J. C. Penney Company Bundle

Can J. C. Penney Reclaim Its Retail Throne?

The retail world is in constant flux, especially for department stores, demanding innovative growth strategies for survival. J. C. Penney, a long-standing name in American retail since 1902, faces this challenge head-on. This article delves into JCPenney's journey, from its foundational principles of fairness to its current efforts to thrive in a competitive market.

This J. C. Penney Company SWOT Analysis will explore the company's strategic initiatives, aiming to unlock its future prospects. We'll examine J. C. Penney's growth strategy, including expansion plans, technological advancements, and the overall financial performance within the context of evolving retail industry trends. Understanding the department store market dynamics and J. C. Penney's financial health is crucial for evaluating its potential in the years to come, including its turnaround plan and how it is adapting to e-commerce.

How Is J. C. Penney Company Expanding Its Reach?

The J. C. Penney growth strategy centers on a multi-pronged expansion approach. It includes penetrating new markets, diversifying product offerings, and forming strategic partnerships. This is essential for navigating the evolving retail landscape and meeting the needs of modern consumers. The company's approach is designed to ensure long-term sustainability and growth within the department store market.

While specific details on new geographical market entries in 2024-2025 are limited, the company has focused on optimizing its existing physical footprint. This includes rightsizing stores and investing in store modernization to enhance the in-store customer experience. The company is also heavily invested in bolstering its online presence to reach a broader customer base. This strategic focus is critical for adapting to the dynamic shifts in the retail industry.

In terms of product categories, J. C. Penney continues to refine its merchandise assortment to align with current consumer trends and preferences. This involves introducing new brands, expanding popular categories like home goods and activewear, and enhancing its private label offerings to provide exclusive value to customers. The company's financial performance is closely tied to its success in these areas.

J. C. Penney is focused on optimizing its existing store network through rightsizing and modernization. This includes renovating stores to enhance the shopping experience and attract customers. These efforts aim to improve the in-store customer experience and drive sales.

The company is diversifying its product offerings to meet changing consumer demands. This involves introducing new brands and expanding categories like home goods and activewear. Enhancing private label offerings is also a key strategy.

J. C. Penney is investing in its omnichannel capabilities to provide a seamless shopping experience. This involves integrating online and in-store shopping. This strategy is crucial for staying ahead of industry changes.

The company explores partnerships to introduce new services or product lines. These partnerships aim to diversify revenue streams and attract new demographics. Such collaborations are vital for long-term growth.

J. C. Penney's expansion initiatives are designed to drive growth and enhance its market position. These initiatives include optimizing the store footprint, expanding product offerings, and improving omnichannel capabilities. These strategies are crucial for navigating the competitive retail industry.

- Rightsizing and modernizing existing stores to improve the customer experience.

- Expanding product categories, including home goods and activewear, to meet consumer demand.

- Enhancing omnichannel capabilities to provide a seamless shopping experience.

- Exploring strategic partnerships to diversify revenue streams and attract new customers.

