Goodyear Tire & Rubber Bundle

Who Buys Goodyear Tires?

In the ever-evolving Goodyear Tire & Rubber SWOT Analysis, understanding customer demographics and the target market is crucial for success. From its early days supplying tires for the Model T to today's diverse automotive landscape, Goodyear's ability to adapt has been key. This deep dive explores the Goodyear Target Market and uncovers the shifts shaping their customer base.

The Goodyear Tire Company strategically navigates the complex Tire Industry by carefully analyzing Customer Demographics and employing effective Market Segmentation techniques. Examining the Consumer Profile allows Goodyear to tailor its products and marketing to meet the specific needs of various segments, from those seeking fuel efficiency to EV owners. This approach ensures Goodyear remains competitive by understanding Goodyear tire customer age range, Goodyear tire buyer income levels, Goodyear tire preferred vehicle types, and more.

Who Are Goodyear Tire & Rubber’s Main Customers?

The primary customer segments for the company include both consumers (B2C) and businesses (B2B). The company serves a diverse customer base, offering a range of tires for various vehicle types, including passenger cars, motorcycles, and commercial vehicles. This wide scope allows the company to cater to different needs and preferences within the tire industry.

In the B2C segment, the company focuses on individual vehicle owners. The company's brand portfolio, which includes brands like Goodyear, Dunlop, and Kelly, enables it to target various consumer segments, from premium performance to value-oriented buyers. The company's brand positioning emphasizes high performance, cutting-edge technology, and operational efficiency, appealing to drivers who prioritize a premium driving experience.

For its B2B segment, the company supplies tires to original equipment manufacturers (OEMs) for new vehicles, as well as to commercial fleets and industries. This includes tires for trucks, buses, airplanes, farm equipment, and heavy earth-moving machinery. The replacement tire market represents a significant share of revenue for the company, accounting for 55% of its annual tire sales, while original equipment manufacturers contribute 45%.

Individual vehicle owners seeking tires for passenger cars, motorcycles, and recreational vehicles. The company targets consumers with diverse needs, from premium performance to value-driven options. The Brief History of Goodyear Tire & Rubber highlights the company's long-standing presence in the market, catering to various consumer profiles.

Original equipment manufacturers (OEMs) for new vehicles, commercial fleets, and various industries. This segment includes tires for trucks, buses, airplanes, and agricultural and heavy machinery. The company's B2B operations are crucial, with significant sales in the replacement tire market.

The company operates globally, with significant sales in the Americas, EMEA (Europe, Middle East, and Africa), and Asia Pacific. In 2024, the Americas segment sold 81.6 million tire units, EMEA sold 48.9 million units, and Asia Pacific sold 36.1 million units. The increasing sales of passenger cars worldwide are a key driver for the automotive tire market.

The company's product portfolio includes tires for passenger cars, trucks, buses, and specialized vehicles. Consumer preferences are shifting towards all-season and low-rolling-resistance tires. There's a rising demand for eco-friendly and specialized tires, particularly for electric vehicles. The company's diverse product range addresses the needs of various customer demographics within the tire industry.

The company's target segments evolve due to changing consumer preferences and technological advancements, such as the rise of EVs. Market research helps identify demand for specific tire types. The company's ability to adapt to these trends is crucial for maintaining its market share and meeting customer needs. Understanding the Goodyear target market involves analyzing various factors, including customer demographics, buying behavior, and market segmentation.

- Shifting consumer preferences towards all-season and low-rolling-resistance tires.

- Increasing demand for eco-friendly and specialized tires, especially for electric vehicles.

- The replacement tire market accounts for a significant portion of the company's revenue.

- Global operations with key markets in the Americas, EMEA, and Asia Pacific.

