Kirkland's Bundle

Who Truly Controls Kirkland's Company?

Navigating the home décor market requires understanding the key players, and at the heart of this lies the question of ownership. Unraveling Kirkland's SWOT Analysis reveals critical insights, but knowing who steers the ship is equally vital. This exploration dives deep into Kirkland's ownership, from its founding roots to the latest strategic partnerships.

Understanding Kirkland's ownership is essential for grasping its future trajectory. The company's history includes significant shifts, including a recent strategic partnership with Beyond, Inc., which closed in February 2025 and expanded in May 2025. This analysis will examine Kirkland's stock, its investors, and the evolution of its ownership structure, providing a comprehensive view of this specialty retailer.

Who Founded Kirkland's?

The story of the company begins with its co-founders, Carl and Robert Kirkland. They launched the business in 1966, establishing a foundation that would evolve into a significant player in the home décor market. Their initial vision focused on offering stylish items at accessible prices, setting the stage for the company's future growth.

Carl Kirkland and Robert Kirkland, cousins, started their ventures independently in Jackson and Nashville, Tennessee, respectively. While specific details on initial equity splits or ownership percentages are not publicly available, their combined efforts were crucial. Their early efforts laid the groundwork for what would become a chain of home accessories stores.

The company's early days saw it grow from a gift shop franchise to a broader retailer of home accessories. This evolution was significantly influenced by the founders' ability to source unique products internationally. The strategy of offering affordable and stylish home décor was central to the company's early growth and expansion.

In 1966, Carl and Robert Kirkland launched the company as a franchised gift shop. This initial setup provided a structured framework for their early operations. The franchise model allowed for a degree of standardization while also enabling local adaptation.

The company's early focus was on finding and merchandising stylish items at affordable prices. This strategy was a key factor in attracting customers. The ability to offer appealing products at competitive prices was a cornerstone of their business model.

Carl Kirkland established his operation in Jackson, Tennessee, while Robert Kirkland did the same in Nashville, Tennessee. This dual-city approach allowed for a broader market reach. This early expansion strategy helped establish a presence in multiple key markets.

By the late 1970s, the company began sourcing unique products internationally. This shift expanded their product offerings and provided a competitive edge. The ability to offer globally sourced products differentiated them from competitors.

In 1984, the company was acquired by Elias Brothers Restaurants Inc. This acquisition provided access to greater financial resources. This event marked a significant change in the company's ownership structure.

Carl Kirkland, along with two partners, re-acquired the company in 1986. This re-acquisition returned the company to its original leadership. This move highlighted the founders' commitment to their vision.

The company's history includes significant ownership changes, such as the 1984 acquisition by Elias Brothers Restaurants Inc. and the subsequent re-acquisition by Carl Kirkland in 1986. Details regarding initial ownership disputes or agreements like vesting schedules are not readily available in public records. Understanding the Growth Strategy of Kirkland's provides further context on how the company has evolved. The founders' vision of affordable and stylish home décor was key to its early growth.

The early ownership of the company involved several key events that shaped its trajectory. These events highlight the dynamic nature of the company's ownership structure and its evolution over time.

- 1966: Carl and Robert Kirkland co-founded the company as a franchised gift shop.

- 1984: Elias Brothers Restaurants Inc. acquired the company.

- 1986: Carl Kirkland re-acquired the company with two partners.

- The company's history reflects its founders' commitment and vision.

- The company's financial performance and ownership structure have evolved over time.

