FDS Group Bundle

Who Really Controls FactSet (FDS)?

Unraveling the FDS Group SWOT Analysis is crucial for understanding its strategic direction. The ownership structure of a company is a critical lens through which to understand its strategic direction, influence, and accountability. Knowing who owns FDS Group is key to grasping its long-term vision and how it navigates the competitive landscape.

This exploration into FDS Group ownership delves into the initial founders, key investors, and the impact of public shareholders. Understanding the FDS Group structure, including its parent company and major stakeholders, provides valuable insights into its governance and strategic decisions. We'll also examine the historical evolution of FDS Group's ownership, offering a comprehensive view of this financial data and software giant, including its subsidiaries and affiliates.

Who Founded FDS Group?

The foundation of FactSet Research Systems Inc., now known as FDS Group, rests on the vision of Howard Wille and Charles Snyder. They established the company in 1978, aiming to revolutionize how financial data was accessed and utilized. Their foresight in leveraging technology to provide computer-based financial information directly to clients set the stage for FDS Group's future.

Wille and Snyder's initiative was a direct response to the evolving needs of financial professionals. They saw the potential to streamline the process of accessing and analyzing financial data, moving away from the cumbersome methods of the time. This focus on delivering usable data directly to clients became a core tenet of the company's early strategy.

The initial capital of approximately $250,000 was instrumental in launching the company. While specific details on early ownership percentages are not publicly available, the founders' commitment to providing accessible financial information was evident from the start. Their first product, 'Company FactSet,' demonstrated their commitment to delivering user-friendly financial analysis.

Howard Wille and Charles Snyder, the founders, recognized the need for computer-based financial information.

The company began with approximately $250,000 in seed funding.

'Company FactSet' was the initial offering, providing four-page company analysis reports.

The founders aimed to deliver usable data directly to clients, simplifying access to financial information.

The company expanded its services to include analytics and portfolio management tools.

Former Chairman Philip A. Hadley joined as a consultant in 1985.

Understanding the FDS Group ownership structure begins with recognizing its founders, Howard Wille and Charles Snyder. While the exact early ownership details are not publicly available, their initial vision and the company's early focus on delivering accessible financial data are clear. The company's early success was built on providing essential tools for financial professionals. For more insights, consider exploring Marketing Strategy of FDS Group. The company's evolution from its inception in 1978 to its current standing reflects a strategic approach to meeting the needs of its clients, which is a key aspect of the FDS Group company profile. The FDS Group structure has evolved, but the core mission of providing valuable financial information remains central to its operations. The early focus on user-friendly data delivery set the stage for the company's growth and its ability to attract FDS Group investors.

The founders' vision was to provide computer-based financial information directly to clients, bypassing the need for companies to purchase raw data and then hire programmers to make it user-friendly.

- The company started with approximately $250,000 in initial capital.

- The first product was 'Company FactSet,' a program that generated a four-page company analysis report.

- Early focus was on expanding services to include analytics and portfolio management tools.

- Howard Wille and Charles Snyder remained integral to the company's development.