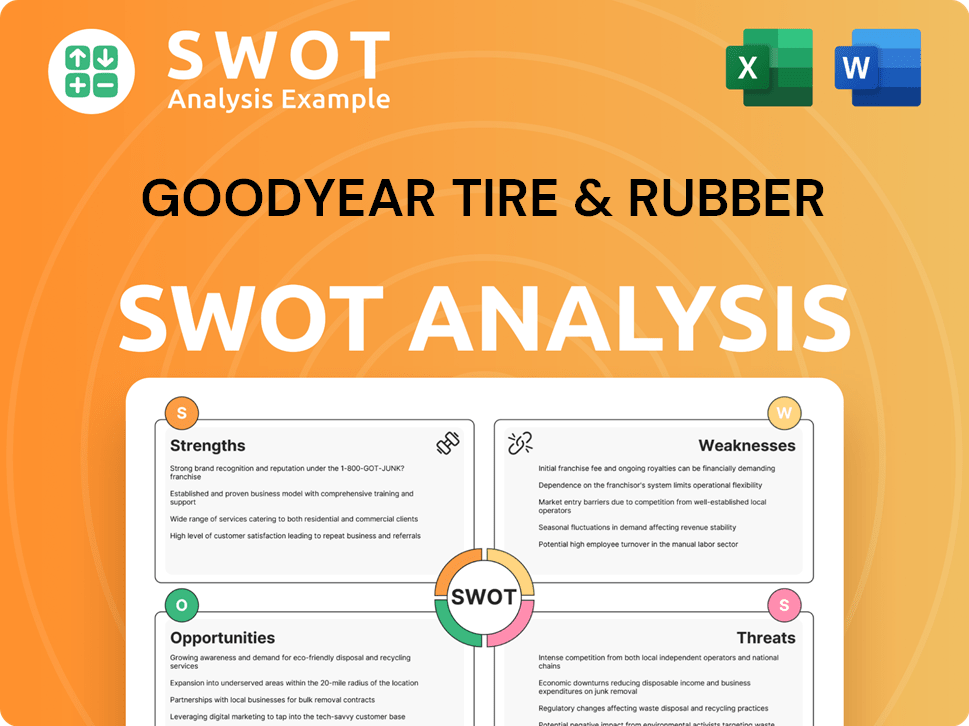

Goodyear Tire & Rubber SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Goodyear Tire & Rubber’s Customers Want?

Understanding the needs and preferences of its customers is crucial for the success of the [Company Name]. The company's customers prioritize safety, performance, and durability when selecting tires. Furthermore, there's a growing emphasis on sustainability and fuel efficiency, reflecting broader consumer trends.

Purchasing decisions are significantly influenced by tire traction and handling, especially in challenging weather conditions. Customers actively seek tires that provide superior grip and control on wet, snowy, or icy roads. This focus underscores the importance of tire performance in ensuring driver safety and satisfaction.

The shift towards electric vehicles (EVs) and increasing environmental awareness are also shaping customer preferences. This has led to a demand for eco-friendly and EV-specific tires, which are designed to meet the unique requirements of these vehicles, such as low noise and high load-carrying capacity.

Customers prioritize safety and performance. Tire traction and handling are critical, especially in adverse weather. Satisfaction with tire traction and handling declined from 2024 to 803 on a 1,000-point scale.

Customers seek durable tires that offer a long lifespan. This preference aligns with the desire for value and reduced replacement frequency. The company invests in R&D to improve tire longevity.

There is a growing demand for eco-friendly and fuel-efficient tires. This trend is driven by environmental consciousness and regulatory policies. The company is developing tires that meet these needs.

The rise of electric vehicles is creating demand for EV-specific tires. These tires are designed to have low noise and high load-carrying capacity. The company is adapting to this market segment.

Customers often consider brand reputation and trust. The company's brand positioning influences purchasing decisions. The brand is positioned as a premium offering.

Customers balance price with perceived value. The company offers products across different price segments. The value proposition influences customer choices.

The company invests heavily in research and development to meet evolving customer needs. In 2024, the company spent $344 million on R&D, focusing on tire longevity, fuel efficiency, and performance. These efforts also include integrating smart technologies like sensors for monitoring tire pressure and tread wear. The company tailors its marketing and product features to specific segments, such as emphasizing the all-weather advantages of its Assurance WeatherReady tires. The company's approach to the Competitors Landscape of Goodyear Tire & Rubber involves catering to diverse consumer needs across premium, value, and budget segments, with the brand positioned as a premium offering.

