FCC Bundle

How Does the FCC Company Thrive?

FCC, a global leader in environmental services, infrastructure, and water management, isn't just surviving; it's thriving. With a remarkable 10.4% turnover increase in 2024, driven by strong performance across its diverse sectors, FCC company showcases a robust financial foundation. Their strategic acquisitions and commitment to sustainable solutions have solidified their position as a key player in essential services.

Delving into the FCC SWOT Analysis reveals the core strengths and strategic initiatives fueling this impressive growth. Understanding the FCC structure and FCC operations is vital for grasping its market influence. This analysis will explore the company's diverse revenue streams, operational strengths, and strategic initiatives, offering insights into its continued success, especially considering the evolving landscape of FCC regulations and responsibilities.

What Are the Key Operations Driving FCC’s Success?

The core of FCC's operations centers on delivering essential environmental services, water management solutions, infrastructure development, and concessions. This integrated approach allows FCC to provide comprehensive services across multiple sectors. These services are designed to meet the diverse needs of municipalities, industrial clients, and residential communities.

FCC's value proposition lies in its ability to offer sustainable and efficient solutions. The company's focus on advanced technologies and an integrated range of services ensures high-quality offerings. This approach translates into tangible benefits for customers, such as improved urban sanitation, efficient resource management, and robust infrastructure.

FCC serves a broad spectrum of clients across more than 25 countries, demonstrating its global presence and operational capabilities. For example, FCC Environmental Services serves over 14 million Americans across 7 states.

FCC's waste management operations include collection, recycling, processing, and waste-to-energy facilities. These systems are designed to handle municipal solid waste efficiently and sustainably. In 2024, FCC Environmental Services recycled over 500,000 tons in the U.S.

Water management involves the integrated water cycle, from treatment to distribution and sewerage maintenance. FCC provides comprehensive water solutions, ensuring the efficient and sustainable management of water resources. This includes advanced technologies and processes to meet the needs of various communities.

FCC's construction and infrastructure projects encompass a wide range of activities, including road and railway construction, and industrial facilities. The company's construction division saw its portfolio increase by 30% in Q1 2025, largely due to international projects.

FCC emphasizes sustainable solutions, utilizing eco-friendly vehicles like those powered by compressed natural gas (CNG) and electric vehicles in its environmental services. The company operates over 500 CNG vehicles in its U.S. fleet. Sustainable practices are integrated throughout its operations.

FCC's differentiation comes from over 120 years of experience, advanced technologies, and an integrated range of products and services. This ensures high-quality and sustainable offerings across all business areas. The company's integrated approach adds value across all business areas, ensuring high-quality and sustainable offerings.

- Extensive experience and expertise in environmental services, water management, and infrastructure.

- Advanced technologies and sustainable practices, including the use of eco-friendly vehicles.

- Integrated range of products and services that add value across all business areas.

- Strong emphasis on customer benefits such as improved urban sanitation and efficient resource management.

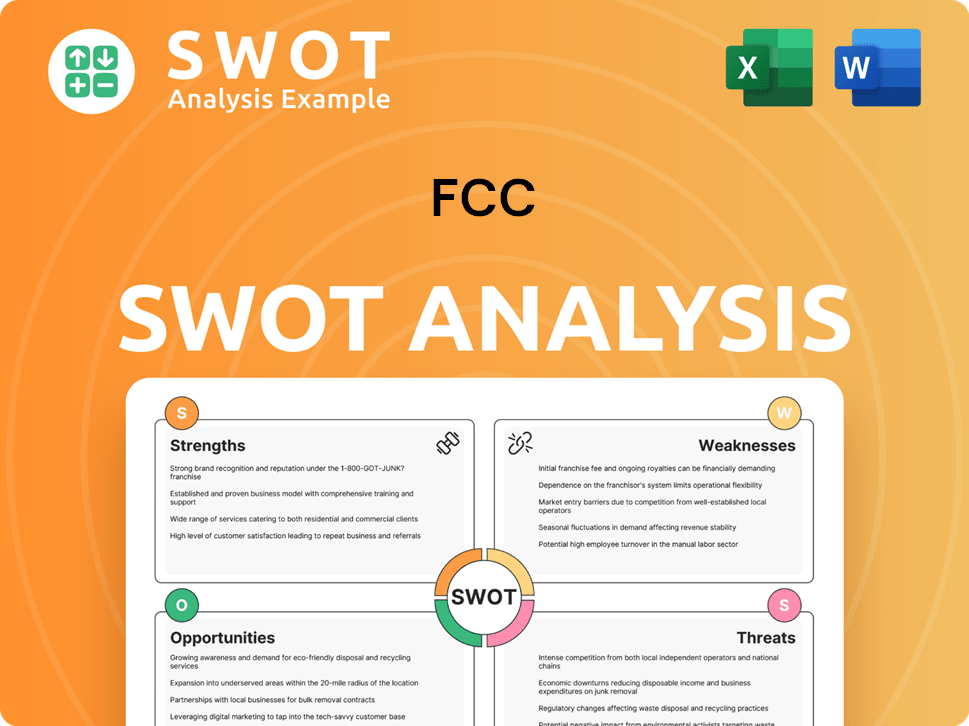

FCC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FCC Make Money?

