Hayward Bundle

Unlocking Hayward Company's Success: How Does It Work?

Hayward Holdings, Inc. dominates the global pool equipment and automation sector, a market poised to hit $15.5 billion by 2027. From Hayward SWOT Analysis to energy-efficient pumps and advanced automation, Hayward's comprehensive product suite caters to both residential and commercial clients. With a century-long legacy, the company's commitment to innovation and sustainability has solidified its market leadership, making it a compelling subject for investors and industry watchers alike.

Hayward's impressive $1.1 billion in net sales for fiscal year 2023 highlight its ability to capitalize on the growing demand for backyard leisure. Understanding the intricacies of Hayward pool equipment, including pool pumps and pool systems, is crucial for anyone interested in pool maintenance or the broader market. Exploring its operational framework and revenue streams offers valuable insights into its sustained success and future growth potential, especially considering the evolving needs of pool owners. This includes examining aspects like "How does a Hayward pool pump work" and "Hayward pool filter troubleshooting" to understand the company's value proposition.

What Are the Key Operations Driving Hayward’s Success?

The core operations of the Hayward Company revolve around designing, manufacturing, and marketing a comprehensive range of residential and commercial pool equipment and automation systems. Their value proposition centers on providing innovative, reliable, and energy-efficient solutions for pool owners and operators. This includes essential components like pumps, filters, heaters, cleaners, sanitization equipment, and lighting, all designed to enhance pool maintenance and overall pool systems.

Their customer base is broad, encompassing homeowners, pool builders, service professionals, and commercial pool operators. Hayward focuses on vertical integration, which includes in-house research and development, manufacturing in state-of-the-art facilities, and a robust global supply chain. This approach allows for stringent quality control and effective responses to market demands. You can learn more about the company's origins in this Brief History of Hayward.

The manufacturing process at Hayward utilizes advanced automation and lean principles, ensuring efficiency and cost-effectiveness. Their distribution networks are extensive, using a combination of direct sales, wholesale distributors, and retail partners to reach various customer segments. The company distinguishes itself through its emphasis on energy efficiency and smart pool technology, which results in reduced operational costs and improved pool management for customers.

The company's core products include pool pumps, filters, heaters, cleaners, sanitization equipment, and lighting. These products are designed to meet the diverse needs of residential and commercial pool owners. Hayward pool equipment is known for its reliability and performance.

Hayward employs vertically integrated operations, including in-house research and development and manufacturing. Their global supply chain sources materials from a diverse network of suppliers while maintaining rigorous quality standards. This ensures that all Hayward products meet high standards.

The company utilizes a multi-channel distribution approach, including direct sales, wholesale distributors, and retail partners. This strategy ensures broad market penetration and efficient access to various customer segments. The company's products are widely available.

A key differentiator for Hayward is its focus on energy efficiency and smart pool technology. Variable-speed pumps, for example, can provide significant energy savings. This commitment to innovation enhances the value proposition for customers.

The company's core capabilities in engineering and product development, combined with its strong distribution network, allow it to deliver innovative, reliable, and energy-efficient solutions. These solutions provide significant advantages to customers.

- Reduced operational costs through energy-efficient products like variable-speed pumps.

- Enhanced pool management via smart pool technology and automation systems.

- Reliable and durable equipment designed for long-term performance.

- A wide range of products to meet the needs of various pool types and sizes.

