FDS Group Bundle

How Does FDS Group Thrive in the Architectural Metalwork Arena?

FDS Group crafts stunning custom metal structures and facades, transforming architectural dreams into reality. Their expertise, spanning design to installation, has fueled a 7% market growth in 2024 within the custom metalwork sector. But how does this FDS Group SWOT Analysis shape their success?

Understanding the inner workings of the FDS Group company is essential for anyone looking to navigate the construction and architectural landscape. This analysis will dissect FDS Group services, operations, and business model, offering insights into their comprehensive approach. Explore the company's strategic moves and competitive advantages to understand how FDS Group works.

What Are the Key Operations Driving FDS Group’s Success?

The FDS Group company excels in creating custom metal structures and facades for architectural projects, delivering value through comprehensive services. They manage the entire project lifecycle, from initial design to final installation, catering to architects, designers, and construction companies. This full-service approach streamlines project management, enhancing efficiency and quality control for their clients.

Their core operations involve specialized manufacturing processes, sourcing raw materials, and complex logistical coordination for installations. The ability of FDS Group to execute intricate architectural visions is a key strength, setting them apart in the industry. This specialization allows them to create bespoke elements, differentiating them from competitors and meeting the unique demands of each project.

The FDS Group business model centers on providing a full-service solution, which includes design consultation, manufacturing, and installation. This approach simplifies the process for clients, allowing them to focus on the overall project vision while FDS Group services handle the technical aspects. Their close collaboration with industry professionals, such as architects and construction companies, further enhances project understanding and success.

The company provides end-to-end solutions, managing all phases of a project from design to installation. This simplifies project management for clients. This comprehensive service is a key aspect of how FDS Group works, ensuring quality and efficiency.

FDS Group specializes in custom metalwork, creating unique architectural elements. This specialization allows them to meet specific project requirements. Their ability to create bespoke elements differentiates them from competitors.

They work closely with architects and construction companies. This collaboration enhances project understanding and success. Collaborative projects increased by 15% in 2024, showing the importance of these partnerships.

Companies with similar capabilities saw a 15% higher project success rate in 2024. This indicates the effectiveness of their operational processes. This highlights the efficiency and quality of FDS Group operations.

The operational processes include specialized manufacturing, sourcing of raw materials, and complex logistical coordination for installation. These processes are critical to FDS Group's ability to execute intricate architectural visions. Understanding these processes provides insight into Brief History of FDS Group.

- Specialized Manufacturing: Custom metal structures and facades.

- Raw Material Sourcing: Procurement of high-quality materials.

- Logistical Coordination: Efficient installation of complex designs.

- Design Consultation: Working with architects and designers.

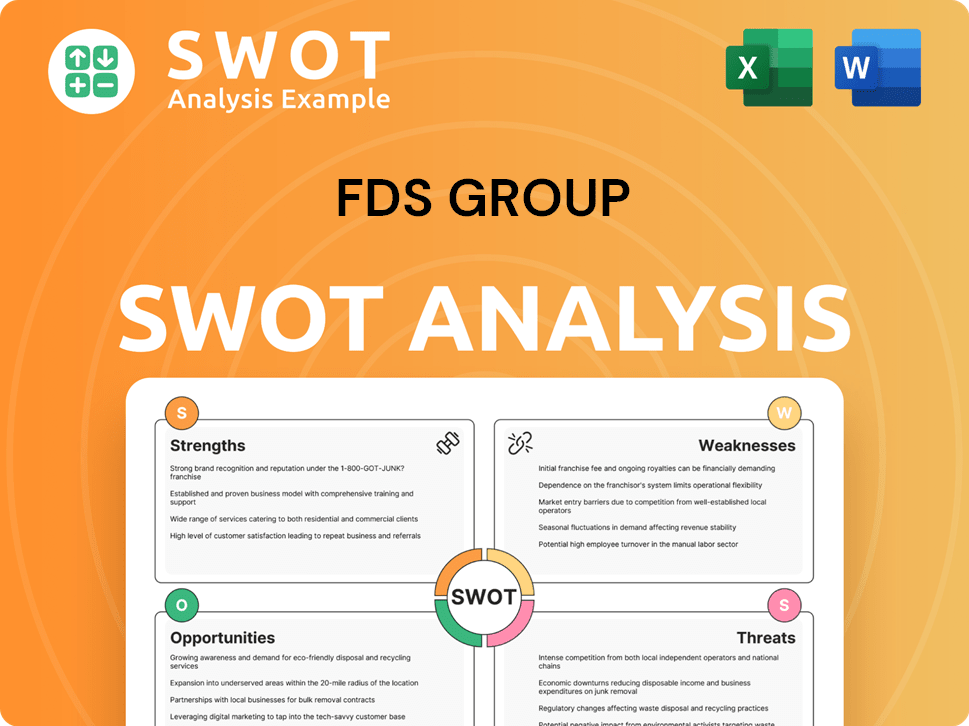

FDS Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FDS Group Make Money?

