FILA Holdings Bundle

Who Really Owns FILA?

Understanding a company's ownership is crucial for investors and strategists alike. FILA, a brand synonymous with athletic style, has a fascinating ownership journey. From its Italian roots to its current global presence, the story of FILA's ownership reveals much about its strategic direction and market position.

The FILA Holdings SWOT Analysis offers a deep dive into the company's strengths, weaknesses, opportunities, and threats, providing a comprehensive understanding of its position in the market. Delving into "Who owns FILA" and "FILA ownership" unveils the evolution of the FILA brand, its transformation into a global player, and the entities that shape its future. This exploration of "FILA Holdings" ownership details the key players, from the founders to the current shareholders, and how these factors influence the "FILA company" and its strategic decisions.

Who Founded FILA Holdings?

The story of FILA begins in 1911, when Ettore and Giansevero Fila established the company in Biella, Italy. Initially, the focus was on textiles, specifically knitwear and underwear. The brothers' early vision was to provide high-quality textile products to the local market.

Before officially becoming FILA, the Fila brothers were involved with the wool mill Giuseppe Regis and Figli di Coggiola, joining in 1906. The company was rebranded as Fratelli Fila S.p.A. in 1911. While the exact initial ownership details are not widely available, the founders' commitment to quality was the cornerstone of the company's early operations.

In the 1970s, FILA made a significant move into sportswear, a decision that would reshape the brand's identity and market presence. This shift was spearheaded by Enrico Frachey, who became managing director in 1974. His goal was to transform FILA into an international sportswear brand.

In the early 1980s, Italian chemical company SNIA S.p.A. acquired an 80.5% stake in FILA.

Unione Manifatture S.p.A. held the remaining 19.5% of the company.

By 1988, Fiat-controlled holding company Gemina acquired FILA.

Gemina later restructured as Holding di Partecipazioni Industriali S.p.A. (HdP).

FILA's shift into sportswear, particularly with endorsements like Björn Borg, boosted its popularity.

The initial focus of the FILA company was on producing knitwear and underwear.

The evolution of FILA ownership reflects significant shifts in the company's strategic direction. From its textile beginnings to its rise as a sportswear brand, FILA has seen various ownership structures. Understanding the FILA history provides insights into its brand trajectory. The company's evolution is also discussed in detail in Target Market of FILA Holdings.

- The founders, Ettore and Giansevero Fila, established the company in 1911.

- The company initially focused on textile production, including knitwear and underwear.

- SNIA S.p.A. acquired an 80.5% stake in the early 1980s.

- Fiat-controlled Gemina acquired FILA in 1988.

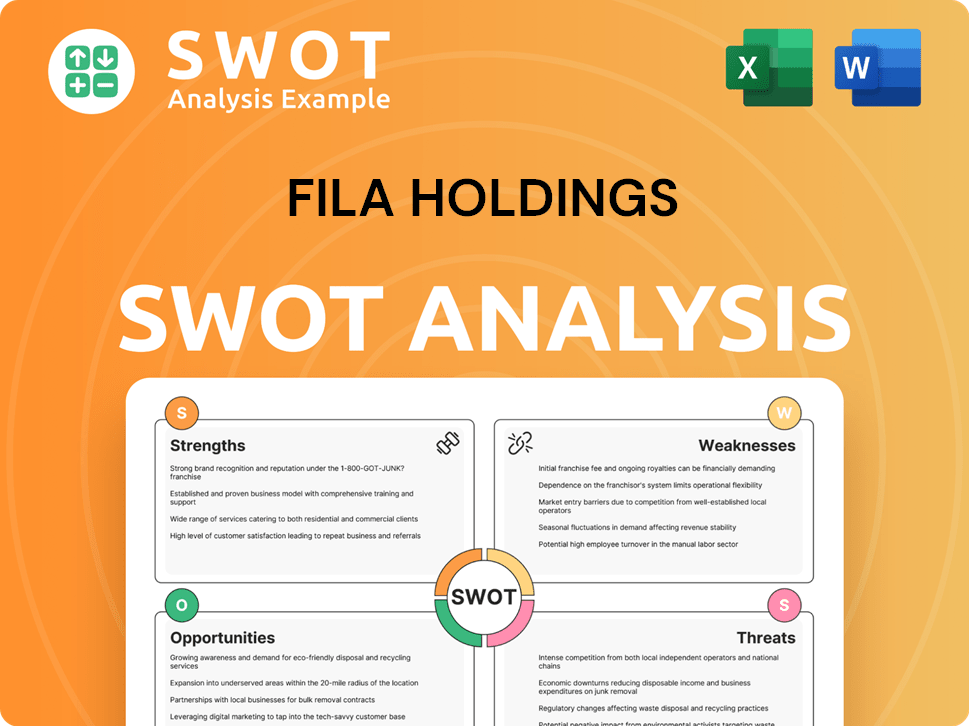

FILA Holdings SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has FILA Holdings’s Ownership Changed Over Time?