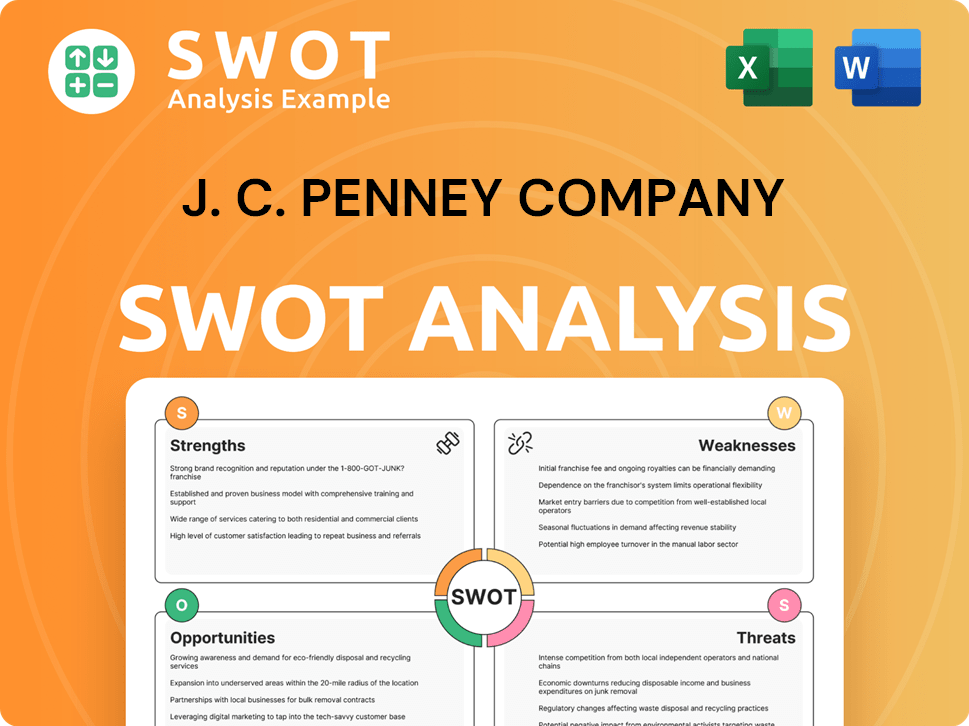

J. C. Penney Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does J. C. Penney Company Invest in Innovation?

To ensure sustained growth, J. C. Penney is heavily investing in technology and innovation. This approach is central to its strategy. The company is focused on upgrading its digital capabilities to provide a better customer experience, which is vital in today's competitive retail landscape.

The company is working to improve its e-commerce platform and mobile applications. This includes using advanced analytics to understand customer behavior better. Tailoring product recommendations and promotions based on customer data is a key part of this strategy.

While specific details on R&D investments or groundbreaking patents in 2024-2025 are not widely publicized, J. C. Penney's commitment to technology is evident. Continuous efforts are made to upgrade supply chain management systems and optimize inventory levels. Enhancing customer service through digital tools is also a priority.

J. C. Penney's digital transformation focuses on improving its e-commerce platform and mobile applications. This ensures a more intuitive and personalized shopping experience for customers. These efforts are crucial for the company's Target Market of J. C. Penney Company.

The company uses advanced analytics to understand customer behavior better. This data helps tailor product recommendations and promotions effectively. This approach is key to enhancing customer engagement and driving sales.

J. C. Penney is continuously upgrading its supply chain management systems. The goal is to optimize inventory levels and enhance operational efficiency. This helps streamline processes and reduce costs.

The company explores how AI can be integrated into its operations. This includes personalized marketing campaigns and more efficient logistics. AI integration is crucial for staying competitive.

Sustainability is also becoming a focus, with technology playing a role. This includes optimizing energy consumption in stores and improving distribution network efficiency. These efforts align with broader industry trends.

Digital tools are being used to enhance customer service capabilities. This includes providing better online support and improving the overall shopping experience. Improved customer service is vital for customer retention.

These technological advancements are critical for J. C. Penney to remain competitive. Streamlining operations and contributing to its growth objectives in the evolving retail landscape is a key goal. The company's focus on innovation and technology is a core component of its J. C. Penney growth strategy and its future prospects within the department store market.

J. C. Penney's technology strategy encompasses several key areas. These initiatives are designed to improve operational efficiency and enhance the customer experience.

- E-commerce Enhancement: Upgrading the online platform and mobile apps for better user experience.

- Data Analytics: Using data to personalize product recommendations and promotions.

- Supply Chain Optimization: Improving inventory management and logistics through technology.

- AI Integration: Exploring AI for marketing and operational efficiency.

- Sustainability: Utilizing technology to reduce energy consumption and improve distribution.

