Infineon Technologies Bundle

How Does Infineon Technologies Power the Future?

Infineon Technologies, a leading semiconductor company, is a cornerstone of modern technology, enabling everything from electric vehicles to smart homes. With a strong financial performance, including impressive revenue figures, this Infineon Technologies SWOT Analysis can give you a better understanding of the company. Its innovative products are essential for addressing key global challenges such as energy efficiency and security.

Infineon, a prominent chip manufacturer, has demonstrated significant growth, making it a compelling subject for investors and industry analysts. Understanding the Infineon Technologies SWOT Analysis, business model, and strategic moves is crucial for anyone looking to navigate the complexities of the semiconductor industry. From its history to its future outlook, this analysis will provide a comprehensive overview of how this semiconductor company operates and thrives.

What Are the Key Operations Driving Infineon Technologies’s Success?

Infineon Technologies, a leading semiconductor company, creates value by designing, developing, manufacturing, and marketing a wide array of semiconductor and system solutions. The Infineon company primarily focuses on power systems and IoT, automotive, and industrial applications. Its core offerings include power semiconductors, microcontrollers, sensors, and security ICs. These products serve diverse customer segments, including automotive manufacturers, industrial equipment producers, and consumer electronics companies.

The operational processes supporting these offerings are vertically integrated, encompassing research and development, wafer fabrication, assembly and testing, and global sales and distribution. Infineon operates a global manufacturing footprint with both front-end (wafer fabrication) and back-end (assembly and test) facilities. The company's commitment to innovation is evident in its substantial investment in R&D.

Infineon's supply chain is robust, utilizing strategic partnerships and a broad distribution network to ensure timely delivery of its critical components. What sets Infineon apart is its deep expertise in power management and security, coupled with a strong focus on application-specific solutions. This focus allows the company to offer highly efficient and reliable products that translate into tangible customer benefits.

Infineon's main products include power semiconductors (MOSFETs, IGBTs, diodes), microcontrollers, sensors, and security ICs. These are crucial components in various applications, from automotive systems to industrial equipment and consumer electronics. The company's product portfolio is designed to meet the evolving needs of its diverse customer base, offering cutting-edge technology and reliable performance.

Infineon's value proposition centers on delivering highly efficient and reliable products that enhance energy efficiency, safety, and security. This is achieved through its expertise in power management and security, combined with a focus on application-specific solutions. This approach allows Infineon to offer tangible benefits to its customers, improving their products' performance and reliability.

Infineon has a global manufacturing footprint, with significant sites in locations like Dresden and Kulim. This extensive network includes both front-end (wafer fabrication) and back-end (assembly and test) facilities. The company's strategic approach to manufacturing supports its ability to meet the demands of its global customer base efficiently.

Infineon invests heavily in research and development, with approximately 13% of its revenue allocated to R&D in fiscal year 2023. This commitment to innovation drives the development of advanced technologies and solutions. This focus on innovation is crucial for maintaining its competitive edge in the semiconductor market.

Infineon's strategic advantages include its strong position in power management and security, a vertically integrated operational model, and a robust supply chain. These factors enable the company to deliver high-quality products and solutions to its customers. Furthermore, its focus on application-specific solutions allows it to cater to the unique needs of various industries.

- Deep expertise in power management and security.

- Vertically integrated operations.

- Strong focus on application-specific solutions.

- Robust supply chain and global distribution network.

For a deeper dive into the competitive landscape, consider exploring the Competitors Landscape of Infineon Technologies.

