Honeywell International Bundle

Can Honeywell's Bold Moves Redefine its Future?

Honeywell International Inc. is undergoing a significant transformation, splitting into three independent companies. This strategic pivot, with separations expected by late 2026, aims to unlock substantial value in the aerospace, automation, and advanced materials sectors. This bold move signals a commitment to tailored growth and enhanced focus within each specialized market, promising exciting opportunities for investors and stakeholders.

This comprehensive analysis explores Honeywell's Honeywell International SWOT Analysis, examining its growth strategy, future prospects, and strategic initiatives for 2024 and beyond. We will delve into Honeywell's expansion plans in aerospace, its investment in automation technologies, and its sustainability strategy, providing a detailed market analysis and financial performance forecast. Understanding Honeywell's competitive advantages and long-term growth potential is key to making informed decisions in today's dynamic market.

How Is Honeywell International Expanding Its Reach?

The expansion initiatives of the company, a global technology and manufacturing leader, are primarily driven by a strategic portfolio optimization. This strategy aims to create three focused, industry-leading companies: Honeywell Automation, Honeywell Aerospace, and Advanced Materials. This restructuring allows each entity to pursue tailored growth strategies, enhancing the overall Honeywell Growth Strategy.

This strategic shift is designed to unlock value by enabling each business to focus on its core strengths and market opportunities. The separation is expected to be completed in the second half of 2026 for Automation and Aerospace, and by the end of 2025 or early 2026 for Advanced Materials. This will allow for more agile responses to market dynamics and customer needs, contributing to Honeywell's Future Prospects.

The company continues to pursue strategic bolt-on acquisitions to strengthen its market position and expand its offerings. These acquisitions, combined with organic growth initiatives, are expected to drive long-term value creation for shareholders. The focus on digital transformation, sustainability, and innovation positions the company for continued success in a rapidly evolving global landscape, shaping Honeywell International's trajectory.

Honeywell Automation, with an $18 billion revenue in 2024, is centered on the transition from automation to autonomy. It focuses on linking people, assets, and processes to drive digital transformation in high-growth verticals. This includes leveraging process technology, software, and AI-enabled, autonomous solutions for productivity, sustainability, and safety.

Honeywell Aerospace, which recorded $15 billion in revenue in 2024, will continue to deliver aviation platforms through electrification and autonomy of flight. It builds on its extensive installed base and prepares for unprecedented demand in commercial and defense markets. This segment is poised to capitalize on the growing aerospace sector.

The Advanced Materials segment, with $4 billion in annual revenue, will operate as a pure-play specialty chemicals and materials business. It focuses on sustainable solutions like Solstice hydrofluoro-olefin technology. This segment is expected to drive innovation in sustainable materials and chemicals.

In 2024, the company deployed $8.9 billion in capital for acquisitions, and a record $14.6 billion in total capital deployment. In March 2025, Honeywell announced the $2.2 billion acquisition of Sundyne, which enhances its portfolio in LNG and related markets. The company plans to continue deploying capital towards high-return capital expenditures, dividends, opportunistic share purchases, and accretive acquisitions through 2025, with a commitment of at least $25 billion.

Geographically, the company is actively expanding its reach. For instance, in June 2025, the company announced collaborations in India to advance carbon capture and sustainable aviation fuel. The company also established an Unmanned Aerial Systems unit to expand into the growing UAS and urban air mobility markets. In the aerospace sector, the latest forecast in October 2024 calls for the delivery of 8,500 new business jets worth $280 billion over the next decade, with deliveries expected to increase by 12% in 2025 over 2024's anticipated total of 750 jets. North America is expected to receive two-thirds of these deliveries over the next five years, followed by Europe (13%), Latin America (10%), and Asia Pacific (7%). For more details, you can read an article about the company's performance and market position, providing a comprehensive overview of its operations and strategies Honeywell's business strategies.

The company's expansion strategy focuses on key areas such as digital transformation, sustainable solutions, and strategic acquisitions. These initiatives are designed to capitalize on emerging market opportunities and enhance its competitive advantage.

