FILA Holdings Bundle

Can Misto Holdings (formerly FILA Holdings) Redefine its Future?

Misto Holdings Company, formerly known as FILA Holdings, is undergoing a significant transformation, aiming to navigate the dynamic global sportswear and lifestyle industry. This strategic shift, symbolized by its new name, reflects a renewed focus on brand diversification and future growth. Founded in Italy, the company has evolved from its textile roots to become a global player, managing iconic brands like FILA, Titleist, and FootJoy.

Despite recent challenges, including an operating loss in the U.S. market, Misto Holdings demonstrated revenue growth in 2024, primarily fueled by its Acushnet segment. This analysis delves into the FILA Holdings SWOT Analysis, exploring the company's growth strategy, market share analysis, and future prospects within the competitive sports apparel market. We'll examine FILA's strategic initiatives, including its global expansion plans and product innovation strategy, to understand its long-term growth potential.

How Is FILA Holdings Expanding Its Reach?

Misto Holdings Company is actively pursuing several key expansion initiatives to fuel its future growth, with a strong focus on strategic market adjustments and product diversification for the FILA brand. The company's approach involves re-evaluating its presence in key markets and expanding its product offerings to meet evolving consumer demands. These initiatives are designed to strengthen the brand's position in the competitive sports apparel market and drive long-term value.

A central element of Misto Holdings' strategy is a strategic re-evaluation of its North American operations for the FILA brand. This involves a temporary pause in the U.S. market to allow for a more effective re-entry strategy. The company is selling off FILA USA inventory by the end of 2025, exploring options such as direct operations, licensing, or distribution to re-establish its presence in the U.S. market.

Geographically, Misto Holdings is seeing strong results in China for the FILA brand, largely due to its partnership with Anta Group. This partnership is a key driver of growth, with design fees from Anta projected to increase to 90 billion won in 2025 from 80 billion won in 2024. This growth is supported by the 'guochao' trend in China, which favors domestic brands. In Q1 2025, North America, which accounts for 46.6% of FILA's core business sales, showed strong growth of 11.2% to reach €63.5 million for the F.I.L.A. Group. Europe also saw a modest increase of 1.5% to €52.4 million in Q1 2025.

The company is leveraging successful regional partnerships, particularly in China, to drive growth. The strategic focus is on the 'guochao' trend, which is boosting brand performance. This approach highlights the importance of adapting to regional market dynamics.

Diversifying the FILA brand's offerings is a key strategy. New product categories such as golf, running shoes, and tennis are being introduced. This is part of a broader effort to enhance brand value and strengthen product competitiveness.

Misto Holdings plans to ramp up sponsorship initiatives across individuals, teams, and events. This strategy aims to nurture sports talent and expand the brand's global presence. The company will build on its history of successful athletic sponsorships.

A strategic pause in the U.S. market allows for a more effective re-entry. The company is exploring models such as direct operations, licensing, or distribution. This is designed to ensure a sustainable and effective presence.

Misto Holdings is implementing a multi-faceted approach to drive growth, focusing on geographic expansion, product diversification, and strategic partnerships. These initiatives are designed to capitalize on emerging market trends and strengthen the brand's position in the global sports apparel market. The company's strategic moves are aimed at enhancing its long-term growth potential.

