Ingredion Bundle

Decoding Ingredion: Who Are Its Customers?

In today's dynamic market, understanding Ingredion SWOT Analysis is essential for business success. Ingredion Company, a global leader in ingredient solutions, thrives on a deep understanding of its customer demographics and Ingredion target market. This knowledge is the cornerstone of their strategic decisions, from product development to market expansion. Founded in 1906, Ingredion has evolved to meet the changing demands of the food, beverage, and industrial sectors.

This exploration delves into Ingredion's diverse customer base, analyzing their geographical distribution and evolving needs. We'll examine how Ingredion leverages market segmentation to cater to specific consumer profiles, focusing on the growing demand for plant-based ingredients and healthier options. The analysis will also touch on Ingredion's market segmentation strategy and Ingredion's consumer profile for sweeteners to understand how the company maintains its competitive edge in a global market. Understanding Ingredion's customer demographics by region and Ingredion's market analysis of its customer base is crucial to understanding its success.

Who Are Ingredion’s Main Customers?

Understanding the customer demographics and target market of the Ingredion company is crucial for grasping its business strategy. Ingredion operates primarily in a Business-to-Business (B2B) model, serving a diverse range of manufacturers. This approach allows Ingredion to focus on specific industry needs and build strong relationships with its clients.

The company's customer base is broad, encompassing various sectors such as food, beverage, animal nutrition, and industrial markets. This diversification helps Ingredion mitigate risks and adapt to changing market dynamics. The company's focus on innovation and tailored solutions further strengthens its position within these sectors.

Ingredion's target market is segmented to better align with strategic value drivers. In 2024, the company resegmented its business, creating a global Texture & Healthful Solutions segment and regional Food & Industrial Ingredients segments. This approach enables Ingredion to better serve its customers and capitalize on market trends.

Ingredion's key customers include large consumer packaged goods (CPG) companies, private label food makers, and restaurants. The company focuses on providing customized ingredient solutions to meet the specific needs of these customers. This strategy allows Ingredion to build strong, long-term relationships and drive sustainable growth.

This segment is a key growth area, valued at $2.4 billion, with high average selling prices and gross margins. It focuses on differentiated ingredient solutions aligned with market trends, such as clean label and plant-based offerings. This segment saw double-digit sales volume growth in 2024, indicating strong demand for these innovative products.

These segments provide core sweeteners and industrial solutions to their respective geographic customer bases. They emphasize service excellence, quality, and cost competitiveness. This focus ensures that Ingredion remains a reliable and competitive supplier in these essential markets.

Ingredion has two growth-oriented operating units focused on sugar reduction and protein fortification. These units benefit from the consumer trend towards healthier food options. The company is strategically positioned to capitalize on these trends, offering innovative solutions that meet evolving consumer demands.

Ingredion continuously adapts its market segmentation and product development strategies to meet evolving consumer demands. The company's focus on healthier and more sustainable products is driven by market research and external trends. For example, the non-dairy cheese market in Europe, with retail sales topping EUR 330 million, and the UK market growing at a 22.3% CAGR from 2021-2023, has prompted Ingredion to focus on developing solutions for this category.

- A 2024 consumer food preference trend report indicated that three-quarters of consumers are more deliberate in assessing food and beverage products to improve their nutrition.

- Consumers prioritize clean labels, natural ingredients, and digestive health benefits, influencing Ingredion's product development and segmentation strategies.

- The company's ability to adapt to these trends is key to its continued success.

- To learn more about Ingredion's strategic marketing, consider reading the Marketing Strategy of Ingredion.

