Kone Bundle

Who Really Owns KONE Corporation?

Delving into Kone SWOT Analysis reveals the importance of understanding a company's ownership. Unraveling the intricacies of Kone ownership is key to grasping its strategic decisions and future prospects. This exploration unveils the forces shaping KONE's trajectory, from its historical roots to its current market position.

The enduring influence of the Herlin family, who founded Kone in 1910, continues to shape the company's direction, even as it operates as a publicly traded entity on Nasdaq Helsinki. Examining the Kone history and the evolution of its shareholder base, including major shareholders, offers critical insights into its resilience and strategic adaptability. Understanding the Kone company ownership structure provides a crucial lens for evaluating its financial performance and long-term investment potential, considering factors like the Kone headquarters location and the composition of the Kone company board of directors.

Who Founded Kone?

The origins of Kone Corporation trace back to 1910, stemming from the sale of the elevator business of 'Osakeyhtiö Gottfr. Strömberg Ab'. While not a traditional startup with a single founder, Harald Herlin, the technical director of Strömberg, played a crucial role in establishing the company. He acquired the elevator business, effectively becoming the driving force behind the newly formed entity.

The initial ownership of Kone Corporation was primarily centered around Harald Herlin and his family. This early structure set the stage for the enduring family influence that has characterized Kone's ownership throughout its history. The Herlin family held a controlling interest from the very beginning, shaping the company's direction and long-term strategies.

Early financial backers beyond the Herlin family aren't widely documented in the public records of Kone history. This suggests that the initial financing and ownership were largely contained within the family's sphere. There were no significant early ownership disputes or buyouts that altered the family's control. The focus was on developing reliable elevator technology, which was reflected in the concentrated control, allowing for long-term strategic planning.

Harald Herlin, the technical director of Strömberg, was pivotal in establishing Kone Corporation. He purchased the elevator business, becoming the driving force behind the new company.

The initial ownership structure was centered around the Herlin family. They held a controlling interest from the outset, setting the stage for long-term family influence.

Early financing and ownership remained largely within the Herlin family's sphere. There is limited documentation of external investors or early ownership changes.

The founding team's vision focused on developing reliable elevator technology. This vision was supported by the concentrated control, which allowed for long-term strategic planning.

The strong family foundation enabled Kone to navigate early industrial challenges. This foundation helped establish its foothold in the elevator market.

The concentrated ownership allowed Kone to focus on long-term strategic planning and investment in research and development. This was done without immediate external pressures.

The early history of Kone is marked by the pivotal role of Harald Herlin and the foundational influence of the Herlin family. This family-centric ownership structure facilitated long-term strategic planning and investment in research and development, solidifying Kone's position in the elevator market. Understanding this early ownership is crucial for grasping the company's subsequent growth and its current Kone ownership structure.

- Harald Herlin was key in establishing Kone by acquiring the elevator business.

- The Herlin family's control from the beginning shaped the company's direction.

- Initial financing and control remained within the Herlin family's influence.

- The focus was on developing reliable elevator technology.

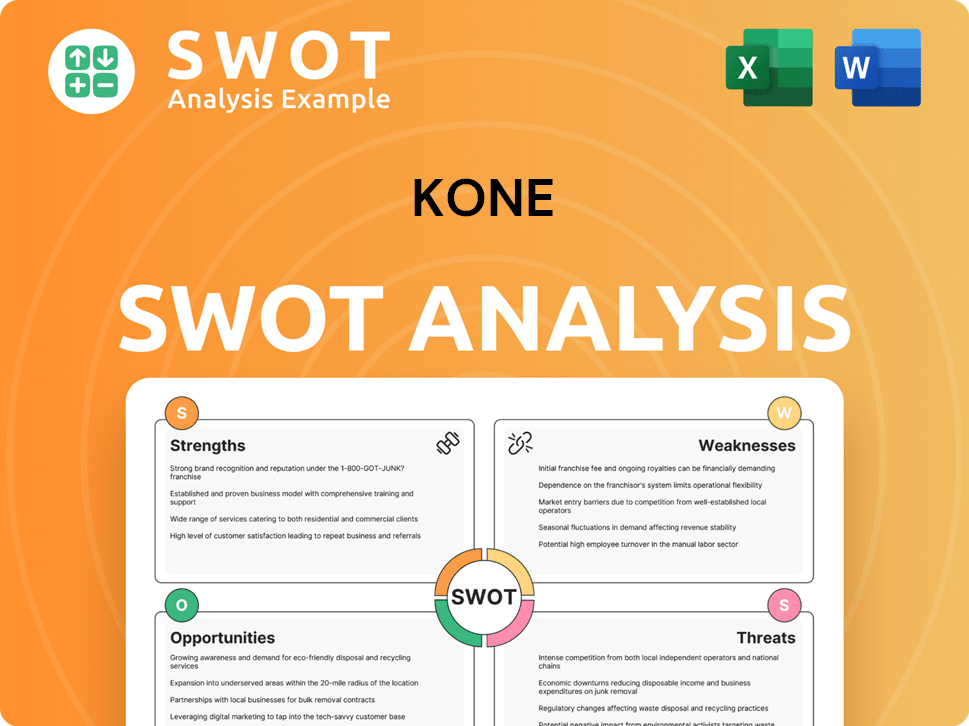

Kone SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Kone’s Ownership Changed Over Time?