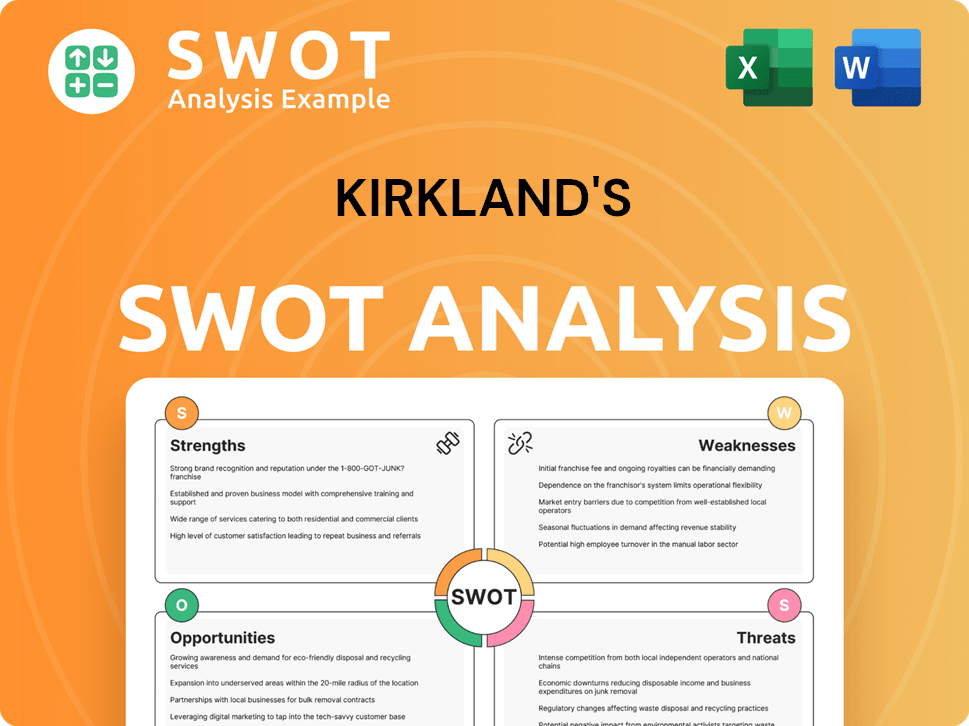

Kirkland's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Kirkland's’s Ownership Changed Over Time?

The journey of Kirkland's from a private entity to a publicly traded company began with its Initial Public Offering (IPO) in 1997. This move was crucial for raising capital and increasing its market presence. As of June 10, 2025, the company's market capitalization stood at approximately $23.49 million, with roughly 22.46 million shares outstanding. The ownership structure is primarily composed of institutional shareholders, insiders, and a small percentage of retail investors, reflecting a shift in its investor base over time.

A significant transformation in Kirkland's ownership occurred with the strategic partnership with Beyond, Inc. (NYSE: BYON). Beyond, Inc. emerged as the largest individual shareholder, holding 8.93 million shares, which represents 39.79% of the company as of early 2025. This investment, finalized in February 2025, provided Kirkland's with crucial financial backing. Furthermore, in May 2025, Beyond, Inc. expanded its credit facility with Kirkland's by $5.2 million and acquired the rights to the Kirkland's brand. These developments are expected to significantly influence Kirkland's strategic direction and growth prospects.

| Shareholder | Shares Held (as of March 31, 2025) | Percentage of Ownership |

|---|---|---|

| Vanguard Group Inc. | 621,693 | Not Available |

| US Bancorp \De\ | 310,000 | Not Available |

| PEAK6 LLC | 233,913 | Not Available |

Other significant institutional investors as of March 31, 2025, include Vanguard Group Inc., US Bancorp \De\, and PEAK6 LLC. These changes in major shareholding, particularly the substantial investment by Beyond, Inc., are expected to significantly influence Kirkland's strategy and governance, focusing on revitalizing the brand and expanding its omni-channel capabilities. The concentration of ownership among institutional investors and the strategic moves by Beyond, Inc. highlight a period of significant change and potential growth for Kirkland's.

The ownership structure of Kirkland's has evolved significantly, with a major shift towards institutional investors and a strategic partnership with Beyond, Inc.

- Beyond, Inc. is now the largest shareholder.

- Institutional investors hold a significant portion of the shares.

- These changes are expected to influence Kirkland's strategy and growth.

- The IPO in 1997 marked a pivotal moment for the company.

