Kone Bundle

Can KONE Continue to Elevate Its Success?

KONE, a titan in the elevator industry, is not just about moving people; it's about shaping the future of urban living. Understanding the Kone SWOT Analysis is key to grasping how this global leader navigates the complexities of the vertical transportation market. This deep dive explores KONE's strategic initiatives, market position, and future prospects, offering actionable insights for investors and industry watchers alike.

The Kone growth strategy is crucial for sustaining its leadership, especially with the evolving demands of the elevator industry. KONE's commitment to innovation and sustainability, as outlined in its 'Rise' strategy, positions it to capitalize on megatrends like urbanization. Analyzing the Kone company analysis reveals how this forward-thinking approach will drive its Kone future prospects and maintain its competitive edge, including its Kone market share in the global market.

How Is Kone Expanding Its Reach?

KONE's expansion strategy focuses on modernization, residential market growth, and digital transformation. The 'Rise' strategy, spanning from 2025 to 2030, outlines these key shifts to drive growth. KONE aims to lead in the elevator industry's largest segment by winning in the residential sector, offering tailored solutions for smaller and mid-sized buildings.

Geographical expansion, particularly in emerging markets, is a core element of KONE's strategy. This includes a strong focus on tier-2 and tier-3 cities, which are experiencing rapid urbanization. KONE India, for example, is actively growing its presence, leveraging the anticipated growth in the Indian elevator market.

Strategic acquisitions also support KONE's expansion, especially in the service business. These acquisitions strengthen service capabilities and broaden customer reach. The company's strong order book at the end of 2024, combined with growth in Service and Modernization, positions KONE for continued sales growth in 2025. For more insights into the company's origins, you can explore a Brief History of Kone.

KONE's growth strategy emphasizes modernizing existing elevator systems. This involves upgrading older equipment with advanced technology to improve efficiency and safety. Modernization projects contribute significantly to KONE's revenue and market share in the elevator industry.

Winning in the residential segment is a key goal for KONE. The company is developing cost-effective and energy-efficient elevator solutions tailored for smaller and mid-sized buildings. This strategy aims to capture a larger share of the growing residential construction market.

KONE is accelerating its digital transformation to enhance service delivery. This includes using data analytics and smart technologies to improve maintenance and customer service. Digital initiatives aim to increase operational efficiency and customer satisfaction.

KONE is expanding its presence in emerging markets, especially in rapidly urbanizing tier-2 and tier-3 cities. This geographical expansion is crucial for long-term growth. KONE India is a prime example, leveraging the anticipated 7-9% CAGR growth of the Indian elevator market through 2030.

In January-December 2024, KONE's orders received grew by 2.1% (3.3% at comparable exchange rates), with strong growth in Service and Modernization businesses offsetting a slight decline in New Building Solutions sales. Orders in the Americas Area grew significantly, and in Europe, orders grew clearly at comparable rates. KONE completed service-related acquisitions totaling EUR 125.6 million in 2024.

- The acquisitions of Orbitz Elevators in Australia and New Zealand, and Capitol Elevator in Sacramento, further strengthen KONE's service capabilities.

- KONE's strong order book at the end of 2024, coupled with momentum in the Service and Modernization businesses, positions the company for continued sales growth in 2025.

- KONE's focus on innovation, including smart building solutions, supports its competitive advantages in the elevator industry.

- The company's strategic initiatives aim to adapt to changing market demands and maintain a strong position in the vertical transportation sector.