- Re-evaluating North American Operations

- Leveraging successful partnerships in China

- Diversifying product offerings to include new categories

- Increasing marketing investment

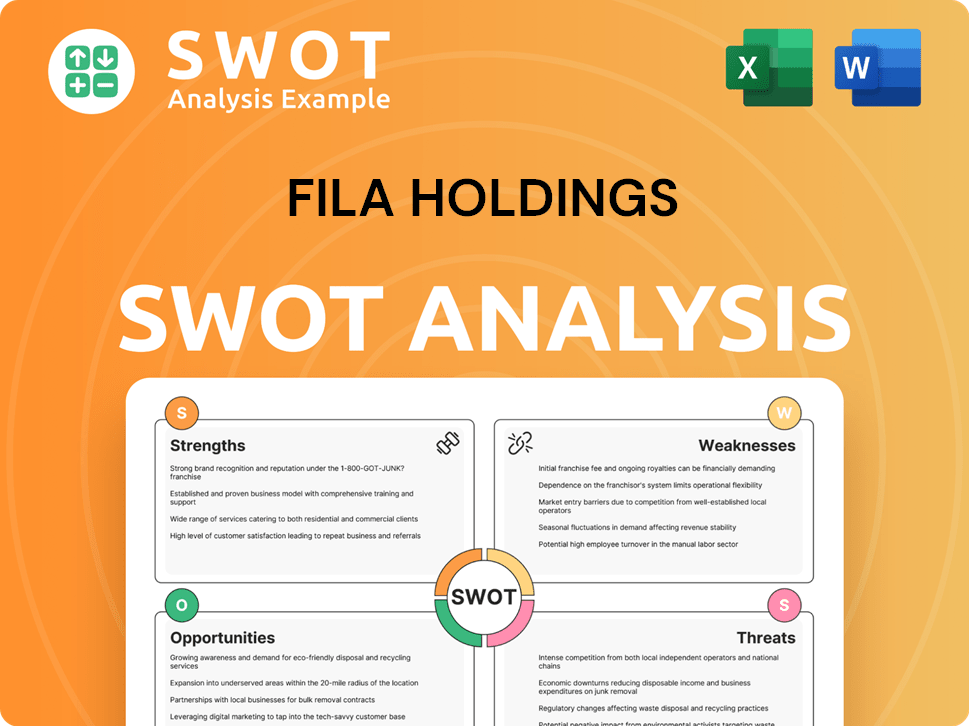

FILA Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does FILA Holdings Invest in Innovation?

The company emphasizes innovation and technology to maintain its competitive edge and drive sustained growth within the sports apparel market. This includes continuous investment in brand marketing and communication to strengthen brand recognition and reputation, alongside introducing brands to new high-potential geographic areas. The 'Bellissimo' campaign by the brand is a prime example of how the company showcases its unique blend of style and performance.

Digital transformation is a key area of focus, with the aim to enhance agility and speed in strategic business decisions. While specific details on cutting-edge technologies like AI or IoT for the company are not extensively disclosed in recent reports, the emphasis on digital transformation suggests an underlying commitment to modernizing operations and improving efficiency. This commitment is crucial for the future of the brand in the sportswear industry.

Product competitiveness is a form of innovation, as demonstrated by the positive market response to the brand's Echappe footwear series. This indicates ongoing efforts in design and development to create products that resonate with consumers. The company's strategic focus on brand revitalization and product enhancement implies continuous investment in these areas, ensuring the brand remains competitive.

The company invests in brand marketing and communication to strengthen brand recognition and reputation. This includes global campaigns, such as the 'Bellissimo' campaign, which showcases the brand's unique blend of style and performance. These efforts are crucial for maintaining and expanding its market share.

The company aims to enhance agility and speed in strategic business decisions through digital transformation. Implementing SAP across all global companies and centralizing capabilities are part of this strategy. This allows individual group companies to focus on their core business and development, improving overall efficiency.

Product competitiveness is a form of innovation, with efforts in design and development to create products that resonate with consumers. The positive market response to the Echappe footwear series is an example of this. This focus helps maintain a strong position in the sports apparel market.

While specific details on R&D investments are not prominently featured in recent financial reports, the strategic emphasis on brand revitalization and product enhancement implies continuous investment in these areas. This investment is key to driving future growth.

The company's strategy includes introducing its brands to new high-potential geographic areas. This expansion is supported by global campaigns and digital initiatives. This approach is critical for achieving long-term growth potential.

By centralizing capabilities and implementing systems like SAP, individual group companies can focus on their core business and development. This allows for greater efficiency and strategic alignment across the organization. This is a key element of the overall growth strategy.

The company's strategic initiatives are focused on brand marketing, digital transformation, and product competitiveness. These efforts aim to enhance brand recognition, streamline operations, and create products that meet consumer needs.

- Brand Marketing: Investments in global campaigns to strengthen brand recognition.

- Digital Transformation: Implementing SAP to improve agility and decision-making.

- Product Innovation: Focus on design and development to create appealing products.

- Global Expansion: Introducing brands to new geographic markets.

- Operational Efficiency: Centralizing capabilities to allow individual companies to focus on core business.

For an in-depth look at the company's marketing strategies, consider reading the Marketing Strategy of FILA Holdings.

