J. C. Penney Company Bundle

How Does J. C. Penney Thrive in Today's Retail World?

J. C. Penney, a long-standing J. C. Penney Company SWOT Analysis, continues to navigate the ever-changing retail landscape. This iconic department store, also known as Penney's, has adapted to consumer demands and economic fluctuations for over a century. Understanding its business model is key to grasping the dynamics of the retail company.

From its humble beginnings, JCPenney has evolved, and its ability to stay relevant offers invaluable insights into the strategies employed by a major player in the department store sector. This exploration will unravel how J. C. Penney generates revenue and maintains its market position, examining its operational strategies and the factors that influence its future. Analyzing J. C. Penney's business model provides a crucial perspective on the broader retail industry, including its challenges and opportunities.

What Are the Key Operations Driving J. C. Penney Company’s Success?

The J. C. Penney (JCPenney) business model centers on offering a wide array of products and services designed to attract the mid-market consumer. As a prominent retail company, it provides a comprehensive selection of merchandise including apparel, home goods, and beauty products. This strategy allows Penney's to cater to a broad customer base, aiming to be a one-stop shopping destination.

Core operations involve a complex interplay of sourcing, logistics, and customer service. The company sources products from a global network of vendors, managing a supply chain that delivers goods to its physical stores and online platform. Customer service is a key component, designed to provide a seamless shopping experience across all channels, enhancing customer loyalty and driving sales.

The value proposition of JCPenney lies in its ability to offer convenience and a diverse product mix. This is achieved through a combination of in-store services like salons and photography studios, and a robust e-commerce platform. This approach differentiates JCPenney from both pure-play online retailers and niche brick-and-mortar competitors, offering customers a comprehensive shopping experience.

JCPenney offers a wide variety of products, including apparel for men, women, and children, home furnishings, fine jewelry, and beauty products. The product range includes both private and national brands. This diverse selection aims to meet the needs of a broad customer base, solidifying its position as a leading department store.

To enhance the shopping experience, JCPenney provides in-store services such as portrait photography, optical services, and full-service salons. These services offer added convenience and encourage customers to spend more time in the stores. This integrated approach helps to differentiate JCPenney from competitors.

JCPenney's supply chain is a critical component of its operations, managing the flow of merchandise from suppliers to stores and online customers. Efficient logistics and distribution networks are essential for ensuring products are available when and where customers need them. This complex system supports the company's extensive retail footprint.

JCPenney has invested significantly in its e-commerce platform to enhance the online shopping experience. This platform allows customers to browse and purchase products online, offering convenience and expanding the company's reach. The online presence is crucial for staying competitive in the modern retail environment.

JCPenney's business model aims to provide a convenient and comprehensive shopping experience. This is achieved through a combination of diverse product offerings, in-store services, and a user-friendly online platform. The focus is on providing value to customers through a wide range of choices and accessible services.

- One-stop shopping for various needs.

- Convenient in-store services.

- Seamless online shopping experience.

- Competitive pricing and promotions.

