McDonald's Bundle

Who Really Calls the Shots at McDonald's?

Understanding the intricate web of McDonald's SWOT Analysis and its ownership structure is crucial for any investor or business strategist. From its humble beginnings as a single hamburger stand in 1940 to a global powerhouse, the evolution of McDonald's has been shaped by pivotal ownership decisions. This exploration dives into the key players and shifts in control that have defined the fast-food giant's journey.

The story of McDonald's SWOT Analysis is a fascinating study in business strategy and market dominance. Knowing who owns McDonald's, its parent company, and the influence of major shareholders provides valuable insight. The company's history, from its founding by the McDonald brothers to its current status as a publicly traded corporation, reveals a dynamic model. Examining the McDonald's ownership structure explained is key to understanding its financial performance and future direction.

Who Founded McDonald's?

The story of McDonald's begins with brothers Richard and Maurice McDonald, who opened their first restaurant on May 15, 1940, in San Bernardino, California. Initially, they operated a barbecue restaurant. They later revolutionized the fast-food industry with the introduction of the 'Speedee Service System' in 1948, focusing on speed and a limited menu.

The early ownership of the company was primarily held by the McDonald brothers. They started franchising their concept, and Ray Kroc, a milkshake machine salesman, became their franchise agent in 1954. Kroc played a pivotal role in the company's expansion.

The evolution of McDonald's brief history is a story of innovation and strategic shifts in ownership. The company's ownership structure has been crucial to its growth and success.

Richard and Maurice McDonald founded the original restaurant.

They pioneered the fast-food concept.

Their initial focus was on efficiency and a limited menu.

The brothers initially managed the restaurant operations.

They started franchising to expand their business model.

The 'Speedee Service System' was a key innovation.

Ray Kroc became the franchise agent in 1954.

He opened his first franchised restaurant in 1955.

Kroc's vision led to the expansion of the company.

Kroc bought out the McDonald brothers in 1961.

The deal was valued at $2.7 million.

This acquisition gave Kroc full control of the company.

Harry J. Sonneborn, the first CEO, developed a financial model.

The model involved owning the land and leasing it to franchisees.

This strategy significantly impacted the company's financial structure.

The McDonald brothers initially sold franchises.

Out of the initial franchises, 10 restaurants became operational.

This marked the beginning of the franchise model.

The early ownership of McDonald's was centered on the McDonald brothers, who established the foundation for the fast-food business. The entry of Ray Kroc and the subsequent buyout in 1961 marked a critical shift in the company's direction.

- The McDonald brothers' initial focus was on operational efficiency.

- Ray Kroc's franchise model was key to the company's expansion.

- The financial strategies developed by Harry J. Sonneborn continue to shape the company.

- The buyout of the McDonald brothers was a pivotal moment in the company's history.