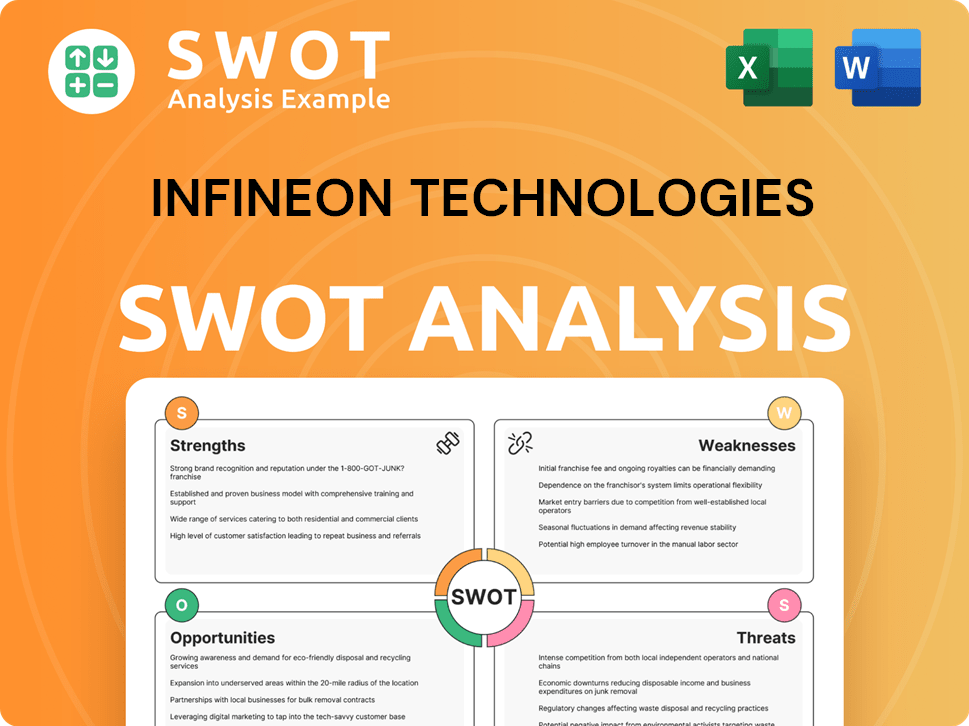

Infineon Technologies SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Infineon Technologies Make Money?

Infineon Technologies, a leading semiconductor company, generates revenue primarily through the sale of its semiconductor products and system solutions. The company operates across four main segments: Automotive (ATV), Green Industrial Power (GIP), Power & Sensor Systems (PSS), and Connected Secure Systems (CSS). Understanding the revenue streams and monetization strategies of the Infineon company is crucial for investors and stakeholders.

The monetization strategy of Infineon revolves around the sale of high-value components. These components are critical for the performance and functionality of end-user applications. Infineon also engages in licensing its intellectual property, though this contributes a smaller portion to the overall revenue. The company's focus on key markets like electromobility and renewable energy allows it to capitalize on increasing demand for its specialized semiconductor solutions.

In fiscal year 2023, the Automotive segment was the largest contributor to Infineon Technologies' revenue, accounting for approximately €7.87 billion, or about 48% of the total. The Green Industrial Power segment brought in €2.34 billion (14%), Power & Sensor Systems contributed €3.56 billion (22%), and Connected Secure Systems generated €2.51 billion (15%). This demonstrates the diversified revenue streams of Infineon, with a strong emphasis on the automotive sector.

Infineon's business model is heavily reliant on product sales, particularly in the automotive and industrial sectors. The company's ability to secure design wins and foster strong customer relationships ensures consistent product sales. The shift in revenue mix towards higher-growth segments, like automotive and green industrial power, reflects strategic investments and market positioning. For more insights into the company's ownership structure, you can read Owners & Shareholders of Infineon Technologies.

- Product Sales: The primary revenue stream comes from selling semiconductor products and system solutions.

- Strategic Focus: Targeting megatrends like electromobility and renewable energy to drive demand.

- Customer Relationships: Strong relationships lead to securing design wins and ensuring sales.

- Segment Performance: The automotive segment is the largest revenue generator, followed by green industrial power.