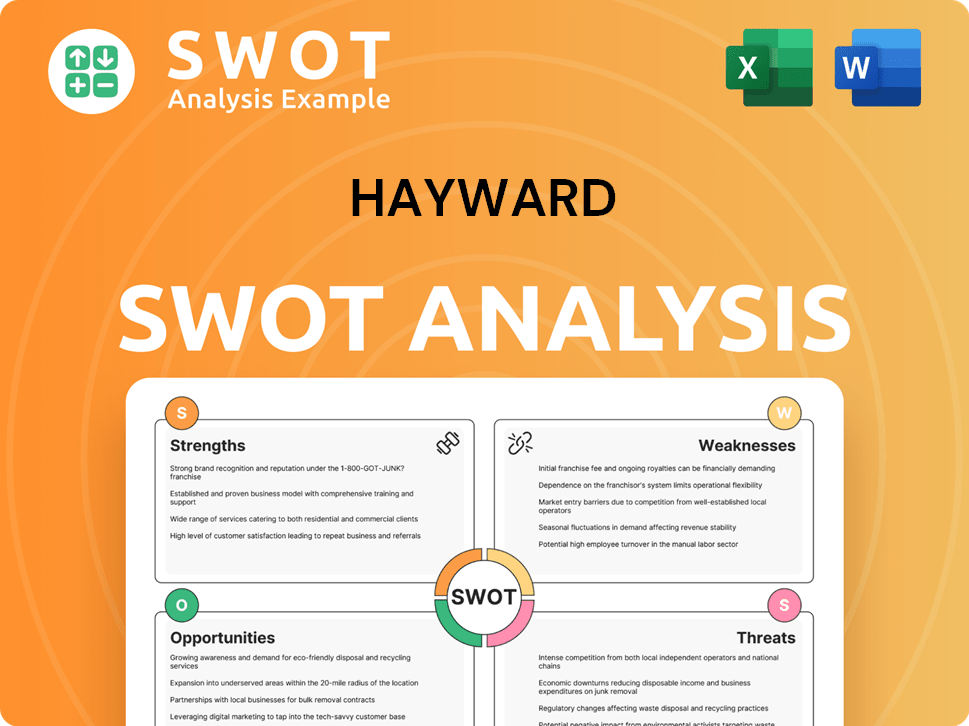

Hayward SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Hayward Make Money?

The primary revenue streams for Hayward Holdings are centered around the sale of its extensive range of pool equipment and automation systems. This includes a variety of products such as pumps, filters, heaters, cleaners, sanitization equipment, and lighting, catering to both residential and commercial pool owners. In fiscal year 2023, the company's net sales reached approximately $1.1 billion, highlighting the significant role of product sales in its revenue generation.

Hayward's monetization strategy focuses on offering premium, energy-efficient products that often come with higher price points due to their advanced features and long-term cost savings. The company employs a tiered pricing approach, providing options to meet different budget levels and functional needs. Additionally, Hayward enhances its revenue by promoting integrated pool systems, encouraging customers to purchase a complete ecosystem of products.

Aftermarket sales of replacement parts and accessories also contribute to revenue, ensuring continued customer engagement. Moreover, Hayward has expanded its revenue sources by investing in smart pool technology and automation, capitalizing on the growing demand for connected home solutions and remote pool management. For a deeper understanding of the company's strategic growth, consider reading about the Growth Strategy of Hayward.

Hayward's revenue model is multifaceted, focusing primarily on product sales. The company leverages various strategies to maximize revenue and customer engagement. Here are some key aspects:

- Product Sales: The core revenue driver includes a wide array of Hayward pool equipment and Hayward products.

- Premium Products: Focusing on energy-efficient and advanced technology products that command higher prices.

- Tiered Pricing: Offering products at different price points to cater to a diverse customer base.

- Integrated Systems: Promoting the sale of complete pool systems to encourage comprehensive purchases.

- Aftermarket Sales: Generating revenue through replacement parts and accessories for ongoing pool maintenance.

- Smart Pool Technology: Investing in automation and connected solutions to meet growing market demands.

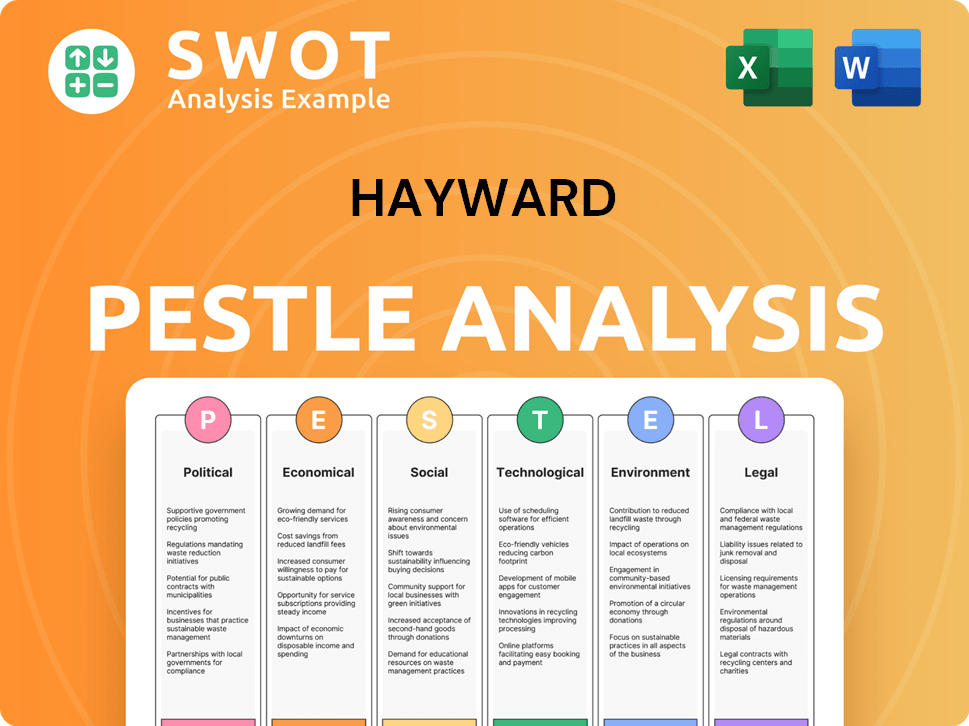

Hayward PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Hayward’s Business Model?

