McDonald's Bundle

Can McDonald's Continue to Reign Supreme?

McDonald's, a global icon, recently unveiled its "Accelerating the Arches 2.0" strategy, setting the stage for its future. This strategic move highlights the importance of a strong growth strategy in the competitive fast-food industry. From its humble beginnings, McDonald's has transformed into a global powerhouse, and now, the company is looking to expand its global footprint.

This article delves into McDonald's SWOT Analysis, exploring its expansion plans and financial performance. We will examine how McDonald's plans to navigate the ever-changing landscape of the fast-food industry, focusing on its growth strategy and future prospects. Understanding McDonald's company analysis is crucial for investors and strategists alike, as the company's market share and long-term growth forecasts continue to shape the global economy.

How Is McDonald's Expanding Its Reach?

The 'Accelerating the Arches 2.0' strategy is central to McDonald's growth strategy, emphasizing both global expansion and optimization of its existing restaurant portfolio. This approach includes a significant focus on opening new restaurants to increase its footprint worldwide. The company is targeting substantial growth in international markets, especially in regions with high growth potential, while also continuing to develop in established markets.

A key aspect of McDonald's expansion plans involves opening approximately 2,000 new locations by 2027. This growth aims to bring the total number of restaurants to around 50,000 globally. The company is also exploring new restaurant formats, such as smaller locations and those optimized for drive-thru and delivery services, to cater to evolving consumer preferences and urban landscapes.

McDonald's leverages its franchising model to support rapid expansion, with franchisees often playing a crucial role in identifying new market opportunities. This strategy allows the company to access new customer bases and diversify revenue streams while maintaining a relatively asset-light business model. Strategic partnerships, such as those with delivery services, also support expansion by extending its reach beyond traditional locations.

McDonald's is prioritizing international markets for expansion, especially those with high growth potential. This includes significant unit growth in markets like China, where it aims to reach 10,000 restaurants by 2028. The company's focus on international markets is a key driver of its future prospects.

The company is exploring new restaurant formats, including smaller locations and those optimized for drive-thru and delivery. This adaptation is crucial for meeting changing consumer demands and navigating urban environments. These formats are designed to enhance convenience and accessibility.

McDonald's uses its franchise model to facilitate rapid expansion. Franchisees are often key in identifying new market opportunities and driving local growth. This approach allows for diversification of revenue streams and a relatively asset-light business model.

Strategic partnerships, particularly with delivery services, extend McDonald's reach beyond traditional locations. These partnerships support expansion and enhance customer convenience. They play a crucial role in adapting to changing consumer behaviors.

McDonald's expansion plans involve a multi-faceted approach to growth, including new restaurant openings, international market focus, and strategic partnerships. The company aims to increase its global footprint while adapting to changing consumer preferences. Further insights can be found in a Brief History of McDonald's.

- Aggressive new restaurant openings, targeting approximately 2,000 new locations by 2027.

- Focus on international markets, with significant growth planned in China and other regions.

- Exploration of new restaurant formats to cater to evolving consumer needs.

- Leveraging the franchise model to facilitate rapid expansion and local market expertise.

