Ingredion Bundle

How will Ingredion reshape the Ingredion SWOT Analysis of the food industry?

Ingredion's journey from a corn refiner to a global ingredient solutions provider is a testament to its strategic prowess. The company's expansion, notably the 2014 acquisition of Penford Corporation, showcases its commitment to growth and diversification within the competitive food ingredients market. This analysis dives deep into Ingredion's past and future, offering a comprehensive look at its growth strategy.

Ingredion's future prospects are deeply intertwined with its ability to innovate and adapt to the evolving demands of the global food industry. This Ingredion company analysis will explore the company's strategic initiatives, including its research and development efforts and expansion plans, to assess its long-term growth potential. Understanding Ingredion's market share analysis and competitive landscape is crucial for investors and strategists alike. Furthermore, we'll examine Ingredion's impact on the food industry and its ingredient solutions for specific applications.

How Is Ingredion Expanding Its Reach?

Ingredion's Ingredion growth strategy is significantly shaped by its expansion initiatives, focusing on geographical and product diversification. This approach aims to tap into new customer segments and boost revenue. The company's strategic moves are closely aligned with global trends, particularly in the food ingredients market, emphasizing healthier and more sustainable options.

A key element of Ingredion future prospects involves substantial investment in the Asia-Pacific region. This area is experiencing a surge in demand for plant-based and specialty ingredients, making it a crucial growth market. Ingredion company analysis shows that it is actively expanding its manufacturing capabilities and forming local partnerships to meet regional preferences.

The focus on specialty ingredients, including plant-based proteins and clean-label starches, is central to Ingredion's strategy. The company is also developing new ingredient solutions to meet changing consumer demands, with several product launches anticipated in 2025 across various platforms. Mergers and acquisitions also play a vital role in Ingredion's expansion strategy.

Ingredion is heavily investing in the Asia-Pacific region to capitalize on the growing demand for plant-based and specialty ingredients. This includes expanding manufacturing capabilities and forming strategic partnerships. The company aims to cater to local preferences and growth trends in countries like China and India.

Ingredion is expanding its specialty ingredients portfolio, which includes plant-based proteins, clean-label starches, and sugar reduction solutions. This aligns with global consumer trends towards healthier and more sustainable food options. New product launches are expected in 2025.

Mergers and acquisitions (M&A) are a key component of Ingredion's expansion strategy, with the company continuously evaluating opportunities to acquire businesses. These acquisitions aim to complement its existing portfolio, enhance technological capabilities, and provide access to new markets. The company's history with acquisitions, such as Penford, indicates a readiness to pursue strategic M&A.

Strategic partnerships are crucial for Ingredion's expansion, enabling the co-development of innovative solutions and extending market reach. These partnerships allow the company to grow without significant capital expenditure. This collaborative approach supports Ingredion's overall growth strategy.

Ingredion's strategic initiatives are designed to drive long-term growth. The company's focus on innovation in food ingredients and sustainability efforts is evident in its product development and market expansion plans. For a deeper understanding of Ingredion's financial structure and revenue streams, consider reading Revenue Streams & Business Model of Ingredion.

Ingredion's expansion strategy includes geographic growth in the Asia-Pacific region, particularly in China and India. The company is also focusing on expanding its specialty ingredients portfolio, including plant-based proteins. Strategic partnerships and M&A activities are also critical components of Ingredion's growth strategy.

- Asia-Pacific: Expanding manufacturing and partnerships.

- Specialty Ingredients: Focus on plant-based and clean-label products.

- M&A: Actively seeking acquisitions to enhance portfolio.

- Strategic Partnerships: Collaborating on innovative solutions.

