Goodyear Tire & Rubber Bundle

Can Goodyear Drive Ahead in the Evolving Automotive World?

The Goodyear Tire & Rubber Company, a titan in the tire industry since 1898, is charting a course for future growth amidst significant market shifts. From its early days, Goodyear has consistently adapted to the demands of the automotive sector, evolving into a global powerhouse with a vast manufacturing footprint. With its 'Goodyear Forward' transformation plan, the company aims to optimize its portfolio and enhance shareholder value, reflecting the importance of a robust Goodyear growth strategy.

This deep dive into Goodyear Tire & Rubber Company will analyze its strategic initiatives, including its expansion plans and focus on innovation within the tire industry. We'll examine the company's financial performance, particularly its recent turnaround, and how it plans to navigate the challenges and opportunities presented by the automotive market trends. Understanding Goodyear's Goodyear Tire & Rubber SWOT Analysis is key to grasping its competitive landscape and future prospects, especially in light of the rise of electric vehicles and the need for sustainable solutions. This exploration will also provide insights into Goodyear's long-term growth outlook.

How Is Goodyear Tire & Rubber Expanding Its Reach?

Goodyear's expansion initiatives are a critical component of its Goodyear growth strategy, designed to enhance its market position and financial performance. These initiatives encompass a range of strategic actions, including portfolio optimization, new product launches, and targeted investments aimed at driving sustainable growth. The company's approach reflects a proactive response to evolving automotive market trends and the dynamic nature of the tire industry analysis.

The 'Goodyear Forward' plan is central to these efforts, involving strategic divestitures to streamline operations and focus on core competencies. This strategic shift is intended to free up capital, reduce debt, and facilitate reinvestment in high-growth areas. These actions are part of a broader strategy to ensure the company's long-term competitiveness and ability to capitalize on future opportunities.

Goodyear's commitment to innovation and market adaptation is evident in its product expansion efforts. The company is focused on introducing new offerings, particularly in high-growth, high-margin segments, to meet the evolving needs of consumers and the automotive industry. This strategic product development pipeline is expected to generate greater value and support premium pricing.

Goodyear is actively optimizing its portfolio through strategic divestitures to sharpen its focus on its core tire business and reduce debt. This includes the sale of non-core assets, such as the off-the-road (OTR) tire business, and the planned sale of the Dunlop brand. These actions are designed to streamline operations and free up capital for growth initiatives.

Goodyear is committed to introducing new products, particularly in high-growth, high-margin segments. Recent launches include the Goodyear Assurance WeatherReady 2, Goodyear ElectricDrive 2, and Cooper Discoverer Stronghold AT. For 2025, the company plans to introduce five new power lines globally and add nearly 200 Stock Keeping Units (SKUs) in profitable market segments.

Goodyear is making strategic investments to modernize and expand its manufacturing capacity. A key example is the planned expansion of its Lawton, Oklahoma plant, which aims to add approximately 10 million units of new capacity for premium tires in 2025 and 2026. These investments are focused on higher rim sizes and increased volume in higher-profit segments.

Goodyear is strategically targeting high-growth segments within the tire market. This includes a focus on premium tires, electric vehicle tires, and other specialized products. The company's product development pipeline is designed to meet the evolving needs of consumers and the automotive industry, ensuring greater value and premium pricing.

These expansion initiatives are crucial for realizing the Goodyear future prospects. Goodyear is positioning itself for long-term growth and sustainability by focusing on strategic portfolio management, innovative product development, and targeted investments. For more insights into the company's marketing strategies, consider reading the Marketing Strategy of Goodyear Tire & Rubber.

Goodyear's expansion initiatives are supported by significant financial and operational strategies. The sale of the OTR tire business to The Yokohama Rubber Company for $905 million closed in February 2025. The sale of the Dunlop brand to Sumitomo Rubber Industries is expected to generate over $2 billion in gross proceeds by the end of 2025, which will be used for strategic reinvestment. The Lawton, Oklahoma plant expansion aims to add approximately 10 million units of new capacity for premium tires in 2025 and 2026.

- Divestiture of non-core assets to streamline operations.

- Introduction of new products in high-growth segments.

- Strategic investments in manufacturing capacity.

- Focus on premium tires and electric vehicle tires.