The evolution of Kone's ownership has been marked by its transition to a publicly traded entity listed on the Nasdaq Helsinki exchange. While the exact date of the Initial Public Offering (IPO) is historical, the ownership structure has consistently featured the Herlin family as a major stakeholder. This family's influence has been maintained over the decades, shaping the company's strategic direction.

As of early 2025, the Herlin family, through holding companies such as Security Trading Oy and Wipunen varainhallinta Oy, remains the largest shareholder group. Security Trading Oy holds a substantial percentage of shares, providing significant voting power. Wipunen varainhallinta Oy also holds a notable stake, further solidifying the family's control. This enduring family presence contrasts with the dynamic involvement of institutional investors and other shareholders, reflecting a blend of long-term strategic vision and market responsiveness.

| Shareholder Group | Approximate Shareholding (Early 2025) | Notes |

|---|---|---|

| Herlin Family (through holding companies) | Significant, controlling stake | Primary influence on strategic direction |

| Institutional Investors (BlackRock, Vanguard, etc.) | Fluctuating, but substantial | Influenced by market activity and financial performance |

| Other Shareholders (Mutual Funds, Individual) | Variable | Reflects broader market participation |

Beyond the Herlin family, Kone's ownership is diversified among institutional investors, mutual funds, and individual shareholders. Major institutional investors, both Finnish and international, hold significant portions of the company's shares. These include large pension funds and asset management firms, which invest due to the company's strong market position and stable performance. For instance, BlackRock, The Vanguard Group, and Norges Bank Investment Management are among the largest institutional investors, holding considerable percentages of outstanding shares as of late 2024 or early 2025. The exact percentages held by these institutional investors fluctuate with market activity but consistently represent a significant portion of the company's free float. These changes in ownership, particularly the increasing presence of large institutional investors, affect company strategy by demanding robust governance and consistent financial performance, while the enduring family control provides a long-term strategic anchor.

The Herlin family remains the largest shareholder, ensuring long-term strategic direction. Institutional investors hold a significant portion of shares, influencing governance and financial performance. The ownership structure of Kone reflects a balance between family influence and market dynamics.

- Herlin family maintains significant control through holding companies.

- Institutional investors like BlackRock and Vanguard hold substantial stakes.

- The ownership structure balances family influence with market demands.

- This balance impacts the company's strategic direction and financial performance.

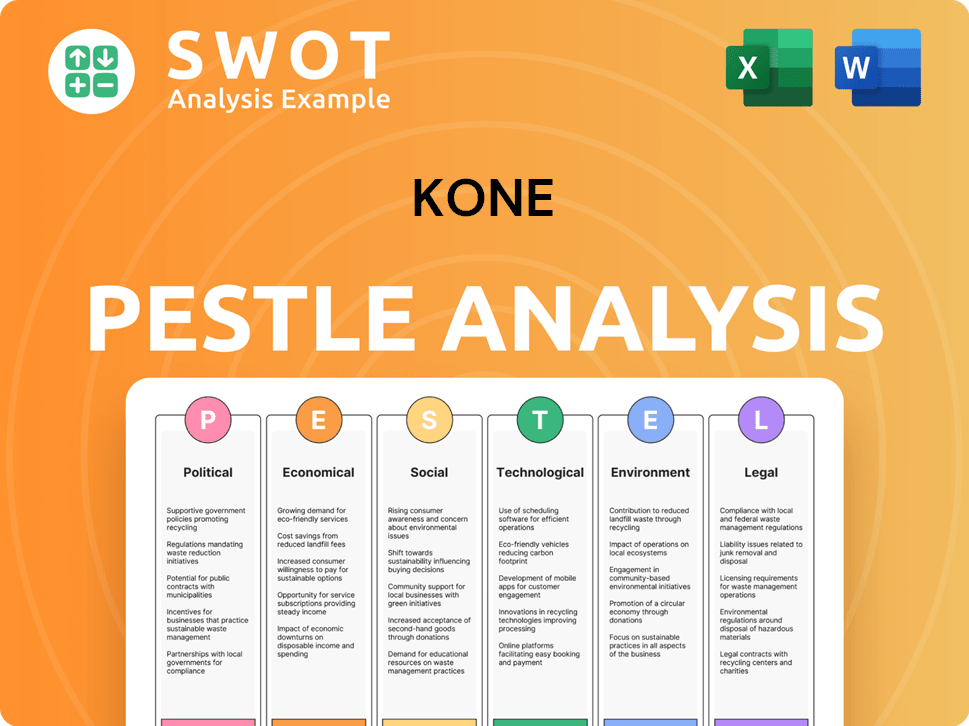

Kone PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Kone’s Board?