The primary revenue streams for the FDS Group company are generated through the design, manufacturing, and installation of custom metal structures and facades. The FDS Group's business model focuses on providing comprehensive, end-to-end solutions for complex architectural projects. This approach allows them to offer specialized services, which is a key aspect of how FDS Group works.

The metal fabrication market, within which FDS Group operates, was valued at $40.7 billion in 2024. Projections indicate a growth of 3.5% by Q1 2025, presenting opportunities for companies like FDS Group to expand their market presence. The monetization strategy of FDS Group is centered on providing turnkey solutions, where the value lies in the customized design and end-to-end service.

Innovative monetization strategies in this sector can include tiered pricing for different levels of customization or bundled services that integrate design, manufacturing, and installation expertise. The project-based nature of their business means that revenue is tied to individual contracts. Some firms saw up to 15% of revenue from single, large clients in 2024.

The FDS Group's revenue model relies on a project-based approach, where each contract contributes significantly to their overall financial performance. The company's ability to secure and execute large-scale projects is critical. To understand more about their strategic goals, you can read about the Growth Strategy of FDS Group.

- Customization: Offering various levels of customization to meet diverse client needs.

- Bundled Services: Providing integrated design, manufacturing, and installation services.

- Project-Based Revenue: Generating income from individual contracts, which can vary in size and scope.

- Client Concentration: Managing the risk associated with large clients, as a significant portion of revenue may come from a few key projects.

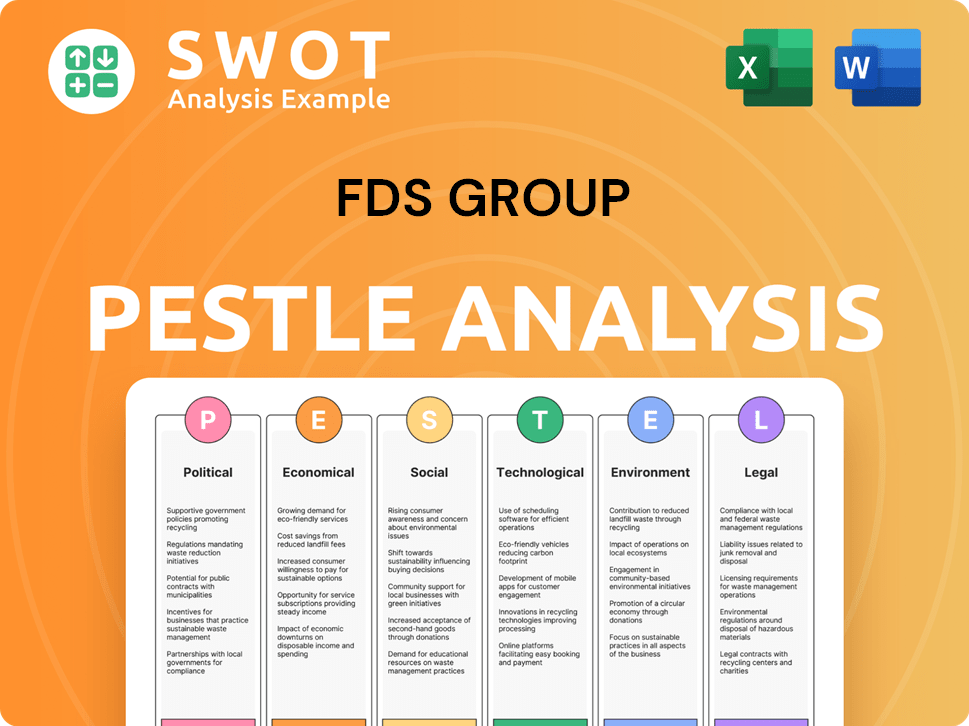

FDS Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped FDS Group’s Business Model?