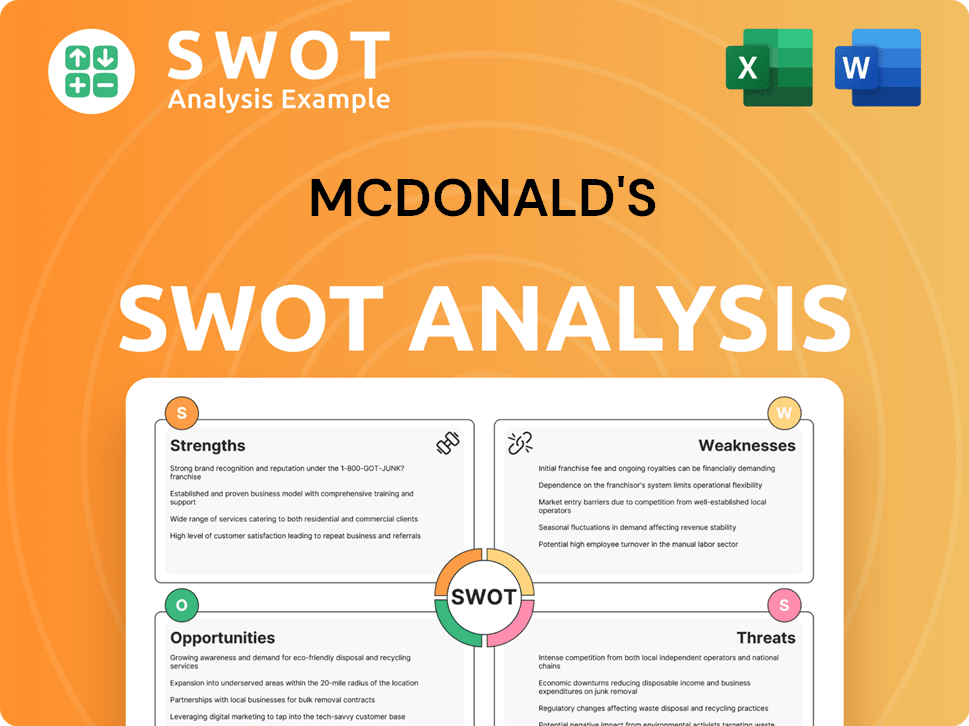

McDonald's SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has McDonald's’s Ownership Changed Over Time?

The evolution of McDonald's ownership is a key aspect of its success story. The McDonald's corporation went public on April 21, 1965, with an initial public offering (IPO) at $22.50 per share. This marked a significant shift from private ownership to a publicly traded entity, opening up opportunities for wider investment and growth. Since the IPO, the company has undergone 12 stock splits, which has greatly increased the number of shares available.

An initial investment of $1,000 at the IPO would have grown into approximately 32,080 shares, worth millions today, not including dividend reinvestment. This growth underscores the long-term value creation for investors since the company's inception. This transition has shaped the company's financial strategy and its relationship with its shareholders.

| Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | April 21, 1965 | Transitioned from private to public ownership; allowed for broader investment. |

| Stock Splits (12 times) | Various Dates | Increased the number of outstanding shares, making the stock more accessible and liquid. |

| Growth of Institutional Ownership | Ongoing | Increased influence of institutional investors on governance and strategic decisions. |

Today, McDonald's ownership is primarily held by shareholders, with institutional investors holding a significant portion of the outstanding shares. As of March 2025, institutional investors collectively hold over 605 million shares, representing approximately 84.72% of the company's shares. This shift reflects the company's transition from founder-led to a publicly owned entity, with institutional investors playing a significant role in its governance and strategic direction. You can also learn more about the Target Market of McDonald's.

Major institutional shareholders significantly influence who owns McDonald's and its strategic direction.

- The Vanguard Group Inc. is the largest institutional shareholder, owning approximately 70 million shares, which is 9.52% of the company (March 2025).

- BlackRock, Inc. is the second-largest, holding approximately 53 million shares, representing 7.20% of the company (March 2025).

- These major shareholders, along with others like JPMorgan Chase & Co and State Street Corp, play a crucial role in the company's financial performance.

- The heavily franchised business model, with approximately 95% of restaurants owned by franchisees, also significantly influences the company's overall strategy and financial performance.