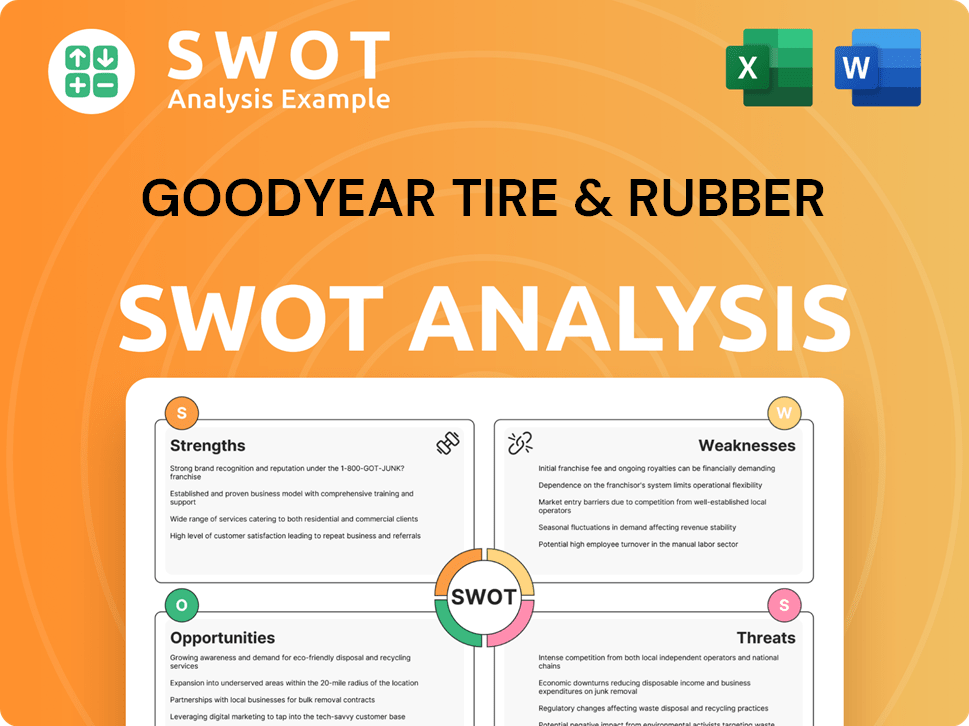

Goodyear Tire & Rubber SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Goodyear Tire & Rubber Invest in Innovation?

Goodyear's growth strategy heavily relies on innovation and technological advancements to maintain a competitive edge in the tire industry. The company invests significantly in research and development to create cutting-edge tire technologies, improve existing products, and explore sustainable solutions. This focus is crucial for adapting to evolving automotive market trends and consumer demands.

A key aspect of Goodyear's future prospects involves digital transformation and the integration of smart technologies. This includes advancing tire intelligence, improving vehicle safety systems, and developing sustainable tire solutions. These initiatives are designed to enhance safety, performance, and fuel efficiency, aligning with the growing demand for eco-friendly products.

Goodyear's commitment to sustainability is another core element of its innovation strategy. By incorporating sustainable materials and implementing energy-efficient practices, the company aims to reduce its environmental impact and meet the growing demand for environmentally responsible products. This approach supports Goodyear's long-term growth outlook and strengthens its position in the automotive industry.

In 2024, Goodyear invested $380 million in research and development. This investment supports the development of new tire technologies and improvements to existing products. This commitment is vital for Goodyear's strategic initiatives 2024.

Goodyear's SightLine sub-brand offers tire intelligence solutions. These solutions include precise tire pressure monitoring, real-time wear tracking, and tire remaining mileage analysis. This technology enhances safety and performance.

In January 2025, Goodyear collaborated with TNO to integrate tire intelligence into autonomous emergency braking (AEB) systems. This advancement demonstrates Goodyear's commitment to enhancing vehicle safety. This integration helps mitigate crashes, especially in challenging road conditions.

Goodyear is actively incorporating sustainable materials into its tire compounds. These materials include soybean oil, silica derived from rice husk ash, and recycled rubber. This supports Goodyear's sustainability efforts.

Goodyear aims to develop a tire made of 100% sustainable materials by 2030. The company also plans to replace all petroleum-derived oils in its products by 2040. This demonstrates Goodyear's long-term commitment to environmental responsibility.

Goodyear's EDS tire, designed for electric vehicles, won a 2025 Tire Technology International Award. This highlights the company's focus on developing sustainable and high-performing tires for the growing EV market. This underscores Goodyear's electric vehicle tire strategy.

Goodyear's innovation strategy focuses on several key areas to drive growth and maintain its competitive position. These areas include:

- Advanced Tire Technologies: Developing tires that enhance safety, performance, and fuel efficiency.