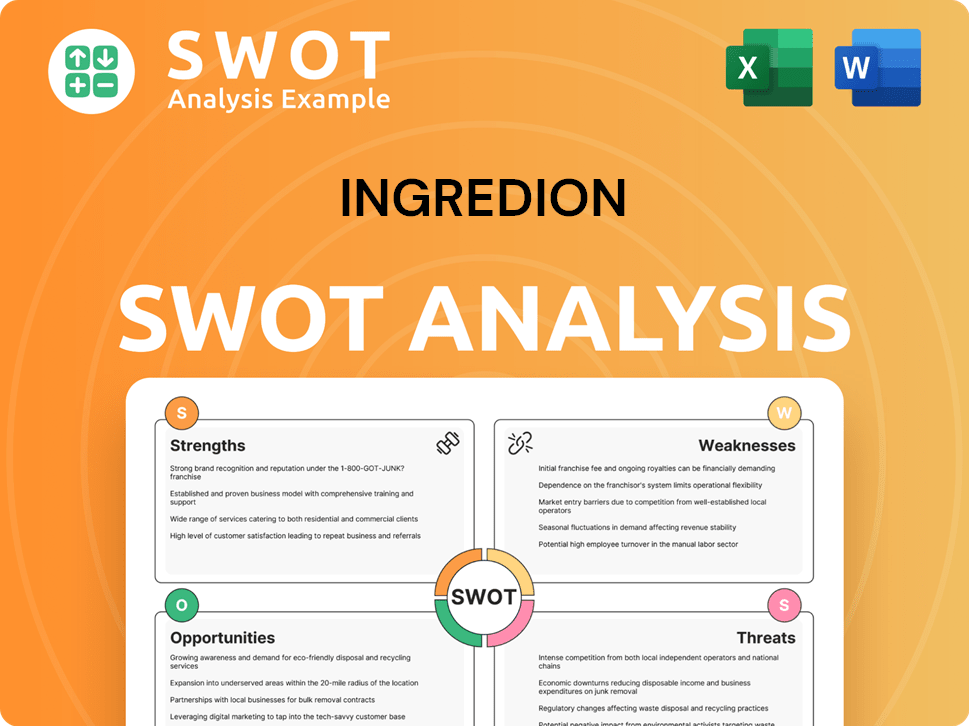

Ingredion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ingredion Invest in Innovation?

Ingredion's innovation and technology strategy is a key driver of its sustained growth, focusing on research and development (R&D), digital transformation, and sustainable solutions. The company consistently invests in R&D to develop novel ingredients and enhance existing product lines, reflecting consumer demands and industry trends. This approach is crucial for maintaining a competitive edge in the dynamic global food industry.

The company's commitment to innovation extends to collaborations with external innovators, including startups and academic institutions. This strategy accelerates the discovery and commercialization of new technologies, which is vital for staying ahead in the food ingredients market. Ingredion's focus on digital transformation and sustainability further strengthens its position in the market.

Ingredion's strategic initiatives are designed to meet the evolving needs of the food industry. By focusing on innovation, the company aims to create value and drive long-term growth. This approach is critical for adapting to changing consumer preferences and maintaining a strong market presence. For more insights, you can explore the Mission, Vision & Core Values of Ingredion.

Ingredion dedicates a significant portion of its capital expenditure to research and development. This investment is crucial for developing new ingredient solutions and enhancing existing product lines. This commitment helps the company stay competitive in the global food industry.

Ingredion is actively pursuing digital transformation to optimize its operations and improve supply chain efficiency. This includes the adoption of automation and data analytics. These initiatives enhance customer engagement and inform product development strategies.

Sustainability is a core pillar of Ingredion’s innovation strategy. The company focuses on developing ingredients and processes with a lower environmental footprint. This includes initiatives to reduce water usage, energy consumption, and waste generation.

Ingredion is heavily investing in plant-based protein solutions to meet growing consumer demand. This focus includes developing innovative texturization technologies. These advancements are key contributors to Ingredion's growth objectives.

Ingredion is developing sugar reduction technologies to meet consumer demand for healthier options. This includes creating ingredients that allow for reduced sugar content in various food products. These innovations are essential for market leadership.

The company focuses on clean label solutions to meet consumer preferences for natural and recognizable ingredients. This includes developing ingredients that align with clean label standards. These solutions are vital for market competitiveness.

Ingredion's innovation strategy includes advancements in plant-based protein texturization and sugar reduction technologies. These developments are highlighted as key contributors to its growth objectives and market leadership. The company is also exploring AI and IoT to improve ingredient functionality.

- R&D Investments: Significant capital expenditure allocated to developing novel ingredients.

- Digital Transformation: Adoption of automation and data analytics to optimize operations.

- Sustainability: Focus on reducing water usage, energy consumption, and waste generation.

- Plant-Based Proteins: Advancements in texturization technologies.

- Sugar Reduction: Development of ingredients for reduced sugar content.

