Kirkland's Bundle

How Does Kirkland's Thrive in the Home Décor Market?

Kirkland's, a well-known name in home décor, operates across the United States with a network of physical stores and an online presence. The company, as of February 2025, maintained 317 stores, showcasing its commitment to providing stylish and affordable home furnishings. But how does Kirkland's SWOT Analysis impact its business model?

Understanding How Kirkland's works is key to grasping its position in the market. Its strategic partnership with Beyond, Inc., including a $25 million investment, is set to reshape its operations. This collaboration makes Kirkland's the exclusive brick-and-mortar operator and licensee for new Bed Bath & Beyond and buybuy BABY stores, offering insights into its future growth and adaptability in the retail sector. Exploring Kirkland's operations, from its stores to its supply chain, reveals a dynamic approach to the home décor market.

What Are the Key Operations Driving Kirkland's’s Success?

Kirkland's company creates value by offering a wide selection of stylish and affordable home décor solutions. Its core offerings include furniture, wall décor, decorative accessories, and seasonal goods. This caters to customers looking to enhance their living spaces. The company uses an omnichannel approach, combining physical retail stores and an e-commerce website to reach a diverse customer base.

As of February 1, 2025, Kirkland's operated 317 stores across 35 states, providing an engaging in-store shopping experience with design ideas. The company focuses on delivering a consistent brand experience across all channels. This includes optimizing its e-commerce performance and expanding its 'Buy Online Pick-up In Store' (BOPIS) capabilities.

Kirkland's business model emphasizes an omnichannel retail strategy focused on customer experience. This includes reallocating lower average unit retail inventory to brick-and-mortar stores. The partnership with Beyond, Inc. is set to enhance operations through joint procurement, refreshing the supply chain and sharing vendor relationships. This strategic alliance also provides Kirkland's with access to Beyond's digital and technical expertise to improve its e-commerce technology, customer experience, and conversion rates.

Kirkland's offers a variety of home décor products. These include furniture, wall décor, decorative accessories, and seasonal goods. The goal is to provide customers with everything they need to enhance their living spaces.

Kirkland's uses an omnichannel strategy to reach customers. This combines physical retail stores with an e-commerce website. This approach aims to provide a seamless shopping experience.

As of February 1, 2025, Kirkland's had 317 stores. These stores are located across 35 states. The stores provide an engaging in-store shopping experience.

Kirkland's has partnered with Beyond, Inc. This partnership aims to improve supply chain and e-commerce capabilities. The goal is to enhance the overall customer experience.

Kirkland's operations are centered around an omnichannel retail model. This includes optimizing e-commerce and expanding BOPIS. The company is also focused on strategic partnerships to improve its supply chain and customer reach.

- Focus on customer experience across all channels.

- Enhancing e-commerce technology and capabilities.

- Leveraging partnerships for supply chain improvements.

- Expanding the reach through the Kirkland's Home brand.