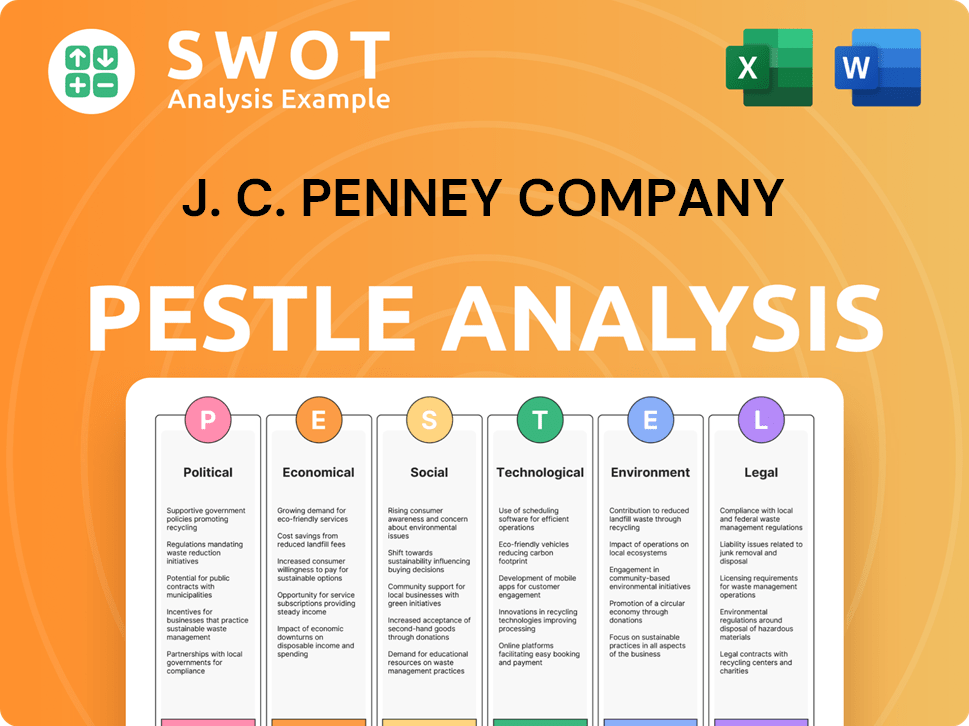

J. C. Penney Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is J. C. Penney Company’s Growth Forecast?

The financial outlook for JCPenney is a key element of its growth strategy. The company is focused on achieving sustainable profitability and strengthening its financial position. As a privately held entity, JCPenney does not publicly disclose detailed revenue targets or profit margins for 2024-2025. However, the company's financial health is closely tied to its ability to adapt to evolving retail industry trends.

JCPenney's financial performance is closely monitored by industry analysts, who look for signs of improvement in key areas. These include increased comparable store sales, which indicate the company's ability to attract and retain customers. Improved inventory turnover is another critical metric, reflecting efficient management of its merchandise. Furthermore, enhanced online sales performance is essential, demonstrating the company's success in its omnichannel strategy. These metrics collectively provide insights into JCPenney's financial health and its capacity to navigate the challenges of the department store market.

Since emerging from bankruptcy, JCPenney has been working to stabilize its financial performance. This involves strategic investments in its core business, optimizing its cost structure, and reducing debt. The company's ability to generate consistent cash flow and manage its liabilities is crucial for funding future growth initiatives. These initiatives include store modernizations and technological upgrades, all of which are vital for long-term sustainability.

JCPenney is prioritizing profitability as a core element of its financial strategy. This involves focusing on improving margins and operational efficiency. The company aims to achieve sustainable financial growth.

Reducing debt is a key financial goal for JCPenney. This will improve its financial flexibility and reduce interest expenses. The company's efforts to reduce debt will bolster its financial stability.

JCPenney is investing in store modernizations to enhance the shopping experience. This includes updating store layouts and improving the overall customer experience. These investments aim to attract and retain customers.

The company is implementing technological upgrades to improve operational efficiency. This includes enhancements to its e-commerce platform. These upgrades are aimed at improving the omnichannel strategy.

Several key financial metrics are crucial for assessing JCPenney's performance and future prospects. These metrics provide insights into the company's financial health and its ability to execute its growth strategy. The company's financial health is critical for its long-term success.

- Comparable Store Sales: Reflects the sales performance of stores open for at least a year.

- Inventory Turnover: Measures how efficiently the company manages its inventory.

- Online Sales Performance: Indicates the success of JCPenney's e-commerce strategy.

- Cash Flow: Crucial for funding future investments and managing liabilities.