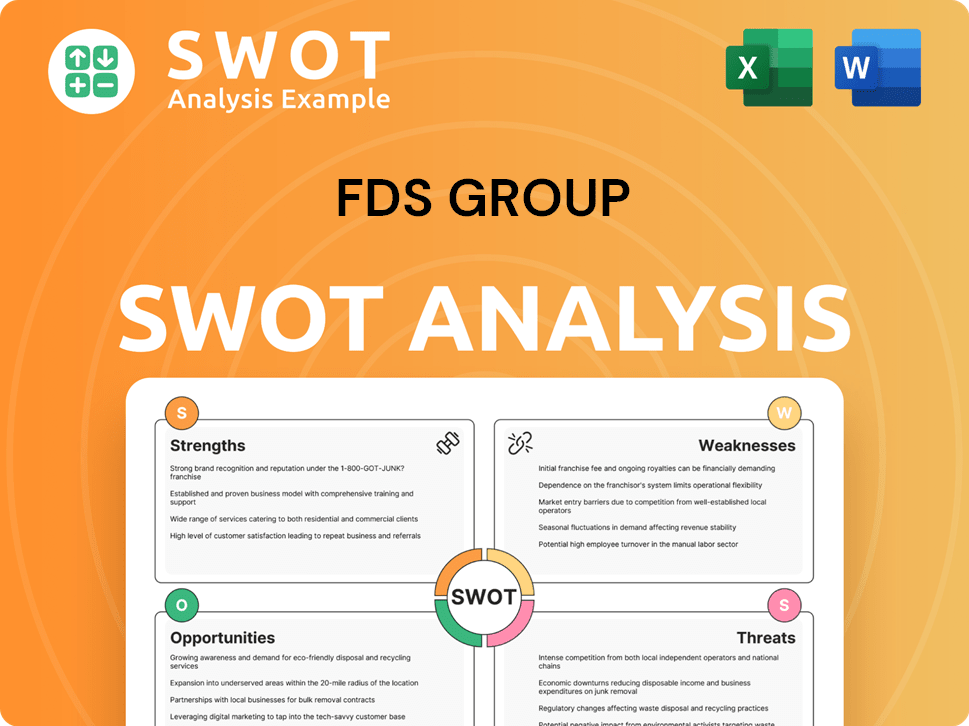

FDS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has FDS Group’s Ownership Changed Over Time?

The evolution of ownership for FactSet Research Systems Inc. (FDS Group company) began with its initial public offering (IPO) in 1996, which marked a pivotal moment in its history. The IPO, which listed the company on the New York Stock Exchange under the symbol FDS, increased its visibility and provided access to capital markets. As of February 29, 2024, the aggregate market value of FactSet's common stock held by non-affiliates was approximately $17.6 billion. This public listing significantly altered the FDS Group structure, transitioning it from a privately held entity to a publicly traded corporation with a diverse shareholder base.

The company's ownership structure is characterized by significant institutional ownership. As of October 21, 2024, there were 37,988,845 shares of FactSet's common stock outstanding. The company's financial performance, including its Annual Subscription Value (ASV), which was $2,265.9 million at November 30, 2024, and Organic ASV, which grew by 4.5% year-over-year to $2,258.8 million as of November 30, 2024, has attracted institutional investors. This consistent revenue stream is a key factor in the company's attractiveness to major stakeholders.

| Key Event | Impact on Ownership | Date |

|---|---|---|

| Initial Public Offering (IPO) | Transitioned from private to public ownership, increased capital access. | 1996 |

| Market Capitalization Growth | Increased market value, attracting institutional investors. | February 29, 2024 |

| Consistent Revenue Growth | Attracted and retained institutional investors. | November 30, 2024 |

FactSet's client base, which influences its revenue and market standing, included 8,217 clients and 216,381 users as of August 31, 2024. Buy-side clients accounted for approximately 82% of FactSet's Organic ASV as of August 31, 2024. The company's strategic acquisitions have also played a role in its evolution, extending its global reach and diversifying product offerings. The company consistently reports its financial performance and ownership details through SEC filings, providing transparency to its shareholders and the broader market. Understanding the FDS Group ownership structure is crucial for investors seeking to assess the company's stability and growth potential.

FactSet's ownership is primarily institutional, with a significant portion of shares held by major investors.

- The IPO in 1996 was a key event in the FDS Group ownership history.

- As of February 29, 2024, the market value held by non-affiliates was approximately $17.6 billion.

- The company's consistent revenue growth is attractive to investors.

- FactSet's financial performance is reported through SEC filings.

