Infosys Bundle

Can Infosys Maintain Its Tech Titan Status?

Infosys, a pioneer in the IT industry, has charted an impressive course since its inception in 1981. From a modest startup to a global powerhouse, the company's journey is a testament to its adaptable Infosys SWOT Analysis and forward-thinking business strategy. This exploration dives into the core of Infosys's growth strategy, examining its evolution and future prospects within the ever-changing digital landscape.

Understanding the Infosys SWOT Analysis is crucial for grasping its competitive positioning and identifying potential investment opportunities. This analysis will delve into Infosys's strategic initiatives, including its expansion plans in North America and its focus on technological advancements like cloud computing and artificial intelligence. Furthermore, we'll examine the company's financial performance review and its ability to navigate the challenges and opportunities within the IT industry trends.

How Is Infosys Expanding Its Reach?

Infosys is aggressively pursuing a multi-pronged expansion strategy to bolster its position in the IT industry and capitalize on evolving IT industry trends. This strategy focuses on entering new markets, diversifying service offerings, and forging strategic partnerships to drive sustainable growth. The company's approach is designed to not only increase its revenue streams but also to enhance its capabilities in high-growth areas like digital transformation.

A key element of Infosys's growth strategy involves penetrating emerging markets, particularly in regions like Africa, Latin America, and Southeast Asia. These markets offer significant opportunities for accessing new customers and diversifying revenue sources. Simultaneously, Infosys is heavily investing in enhancing its digital service offerings worldwide, with a strong emphasis on high-margin services such as cloud computing, data analytics, artificial intelligence, and cybersecurity.

Infosys's expansion initiatives are also fueled by strategic acquisitions and partnerships aimed at strengthening its capabilities in cloud technologies and other emerging areas. This approach is crucial for maintaining a competitive edge and meeting the growing demands of clients undergoing digital transformation. For more insights into the company's ownership structure and financial performance, you can explore Owners & Shareholders of Infosys.

Infosys is targeting emerging markets in Africa, Latin America, and Southeast Asia. This geographic diversification aims to broaden the customer base and reduce reliance on existing markets. The focus is on capturing growth opportunities in regions with increasing digital adoption rates.

The company is enhancing its digital service offerings worldwide, focusing on high-margin services. Key areas include cloud computing, data analytics, artificial intelligence, and cybersecurity. This strategic move aims to meet growing client demand for digital transformation solutions.

Infosys is actively acquiring and partnering with niche tech firms. These moves are designed to strengthen capabilities in cloud and other emerging technologies. Recent acquisitions, such as in-tech in Q1 FY25, demonstrate this strategic focus.

The company is shifting towards value-based selling and automation efficiencies to support margin expansion. This approach aims to deliver greater value to clients while improving profitability. This strategy is critical for long-term financial performance.

Infosys's expansion strategy includes significant large deal wins and strategic acquisitions to boost its market position. In Q1 FY25, Infosys secured large deal wins totaling $4.1 billion, with 56% being net new business, reflecting client confidence. The acquisitions of in-tech and The Missing Link Security Pty Ltd further enhance its digital solutions offerings.

- Focus on cloud-first strategies and partnerships with leading cloud providers.

- Acquisition of in-tech in Q1 FY25 to strengthen engineering R&D services.

- Approval of acquisitions including The Missing Link Security Pty Ltd in April 2025.

- Emphasis on value-based selling and automation to support margin expansion.

