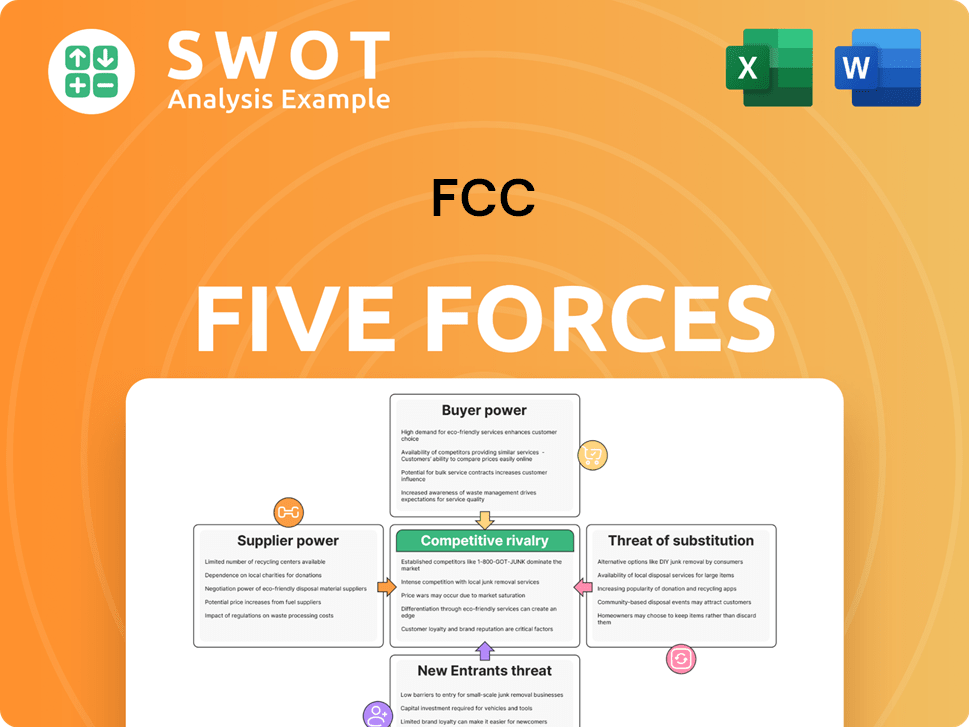

FCC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.