- Digital Transformation: Integrating smart technologies and tire intelligence solutions.

- Sustainable Materials: Incorporating sustainable materials and reducing environmental impact.

- Manufacturing Efficiency: Implementing energy-efficient technologies and practices.

- Electric Vehicle Tires: Creating high-performing and sustainable tires for EVs.

For more insights, consider exploring the Target Market of Goodyear Tire & Rubber.

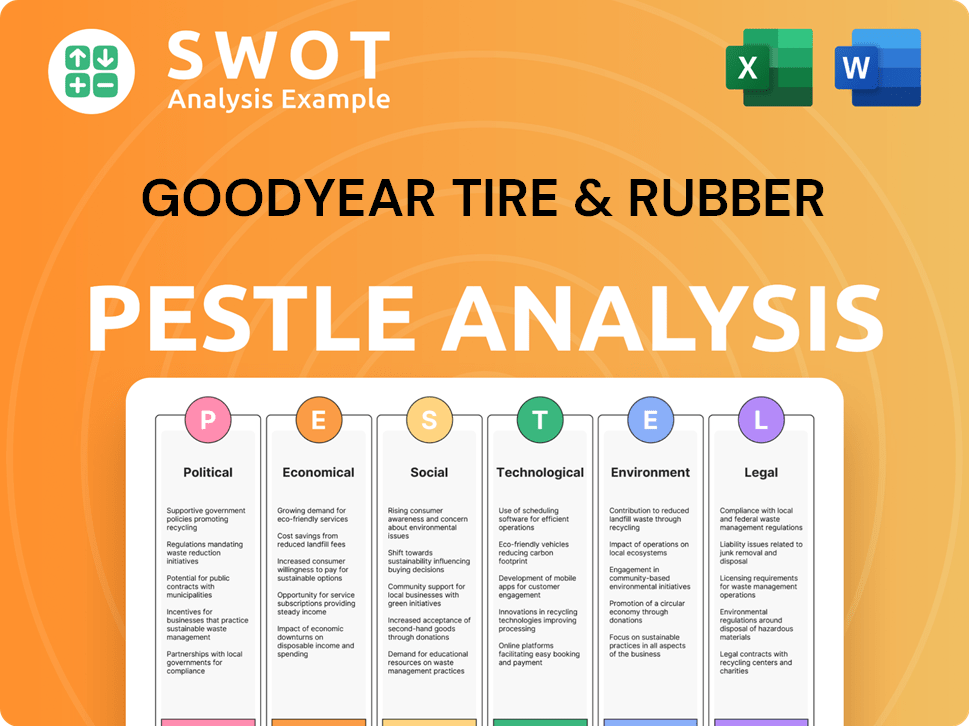

Goodyear Tire & Rubber PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Goodyear Tire & Rubber’s Growth Forecast?

The financial outlook for the Goodyear Tire & Rubber Company in 2025 is largely shaped by its 'Goodyear Forward' transformation plan. This plan is designed to drive significant margin expansion and debt reduction, which are key components of the company's Goodyear growth strategy. The company's strategic initiatives for 2024 and beyond are geared towards enhancing its financial performance and market position.

In 2024, the company reported net sales of $18.9 billion, marking a period of recovery and strategic adjustment. The net income for 2024 was $70 million, a substantial improvement compared to a net loss of $689 million in 2023. The adjusted net income for 2024 was $302 million, reflecting the impact of the 'Goodyear Forward' plan and other strategic actions. This financial performance review highlights the company's resilience and its ability to adapt to the changing automotive market trends.

Looking towards 2025, the company has reaffirmed its expanded 'Goodyear Forward' targets. The company aims to achieve $1.5 billion in annual run-rate benefits through cost actions and margin expansion. A key goal is to reach a segment operating margin of 10% and a net leverage ratio of 2.0x to 2.5x by the end of 2025. The company's Goodyear future prospects are closely tied to the successful implementation of this plan.

In the first quarter of 2025, the 'Goodyear Forward' program delivered $200 million in benefits. Net sales in Q1 2025 were $4.3 billion, with tire unit volumes totaling 38.5 million. The company reported a net income of $115 million, a significant improvement from a net loss of $57 million a year ago. This positive result included an estimated gain of $260 million from the sale of its Off-the-Road (OTR) tire business.

The company expects to achieve $750 million in benefits from the 'Goodyear Forward' plan in 2025, focusing on improving operating margins and reducing costs. Capital expenditures for 2025 are planned to be approximately $950 million. These financial targets are crucial for understanding Goodyear's long-term growth outlook.