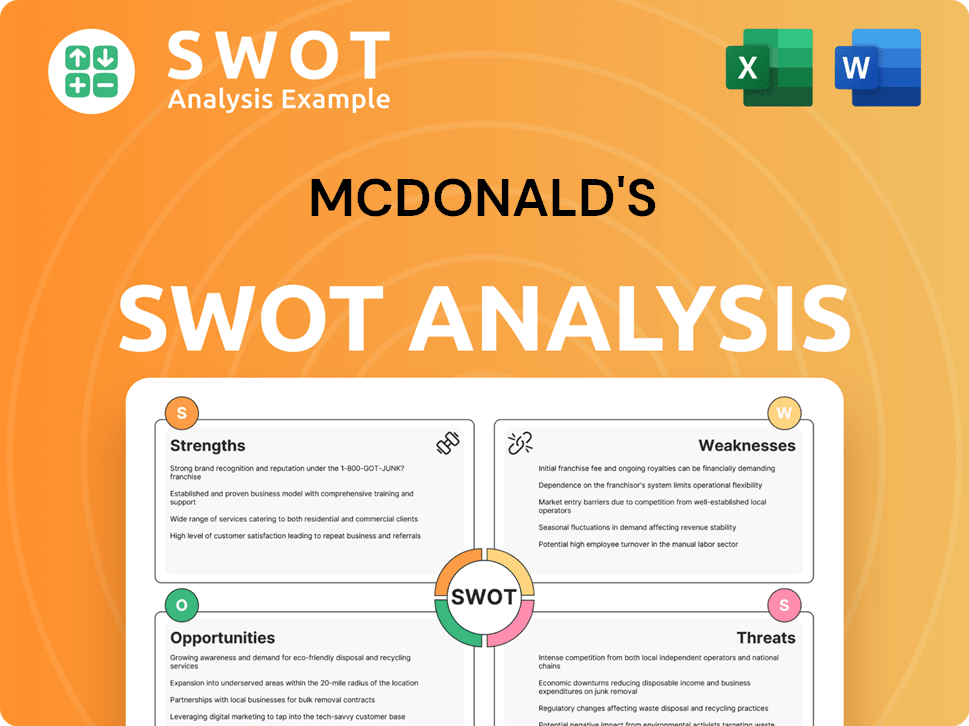

McDonald's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does McDonald's Invest in Innovation?

The fast-food landscape is constantly evolving, and understanding how major players like McDonald's adapt is crucial for investors and analysts. McDonald's growth strategy hinges significantly on its ability to innovate and leverage technology to meet changing customer needs and preferences. This includes everything from streamlining ordering processes to personalizing the customer experience.

Consumer expectations are higher than ever, with a demand for convenience, speed, and personalized experiences. McDonald's addresses these demands through its digital transformation initiatives and by focusing on operational efficiency. Furthermore, sustainability and ethical sourcing are increasingly important to consumers, influencing McDonald's innovation strategy.

McDonald's company analysis reveals a strong commitment to technological advancements and innovation. This commitment is essential for maintaining its market share and achieving its expansion plans. The company's ability to adapt to these trends will be a key factor in its future prospects within the fast-food industry.

McDonald's is heavily invested in digital transformation to enhance customer experience and drive growth. This includes expanding its loyalty program, MyMcDonald's Rewards, and improving mobile ordering capabilities. These initiatives aim to increase customer engagement and provide personalized offers.

MyMcDonald's Rewards program has tens of millions of active members as of early 2024, driving increased engagement. Mobile ordering capabilities are constantly being refined to offer greater convenience and speed. These digital tools are crucial in adapting to changing consumer preferences and boosting revenue.

Automation is being implemented in kitchens and drive-thrus to improve efficiency and speed of service. Automated order-taking systems are undergoing trials to streamline operations. This focus on efficiency supports McDonald's growth strategy.

McDonald's is exploring AI for various applications, including menu recommendations, inventory management, and personalized marketing. The acquisitions of Dynamic Yield in 2019 and Apprente in 2019 highlight its commitment to AI and machine learning. These technologies are key to the company's future prospects.

Sustainability is a core part of McDonald's innovation strategy, with efforts focused on sustainable sourcing, packaging, and energy efficiency. These initiatives are designed to meet consumer demand for environmentally responsible practices. These efforts are part of Mission, Vision & Core Values of McDonald's.

Technological advancements and innovative approaches contribute to growth objectives by improving operational efficiency. They also enhance customer convenience and create new revenue streams through digital channels. These improvements are vital for McDonald's financial performance.

McDonald's is focusing on several key areas to drive growth and maintain its competitive edge. These strategies are designed to enhance customer experience, improve operational efficiency, and create new revenue streams. The company's digital transformation is central to these efforts.

- Digitalization: Expanding digital channels, including mobile ordering and delivery, to increase convenience and sales.

- Automation: Implementing automation in kitchens and drive-thrus to speed up service and reduce costs.

- Personalization: Using data and AI to personalize offers and recommendations, enhancing customer loyalty.

- Sustainability: Integrating sustainable practices throughout the supply chain and operations to meet consumer expectations.