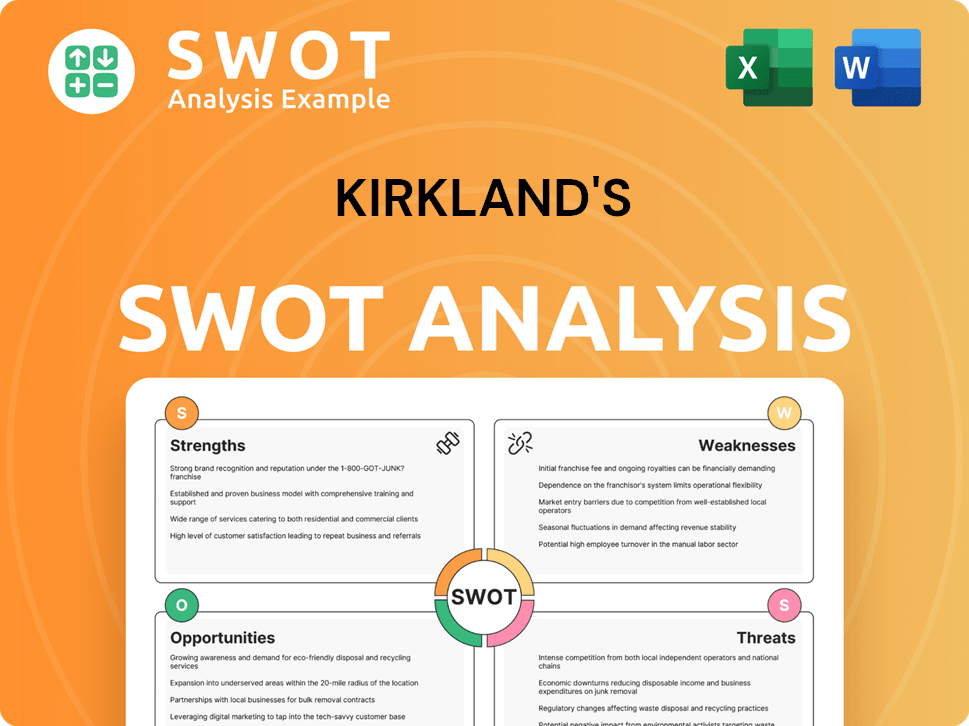

Kirkland's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kirkland's Make Money?

The primary revenue stream for Kirkland's company comes from selling home décor merchandise through its physical stores and online platform. The company's business model focuses on providing a wide range of products to customers, aiming to create a strong brand presence in the home goods market. Understanding how Kirkland's works involves examining its sales channels and how it generates income.

For the fiscal year 2024, which ended on February 1, 2025, Kirkland's reported net sales of $441.4 million. The fourth quarter of fiscal year 2024 saw net sales of $148.9 million. This financial data indicates the company's overall sales performance and the significance of its revenue streams.

The company's operations include various monetization strategies to boost revenue and profitability. These strategies involve both traditional retail sales and innovative partnerships to adapt to changing market conditions. The company aims to optimize its sales channels and enhance its brand presence in the home décor market.

Comparable store sales saw a positive growth of 1.9% for fiscal year 2024 and 1.6% in the fourth quarter of fiscal 2024. This growth indicates the company's ability to attract customers and drive sales within its existing store locations. The positive performance in comparable store sales shows the company's success in maintaining its customer base and increasing sales.

E-commerce sales experienced a decline of 12.9% for the full fiscal year and 7.9% in the fourth quarter of fiscal 2024. Despite the decline, e-commerce still constituted 23.5% of net sales in fiscal year 2024. The company is addressing this by expanding e-commerce distribution and focusing on categories like furniture, patio, and rugs.

Kirkland's has a partnership with Beyond, Inc., involving a quarterly collaboration fee. This fee is 0.50% of Kirkland's brick-and-mortar retail revenues, starting in the first fiscal quarter of fiscal 2025. This strategic move aims to drive revenue and enhance brand visibility.

The company plans to expand e-commerce distribution in categories such as furniture, patio, and rugs. This expansion aims to increase the average order value through Kirkland's, Overstock, and other marketplaces. This strategy helps drive revenue and enhance profitability.

The conversion of certain Kirkland's locations to Bed Bath & Beyond Home and Overstock stores is part of their strategy. This initiative is designed to drive revenue and improve profitability. This approach helps optimize the company's store network.

In fiscal year 2024, Kirkland's reported net sales of $441.4 million. The fourth quarter of fiscal year 2024 saw net sales of $148.9 million. E-commerce constituted 23.5% of net sales in fiscal year 2024. These figures highlight the company's overall financial health and the impact of its various sales channels and strategies.

Kirkland's utilizes several key monetization strategies to drive revenue and enhance profitability. These strategies include optimizing sales channels and forming strategic partnerships. The company focuses on improving its financial performance and adapting to market changes.

- Leveraging physical stores and e-commerce platforms for sales.

- Partnering with Beyond, Inc. for quarterly collaboration fees.