The current Board of Directors of KONE Corporation balances representation from major shareholders with independent members. As of early 2025, the board includes members of the Herlin family, the largest shareholder group, ensuring their strategic interests align with the company's direction. For instance, Antti Herlin serves as the Chairman of the Board, highlighting the family's ongoing influence. Other board members bring extensive experience in international business, technology, and finance, providing diverse perspectives and expertise. These independent directors are crucial for maintaining good corporate governance and bringing external viewpoints to strategic discussions. The company's leadership structure is designed to foster both stability and innovation within the elevator and escalator industry.

The composition of the board reflects a commitment to both shareholder interests and independent oversight. The presence of independent directors ensures that decisions are made with a broad view, considering various stakeholders. This structure helps in navigating the complexities of the global market and maintaining a competitive edge. The board's role is pivotal in guiding the company's long-term strategy and ensuring sustainable growth. The board's decisions are critical for the company's financial performance, market share, and overall success. The company's commitment to innovation and sustainability is also reflected in the board's strategic direction.

| Board Member | Title | Affiliation |

|---|---|---|

| Antti Herlin | Chairman | Herlin Family |

| Jussi Herlin | Vice Chairman | Herlin Family |

| Sari Baldauf | Independent Director | Various |

KONE operates with a one-share-one-vote structure for its publicly traded shares, meaning each share carries equal voting rights. However, the concentration of shares within the Herlin family through their holding companies grants them significant voting power. While there are no special voting rights or golden shares beyond the standard share structure, the sheer volume of shares held by the family effectively gives them a controlling interest in key decisions, including the election of board members and approval of major corporate actions. This structure influences the company's strategic direction and long-term goals. For more insights into the company's financial strategies, consider reading about Revenue Streams & Business Model of Kone.

The Herlin family holds a significant portion of shares, influencing key decisions. The board includes both family members and independent directors. KONE's ownership structure impacts its strategic direction and market position.

- Antti Herlin serves as Chairman, representing the family's influence.

- Independent directors provide diverse expertise and oversight.

- One-share-one-vote structure, but family holds substantial voting power.

- The company's governance structure supports long-term strategy and innovation.

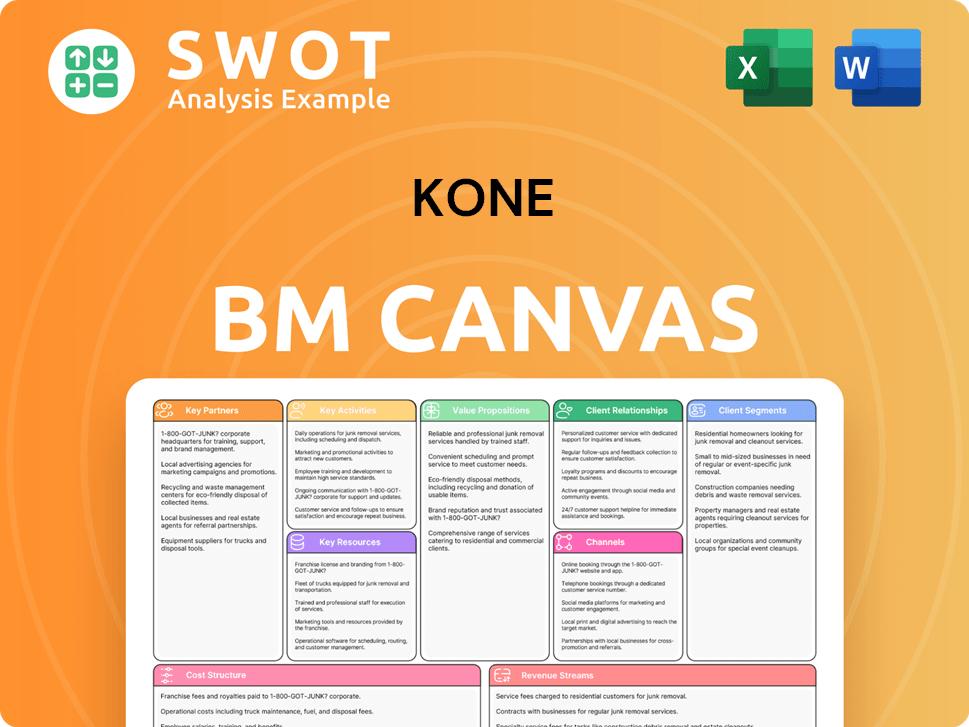

Kone Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Kone’s Ownership Landscape?