- Menu Innovation: Continuously updating the menu with new items and limited-time offers to attract customers.

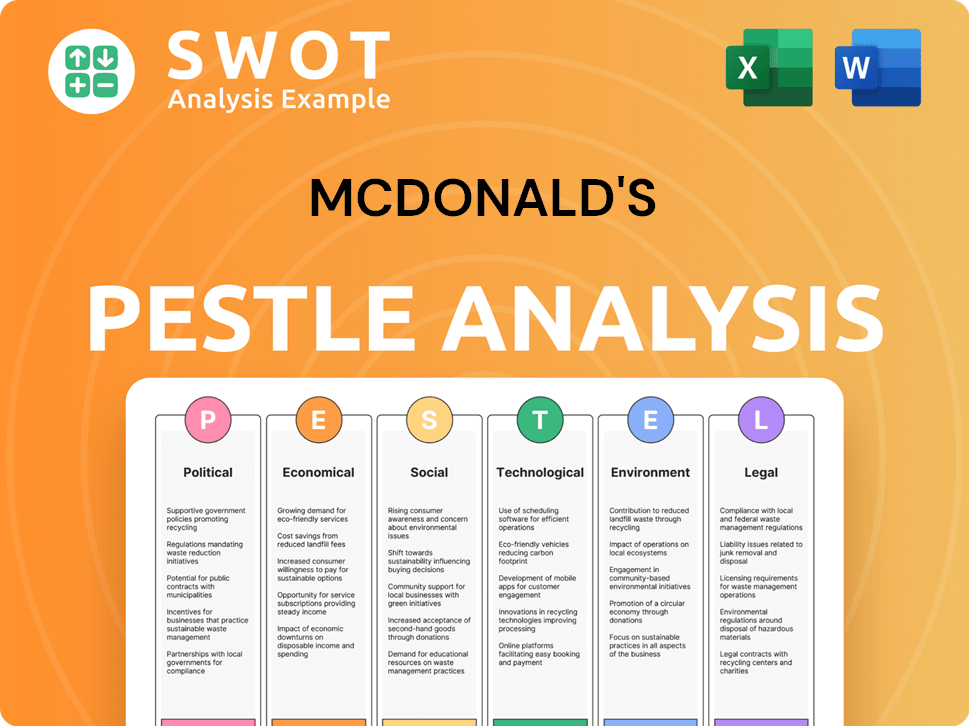

McDonald's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is McDonald's’s Growth Forecast?

McDonald's anticipates strong financial results, driven by its 'Accelerating the Arches 2.0' growth strategy. This strategy focuses on enhancing customer experience, expanding its digital capabilities, and broadening its global footprint. The company's financial outlook reflects confidence in its ability to capitalize on market opportunities and deliver value to its shareholders.

The company's financial performance is supported by its robust cash flow generation and commitment to returning value to shareholders. This includes dividends and share repurchases, which are key components of McDonald's financial strategy. The company's expansion initiatives, technological investments, and operational efficiency efforts are all geared towards sustaining its growth trajectory and enhancing its competitive position.

In the fourth quarter of 2023, McDonald's demonstrated strong momentum, with a 14% increase in revenues, reaching $6.4 billion. Global comparable sales increased by 7% during the same period, highlighting the effectiveness of its strategic initiatives. This performance underscores the company's resilience and its ability to adapt to changing market dynamics. For a deeper dive into the company's marketing approaches, consider reading about the Marketing Strategy of McDonald's.

McDonald's projects systemwide sales growth of approximately 4% in 2024. This growth is fueled by strategic investments in technology, menu innovation, and enhanced customer service. The company's focus remains on driving sales through various initiatives.

The company anticipates its operating margin to remain in the mid-40% range for 2024. This reflects efficient cost management and operational excellence. McDonald's aims to maintain profitability through strategic financial planning.

Capital expenditures for 2024 are projected to be between $2.5 billion and $2.7 billion. These investments support the company's expansion plans, including new restaurant openings and upgrades. This funding is crucial for long-term growth.

McDonald's aims for average annual systemwide sales growth of 6% to 7% through 2027. This ambitious target reflects the company's confidence in its strategic initiatives and market opportunities. This is a key indicator of McDonald's future prospects.