The company's customers are driven by needs related to safety, performance, durability, and sustainability. These preferences influence purchasing behaviors and drive the company's product development and marketing strategies.

- Safety and Performance: Tire traction and handling are critical, especially in adverse weather.

- Durability: Customers seek tires that offer a long lifespan.

- Sustainability: There is a growing demand for eco-friendly and fuel-efficient tires.

- EV-Specific Tires: The rise of electric vehicles is creating demand for tires designed for EVs.

- Brand Reputation: Customers consider brand reputation and trust.

- Price and Value: Customers balance price with perceived value.

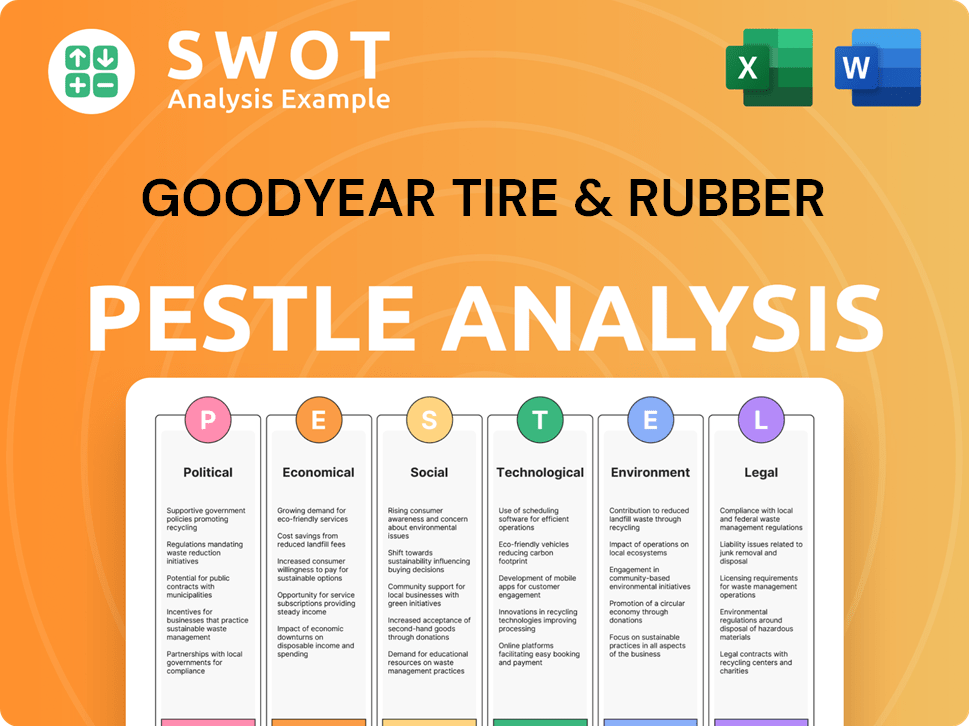

Goodyear Tire & Rubber PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Goodyear Tire & Rubber operate?

The geographical market presence of the [Company Name] is substantial, with operations spanning across numerous regions globally. The company operates manufacturing facilities in approximately 20 countries, demonstrating a widespread reach in the tire industry. This extensive network allows for localized production and distribution, catering to diverse consumer needs worldwide.

The company's operations are primarily divided into three key geographical segments: Americas, Europe, Middle East, and Africa (EMEA), and Asia Pacific. Each segment contributes significantly to the company's revenue and unit sales, reflecting a balanced global presence. The strategic allocation of resources and marketing efforts within these segments is crucial for maintaining its competitive edge in the global tire market.

In 2024, the Americas segment led in both revenue and tire unit sales, selling 81.6 million units. EMEA followed with 48.9 million units, and Asia Pacific recorded 36.1 million units. The Asia-Pacific region is also the largest overall tire market, indicating significant growth potential for the company in that area. Understanding the Revenue Streams & Business Model of Goodyear Tire & Rubber can provide further insights into the company's financial strategies within these markets.

The company holds a strong market share in North America and Latin America. It is the number one tire maker in these regions. This strong position is a result of brand recognition and effective distribution channels.