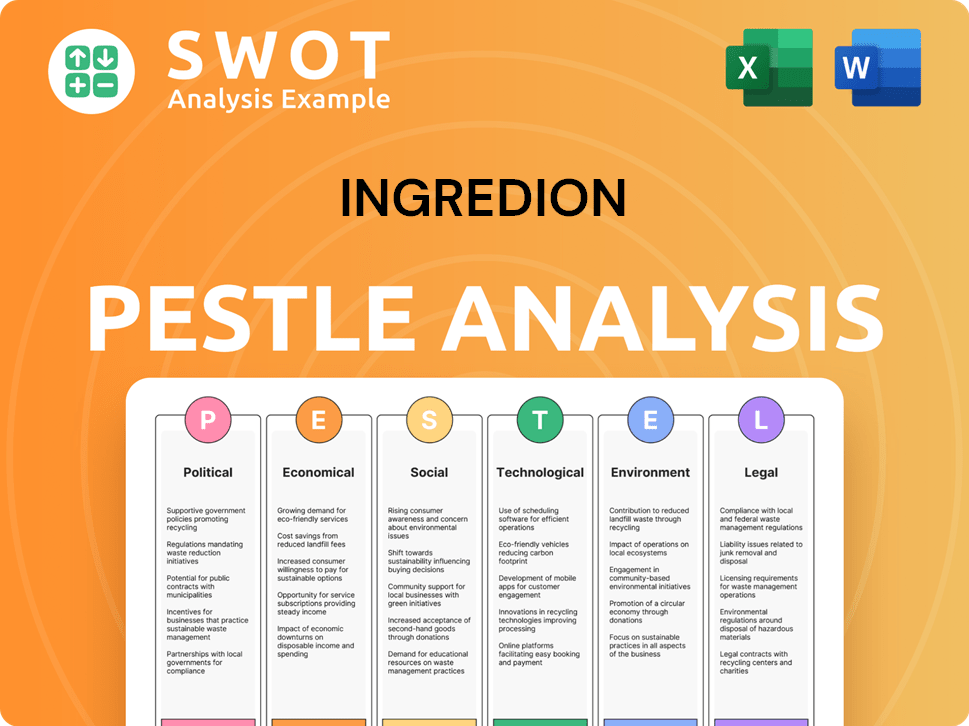

Ingredion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ingredion’s Growth Forecast?

The financial outlook for Ingredion reflects a strategic emphasis on sustained growth, underpinned by robust revenue targets and disciplined investment. The company's Ingredion growth strategy is designed to capitalize on the evolving demands of the food ingredients market. This approach is essential for achieving its Ingredion future prospects.

For the full year 2024, Ingredion projected net sales to be in the range of $8.0 billion to $8.3 billion. This projection demonstrates a steady upward trajectory, indicating the company's ability to navigate market dynamics effectively. Ingredion aims to improve profit margins through operational efficiencies and a continued shift towards higher-value specialty ingredients. This strategic shift is a key component of the Ingredion company analysis.

Ingredion's long-term financial goals include consistent earnings per share growth and strong free cash flow generation, which supports ongoing investments in R&D and strategic expansion. Recent quarterly reports, such as the first quarter of 2025, indicate a resilient performance, with solid net sales driven by strong demand in its Food & Beverage segment and pricing actions. For a deeper understanding of the company's background, you can explore Brief History of Ingredion.

Ingredion's financial forecasts for 2024 anticipate net sales between $8.0 billion and $8.3 billion. This projection reflects the company's confidence in its strategic initiatives and market position. These revenue targets are a key indicator of Ingredion's growth trajectory.

The company is focused on improving profit margins through operational efficiencies and a strategic shift towards higher-value specialty ingredients. This focus is crucial for enhancing profitability and strengthening Ingredion's competitive advantage. These improvements are critical for long-term sustainability.

Ingredion's capital allocation strategy prioritizes investments that support organic growth, such as facility upgrades and R&D. The company also maintains a balanced approach to shareholder returns through dividends and share repurchases. This balanced approach is essential for financial stability.

Ingredion has demonstrated a prudent approach to managing its debt, ensuring financial flexibility to pursue strategic opportunities. This careful management of debt provides the company with the agility to adapt to market changes. Prudent debt management is crucial for long-term financial health.