The journey of FILA ownership has been marked by significant transitions. Initially under Gemina S.p.A. and later HdP, the FILA company was acquired by Cerberus Capital Management in 2003. Cerberus managed FILA through Sports Brands International, overseeing global operations, excluding Fila Korea. This period set the stage for future developments in the FILA ownership structure.

A crucial shift occurred in January 2007 when Fila Korea took over the entire global FILA brand and its international subsidiaries in a leveraged buyout valued at approximately $400 million. Fila Korea then went public on the Korea Exchange in September 2010. Further expanding its portfolio, FILA Korea, along with Mirae Asset Global Investments, acquired Acushnet Company, the global golf equipment maker, for $1.23 billion in 2011, diversifying the holdings of FILA Holdings.

| Shareholder | Approximate Shareholding | Notes |

|---|---|---|

| Piemonte Co., Ltd. | ~20% | Gene Yoon (Yoon Yoon-su) holds a 75% stake. |

| FILA Holdings | ~20% | Owns a portion of its own shares. |

| National Pension Service of South Korea | ~13% | A significant institutional investor. |

| SEI Investments (Europe) Ltd. | 6.78% | Institutional investor. |

| Amundi Asset Management SA | 1.58% | Institutional investor. |

As of recent reports, the FILA Holdings Corp. has a diverse shareholder base. Piemonte Co., Ltd. holds around 20% of the shares, with Gene Yoon, the chairman, owning a substantial stake in Piemonte. FILA Holdings itself holds about 20% of its own shares. The National Pension Service of South Korea is another key shareholder, holding approximately 13%. SEI Investments (Europe) Ltd. and Amundi Asset Management SA also hold significant portions. In May 2025, the company changed its name to Misto Holdings Company, a strategic move to strengthen its global brand portfolio. For more insights into the company's strategic direction, consider reading about the Growth Strategy of FILA Holdings.

The ownership of FILA has evolved significantly over time, from European ownership to a Korean-led structure.

- Fila Korea's acquisition of the global brand in 2007 was a pivotal moment.

- The company's IPO in 2010 marked its public status.

- Institutional investors like the National Pension Service of South Korea hold substantial shares.

- The name change to Misto Holdings Company reflects a strategic shift.

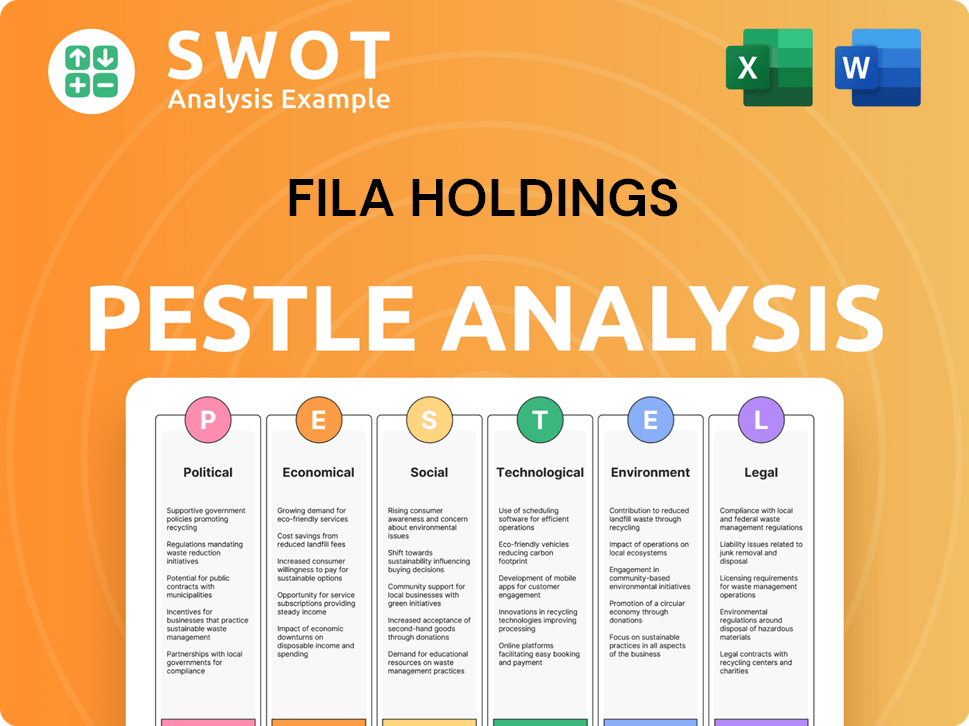

FILA Holdings PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on FILA Holdings’s Board?

