Hayward Bundle

Can Hayward Company Maintain Its Leading Edge in the Pool Industry?

Hayward Holdings, Inc.'s acquisition of Water Tech in early 2024 signals its ambition to dominate the Hayward SWOT Analysis. This strategic move is just one example of how Hayward Company Growth is evolving. Founded in 1925, the company has consistently innovated to simplify pool ownership, establishing itself as a global leader. This article dives into the Hayward Company Strategy for sustained success.

From its humble beginnings, Hayward has expanded its product offerings to include pumps, filters, and automation systems, serving a global customer base. The company’s focus on innovation and energy efficiency positions it well within the Pool Equipment Market. This analysis will explore Hayward Company Future prospects, examining its expansion plans, technological advancements, and financial outlook to understand its potential for continued growth and market share in the competitive landscape.

How Is Hayward Expanding Its Reach?

Hayward Holdings is actively pursuing several expansion initiatives to drive future growth, focusing on entering new geographical markets and expanding its product categories. This strategic approach aims to capitalize on the increasing global demand for pool and leisure products. The company is also committed to offering sustainable and energy-efficient products to meet evolving consumer preferences and regulatory standards.

A key aspect of Hayward's expansion strategy involves targeting regions with growing demand for pool ownership and leisure activities. By diversifying its product offerings, such as through the Water Tech acquisition, Hayward aims to access new customer segments and diversify its revenue streams. These initiatives are designed to strengthen Hayward's position as a comprehensive pool solutions provider.

Hayward's growth strategy also includes a focus on innovation and technology, particularly in smart pool technology and advanced water chemistry solutions. Strategic partnerships with home automation companies and pool service providers are also being explored to expand reach and offer integrated solutions. These efforts are designed to reinforce Hayward's position as a comprehensive provider of pool solutions and to capitalize on the increasing global demand for leisure and wellness products.

Hayward is investing in international markets, with a focus on increasing market share in Europe, Asia, and Latin America. This expansion strategy aims to tap into the growing demand for pool products in these regions. The company is actively seeking to broaden its global footprint and reach new customer segments.

The acquisition of Water Tech demonstrates Hayward's commitment to expanding its product categories. This move allows Hayward to offer a wider range of pool cleaning solutions. This diversification strategy aims to capture a larger share of the pool equipment market and cater to various customer needs.

Hayward has a robust product pipeline, with new product launches anticipated in smart pool technology and advanced water chemistry solutions. These innovations aim to enhance the user experience and provide more efficient pool management solutions. This focus on innovation helps maintain a competitive edge in the market.

Hayward is exploring strategic partnerships with home automation companies and pool service providers. These collaborations aim to expand the company's reach and offer integrated solutions to customers. This approach helps create a broader ecosystem of products and services.

Hayward is focused on offering more sustainable and energy-efficient products, catering to environmentally conscious consumers. This includes developing products that comply with evolving regulatory standards. The company's commitment to sustainability is a key driver of its long-term growth strategy.

- Focus on energy-efficient pool pumps and heaters.

- Development of products with reduced environmental impact.

- Compliance with global environmental regulations.

- Meeting the growing demand for eco-friendly pool solutions.