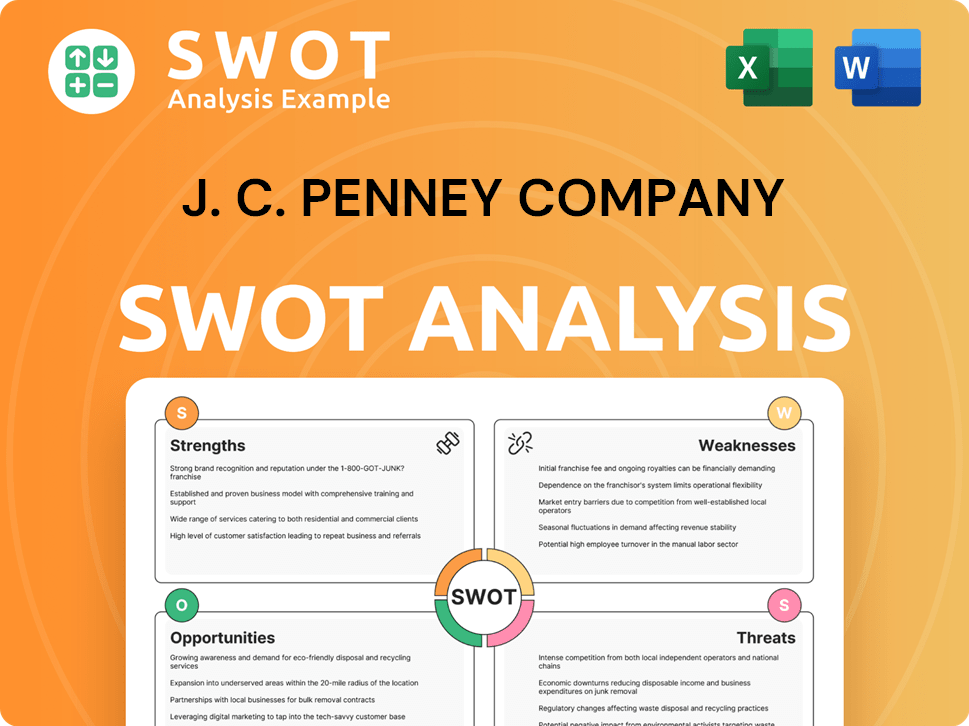

J. C. Penney Company SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does J. C. Penney Company Make Money?

The primary revenue stream for Owners & Shareholders of J. C. Penney Company, often referred to as JCPenney or Penney's, is the sale of merchandise. This includes a wide array of products sold through its department stores and online platforms. Merchandise sales historically account for the vast majority of the company's total revenue, making it the core of its business model.

JCPenney's monetization strategy focuses on direct sales of goods, including apparel, home goods, and beauty products. The company also generates revenue through in-store services like portrait studios and salons. These services not only provide additional income but also encourage customer visits, potentially increasing merchandise sales.

While specific financial figures for 2024-2025 are not yet fully detailed, it's evident that the company's strategy centers on optimizing merchandise sales. This is achieved through strategic pricing, promotional activities, and effective inventory management. Furthermore, leveraging in-store services helps to boost customer loyalty and profitability.

Merchandise sales are the main source of revenue for JCPenney. This includes clothing, home goods, and beauty products sold in stores and online. The focus is on driving sales through strategic pricing and promotions.

JCPenney uses its physical store locations to offer services like portrait studios and salons. These services generate additional revenue and bring customers into the stores. This increases the chances of merchandise purchases.

The company may use credit card programs to generate income. This includes interest and transaction fees. However, these are typically a smaller part of the overall revenue mix.

JCPenney uses strategic pricing to attract customers. This involves setting prices that are competitive and appealing. The company also uses promotions to boost sales.

Effective inventory management is key to maximizing revenue. This involves keeping the right products in stock. It also helps to reduce costs and improve profitability.

JCPenney focuses on strategies that enhance customer loyalty. This includes providing excellent customer service. It also involves offering rewards programs and other incentives.

JCPenney's financial performance is heavily influenced by its ability to drive merchandise sales. Effective pricing strategies, promotional campaigns, and efficient inventory management are critical. The company's physical stores also play a significant role in generating revenue, not only through direct sales but also by offering in-store services that attract customers.

- Merchandise Sales: Apparel, home goods, jewelry, and beauty products sold in stores and online.

- In-Store Services: Portrait studios, optical centers, and hair salons.

- Strategic Pricing and Promotions: Competitive pricing and promotional activities to boost sales.

- Inventory Management: Efficiently managing inventory to meet customer demand and control costs.

- Customer Loyalty Programs: Rewards and incentives to retain customers and drive repeat business.

