Global Brands Group Bundle

What Went Wrong at Global Brands Group?

Global Brands Group, once a powerhouse in the fashion industry, boasted a portfolio of iconic brands and ambitious growth targets. Founded in 2005, the company aimed for significant expansion, reaching impressive revenue figures. But what strategic missteps led to its eventual liquidation, and what lessons can be learned? This analysis dives deep into the Global Brands Group SWOT Analysis to uncover the factors that shaped its trajectory.

Understanding the Growth strategy and the Future prospects of companies like Global Brands Group is crucial for anyone involved in Brand management or Business development. This exploration offers a critical Market analysis of the challenges and opportunities facing global brands, providing insights into the dynamics of the fashion industry and the importance of strategic planning for sustainable growth. Analyzing the Global Brands Group company profile helps understand the challenges faced by Global Brands Group and the Global Brands Group competitive landscape.

How Is Global Brands Group Expanding Its Reach?

Global Brands Group Holding Limited's expansion strategy centered on organic growth, leveraging both existing and new licenses. The company aimed for a $5 billion revenue target by fiscal year 2020, supplemented by strategic acquisitions to bolster its existing platform. Key business segments included men's and women's fashion, alongside footwear and accessories.

A core element of its strategy was international expansion and diversifying revenue streams. The company's approach involved expanding its footprint in new territories and broadening its product offerings. This included a focus on brand management, aiming to extend clients' brand assets into new product categories and geographies.

The company's strategy included international expansion and diversifying revenue streams. For example, in 2020, Global Brands established a subsidiary importation company in the US to launch its Franklin & Sons premium mixer brand in the American market. This initiative contributed to a doubling of its export volumes since 2021, with a strategic plan to generate 25-30% of total sales from exports within five years.

Global Brands Group focused on expanding its presence in new territories. This included entering markets such as Georgia, Kosovo, Albania, Brazil, Chile, the British Virgin Islands, Jordan, and Saudi Arabia. These moves were part of a broader strategy to diversify revenue streams and increase its global footprint.

The brand management segment saw substantial growth, with a 75.7% increase in revenue to $188 million due to a merger with CAA. The company aimed to expand its clients' brand assets into new product categories, geographies, and retail collaborations. This strategic move helped to strengthen its position in the market.

Global Brands Group planned to make smaller, strategic acquisitions to complement its existing platform. These acquisitions were intended to support its overall growth strategy. The company's focus on organic growth, combined with strategic acquisitions, aimed to drive long-term value.

The company's international expansion efforts included establishing a subsidiary in the US. This allowed for the launch of the Franklin & Sons premium mixer brand. Export volumes doubled since 2021, with a goal of generating 25-30% of total sales from exports within five years.

The company's growth strategy involved a combination of organic expansion, strategic acquisitions, and international market penetration. This approach was designed to create a diversified portfolio and enhance its market position. The company's focus on international markets and brand management was crucial for its future prospects.

- Organic Growth: Focused on expanding through new and existing licenses.

- Strategic Acquisitions: Planned to make smaller acquisitions to complement its platform.

- International Expansion: Entered new territories, including the US, Georgia, and Saudi Arabia.

- Brand Management: Expanded clients' brand assets into new product categories and geographies.