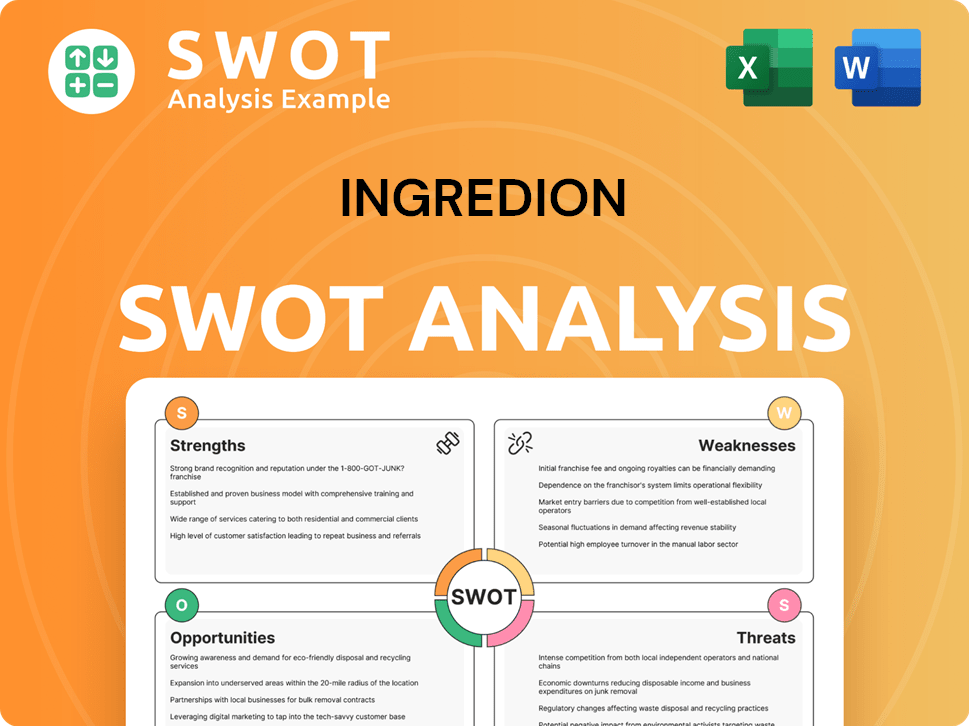

Ingredion SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Ingredion’s Customers Want?

Understanding the customer needs and preferences is crucial for Ingredion, a leading global ingredient solutions company. Its customers, primarily businesses in the food and beverage industry, are heavily influenced by evolving consumer trends. These trends include a growing demand for healthier, more natural, and sustainable products, which directly shapes the requirements for Ingredion's offerings.

The primary drivers for Ingredion's business customers are rooted in consumer preferences for 'better-for-you' options. This includes a focus on clean labels, natural ingredients, and products with added health benefits. This shift is evident in the willingness of consumers to pay more for products with natural claims and recognizable ingredients, as highlighted in recent market research.

Ingredion's customer base is driven by the need to meet consumer demands for healthier and more transparent food options. This is reflected in purchasing behaviors and ingredient label scrutiny. Addressing these evolving consumer expectations is a key psychological driver for choosing Ingredion's offerings, especially in areas like replicating the taste and texture of traditional products in non-dairy alternatives.

Consumers increasingly seek healthier food choices. This includes clean labels and products with added health benefits. This drives Ingredion's customers to source ingredients that support these claims.

Consumers are willing to pay more for 'natural' or 'all-natural' claims. This preference influences the purchasing decisions of Ingredion's customers. It highlights the importance of ingredient transparency.

There's a growing consumer focus on sugar reduction and alternative sweeteners. A significant percentage of consumers check ingredient labels more frequently. This impacts the criteria Ingredion's clients use.

Ingredion's customers need to balance health and indulgence in their products. This includes replicating traditional tastes in non-dairy alternatives. This is a key psychological driver for choosing Ingredion's products.

Ingredion helps customers overcome formulation difficulties. This is particularly true in categories like non-dairy cheese. They provide solutions through innovation centers.

Ingredion invests heavily in R&D to address evolving customer preferences. This investment directly influences product development. It enables clean label claims and desired sensory attributes.

Ingredion's customers, which include food and beverage manufacturers, face several challenges and opportunities. These are driven by consumer preferences for healthier and more transparent food options. Ingredion addresses these needs through its product offerings and innovation efforts.

- Customer Demographics: The primary customers are businesses in the food and beverage sector.

- Ingredion Target Market: Focus is on manufacturers seeking ingredients that support 'better-for-you' claims.

- Market Segmentation: Tailoring products to specific segments, such as the non-dairy cheese market.

- Consumer Profile: Understanding consumer preferences for natural ingredients and sugar reduction.

