Infineon Technologies Bundle

Can Infineon Technologies Continue Its Semiconductor Dominance?

Infineon Technologies, a powerhouse in the semiconductor industry, has consistently adapted to evolving technology trends since its spin-off from Siemens AG in 1999. With a global presence and a focus on diverse applications, from automotive to industrial solutions, Infineon has solidified its position as a market leader. The company's impressive growth, including a €15 billion revenue in fiscal year 2024, underscores its robust Infineon Technologies SWOT Analysis and strategic vision.

Infineon's recent acquisition of Marvell's Automotive Ethernet business for $2.5 billion is a clear indication of its ambitious Growth Strategy and commitment to strengthening its position in the automotive sector. This strategic move, alongside its existing dominance in microcontrollers, positions Infineon for significant Future Prospects in high-growth areas like electric vehicles and renewable energy. A thorough Market Analysis reveals how Infineon is poised to capitalize on emerging opportunities and maintain its competitive edge in the dynamic semiconductor landscape.

How Is Infineon Technologies Expanding Its Reach?

Infineon Technologies' Growth Strategy centers on strengthening its core business through strategic expansions. This involves leveraging its Product to System (P2S) approach and in-house manufacturing capabilities. The company is also focused on capitalizing on high-growth markets such as Gallium Nitride (GaN), Silicon Carbide (SiC), and IoT through acquisitions and R&D investments. This approach aims to solidify its position as a leading Semiconductor Company.

The company is actively pursuing international expansion, particularly in India. This includes plans to significantly increase its workforce and revenue. These initiatives are designed to enhance its global footprint and cater to the increasing demand for its products and solutions. Market Analysis indicates a strong potential for growth in these strategic areas.

Infineon's expansion strategy is multifaceted, involving both organic growth and strategic partnerships. These initiatives are crucial for long-term sustainability and competitive advantage within the evolving semiconductor industry. The company is adapting its capital expenditures to align with current market conditions and future growth prospects.

Infineon aims to double its workforce in India, from 2,500 to 5,000 employees by 2030. The goal is to achieve $1 billion in revenue within the same period. This expansion primarily focuses on R&D and software-related work through its Global Capability Centres (GCCs) in Bengaluru and Ahmedabad.

A significant manufacturing partnership with Continental Device India Limited (CDIL) has been established. This partnership will supply silicon wafers for power chip manufacturing. The collaboration aims to leverage local expertise and boost local manufacturing capabilities in India. This strategic move supports the Infineon Technologies' growth.

Infineon broke ground for a new backend production site in Samut Prakan, Thailand, on January 14, 2025. This site is designed to meet the growing demand for power modules. The expansion supports overall growth while maintaining competitive costs. This expansion is a key part of Infineon Technologies' strategic plan.

Capital expenditures for fiscal year 2025 are reduced to approximately €2.3 billion, down from the previously planned €2.5 billion. The second-phase expansion of the new fab in Kulim, Malaysia, has been delayed. These adjustments reflect the company's response to current market conditions.

Infineon's Future Prospects are bolstered by strategic investments and innovative approaches. The company is committed to expanding its footprint in key markets. This includes a focus on R&D and acquisitions to stay ahead of Technology Trends.

- Emphasis on high-growth markets like GaN and SiC.

- Strategic partnerships to enhance manufacturing capabilities.

- Adjustments in capital expenditure to align with market conditions.

- Continued investment in R&D and innovation.