In Europe, the company is the second-largest tire manufacturer. The premium tire brands are experiencing strong growth in both Europe and North America, driven by demand for safety and performance.

The company uses a multi-brand strategy to cater to diverse consumer profiles. This includes premium, value, and budget brands. The goal is to meet the needs of any type of consumer in an evolving market.

The company is expanding the Dunlop car tire range to cover 84% of the market. This includes summer, winter, and all-season products. This expansion increases the company's market coverage.

The company offers brands like Fulda, Avon, Dębica, Sava, and Cooper. These brands cater to drivers seeking affordable and durable tires. This strategy broadens the customer base.

The company completed the sale of its Off-the-Road (OTR) tire business in February 2025. The sale of the Dunlop brand to Sumitomo Rubber Industries is expected by mid-2025. These moves are part of a strategic portfolio optimization.

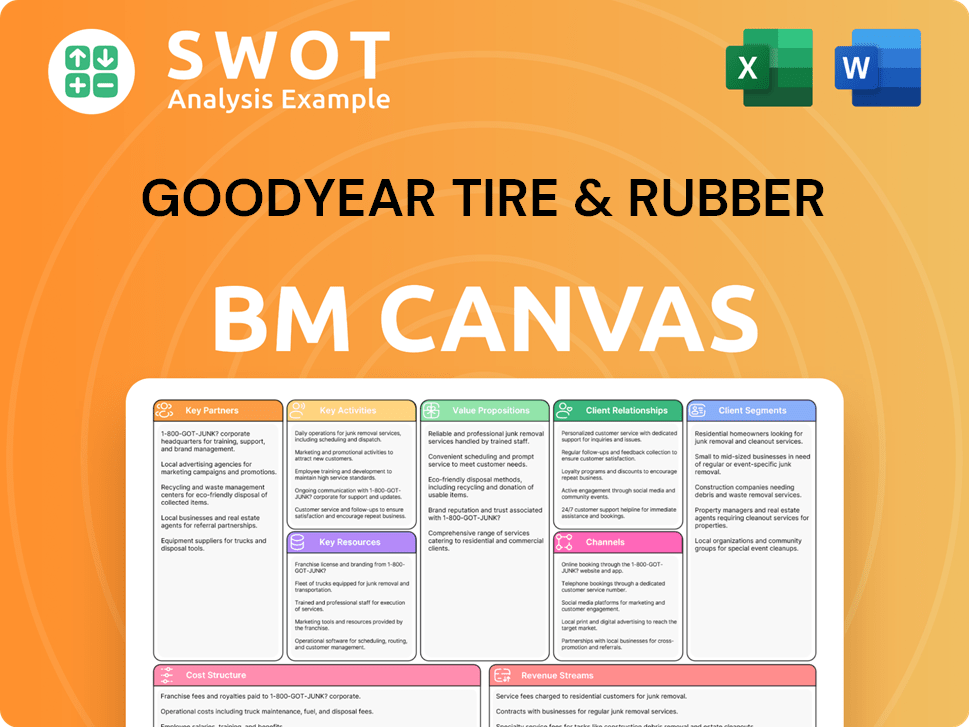

Goodyear Tire & Rubber Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Goodyear Tire & Rubber Win & Keep Customers?

To acquire and retain customers, the company employs a comprehensive strategy that blends traditional and digital marketing, sales tactics, and a strong emphasis on product innovation and customer satisfaction. The company actively engages with its audience across various social media platforms, creating compelling content and interactive campaigns to build brand loyalty and trust. This multi-faceted approach is essential in the competitive tire industry.

The company's brand positioning centers around high performance, cutting-edge technology, and operational efficiency. This appeals to drivers seeking a premium experience. The company's commitment to research and development, with an investment of $344 million in 2024, ensures continuous innovation in tire technology. This includes advanced features like improved fuel efficiency and superior wet-weather traction. This commitment helps maintain a strong consumer profile.

The company’s longstanding partnership with NASCAR as the official tire supplier since 1954 further enhances its brand reputation, showcasing its commitment to performance, reliability, and safety. This association provides significant exposure within the target market.