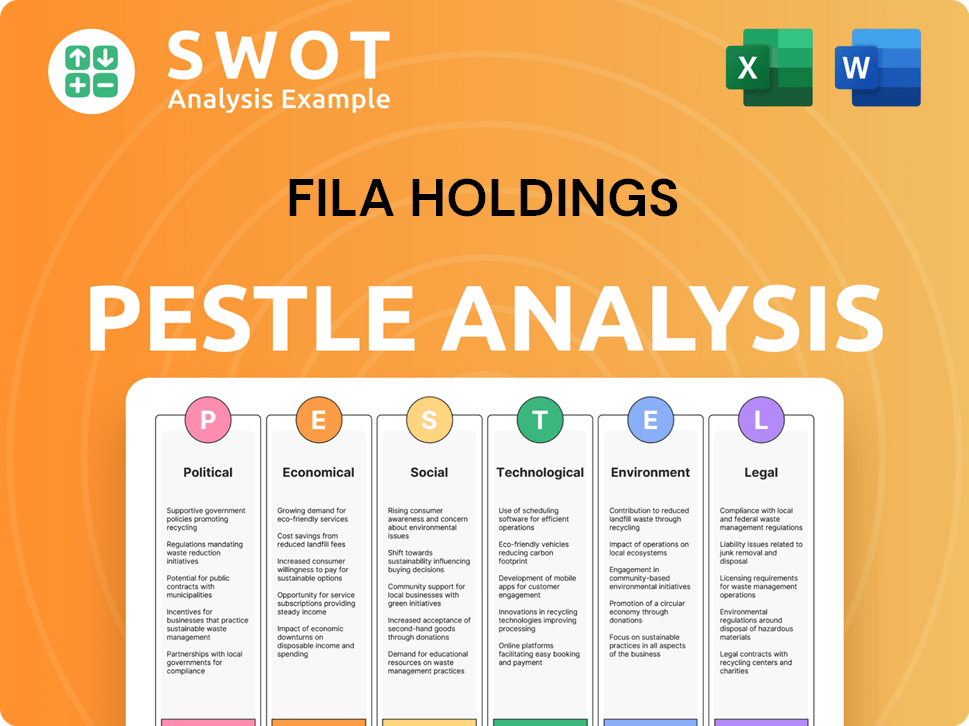

FILA Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is FILA Holdings’s Growth Forecast?

The financial outlook for FILA Holdings in 2025 indicates a focus on sustained growth, despite acknowledging market uncertainties. The company anticipates revenue growth ranging from flat to a 5 percent increase for the full year 2025, primarily driven by the strong performance of its Acushnet subsidiary and overall Misto business, excluding FILA North America. This projection reflects a strategic approach to navigate the dynamic sports apparel market.

Consolidated full-year 2024 revenue reached ₩4,269 billion ($3.13 billion), marking a 6.5 percent increase compared to 2023. The FILA brand segment specifically saw revenues of ₩917,320 million ($672.5 million) in 2024, a 2.2 percent increase. These figures highlight the company's ability to maintain revenue growth in a competitive landscape, focusing on brand expansion.

Despite a net loss in Q4 2024, the consolidated net income for 2024 was ₩207,722 million ($152.3 million), up from ₩153,057 million in 2023. The FILA brand segment reduced its operating loss, attributed to cost-cutting efforts. For a deeper understanding of the financial structure, you can explore Revenue Streams & Business Model of FILA Holdings.

For 2025, FILA Holdings anticipates revenue growth between flat and 5 percent. This projection reflects a cautious yet optimistic view of the FILA Future in the sports apparel market. The growth is expected to be driven by the Acushnet subsidiary and the overall Misto business.

Consolidated revenue for 2024 reached ₩4,269 billion ($3.13 billion), a 6.5 percent increase. The FILA Company segment saw revenues of ₩917,320 million ($672.5 million), a 2.2 percent increase. Net income for 2024 was ₩207,722 million ($152.3 million), up from ₩153,057 million in 2023.

The FILA brand segment narrowed its operating loss in 2024 due to cost-cutting measures. FILA USA, however, posted an operating loss of $78.6 million in 2024, an improvement from $108.8 million in 2023. This highlights the ongoing efforts to improve profitability within the brand.

F.I.L.A. Group's Q1 2025 revenue increased by 3.4% year-over-year to €136.3 million, and adjusted EBITDA grew 7% to €22.6 million. They project low to medium single-digit revenue growth and mid-single-digit adjusted EBITDA growth for 2025.

The company plans to allocate up to ₩500 billion for shareholder returns from 2025 to 2027. This commitment aims to maximize shareholder value through strong cash flows from its core businesses, reflecting a focus on FILA Holdings long-term growth potential.

The financial outlook demonstrates the company's strategic approach to the sports apparel market. Key strategies include managing costs, driving revenue growth, and improving profitability. These initiatives are crucial for FILA's strategic initiatives.