- Expanding e-commerce distribution in key categories.

- Converting certain locations to other store formats.

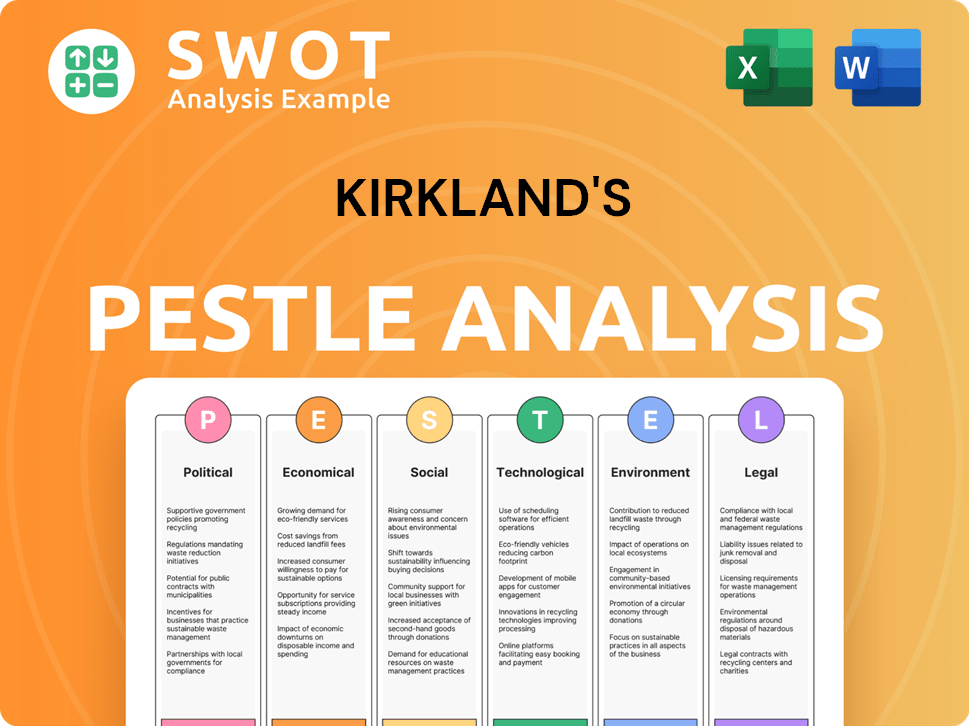

Kirkland's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Kirkland's’s Business Model?

The strategic landscape for Kirkland's is marked by significant milestones and strategic initiatives. A pivotal move was the October 2024 partnership with Beyond, Inc., which injected $25 million into Kirkland's, bolstering its financial position and opening avenues for growth. This collaboration is crucial, as Kirkland's is set to become the exclusive brick-and-mortar operator and licensee for new, smaller format Bed Bath & Beyond and buybuy BABY stores.

Kirkland's has navigated operational challenges, including fluctuations in e-commerce and external economic factors. In response, the company has focused on revitalizing its brand through initiatives such as re-engaging its core customer base and refining its product assortment. These strategic pivots aim to enhance the company's market position and drive sustainable growth.

The company's competitive edge is rooted in its value-driven home décor offerings, a well-established brand presence, and an evolving omnichannel strategy. The partnership with Beyond, Inc. further strengthens this advantage by expanding its brand portfolio to include Bed Bath & Beyond, buybuy BABY, and Overstock. This diversification allows Kirkland's to tap into new customer segments and broaden its physical retail footprint.

The partnership with Beyond, Inc., in October 2024, provided a $25 million investment. Kirkland's will operate new Bed Bath & Beyond and buybuy BABY stores. The new store formats are expected to generate double the revenue of a typical Kirkland's Home store.

Kirkland's is re-engaging its core customer base and refocusing its product assortment. The company is also strengthening its omnichannel capabilities. Approximately 6% of stores are being evaluated for conversion, augmentation, or closure.