- Focus on Automation and Autonomy

- Aerospace Growth through Electrification and Autonomy

- Strategic Acquisitions to Enhance Portfolio

- Geographic Expansion, Including India and UAS Markets

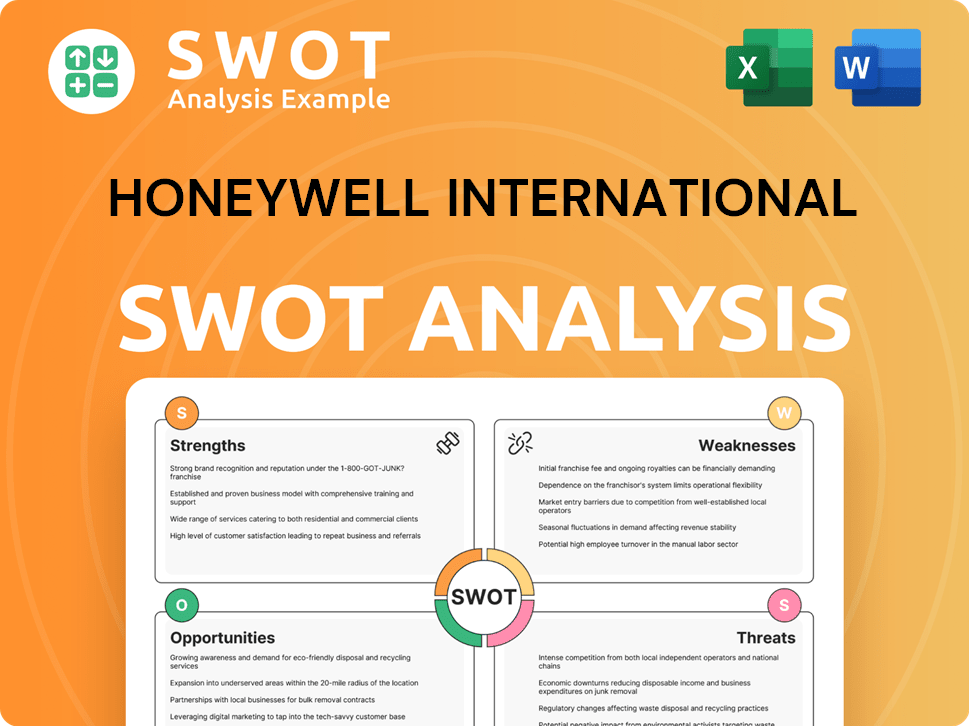

Honeywell International SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Honeywell International Invest in Innovation?

The growth strategy of Honeywell International is significantly driven by innovation and the application of advanced technologies. The company strategically aligns its business with key megatrends: automation, the future of aviation, and energy transition. These areas are supported by the Honeywell Accelerator operating system and the Honeywell Connected Enterprise software platform, which are critical to its strategic initiatives.

Honeywell's commitment to digital transformation and emerging technologies, like artificial intelligence (AI) and the Internet of Things (IoT), is core to its strategy. This approach enables the company to provide cutting-edge solutions across its diverse business segments. The company's focus on these technologies is designed to enhance operational efficiency and create new market opportunities.

Honeywell's strategic initiatives are designed to position it for sustained growth. By concentrating on these areas, the company aims to meet evolving market demands and maintain a competitive edge. This approach is reflected in its investments in research and development, as well as its strategic partnerships and acquisitions.

Honeywell is actively integrating AI and IoT across its offerings to drive digital transformation. In May 2025, the company unveiled an innovative AI Assistant. This focus is in line with the growing market demand for smart solutions.

Over 80% of retailers plan to increase their AI capabilities in 2025. This highlights a significant market opportunity for Honeywell's solutions. This shift towards AI is transforming how businesses operate.

AI is revolutionizing building operations, with solutions like Honeywell Forge helping organizations cut costs. Bluewater Health has improved operational efficiency through building maintenance. This showcases the practical applications of AI in real-world settings.

Honeywell leads in technology and systems that are shaping the future of aviation through electrification and autonomy. The company is expanding its presence in the aerospace sector. This includes partnerships and technological advancements.

In January 2025, Honeywell and NXP expanded their partnership to accelerate next-generation aviation technology. This collaboration is crucial for advancing innovation in the industry. The partnership focuses on developing new technologies.

Honeywell's cockpit technologies were selected by Avianca for its new Airbus A320neo fleet in October 2024. This demonstrates the company's commitment to providing actionable solutions. The company's technologies are used by major airlines.

Honeywell is heavily invested in sustainability and energy transition technologies. This includes initiatives like sustainable aviation fuel (SAF) and carbon capture projects. These efforts demonstrate the company's commitment to environmental responsibility and long-term growth potential.

- In June 2025, Taiyo Oil selected Honeywell's Ethanol To Jet Technology for SAF production.

- Honeywell and AM Green are collaborating on carbon capture and SAF in India, with a feasibility study expected by mid-2025.