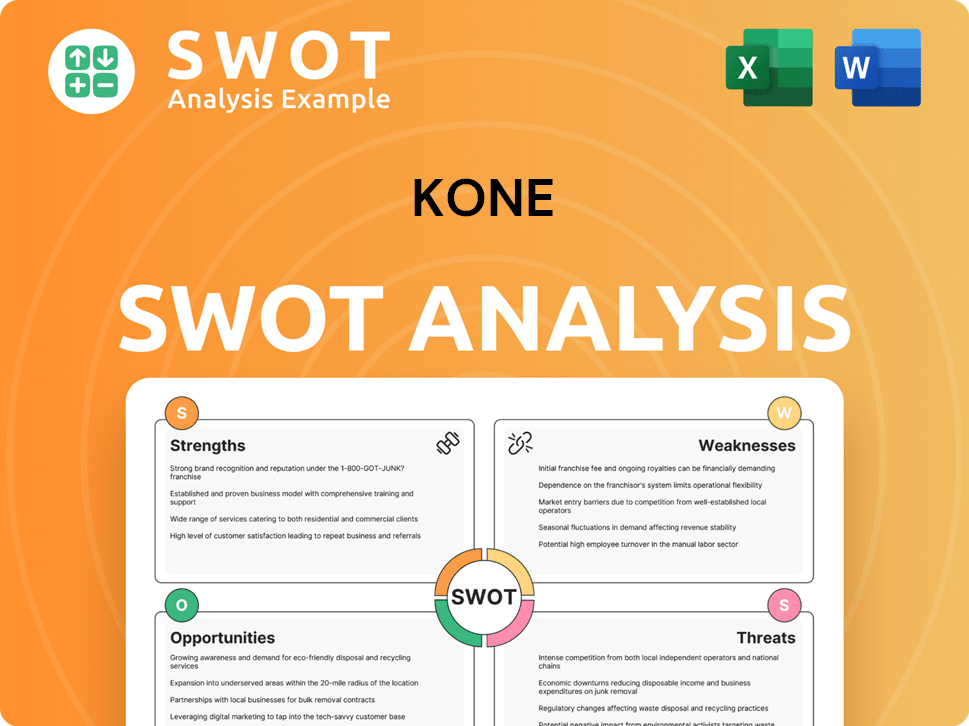

Kone SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Kone Invest in Innovation?

The focus on innovation and technology is central to the Mission, Vision & Core Values of Kone and its strategy for future growth. This approach is designed to meet evolving customer needs in the elevator industry and to maintain a strong position in the vertical transportation market. By investing heavily in research and development, the company aims to create cutting-edge solutions that enhance both the user experience and operational efficiency.

KONE's strategic initiatives are geared towards adapting to changing market demands and expanding its presence globally. The company's long-term growth potential is significantly influenced by its ability to integrate smart building solutions and capitalize on the rising demand for sustainable and energy-efficient products. This commitment to innovation is crucial for driving the Kone growth strategy and securing its future prospects.

Kone's approach to innovation is multifaceted, encompassing digital transformation, IoT integration, and a strong emphasis on sustainability. This comprehensive strategy ensures the company remains competitive and responsive to the needs of its global customer base.

Kone is accelerating its digital transformation to fundamentally change how it delivers services. This involves building a digital core on the Amazon Web Services (AWS) platform. This shift enables new business opportunities beyond traditional elevator and escalator services.

Significant investments in research and development (R&D) are a key part of Kone's strategy. In January–March 2025, R&D expenditure reached EUR 56.8 million, a 17.4% increase year-over-year. For the full year 2024, R&D spending was EUR 203.6 million, or 1.8% of sales.

Kone's '24/7 Connected Services' leverages technological advancements to improve efficiency. This has led to a reduction in repair call-outs by over 40% and the proactive identification of up to 70% of faults. This predictive maintenance capability enhances customer experience.

In Q1 2025, Kone's connectivity rate was approximately 36%. Dynamic Maintenance Planning is live in 22 countries, and Remote Services are available in 15 countries. This expansion of connected services is a core component of the Kone company analysis.

Kone is strengthening its position in low-rise residential buildings. Products such as the KONE MonoSpace 100 DX are now available in 19 countries. This expansion into new markets supports the Kone market share.

Kone is committed to sustainability, aiming to reduce carbon emissions. The introduction of energy-efficient products, like the High-Rise MiniSpaceTM DX elevator in 2024, is a key part of this effort. This elevator is designed for buildings exceeding 60 floors, offering enhanced energy efficiency and customization options.

Kone's innovation in elevator technology is focused on creating smart, connected, and sustainable solutions. These advancements are designed to meet the evolving demands of the elevator industry and support Kone's long-term growth potential.

