Hayward Bundle

Who Really Owns Hayward Company?

Understanding the ownership structure of Hayward Holdings, Inc. is critical for investors and industry watchers alike. From its humble beginnings in 1925 to its current status as a publicly traded entity, Hayward's ownership has undergone a fascinating transformation. This evolution directly impacts its strategic direction and overall performance in the competitive pool equipment market. The company's journey includes a pivotal shift with private equity involvement and a subsequent IPO.

Hayward, a leading Hayward SWOT Analysis, has a rich history as a pool equipment manufacturer. Knowing who owns Hayward is essential for evaluating its future prospects. This article examines the key players, from early investors to current shareholders, and analyzes how these ownership changes have shaped the company's path. Discover the influence of private equity and the impact of being a public company, including the answer to "Who owns Hayward Pool Products?"

Who Founded Hayward?

The story of the Hayward Company ownership begins in 1925, with its foundation by Irving M. Hayward in Brooklyn, New York. Initially, the company focused on specialty metal valves and industrial flow control products. The early years laid the groundwork for what would become a significant player in the pool equipment market. The company's evolution reflects a strategic adaptation to market opportunities and technological advancements.

Irving M. Hayward's vision extended to the swimming pool sector, aiming to improve pump design and simplify maintenance for pool owners. While specific details about the initial capital or funding are not readily available, his focus on innovation set the stage for the company's future direction. This early emphasis on improving pool equipment was a key factor in the company's eventual success.

In 1964, Irving M. Hayward retired and sold the company to Oscar Davis. This marked a pivotal moment in the Hayward Company ownership history, ushering in a period of diversification and growth. Under Davis's leadership, Hayward embraced new technologies and expanded its product offerings, solidifying its position in the pool equipment industry.

The transition from Irving M. Hayward to Oscar Davis in 1964 was a key change in the Hayward Company ownership. Davis's leadership led to significant innovations, including the use of thermoplastics in pool equipment. This move was a strategic decision that set the company apart in the market. To learn more about the financial aspects and business model of the company, you can check out this article: Revenue Streams & Business Model of Hayward.

- 1925: Irving M. Hayward founded the company.

- 1964: Oscar Davis acquired the company.

- The company's early focus was on industrial products before shifting to pool equipment.

- The adoption of thermoplastics was a major innovation under Davis's leadership.

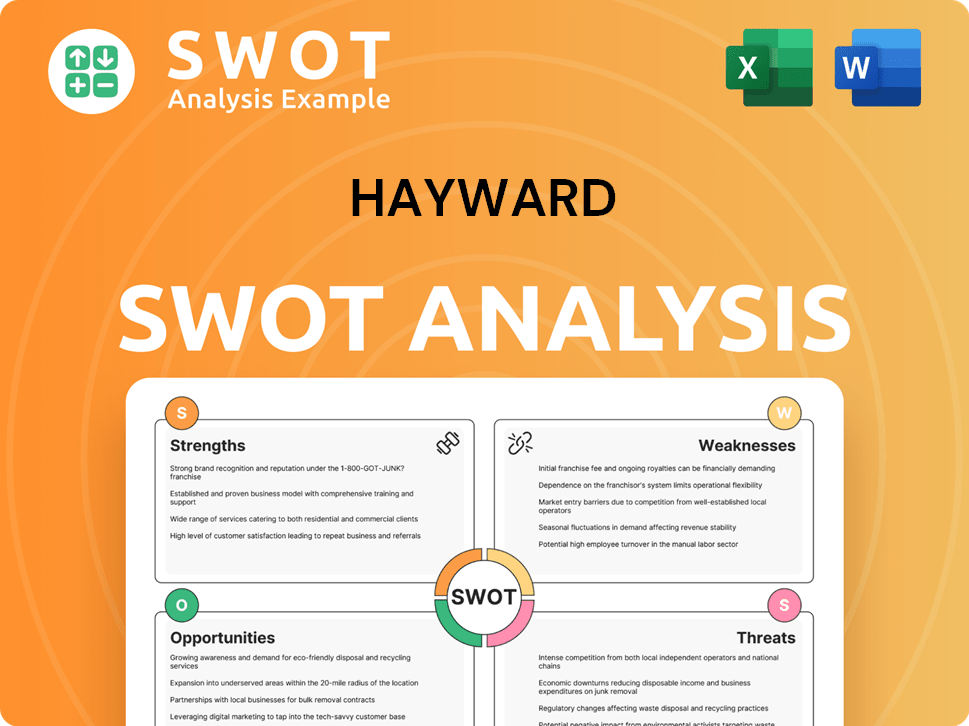

Hayward SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Hayward’s Ownership Changed Over Time?