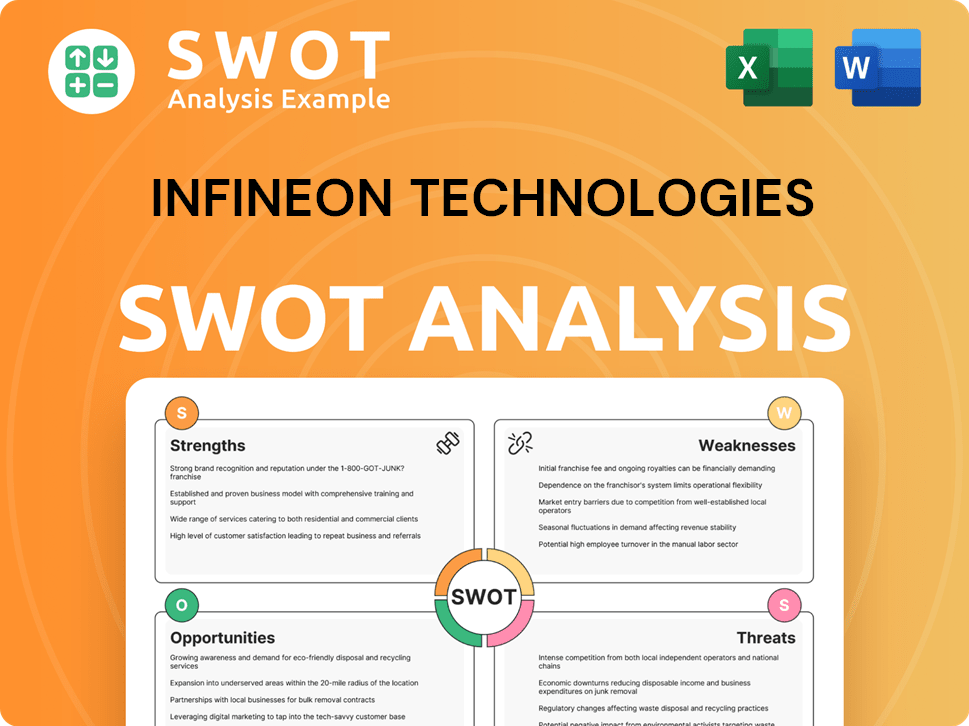

Infineon Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Infineon Technologies Invest in Innovation?

The innovation and technology strategy of Infineon Technologies is a key driver of its sustained growth, particularly in the areas of digitalization and decarbonization. This focus enables the company to address evolving market demands and capitalize on emerging opportunities within the semiconductor industry. The company's strategic investments in research and development, coupled with its mastery of essential materials, position it to maintain a competitive edge.

Infineon's approach to technology emphasizes its commitment to long-term growth drivers such as artificial intelligence. This is reflected in its development of AI power solutions and its strategic acquisitions, which are designed to strengthen its product offerings and expand its market reach. The company's proactive stance in these areas is crucial for navigating the dynamic landscape of the semiconductor market.

Infineon's dedication to innovation is evident in its significant investments in R&D and in-house development. These investments are aimed at bolstering its product portfolio and expanding its market share. The company's focus on key materials like Silicon (Si), Silicon Carbide (SiC), and Gallium Nitride (GaN) enables it to offer a comprehensive range of products that cater to diverse applications.

Infineon plans to invest approximately €2.5 billion in fiscal year 2025 in R&D. This investment will focus on completing its fourth manufacturing module in Dresden, Germany, specifically for smart power technologies. These investments are crucial for the company's future growth.

AI power solutions are expected to contribute €500 million in revenue in 2025. This figure has the potential to double to €1 billion within the next 2-3 years. These solutions are vital for AI data centers.

Infineon became the global market leader in microcontrollers in 2024. The company increased its market share to 21.3% from 17.8% in 2023. This market leadership is a significant achievement.

The acquisition of Marvell's Automotive Ethernet business is expected to generate $225-$250 million in revenue in calendar year 2025. This acquisition strengthens Infineon's system offerings for software-defined vehicles. It also has potential applications in humanoid robots and physical AI.

Infineon's mastery of key materials, including Silicon (Si), Silicon Carbide (SiC), and Gallium Nitride (GaN), enables a comprehensive product portfolio. These materials are essential for various applications.

Infineon's strategic acquisitions, such as Marvell's Automotive Ethernet business, are vital for expanding its market reach and product offerings. These acquisitions are part of the company's growth strategy.

The company's focus on innovation and technology is a core element of its target market strategy. This approach allows Infineon to address the evolving needs of its customers and maintain a strong position in the competitive semiconductor market. The company's investments in R&D and strategic acquisitions are key to its continued success and future prospects. The company's focus on AI power solutions and its leadership in microcontrollers highlight its commitment to innovation and its ability to capitalize on emerging technology trends.

Infineon's innovation strategy centers on digitalization and decarbonization, driving growth through advanced technologies and strategic investments. The company is focusing on several key areas to maintain its competitive edge and capitalize on market opportunities.

- AI Power Solutions: Expected to generate significant revenue, with potential for substantial growth in the coming years.

- Microcontroller Leadership: Increased market share, solidifying its position in the global market.

- Strategic Acquisitions: Enhancing product offerings and expanding market reach, particularly in the automotive sector.

- R&D Investments: Significant financial commitments to develop advanced manufacturing capabilities and new technologies.

- Focus on Key Materials: Leveraging expertise in Si, SiC, and GaN to create a comprehensive product portfolio.