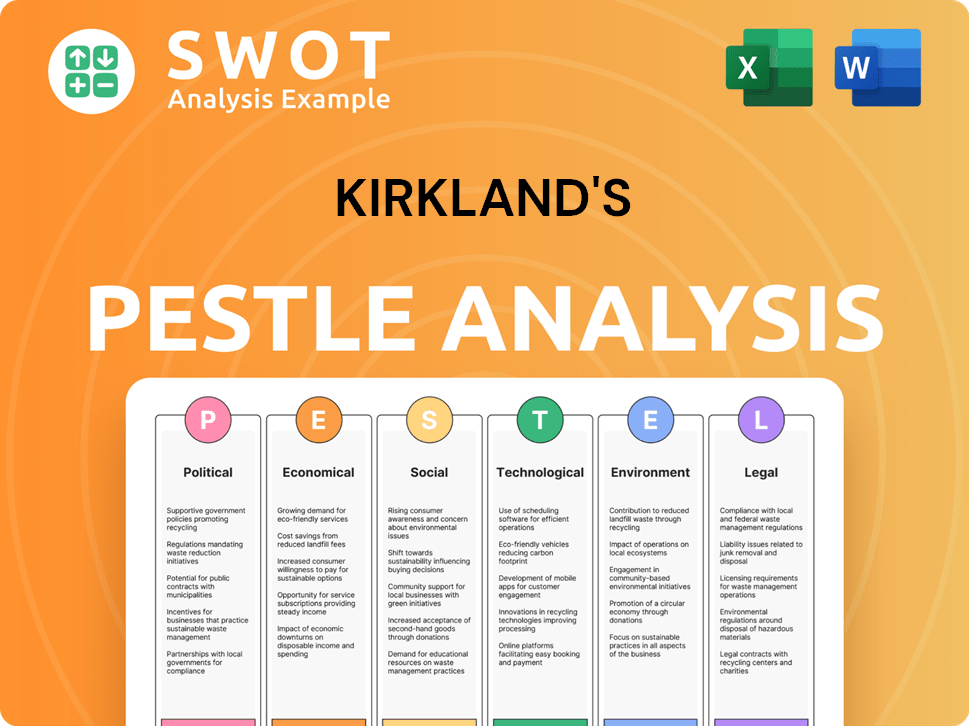

Kirkland's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Kirkland's’s Board?

As of June 2024, the Board of Directors of Kirkland's, Inc. comprised six members, a reduction from eight. This change followed the departure of two long-standing board members, R. Wilson Orr, III and Steven J. Collins, in June 2024, after they did not receive majority shareholder support. Amy Sullivan, who became CEO in February 2024, also joined the board. Ann Joyce was re-elected and named Chairman of the Board in June 2024. Furthermore, Susan S. Lanigan and Charlie Pleas, III announced their intention not to seek re-election at the 2025 Annual Meeting of Shareholders, scheduled for July 24, 2025.

The board's composition reflects recent shifts in the company's leadership and shareholder influence. The changes in the board's structure are pivotal for the future direction of the company, particularly given the significant shareholder influence and strategic partnerships. These adjustments are critical as the company navigates its strategic objectives and market dynamics. Understanding Kirkland's growth strategy is key to appreciating these board changes.

| Board Member | Role | Date Joined (Approximate) |

|---|---|---|

| Amy Sullivan | CEO & Director | February 2024 |

| Ann Joyce | Chairman of the Board | June 2024 (Re-elected) |

| Remaining Directors | Directors | Various |

The voting structure at Kirkland's generally follows a majority voting system for director elections, where the votes 'for' a nominee must surpass the votes 'against'. Each share of common stock typically entitles the holder to one vote. As of April 29, 2024, there were 13,038,978 shares of common stock outstanding and eligible to vote. This structure is crucial for understanding the dynamics of Kirkland's ownership and the influence of its investors.

Beyond, Inc. holds a substantial stake in Kirkland's, with approximately 40% ownership as of February 2025. This significant ownership gives Beyond, Inc. considerable influence over the company's strategic direction. This influence is formalized through strategic partnership agreements.

- Beyond, Inc. can designate two independent directors to Kirkland's Board.

- Beyond, Inc. can appoint one non-voting observer, subject to shareholder approval.

- Beyond, Inc. is bound to vote its shares in line with the Board's recommendations on shareholder matters, with some exceptions.

- Beyond, Inc. is restricted from taking actions to change the company's control or management during a standstill period.

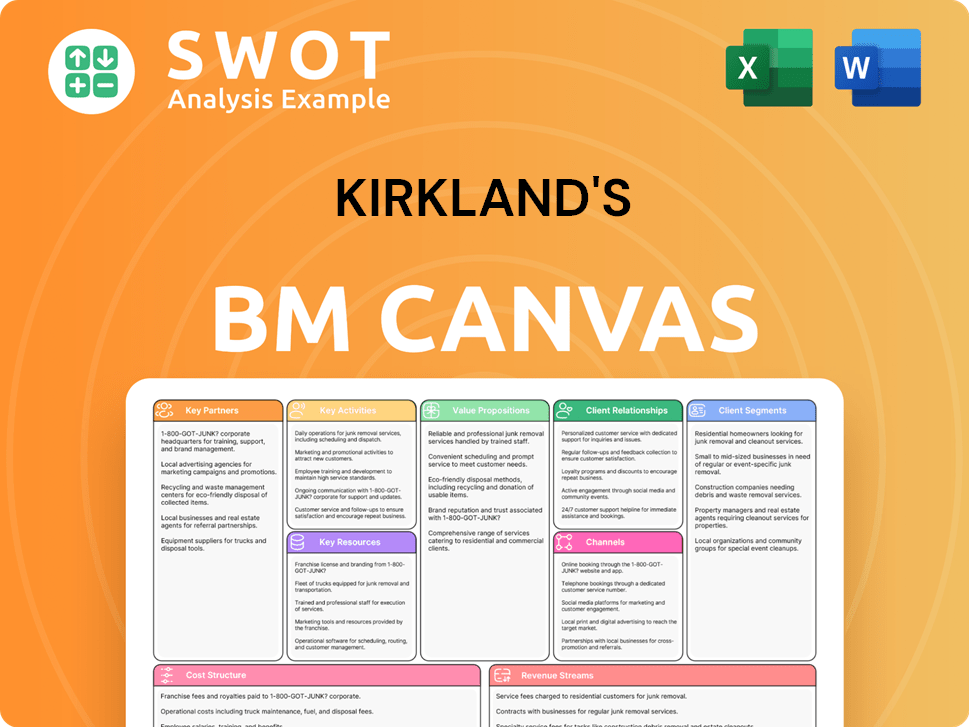

Kirkland's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Kirkland's’s Ownership Landscape?