The Hayward Company's ownership has seen significant shifts over time. Initially, Oscar Davis acquired the company in 1964, and the Davis family maintained control for more than five decades. During this period, Hayward experienced an average annual growth exceeding 10%. This long-term ownership structure provided stability and fostered growth within the pool equipment manufacturer.

A major change occurred in 2017 when a partnership led by CCMP Capital Advisors, L.P., MSD Partners, L.P., and Alberta Investment Management Corporation (AIMCo) took over Hayward Industries. This acquisition introduced new investment and strategic direction. Subsequently, in 2021, Hayward Holdings, Inc. became a publicly traded company on the New York Stock Exchange (NYSE: HAYW) through an Initial Public Offering (IPO), further diversifying its ownership structure.

| Event | Date | Details |

|---|---|---|

| Davis Family Ownership | 1964 - 2017 | Oscar Davis acquired the company; family ownership for over 50 years. |

| Acquisition by CCMP Capital Advisors, L.P., et al. | 2017 | Partnership acquired Hayward Industries. |

| Initial Public Offering (IPO) | 2021 | Hayward Holdings, Inc. went public on the NYSE (HAYW). |

As of June 5, 2025, Hayward Holdings (NYSE: HAYW) has 572 institutional owners and shareholders holding a total of 265,499,610 shares. Key institutional shareholders include Vanguard Group Inc, BlackRock, Inc., and Fmr Llc. The IPO in 2021 involved the sale of 40,277,778 common shares at $17.00 per share, generating gross proceeds of $684.7 million. This transformation from private to public ownership has significantly impacted who owns Hayward, broadening its investor base and increasing its market visibility. For more information on the company's strategic direction, consider reading about the Target Market of Hayward.

Hayward's ownership has evolved from family control to a publicly traded company.

- The IPO in 2021 was a major milestone.

- Institutional investors now hold a significant portion of the shares.

- The company's structure has changed over time.

- The company is a leading pool equipment manufacturer.

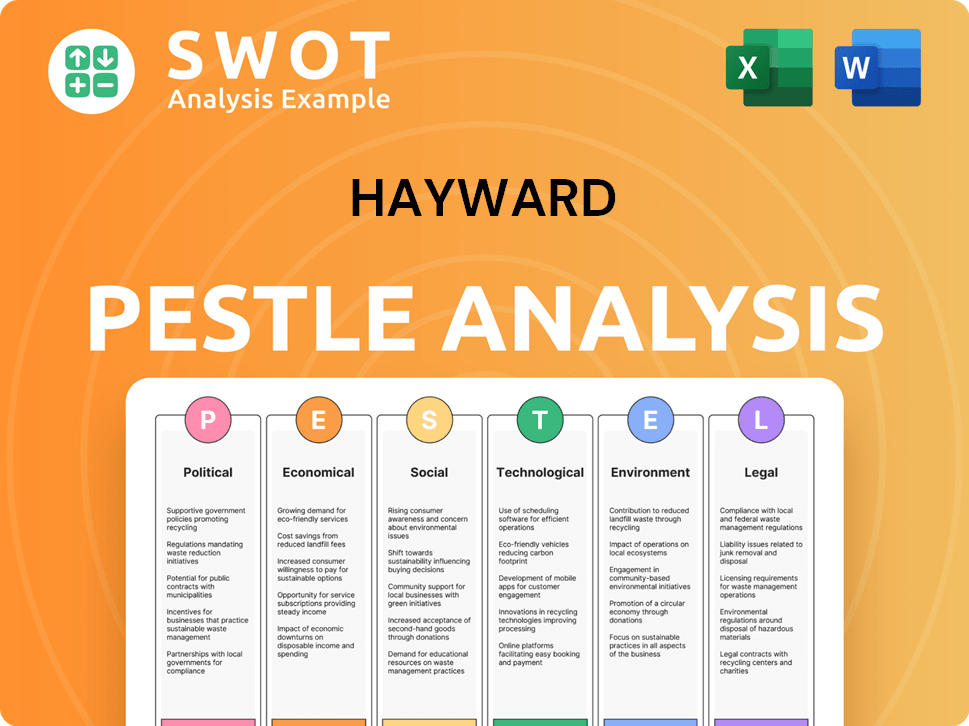

Hayward PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Hayward’s Board?