The company is navigating market uncertainties and competitive pressures. The performance of the Acushnet subsidiary and the overall Misto business, excluding FILA North America, are key drivers. Understanding the FILA's competitive landscape is essential.

The company projects low to medium single-digit revenue growth and mid-single-digit adjusted EBITDA growth for 2025. Free cash flow to equity is expected to be between €40 million and €50 million. These projections reflect FILA Holdings financial performance.

Cost-cutting efforts have been instrumental in improving the FILA brand segment's operating performance. This focus on efficiency is a key factor in the company's financial strategy. The FILA Holdings revenue growth is also dependent on cost management.

The allocation of funds for shareholder returns underscores the company's commitment to maximizing shareholder value. This strategy is supported by strong cash flows from its core businesses, which is part of FILA's global expansion plans.

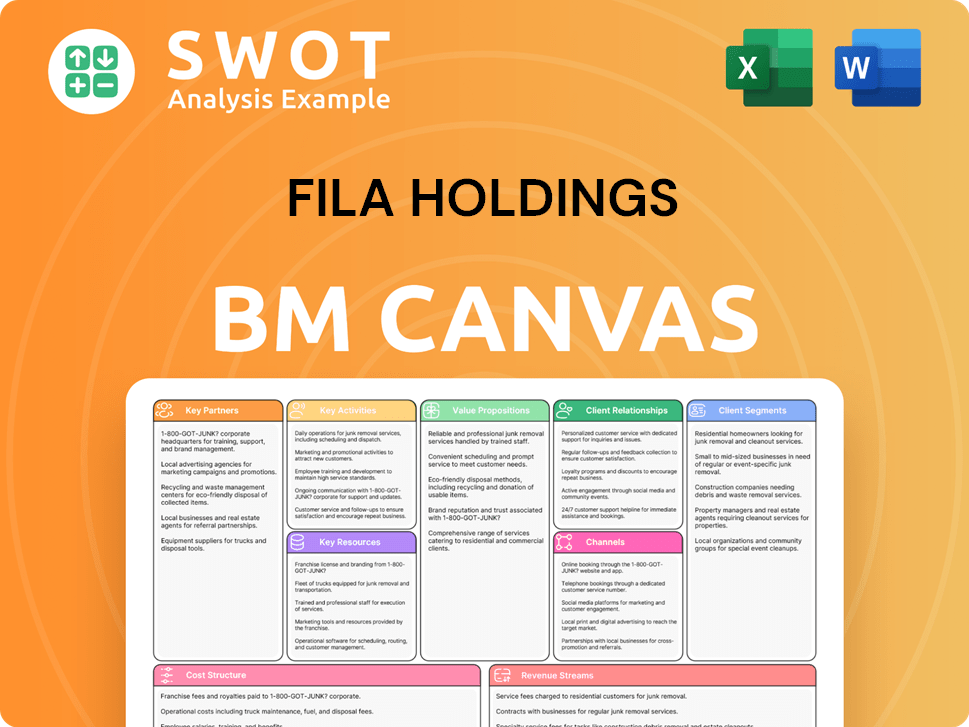

FILA Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow FILA Holdings’s Growth?

The growth strategy of FILA Holdings faces several hurdles. The sportswear market is fiercely competitive, and the company must navigate macroeconomic uncertainties, including potential tariff increases and shifting consumer sentiment. Furthermore, supply chain vulnerabilities and technological disruptions pose inherent risks to global operations.

The company's performance in the U.S. market has been particularly challenging, with FILA USA reporting an operating loss. Currency fluctuations, such as the strong U.S. dollar against the Korean won, have also negatively impacted earnings. The need for a robust re-entry strategy and effective brand revitalization is crucial to regaining market share.

To address these challenges, the company is focusing on cost structure improvements and brand enhancements in its direct markets, excluding North America. A diversified business model, including joint ventures and licensing agreements, aids in mitigating regional market risks. Management's cautious stance on its 2025 guidance, subject to global macroeconomic conditions, reflects an awareness of external factors. This strategic approach, coupled with digital transformation efforts, is vital for FILA's future.

The sports apparel market is highly dynamic, presenting a constant challenge for FILA Company. Competitors continually innovate and introduce new products, requiring FILA to stay agile and responsive. Maintaining and growing market share necessitates ongoing strategic adjustments and marketing efforts.

Macroeconomic factors, such as potential tariff increases in North America and shifts in consumer confidence, pose significant risks. These uncertainties can impact sales, profitability, and overall financial performance. The company must monitor and adapt to these external factors to mitigate their effects.