The revenue streams and monetization strategies of the company are multifaceted, primarily stemming from its Environment, Water, and Construction/Concessions divisions. In 2024, the company reported a total revenue of 9,071.4 million euros, demonstrating a 10.4% increase compared to the previous year. The company's approach focuses on securing long-term contracts and concessions to ensure a steady income stream.

The Environment segment, boosted by acquisitions in the UK, US, and France during the first half of 2024, saw its turnover increase by 16.7% in the first quarter of 2025. This segment encompasses services like municipal solid waste collection, street cleaning, waste treatment, and energy recovery. The Water segment also experienced strong growth, with a 10.1% increase in Q1 2025, driven by higher revenue from integrated water cycle concession businesses and the operation and maintenance of infrastructure assets.

The Construction division's portfolio expanded by 30% in Q1 2025, with international growth reaching 42.6%, significantly contributing to future revenue. The company's backlog at the end of 2024 was 43,043.8 million euros, providing nearly five years of activity. The spin-off of its Real Estate and Cement businesses in November 2024 allowed the company to concentrate on its core environmental, water, and infrastructure services.

The company's revenue model is heavily reliant on long-term contracts and strategic acquisitions. The Environment segment benefits from diverse contracts, including municipal solid waste management and waste treatment. The Water segment's growth is fueled by concessions and infrastructure operation. The Construction division's expansion is driven by international projects, ensuring a robust backlog.

- A new 15-year contract for waste collection and street cleaning in Granada, Spain, valued at €740 million.

- A 7-year, $170 million contract for residential solid waste collection in Orange County, Florida, starting January 2026.

- A contract in Minneapolis for municipal solid waste transfer station operation initially valued at $5.0 million, with a potential total backlog of $8.7 million over five years.

- Major construction projects like the Scarborough metro extension in Canada (over €1.9 billion) and railway projects in Toronto.

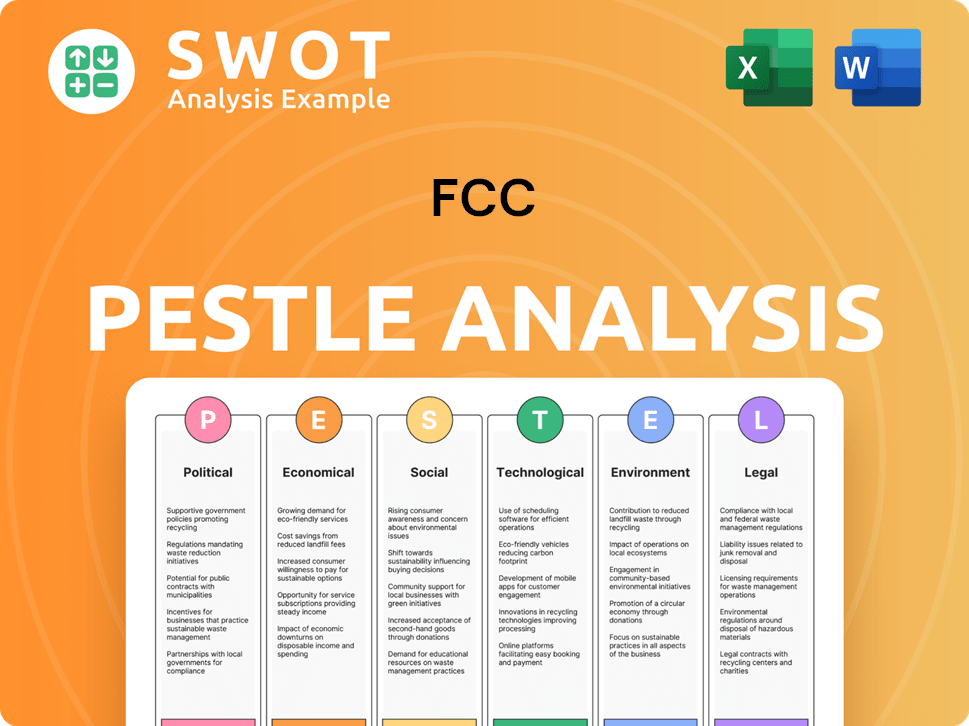

FCC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped FCC’s Business Model?