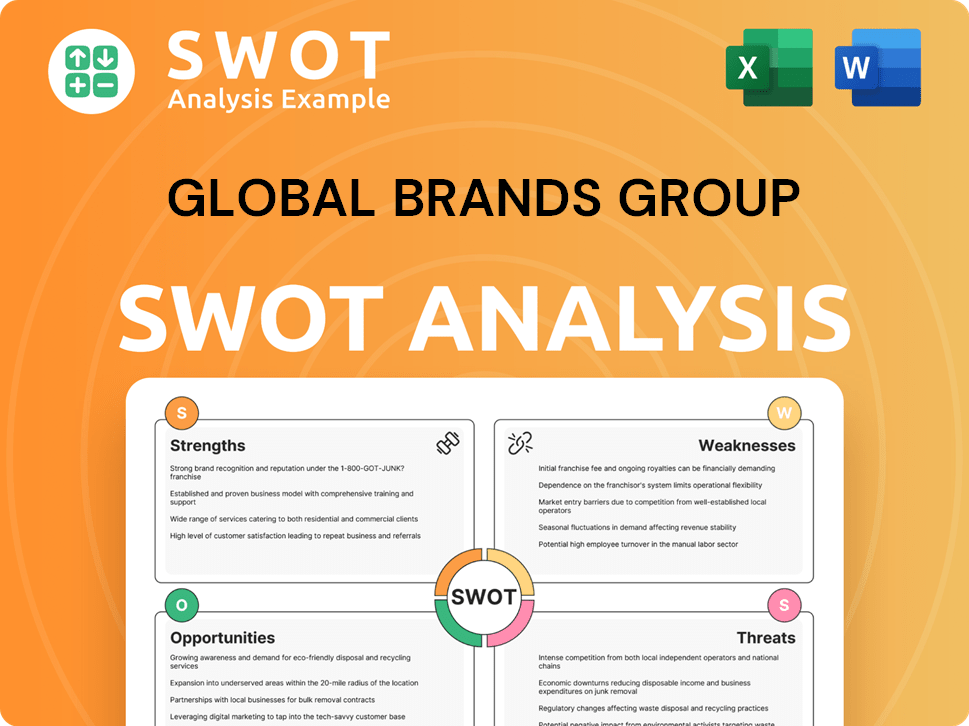

Global Brands Group SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Global Brands Group Invest in Innovation?

Focusing on innovation and technology, 'Global Brands Group' (GBG), a digital transformation company based in Egypt, is distinct from the apparel and accessories-focused Global Brands Group Holding Limited. This GBG entity, established in Cairo in 1997, places a strong emphasis on digital transformation, particularly within IT infrastructure. Their strategic approach involves leveraging cutting-edge solutions in areas like AI, data, and cybersecurity to drive business growth.

GBG's innovation strategy is centered on providing solutions that include datacenter modernization, cloud technologies, and advanced networking. This company actively participates in industry events, such as LEAP 2025 in Saudi Arabia, to showcase its capabilities in AI, data, and security. This approach allows them to engage with industry leaders and foster new partnerships, which are crucial for future prospects. GBG's commitment to innovation is further demonstrated by its use of AI across various functions, including review response management and personalized messaging.

The company's dedication to innovation has been recognized with accolades such as the Egypt Partner of the Year Award for 2024 from Microsoft. This recognition underscores GBG's commitment to continuous innovation to meet evolving industry demands and customer needs. The company's focus on digital transformation and AI-driven solutions positions it well for future growth in a rapidly changing technological landscape. For more details, you can explore the Owners & Shareholders of Global Brands Group.

GBG specializes in digital transformation, focusing on IT infrastructure, AI, data, and cybersecurity. This focus allows them to offer cutting-edge solutions to businesses. Their expertise in these areas is key to their growth strategy.

GBG actively integrates AI into various business functions. This includes review response management, data analysis, and personalized messaging. Their AI-powered solutions drive insights and optimize operations.

GBG has received the Egypt Partner of the Year Award for 2024 from Microsoft. This award highlights their commitment to innovation and their ability to meet industry demands. This recognition supports their future prospects.

GBG actively seeks new partnerships through events like LEAP 2025. These partnerships are crucial for expanding their reach and providing innovative solutions. This approach supports their business development.

GBG offers solutions such as datacenter modernization, cloud technologies, and advanced networking. These services are designed to meet the evolving needs of businesses. This demonstrates their strategic planning for brand growth.

Established in Cairo, Egypt, in 1997, GBG has a strong presence in the digital transformation market. Their location and experience provide a solid foundation for future expansion. This helps with Global Brands Group market share.

GBG's growth strategy involves a focus on digital transformation, AI integration, and strategic partnerships. Their future prospects are promising due to their innovative solutions and industry recognition. They are well-positioned to capitalize on future trends in the fashion industry and other sectors.