- ExxonMobil's low-carbon hydrogen project will incorporate Honeywell technology for carbon capture and storage.

- These initiatives are part of Owners & Shareholders of Honeywell International's focus on sustainable growth and innovation.

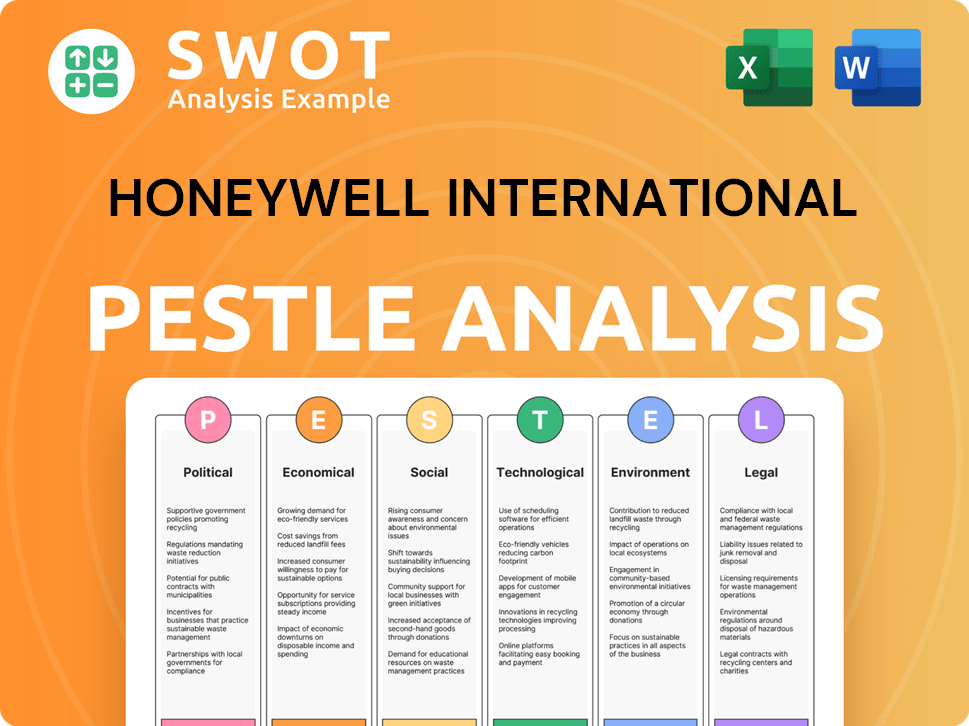

Honeywell International PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Honeywell International’s Growth Forecast?

The financial outlook for Honeywell International in 2025 suggests continued expansion and strategic evolution. The company anticipates solid sales figures and organic growth, driven by strategic initiatives and market opportunities. These projections reflect a positive trajectory for Honeywell's business segments and overall performance.

Honeywell's strategic focus on key areas such as building automation, energy solutions, and aerospace is expected to contribute significantly to its financial results. The company's commitment to deploying capital towards high-return investments and acquisitions further supports its growth strategy. This approach is designed to enhance shareholder value and solidify Honeywell's position in the market.

In the first quarter of 2025, Honeywell demonstrated strong performance, exceeding expectations in sales and adjusted EPS. This positive start to the year, coupled with a growing backlog, sets a favorable tone for the rest of the year. The company's ability to innovate and adapt to market demands is crucial for its future prospects.

Honeywell projects sales between $39.6 billion and $40.5 billion for 2025. This forecast indicates the company's expectation for continued market presence and revenue growth.

Organic sales growth is anticipated to be between 2% and 5% in 2025. This growth reflects Honeywell's ability to expand its market share and increase sales organically.

Honeywell expects segment margin to be in the range of 23.2% to 23.5% in 2025. The company anticipates an expansion of 60 to 90 basis points year over year, indicating improved profitability.

Adjusted earnings per share (EPS) for 2025 are projected to be between $10.20 and $10.50. This represents a 3% to 6% increase year-over-year from the 2024 adjusted EPS of $9.89.

Honeywell's strategic initiatives, including investments in automation technologies and expansion in emerging markets, are key drivers of its Honeywell growth strategy. The company's focus on sustainability and digital transformation further supports its long-term growth potential. For deeper insights into Honeywell's core values and mission, explore the article Mission, Vision & Core Values of Honeywell International.

In Q1 2025, Honeywell reported sales of $9.8 billion, an 8% increase year-over-year. Organic sales growth was 4%, exceeding prior guidance, demonstrating strong market performance.

