H.B. Fuller Bundle

Can H.B. Fuller Maintain Its Momentum?

H.B. Fuller, a century-old titan in adhesives and specialty chemicals, has consistently demonstrated a knack for strategic growth. From its humble beginnings in St. Paul, Minnesota, the company has evolved into a global force, serving diverse industries with innovative adhesive solutions. This H.B. Fuller SWOT Analysis will explore the company's journey and future potential.

This comprehensive H.B. Fuller company analysis delves into the company's market position and business strategy, exploring its historical growth and future prospects. The adhesives industry trends and H.B. Fuller's ability to adapt will be key factors in determining its long-term investment potential. We'll examine the company's expansion plans, sustainability initiatives, and competitive landscape to provide actionable insights for investors and strategists alike.

How Is H.B. Fuller Expanding Its Reach?

The growth strategy of H.B. Fuller centers on strategic expansion initiatives, targeting both new geographical markets and product categories. This approach aims to broaden the customer base and diversify revenue streams, positioning the company to adapt to industry changes effectively. The company's focus includes international expansion, particularly in emerging markets, where the demand for advanced adhesive solutions is increasing. This strategy is crucial for maintaining and enhancing its market position within the adhesives industry.

A key aspect of the H.B. Fuller business strategy involves launching new products and services, especially those designed for high-growth segments like sustainable adhesives and solutions for electric vehicles. The company’s product pipeline is geared towards meeting the growing customer demand for environmentally friendly and high-performance materials. This includes advancements in hot melt adhesives, which are essential for packaging and hygiene applications. Strategic partnerships are also a vital component of H.B. Fuller’s expansion, allowing the company to co-develop specialized solutions and penetrate new sectors more effectively.

Mergers and acquisitions are a core element of H.B. Fuller's expansion strategy. The company regularly assesses opportunities to acquire businesses that complement its existing portfolio, enhance technological capabilities, or provide access to new markets. These acquisitions are vital for accelerating growth and increasing market share in key segments. This strategy builds upon the company's established global network, which includes over 70 manufacturing facilities and 3,000 active patents. For more insights into the company's financial performance, you can explore Owners & Shareholders of H.B. Fuller.

H.B. Fuller is actively expanding its presence in emerging markets, such as India. Plans include opening new manufacturing facilities and innovation centers to cater to local market needs. This expansion strengthens the company's supply chain and supports its long-term growth strategy.

The company focuses on launching new products, particularly in sustainable adhesives and solutions for electric vehicles. This includes advancements in hot melt adhesives for packaging and hygiene. These innovations are designed to meet increasing customer demand for environmentally friendly and high-performance materials.

Strategic partnerships are a vital component of H.B. Fuller’s expansion. These collaborations allow the company to co-develop specialized solutions and penetrate new sectors more effectively. For example, the company has engaged in collaborations to develop adhesives for advanced electronics, a rapidly expanding market.

Mergers and acquisitions are a core part of H.B. Fuller's expansion strategy. The company continuously evaluates opportunities to acquire businesses that complement its existing portfolio. These acquisitions are instrumental in accelerating growth and consolidating market share in key segments.

H.B. Fuller's expansion plans for the next 5 years include significant investments in emerging markets and new product development. The company aims to increase its market share through strategic acquisitions and partnerships, focusing on innovation and sustainability. These initiatives are designed to drive revenue growth and enhance the company's long-term value.

- Expanding in Asia Pacific to capitalize on growing demand.

- Investing in sustainable adhesive solutions to meet environmental standards.

- Acquiring companies to broaden its product portfolio and market reach.

- Developing innovative adhesive products for various industries.

