FCC Bundle

Who Really Owns FCC?

Understanding FCC's ownership is crucial for grasping its strategic direction and future potential. The company's evolution, from its roots as Focsa to its current global presence, has been marked by significant shifts in its ownership structure. A key turning point was the involvement of Carlos Slim Helú, which dramatically altered the company's landscape. This deep dive explores the key players and influences shaping FCC today.

FCC, a global leader in essential services, operates in a complex financial environment, making its ownership structure a critical factor for investors and stakeholders. The FCC SWOT Analysis can provide valuable insights into the company's strengths, weaknesses, opportunities, and threats, further illuminating the impact of its ownership. Examining the FCC structure, its leadership, and governance reveals how decisions are made and who controls FCC. This analysis will also explore the roles of key investors and the influence they wield.

Who Founded FCC?

The story of FCC's ownership begins with its founding as Fomento de Obras y Construcciones, S.A. (Focsa) on July 3, 1900. Initially, the company was established with a share capital of 5 million pesetas. The early focus was on construction projects in Catalonia, laying the groundwork for its future endeavors.

A significant shift occurred in 1911 when Focsa expanded its services to include sewer cleaning and maintenance in Barcelona. This marked an early diversification, moving beyond pure construction. The evolution of the company reflects a strategic adaptation to provide essential services.

The parent company, FCC Group, was formally created in 1992 through the merger of Fomento de Obras y Construcciones (Focsa) and Construcciones y Contratas, which was founded in 1944. This merger consolidated the entity, setting the stage for its modern structure. While specific details about the initial shareholders are not readily available, the core mission was always centered on building infrastructure and providing essential services to citizens.

The early years of FCC, then Focsa, were defined by construction projects and an expansion into essential services. The company's initial focus was on construction in Catalonia, with the Port of Barcelona being one of its first projects. The move into sewer cleaning and maintenance in 1911 marked a strategic diversification.

- The company started with a share capital of 5 million pesetas.

- The merger in 1992 created the FCC Group.

- The primary focus was on building cities and providing essential services.

- The Growth Strategy of FCC has evolved significantly since its inception.

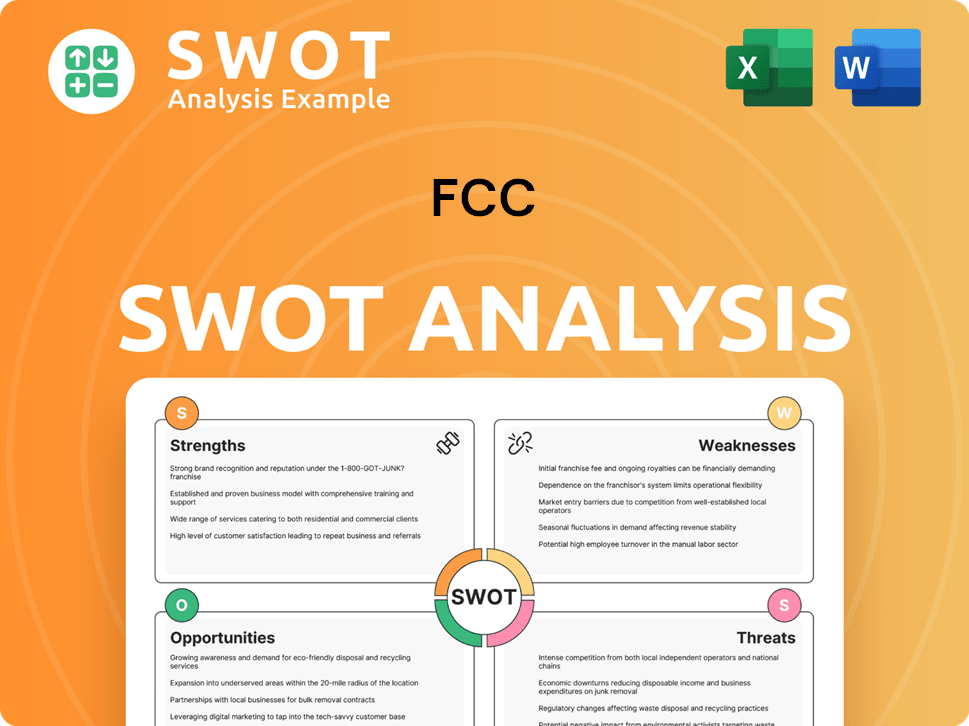

FCC SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has FCC’s Ownership Changed Over Time?