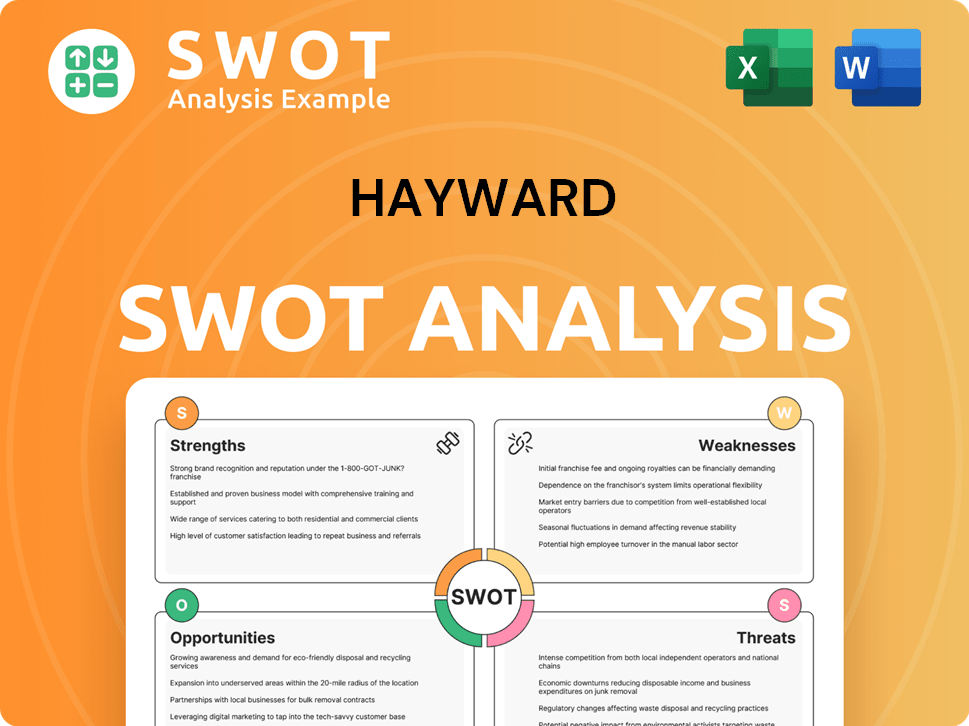

Hayward SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hayward Invest in Innovation?

Innovation and technology are central to the growth strategy of the Hayward Company. The company's commitment to research and development (R&D) drives the creation of new products and solutions. This includes both internal development efforts and collaborations with external partners.

Hayward's approach to digital transformation is evident in its smart pool technologies. These technologies allow pool owners to control and monitor their pools remotely via mobile apps. The company leverages the Internet of Things (IoT) to integrate various pool components.

Hayward is also focused on sustainability. They develop energy-efficient pumps, heaters, and lighting systems to reduce energy consumption. These advancements align with the growing consumer demand for eco-friendly products, which is a key part of their future. For more information, consider reading an article for Owners & Shareholders of Hayward.

Hayward consistently invests in research and development to stay ahead in the pool equipment market. These investments support the creation of cutting-edge products.

Smart pool technologies are a key focus, allowing remote control and monitoring. This enhances user convenience and efficiency through mobile applications.

The Internet of Things (IoT) is used to integrate various pool components. This integration improves the overall user experience and pool management.

Hayward prioritizes sustainability by developing energy-efficient products. This includes pumps, heaters, and lighting systems that reduce energy use.

Innovation efforts aim to enhance the product portfolio and improve user experience. This helps maintain a competitive edge in the market.

Regular introduction of new products and platforms contributes to growth. This expands the addressable market and increases customer loyalty.

Hayward's focus on innovation and technology directly supports its business expansion plans. The company's strategic investments in R&D and digital transformation are crucial for maintaining a competitive edge and driving future growth. As of late 2024, the pool equipment market is projected to reach a value of over $4 billion, with smart pool technologies showing the fastest growth. Hayward's commitment to these areas positions it well to capitalize on these market trends.

- Smart Pool Technology: The demand for smart pool technologies is increasing, with a projected growth rate of approximately 15% annually through 2025.

- Energy-Efficient Products: The market for energy-efficient pool equipment is growing, driven by consumer demand and environmental regulations.

- Digital Transformation: Hayward's digital initiatives, including mobile apps and IoT integration, are enhancing customer experience and operational efficiency.

- Strategic Partnerships: Collaborations with technology partners help accelerate innovation and expand market reach.