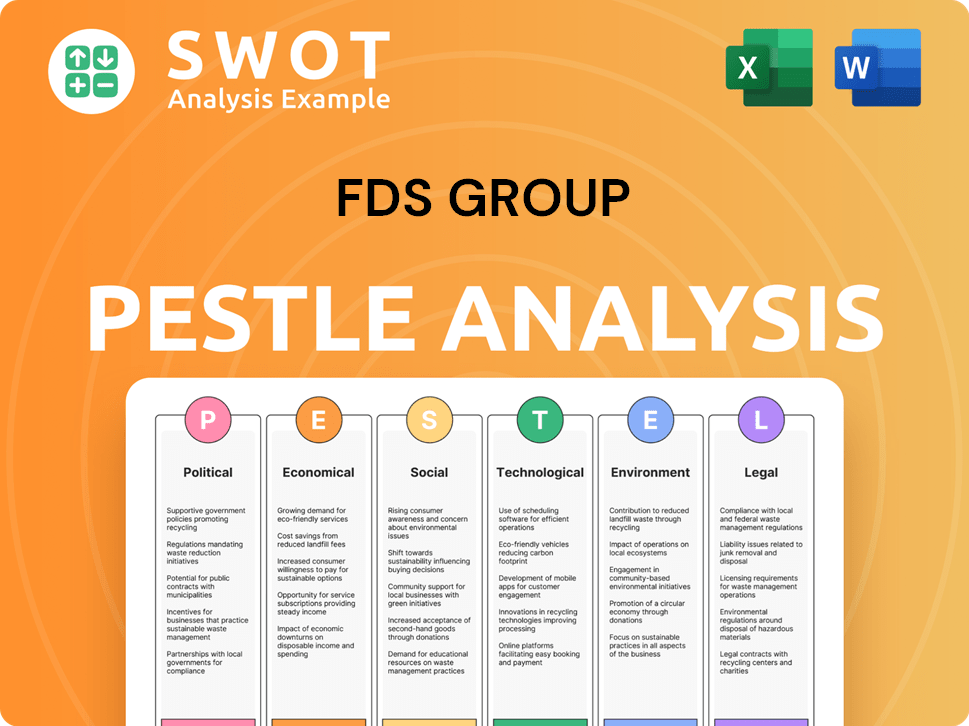

FDS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on FDS Group’s Board?

The Board of Directors of the FDS Group company, officially known as FactSet Research Systems Inc., is pivotal in steering the company's strategic direction and overseeing its operations. Information regarding the board members and their affiliations is detailed in the company's corporate governance documents, which are accessible through its investor relations website. As of June 13, 2025, key executive leadership includes Frederick Philip Snow as Chief Executive Officer and Director, alongside other key executives such as Helen L. Shan as Executive Vice President and Chief Financial Officer, and Katherine M. Stepp as Executive Vice President and Chief Technology Officer.

Other key individuals include Goran Skoko (Executive Vice President, Chief Revenue Officer and MD of EMEA and Asia Pacific), Gregory T. Moskoff (MD, Controller and Chief Accounting Officer), Kevin J. Toomey Jr. (Head of Investor Relations), Christopher McLoughlin (Executive Vice President and Chief Legal Officer), Christopher R. Ellis (Executive Vice President and Head of Strategic Initiatives and Partnership), and Robert James Robie (Executive Vice President and Head of Institutional Buyside). The board's composition and the company's governance structure are designed to ensure accountability to its shareholders, including significant institutional investors. For more information on the Competitors Landscape of FDS Group, you can find additional insights.

| Executive Role | Name | Title |

|---|---|---|

| Chief Executive Officer and Director | Frederick Philip Snow | CEO and Director |

| Executive Vice President and Chief Financial Officer | Helen L. Shan | CFO |

| Executive Vice President and Chief Technology Officer | Katherine M. Stepp | CTO |

FactSet, a publicly traded company, operates with a one-share-one-vote structure. This means each share of common stock typically grants one voting right. The company's commitment to transparency is evident through its regular SEC filings, which include proxy statements for annual stockholder meetings. These filings provide detailed information on director elections and other governance matters. There have been no recent major governance controversies involving FactSet reported in the public domain.

FactSet is a publicly traded company, listed on the NYSE and NASDAQ. The Board of Directors oversees the company's strategic direction and operations. Key executive leadership includes Frederick Philip Snow as CEO.

- FactSet operates with a one-share-one-vote structure.

- The company's governance structure ensures accountability to shareholders.

- Information on board members is available in corporate governance documents.

- The company is committed to transparency through SEC filings.