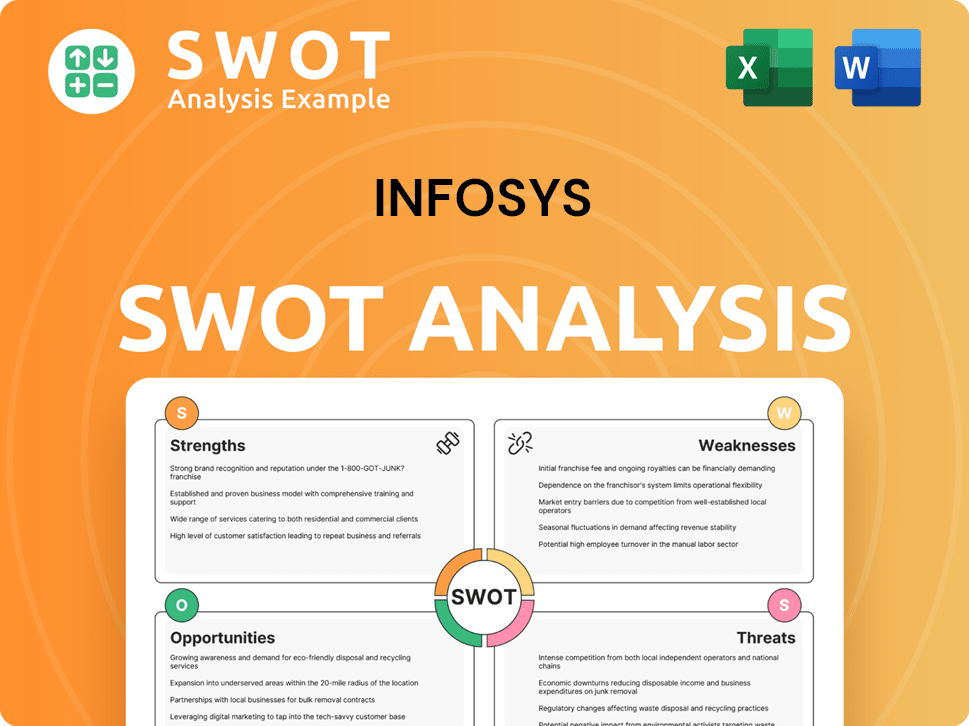

Infosys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Infosys Invest in Innovation?

Infosys is strategically leveraging innovation and technology to drive sustained growth. The company's approach is centered on significant investments in research and development, fostering in-house development, and establishing collaborations with external innovators. This focus is crucial for navigating the evolving IT industry trends and maintaining a competitive edge.

A core element of Infosys's strategy is its 'AI-first mantra.' This involves applying artificial intelligence to transform both its internal operations and those of its clients. Infosys is actively building a robust suite of AI assets, including advanced AI models and platforms, to meet the growing demands of digital transformation.

The company has developed two small and medium-sized language models (SLMs) tailored for finance and operations. These SLMs are expected to play a significant role in the enterprise AI landscape in 2025. Infosys is also creating 'templates for AI success' across various industries, aiming to generate enterprise-scale value for its clients and solidify its position in the market.

Infosys prioritizes customer needs by focusing on innovation, ensuring solutions are tailored to client requirements. This approach enhances customer satisfaction and promotes long-term partnerships. This is a key driver for Infosys's revenue growth, as it fosters loyalty and repeat business.

The company strives for operational excellence to improve efficiency and reduce costs. Streamlined processes and optimized resource allocation are crucial for maintaining profitability and competitiveness. This focus supports the company's financial performance review and overall business strategy.

Infosys invests in infrastructure modernization to support its digital transformation initiatives. This includes upgrading IT infrastructure to enhance performance, security, and scalability. Modern infrastructure is essential for delivering cutting-edge services and meeting evolving client needs.

Digital transformation is a core focus, with AI as a key supporting technology. Infosys helps clients adopt digital technologies to improve their business processes and gain a competitive advantage. This strategy is crucial for navigating the IT industry trends and securing future prospects.

AI is a critical enabler, used to support and enhance digital transformation efforts. Infosys develops and implements AI solutions to automate tasks, improve decision-making, and create new business opportunities for clients. This is a core element of the company's strategic partnerships.

Strategic partnerships, such as the collaboration with NVIDIA, are vital for expanding capabilities and market reach. These alliances allow Infosys to offer advanced solutions and stay at the forefront of technological advancements. This supports the company's global market presence.

Infosys is actively involved in several key technological initiatives to drive innovation and provide value to its clients. These initiatives reflect the company's commitment to staying ahead of IT industry trends and enhancing its competitive position. Infosys's focus on technological advancements is a key aspect of its Mission, Vision & Core Values of Infosys.

- Generative AI (GenAI) Solutions: Infosys has co-launched several NVIDIA-enabled GenAI solutions. These solutions utilize NVIDIA NIM inference microservices, NVIDIA NeMo Retriever embedding models, and NeMo Guardrails to customize and deploy GenAI for domain-specific Large Language Models (LLMs), particularly in the telco sector.

- SLMs for Specific Domains: The company has launched NVIDIA-enabled SLMs, including Infosys Topaz BankingSLM and Infosys Topaz ITOpsSLM. These SLMs are designed to provide specialized solutions for the banking and IT operations sectors.

- Quantum Computing: Infosys is investing in quantum computing through its Quantum Living Labs (QLL). This initiative aims to deliver solutions that leverage quantum technology to accelerate client innovation.