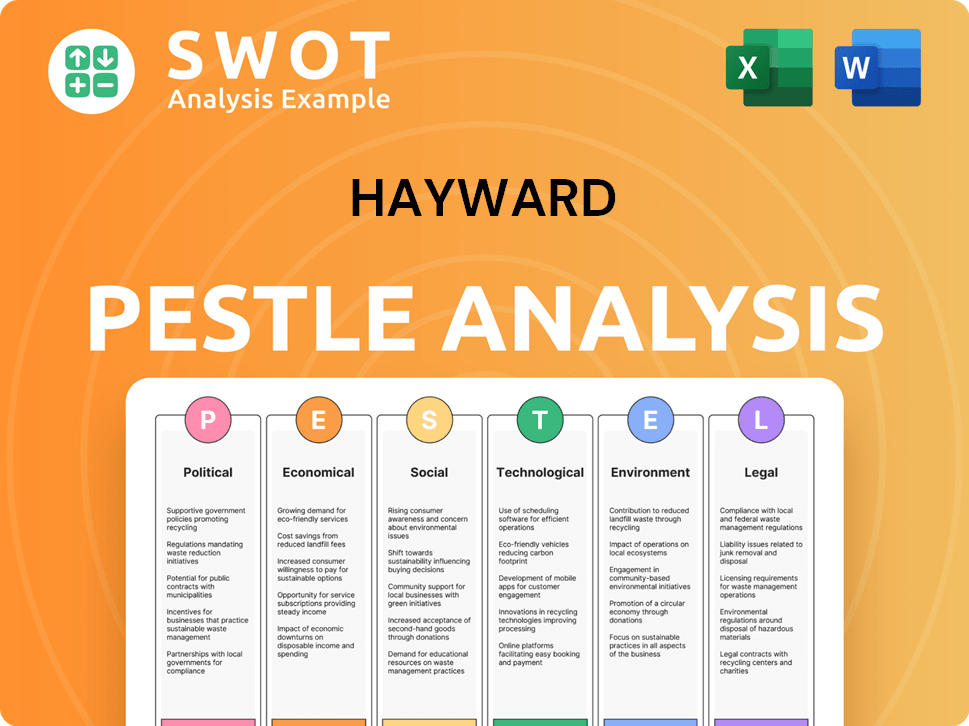

Hayward PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Hayward’s Growth Forecast?

The financial outlook for Hayward Holdings reflects a strategic focus on sustainable growth and operational efficiency. Recent reports indicate a strong financial performance, setting a positive tone for future projections. The company's ability to navigate market dynamics and capitalize on opportunities is a key factor in its financial strategy.

For the full year 2023, Hayward reported net sales of $1.0 billion, although this represented a 16% decline compared to the previous year, mainly due to channel inventory adjustments. Despite this, the company maintained a robust gross profit margin of 44.5%. This financial resilience is a testament to its strategic planning and operational effectiveness. The Competitors Landscape of Hayward provides additional context on the market dynamics influencing these financial outcomes.

Looking ahead, Hayward anticipates net sales for the full year 2024 to be in the range of $1.070 billion to $1.150 billion, indicating a growth of 7% to 15% compared to 2023. The projected adjusted EBITDA for 2024 is between $290 million and $320 million. These projections underscore the company's confidence in its growth trajectory and its ability to deliver value to shareholders.

Hayward's growth strategy focuses on operational efficiency, new product innovation, and strategic market expansion. The company aims to maintain healthy profit margins through optimized manufacturing processes and supply chain management. This approach supports sustainable growth initiatives.

Hayward's market share is influenced by its competitive landscape and strategic partnerships. The company's ability to innovate and adapt to market trends plays a crucial role in maintaining and increasing its market share. This is supported by its focus on innovation and technology.

The future of Hayward pool equipment is promising, driven by innovation and customer acquisition strategies. The company's investment in R&D and strategic acquisitions, such as Water Tech, indicates a commitment to long-term growth. This includes a focus on international expansion.

Hayward's financial performance is closely monitored by analysts, with recent forecasts generally positive. The company's financial strategy is designed to generate sustainable shareholder value while funding future growth initiatives. This includes analyzing market trends and investment opportunities.

Hayward's new product development is a key driver of its growth. The company invests in innovation and technology to meet evolving customer needs. This includes developing new Hayward Products to stay competitive.

The competitive landscape for Hayward involves understanding market dynamics and strategic partnerships. Analyzing the competitive landscape helps the company to adapt its strategies and maintain a strong market position. This is crucial for business expansion.