The current board of directors of Hayward Holdings, Inc. is key to steering the company's strategic direction. Details about board members and their affiliations, including major shareholders, founders, and independent seats, are usually found in the company's definitive proxy statements filed with the SEC. Hayward operates as a 'controlled company' under the New York Stock Exchange's corporate governance standards. This means that certain affiliates of CCMP Capital Advisors, MSD Partners, and AIMCo, who were part of a stockholders agreement, hold a significant portion of the combined voting power of the common stock. Understanding Hayward Company ownership is crucial for investors.

As of March 20, 2025, Hayward appointed Ron Keating, a leader in the water industry, to its Board of Directors. Information on recent proxy battles, activist investor campaigns, or governance controversies would typically be available in the company's SEC filings, such as 8-K reports and proxy statements (DEF 14A). For those interested in the company's background, a Brief History of Hayward provides additional context.

| Board Member | Affiliation | Role |

|---|---|---|

| Ron Keating | Water Industry | Board Member |

| Details available in SEC filings | CCMP Capital Advisors, MSD Partners, AIMCo | Significant Shareholders |

| Details available in SEC filings | Other Board Members |

Hayward operates under a 'controlled company' structure, impacting voting power. The board includes industry leaders like Ron Keating. Information on Hayward Pool Products owner and governance details are available in SEC filings.

- SEC filings provide details on board members and their affiliations.

- Controlled company status affects voting power.

- Recent appointment of Ron Keating to the Board.

- Key details about Who owns Hayward are available in public documents.

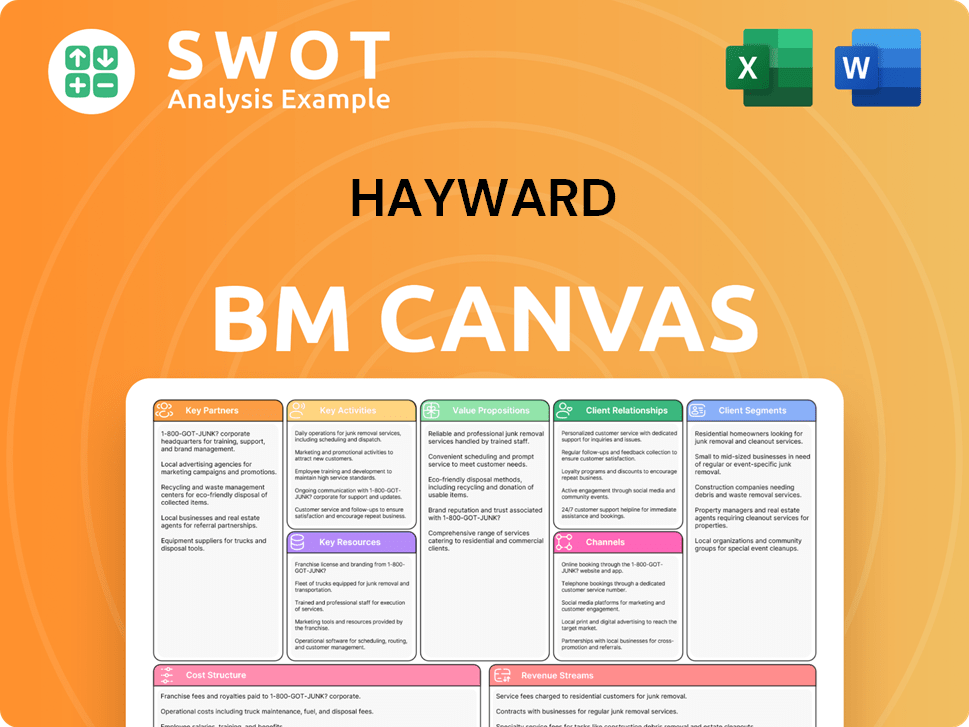

Hayward Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Hayward’s Ownership Landscape?

In the past few years, Hayward Holdings has focused on strengthening its financial position and expanding its market reach. The company has successfully reduced its net leverage and made strategic acquisitions. This strategic approach has positioned the company for growth and enhanced its market presence within the pool equipment sector.