- AI and IoT Integration: Infosys is focused on integrating AI with the Internet of Things (IoT). This approach recognizes the immense opportunity to extract value from the data generated by connected devices. By 2025, it's predicted that 55.7 billion connected devices will generate 80 zettabytes of data.

- Ethical Practices: Infosys was recognized as one of the World's Most Ethical Companies in 2025 for the fifth consecutive year by Ethisphere, highlighting its commitment to ethical business practices.

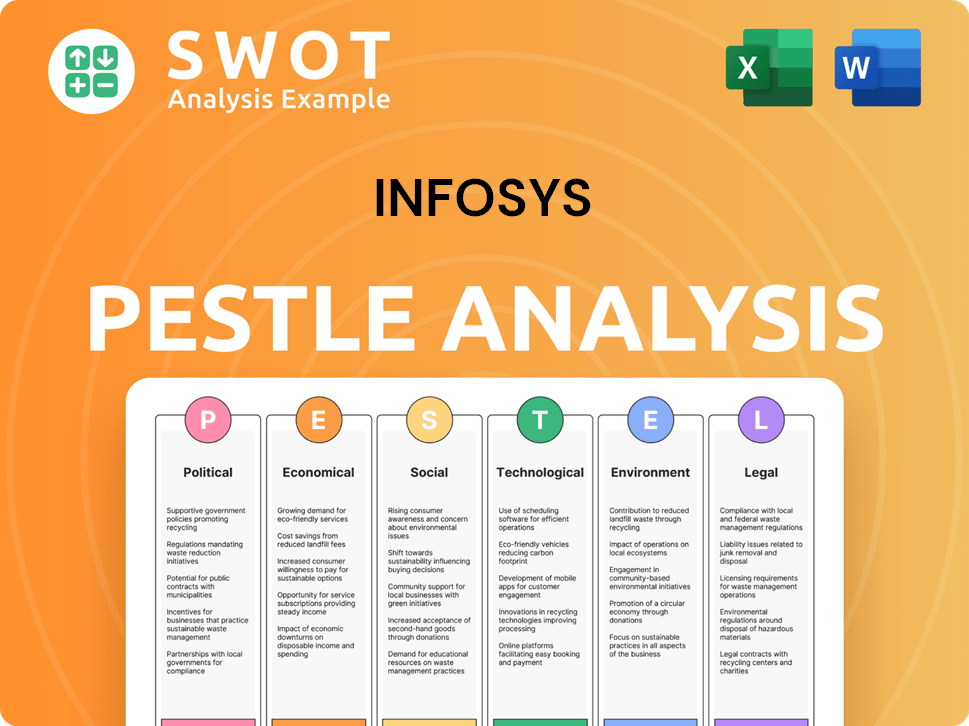

Infosys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Infosys’s Growth Forecast?

Infosys demonstrated resilience in fiscal year 2025 (FY25), navigating a challenging macroeconomic environment. The company's financial performance reflects its ability to adapt and maintain a strong position within the IT industry. A detailed Infosys company analysis reveals strategic initiatives aimed at sustained growth.

The company's revenue for FY25 reached $19.28 billion in constant currency (CC) terms, indicating a 4.2% increase. The operating margin for FY25 was 21.1%, showing a 0.5% year-on-year improvement. Infosys' financial performance review highlights its ability to manage costs and maintain profitability despite external pressures.

For the March quarter of 2025 (Q4 FY25), Infosys reported a consolidated revenue of ₹40,925 crore, up 7.9% year-on-year, although it declined 2% sequentially. The net profit for Q4 FY25 was ₹7,033 crore, an 11.7% decline year-on-year. These figures provide insights into the company's quarterly performance and its ability to adapt to changing market dynamics. Understanding the Infosys growth strategy is key to interpreting these results.

Infosys projects a modest revenue growth guidance of 0-3% in constant currency for fiscal year 2026 (FY26). This forecast reflects the current macroeconomic uncertainties and cautious client spending. This cautious outlook is one of the company's weakest in over a decade, excluding the pandemic period.

Despite the conservative revenue outlook, Infosys has maintained its margin guidance of 20-22% for FY26. This suggests the company's focus on operational efficiency and cost management. This strategic approach is crucial for maintaining profitability in a competitive market.

Infosys' free cash flow (FCF) for FY25 reached a record $4.1 billion, marking a 41.8% year-on-year surge. This strong FCF provides a significant liquidity buffer. The robust FCF is a positive indicator of the company's financial health and its ability to invest in future growth.