The story of the FDS Group company is marked by strategic decisions and operational adaptations. A pivotal moment in early 2025 was its acquisition by BLG Group of Companies. This move, part of a multi-million-dollar deal, aims to bolster BLG's global presence in consulting, technology, and industrial innovation by leveraging FDS Group's expertise in retail and engineering.

This acquisition is a significant step for FDS Group, potentially reshaping its market position and operational strategies. The integration process and the ability to capitalize on new opportunities will be crucial for the company's future success. Understanding the interplay between these strategic moves and the company's operational challenges provides a clearer picture of how FDS Group works.

The company's approach to the construction industry, its ability to manage supply chain dynamics, and its financial performance all play key roles in its overall strategy. For more details, consider exploring the Marketing Strategy of FDS Group.

The acquisition by BLG Group in early 2025 was a significant milestone. This strategic move aimed to strengthen BLG's global reach. FDS Group's innovative capabilities in retail and engineering were key to this acquisition.

Focus on custom metalwork and comprehensive services, from design to installation, is a key strategic focus. Adapting to sustainability trends in the construction industry presents new opportunities. The company's ability to navigate supply chain disruptions and manage fluctuating raw material costs is crucial.

Specialization in custom metalwork and comprehensive service offerings are competitive advantages. Strong brand reputation and established industry relationships create barriers to entry. Adapting to sustainability trends in construction is a key opportunity.

Volatile revenue streams linked to projects pose a challenge. Increased production costs due to specialized manufacturing can impact profitability. Fluctuating raw material prices, like steel and aluminum, significantly affect costs. Supply chain disruptions can also hinder production schedules.

FDS Group's operations are influenced by external factors, including raw material prices and supply chain issues. In 2024, many companies faced a 10-15% increase in costs due to global supply chain problems. Steel and aluminum price volatility significantly impacted costs in 2024. The company's ability to manage these factors is crucial for financial performance.

- The acquisition by BLG Group is a strategic pivot.

- Custom metalwork and comprehensive services are key differentiators.

- The construction industry's shift towards sustainability offers opportunities.

- Supply chain disruptions and raw material costs are operational challenges.

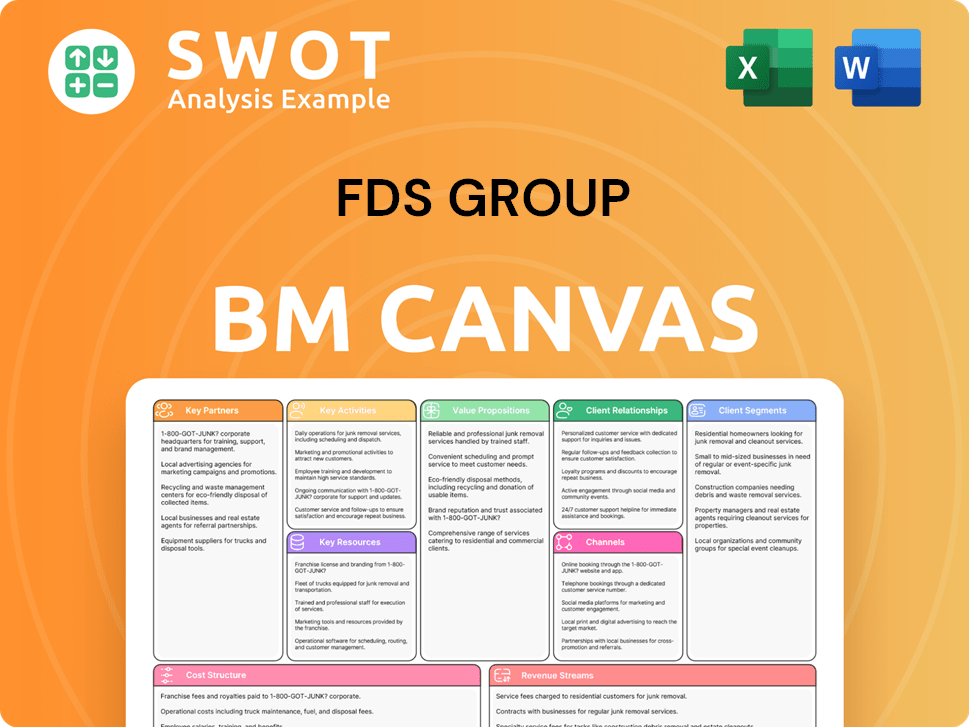

FDS Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is FDS Group Positioning Itself for Continued Success?