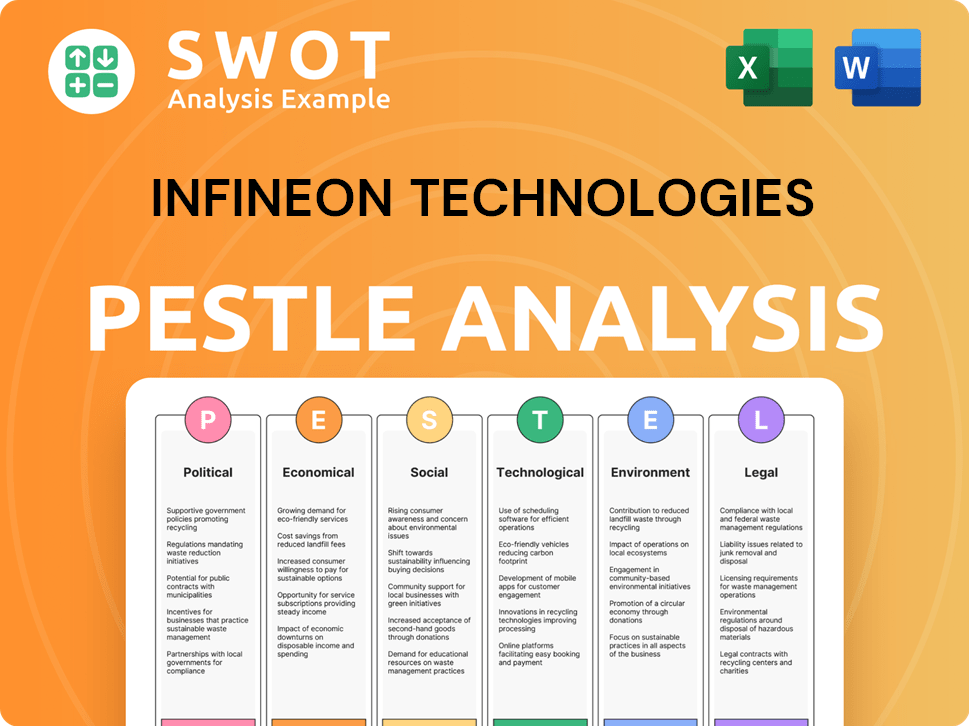

Infineon Technologies PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Infineon Technologies’s Business Model?

The trajectory of Infineon Technologies, a leading semiconductor company, has been marked by strategic milestones and significant moves, particularly its focus on high-growth markets. A critical strategic move was the acquisition of Cypress Semiconductor in 2020. This acquisition significantly strengthened Infineon's position in microcontrollers, connectivity, and software, especially for IoT and automotive applications. This expansion of its product portfolio and market reach has been instrumental in driving revenue growth, particularly within the Connected Secure Systems segment.

Infineon has consistently invested in expanding its manufacturing capacity to meet the surging demand for power semiconductors. The opening of its new 300-millimeter wafer fab in Kulim, Malaysia, in early 2024, exemplifies this commitment. This expansion is crucial for enhancing Infineon's supply chain resilience, allowing it to better serve its global customer base. The company's ability to navigate operational challenges, such as global supply chain disruptions and geopolitical uncertainties, through strategic capacity investments and diversified sourcing, has also been a key factor in its success.

Infineon's competitive advantages are rooted in its technological leadership in power semiconductors and microcontrollers, its extensive patent portfolio, and deep customer relationships across key industries. The company's focus on energy efficiency, mobility, and security provides a sustainable competitive edge as these themes become increasingly critical globally. The company's commitment to innovation is evident in its substantial R&D investments, reaching €2.25 billion in fiscal year 2023, representing 13.8% of its revenue. This continuous investment allows Infineon to maintain its leadership in developing next-generation semiconductor solutions. To learn more about their strategic approach, consider exploring the Growth Strategy of Infineon Technologies.

The acquisition of Cypress Semiconductor in 2020 was a major strategic move, significantly expanding Infineon's capabilities in microcontrollers and connectivity.

Infineon consistently invests in expanding its manufacturing capacity, exemplified by the new 300-millimeter wafer fab in Kulim, Malaysia, opened in early 2024.