Infosys declared a final dividend of ₹22 per equity share for FY25, demonstrating its commitment to shareholder returns. The company's total assets for FY25 stood at ₹1,478 billion, reflecting an 8% growth compared to FY24. This growth in assets supports the company's long-term expansion plans.

The financial performance of Infosys in FY25 and the outlook for FY26 provide a clear picture of the company's position in the IT industry. The focus on maintaining margins, despite a cautious revenue forecast, indicates a strategic emphasis on efficiency and profitability. Understanding Infosys future prospects requires a close look at these financial metrics and strategic decisions.

- The company's ability to generate a record free cash flow of $4.1 billion in FY25 is a significant positive, providing financial flexibility for future investments and shareholder returns.

- The maintained margin guidance of 20-22% for FY26, despite the conservative revenue outlook, highlights the company's focus on cost management and operational efficiency.

- The 8% growth in total assets, reaching ₹1,478 billion, indicates the company's ongoing expansion and investment in its capabilities.

- The declaration of a final dividend of ₹22 per equity share for FY25 underscores Infosys' commitment to rewarding its shareholders.

For more insights into the company's financial model, consider exploring the Revenue Streams & Business Model of Infosys.

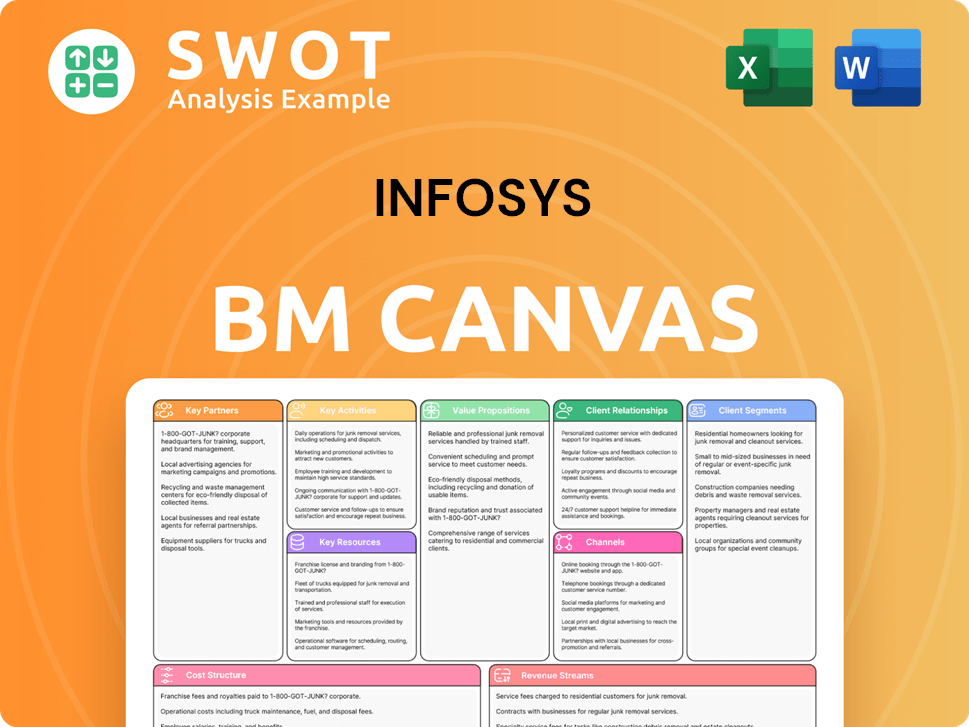

Infosys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Infosys’s Growth?

The IT services sector presents significant challenges for companies like Infosys. Intense competition, economic uncertainties, and rapid technological changes are key factors that could impact the company's growth trajectory. Understanding these risks is crucial for assessing the Infosys future prospects and making informed decisions.

Several operational and strategic risks could hinder Infosys's ambitions. These include competition from global IT players, economic downturns, technological disruptions, and cybersecurity threats. Addressing these challenges is vital for maintaining market share and achieving sustainable growth. The company's ability to navigate these obstacles will determine its success in the long run.

Infosys faces a dynamic business environment where adaptability is essential. Factors such as regulatory changes, talent management issues, and the need for strategic partnerships require careful management. These elements are critical to the company's ability to innovate and maintain a competitive edge. A comprehensive Infosys company analysis must consider these diverse challenges.