Adjusted EPS for Q1 2025 was $2.51, surpassing the high end of guidance by $0.26. This strong performance reflects efficient operations and strategic financial management.

The company's backlog grew 8% excluding acquisitions. This growth, driven by Building Automation and Energy and Sustainability Solutions, indicates future revenue potential.

Honeywell projects operating cash flow for 2025 to be between $6.7 billion and $7.1 billion. This projection highlights the company's strong cash generation capabilities.

Free cash flow is expected to be between $5.4 billion and $5.8 billion in 2025. This underscores the company's financial flexibility and ability to invest in growth.

In 2024, Honeywell deployed a record $14.6 billion of capital, including $8.9 billion for acquisitions. The company is on track to deploy at least $25 billion through 2025.

Analysts have a consensus rating of 'Buy' for Honeywell stock in 2025. The average twelve-month price target is $245.57, with a high forecast of $298.00, reflecting positive market sentiment.

- The consensus EPS forecast for the fiscal year ending December 2025 is $10.38.

- These forecasts indicate confidence in Honeywell's ability to achieve its financial goals.

- Honeywell's market analysis suggests a positive outlook for the company.

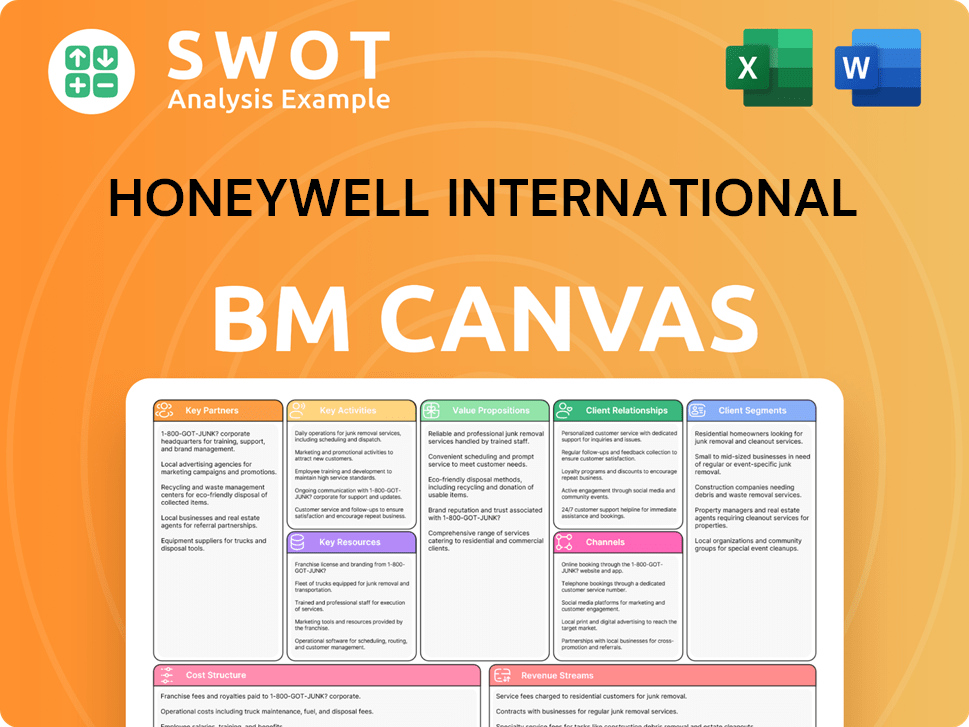

Honeywell International Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Honeywell International’s Growth?

The growth strategy of the Honeywell Company is subject to several potential risks and obstacles. These challenges span market competition, regulatory changes, supply chain issues, and technological disruption. Navigating these complexities requires proactive risk management and strategic adaptation.

Market dynamics, particularly in segments like industrial automation, present ongoing hurdles. External factors such as geopolitical risks and internal resource constraints also influence the company's trajectory. Understanding these potential challenges is crucial for assessing Honeywell's future prospects.

Honeywell International faces a multifaceted risk landscape that demands strategic agility. The company's ability to mitigate these risks will be critical for sustaining its growth and achieving its strategic objectives. This includes adapting to market changes and leveraging its core strengths.

Honeywell's diversified business faces intense competition across various sectors. The Aerospace Technologies segment showed strong performance, with organic sales up 9% year-over-year in Q4 2024. However, the Industrial Automation segment experienced a 5% organic sales decrease in Q3 2024 due to volume softness.