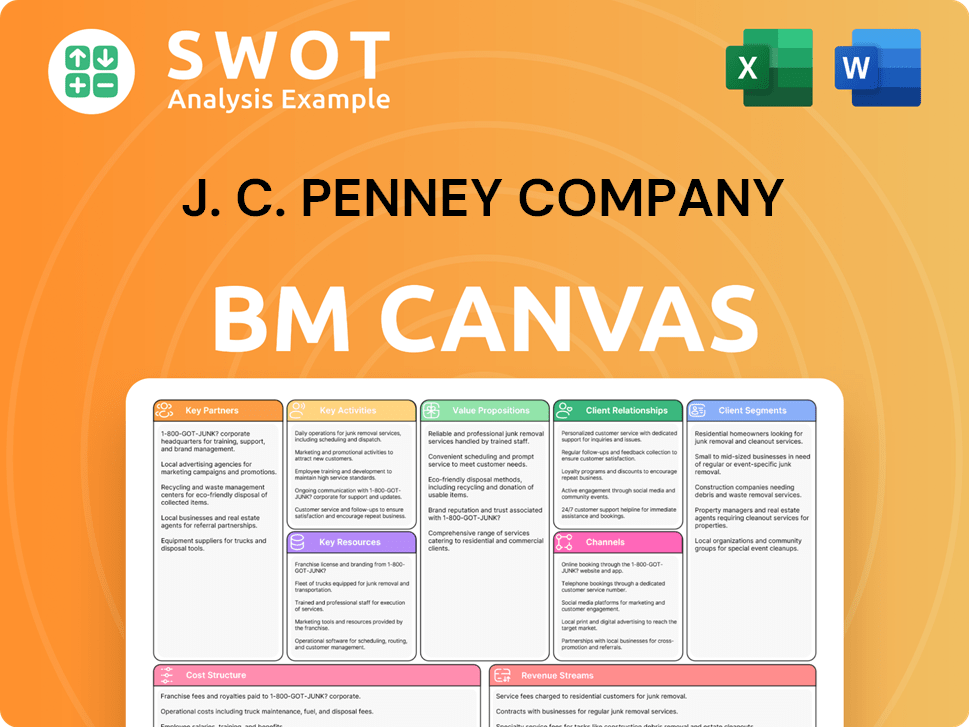

J. C. Penney Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow J. C. Penney Company’s Growth?

The path to growth for J. C. Penney is fraught with challenges, particularly within the highly competitive retail sector. The company faces significant hurdles from various fronts, including intense competition from e-commerce giants, off-price retailers, and other department store chains. Understanding the potential risks and obstacles is crucial for evaluating J. C. Penney's future prospects and its ability to execute its growth strategy effectively.

Technological advancements and changing consumer behaviors pose continuous threats. Adapting to these shifts requires significant investment and strategic agility. Furthermore, external factors like supply chain disruptions and economic fluctuations add layers of complexity to J. C. Penney's operational environment. Analyzing these risks is vital for understanding the company's long-term potential and its ability to navigate the dynamic retail landscape.

Internal resource constraints, such as securing adequate capital or attracting skilled talent, could also impede J. C. Penney's expansion plans. The company's ability to overcome these obstacles will significantly influence its financial performance and market position. For a deeper understanding of the company's core principles, consider exploring the Mission, Vision & Core Values of J. C. Penney Company.

The department store market is intensely competitive, with rivals like Macy's and Kohl's vying for market share. E-commerce giants such as Amazon and off-price retailers like TJX Companies also pose significant threats. This competition necessitates continuous innovation and strategic adaptation for J. C. Penney to maintain its relevance.

Rapid advancements in e-commerce, supply chain automation, and digital marketing require constant investment and adaptation. Retail industry trends necessitate an omnichannel strategy to meet evolving customer expectations. Failure to keep pace with these technological shifts could significantly impact J. C. Penney's competitiveness.

Global events, economic fluctuations, and geopolitical tensions can disrupt supply chains, affecting inventory levels and product availability. Regulatory changes, including trade policies and tariffs, can also impact costs and operations. Mitigating these risks requires robust supply chain management and diversification strategies.