Kirkland's focuses on value-priced home décor. It has an established brand presence. The omnichannel strategy is evolving. The Beyond, Inc. partnership expands the brand portfolio.

The $25 million investment from Beyond, Inc. boosts liquidity. The new store formats are projected to significantly increase revenue. The company is strategically managing store locations to improve profitability.

Kirkland's business model centers on offering value-priced home décor and gifts through its stores and online platform. The company's operations include sourcing products, managing its supply chain, and ensuring customer satisfaction. For a deeper dive into the company's origins, consider reading a Brief History of Kirkland's.

- Value-Driven Products: Kirkland's focuses on providing affordable home décor.

- Omnichannel Strategy: The company operates both physical stores and an online platform.

- Strategic Partnerships: The collaboration with Beyond, Inc. expands brand offerings.

- Store Network: Kirkland's manages a network of stores, with strategic adjustments.

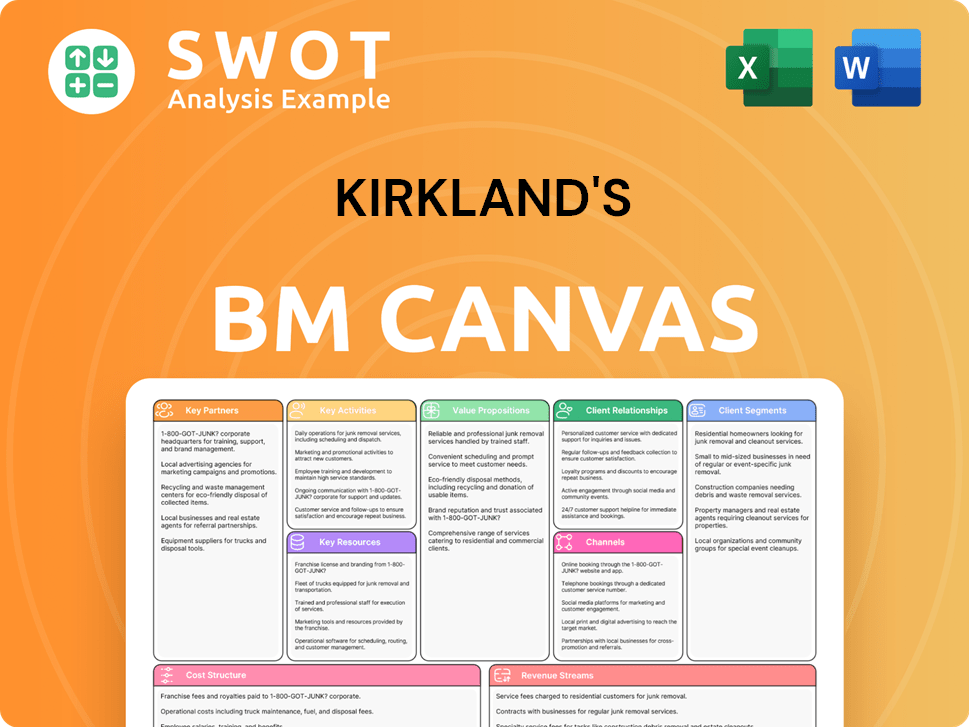

Kirkland's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Kirkland's Positioning Itself for Continued Success?

As of February 1, 2025, Kirkland's, a specialty retailer in the home décor market, operated 317 stores across 35 states, alongside its e-commerce platform. The company is undergoing a brand strategy pivot and has received strategic capital from Beyond, Inc., aiming to improve its market position after recent challenges. This strategic shift is crucial for navigating the competitive landscape and achieving sustainable growth.

The company's performance is influenced by various factors, including economic conditions, tariff changes, and the success of its e-commerce segment. Risks also include fluctuations in inventory costs, transportation expenses, and supply chain disruptions. Understanding these challenges is essential for evaluating Kirkland's future prospects and its ability to adapt to market dynamics.

Kirkland's competes in the home décor market, which is highly competitive. The company's focus on specialty retail, with a mix of physical stores and online presence, defines its market position. The company's strategic initiatives, including brand revitalization and omnichannel enhancements, are designed to strengthen its competitive edge.