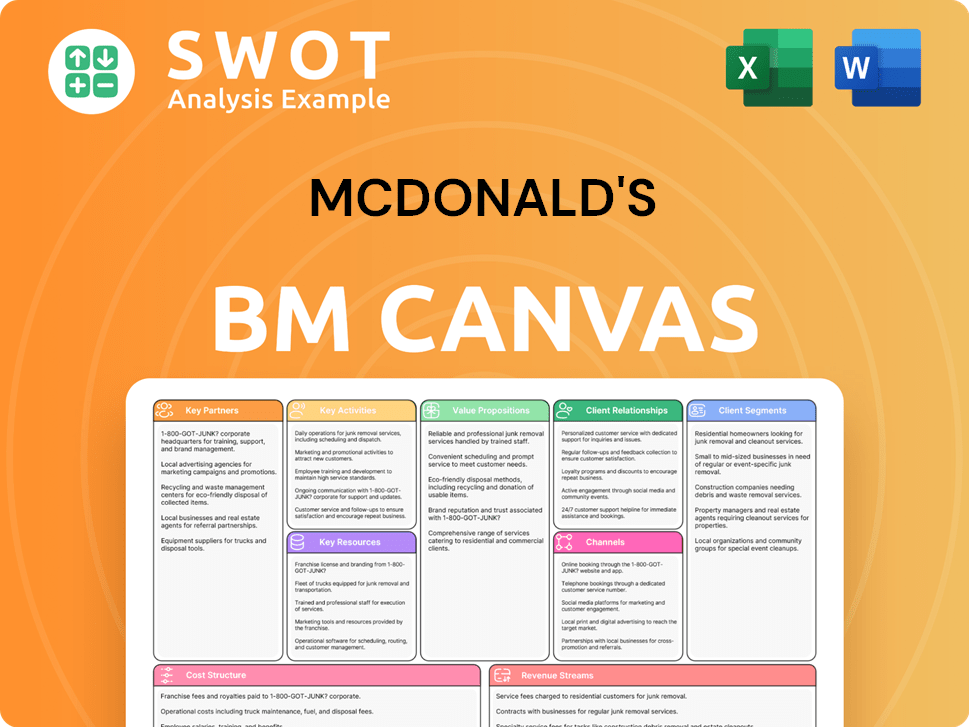

McDonald's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow McDonald's’s Growth?

The growth strategy and future prospects of McDonald's face several potential hurdles. The fast-food industry is highly competitive, and McDonald's must continuously adapt to maintain its market share. Regulatory changes, supply chain issues, and technological disruptions also pose significant risks to the company's operations and financial performance.

McDonald's expansion plans could be affected by internal resource constraints, such as attracting and retaining talent. Furthermore, changing consumer preferences, including a growing demand for healthier options and sustainable practices, require ongoing menu innovation and responsible sourcing. These challenges necessitate proactive risk management and strategic agility.

To navigate these obstacles, McDonald's has implemented diversification strategies for its supply chain and robust risk management frameworks. The company has demonstrated its ability to adapt to changing consumer preferences by accelerating its digital initiatives and enhancing drive-thru capabilities, as seen during the pandemic. McDonald's company analysis reveals a focus on innovation to stay ahead.

McDonald's operates in a fiercely competitive market, facing rivals such as Burger King, Wendy's, and numerous emerging fast-food concepts. These competitors constantly innovate and vie for market share, requiring McDonald's to maintain a strong brand and competitive offerings. The fast-food industry's dynamic nature necessitates continuous adaptation and strategic initiatives.

Changes in regulations, particularly concerning food safety, labor laws, and environmental standards, can significantly impact McDonald's operations. These changes may lead to increased costs, operational restrictions, or the need for adjustments to business practices. Compliance with evolving regulations is crucial for maintaining operational efficiency and avoiding penalties.

Global supply chain disruptions pose a continuous threat to McDonald's, affecting the availability of ingredients and operational continuity. Geopolitical events and extreme weather can impact commodity prices and logistics, increasing operational costs. Diversifying the supply chain and implementing robust risk management are critical for mitigating these vulnerabilities.

