FDS Group Bundle

Can FDS Group Capitalize on the Booming Architectural Metals Market?

In a market projected to reach billions, FDS Group, specializing in custom metal structures and facades, stands at a pivotal moment. With the architectural and structural metals market experiencing robust growth and the facade systems market expanding rapidly, understanding FDS Group's growth strategy is crucial. This analysis dives deep into the company's plans to navigate this dynamic landscape and achieve sustainable success.

This comprehensive FDS Group SWOT Analysis provides a detailed examination of the company's market position, business model, and financial performance. We'll explore FDS Group's expansion plans, strategic initiatives, and how it plans to overcome challenges, offering insights into its long-term growth potential within the competitive landscape. Discover the future market opportunities for FDS Group and what drives its innovative approach.

How Is FDS Group Expanding Its Reach?

FDS Group's expansion initiatives are closely tied to the dynamic growth within the architectural and construction sectors. The company is likely employing a multi-pronged approach that includes entering new geographical markets, diversifying its product offerings, and potentially engaging in mergers and acquisitions. This strategic alignment aims to capitalize on emerging opportunities and strengthen its market position.

The architectural and structural metals market is experiencing significant expansion due to global construction and infrastructure projects, urbanization, and evolving architectural designs. This growth provides a favorable environment for FDS Group to broaden its geographical reach, especially in regions with high construction activity. The company's strategic initiatives are designed to leverage these trends effectively.

The company's plans likely include a multi-faceted approach, including geographical market entry, product diversification, and potential mergers and acquisitions. The architectural and structural metals market is experiencing significant growth due to global construction and infrastructure development, urbanization, and evolving architectural trends, with a projected market size of $682.81 billion in 2025. This provides a fertile ground for FDS Group to expand its geographical footprint, particularly in regions with high construction activity.

FDS Group's strategy involves expanding its presence in regions with substantial construction activity. North America is expected to be the fastest-growing market for architectural metal coatings from 2025 to 2034. The U.S. construction market is also forecasted to rise by 9% in 2025, supported by lower interest rates and increased infrastructure spending. This expansion is a key component of the Marketing Strategy of FDS Group.

The company aims to diversify its offerings to include 'smart facades' and components that integrate with smart building technologies. This involves expanding its product pipeline to include new material compositions or modular facade systems that offer enhanced sustainability and installation efficiency. The global facade market is experiencing significant growth driven by the increasing demand for energy-efficient and sustainable construction materials, with a forecast to increase by USD 161.8 million at a CAGR of 9% between 2024 and 2029.

Strategic acquisitions could provide access to new technologies, expand its manufacturing capacity, or allow for quicker entry into new geographical markets. In the broader financial technology sector, M&A activity has shown steady growth, with 400 transactions announced or completed year-to-date in 2025, representing a 5% year-over-year increase. This trend is driven by a focus on accessing new markets, enhancing capabilities, and improving operational efficiencies.

The company's pursuit of these initiatives is driven by the need to access new customer segments, diversify revenue streams beyond traditional architectural projects, and stay ahead of rapid industry changes. This includes the increasing demand for sustainable construction practices and technological advancements. FDS Group is focusing on its FDS Group Growth Strategy to achieve its goals.

FDS Group's expansion initiatives are designed to capitalize on the growth in the architectural and construction sectors. The company is focused on several key areas to drive its future prospects.

- Geographical expansion into high-growth markets like North America.

- Product diversification to include smart facades and sustainable materials.

- Strategic mergers and acquisitions to enhance capabilities and market access.

- Focus on accessing new customer segments and diversifying revenue streams.