Kirkland's faces several risks, including economic uncertainty and potential tariff changes. The e-commerce segment also presents challenges. Fluctuations in inventory costs, transportation expenses, and supply chain disruptions can impact operations. These factors can affect the company's profitability and growth.

The company is focused on brand revitalization and omnichannel enhancements. Strategic initiatives include optimizing e-commerce and maximizing the Kirkland's Home brand value. Kirkland's is also expanding with Bed Bath & Beyond Home and Overstock stores. Further strategic initiatives are supported by an additional $5.0 million term loan from Beyond.

Kirkland's business model involves sourcing home décor products and selling them through physical stores and online channels. The company manages its supply chain to ensure product availability and efficiency. A deeper understanding of Marketing Strategy of Kirkland's provides insights into its approach.

Kirkland's is actively working on improving its store portfolio and optimizing its e-commerce platform. The company is focusing on enhancing its brand and distribution through private label offerings. This includes expanding its e-commerce presence and leveraging the Bed Bath & Beyond brand.

- Improving or eliminating underperforming assets.

- Optimizing e-commerce performance.

- Maximizing Kirkland's Home brand value.

- Expanding e-commerce presence.

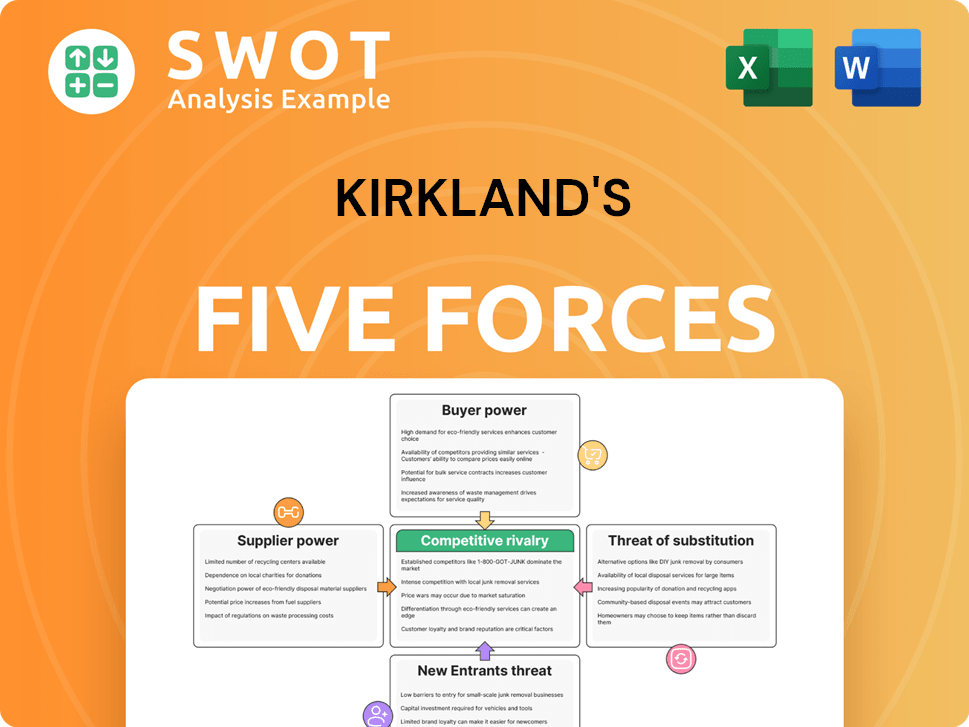

Kirkland's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kirkland's Company?

- What is Competitive Landscape of Kirkland's Company?

- What is Growth Strategy and Future Prospects of Kirkland's Company?

- What is Sales and Marketing Strategy of Kirkland's Company?

- What is Brief History of Kirkland's Company?

- Who Owns Kirkland's Company?

- What is Customer Demographics and Target Market of Kirkland's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.