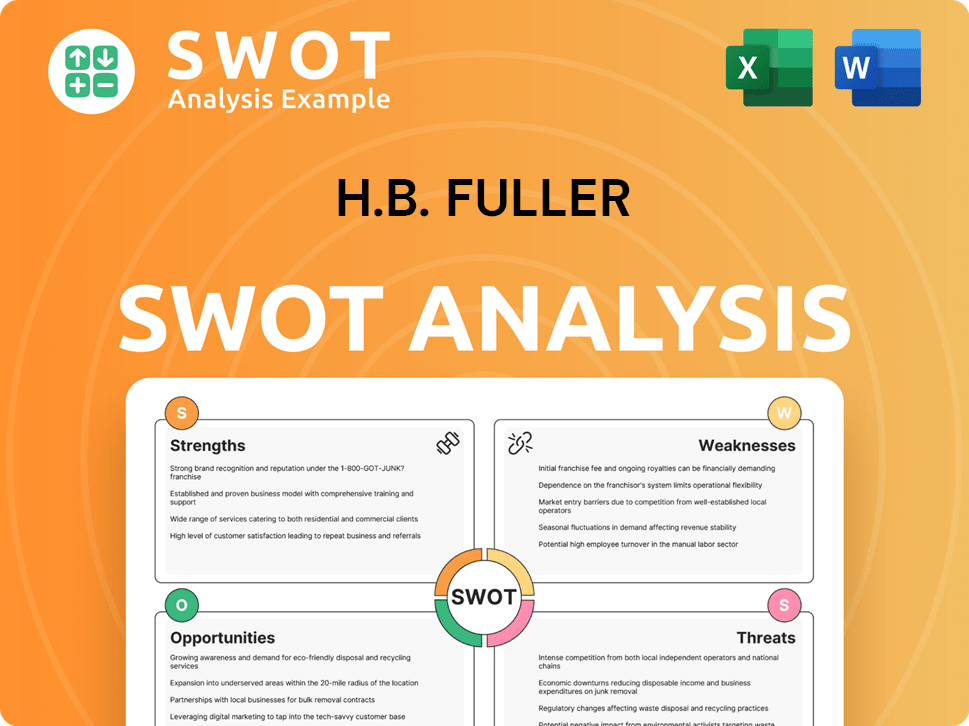

H.B. Fuller SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does H.B. Fuller Invest in Innovation?

The company's commitment to innovation and technology is critical to its overall H.B. Fuller growth strategy. This focus allows them to develop advanced adhesive solutions and maintain a strong H.B. Fuller market position within the industry. Their approach integrates both in-house development and external collaborations, ensuring a continuous flow of new technologies and capabilities.

H.B. Fuller heavily invests in research and development (R&D) to create advanced adhesive solutions, which is a key part of their H.B. Fuller business strategy. This includes significant investments in both in-house development and collaborations with external innovators, such as universities and technology startups, to accelerate product development and foster new technical capabilities. The company's R&D efforts are designed to meet the evolving needs of various industries, including packaging, construction, and electronics.

A core element of H.B. Fuller's future prospects is digital transformation, which involves using data analytics and automation to optimize manufacturing processes and improve supply chain efficiency. This strategy enhances customer experience and supports the company's ability to respond quickly to market changes. By integrating cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT), the company aims to enhance product performance and develop smart adhesive solutions.

H.B. Fuller dedicates substantial resources to R&D to stay ahead in the adhesives industry. These investments are crucial for creating innovative products and maintaining a competitive edge. The company's R&D spending supports its ability to develop new solutions and improve existing ones.

Digital transformation is a key focus for H.B. Fuller, involving the use of data analytics and automation. This helps optimize manufacturing, improve supply chains, and enhance customer experiences. The company is leveraging technology to streamline operations and drive efficiency.

H.B. Fuller integrates AI and IoT into its operations and product development. These technologies improve product performance and enable predictive maintenance. They are exploring how AI can optimize adhesive formulations for specific applications.

Sustainability is central to H.B. Fuller's innovation strategy, focusing on environmentally friendly adhesives. The company aims to develop bio-based and recyclable solutions. Their commitment to sustainability is reflected in their revenue goals.

H.B. Fuller aims to achieve 75% of its revenue from sustainable products by 2025. This ambitious goal underscores the company's commitment to environmental responsibility. This focus on sustainability is a key driver of their innovation efforts.

The company's focus on sustainable solutions has led to numerous industry awards and recognitions. These accolades highlight H.B. Fuller's leadership in sustainable innovation. Such recognition validates their commitment to environmental stewardship.

H.B. Fuller uses several key strategies to drive innovation and maintain its competitive edge in the adhesives industry. These strategies include significant investments in R&D, digital transformation initiatives, and a strong focus on sustainability. These efforts are designed to meet the demands of a rapidly changing market and ensure long-term growth.

- Research and Development: Investing heavily in R&D to create new and improved adhesive solutions.

- Digital Transformation: Leveraging data analytics and automation to optimize manufacturing and supply chain efficiency.

- AI and IoT Integration: Implementing AI and IoT technologies to enhance product performance and enable predictive maintenance.