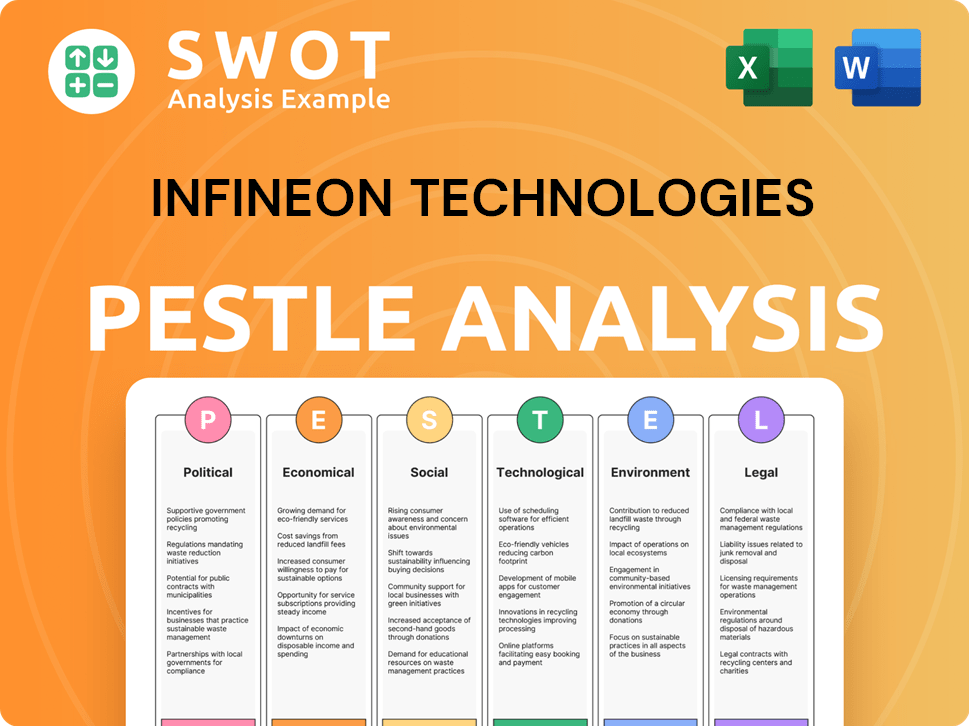

Infineon Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Infineon Technologies’s Growth Forecast?

Analyzing the financial outlook for Infineon Technologies, a leading Semiconductor Company, reveals key insights into its Growth Strategy and Future Prospects. The company's performance and strategic decisions are crucial for understanding its position in the market and potential for growth. This analysis incorporates the latest financial data and market trends to provide a comprehensive view of Infineon's trajectory.

The financial landscape for Infineon Technologies is shaped by various factors, including global economic conditions, technological advancements, and competitive dynamics. Understanding these elements is essential for evaluating the company's performance and making informed investment decisions. This overview provides a detailed look at Infineon's financial health and future outlook.

For Q1 FY2025 (ended December 31, 2024), Infineon reported a revenue of €3.424 billion, a segment result of €573 million, and a segment result margin of 16.7%. The company's performance in this period sets the stage for the rest of the fiscal year. The following are the key highlights and projections for the company.

Infineon anticipates revenue of around €3.6 billion for Q2 FY2025. The company expects a segment result margin in the mid-teens percentage range. This projection indicates a steady performance, building on the results of the previous quarter.

Initially, Infineon expected flat to slightly increased revenue for FY2025 compared to FY2024. The outlook was later revised to a 'slight decline'. This adjustment reflects the current market conditions and strategic decisions. The revision also accounts for potential trade disruptions.

The adjusted gross margin is projected to be around 40%. The segment result margin is expected to be in the mid-to-high-teens percentage range. These margins are crucial indicators of the company's profitability and operational efficiency.

Investments for FY2025 are planned at approximately €2.3 billion, down from an earlier €2.5 billion. Adjusted Free Cash Flow is forecast to be about €1.6 billion, and reported Free Cash Flow around €900 million. These figures highlight the company's financial priorities and cash management strategies.

Despite the revised outlook, analysts predict that Infineon Technologies will experience revenue growth. The company is expected to grow revenues at a CAGR of 6.1% between 2025E and 2032E, with a long-term growth rate of 2.0%. The company's shares have underperformed semiconductor peers, down approximately 12% since January 2024. For a deeper understanding of the company's origins, you can refer to Brief History of Infineon Technologies.

The Market Analysis of Infineon Technologies involves assessing its position within the Semiconductor Company industry. This includes evaluating Market Share, competitive advantages, and Technology Trends. Understanding the market dynamics is crucial for making informed investment decisions.