The evolution of the company, a prominent player in the pool equipment industry, has been marked by significant milestones and strategic decisions. These actions have shaped its trajectory and contributed to its financial performance. A key focus has been on innovation and expansion, positioning the company for sustained growth in a competitive market.

Strategic moves have included continuous investment in research and development, leading to the introduction of energy-efficient and smart pool technologies. This focus has been a key differentiator, aligning with increasing consumer demand for sustainability and convenience. Furthermore, the company has strategically expanded its global footprint, enhancing its market reach and diversifying its revenue base.

Operational challenges have included navigating supply chain disruptions, particularly those experienced globally in recent years. The company has responded by optimizing its supply chain resilience, diversifying sourcing, and enhancing inventory management to mitigate future impacts. These efforts are designed to ensure the company's ability to meet customer needs and maintain its market position.

The company has achieved several key milestones throughout its history, including significant product innovations and market expansions. These milestones have helped the company to establish a strong brand presence and a loyal customer base. The company's ability to adapt to changing market conditions has been crucial to its success.

Strategic moves have included a focus on energy-efficient products, such as variable-speed pumps, which align with consumer demand for sustainability. The company has also expanded its global presence to diversify its revenue streams. These strategic initiatives have positioned the company for long-term growth and market leadership.

The company's competitive advantages include strong brand recognition and technological leadership in pool automation. Its extensive distribution network and strong relationships with pool builders and service professionals also provide a significant edge. The company's ability to innovate and adapt to market trends ensures its continued competitiveness.

The company has faced operational challenges, including supply chain disruptions. The company has responded by optimizing its supply chain resilience and diversifying sourcing. These proactive measures are designed to mitigate future impacts and ensure the company's ability to meet customer needs.

The company's competitive advantages are rooted in its strong brand recognition and technological leadership in pool automation and energy efficiency. Its extensive distribution network and strong relationships with pool builders and service professionals further enhance its market position. The company's ability to adapt to new trends, such as the growing demand for eco-friendly solutions and the integration of smart home technology into pool management, ensures its business model remains robust and competitive. For a deeper dive into who the company is targeting, check out Target Market of Hayward.

- Brand Recognition: Nearly a century in the industry has built significant brand trust.

- Technological Leadership: Focus on energy-efficient and smart pool technologies.

- Distribution Network: Extensive reach through various channels.

- Customer Relationships: Strong ties with pool builders and service professionals.

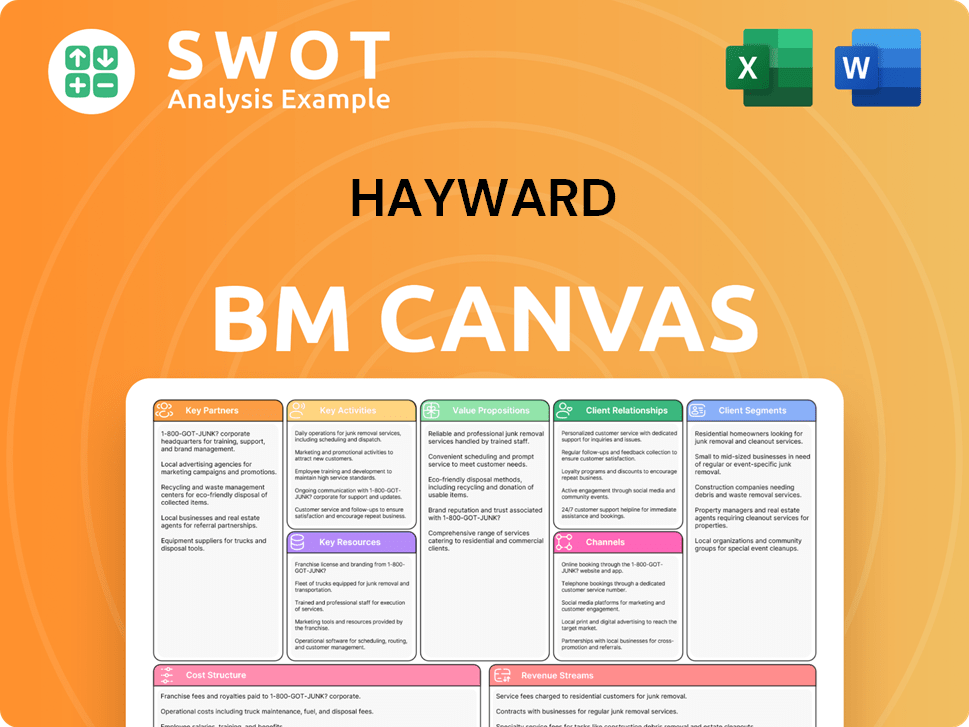

Hayward Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Hayward Positioning Itself for Continued Success?

