Kirkland's Bundle

Can Kirkland's Redefine Home Décor in the Coming Years?

Kirkland's, a well-known name in home décor, is undergoing a significant transformation, highlighted by its strategic partnership with Beyond, Inc. This collaboration, sealed in late 2024, is a pivotal move for the company, promising to unlock new growth opportunities. Founded in 1966, Kirkland's has a rich history and a vision of offering great style at accessible prices, making it a key player in the Kirkland's SWOT Analysis.

This analysis delves into Kirkland's growth strategy and future prospects, examining how the company is adapting to evolving retail industry trends and the dynamic home décor market. We'll explore Kirkland's financial performance and expansion plans, considering its competitive advantages and innovative marketing strategies. Understanding Kirkland's e-commerce strategy and supply chain management is crucial to assess its ability to navigate future investment opportunities and achieve sustained revenue growth.

How Is Kirkland's Expanding Its Reach?

To secure its future, the company is actively pursuing several expansion initiatives. These efforts are designed to drive growth and strengthen its position in the market. The company's strategy includes optimizing its existing store network and leveraging strategic partnerships to expand its brand reach.

A key part of this strategy involves evaluating its current store portfolio. Roughly 6% of the stores have been identified as underperforming. The company plans to address this by converting some locations to brands within the Beyond, Inc. family, like Bed Bath & Beyond and Overstock. Other locations may be closed to better align real estate investments with new company standards.

The partnership with Beyond, Inc. plays a crucial role in the company's expansion plans. This collaboration allows the company to use a family of brands, including Kirkland's Home, Bed Bath & Beyond, buybuy Baby, and Overstock. This partnership is expected to unlock new avenues for growth and reshape future opportunities for both the company and each brand.

The company is strategically evaluating its store locations. Underperforming stores, representing about 6% of the total, are being assessed for potential conversion or closure. This aims to improve profitability and align real estate investments with new standards.

The partnership with Beyond, Inc. is central to the company's expansion strategy. This collaboration allows the company to leverage a family of brands. This partnership is expected to unlock new avenues for growth and reshape future opportunities for both the company and each brand.

The company intends to strategically expand its product categories. The goal is to increase average order value and maximize its omnichannel assets. This includes reallocating lower average unit retail inventory to brick-and-mortar stores to enhance buy-online-pick-up-in-store capabilities.

The company focuses on enhancing its omnichannel capabilities. This includes improving buy-online-pick-up-in-store services. These efforts aim to provide more profitable transactions and improve the overall customer experience.

Furthermore, the company aims to strategically expand its product categories. This initiative is designed to increase the average order value and maximize its omnichannel assets. The company is reallocating lower average unit retail inventory to brick-and-mortar stores to enhance buy-online-pick-up-in-store capabilities, leading to more profitable transactions. For more insights, consider exploring the Competitors Landscape of Kirkland's.

The company's expansion plans involve several key strategies. These include optimizing the store portfolio, leveraging strategic partnerships, and expanding product categories. These initiatives are designed to drive future growth and enhance market position.

- Store Portfolio Optimization: Evaluating and adjusting the existing store network.

- Strategic Partnerships: Leveraging collaborations to expand brand reach.

- Product Category Expansion: Increasing average order value and enhancing omnichannel assets.

- Omnichannel Enhancement: Improving buy-online-pick-up-in-store capabilities.