Recent financial results demonstrate Hayward's growth trajectory. For fiscal year 2024, net sales increased by 6% year-over-year to $1,051.6 million, and net income increased by 47% to $118.7 million. The first quarter of fiscal year 2025 showed further growth, with net sales up 8% year-over-year to $228.8 million and net income increasing by 46% to $14.3 million. This performance reflects the successful integration of acquisitions, such as ChlorKing in June 2024, and the introduction of innovative products. The company's ability to capture a larger share of the commercial pool market and advance its technology leadership has been key to its recent success.

| Metric | Fiscal Year 2024 | Fiscal Year 2025 (Projected) |

|---|---|---|

| Net Sales | $1,051.6 million | $1.060 billion - $1.100 billion |

| Net Income | $118.7 million | N/A |

| Adjusted EBITDA | N/A | $280 million - $290 million |

Industry trends indicate increased institutional ownership in companies like Hayward. With approximately 80% of its revenue historically coming from aftermarket sales, the company maintains a stable outlook, even with fluctuations in new pool demand. For fiscal year 2025, Hayward anticipates net sales between approximately $1.060 billion and $1.100 billion and Adjusted EBITDA between $280 million and $290 million. The company's optimism about the long-term dynamics of the pool industry is driven by favorable secular demand trends, sunbelt migration, and technology adoption. To learn more about the strategic direction of the company, read about the Growth Strategy of Hayward.

Understanding who owns Hayward is crucial for investors and stakeholders. The company's ownership structure influences its strategic decisions and financial performance. Recent trends show growing institutional interest.

The ownership of Hayward Pool Products is a key factor in assessing its market position. The company's ability to capitalize on market trends is influenced by its owners. This includes factors such as product innovation and market expansion.

Determining who owns Hayward provides insight into the company's strategic direction. Analyzing the ownership structure helps in understanding its financial stability and long-term goals. This is important for making informed investment decisions.

As a pool equipment manufacturer, Hayward's ownership impacts its market competitiveness. The company's ability to innovate and adapt to market changes is influenced by its owners. The ownership structure influences the company's strategic decisions.

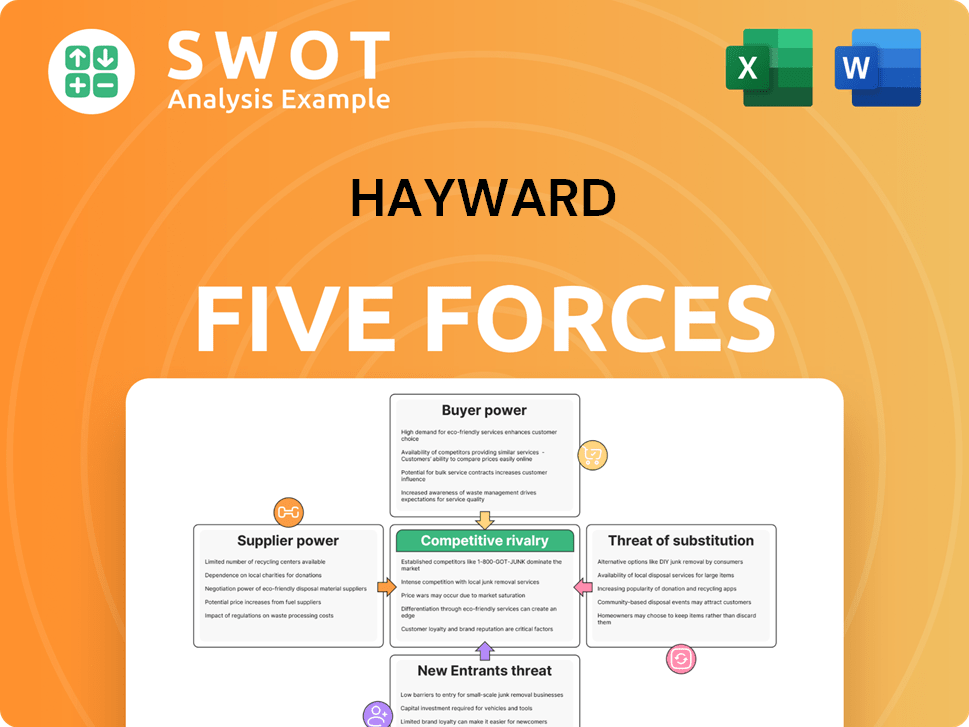

Hayward Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Hayward Company?

- What is Competitive Landscape of Hayward Company?

- What is Growth Strategy and Future Prospects of Hayward Company?

- How Does Hayward Company Work?

- What is Sales and Marketing Strategy of Hayward Company?

- What is Brief History of Hayward Company?

- What is Customer Demographics and Target Market of Hayward Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.