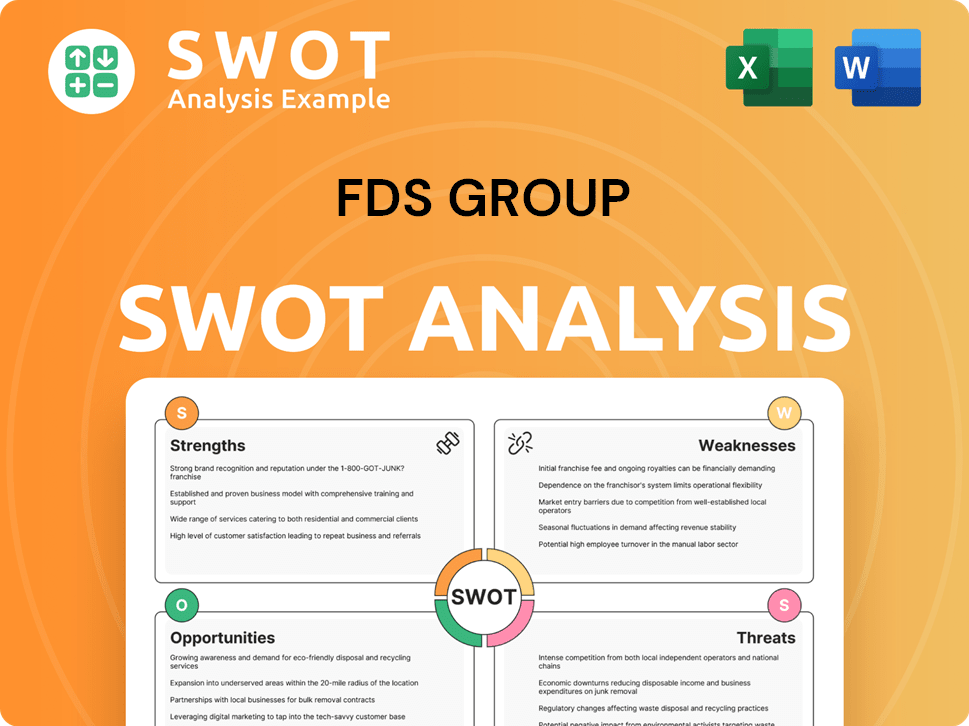

FDS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FDS Group Invest in Innovation?

The innovation and technology strategy of FDS Group is critical for its sustained growth within the evolving architectural and construction industries. Technological advancements are becoming increasingly important in the architectural and structural metals market. The company's ability to adapt and integrate new technologies will significantly influence its future prospects and overall FDS Group growth strategy.

FDS Group is expected to make substantial investments in research and development (R&D) to enhance its product offerings and operational efficiencies. This includes in-house development of new materials and fabrication techniques, as well as collaborations with external innovators and research institutions. Such strategic investments are vital for maintaining a competitive edge and capitalizing on future market opportunities for FDS Group.

A key aspect of FDS Group's strategy will be its approach to digital transformation and automation. The construction industry is increasingly leveraging digital technologies such as 3D modeling and Building Information Modeling (BIM) software for designing and constructing facades. FDS Group can enhance its design capabilities, streamline manufacturing processes, and improve project management through the adoption of advanced digital tools. The use of cutting-edge technologies like Artificial Intelligence (AI) and the Internet of Things (IoT) will also play a pivotal role.

The Ministry of Science and ICT (MSIT) in South Korea has allocated a record-high budget of KRW 19 trillion for 2025, with KRW 9.7 trillion specifically for R&D, a 16.1% increase compared to 2024. This highlights the importance of strategic investments in advanced technologies.

Adopting digital tools like 3D modeling and BIM can enhance design capabilities and streamline manufacturing. AI-driven automation is transforming industries, enabling predictive maintenance and optimizing processes, which can be applied to FDS Group's operations.

AI can optimize material usage, predict structural performance, and automate manufacturing processes. The integration of smart technologies in steel building design enhances operational efficiencies and reduces environmental footprints.

Developing energy-efficient and eco-friendly facade systems aligns with the growing demand for green building projects. Innovations like cool roof coatings and self-cleaning coatings can enhance energy efficiency and reduce maintenance costs.

The architectural and structural metals market is seeing increased demand for sustainable solutions. FDS Group can leverage these trends to gain a competitive advantage and expand its market share. Owners & Shareholders of FDS Group should consider these factors for strategic planning.

By focusing on innovation and technology, FDS Group can differentiate itself from competitors. This includes developing new materials, adopting advanced digital tools, and prioritizing sustainability. This approach is crucial for FDS Group's long-term growth potential.

Sustainability initiatives are becoming a key metric for success in the construction sector. FDS Group can leverage technology to develop more energy-efficient and eco-friendly facade systems, aligning with the growing demand for green building projects.

- Explore new products or platforms that offer enhanced thermal performance, reduced carbon footprints, or incorporate recycled materials.