- Leveraging AI for personalized customer experiences.

- Expanding service offerings to include cloud and cybersecurity solutions.

- Forming strategic partnerships to enhance market reach.

- Participating in industry events to showcase innovative solutions.

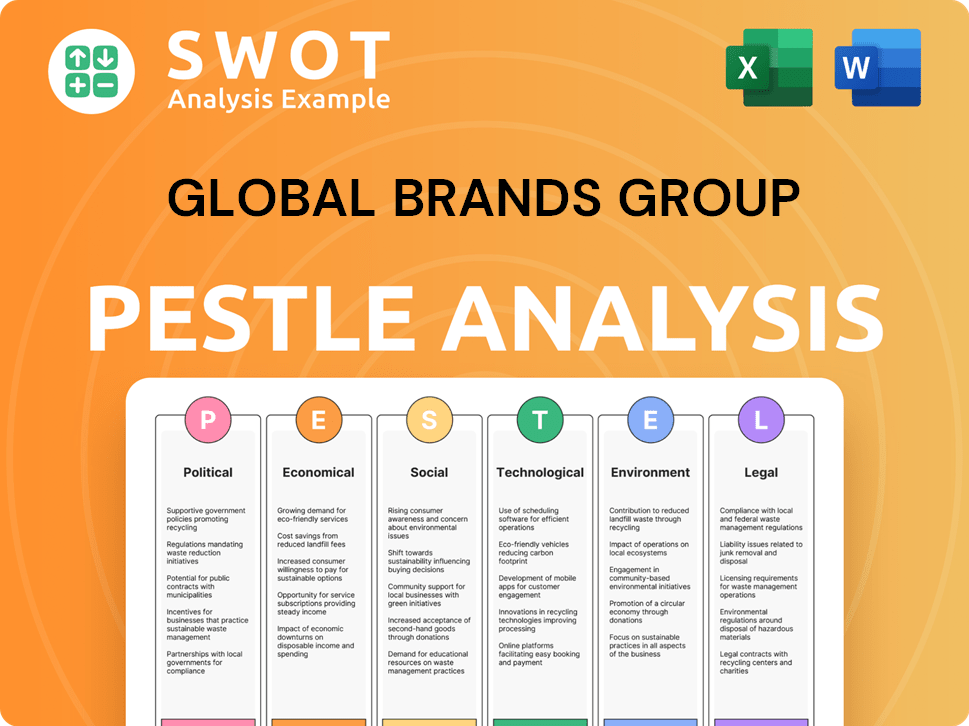

Global Brands Group PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Global Brands Group’s Growth Forecast?

The financial landscape for entities operating under the 'Global Brands Group' name presents a stark contrast. One, a fashion and footwear company, faced severe financial difficulties, leading to liquidation. The other, a digital transformation company, shows a promising outlook, aiming for significant revenue growth. Understanding these differing trajectories is crucial for any market analysis.

The apparel and footwear company, Global Brands Group Holding Limited, experienced substantial financial distress. Its liabilities surpassed its assets, leading to liquidation by the Bermuda Supreme Court. Shareholders were warned against expecting any disbursements. For the fiscal year ending March 31, 2021, the group reported an unaudited operating loss before impairment and other losses of approximately $222,753,000.

In contrast, the digital transformation company, also operating as Global Brands Group, is pursuing an aggressive growth strategy. The company aims to double its revenue to $50 million within five years. This divergence highlights the importance of differentiating between the various entities using the same name when assessing their respective future prospects.

The apparel and footwear company faced severe financial challenges. Liabilities exceeded assets, leading to formal liquidation. Shareholders were unlikely to receive any distributions after creditors were satisfied. This situation underscores the risks associated with financial instability in the fashion industry.

The digital transformation company targets significant revenue growth. It aims to double its revenue to $50 million within the next five years. This ambitious goal reflects a positive outlook and strategic planning for business development.