Regulatory changes and geopolitical risks, such as tariffs, pose significant obstacles. The company faces an estimated $500 million annual tariff burden, with 60-70% linked to Chinese imports. Despite these challenges, Honeywell has revised its 2025 profit forecast upward.

Supply chain issues, though improving, have historically affected business jet deliveries. While improvements are enabling production rate increases, continued vigilance is necessary. For example, business jet deliveries were affected between 2020 and 2023.

Technological disruption is an ongoing risk, requiring continuous investment in R&D and strategic partnerships. Honeywell is focusing on digital transformation, AI, and IoT to maintain a competitive edge. The rapid pace of technological advancement necessitates constant adaptation.

Internal resource constraints, such as attracting and retaining skilled talent, could impact growth. Honeywell's management addresses these risks through various strategies, including portfolio diversification. The planned separation into three independent companies is part of this strategy.

Honeywell's risk management includes portfolio diversification and a 'prudent guidance posture' for 2025. The company's consistent capital deployment strategy, including share repurchases and accretive acquisitions, enhances shareholder value. These measures help strengthen its market position.

The company's strategic initiatives include a focus on digital transformation and AI to counter technological disruptions. Honeywell is investing heavily in R&D and forming strategic partnerships to stay competitive. These efforts are designed to drive Honeywell's growth strategy.

The Aerospace Technologies segment has shown strong performance, with aerospace sales up 18% in Q1 2024. Honeywell is focusing on expanding its presence in the aerospace sector. This expansion is a key component of Honeywell's business strategy.

Honeywell's digital transformation strategy focuses on incorporating AI and IoT across its operations. This strategy aims to improve efficiency and create new revenue streams. For more information, check out the Brief History of Honeywell International.

The company's long-term growth potential is influenced by its ability to adapt to market changes and manage risks. Honeywell is focused on strategic initiatives and capital deployment to achieve sustainable growth. This includes investment in automation technologies.

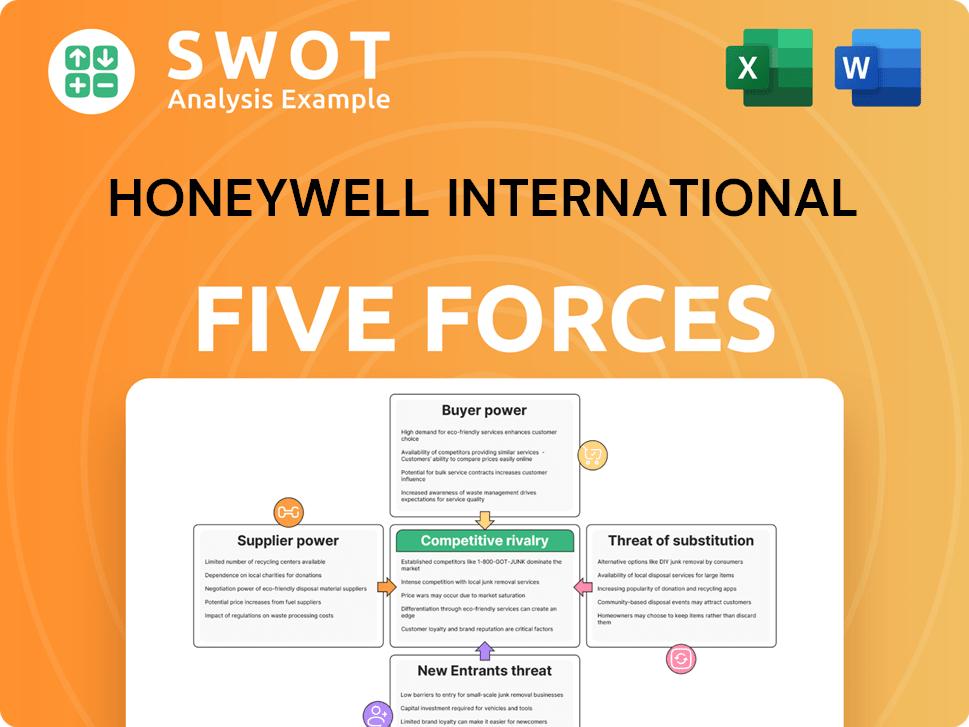

Honeywell International Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Honeywell International Company?

- What is Competitive Landscape of Honeywell International Company?

- How Does Honeywell International Company Work?

- What is Sales and Marketing Strategy of Honeywell International Company?

- What is Brief History of Honeywell International Company?

- Who Owns Honeywell International Company?

- What is Customer Demographics and Target Market of Honeywell International Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.