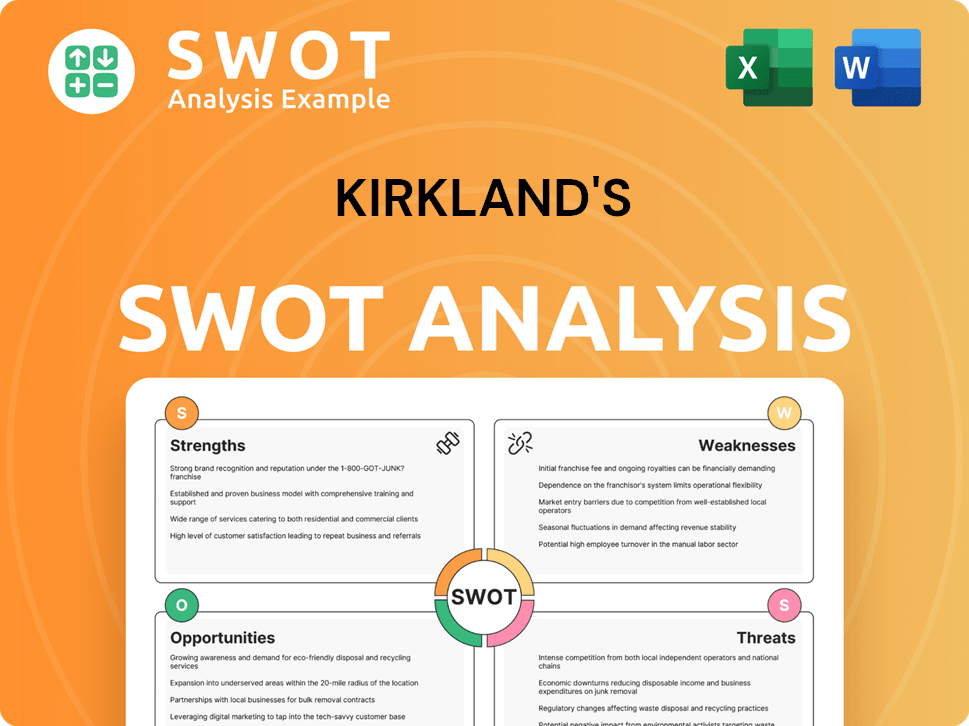

Kirkland's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kirkland's Invest in Innovation?

The innovation and technology strategy of the company centers on digital transformation and enhancing its omnichannel capabilities. This approach is crucial for driving sustained growth within the competitive retail landscape. The company focuses on optimizing its e-commerce performance, which is a key element of its overall strategy.

A significant aspect of the company's strategy involves a partnership with Beyond, Inc. This collaboration aims to improve the online segment through SKU rationalization and optimizing inventory allocation. These efforts support services like buy online, pick up in store across its physical locations, reflecting a commitment to integrating digital and physical retail experiences.

The company's strategic initiatives emphasize strengthening its omnichannel capabilities, which are foundational in building brand health and maximizing customer lifetime value. This strategic direction is designed to deliver sustainable profitable growth. The company is working to re-engage its core customer base and refocus its product assortment, supported by technological improvements that facilitate a seamless shopping experience. For more insights into the company's ownership structure, you can read the article about Owners & Shareholders of Kirkland's.

The primary focus is on enhancing the online shopping experience. This includes streamlining product offerings and improving inventory management. The goal is to make online shopping more efficient and appealing to customers.

The company aims to seamlessly blend online and in-store shopping experiences. This includes features like buy online, pick up in store. The objective is to provide customers with flexibility and convenience.

Efficient inventory allocation is key to meeting customer demand and reducing costs. The company is focused on optimizing how products are stored and distributed. This ensures products are available when and where customers need them.

The company is working to re-engage its core customer base. This involves understanding their needs and preferences. The goal is to build stronger customer relationships.

Refocusing the product assortment is a key part of the strategy. This involves curating the products to align with customer preferences. The aim is to offer a compelling selection of home décor items.

Underlying all these efforts are technological enhancements to improve the shopping experience. This includes website improvements and better in-store technology. The goal is to make shopping easier and more enjoyable.

The company's technology strategy focuses on enhancing the customer experience and streamlining operations. This includes improvements in e-commerce and omnichannel capabilities. The goal is to drive sustainable growth in the home décor market.

- E-commerce Optimization: Enhancements to the online platform to improve user experience and drive sales.

- Omnichannel Integration: Seamless integration of online and in-store experiences, such as buy online, pick up in store.

- Inventory Management: Utilizing technology to optimize inventory allocation and reduce costs.

- Data Analytics: Leveraging data to understand customer behavior and improve decision-making.