The UK-based beverage company saw strong performance in international trade, with revenues reaching £5.3 million in 2022. This represented 6% of its turnover. Overseas sales grew by 49% in the last two years and 152% over the past six years.

The UK-based beverage company increased its net revenue from £55 million to £75 million since 2019. The company plans to increase turnover to more than £135 million as part of its five-year growth strategy. This highlights the strategic planning for brand growth.

The financial performance of different entities under the 'Global Brands Group' name varies significantly. The apparel and footwear company's operating loss was substantial, while the digital transformation company aims for significant revenue growth. The beverage company has also shown positive revenue trends.

- The apparel and footwear company reported an unaudited operating loss of approximately $222,753,000.

- The digital transformation company aims to double its revenue to $50 million within five years.

- The beverage company increased net revenue from £55 million to £75 million since 2019.

- The beverage company's international trade reached £5.3 million in 2022.

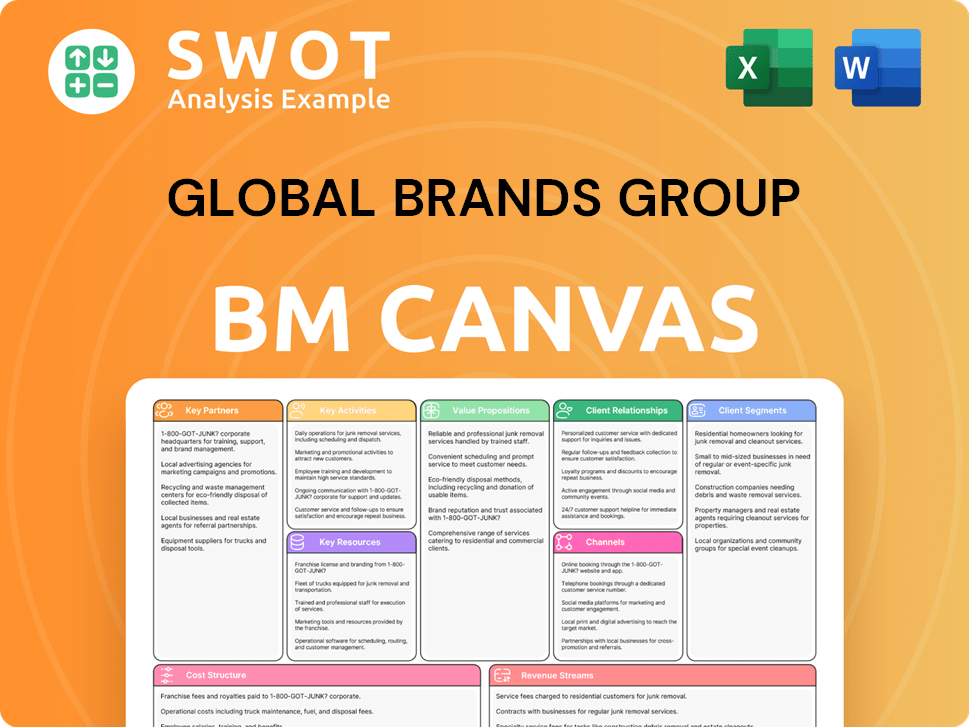

Global Brands Group Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Global Brands Group’s Growth?

The fashion industry, where Global Brands Group once operated, faces significant risks that can impact a brand's growth strategy. Economic uncertainties, consumer price sensitivity, and the rise of 'dupes' are major factors. Additionally, geopolitical issues and technological disruptions add to the complexity of navigating the market.

Supply chain vulnerabilities and the potential for trade protectionism further complicate the landscape. Companies must also adapt to shifting consumer preferences and the need to integrate digital and physical presences. These challenges require careful brand management and strategic planning to ensure long-term success in the apparel industry.

For brands focused on digital transformation, aligning online and offline experiences is crucial. Cultural intelligence is also vital to adapt technologies like AI to diverse regional markets. These factors present both obstacles and opportunities for business development and Global Brands Group's future prospects.