Infineon Technologies' Financial Performance is a key factor in evaluating its Investment Potential. This includes analyzing revenue growth, profitability, and cash flow. The company's ability to generate sustainable financial results is critical for long-term success.

The Growth Strategy of Infineon Technologies involves strategic initiatives to expand its market presence and increase revenue. This includes product innovation, strategic acquisitions, and expansion into new markets. The company's ability to execute its growth strategy is crucial for its future success.

The Future Prospects for Infineon Technologies are influenced by factors such as Technology Trends and market demand. The company's ability to adapt to these changes and capitalize on new opportunities will determine its long-term success. The company's Product Portfolio is a key driver of future growth.

Understanding the Competitive Landscape is essential for assessing Infineon Technologies' position in the market. This includes analyzing the strengths and weaknesses of competitors and identifying opportunities for differentiation. The company's ability to maintain a competitive edge is critical.

Strategic Acquisitions play a significant role in Infineon Technologies' Growth Strategy. These acquisitions allow the company to expand its product portfolio and enter new markets. This strategy can enhance the company's Innovation and Development capabilities.

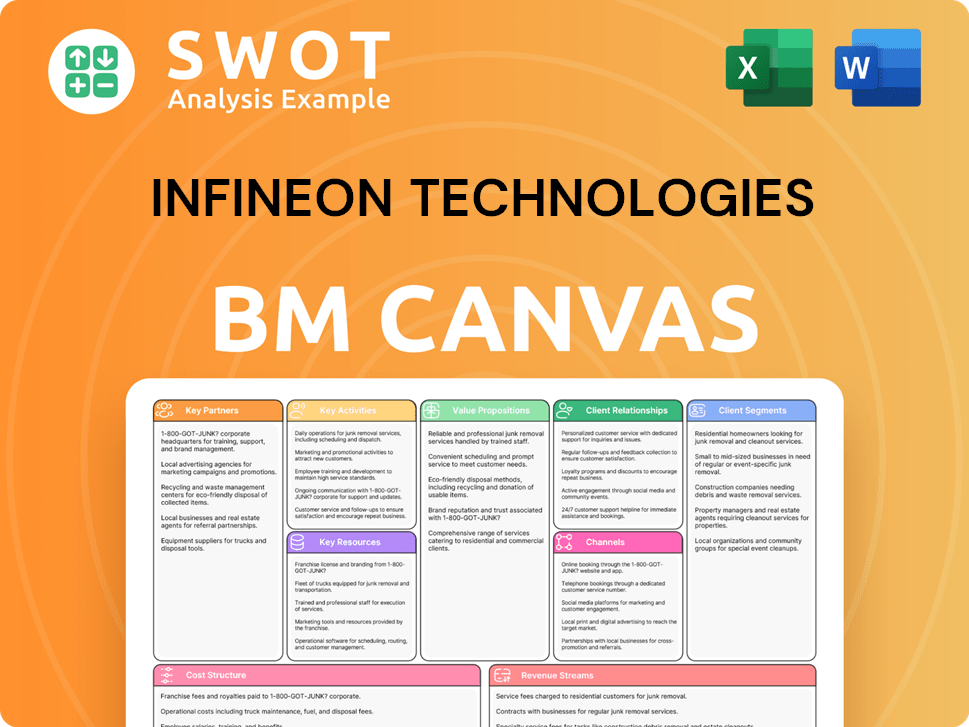

Infineon Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Infineon Technologies’s Growth?

The Semiconductor Company Infineon Technologies faces several potential risks and obstacles that could impact its Growth Strategy and overall Future Prospects. These challenges range from market-specific downturns to broader geopolitical and economic uncertainties. Understanding these risks is crucial for investors and stakeholders assessing the company's long-term viability and potential for growth.

A primary concern revolves around the subdued demand in key markets like automotive, industrial applications, and consumer electronics. This is compounded by high inventory levels across the supply chain, which is delaying the cyclical recovery. Furthermore, shifts in government policies and global trade dynamics add another layer of complexity, necessitating proactive risk management strategies.

The rollback of EV targets in the US and the suspension of subsidies could further slow EV adoption, a critical growth driver for Infineon. Intense market competition and product commoditization also pose threats. Supply chain vulnerabilities and geopolitical tensions, particularly related to Taiwan and the relationship between the USA and China, represent significant risks.