As of April 2025, the key leadership at FILA Holdings Corp. includes Gene Yoon (Yoon Yoon-su) as Chairman and Yoon Keun-chang as Chief Executive Officer. Their influence is significant, especially considering their potential beneficial ownership through Magnus Holdings Co., Ltd., a wholly-owned subsidiary of FILA Holdings Corp.

Magnus Holdings Co., Ltd. holds a controlling interest in Acushnet Holdings Corp., which represents approximately 52% of its common stock. While the exact composition of the entire board and the specific voting structures are not fully detailed in the provided information, the ownership structure indicates a concentrated voting power.

| Role | Name | Ownership |

|---|---|---|

| Chairman | Gene Yoon (Yoon Yoon-su) | Indirectly through Magnus Holdings Co., Ltd. and Piemonte Co., Ltd. |

| CEO | Yoon Keun-chang | Indirectly through Magnus Holdings Co., Ltd. |

| Majority Shareholder | Magnus Holdings Co., Ltd. | Wholly-owned subsidiary of FILA Holdings Corp. |

The concentrated ownership, particularly through Magnus Holdings Co., Ltd., and the influence of Gene Yoon, who owns 75% of Piemonte, suggest a significant degree of control over the company's direction. For a deeper understanding of the board composition and voting rights, detailed information can be found in the company's annual corporate governance and ownership structure reports. To learn more about the strategies employed by the company, you can read more about the Marketing Strategy of FILA Holdings.

FILA Holdings Corp. is primarily controlled by key executives through subsidiaries.

- Gene Yoon and Yoon Keun-chang are central to the company's leadership.

- Magnus Holdings Co., Ltd. plays a critical role in FILA ownership.

- Acushnet Holdings Corp., with its significant stake, is also influenced by FILA's ownership structure.

- Detailed ownership information is available in the company's reports.

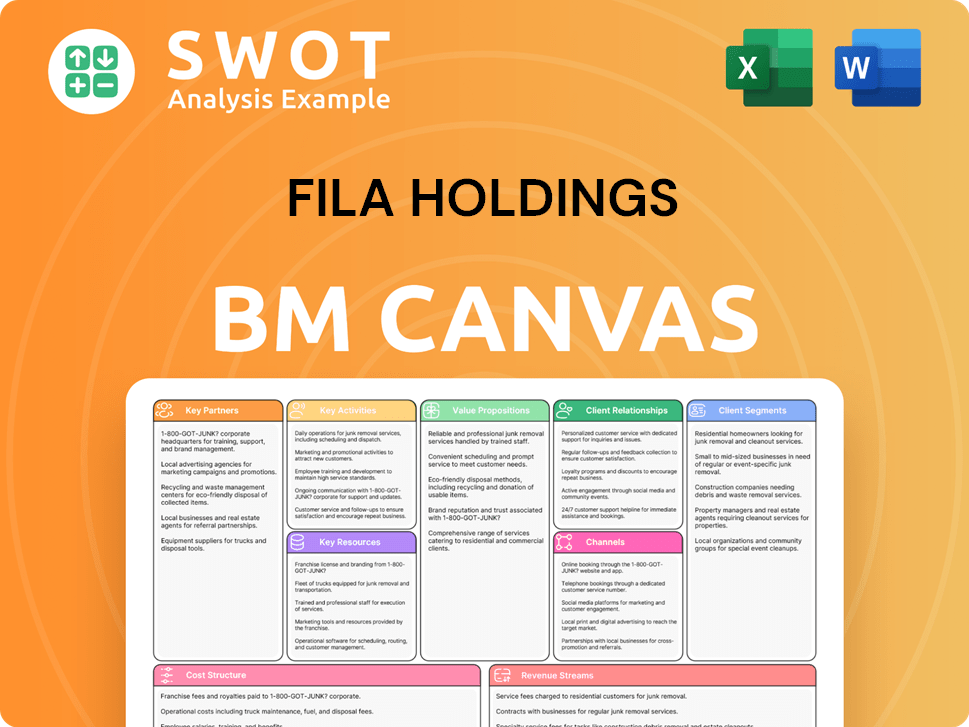

FILA Holdings Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped FILA Holdings’s Ownership Landscape?