- Sustainability Initiatives: Developing environmentally friendly adhesives, including bio-based and recyclable solutions.

- Collaboration: Partnering with external innovators, such as universities and technology startups, to accelerate product development.

For more insights into the company's customer base and market positioning, consider exploring the Target Market of H.B. Fuller. This article provides a deeper understanding of the company's strategic approach to meeting customer needs and preferences.

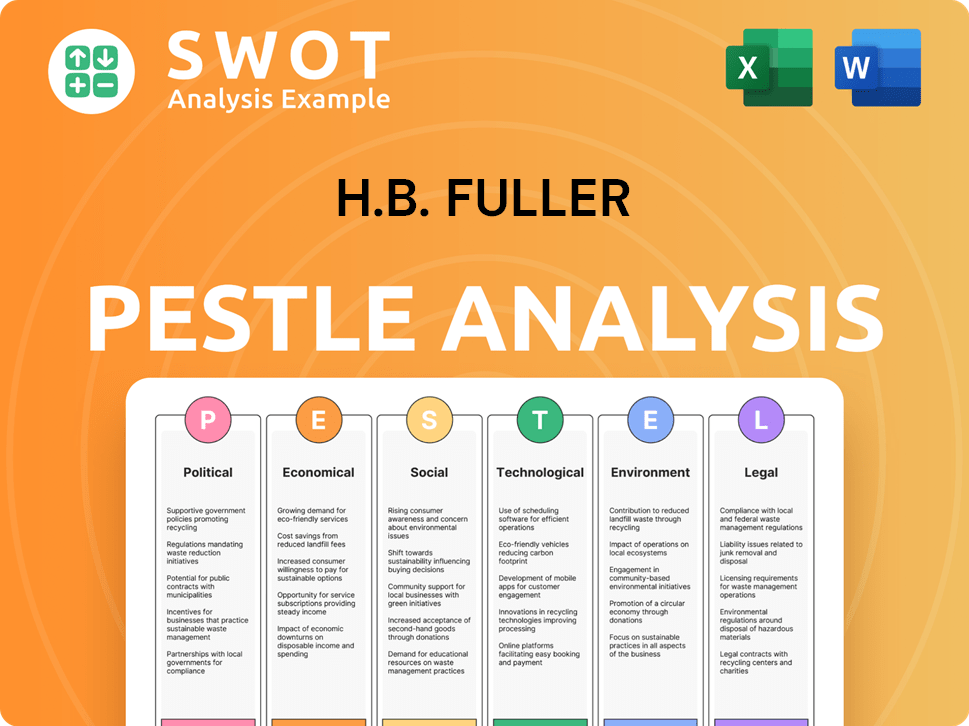

H.B. Fuller PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is H.B. Fuller’s Growth Forecast?

The financial outlook for H.B. Fuller reflects a strategic emphasis on sustained growth, supported by robust revenue targets and disciplined investment. For fiscal year 2024, the company anticipates net revenue to be between $3.5 billion and $3.6 billion. This projection underscores the company's confidence in its market position and its ability to capitalize on industry trends. H.B. Fuller's growth strategy includes a focus on expanding profit margins and generating strong cash flow to fund future initiatives.

In the first quarter of fiscal year 2024, the company reported net revenue of $824 million. Although there was a slight organic decrease of 1.6% compared to the previous year, the company achieved an adjusted EBITDA of $133 million, representing 16.1% of net revenue. This demonstrates the effectiveness of H.B. Fuller's cost management and operational efficiency. The company's financial performance is continually assessed against industry peers, with a focus on outperforming the market through product innovation and market penetration.

H.B. Fuller's financial strategy also includes prudent capital allocation, balancing investments in organic growth with strategic mergers and acquisitions. The company maintains a history of strong cash generation, providing flexibility for strategic investments and debt reduction. Management's financial narrative is centered on delivering shareholder value through consistent earnings growth and strategic market expansion. For a deeper understanding of the competitive environment, consider reviewing the Competitors Landscape of H.B. Fuller.

The company projects net revenue between $3.5 billion and $3.6 billion for fiscal year 2024. This ambitious target reflects the company's confidence in its ability to navigate the adhesives industry trends and achieve sustainable growth.

Adjusted EBITDA is expected to be in the range of $560 million to $590 million for fiscal year 2024. This demonstrates the company's focus on profitability and operational efficiency, which is key to H.B. Fuller's business strategy.