The FCC company has strategically navigated several key milestones, significantly impacting its FCC operations and financial results. A notable move in May 2024 was the acquisition of Gel Recycling Holdings by FCC Environmental Services, boosting its presence in the U.S. market. This strategic acquisition, along with other initiatives, demonstrates the company's commitment to expanding its service offerings and market reach.

In January 2024, FCC Concesiones secured the Lot 8 contract of the Extraordinary Road Investment Plan in Aragon, Spain, with a 25-year concession and an initial investment exceeding 40 million euros. This was followed by the acquisition of all shares in the Parla Tram concession in Madrid, extending its operational timeline to 2045. These moves highlight FCC's focus on infrastructure development and its ability to secure long-term contracts.

In November 2024, FCC completed a partial financial spin-off of its Real Estate and Cement businesses under the Inmocemento brand. This strategic shift aims to streamline operations and concentrate on core services. These strategic actions collectively highlight FCC's adaptability and proactive approach to market dynamics, shaping its trajectory and competitive standing.

The company has faced operational challenges, such as economic headwinds in the CEE region, where FCC Environment CEE Group achieved solid growth in 2024 despite subdued GDP growth. Their response included adjusting prices for collection services and leveraging improvements in the secondary raw materials market. These actions demonstrate FCC's resilience and ability to adapt to changing market conditions.

FCC's competitive edge stems from its extensive experience (over 120 years), technological leadership, and diverse service offerings. The company's commitment to sustainability is evident through its use of eco-friendly vehicles and investment in renewable energy. FCC's ability to secure large, long-term municipal contracts underscores its strong market position and reliability. You can read more about the Growth Strategy of FCC.

FCC has made several strategic moves to strengthen its market position and operational efficiency. These include acquisitions, securing long-term contracts, and restructuring its business segments.

- Acquisition of Gel Recycling Holdings in May 2024.

- Award of Lot 8 of the Extraordinary Road Investment Plan in January 2024.

- Acquisition of all shares in the Parla Tram concession.

- Partial financial spin-off of Real Estate and Cement businesses in November 2024.

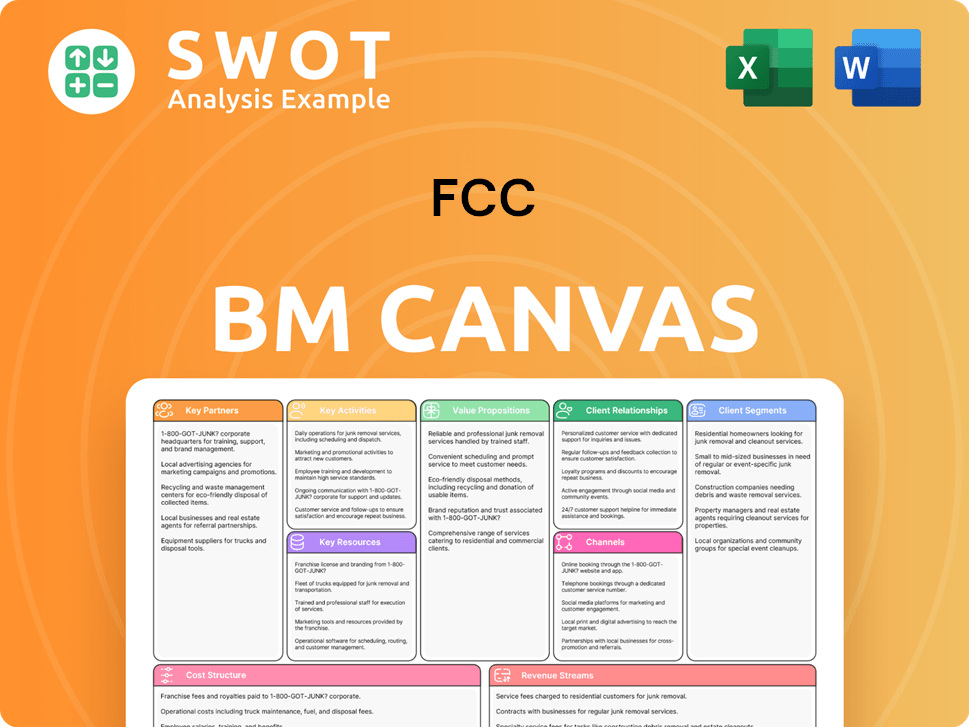

FCC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is FCC Positioning Itself for Continued Success?