The FDS Group company holds a strong position in the custom metal structures and facades market. Its specialization and comprehensive services set it apart. However, the company faces various risks and opportunities that will shape its future.

The company's outlook is significantly influenced by its ability to adapt to market changes and leverage its core strengths. Strategic decisions, such as the 2025 acquisition by BLG Group, are crucial for long-term growth and market competitiveness.

FDS Group operates within the niche of custom metal structures and facades. This specialization allows for a focused approach to service offerings. The company's ability to provide comprehensive solutions enhances its market position.

Economic downturns pose a significant risk, potentially decreasing construction spending. Competition and supply chain disruptions can increase costs. Technological advancements and evolving architectural styles require adaptation and innovation.

The future outlook depends on leveraging expertise and capitalizing on infrastructure investment. The acquisition by BLG Group in 2025 indicates a strategic move for broader integration and expansion. The global infrastructure investment market reached $4.5 trillion in 2024.

FDS Group's services include custom metal structures and facades. These services are designed to meet specific architectural needs. Comprehensive solutions enhance the company's market competitiveness.

The company faces challenges from economic downturns and intense competition. It must adapt to evolving architectural styles and supply chain disruptions. Opportunities exist within the expanding global infrastructure market.

- Economic Downturns: U.S. construction spending declined by 2.5% in 2023, impacting the construction sector.

- Competition: Intense competition requires continuous innovation and efficiency.

- Supply Chain: Disruptions potentially increase costs by 10-15% in 2024.

- Technological Advancements: The growing use of composite materials (8% growth in 2024) necessitates adaptation.

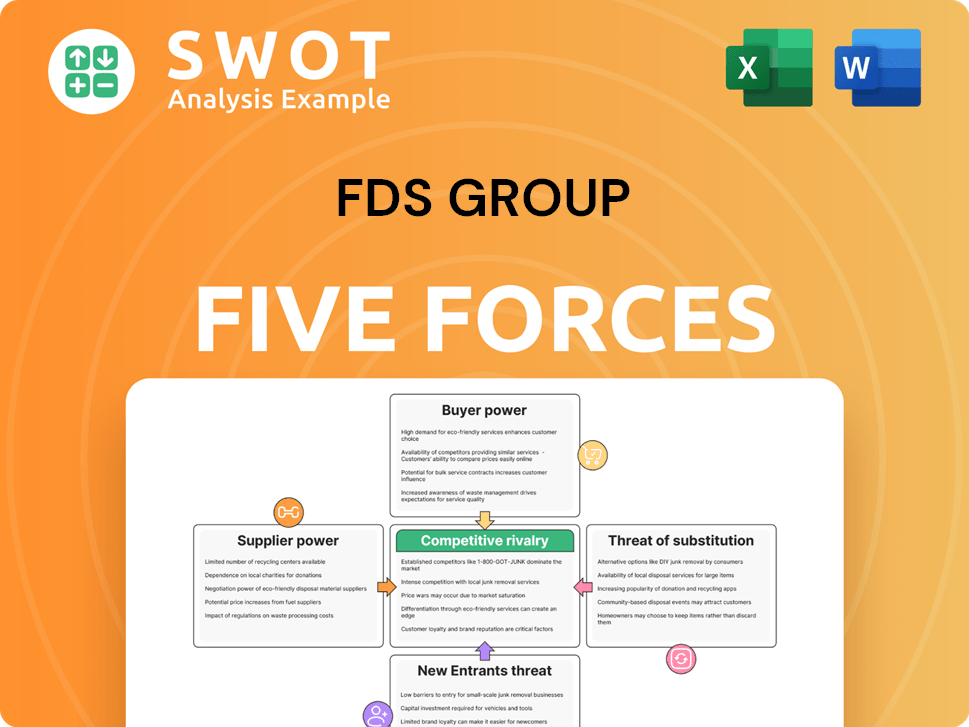

FDS Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FDS Group Company?

- What is Competitive Landscape of FDS Group Company?

- What is Growth Strategy and Future Prospects of FDS Group Company?

- What is Sales and Marketing Strategy of FDS Group Company?

- What is Brief History of FDS Group Company?

- Who Owns FDS Group Company?

- What is Customer Demographics and Target Market of FDS Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.