The IT services market is highly competitive, with rivals like Tata Consultancy Services (TCS), Accenture, and IBM vying for market share. This competition can affect pricing, client retention, and overall profitability. Staying ahead requires continuous innovation and a strong focus on customer satisfaction.

Economic downturns, inflation, and currency fluctuations can significantly impact revenue. North America, which accounts for over 60% of Infosys' revenue, is a crucial market. Economic instability in this region can lead to reduced client spending and affect financial performance.

Rapid advancements in AI and automation present both opportunities and challenges. While Infosys invests heavily in these areas, scaling emerging tech offerings to meet market demand is crucial. Failure to adapt quickly could lead to a loss of market share. Brief History of Infosys provides a deeper understanding of how the company has evolved to meet such challenges.

Cybersecurity threats are a constant risk, and any breach could damage the company's reputation and lead to financial losses. Investing in robust security measures and staying ahead of evolving cyber threats is essential. Data breaches can result in significant financial and reputational damage.

Changes in data protection laws, trade policies, and immigration regulations can impact business operations and growth. Compliance with these regulations requires continuous adaptation and investment. Navigating these regulatory landscapes is essential for global operations.

High employee attrition rates can lead to talent gaps and increased recruitment and training costs. Retaining skilled employees and fostering a positive work environment are critical. Addressing these internal challenges is vital for sustained growth.

Infosys employs various strategies to mitigate these risks, including diversification, risk management frameworks, and strategic planning. The 'Project Maximus' initiative focuses on streamlining operations and improving efficiency. The company is also emphasizing ethical AI adoption and high-value services.

Economic uncertainties and cautious client spending are impacting revenue growth projections. Infosys is focusing on cost optimization and margin improvement to navigate these challenges. The company aims to maintain profitability while adapting to market dynamics. According to recent reports, the IT services market is expected to grow at a moderate pace in FY26.

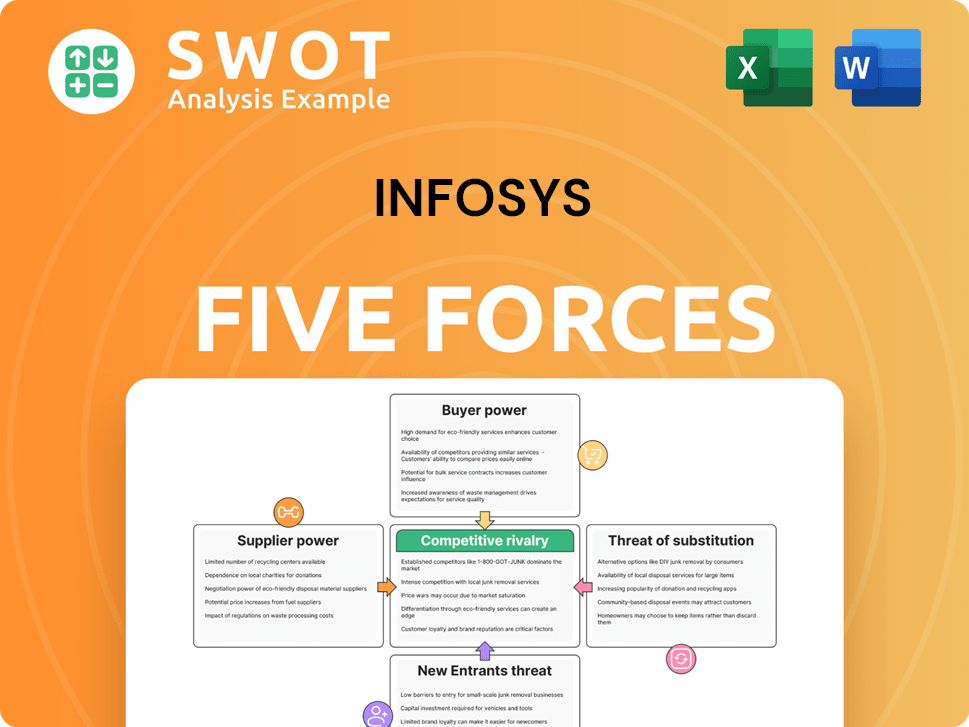

Infosys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Infosys Company?

- What is Competitive Landscape of Infosys Company?

- How Does Infosys Company Work?

- What is Sales and Marketing Strategy of Infosys Company?

- What is Brief History of Infosys Company?

- Who Owns Infosys Company?

- What is Customer Demographics and Target Market of Infosys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.