Over the past few years, the ownership structure of Kirkland's has undergone significant changes. A key development has been the strategic partnership with Beyond, Inc. In February 2025, Beyond, Inc. invested $25 million, acquiring roughly 40% of Kirkland's outstanding common stock. This move aimed to boost Kirkland's liquidity and support its transformation. The partnership also included Beyond, Inc. expanding its credit facility with Kirkland's by $5.2 million in May 2025, and acquiring the rights to the Kirkland's brand. These steps highlight a growing strategic investment and collaboration with a larger e-commerce focused retailer.

This shift in ownership reflects a broader strategy to revitalize the brand. The partnership with Beyond, Inc. is designed to help Kirkland's navigate the changing retail landscape. The infusion of capital and the strategic alignment with Beyond, Inc. are aimed at bolstering Kirkland's financial position and supporting its long-term growth. For those interested in a broader view, you can explore the Competitors Landscape of Kirkland's.

Beyond, Inc. has become a major shareholder, acquiring approximately 40% of Kirkland's stock. This strategic partnership includes capital investments and brand rights acquisition. These moves aim to improve Kirkland's financial health and support its growth strategy.

Amy Sullivan was promoted to CEO in February 2024. The company has adjusted its store footprint, opening 2 stores and closing 15 in fiscal year 2024. James E. Schisler was appointed as COO in June 2025.

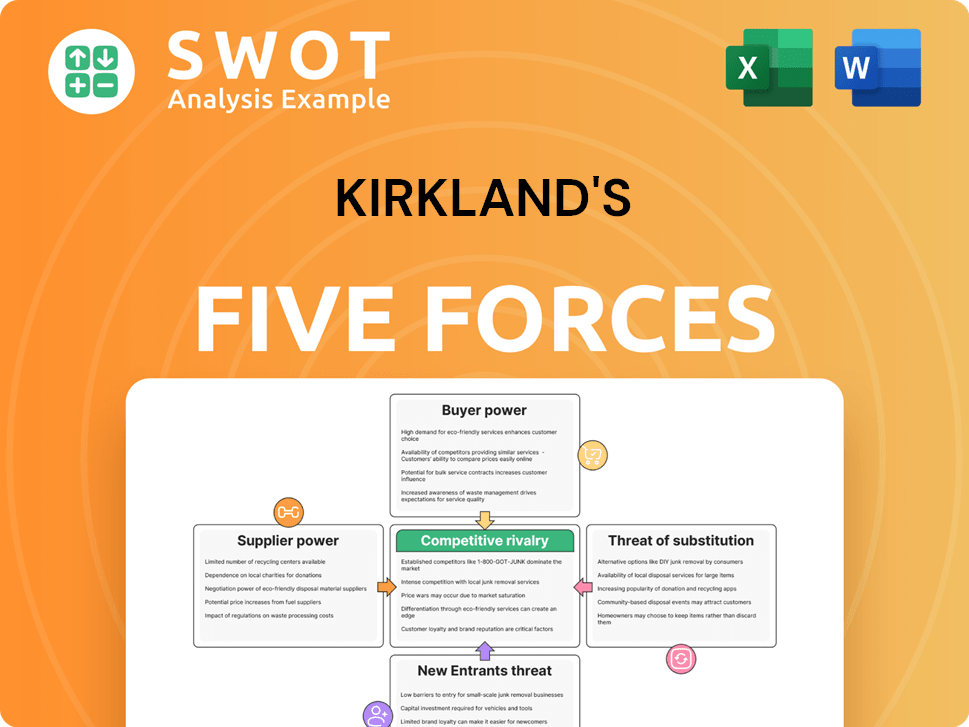

Kirkland's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kirkland's Company?

- What is Competitive Landscape of Kirkland's Company?

- What is Growth Strategy and Future Prospects of Kirkland's Company?

- How Does Kirkland's Company Work?

- What is Sales and Marketing Strategy of Kirkland's Company?

- What is Brief History of Kirkland's Company?

- What is Customer Demographics and Target Market of Kirkland's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.