- Highlight key patents, industry awards, or breakthroughs in sustainable facade technology to demonstrate leadership in innovation.

- In November 2024, a company announced an advanced metal coating system with self-cleaning properties, aiming to improve aesthetics and durability while lowering maintenance.

- Focus on how FDS Group can innovate and adapt to changing market demands.

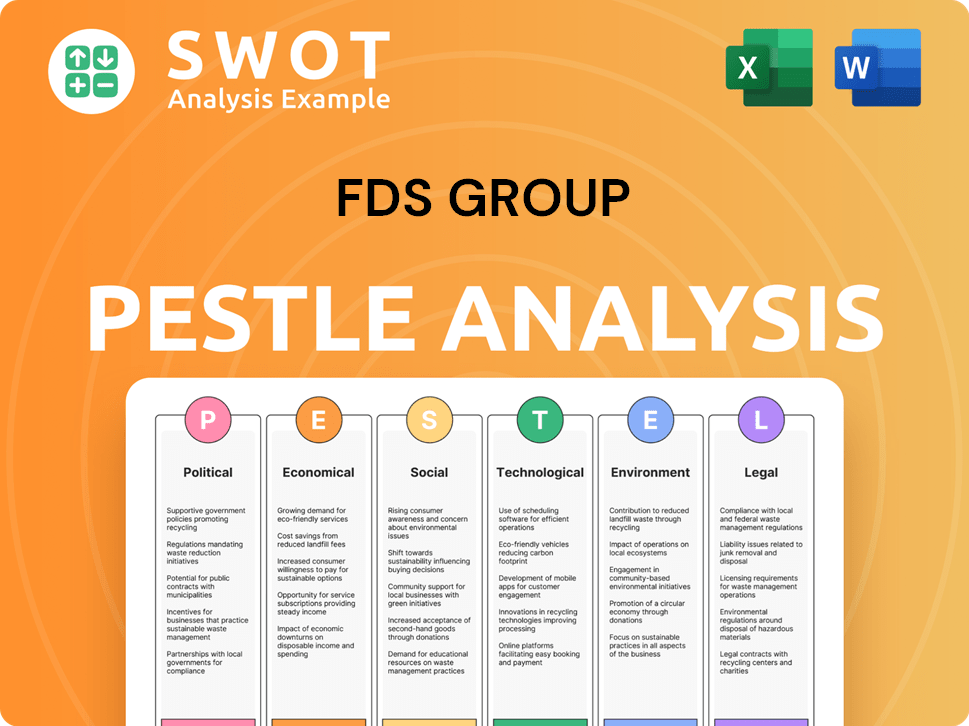

FDS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is FDS Group’s Growth Forecast?

Analyzing the FDS Group Growth Strategy requires an understanding of its financial outlook within the architectural metal structures and facades industry. While specific financial details for the company aren't publicly available, market trends and the strategies of similar companies offer insights. The industry's growth trajectory provides a foundation for evaluating FDS Group's Future Prospects.

The global architectural and structural metals market is expected to grow significantly. It is projected to expand from $643.22 billion in 2024 to $682.81 billion in 2025, with a compound annual growth rate (CAGR) of 6.2%. Furthermore, the market is anticipated to reach $827.69 billion by 2029, at a CAGR of 4.9%. This positive outlook is a key factor in assessing the potential for FDS Group Company Analysis.

The global facade market is estimated to be USD 325.99 billion in 2025 and is forecasted to reach around USD 640.87 billion by 2034, expanding at a CAGR of 7.80%. This growth in a core segment for FDS Group suggests significant opportunities for increased revenue and potentially improved profit margins. Companies in the construction and manufacturing sectors are increasingly focused on optimizing operating models and reducing costs, which could contribute to healthier profit margins.

The architectural and structural metals market is predicted to grow from $643.22 billion in 2024 to $682.81 billion in 2025. This growth indicates a strong market for FDS Group.

The global facade market is expected to reach approximately $640.87 billion by 2034. This growth presents opportunities for FDS Group to increase revenue.

Companies are investing in AI-driven automation and sustainable technologies. FDS Group's ability to secure funding will support these initiatives.

The financial services sector is developing a growth and competitiveness strategy. This focus highlights the importance of sustainable, inclusive growth.