Global economic growth is expected to remain stagnant at 2.8% in 2025, mirroring 2024, which can affect consumer spending. This economic climate necessitates careful financial planning and market analysis.

High inflation has made consumers more price-conscious, impacting brand value and sales. This requires brands to offer competitive pricing and demonstrate value to maintain market share.

Geopolitical risks and conflicts can disrupt supply chains, increasing costs and operational challenges. Companies must diversify their sourcing and manufacturing locations to mitigate these risks, which is a challenge faced by Global Brands Group.

The rapid growth of AI presents both opportunities and risks. Unregulated digital and AI solutions could damage ethical reputations. Therefore, strategic planning for brand growth is essential.

Increased preference for 'local' products can challenge global brands. Brands must adapt their strategies to resonate with local consumer preferences and values, which impacts Global Brands Group's expansion strategies.

Aligning digital and physical presence and adapting AI technologies to diverse regional nuances are key. Brands must invest in cultural intelligence to succeed, which can affect Global Brands Group's financial performance.

Potential protectionist policies and higher tariffs can increase costs and limit market access. Brands need to monitor trade regulations and consider diversifying their manufacturing base. This could influence the future of the apparel industry.

The rise of 'dupes' erodes brand value and can impact sales. Brands must focus on innovation, quality, and strong brand identity to differentiate themselves. Read this article about Global Brands Group company profile for more details.

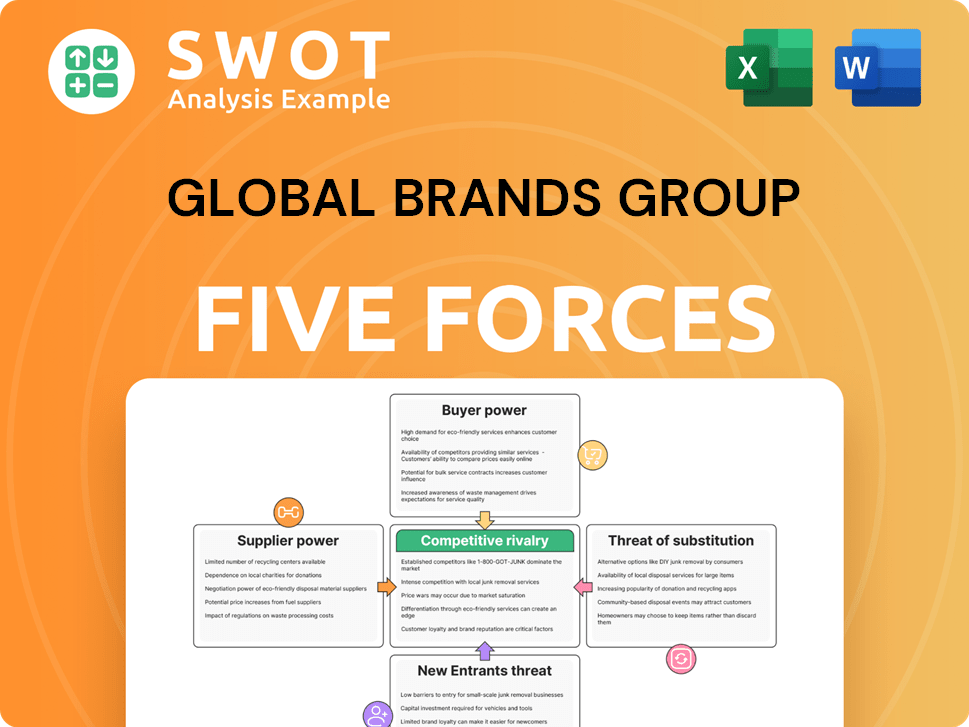

Global Brands Group Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Global Brands Group Company?

- What is Competitive Landscape of Global Brands Group Company?

- How Does Global Brands Group Company Work?

- What is Sales and Marketing Strategy of Global Brands Group Company?

- What is Brief History of Global Brands Group Company?

- Who Owns Global Brands Group Company?

- What is Customer Demographics and Target Market of Global Brands Group Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.