Infineon's strengths lie in its technology leadership in power semiconductors and microcontrollers, its extensive patent portfolio, and strong customer relationships.

The company's R&D expenses reached €2.25 billion in fiscal year 2023, reflecting a commitment to developing next-generation semiconductor solutions.

Infineon's competitive edge is built on several key pillars, including technological leadership and a strong focus on innovation. The company's ability to navigate market challenges and capitalize on growth opportunities further enhances its position.

- Technological Leadership: Strong in power semiconductors and microcontrollers.

- Strategic Investments: Consistent investment in R&D and manufacturing capacity.

- Market Focus: Targeting energy efficiency, mobility, and security markets.

- Customer Relationships: Deep relationships across key industries.

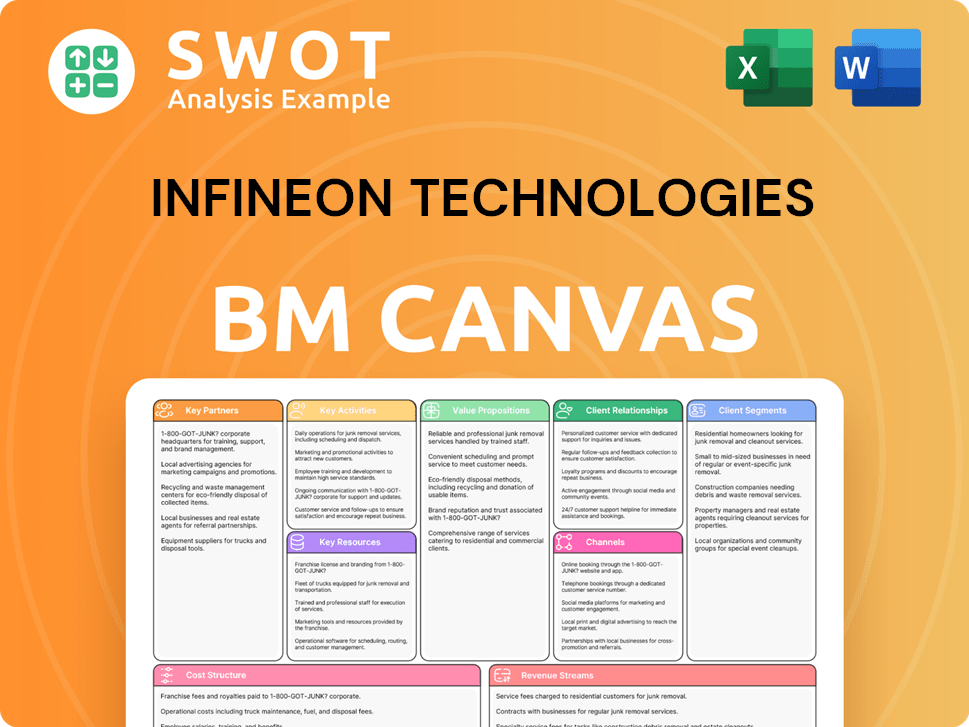

Infineon Technologies Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Infineon Technologies Positioning Itself for Continued Success?

The semiconductor industry is a dynamic landscape, and Infineon Technologies (Infineon) strategically positions itself as a leading player. The Infineon company is recognized for its strong market presence, particularly in power semiconductors and automotive semiconductors. This positions the company to capitalize on the growing demand for efficient and reliable electronic components across various sectors. You can learn more about the Target Market of Infineon Technologies.

However, Infineon, like any major chip manufacturer, faces several risks. These include economic downturns, geopolitical tensions impacting supply chains, and intense competition. Rapid technological advancements necessitate continuous innovation to maintain a competitive edge. Furthermore, regulatory changes, especially those related to environmental standards, could impact operations.

Infineon is a global leader in power semiconductors and a top automotive semiconductor supplier. Its extensive global reach includes significant revenue contributions from Asia, Europe, and the Americas. The company's strong market share and customer loyalty demonstrate its robust position in critical sectors.