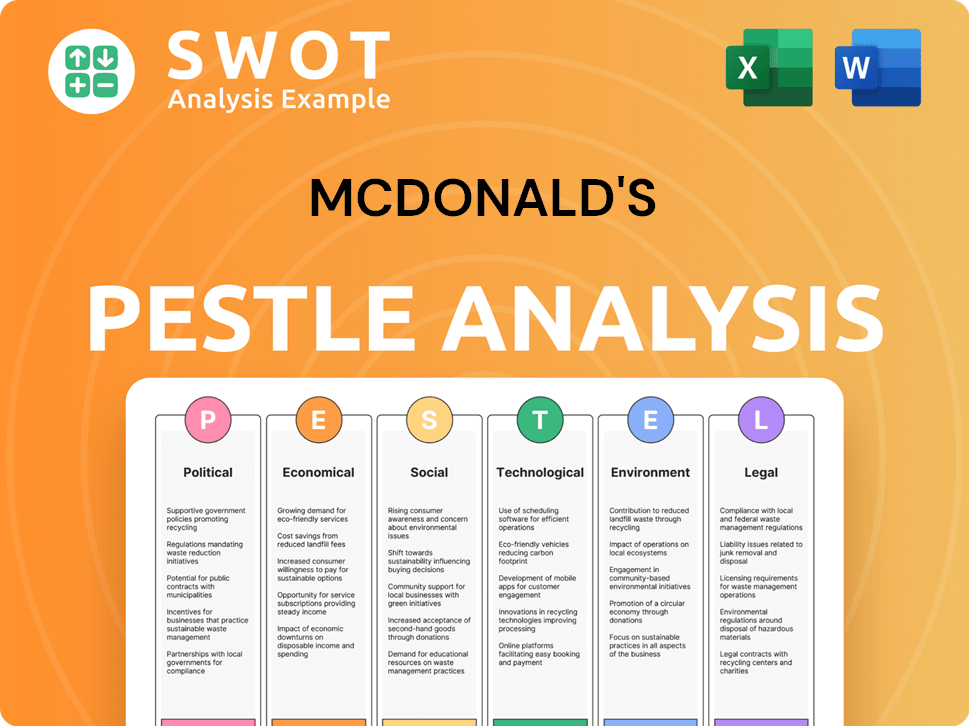

McDonald's PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on McDonald's’s Board?

As of December 2024, McDonald's Corporation has a Board of Directors that oversees the company's operations and strategic decisions. The board includes a mix of major shareholders, executive leadership, and independent voices, ensuring diverse expertise. While specific affiliations of each board member with major shareholders are not explicitly detailed in broad public information, the presence of institutional investors as dominant shareholders suggests their influence in board appointments and corporate governance.

Recent corporate governance activities show the board's active role. In March 2025, the Board approved changes to its senior management, including the appointment of Gillian (Jill) McDonald as Executive Vice President – Global Chief Restaurant Experience Officer, effective May 1, 2025, and Manuel JM Steijaert as her successor for Executive Vice President – President, International Operated Markets. These changes highlight the board's focus on strategic leadership and enhancing the global restaurant experience.

| Board Member | Title | Key Responsibilities |

|---|---|---|

| Enrique Hernandez Jr. | Lead Independent Director | Oversees board meetings and independent oversight |

| Chris Kempczinski | President and Chief Executive Officer | Leads the company's overall strategy and operations |

| John Rogers Jr. | Independent Director | Provides independent oversight and strategic guidance |

McDonald's operates under a one-share-one-vote structure for its common stock. This means each share has equal voting power. This standard structure ensures that the collective ownership of institutional investors, who hold the majority of shares, directly translates into significant voting influence on corporate matters. There are no publicly reported dual-class shares, special voting rights, or golden shares that would grant outsized control to specific individuals or entities beyond their proportional shareholding. No major proxy battles or activist investor campaigns have been widely reported in late 2024 or 2025 that have significantly reshaped decision-making at the board level, indicating a relatively stable governance environment.

The Board of Directors oversees McDonald's operations and strategic decisions. The company uses a one-share-one-vote structure, ensuring equal voting power for each share.

- Board members include major shareholders and independent voices.

- Executive leadership changes reflect the board's focus on strategic leadership.

- Institutional investors have significant voting influence.

- No dual-class shares or special voting rights are reported.