Analyst forecasts generally align with Ingredion's positive outlook, citing the company's diversified product portfolio and strong market position as key drivers. These positive forecasts reflect confidence in Ingredion's strategic direction and market performance.

Ingredion's focus on ingredient solutions for various applications is a significant driver of its financial performance. The company's ability to provide innovative solutions enhances its market position. This focus is a key element of Ingredion's success.

Ingredion's strong market position within the global food industry is a critical factor supporting its financial outlook. The company's diversified product portfolio and global presence contribute to its resilience. A strong market position is vital for consistent financial performance.

Ongoing investments in research and development (R&D) are crucial for Ingredion's long-term growth. These investments support innovation and the development of new ingredient solutions. R&D is essential for maintaining a competitive edge.

Ingredion is committed to delivering consistent value to its shareholders through dividends and share repurchases. This commitment reflects the company's confidence in its financial performance. Shareholder value is a key priority.

Ingredion's expansion plans include strategic investments in facilities and R&D to support organic growth. These investments are designed to increase the company's market presence. Expansion is a key component of Ingredion's strategy.

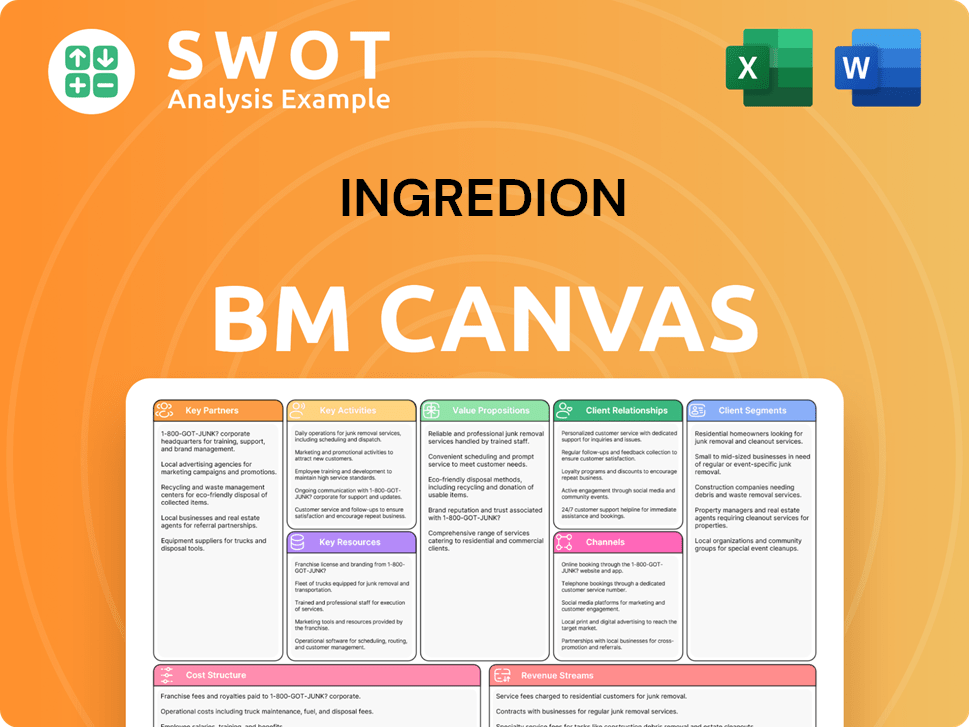

Ingredion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ingredion’s Growth?

The growth strategy of Ingredion faces several potential risks and obstacles that could impact its future prospects. These challenges necessitate robust risk management to maintain its position in the food ingredients market. Understanding these potential pitfalls is crucial for a comprehensive Ingredion company analysis.

Intense competition, regulatory changes, and supply chain vulnerabilities represent significant challenges. Technological disruptions and internal resource constraints also pose risks. Addressing these issues is key for Ingredion's long-term growth potential and strategic success.

Ingredion's ability to navigate these risks will determine its success in the global food industry. Effective mitigation strategies and proactive measures are essential for maintaining Ingredion's market share analysis and achieving its expansion plans. For a deeper understanding, consider examining the Competitors Landscape of Ingredion.