Weak demand in automotive, industrial, and consumer electronics markets poses a significant risk. Elevated inventory levels and a delayed cyclical recovery are exacerbating this issue. This can lead to reduced sales volumes and slower revenue growth for Infineon Technologies.

The EV market is a crucial growth area, but it faces uncertainties. The rollback of EV targets and subsidy suspensions in the US could slow EV adoption. This directly impacts Infineon Technologies' revenue stream from automotive semiconductors.

Intense competition and product commoditization threaten profit margins. As products become more standardized, it becomes harder for Infineon Technologies to differentiate its offerings. This can lead to price pressures and reduced profitability.

Supply chain vulnerabilities, especially those related to Taiwan, present major risks. Geopolitical tensions and trade disputes can disrupt the flow of components. This can lead to production delays and increased costs for Infineon Technologies.

Geopolitical tensions, particularly between the U.S. and China, can significantly affect Infineon Technologies. Tariff disputes and trade restrictions can lead to revised revenue outlooks and impact market access. The company's production footprint, largely based in Europe and Southeast Asia, helps to mitigate some of the potential risks from changing U.S. trade policies toward China.

Subdued demand can lead to margin compression if manufacturing capacity is underutilized. Fixed costs remain, even when sales decline. This can reduce profitability and impact financial performance, as seen in the Q4 forecasts where a 10% revenue haircut was applied.

To mitigate these risks, Infineon Technologies is implementing several strategies. These include cost control measures to manage expenses effectively. Diversifying its market presence across different regions and sectors can reduce dependence on any single market. Strategic partnerships are also vital for expanding market reach and accessing new technologies.

The company's financial performance is closely tied to its ability to navigate these challenges. The impact of subdued demand and geopolitical tensions has already led to adjustments in revenue forecasts. For more details on the Infineon Technologies business model and revenue streams, you can refer to this article: Revenue Streams & Business Model of Infineon Technologies.

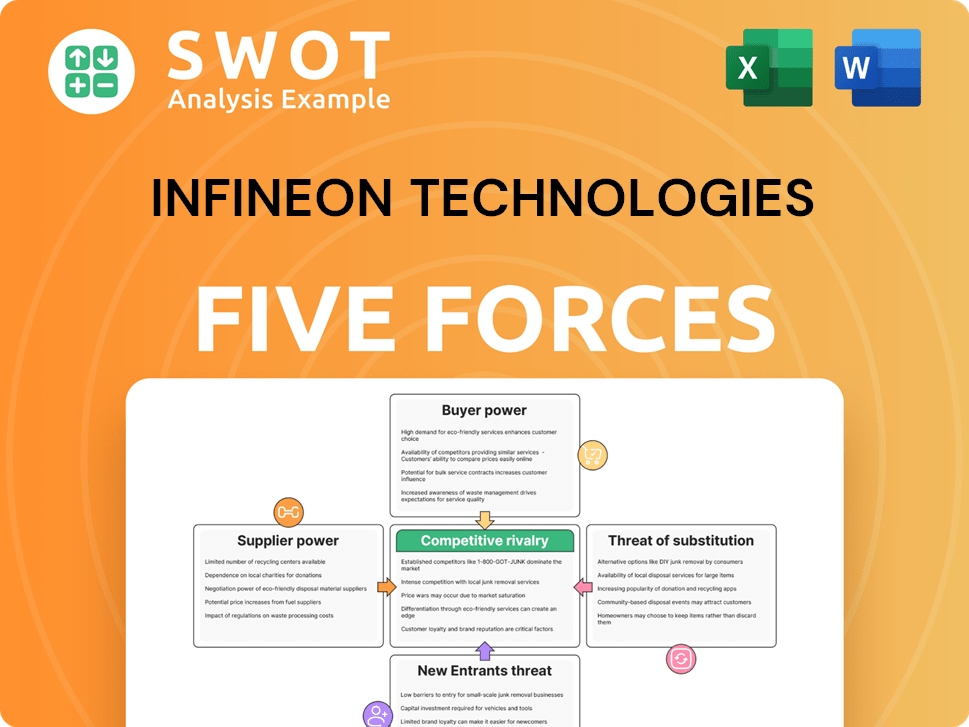

Infineon Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Infineon Technologies Company?

- What is Competitive Landscape of Infineon Technologies Company?

- How Does Infineon Technologies Company Work?

- What is Sales and Marketing Strategy of Infineon Technologies Company?

- What is Brief History of Infineon Technologies Company?

- Who Owns Infineon Technologies Company?

- What is Customer Demographics and Target Market of Infineon Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.