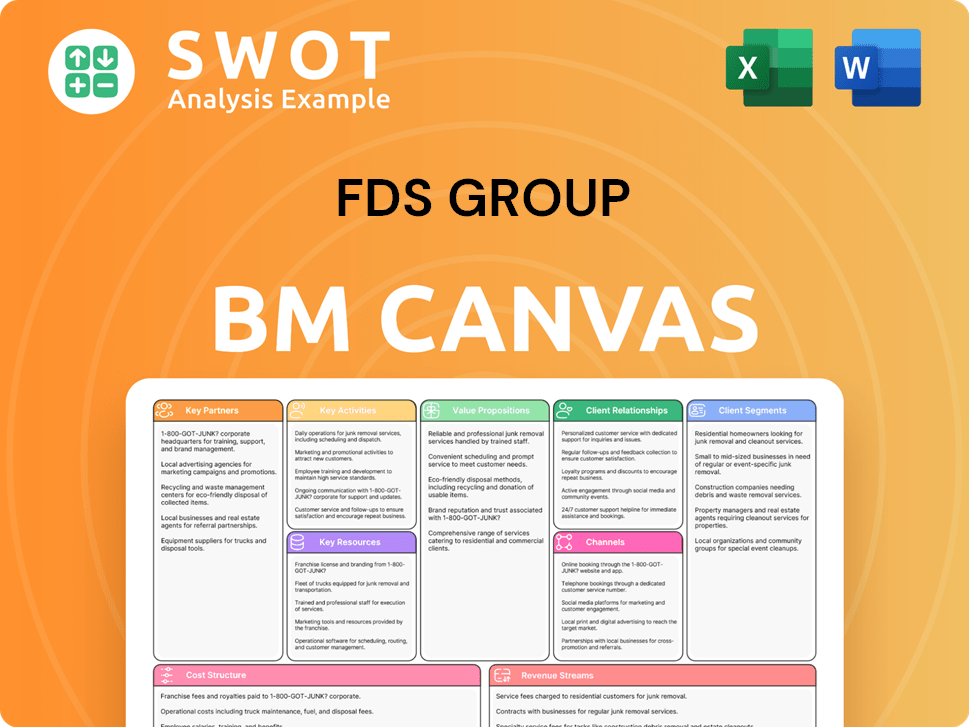

FDS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped FDS Group’s Ownership Landscape?

Over the past few years, the ownership profile of FDS Group has been marked by consistent financial performance and strategic capital management. For the fiscal year 2023, FactSet reported revenues of $2.09 billion. As of August 31, 2024, the company had 8,217 clients and 216,381 users. The company's focus on innovation, particularly in generative AI, is likely to attract and retain institutional investors seeking growth opportunities in the financial technology sector.

Share buybacks have been a significant aspect of FDS Group's capital allocation strategy. In the first quarter of fiscal 2025 (ended November 30, 2024), the company repurchased 104,475 shares for $48.8 million at an average price of $467.00. As of November 30, 2024, $251.2 million remained available for share repurchases under the company's program. On September 17, 2024, the Board of Directors authorized up to $300 million for share repurchases in fiscal 2025. This indicates a continued focus on returning value to shareholders through these buyback programs. The company's commitment to returning value to shareholders is evident through its share repurchase and dividend programs, emphasizing its management of outstanding shares.

| Metric | Fiscal Year 2023 | As of November 30, 2024 (Q1 FY2025) |

|---|---|---|

| Total ASV and Professional Services Revenue | $2.09 billion | N/A |

| Shares Repurchased (Q1 FY2025) | N/A | 104,475 shares |

| Share Repurchase Cost (Q1 FY2025) | N/A | $48.8 million |

| Average Share Price (Q1 FY2025) | N/A | $467.00 |

| Remaining for Share Repurchases (as of Nov 30, 2024) | N/A | $251.2 million |

The company's focus on technology and commitment to returning value to shareholders are key trends shaping the FDS Group ownership landscape. The company's strategic initiatives, including the use of generative AI, are designed to enhance client efficiency. For more insight into the company's background, consider reading the Brief History of FDS Group.

Consistent financial performance and strategic capital management. Share buybacks represent a significant capital allocation strategy.

Continued focus on returning value to shareholders through buyback programs. The company repurchased shares in Q1 FY2025 and authorized additional funds for future repurchases.

Emphasis on generative AI to drive client efficiency and workflow enhancements. This focus is aimed at attracting and retaining institutional investors.

Increased institutional ownership is likely to continue, with a focus on sustainable growth and technological innovation to maintain market position.

FDS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FDS Group Company?

- What is Competitive Landscape of FDS Group Company?

- What is Growth Strategy and Future Prospects of FDS Group Company?

- How Does FDS Group Company Work?

- What is Sales and Marketing Strategy of FDS Group Company?

- What is Brief History of FDS Group Company?

- What is Customer Demographics and Target Market of FDS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.