Investment levels for FDS Group are likely to be driven by its expansion and innovation strategies. The ability to secure funding is critical. The broader financial services sector is also developing a growth and competitiveness strategy. Maintaining disciplined capital allocation and a strategic approach to mergers and acquisitions will be crucial for FDS Group to drive sustainable growth and value creation. For more insights, consider reading about FDS Group's market position and strategic initiatives.

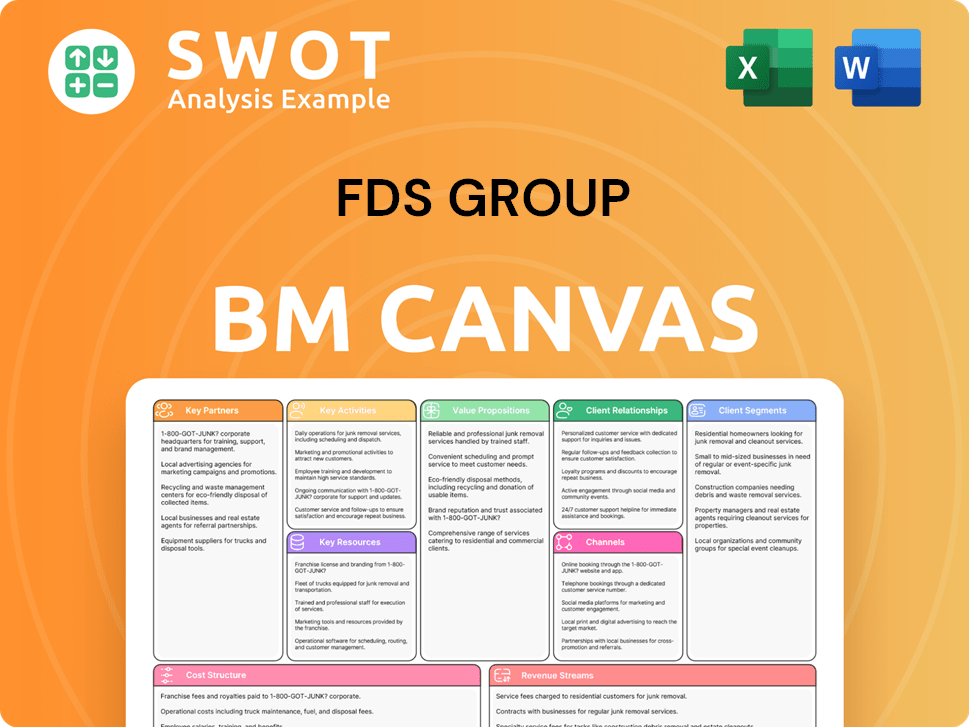

FDS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow FDS Group’s Growth?

The path to growth for the FDS Group is intertwined with navigating potential risks and obstacles inherent in its operations. Understanding these challenges is crucial for a thorough FDS Group Company Analysis and assessing its Future Prospects. These hurdles span market dynamics, regulatory changes, supply chain vulnerabilities, and technological disruptions, all of which can significantly impact the company's strategic initiatives for growth.

Market competition is a primary concern, given the presence of numerous players in the architectural and construction materials sectors. Regulatory shifts, particularly concerning international freight and building standards, pose significant challenges. Supply chain vulnerabilities, exacerbated by geopolitical risks and labor issues, further complicate the landscape, demanding proactive risk management strategies.

Technological advancements and internal resource constraints also present obstacles that FDS Group must address. The company's ability to adapt and innovate will be key to mitigating these risks and achieving its long-term growth potential. A robust risk management framework, including diversification and scenario planning, is essential for navigating these challenges and ensuring sustainable growth. For more information on the company's foundational principles, see Mission, Vision & Core Values of FDS Group.

The construction and manufacturing industries are highly competitive, with numerous companies vying for projects. The FDS Group's Market Position is affected by this intense competition. For instance, in the business intelligence and cloud services sector, there are tens of thousands of active competitors, illustrating the scale of competition companies face.

Evolving regulations pose a considerable risk to FDS Group. Stricter policies on international freight services can directly influence shipping costs. Changes in building codes, environmental standards, and sustainability initiatives could necessitate costly adjustments, impacting the FDS Group's Financial Performance.