FCC, a global leader in environmental services, infrastructure, and water management, holds a strong market position. Operating across more than 25 countries, it ranks among the world's top five environmental services companies. The company's substantial backlog of €43,043.8 million at the end of 2024 provides significant revenue visibility for nearly five years of activity. This is further supported by customer loyalty, shown through contract renewals, such as a seven-year extension for residential solid waste collection in Orange County, Florida, a contract FCC has maintained since 2016.

Despite its strong market position, FCC faces potential risks. These include regulatory changes, especially within the environmental and infrastructure sectors. The emergence of new competitors and technological disruptions also present ongoing challenges. Furthermore, global economic conditions and evolving consumer preferences for sustainable solutions could impact the demand for its services. For instance, the Owners & Shareholders of FCC are constantly monitoring the impact of the Federal Communications Commission (FCC) regulations.

FCC is a leading global player in environmental services, infrastructure, and water management, operating in over 25 countries. It's recognized as one of the top five companies in environmental services globally. This position is reinforced by a robust backlog and contract renewals, indicating strong market presence and customer loyalty.

Key risks for FCC include regulatory changes in environmental and infrastructure sectors, competition, and technological disruptions. Economic conditions and changing consumer preferences towards sustainability also pose potential challenges. The dynamic regulatory landscape, such as those related to the FCC, adds complexity.

FCC's future outlook is driven by strategic initiatives focused on expansion and sustainability. The company aims to maintain stable performance in its Water segment and reduce project risks. Investments in sustainable practices, such as new electric vehicles, are also central to its strategy.

The company is focused on continuous operational excellence, strategic acquisitions, and sustainable urban development and infrastructure. The FCC Environment CEE Group anticipates a positive trajectory, influenced by factors like the market for secondary raw materials. The construction division is also poised for growth, with its portfolio increasing by 30% in Q1 2025.

FCC is concentrating on several key areas to ensure future growth and sustainability. These include operational excellence, strategic acquisitions, and a strong emphasis on sustainable urban development and infrastructure. The company is also focused on maintaining financial stability and adapting to regulatory changes.

- Continued expansion in environmental and water services.

- Investment in new equipment, including sustainable vehicles.

- Maintaining leverage below 3x EBITDA.

- Focus on design-to-construction models to reduce project risks.

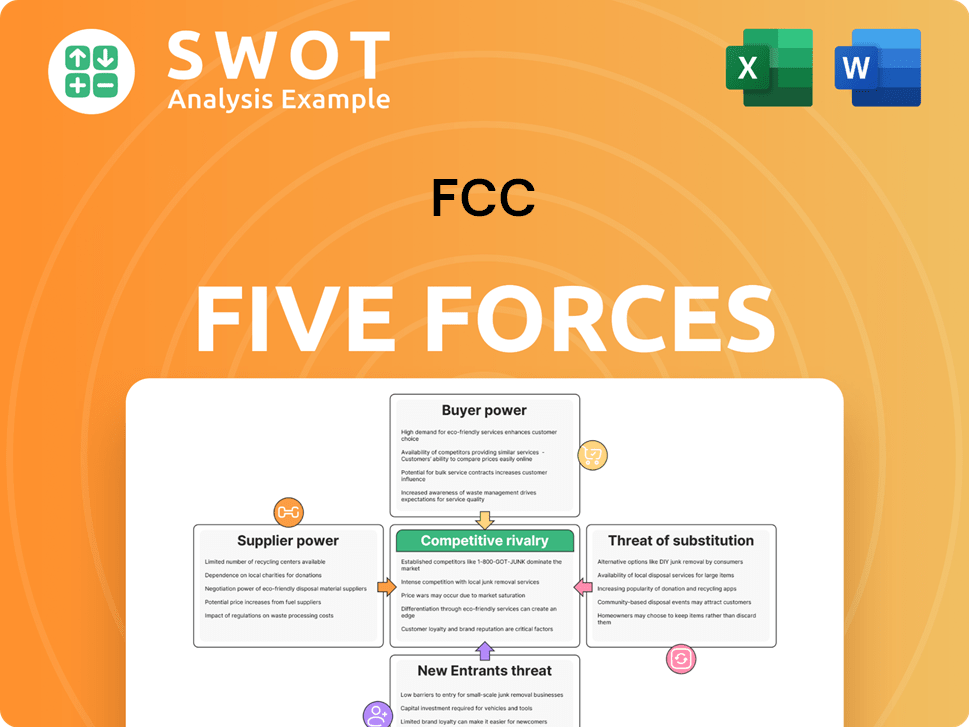

FCC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FCC Company?

- What is Competitive Landscape of FCC Company?

- What is Growth Strategy and Future Prospects of FCC Company?

- What is Sales and Marketing Strategy of FCC Company?

- What is Brief History of FCC Company?

- Who Owns FCC Company?

- What is Customer Demographics and Target Market of FCC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.