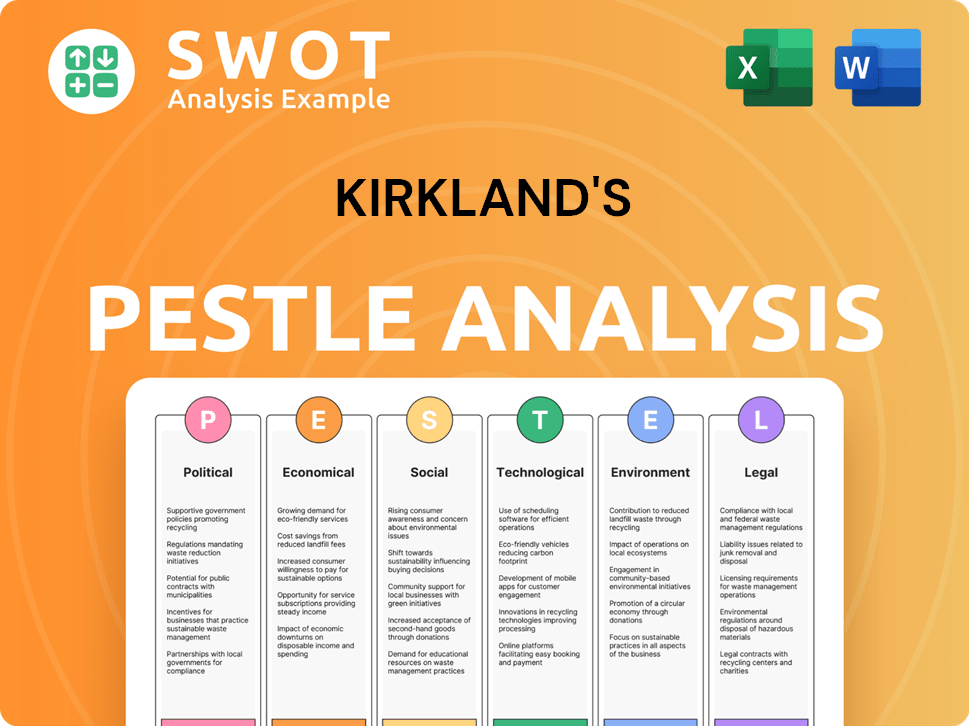

Kirkland's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kirkland's’s Growth Forecast?

The financial landscape of Kirkland's reflects a period of transition and strategic adjustments. The company's performance in fiscal year 2024 indicates both challenges and areas of strength, particularly in its ability to manage costs and adapt to evolving retail industry trends. Understanding these dynamics is crucial for assessing Kirkland's growth strategy and future prospects.

A closer look at the numbers reveals a mixed picture. While net sales experienced a decrease, the company demonstrated improvements in gross profit margin. This suggests that Kirkland's is focusing on operational efficiencies and strategic pricing to navigate the complexities of the home décor market. The impact of these efforts is evident in both the annual and quarterly financial results.

For fiscal year 2024, Kirkland's reported net sales of $441.4 million, a decrease of 5.8% compared to fiscal year 2023. Comparable sales decreased by 2.0%, influenced by a 12.9% decline in e-commerce sales, despite a 1.9% increase in comparable store sales. The gross profit margin expanded by 50 basis points to 27.6% in fiscal year 2024. These figures provide a foundation for a detailed Kirkland's company analysis.

Net sales for fiscal year 2024 were $441.4 million, a 5.8% decrease from the previous year. Comparable sales decreased by 2.0%, reflecting a decline in e-commerce sales. The gross profit margin improved to 27.6%, indicating better cost management.

Net sales in Q4 2024 were $148.9 million, with a 0.6% decrease in comparable sales. The gross profit margin was 30.3%, a decrease from the prior year. Net income for Q4 2024 was $7.9 million, or $0.51 per diluted share.

As of February 1, 2025, Kirkland's had a cash balance of $3.8 million. The company has $43.0 million in outstanding debt under its revolving credit facility and $17.0 million in debt to Beyond, Inc.

The partnership with Beyond, Inc. has provided Kirkland's with $25 million in capital. Beyond, Inc. now owns approximately 40% of Kirkland's outstanding shares of common stock as of February 5, 2025. This strategic move is crucial for Kirkland's future investment opportunities.

Kirkland's financial performance in 2024 reflects a challenging retail environment, yet the company is taking steps to improve its position. The focus on cost management and strategic partnerships is essential for navigating the home décor market. For a deeper understanding of the company's origins, consider reading Brief History of Kirkland's.

- Net Sales Decline: A decrease in net sales indicates the need for enhanced marketing strategies and new product development.

- E-commerce Challenges: The decline in e-commerce sales highlights the importance of adapting to online retail trends.