The company's strategy involves a dual approach: cost reduction and margin expansion. This includes optimizing manufacturing processes, streamlining operations, and focusing on higher-margin products. The Goodyear business model is evolving to meet the demands of the tire industry analysis and the changing automotive landscape.

The company is navigating a competitive market, with challenges and opportunities. The Goodyear's competitive landscape includes both established and emerging players. The company is also focusing on Goodyear's electric vehicle tire strategy to capitalize on the growing EV market.

Innovation plays a key role in the company's strategy. Goodyear's innovation in tire manufacturing, including the development of advanced materials and smart tires, is critical for long-term success. The company is also exploring future of tire technology at Goodyear, including sustainable and connected tire solutions.

While the primary focus is on internal improvements, the company may consider strategic acquisitions or partnerships to enhance its market position. Any Goodyear's recent acquisitions and mergers would be aimed at expanding its product portfolio or geographic reach. For more details, you can read this article about the company's performance: Goodyear's Financial Performance.

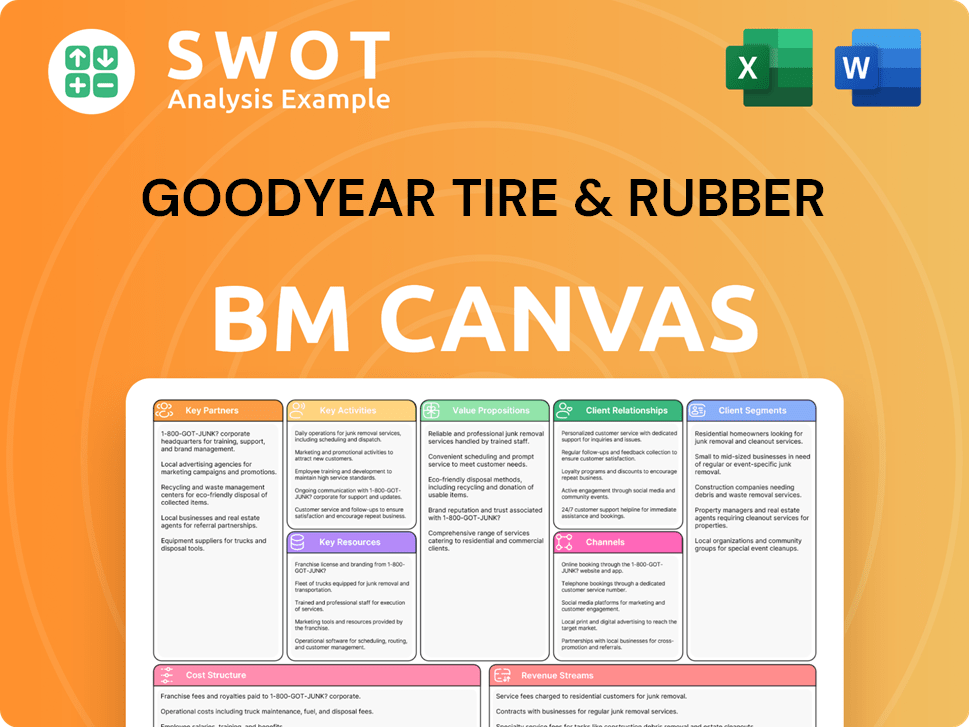

Goodyear Tire & Rubber Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Goodyear Tire & Rubber’s Growth?

The Owners & Shareholders of Goodyear Tire & Rubber face several risks that could impact its growth strategy and future prospects. These challenges range from intense market competition to economic uncertainties and regulatory changes. Understanding these potential obstacles is crucial for evaluating the company's long-term viability and investment potential.

One of the primary risks is the highly competitive tire industry, with major players like Bridgestone and Michelin constantly innovating. Additionally, the influx of low-cost tires, particularly from Southeast Asia, adds pressure. Economic downturns, inflation, and supply chain disruptions further complicate the landscape, potentially affecting raw material costs and operational efficiency.

Goodyear's financial health and strategic initiatives are also subject to external factors. Fluctuations in currency exchange rates, regulatory changes, and labor relations can significantly impact the company's performance. Moreover, a substantial debt load, approximately $7.8 billion as of December 31, 2024, presents a significant financial burden.

The tire industry is highly competitive, with global giants like Bridgestone and Michelin constantly vying for market share. Goodyear must continuously innovate to stay ahead. Competition also comes from low-cost tire imports, particularly from Southeast Asia.