Key risks include economic downturns, geopolitical tensions, and intense competition. Rapid technological advancements and regulatory changes also pose challenges. The cyclical nature of the semiconductor industry adds to the inherent risks faced by the Infineon company.

Infineon is focusing on electromobility, renewable energy, and the Internet of Things. The company is investing in wide bandgap materials like SiC and GaN. Infineon aims for a long-term revenue growth rate of 9% to 12% per annum.

In fiscal year 2023, Infineon reported revenue of approximately €16.3 billion. The company's continued focus on innovation and capacity expansion supports its financial goals. Infineon's strategic initiatives are designed to enhance long-term profitability.

Infineon's strategic focus is on sustainable revenue growth by leveraging megatrends and expanding its product portfolio. The company emphasizes innovation in wide bandgap semiconductors to enhance efficiency and performance.

- Electromobility: Expanding its automotive semiconductor offerings.

- Renewable Energy: Providing solutions for solar and wind power systems.

- Internet of Things (IoT): Developing semiconductors for connected devices.

- Capacity Expansion: Investing in manufacturing capabilities to meet growing demand.

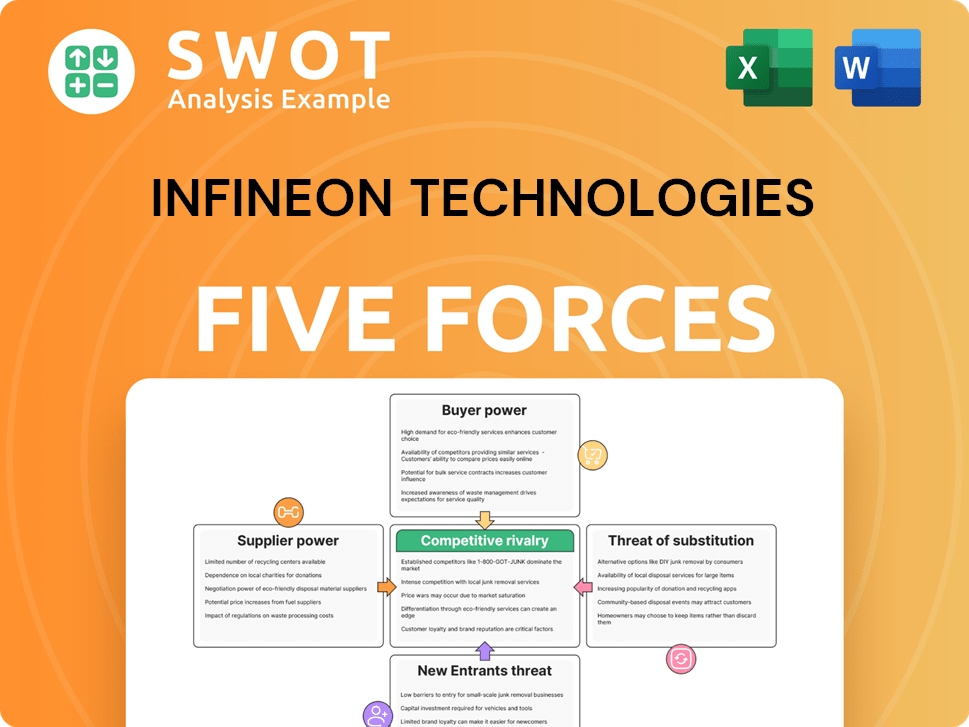

Infineon Technologies Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Infineon Technologies Company?

- What is Competitive Landscape of Infineon Technologies Company?

- What is Growth Strategy and Future Prospects of Infineon Technologies Company?

- What is Sales and Marketing Strategy of Infineon Technologies Company?

- What is Brief History of Infineon Technologies Company?

- Who Owns Infineon Technologies Company?

- What is Customer Demographics and Target Market of Infineon Technologies Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.