The company utilizes digital ads and weather-activated ad delivery. For example, its 2024 marketing strategy for Assurance WeatherReady tires highlighted all-weather advantages. This approach helps to dispel misconceptions and target specific customer needs.

Continuous investment in research and development, totaling $344 million in 2024, drives innovation in tire technology. This includes features like improved fuel efficiency and superior wet-weather traction, addressing consumer demands for enhanced performance and safety. These innovations are crucial for Growth Strategy of Goodyear Tire & Rubber.

The company prioritizes customer satisfaction, as demonstrated by its high rankings in the J.D. Power 2025 U.S. Original Equipment Tire Customer Satisfaction Study. It ranked highest in the luxury segment with a score of 821 and in the passenger car segment with a score of 815. This focus is key to building brand loyalty factors.

The partnership with NASCAR, ongoing since 1954, enhances brand reputation and showcases a commitment to performance and safety. This long-term association provides significant visibility within the target market and reinforces brand image.

Customer retention is further supported by a focus on quality and customer satisfaction. The company emphasizes customer engagement and values feedback to continuously improve products and services. The company's goal to achieve a 10% segment operating margin and a net leverage ratio of 2.0x to 2.5x by the end of 2025 through its Goodyear Forward transformation plan aims to improve overall business performance, which indirectly supports customer acquisition and retention efforts by ensuring competitive products and services. This focus on operational efficiency and financial health strengthens its position in the tire industry.

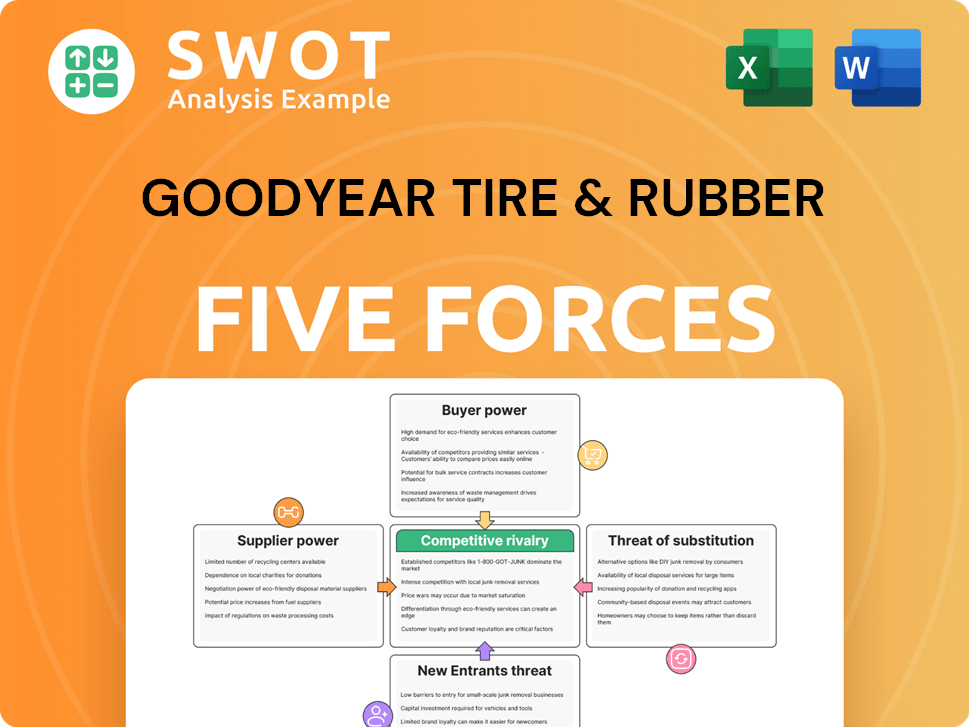

Goodyear Tire & Rubber Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Goodyear Tire & Rubber Company?

- What is Competitive Landscape of Goodyear Tire & Rubber Company?

- What is Growth Strategy and Future Prospects of Goodyear Tire & Rubber Company?

- How Does Goodyear Tire & Rubber Company Work?

- What is Sales and Marketing Strategy of Goodyear Tire & Rubber Company?

- What is Brief History of Goodyear Tire & Rubber Company?

- Who Owns Goodyear Tire & Rubber Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.