- Ingredion Products: Developing ingredients that enable clean label claims and deliver desired sensory attributes.

- Ingredion Company Customer Base Analysis: Analyzing customer needs related to health, indulgence, and ingredient transparency.

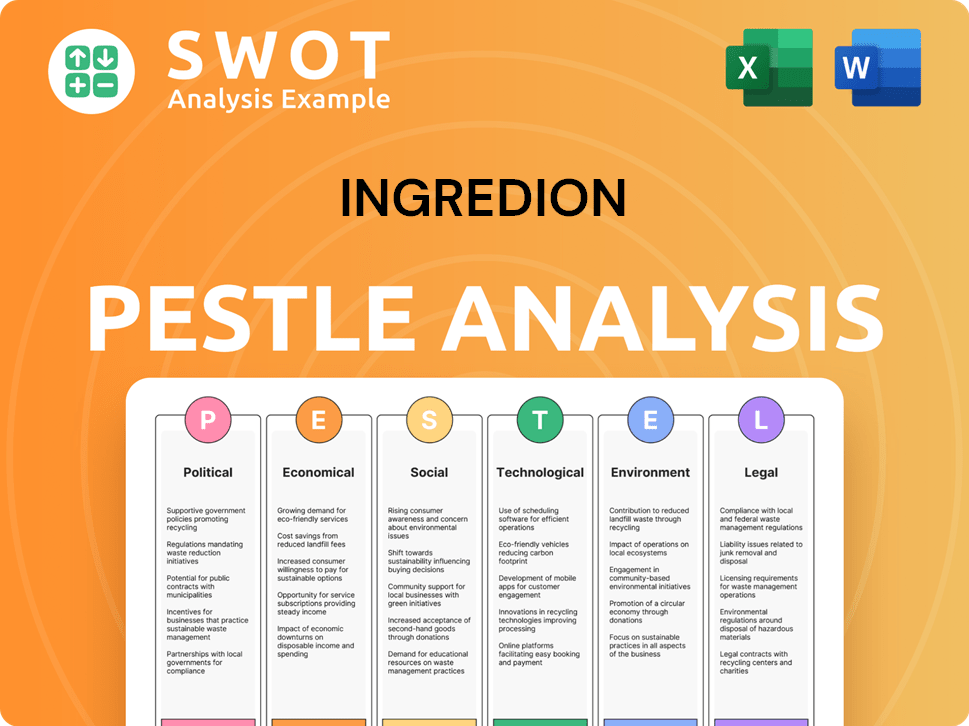

Ingredion PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Ingredion operate?

Ingredion's global presence is substantial, serving customers in over 120 countries. The company operates through a network of 47 manufacturing facilities and joint ventures. Its geographical operations are managed through regional segments, including North America, South America, Asia-Pacific, and Europe, Middle East, and Africa (EMEA).

In 2024, North America held the largest share of the global industrial starch market, exceeding 40%. This strong presence is supported by robust production capacity and high demand in the region. The U.S. and Canada are particularly important for Ingredion within the industrial market, with applications in food, beverages, and pharmaceuticals. The company's resegmentation in late 2023, shifting to a structure based on production assets, aims to improve customer service.

To succeed in diverse markets, Ingredion tailors its offerings and partnerships. For example, in November 2024, Ingredion partnered with Lantmännen to accelerate the development of plant-based proteins, specifically pea protein isolates, to meet European market needs. This collaboration includes Lantmännen investing over €100 million in a new production facility in Sweden, expected to be completed by 2027. This strategic move demonstrates Ingredion's commitment to expanding its European footprint in the plant-based protein industry. The company also works with growers to implement climate-resilient practices and has a goal of sustainably sourcing 100% of its Tier 1 priority crops by 2025, with 66.8% achieved by the end of 2023. Ingredion's geographic distribution of sales is influenced by varying raw material costs and currency fluctuations, which the company actively manages, as seen in its Latin America (LATAM) segment's ability to manage pricing despite changing corn costs.

Ingredion operates in over 120 countries, demonstrating a wide reach. It utilizes a network of 47 manufacturing facilities and joint ventures to serve its global customer base. This extensive network supports its ability to meet diverse market demands.