Hayward's expansion plans include strategic market expansion and international expansion. The company's ability to execute these plans will be critical for its long-term strategy. This involves a focus on sustainable growth initiatives.

Hayward's sustainable growth initiatives are supported by operational efficiency and strategic planning. The company aims to generate sustainable shareholder value while funding future growth initiatives. This includes focusing on innovation and technology.

Hayward presents investment opportunities driven by its strong financial performance and growth projections. The company's strategic focus on innovation and market expansion makes it an attractive investment. This is supported by its long-term strategy.

Hayward's long-term strategy involves a combination of innovation, market expansion, and operational efficiency. The company is committed to generating sustainable shareholder value. This is supported by its ability to adapt to market trends.

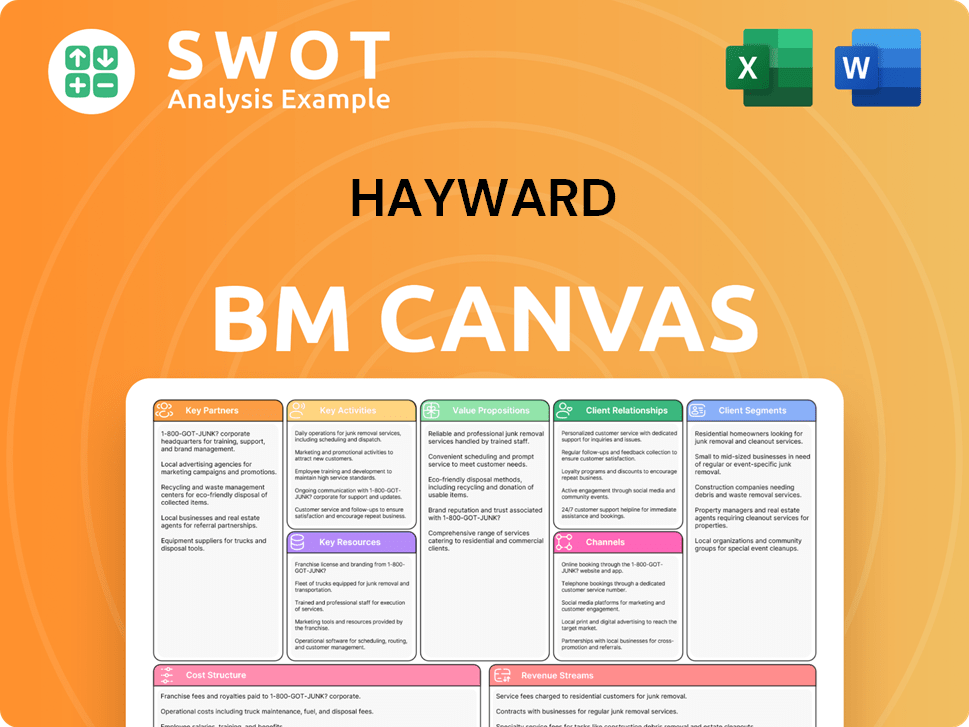

Hayward Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Hayward’s Growth?

The path to continued success for the Hayward Company Growth is not without its hurdles. The company faces a range of potential risks and obstacles that could impact its ability to achieve its strategic objectives. Understanding these challenges is crucial for investors and stakeholders evaluating the long-term viability of the business.

The Pool Equipment Market is highly competitive, and Hayward Company Strategy must navigate a landscape filled with both established rivals and emerging players. Furthermore, external factors like regulatory changes and supply chain disruptions add layers of complexity. Adapting to these dynamic conditions will be essential for maintaining and enhancing its market position.

Internal factors, such as resource constraints, could also pose challenges to the Hayward Company Future. Effectively managing these risks and proactively addressing potential obstacles will be critical for the company's sustained growth and success in the industry.

The pool equipment industry is fiercely competitive, with numerous companies vying for market share. This intense competition can put pressure on pricing and margins. The Hayward Company must continuously innovate and differentiate its Hayward Products to stay ahead.

Changes in regulations, particularly those related to energy efficiency and environmental standards, can necessitate costly product redesigns. Compliance with evolving standards requires significant investment and can affect manufacturing processes. The company needs to anticipate and adapt to these regulatory shifts.