Currency fluctuations, particularly the strength of the U.S. dollar against the Korean won, can negatively affect earnings. This is especially relevant for FILA USA, where these fluctuations can impact reported financial results. Hedging strategies and financial planning are critical to managing these risks.

Supply chain vulnerabilities and potential technological disruptions are inherent risks. Efficient supply chain management is crucial for timely product delivery and cost control. The company's focus on operational efficiency and cost-cutting suggests an awareness of these risks.

The U.S. market has been particularly challenging, with FILA USA reporting operating losses. This indicates a need for a robust re-entry strategy and effective brand revitalization. Addressing these challenges is crucial for overall FILA Holdings financial health and growth.

Digital transformation is a key strategic initiative for enhancing agility and oversight. Implementing SAP across global companies can streamline operations and improve efficiency. This strategic focus is critical for long-term success and resilience in the market.

Focusing on cost structure improvements is a key strategy for enhancing profitability. Streamlining operations and reducing expenses can improve financial performance. This approach is particularly crucial in the competitive sports apparel market to maintain a competitive edge.

Investing in brand enhancements is essential for maintaining and increasing market share. This includes product innovation, marketing efforts, and strengthening brand image. These efforts help FILA stay relevant and appealing to its target audience.

A diversified business model, including joint ventures and licensing agreements, helps mitigate regional market risks. This approach provides multiple revenue streams and reduces reliance on any single market. The strong performance in China through its partnership with Anta Group exemplifies this strategy.

Management's cautious stance on its 2025 guidance, subject to adjustments based on global macroeconomic conditions, reflects a realistic approach. This demonstrates an awareness of external factors that can impact financial performance. The company is actively managing risks to ensure stability.

To better understand the core values that drive FILA Holdings, you can read more about the company's mission and vision at Mission, Vision & Core Values of FILA Holdings.

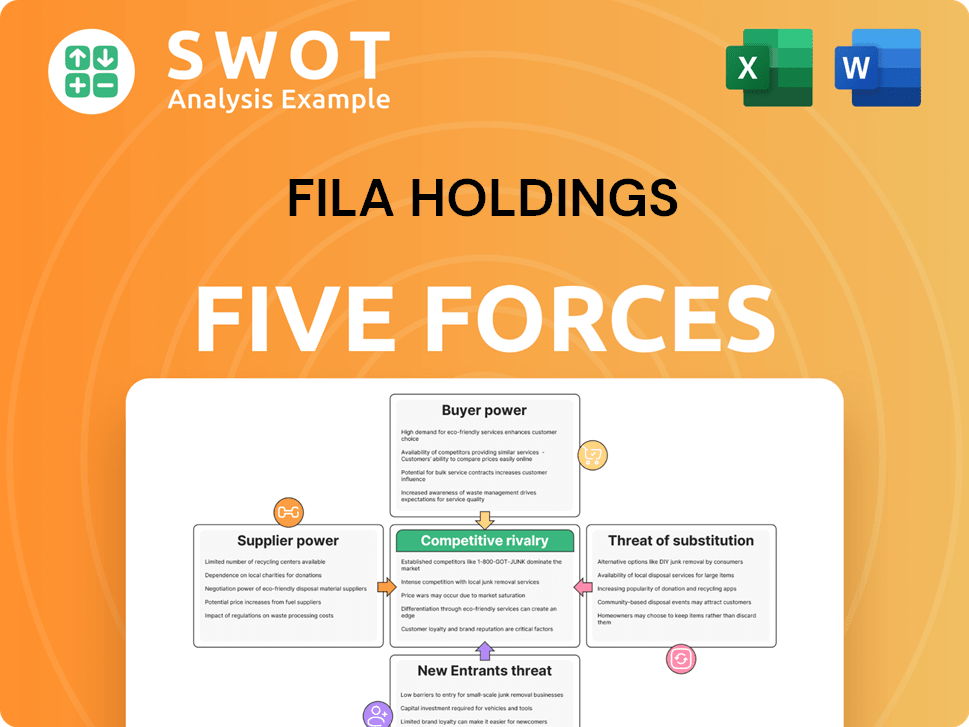

FILA Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FILA Holdings Company?

- What is Competitive Landscape of FILA Holdings Company?

- How Does FILA Holdings Company Work?

- What is Sales and Marketing Strategy of FILA Holdings Company?

- What is Brief History of FILA Holdings Company?

- Who Owns FILA Holdings Company?

- What is Customer Demographics and Target Market of FILA Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.