Supply chain disruptions are a major concern. Geopolitical risks, trade tensions, and conflicts between nations can disrupt material availability. In 2024, approximately 90% of supply chain leaders faced significant challenges due to disruptions from various sources. This impacts FDS Group's Business Model.

The rapid pace of technological advancements, including AI-powered cyber threats, introduces new vulnerabilities. Continuous investment in cybersecurity and adaptation of technologies are essential. This affects the FDS Group's ability to innovate and adapt.

Internal resource constraints, such as shortages of skilled labor or insufficient capital for large-scale investments, can impede growth. Managing these constraints is critical for the FDS Group's Expansion Plans and Strategies. Effective resource allocation is key.

A robust risk management framework is crucial for FDS Group. This includes diversification of the client base and project types to reduce reliance on any single market segment. Scenario planning is essential to prepare for various market, regulatory, and supply chain disruptions. This aids in mitigating the key challenges for FDS Group.

Diversifying the client base reduces reliance on any single market segment. This strategy helps to mitigate the risk of economic downturns. Diversifying manufacturing locations can also mitigate geographical risks, making the company more resilient.

Scenario planning is essential for anticipating and preparing for market, regulatory, and supply chain disruptions. This helps the company to develop flexible strategies. Companies in various sectors use scenario planning to address known and unpredictable risks.

Continuous monitoring of market trends is crucial for proactive adaptation. This involves staying informed about regulatory changes and industry developments. This helps in understanding the impact of industry trends on FDS Group.

Proactive engagement with regulatory bodies is essential for compliance and influence. Fostering strong relationships with suppliers and partners builds a resilient business model. This is vital for the FDS Group's long-term growth potential.

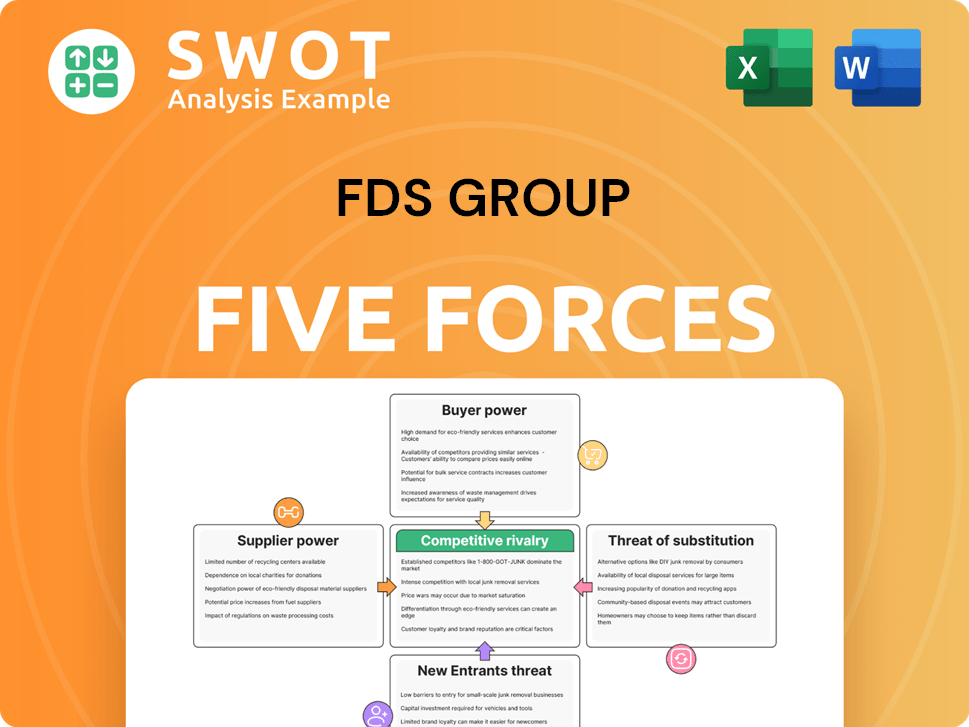

FDS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FDS Group Company?

- What is Competitive Landscape of FDS Group Company?

- How Does FDS Group Company Work?

- What is Sales and Marketing Strategy of FDS Group Company?

- What is Brief History of FDS Group Company?

- Who Owns FDS Group Company?

- What is Customer Demographics and Target Market of FDS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.