The evolution of FCC's ownership has been marked by significant strategic shifts. A pivotal moment occurred in November 2014, when a €1 billion capital injection from Carlos Slim Helú provided crucial financial stability, leading to a 25.6% stake. This investment was a key factor in shaping the current ownership landscape. The company's structure reflects a diversified conglomerate with interests in environmental services, water management, and infrastructure, each with its own specific ownership arrangements.

As of June 2023, Carlos Slim Helú indirectly held 11.916% of the total voting rights. The environmental services division, FCC Servicios Medio Ambiente Holding, S.A.U., is primarily owned by Fomento de Construcciones y Contratas, S.A., with CPP Investments (Canada Pension Plan Investment Board) holding a 24.99% stake acquired for €965 million (C$1,438 million). In the water management sector, FCC Aqualia is jointly owned by FCC (51%) and IFM Investors (49%).

| Ownership Structure | Stakeholder | Percentage |

|---|---|---|

| Environmental Services | Fomento de Construcciones y Contratas, S.A. | 75.01% |

| Environmental Services | CPP Investments (Canada Pension Plan Investment Board) | 24.99% |

| Water Management (Aqualia) | FCC | 51% |

| Water Management (Aqualia) | IFM Investors | 49% |

| Indirect Voting Rights | Carlos Slim Helú | 11.916% |

The infrastructure arm, FCC Construcción, is a vital component of the FCC Group. In November 2024, FCC completed a partial financial spin-off of its Real Estate and Cement businesses under the Inmocemento brand, which resulted in a 39.2% reduction in equity compared to December 2023. This restructuring aimed to streamline operations. As of May 28, 2025, institutional shareholders include Vanguard Total International Stock Index Fund Investor Shares (VGTSX), Putnam International Capital Opportunities Fund Class A Shares (PNVAX), SPDR(R) Portfolio Europe ETF (SPEU), and International Small Company Fund Class NAV (JISAX). The company's revenue increased by 8.9% in the first quarter of 2025, reaching €2,181.7 million, driven by growth in its Environment and Water segments. For more insights, you can explore the Target Market of FCC.

FCC's ownership structure involves various stakeholders, including institutional investors and strategic partners.

- Carlos Slim Helú is a significant shareholder.

- CPP Investments and IFM Investors hold substantial stakes in key divisions.

- The company's revenue increased in the first quarter of 2025.

- The company is listed in Spain.