Ingredion manages its operations through regional segments: North America, South America, Asia-Pacific, and EMEA. This structure allows for focused strategies in each region. The company's segmentation strategy helps to effectively target the Ingredion target market.

North America accounted for over 40% of the global industrial starch market in 2024. The U.S. and Canada are key markets. This dominance highlights the importance of the region for Ingredion company.

Ingredion forms partnerships to expand its market presence and meet specific regional needs. Its collaboration with Lantmännen to develop plant-based proteins in Europe is a prime example. These partnerships help to refine the Ingredion products.

Ingredion is committed to sustainable practices, targeting 100% sustainable sourcing of Tier 1 priority crops by 2025. By the end of 2023, 66.8% of this goal was achieved. This commitment aligns with consumer preferences for sustainable products.

Raw material costs and currency fluctuations influence Ingredion's geographic sales distribution. The company actively manages these factors, as demonstrated by its ability to manage pricing in the LATAM segment despite changes in corn costs. This helps to understand the customer demographics.

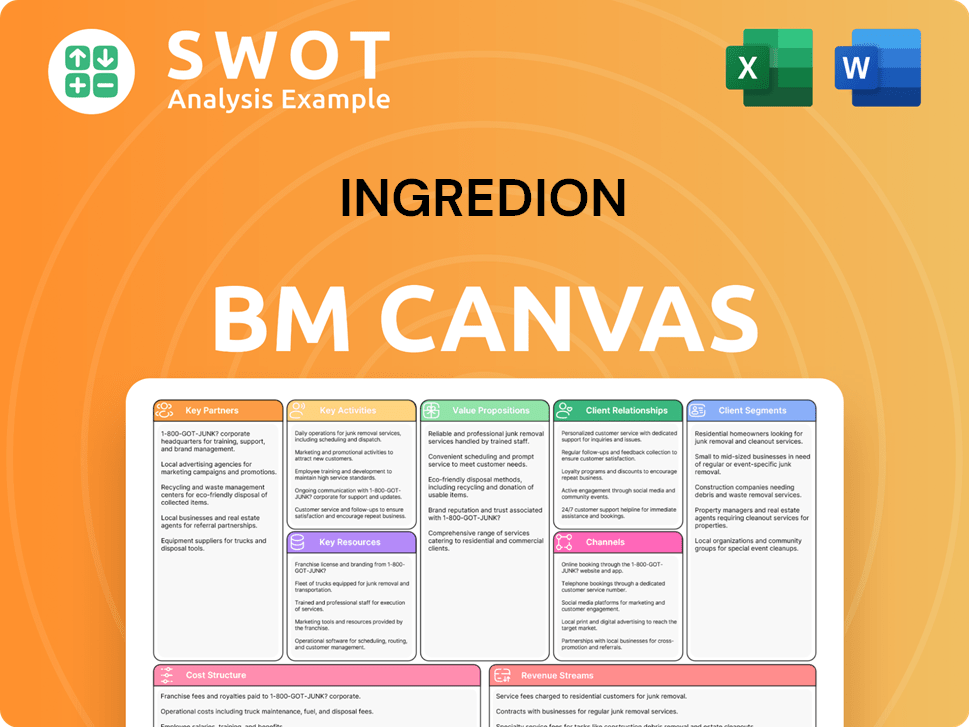

Ingredion Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Ingredion Win & Keep Customers?

Ingredion's approach to customer acquisition and retention centers on collaborative innovation, operational excellence, and a customer-centric strategy, leveraging its global network and expertise. A key method for acquiring and retaining customers involves co-creation through its global network of 'Idea Labs' innovation centers. This strategy is designed to meet the needs of its customer base.

In 2023, customer engagement, both online and in-person at these 32 labs, increased by 26%, which indicates the value customers place on Ingredion's insights and expertise in product development. This co-creation model allows Ingredion to develop tailored ingredient solutions that meet evolving consumer demands, such as clean labels, sugar reduction, and plant-based alternatives. This focus helps in defining the Ingredion target market and refining its market segmentation approach.