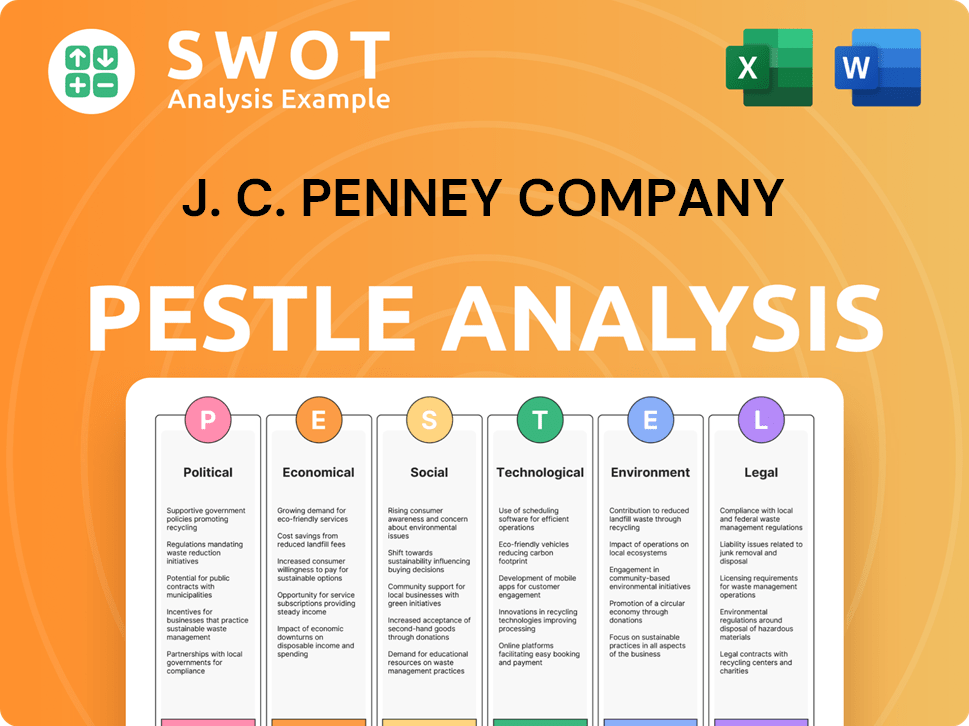

J. C. Penney Company PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped J. C. Penney Company’s Business Model?

The J. C. Penney Company, often referred to as JCPenney or Penney's, has a rich history marked by significant milestones and strategic shifts. A critical turning point in recent years was its emergence from Chapter 11 bankruptcy in December 2020. This restructuring allowed the retail company to shed unprofitable stores and liabilities, setting the stage for a new business model.

Post-bankruptcy, JCPenney has focused on revitalizing its brand, enhancing its digital presence, and refining its merchandise assortment. The company aims to better resonate with its target customer base in a dynamic retail environment. The company continues to adapt by focusing on private brands, enhancing the customer experience, and exploring strategic partnerships to maintain its relevance.

Operational challenges have included intense competition from online retailers and other brick-and-mortar stores, supply chain disruptions, and shifting consumer shopping habits. JCPenney has responded by investing in its e-commerce platform and improving its omnichannel capabilities to integrate online and in-store experiences.

Key milestones for J. C. Penney include its founding in 1902, expansion throughout the 20th century, and the recent emergence from bankruptcy in 2020. These events have shaped its evolution as a department store. The brand has adapted to changing consumer preferences and market dynamics.

Strategic moves include the focus on e-commerce, omnichannel integration, and supply chain optimization. JCPenney has invested in its online platform to enhance the online shopping experience. The company is also streamlining its supply chain to improve efficiency and reduce costs.

JCPenney's competitive advantages include its established brand recognition and extensive physical store footprint. It offers a value proposition as a mid-tier department store. The company's focus on private brands also helps it differentiate itself in the market.

J. C. Penney's financial performance is closely watched by investors. The company's ability to manage debt and improve profitability is crucial for its long-term success. The company's stock price and overall financial health are key indicators of its performance.

JCPenney is adapting to the market by focusing on private brands, enhancing the customer experience, and exploring strategic partnerships. The company's marketing strategy is also evolving to reach a broader audience. The company strives to improve its customer service and return policy to enhance customer satisfaction.

- Emphasis on private-label brands to increase margins.

- Investment in e-commerce and omnichannel capabilities.

- Streamlining of the supply chain to improve efficiency.

- Strategic partnerships to expand product offerings.

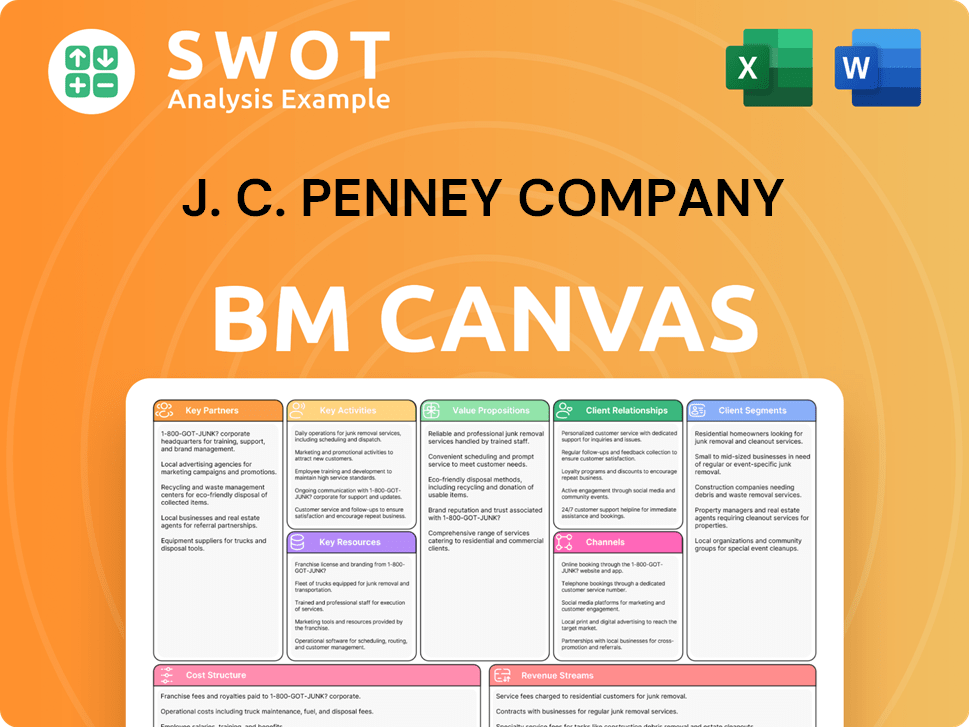

J. C. Penney Company Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is J. C. Penney Company Positioning Itself for Continued Success?