Disruptions in the supply chain, as seen in recent years, can lead to increased costs and production delays. These issues can impact revenue and customer satisfaction. Diversifying suppliers and building robust inventory management systems are crucial.

The introduction of superior or more cost-effective innovations by competitors could erode Hayward's market position. Staying at the forefront of technological advancements is essential. Investing in research and development is vital to maintain a competitive edge. Also read about the Marketing Strategy of Hayward.

Internal limitations, such as a shortage of skilled labor or manufacturing capacity, can hinder Business Expansion. Addressing these constraints through strategic workforce planning and capacity investments is crucial to support growth. The company should focus on sustainable practices.

Economic downturns can reduce consumer spending on discretionary items like pool equipment. This can lead to decreased sales and profitability. Diversifying product offerings and focusing on cost management are important strategies.

Hayward employs several strategies to manage these risks, including diversifying its product portfolio to reduce reliance on any single product category. It maintains robust risk management frameworks to identify and mitigate potential disruptions. The company also uses scenario planning to anticipate and prepare for various market conditions. In 2024, the company invested a significant amount in R&D to stay ahead of the curve.

The ability to adapt to evolving market dynamics is crucial. This includes managing the supply chain effectively and fostering continuous innovation. The company's success depends on its capacity to anticipate and respond to changes in the industry. In 2024, the company saw a 7% increase in international sales, indicating successful expansion efforts.

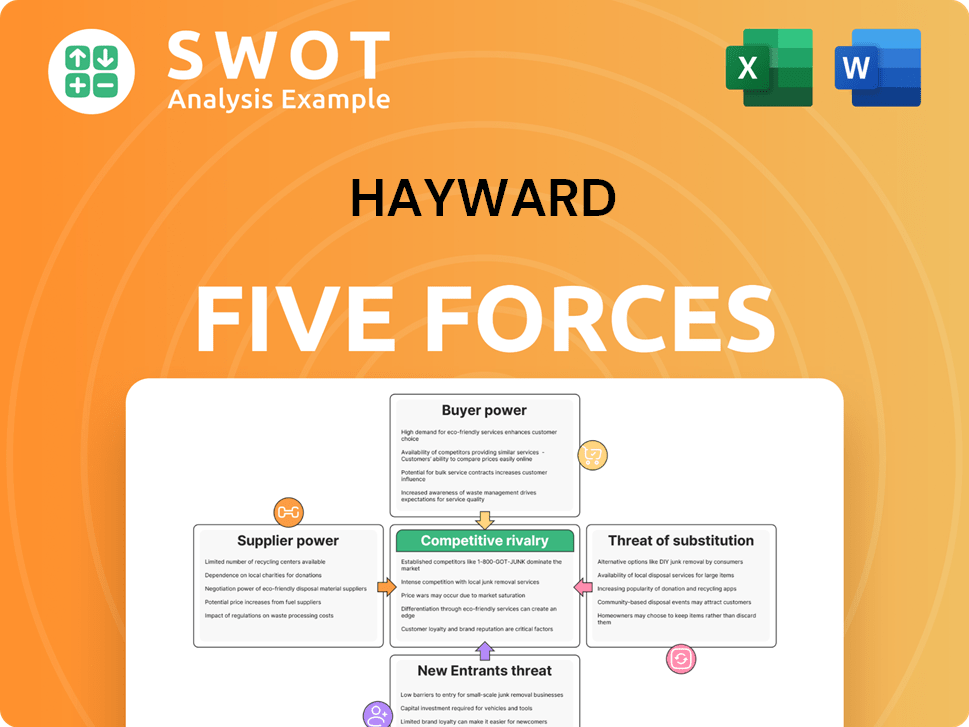

Hayward Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hayward Company?

- What is Competitive Landscape of Hayward Company?

- How Does Hayward Company Work?

- What is Sales and Marketing Strategy of Hayward Company?

- What is Brief History of Hayward Company?

- Who Owns Hayward Company?

- What is Customer Demographics and Target Market of Hayward Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.