Over the past three to five years (2022-2025), the ownership structure of the [Company Name] has remained relatively consistent. The Herlin family continues to exert a significant influence, coupled with sustained institutional investment. While there haven't been any major shifts like substantial share buybacks or secondary offerings, the company has maintained its appeal to large institutional investors. Reports from late 2024 and early 2025 indicate that major global asset managers still hold considerable stakes, reflecting confidence in [Company Name]'s market position and financial performance. Key questions often asked include; 'Who owns Kone' and 'Who are the major shareholders of Kone'.

Industry trends reveal an increase in institutional ownership and, in some cases, founder dilution, but [Company Name]'s situation remains unique due to the enduring family control. Although the Herlin family's ownership percentage may fluctuate slightly due to market dynamics or share transactions, their strategic influence remains largely undiminished. There have been no public statements regarding planned succession that would fundamentally alter the family's control or potential privatization/public listing changes. The focus is on organic growth, technological innovation, and maintaining a competitive edge in the global elevator and escalator market. The stability in ownership allows [Company Name] to pursue long-term strategic goals without short-term pressures. For further insights into the company's strategic approach, consider exploring the Marketing Strategy of Kone.

| Key Aspect | Details | Recent Data (2024-2025) |

|---|---|---|

| Ownership Stability | Family and Institutional Influence | Herlin family maintains significant control; consistent institutional investment. |

| Institutional Investors | Major asset managers | Continued strong holdings, reflecting confidence in market position. |

| Strategic Focus | Long-term goals | Organic growth, technological innovation, and competitive advantage in the market. |

The ownership structure of [Company Name] is characterized by a strong presence of the Herlin family and substantial holdings by institutional investors. This balance contributes to stability and supports long-term strategic planning.

Major shareholders include the Herlin family and various institutional investors. The specific percentages held by each group can fluctuate slightly due to market dynamics, but the core structure remains consistent.

The stable ownership structure allows [Company Name] to focus on long-term goals, technological advancements, and maintaining its competitive edge in the global elevator and escalator market. This stability is a key factor.

The company's focus on organic growth and innovation suggests a continued commitment to its current strategic direction. There are no public plans for significant changes in ownership or control.

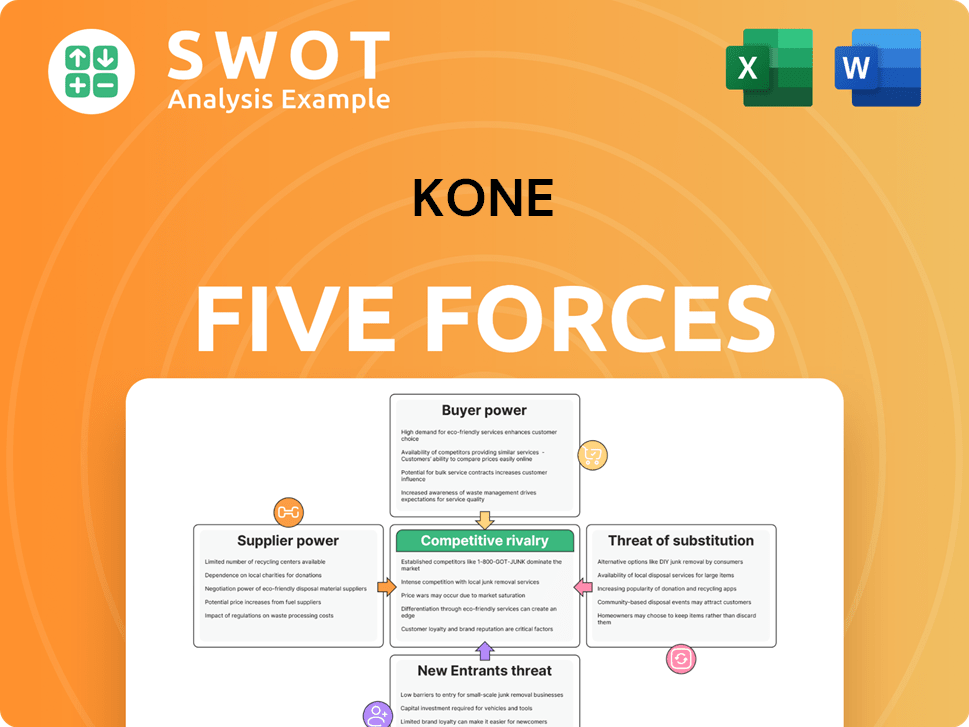

Kone Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Kone Company?

- What is Competitive Landscape of Kone Company?

- What is Growth Strategy and Future Prospects of Kone Company?

- How Does Kone Company Work?

- What is Sales and Marketing Strategy of Kone Company?

- What is Brief History of Kone Company?

- What is Customer Demographics and Target Market of Kone Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.