- Digital Platform: Building a digital core on AWS to enable new business opportunities and integrate physical and digital worlds.

- IoT and Analytics: Leveraging IoT and analytics for predictive maintenance and improved service delivery.

- '24/7 Connected Services': Reducing repair call-outs and proactively identifying faults through connected services.

- Energy-Efficient Products: Developing elevators like the High-Rise MiniSpaceTM DX to reduce carbon emissions and enhance sustainability.

- Expansion of Connected Services: Increasing connectivity rates and expanding the availability of remote services globally.

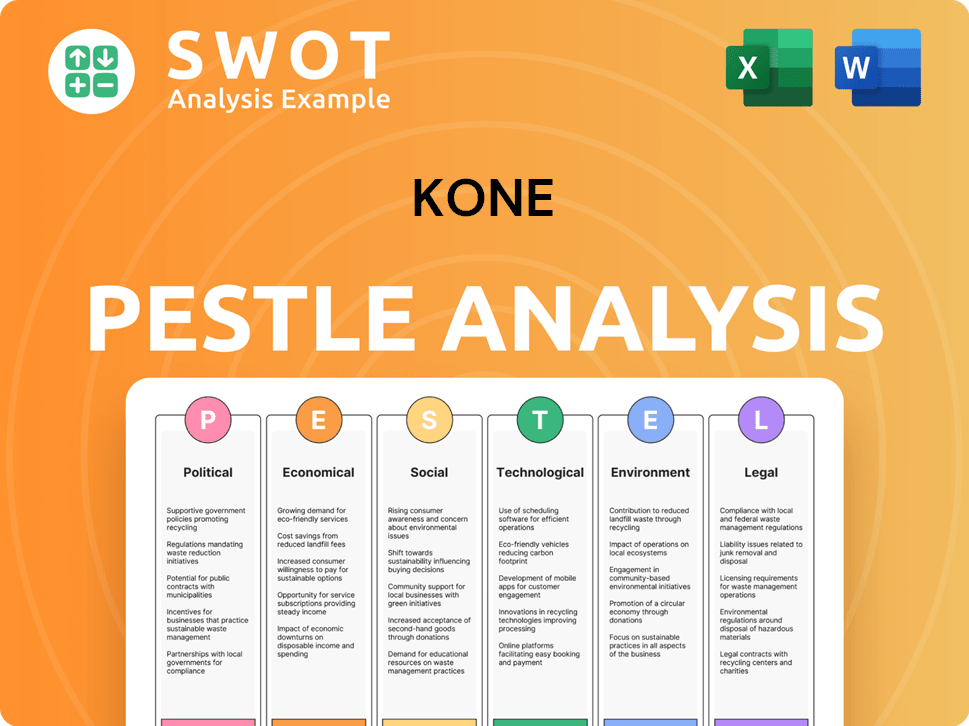

Kone PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Kone’s Growth Forecast?

In 2025, the company anticipates slight sales growth at comparable exchange rates. This positive outlook is supported by expected strong performance in the Service and Modernization businesses. The company's focus on these areas, combined with a solid order book, positions it well for future growth. For a comprehensive understanding of the company's financial performance, you can find detailed information for Owners & Shareholders of Kone.

The company's financial results for 2024 showed resilience. Sales reached EUR 11,098.4 million, marking a 1.3% increase from the previous year. The adjusted EBIT was EUR 1,303.0 million, resulting in an 11.7% adjusted EBIT margin. Cash flow from operations remained strong at EUR 1,589.3 million, demonstrating the company's financial stability.

Looking ahead to 2025, the company projects sales growth in the range of 1-6% at comparable exchange rates. The adjusted EBIT margin is expected to be between 11.8% and 12.4%. This positive trend is driven by the robust performance in the Service and Modernization sectors and a healthy order book. In the first quarter of 2025, orders received grew by 6.4% to EUR 2,378.4 million (5.1% at comparable exchange rates), and sales increased by 4.1% to EUR 2,672.3 million (2.8% at comparable exchange rates). The adjusted EBIT margin for Q1 2025 improved to 10.5% from 10.2% in Q1 2024, due to a favorable business mix. Cash flow from operations in Q1 2025 surged by 22.2% to EUR 486.7 million.