The retail landscape is highly competitive, and J. C. Penney (JCPenney) operates within the U.S. mid-scale department store sector. This retail company competes with both national chains and online retailers, influencing its market share. The company has maintained a customer base, particularly in areas with established physical stores.

JCPenney's business model is subject to various risks, including competition from e-commerce and off-price retailers. Economic downturns, changing consumer preferences, and technological advancements are also significant factors. The company must adapt to supply chain vulnerabilities and rising operational costs.

J. C. Penney is a key player in the department store industry, competing with major retailers. Its position is affected by shifts in consumer behavior and the rise of online shopping. The company's performance is influenced by its ability to adapt to these changes.

The company faces intense competition, particularly from online retailers and off-price stores. Economic fluctuations and changes in consumer tastes pose risks. JCPenney's supply chain and operational costs also present ongoing challenges.

JCPenney is focusing on enhancing its omnichannel capabilities and optimizing its store network. The company aims to improve operational efficiency and invest in digital transformation. These strategies are designed to meet modern consumer demands.

The company is committed to customer-centric strategies and financial stability. Leadership focuses on long-term viability through these approaches. Improving the J. C. Penney's ability to make money is a key goal.

JCPenney is concentrating on boosting its omnichannel presence and refining its product assortment. This includes optimizing its store locations and improving its digital platforms. The goal is to boost customer engagement and sales.

- Enhancing online shopping experience.

- Optimizing store locations.

- Improving supply chain efficiency.

- Focusing on customer service.

For more details on the competitive environment, consider reading about the Competitors Landscape of J. C. Penney Company. This offers insights into the challenges and opportunities facing Penney's in the retail sector.

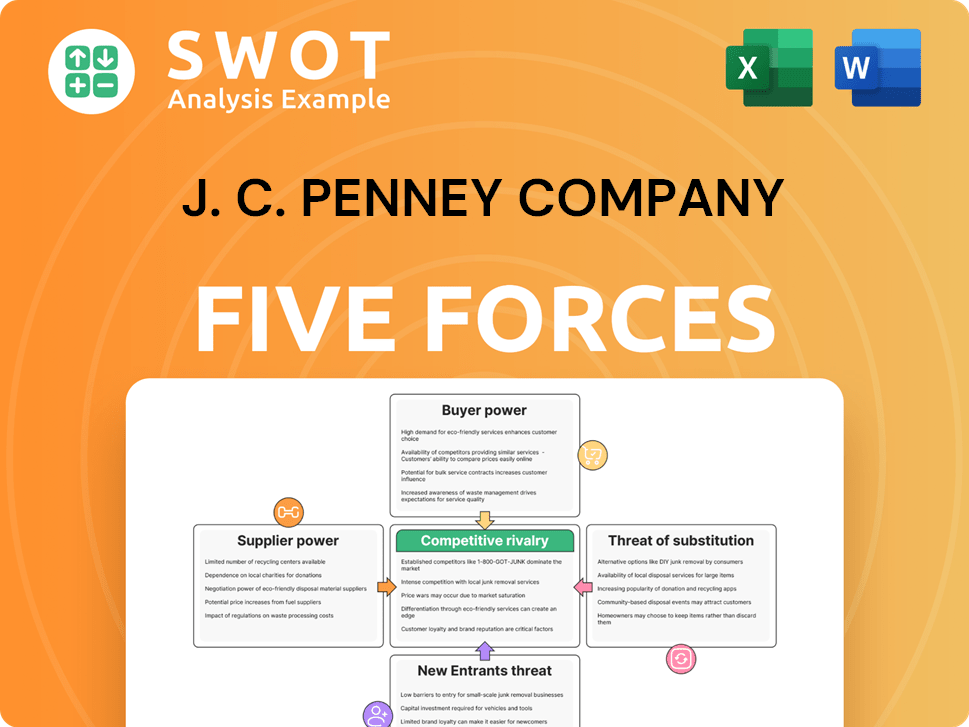

J. C. Penney Company Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of J. C. Penney Company Company?

- What is Competitive Landscape of J. C. Penney Company Company?

- What is Growth Strategy and Future Prospects of J. C. Penney Company Company?

- What is Sales and Marketing Strategy of J. C. Penney Company Company?

- What is Brief History of J. C. Penney Company Company?

- Who Owns J. C. Penney Company Company?

- What is Customer Demographics and Target Market of J. C. Penney Company Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.