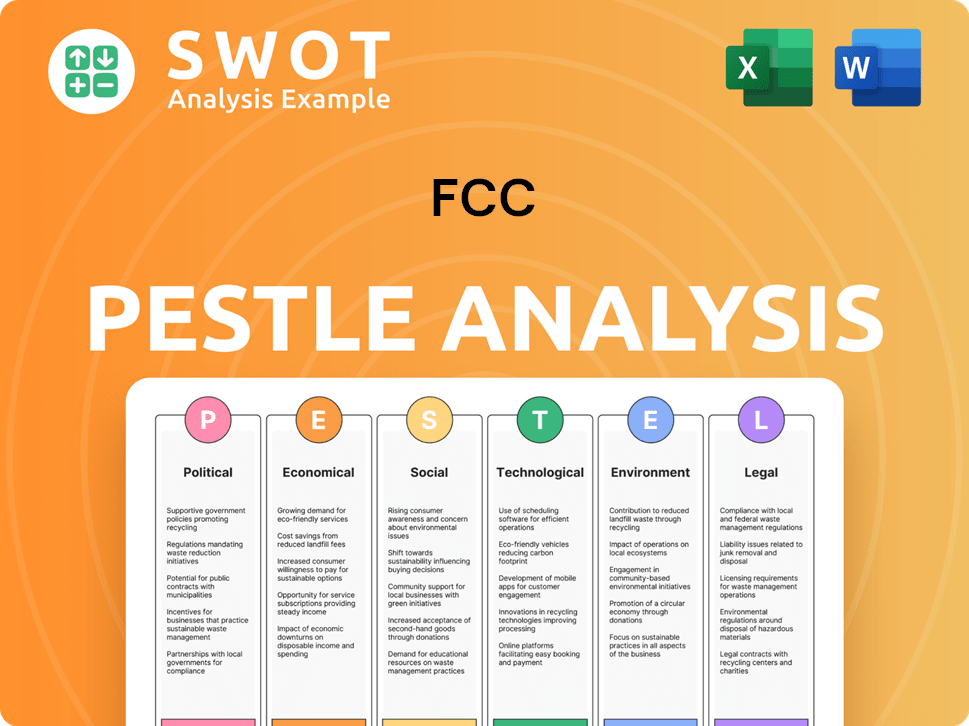

FCC PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on FCC’s Board?

The current Board of Directors of FCC reflects its major ownership stakes. As of June 2023, Carlos Slim Helú, representing Control Empresarial de Capitales, S.A. de C.V., holds a proprietary director position and indirectly controls 11.916% of the total voting rights. Esther Koplowitz Romero de Juseu, the First Vice Chairman and a proprietary director, holds 3.218% of the total voting rights, with 0.035% directly and 3.183% indirectly. Esther Alcocer Koplowitz serves as the Chairman and holds 0.099% of the total voting rights. Other proprietary directors include Alicia Alcocer Koplowitz and Carmen Alcocer Koplowitz, who represent Esther Koplowitz Romero de Juseu and Control Empresarial de Capitales, S.A. de C.V., respectively, holding 0.083% and 0.129% of the voting rights. Alejandro Aboumrad González, Vice Chairman of the Board and Chairman of the Executive Committee, is also a proprietary director proposed by Control Empresarial de Capitales, S.A. de C.V., and holds 0.078% of the voting rights.

The composition of the board showcases the influence of key shareholders. The board's structure is a critical aspect of FCC's growth strategy, with the balance of power between major stakeholders like Carlos Slim Helú and the Koplowitz family. This balance is crucial for the company's strategic direction and decision-making processes. This structure directly impacts the FCC's governance and leadership.

| Director | Role | Voting Rights |

|---|---|---|

| Carlos Slim Helú | Proprietary Director | 11.916% (indirectly) |

| Esther Koplowitz Romero de Juseu | First Vice Chairman, Proprietary Director | 3.218% (0.035% directly, 3.183% indirectly) |

| Esther Alcocer Koplowitz | Chairman | 0.099% |

The voting structure largely follows a one-share-one-vote principle. However, the significant holdings of major shareholders like Carlos Slim Helú and the Koplowitz family grant them substantial influence over decision-making. Carlos Slim Helú and the Koplowitz family each have four seats on the FCC board, reflecting their considerable ownership and control. This balance of power is a key element in the FCC's governance structure.

The FCC's Board of Directors is structured to reflect major shareholder interests, ensuring significant influence over strategic decisions.

- Carlos Slim Helú and the Koplowitz family hold substantial voting power.

- The board's composition is crucial for the company's strategic direction.

- The voting structure follows a one-share-one-vote principle, with concentrated holdings influencing decisions.

- Understanding the FCC's leadership is key to understanding its governance.