Economic downturns, inflation, and supply chain disruptions can significantly impact Goodyear's operations. The company anticipates raw material cost increases of about $350 million in the first half of 2025, along with an additional $75 million from inflation and other costs. Foreign currency fluctuations also pose a risk.

Regulatory changes, environmental compliance, and shifts in tariffs can affect Goodyear's global operations. Labor relations, particularly with unionized employees, also present potential operational challenges. Goodyear's substantial debt, approximately $7.8 billion as of December 31, 2024, could restrict growth.

Raw material costs are a critical factor, with increases directly impacting profitability. Goodyear's ability to manage these costs through efficient sourcing and pricing strategies is essential. The company's financial performance review is closely tied to its success in mitigating these cost pressures.

Foreign currency fluctuations can significantly affect sales and operating income. Goodyear's international market presence exposes it to currency risks. Effective hedging strategies and global market presence are critical for mitigating these impacts.

A high debt load, as of December 31, 2024, potentially restricts Goodyear's financial flexibility and could put it at a competitive disadvantage. Reducing debt through asset divestitures and improved cash flow is a key strategic objective. This impacts the company's long-term growth outlook.

To mitigate these risks, Goodyear is implementing the 'Goodyear Forward' plan. This includes portfolio optimization through asset divestitures to reduce leverage and sharpen focus on core businesses. The company is also investing in capital improvements to modernize facilities and increase the production of higher-margin tires, aiming to offset potential increases in labor and raw material costs. These initiatives are crucial for the company's future prospects.

Goodyear's market share is constantly challenged by competitors like Bridgestone and Michelin. The company's ability to maintain and grow its market share depends on innovation, competitive pricing, and effective marketing. This is a key factor in Goodyear's long-term growth outlook and its impact on the automotive industry.

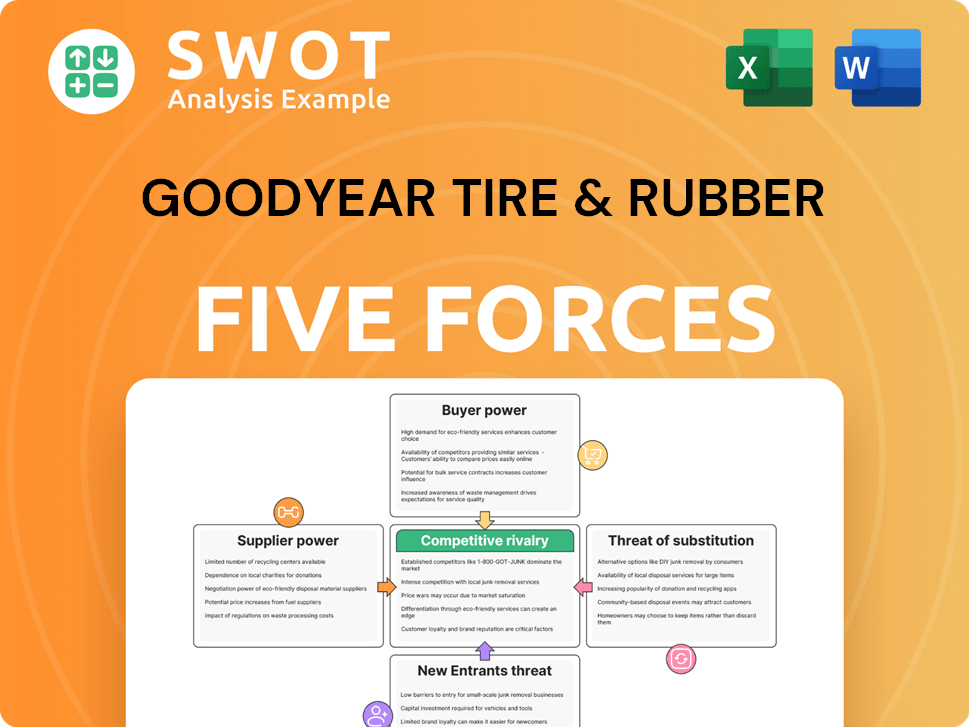

Goodyear Tire & Rubber Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Goodyear Tire & Rubber Company?

- What is Competitive Landscape of Goodyear Tire & Rubber Company?

- How Does Goodyear Tire & Rubber Company Work?

- What is Sales and Marketing Strategy of Goodyear Tire & Rubber Company?

- What is Brief History of Goodyear Tire & Rubber Company?

- Who Owns Goodyear Tire & Rubber Company?

- What is Customer Demographics and Target Market of Goodyear Tire & Rubber Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.