Ingredion faces stiff competition from both established and emerging players in the food ingredients market. This competition can pressure pricing and market share, especially in commodity ingredient segments. The competitive landscape requires constant vigilance and strategic adaptation to maintain a strong position.

Regulatory changes pose an ongoing risk, particularly concerning food safety, labeling, and environmental standards. Compliance with diverse international regulations requires continuous monitoring and adaptation. These changes can impact operational costs and product development timelines, requiring proactive strategies.

Supply chain vulnerabilities include raw material price volatility, geopolitical disruptions, and extreme weather events. These factors can significantly impact Ingredion's production and profitability. Fluctuations in corn prices or logistics disruptions can directly affect the cost of goods sold.

Technological disruption presents a risk if competitors introduce superior or more cost-effective ingredient solutions. Ingredion mitigates this through continuous R&D and strategic partnerships. The pace of innovation demands constant vigilance and investment in new technologies.

Internally, resource constraints, including talent acquisition and retention in specialized areas, could hinder growth initiatives. Ingredion addresses these risks through diversification and comprehensive risk management frameworks. These internal factors require strategic planning and investment.

Ingredion employs diversification of its product portfolio and geographical presence to reduce reliance on any single market or ingredient category. The company uses comprehensive risk management frameworks, including scenario planning and contingency measures. These strategies help prepare for potential disruptions.

Ingredion's financial performance outlook is influenced by its ability to manage these risks effectively. The company's strategic initiatives and adaptations are crucial for maintaining its financial health. Understanding these factors is vital for assessing Ingredion's financial performance outlook.

Innovation in food ingredients and sustainability efforts are key areas for Ingredion. The company's research and development efforts are essential for staying competitive. These initiatives are vital for Ingredion's future in the plant-based food market.

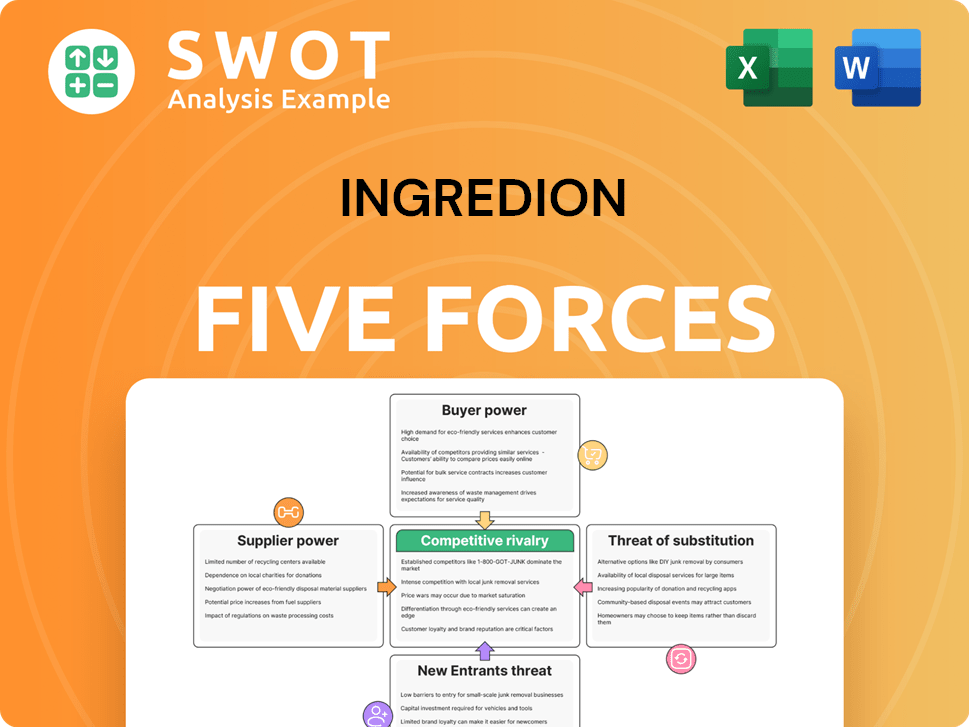

Ingredion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ingredion Company?

- What is Competitive Landscape of Ingredion Company?

- How Does Ingredion Company Work?

- What is Sales and Marketing Strategy of Ingredion Company?

- What is Brief History of Ingredion Company?

- Who Owns Ingredion Company?

- What is Customer Demographics and Target Market of Ingredion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.