Over the past few years, FILA Holdings, now known as Misto Holdings Company, has shown a commitment to enhancing shareholder value. In March 2025, the company announced an increased shareholder return policy, allocating up to 500 billion won for returns from 2025 to 2027, bringing the total to up to 800 billion won from 2022 to 2027. This financial strategy includes special dividends and share buyback programs, with a payout ratio of 201.8% in 2024, totaling 170 billion won.

In November 2024, Misto Holdings initiated a share buyback program worth 50 billion won ($35.8 million), repurchasing 723,688 shares between November 12 and December 31, 2024. The company's buyback plans have been extended, with one plan set to expire on September 20, 2025. These actions reflect a proactive approach to managing the company's capital structure and returning value to its shareholders. For more insights, see Brief History of FILA Holdings.

| Metric | 2024 Performance | 2023 Performance |

|---|---|---|

| Consolidated Revenue (KRW) | 4.27 trillion | 4.01 trillion |

| Operating Profit (KRW) | 360.8 billion | 303.4 billion |

| Adjusted Net Profit (€) | €40.9 million | €30.7 million |

| EBITDA (€) | €180 million | €168 million |

The rebranding to Misto Holdings Company, effective April 1, 2025, signals a strategic shift towards a diversified global brand portfolio. Financially, the company demonstrated robust performance in 2024, with consolidated revenue reaching 4.27 trillion won (approximately $3.13 billion), a 6.5% year-on-year increase, and operating profit rising to 360.8 billion won, up 18.9%. Q1 2025 saw consolidated revenue of 1.24 trillion won, a 4.6% increase year-on-year, driven by the strong performance of Acushnet. The company anticipates continued growth in 2025, with low to medium single-digit revenue growth and mid-single digit adjusted EBITDA growth.

Enhanced shareholder return policy announced in March 2025, targeting up to 800 billion won from 2022 to 2027.

2024 consolidated revenue reached 4.27 trillion won, with operating profit at 360.8 billion won.

Share buyback programs and special dividends reflect a commitment to shareholder value.

Anticipates continued growth in 2025, driven by strong performance of Acushnet.

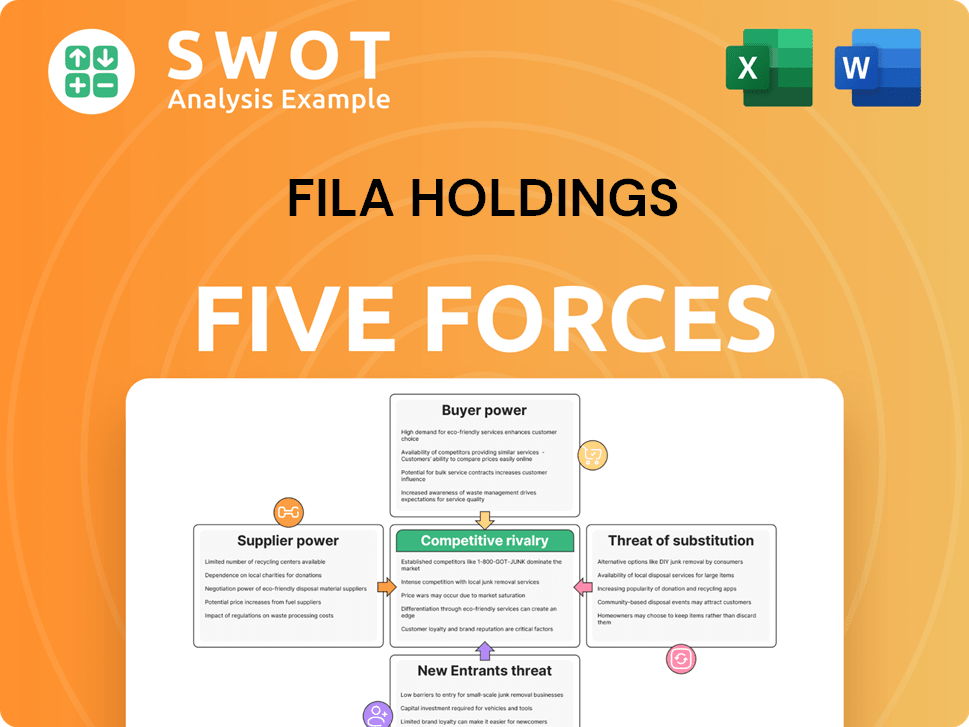

FILA Holdings Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of FILA Holdings Company?

- What is Competitive Landscape of FILA Holdings Company?

- What is Growth Strategy and Future Prospects of FILA Holdings Company?

- How Does FILA Holdings Company Work?

- What is Sales and Marketing Strategy of FILA Holdings Company?

- What is Brief History of FILA Holdings Company?

- What is Customer Demographics and Target Market of FILA Holdings Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.