Technological advancements present both opportunities and risks for McDonald's. Competitors innovating faster or difficulties in effectively implementing new technologies can hinder McDonald's growth. The company must invest in digital transformation to enhance customer experience and streamline operations. This is a key part of McDonald's digital transformation strategy.

Attracting and retaining talent in a competitive labor market can hinder McDonald's expansion and operational efficiency. High employee turnover and difficulties in finding skilled workers can impact service quality and productivity. Addressing these constraints requires competitive compensation, benefits, and a positive work environment.

Increasing consumer demand for healthier options and sustainable practices requires continuous menu innovation and responsible sourcing. McDonald's must adapt its offerings to meet evolving preferences and maintain its appeal. This includes incorporating healthier ingredients, reducing environmental impact, and promoting sustainable practices. McDonald's menu innovation is crucial for its future.

McDonald's addresses these risks through diversification of its supply chain, robust risk management frameworks, and continuous scenario planning. The company's ability to adapt to challenges, such as changing consumer preferences, is a key strength. For example, during the pandemic, McDonald's accelerated its digital initiatives and enhanced drive-thru capabilities. These strategies are important for McDonald's expansion plans.

Emerging risks include increasing consumer demand for healthier options and sustainable practices. This necessitates continuous menu innovation and responsible sourcing. The company must also stay ahead of technological trends and adapt its business model accordingly. These factors are critical to McDonald's future prospects.

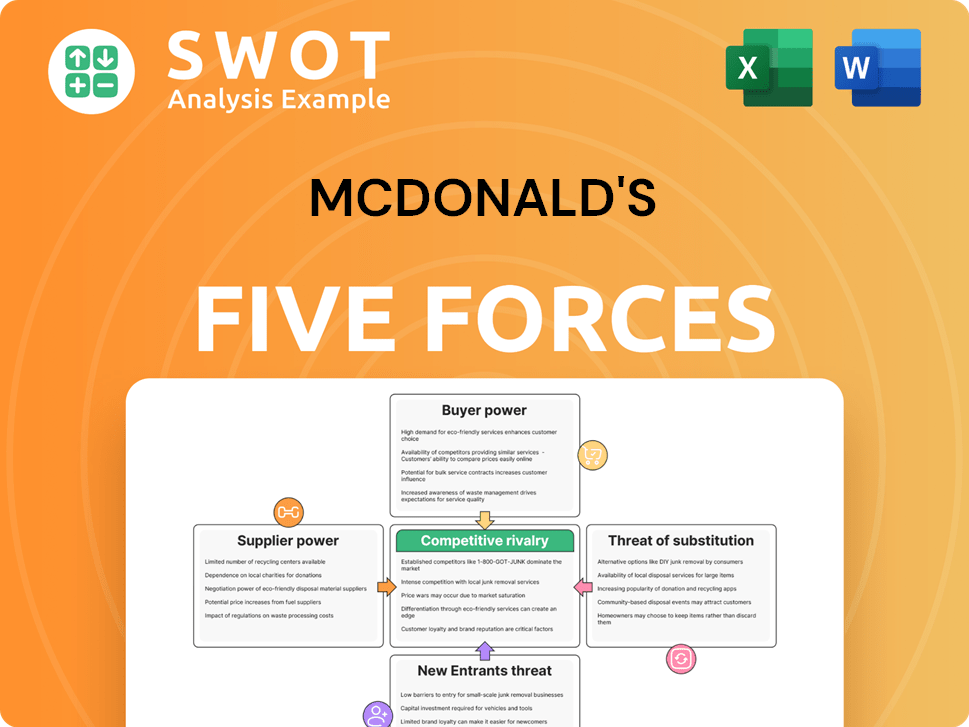

McDonald's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of McDonald's Company?

- What is Competitive Landscape of McDonald's Company?

- How Does McDonald's Company Work?

- What is Sales and Marketing Strategy of McDonald's Company?

- What is Brief History of McDonald's Company?

- Who Owns McDonald's Company?

- What is Customer Demographics and Target Market of McDonald's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.