- Gross Margin Improvement: The increased gross profit margin signals effective cost control and pricing strategies.

- Strategic Partnerships: The partnership with Beyond, Inc. provides crucial capital and support for future growth.

- Debt and Liquidity: Managing debt and maintaining liquidity are critical for long-term sustainability.

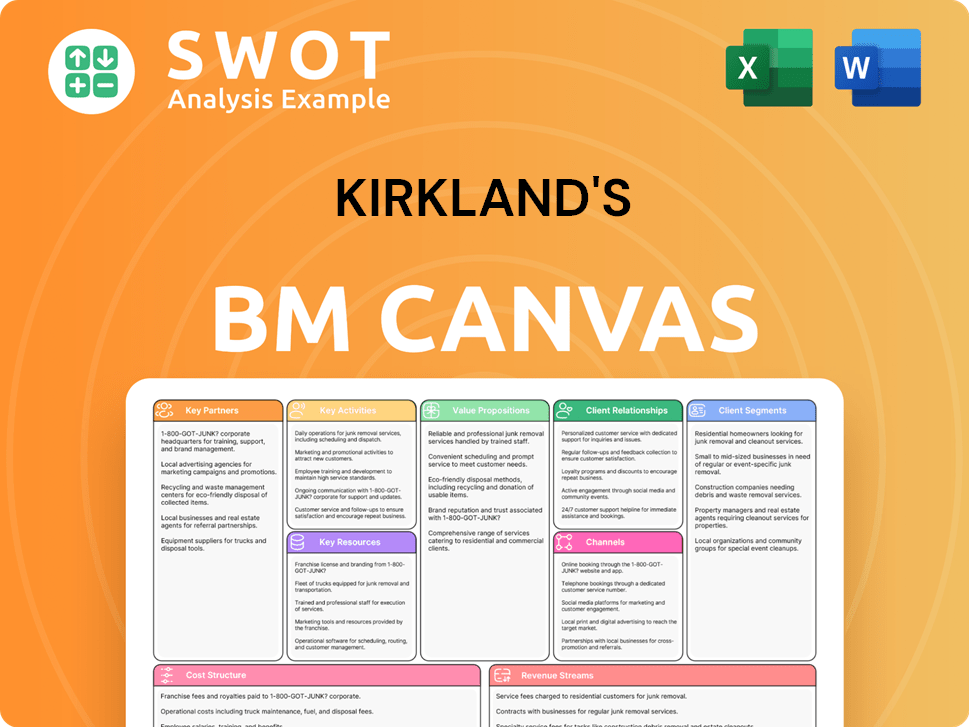

Kirkland's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kirkland's’s Growth?

The growth strategy of Kirkland's faces several risks and obstacles that could impact its future prospects. Economic uncertainties, including potential tariff impacts and shifts in consumer behavior, pose challenges to sales and cost structures. The company’s e-commerce segment, despite improvements, continues to experience headwinds, which could hinder overall revenue growth.

Supply chain vulnerabilities present another risk, especially as the company works to reduce its reliance on sourcing from China, potentially leading to operational difficulties. The competitive landscape within the home décor retail sector intensifies these challenges, requiring constant adaptation to market trends and consumer demands. Furthermore, the strategic partnership with Beyond, Inc., while offering opportunities, also introduces potential risks.

The focus on the special shareholders' meeting and other transaction components could distract management from day-to-day operations. There's also the potential for unforeseen expenses and legal challenges related to the transaction, which could strain the company's financial health and stability. As of May 2025, the company was not in compliance with covenants under its revolving credit facility and the Beyond Credit Agreement, though it anticipated receiving waivers. The company emphasizes risk management frameworks and strategic diversification, such as expanding its brand portfolio, to mitigate these obstacles and navigate the evolving retail environment. For a deeper dive into the customer base, check out the Target Market of Kirkland's.

Economic fluctuations, including potential tariff impacts and changes in consumer sentiment, can directly influence sales and cost structures. These factors create an unpredictable environment for the company, affecting its ability to forecast and manage expenses effectively. The home décor market is sensitive to economic cycles, which can significantly impact Kirkland's financial performance.

Despite improvements in conversion rates and store traffic, the e-commerce segment continues to face significant headwinds. This can limit overall revenue growth and necessitate strategic adjustments to online sales strategies. The company needs to continually adapt its e-commerce approach to stay competitive in the rapidly evolving retail industry.