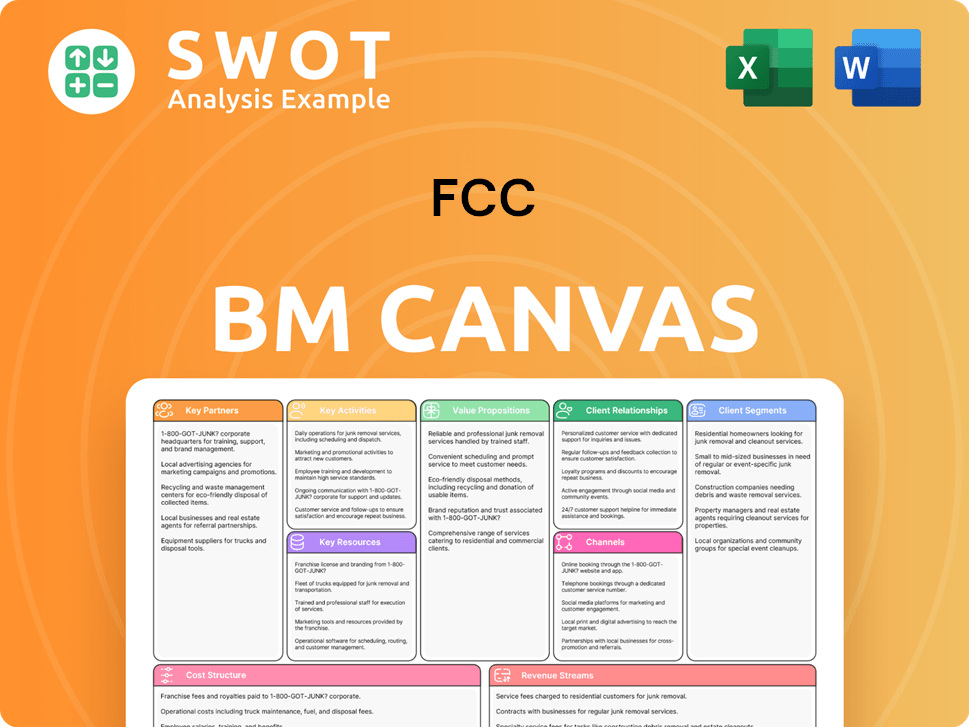

FCC Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped FCC’s Ownership Landscape?

In the past few years, there have been notable shifts in the ownership profile and strategic direction of FCC. In June 2023, Canada Pension Plan Investment Board (CPP Investments) acquired a 24.99% stake in FCC Servicios Medio Ambiente Holding, SAU, the environmental services division of FCC, for €965 million. This investment highlights a growing trend of institutional ownership in key operational segments of large conglomerates, influencing the FCC ownership structure.

In November 2024, FCC completed a partial financial spin-off of its Real Estate and Cement businesses, transferring them to Inmocemento, a wholly-owned subsidiary. This strategic move streamlined the FCC Group, focusing its core operations on environmental services, water, and infrastructure. This resulted in a 39.2% reduction in equity compared to December 2023, indicating a focused approach to its core business areas and influencing the FCC structure.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Revenue (€ million) | €2,003.4 | €2,181.7 | +8.9% |

| Environment Segment Growth | N/A | +16.7% | N/A |

| Water Segment Growth | N/A | +10.1% | N/A |

| Construction Division Portfolio Growth | N/A | +30% | N/A |

| International Division Growth | N/A | +42.6% | N/A |

| Net Financial Debt (€ million) | €2,991.3 | €3,096.2 | +3.5% |

| Backlog of Revenue (€ million) | €42,900.0 | €45,757.6 | +6.3% |

FCC's revenue increased by 8.9% in the first quarter of 2025, reaching €2,181.7 million, primarily driven by growth in its Environment and Water segments. The company's net financial debt increased by 3.5% to €3,096.2 million as of March 31, 2025, reflecting expansion through acquisitions. The backlog of revenue also grew to €45,757.6 million, up 6.3% from the end of Q1 2024. These financial and operational developments point towards a strategic focus on expanding its core environmental and water services, alongside significant infrastructure projects. For more insight into the competitive landscape, consider examining the Competitors Landscape of FCC.

Institutional investment is increasing in key FCC divisions, such as the environmental services sector. Financial restructuring has streamlined the company, focusing on core operations. Revenue and backlog growth indicate a strategic expansion of environmental and water services.

Revenue increased by 8.9% in Q1 2025, reaching €2,181.7 million. Net financial debt rose by 3.5% to €3,096.2 million. The backlog of revenue grew by 6.3% to €45,757.6 million, showing strong project demand.

FCC is prioritizing growth in environmental and water services. Acquisitions in the UK, USA, and France support expansion. The construction division is also seeing significant growth, particularly internationally.

Institutional investors, such as CPP Investments, are becoming more involved. The company's focus on environmental services and water suggests key stakeholders are aligned with sustainable infrastructure. Understanding who controls FCC is crucial.

FCC Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FCC Company?

- What is Competitive Landscape of FCC Company?

- What is Growth Strategy and Future Prospects of FCC Company?

- How Does FCC Company Work?

- What is Sales and Marketing Strategy of FCC Company?

- What is Brief History of FCC Company?

- What is Customer Demographics and Target Market of FCC Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.