Net revenue in Q1 2024 was $824 million, with an organic decrease of 1.6%. Despite this, the company achieved an adjusted EBITDA of $133 million, showcasing effective cost management.

H.B. Fuller's strategy involves prudent capital allocation, balancing investments in organic growth with strategic mergers and acquisitions. This approach supports long-term investment potential and market share analysis.

The company aims to expand profit margins and generate strong cash flow. These goals are crucial for funding future growth initiatives and supporting H.B. Fuller's expansion plans for the next 5 years.

Investments in R&D and strategic acquisitions are central to H.B. Fuller's growth strategy. These investments drive product innovation and enhance the company's market position in the adhesives market.

Management is committed to delivering shareholder value through consistent earnings growth and strategic market expansion. This commitment is a core part of H.B. Fuller's company analysis.

Effective cost management and operational efficiency are evident in the Q1 2024 adjusted EBITDA. This efficiency is a key factor in H.B. Fuller's competitive landscape.

The company focuses on outperforming the market through product innovation and market penetration. This strategy is essential for H.B. Fuller's future prospects.

H.B. Fuller's strong cash generation provides flexibility for strategic investments and debt reduction. This financial strength supports the company's growth in the packaging sector.

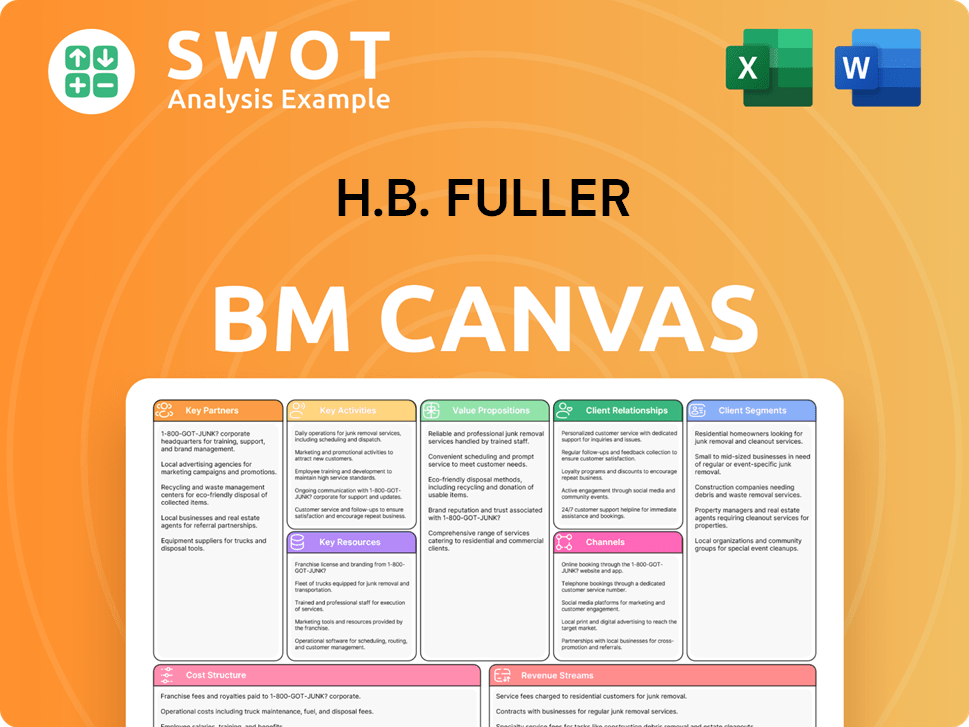

H.B. Fuller Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow H.B. Fuller’s Growth?

The path of H.B. Fuller's growth strategy and future prospects is not without its obstacles. The company faces a complex web of challenges that could impact its ability to expand and maintain its market position. Understanding these potential risks is crucial for anyone assessing the long-term investment potential of this adhesives and sealants industry leader.

Market competition is a constant pressure, with numerous global and regional players vying for market share. Regulatory shifts, particularly regarding environmental and safety standards for chemical products, present another significant hurdle. These factors necessitate a proactive approach to risk management and strategic planning to ensure sustained growth.

Supply chain vulnerabilities, including raw material price volatility and disruptions, represent a substantial risk. Technological advancements and the emergence of new bonding technologies could also disrupt established product lines. Internal resource constraints, such as talent acquisition, further complicate the landscape.