Efforts to reduce dependency on China sourcing can lead to operational challenges and supply chain disruptions. These disruptions can impact the timely delivery of products and increase costs, affecting customer satisfaction and profitability. Effective supply chain management is crucial for mitigating these risks.

The competitive landscape within the home décor retail sector is intense, requiring constant adaptation to changing consumer behaviors and market trends. Competitors' strategies and innovations can impact the company’s market share and profitability. The company must stay agile and innovative to remain competitive.

The strategic partnership with Beyond, Inc. introduces potential risks, including distractions from day-to-day operations due to the focus on the special shareholders' meeting. Unforeseen expenses and legal challenges could also strain the company’s financial health. Managing this partnership effectively is critical to the company's success.

As of May 2025, the company was not in compliance with covenants under its revolving credit facility and the Beyond Credit Agreement, though it anticipated receiving waivers. This highlights the importance of maintaining financial stability and meeting financial obligations. The company must manage its finances prudently to avoid further complications.

The company emphasizes risk management frameworks to address these obstacles. Strategic diversification, such as expanding its brand portfolio, is a key approach. By diversifying its offerings, the company can reduce its reliance on any single product category or market segment. This strategy helps to build resilience against economic downturns and changing consumer preferences.

Economic trends significantly impact the company’s financial performance. Fluctuations in consumer spending, inflation, and interest rates can affect sales, profitability, and investment decisions. The company must closely monitor these trends and adjust its strategies accordingly. Understanding and adapting to these economic factors is critical for long-term success.

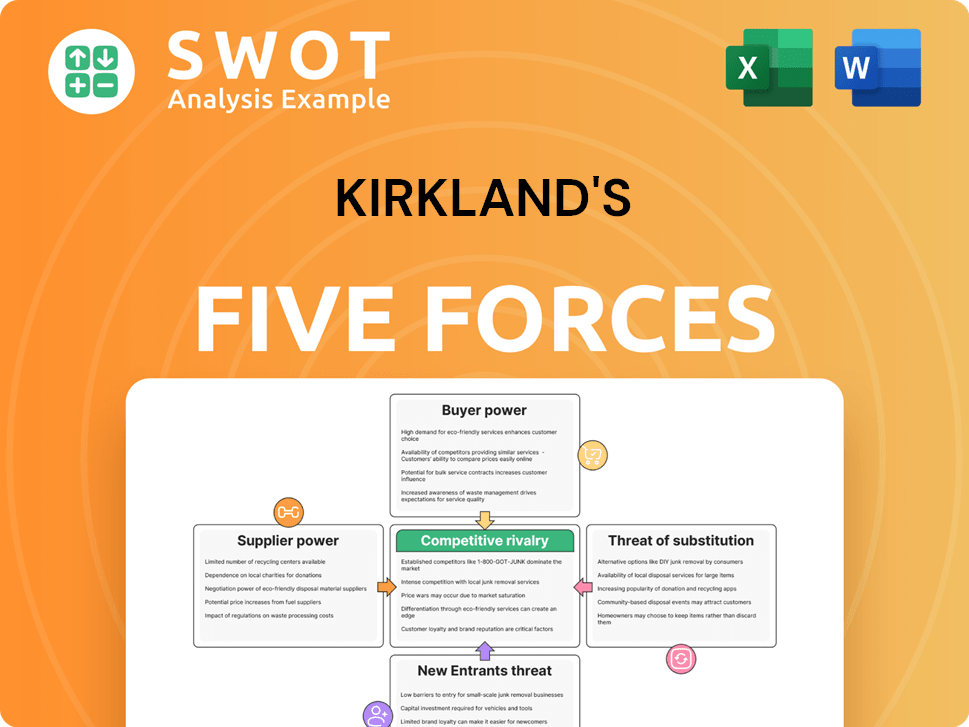

Kirkland's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kirkland's Company?

- What is Competitive Landscape of Kirkland's Company?

- How Does Kirkland's Company Work?

- What is Sales and Marketing Strategy of Kirkland's Company?

- What is Brief History of Kirkland's Company?

- Who Owns Kirkland's Company?

- What is Customer Demographics and Target Market of Kirkland's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.