The company has set mid-term financial targets to be achieved by the end of 2027. These include mid-single-digit sales growth and an adjusted EBIT margin of 13-14%. This demonstrates the company's commitment to sustained financial improvement.

The long-term goal is to achieve an EBIT margin of 16% and improve working capital turnover. These ambitious goals highlight the company's focus on operational efficiency and financial performance.

The company acknowledges the impact of the declining New Building Solutions market in China and a slight overall decline in order margins in 2024. These factors are expected to negatively impact profitability.

The company's strategic focus on Service and Modernization growth, coupled with efficiency programs, is expected to support margin development. This strategic approach is crucial for navigating market challenges and achieving financial goals.

The company's growth strategy emphasizes expansion in the Service and Modernization businesses. This focus is designed to capitalize on the increasing demand for elevator maintenance and upgrades, which are key components of the Kone growth strategy.

The company's future prospects are positive, supported by a strong order book and strategic initiatives. The company's ability to adapt to changing market demands and innovate in elevator technology positions it well for long-term growth potential.

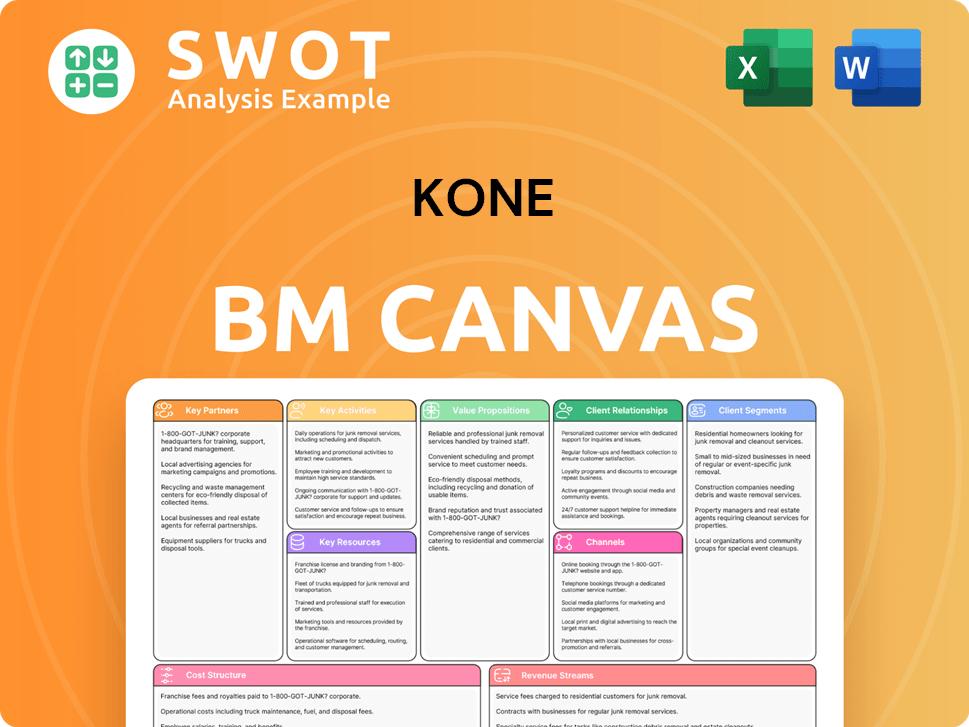

Kone Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Kone’s Growth?

Several risks and obstacles could impact the Kone growth strategy. Market competition and pricing pressures, especially in China's new building solutions market, pose significant challenges. Supply chain disruptions and macroeconomic factors also present potential hurdles for the company.

The anticipated decline in China's new building solutions market in 2025 is a major concern. This, combined with slight decreases in order margins in 2024, is expected to affect profitability. Furthermore, foreign exchange rate fluctuations are projected to negatively impact adjusted EBIT by approximately EUR 50 million in 2025.

Technological advancements and the need for new skills, particularly in digitalization, are ongoing challenges. Kone company analysis indicates that the company is addressing these risks through diversification and strategic initiatives.