The company's strategic resegmentation in 2024, creating the global Texture & Healthful Solutions segment, further strengthens customer collaboration by aligning with targeted market and customer opportunities. The focus on renewing multi-year customer contracts also significantly contributes to operating income growth in segments like Food & Industrial Ingredients US/CAN.

Ingredion utilizes its network of 'Idea Labs' to co-create solutions with customers. This collaborative approach allows for the development of tailored ingredient solutions. In 2023, customer engagement increased by 26%, highlighting the effectiveness of this strategy.

The creation of the global Texture & Healthful Solutions segment in 2024 strengthens customer collaboration. This segment focuses on differentiated ingredient solutions, driving acquisition and expansion. The focus on renewing multi-year customer contracts also significantly contributes to operating income growth.

Ingredion is committed to sustainability and responsible sourcing. The company aims to sustainably source 100% of its Tier 1 priority crops by 2025. By the end of 2023, Ingredion had reached 66.8%, which resonates with customers seeking eco-friendly supply chains.

Investments in digital transformation and operational efficiency enhance customer benefits. This includes a pilot of a new Laboratory Information Management System (LIMS) in 2024. These efforts aim to standardize quality data and reduce costs.

Ingredion's customer strategies are designed to be 'preferred by customers' through collaborative innovation and consumer-focused innovation.

- Co-creation through 'Idea Labs' to develop tailored solutions.

- Strategic resegmentation to align with market opportunities.

- Sustainability initiatives to meet customer expectations.

- Digital transformation and operational efficiency for improved product quality.

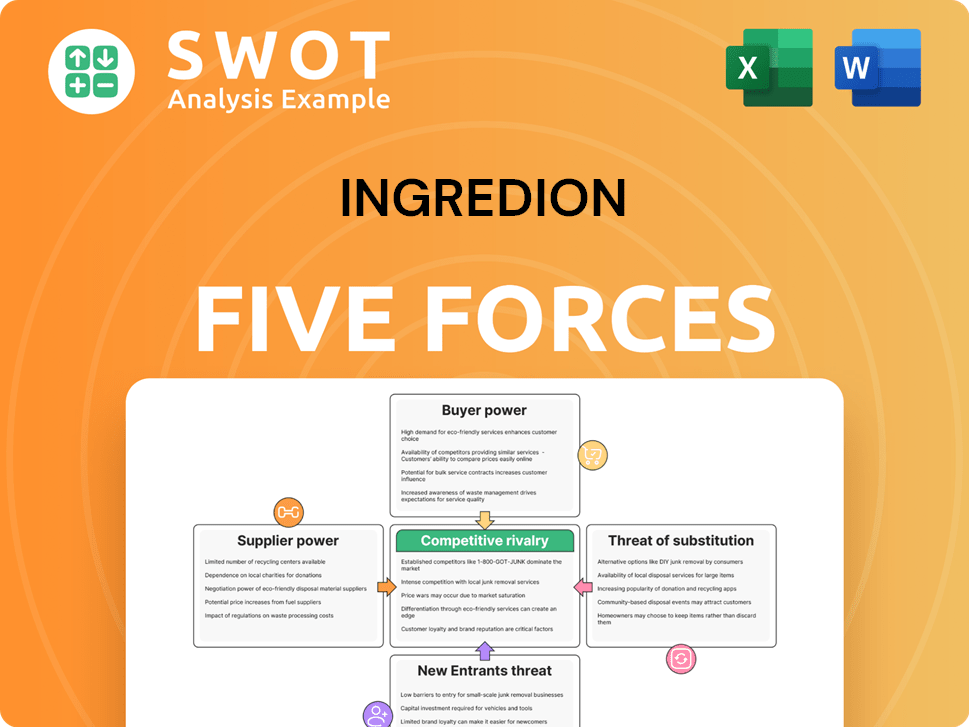

Ingredion Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ingredion Company?

- What is Competitive Landscape of Ingredion Company?

- What is Growth Strategy and Future Prospects of Ingredion Company?

- How Does Ingredion Company Work?

- What is Sales and Marketing Strategy of Ingredion Company?

- What is Brief History of Ingredion Company?

- Who Owns Ingredion Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.