The position of the Hayward Company in the pool equipment and automation industry is strong. The company competes effectively with other major global players. Customer loyalty is bolstered by reliable and innovative Hayward products, coupled with a robust after-sales service network. Its global reach extends across key markets, using established distribution channels.

Several risks could affect Hayward's operations. These include fluctuations in residential construction and renovation markets, which directly influence demand for new pool installations. Economic downturns or rising interest rates could also impact consumer spending. Regulatory changes and the emergence of new competitors could also pose threats. You can learn more about the competitive landscape in the Competitors Landscape of Hayward article.

Hayward holds a leading position in the pool equipment market. Although specific market share figures for 2024-2025 aren't publicly available, revenue performance suggests a strong standing. They have a broad product portfolio and a global reach.

Risks include market fluctuations in residential construction, economic downturns, and regulatory changes. New competitors and disruptive technologies could also pose challenges. These factors could impact the demand for Hayward pool equipment.

The future outlook for Hayward is positive, driven by innovation, and adapting to consumer preferences. The company focuses on innovation in energy efficiency and automation. It aims to expand market share through product differentiation.

Hayward's strategic initiatives focus on continued product innovation, especially in energy efficiency and automation. They are committed to expanding market share and strengthening distribution partnerships. This includes focusing on pool systems and pool pumps.

Hayward's focus includes innovation in energy efficiency, automation, and sustainable pool solutions. They aim to leverage trends in home-centric leisure and smart home technologies. This involves continuous improvement in pool maintenance and offering advanced features.

- Product innovation, especially in energy efficiency.

- Expansion of market share through product differentiation.

- Strengthening distribution partnerships.

- Adaptation to evolving consumer preferences.

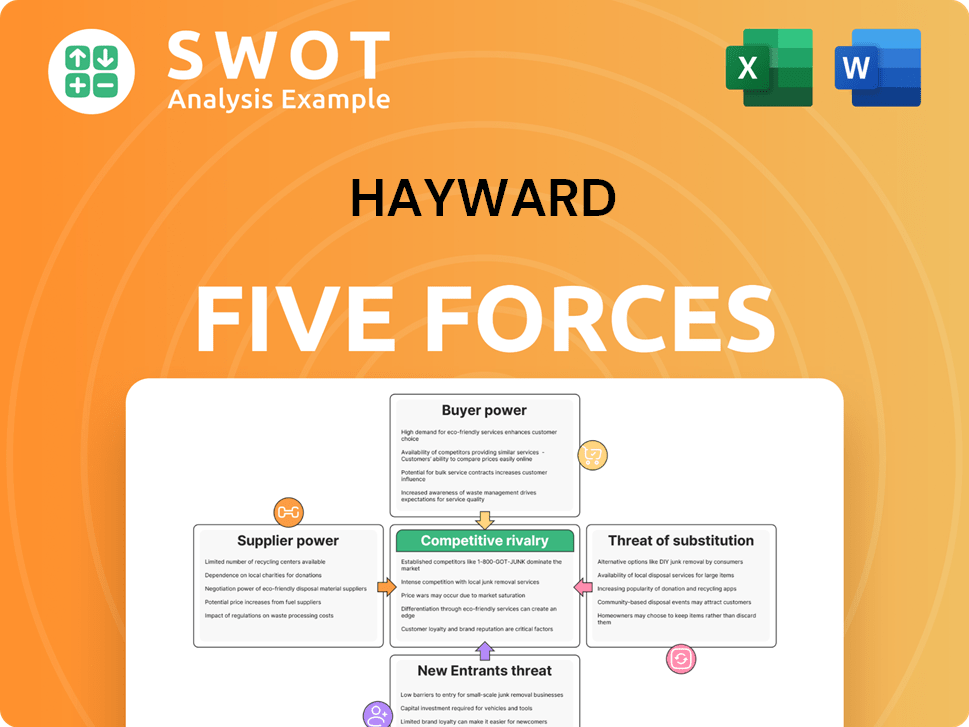

Hayward Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hayward Company?

- What is Competitive Landscape of Hayward Company?

- What is Growth Strategy and Future Prospects of Hayward Company?

- What is Sales and Marketing Strategy of Hayward Company?

- What is Brief History of Hayward Company?

- Who Owns Hayward Company?

- What is Customer Demographics and Target Market of Hayward Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.