Intense pricing pressure, particularly in the New Building Solutions market in China, is a key challenge. This pressure can squeeze profit margins and affect Kone market share. The competitive landscape requires continuous innovation and efficiency improvements.

The Chinese market is expected to decline significantly in 2025, which could be a headwind for sales and profitability. This decline is a significant factor in Kone's future prospects. Adapting to changing market dynamics is crucial.

Disruptions in the global supply chain can affect manufacturing and delivery timelines. Reliance on a global network means that challenges in securing materials can lead to business interruptions. Kone's strategic initiatives for expansion must consider supply chain resilience.

Economic downturns can impact construction and modernization projects. Fluctuations in foreign exchange rates are also a concern. Kone's financial performance and growth trends are influenced by these broader economic factors.

The need for new organizational capabilities and talent, especially in digitalization, is an ongoing challenge. Kone's innovation in elevator technology is crucial in this context. Investing in digital transformation is essential.

Addressing concerns about modernization order margins is a key focus. Improvements in receivables and collections are also critical. Kone's response to industry competition includes proactive financial management.

Kone emphasizes growth in the service and modernization segments to mitigate risks. The company is accelerating its digital transformation and focusing on the residential market. These strategies aim to capture growth opportunities and improve resilience.

Proactive management of financial health is evident in addressing modernization order margins. Improvements in receivables and collections in Q1 2025 indicate a focus on financial stability. This approach supports Kone's long-term growth potential.

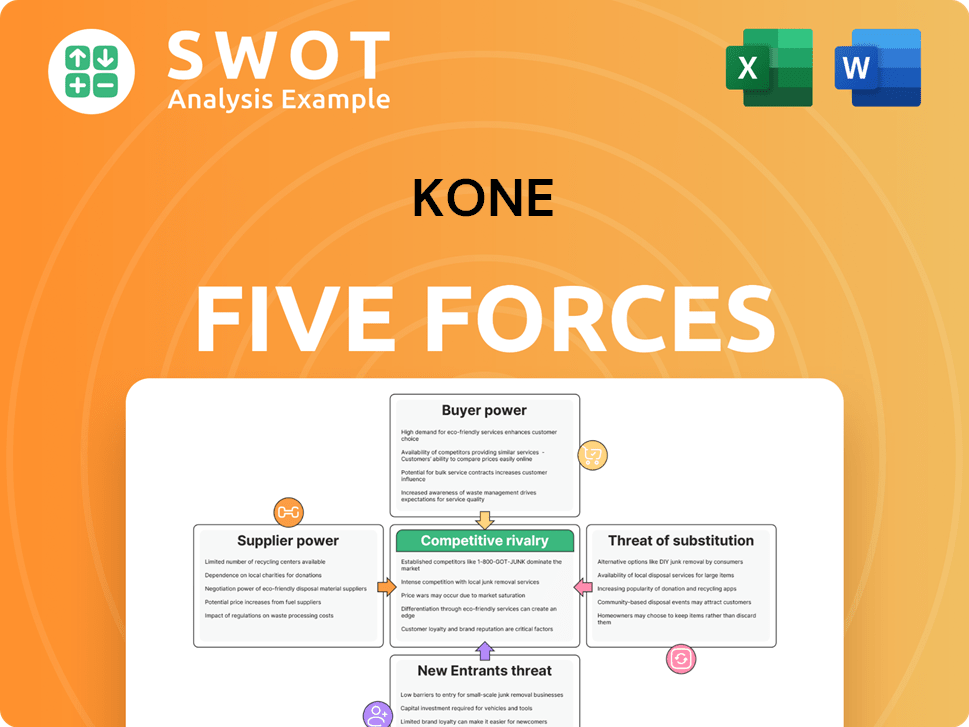

Kone Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kone Company?

- What is Competitive Landscape of Kone Company?

- How Does Kone Company Work?

- What is Sales and Marketing Strategy of Kone Company?

- What is Brief History of Kone Company?

- Who Owns Kone Company?

- What is Customer Demographics and Target Market of Kone Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.