Changes in labor laws, consumer protection regulations, and trade policies can affect operational costs and profitability. Compliance with evolving environmental, social, and governance (ESG) standards also presents challenges. Staying ahead of these regulatory shifts is essential for long-term sustainability.

Securing adequate capital for modernization, attracting and retaining skilled talent, and managing operational costs are ongoing challenges. Financial health and efficient resource allocation are critical for supporting J. C. Penney's growth strategy. Effective financial planning and management are therefore essential.

Shifts in consumer spending habits, preferences for sustainable products, and the impact of inflation on purchasing power can influence J. C. Penney's sales. Understanding and adapting to these evolving trends is crucial for maintaining customer loyalty and driving revenue growth. J. C. Penney's customer loyalty programs are key in this area.

J. C. Penney's financial health is a key indicator of its ability to navigate risks. Recent financial performance, including revenue and profitability figures, provides insights into the company's resilience and strategic effectiveness. Analyzing financial data helps assess the impact of market trends and internal initiatives on the company's overall success. The department store market has seen fluctuations, with some competitors experiencing challenges.

J. C. Penney's strategic initiatives, such as store closures and openings, and investments in e-commerce, are critical for adapting to retail industry trends. The company's ability to execute its turnaround plan and expansion strategies will determine its future prospects. Omnichannel strategy implementation is crucial for meeting evolving customer needs. The company is focusing on enhancing its omnichannel presence.

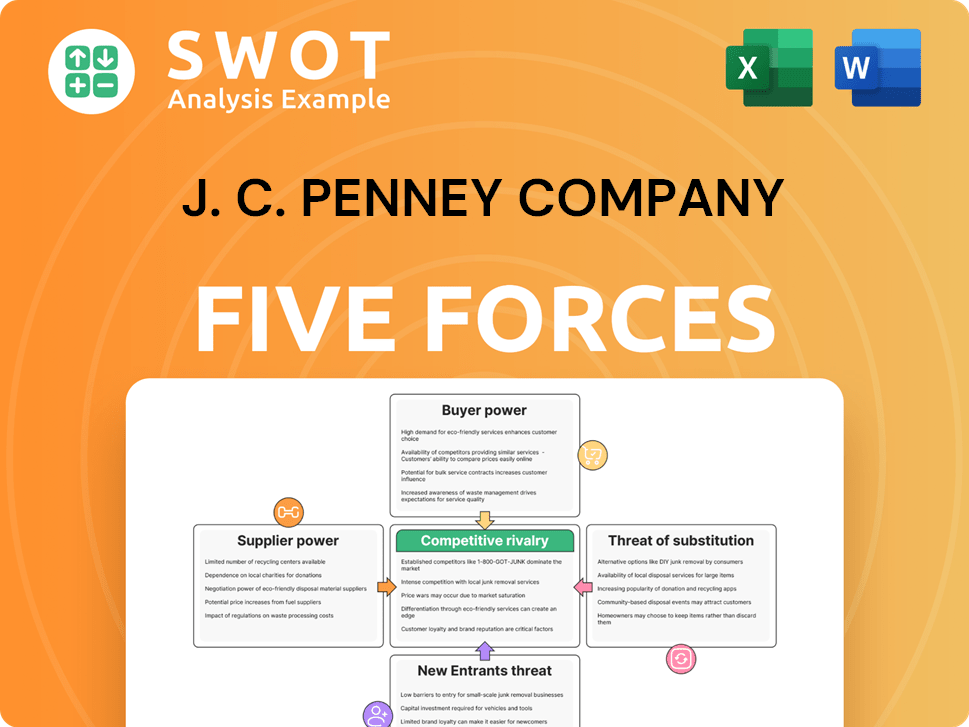

J. C. Penney Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of J. C. Penney Company Company?

- What is Competitive Landscape of J. C. Penney Company Company?

- How Does J. C. Penney Company Company Work?

- What is Sales and Marketing Strategy of J. C. Penney Company Company?

- What is Brief History of J. C. Penney Company Company?

- Who Owns J. C. Penney Company Company?

- What is Customer Demographics and Target Market of J. C. Penney Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.