The adhesives industry is highly competitive, with both global and local players. This competition can squeeze pricing and profit margins, affecting H.B. Fuller's financial performance. The company must continually innovate and differentiate its products to stay ahead.

Evolving environmental and safety regulations for chemical products require ongoing investment. Compliance necessitates continuous R&D and operational adjustments, impacting profitability. This requires the company to be agile and responsive to regulatory changes.

Raw material price volatility and disruptions from geopolitical events or natural disasters can impede growth. H.B. Fuller's reliance on specific raw materials is a concern, despite its global manufacturing footprint. The company must manage these risks proactively.

The emergence of new bonding technologies could disrupt established product lines. Continuous innovation is essential to remain competitive. This requires significant investment in research and development to stay ahead of the curve.

Talent acquisition and retention in specialized fields can present obstacles. Securing and retaining skilled employees is critical for innovation and growth. This includes competitive compensation and development opportunities.

Increasing cybersecurity threats and data privacy concerns are emerging risks. Robust IT infrastructure and security protocols require ongoing investment. The company must protect sensitive data and systems from cyberattacks.

H.B. Fuller employs a comprehensive risk management framework. This includes diversifying its product portfolio and geographical markets to reduce risk exposure. The company also uses scenario planning to prepare for various market conditions and potential disruptions. For instance, during recent inflationary pressures and supply chain challenges, H.B. Fuller optimized its operational footprint and implemented strategic pricing.

In 2024, the company reported net revenue of approximately $3.5 billion. Navigating these challenges is crucial for maintaining and improving financial health. The company's ability to adapt to market dynamics is key to its long-term success. For further context, a Brief History of H.B. Fuller provides additional background.

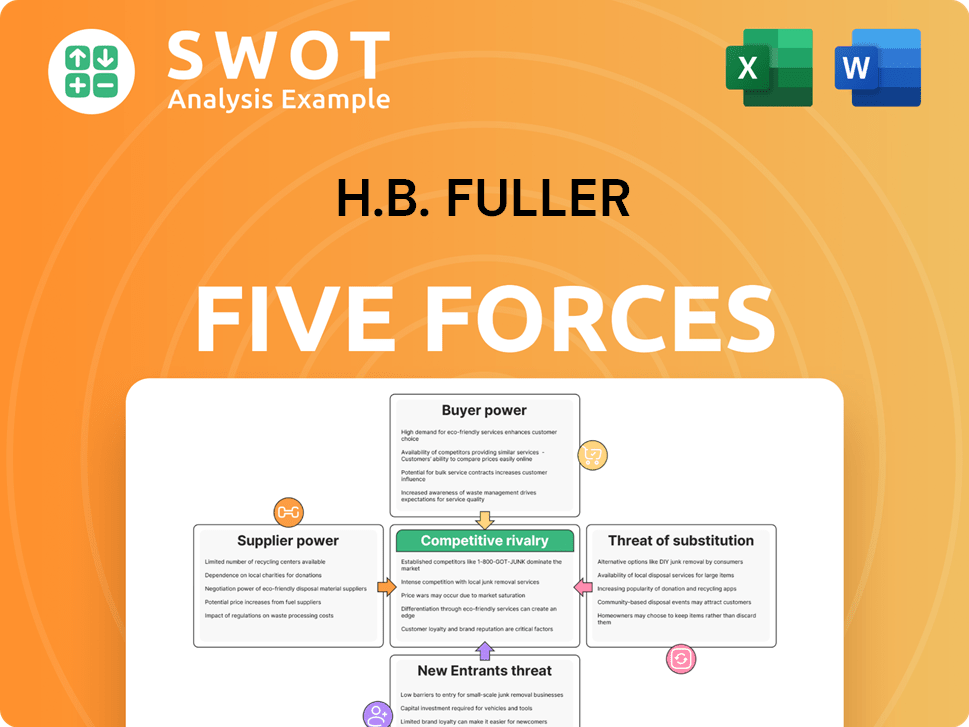

H.B. Fuller Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of H.B. Fuller Company?

- What is Competitive Landscape of H.B. Fuller Company?

- How Does H.B. Fuller Company Work?

- What is Sales and Marketing Strategy of H.B. Fuller Company?

- What is Brief History of H.B. Fuller Company?

- Who Owns H.B. Fuller Company?

- What is Customer Demographics and Target Market of H.B. Fuller Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.