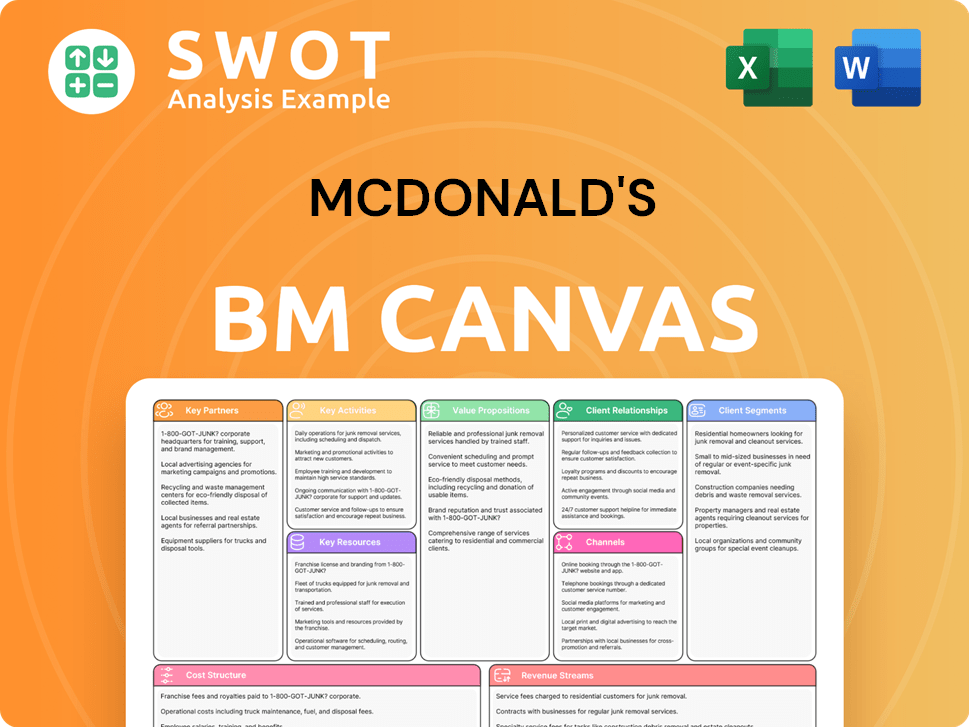

McDonald's Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped McDonald's’s Ownership Landscape?

Over the past few years, the company has actively managed its ownership profile through strategic financial maneuvers. A key aspect of this has been significant share buybacks, demonstrating a commitment to returning capital to shareholders. In 2024, approximately $2.82 billion worth of stock was repurchased. Continuing this trend, share buybacks for the quarter ending March 31, 2025, totaled $477 million. This is further supported by the Board of Directors approving a new share repurchase program effective January 1, 2025, authorizing the purchase of up to $15.0 billion of outstanding common stock, which replaces a similar program from 2020. This indicates a sustained effort to reduce outstanding shares and enhance shareholder value. The company's ownership structure is also heavily influenced by its franchise model, with roughly 95% of its restaurants being independently owned and operated.

Recent leadership changes have also played a role in shaping the company's future. Executive reshuffles in early 2025 were aimed at optimizing operations and enhancing the customer experience. Notable changes include Jill McDonald transitioning to Executive Vice President – Global Chief Restaurant Experience Officer and Manuel JM Steijaert being appointed Executive Vice President – President, International Operated Markets, effective May 1, 2025. Furthermore, Bob Stewart, Senior Vice President and Chief Supply Chain Officer for North America, retired on October 1, 2024, and was succeeded by Cesar Piña. Pat Myers was appointed as the new U.S. Chief People Officer, effective May 19, 2025. These changes reflect the company's ongoing efforts to adapt and improve its operational framework.

Industry trends in ownership, such as increased institutional ownership, are clearly reflected in the company. While insider selling by executives has been observed in 2025, amounting to about $9.2 million, it is considered inconsequential compared to the substantial share repurchase programs. This suggests that these sales are likely linked to share-based compensation rather than a loss of confidence in the company's future. The company continues to emphasize its heavily franchised model. For more information about the company's competitors, you can read about the Competitors Landscape of McDonald's.

The company operates with a significant franchise model, with about 95% of restaurants independently owned and operated. This structure contributes to consistent royalty and rent income.

The company has been actively repurchasing its shares. In 2024, around $2.82 billion worth of stock was repurchased. In Q1 2025, share buybacks amounted to $477 million.

Recent executive reshuffles are aimed at optimizing operations and enhancing the customer experience. These changes reflect efforts to adapt and improve the operational framework.

The company's strategic focus remains on growth, with an expected net restaurant unit expansion contributing slightly over 2% to 2025 Systemwide sales growth.

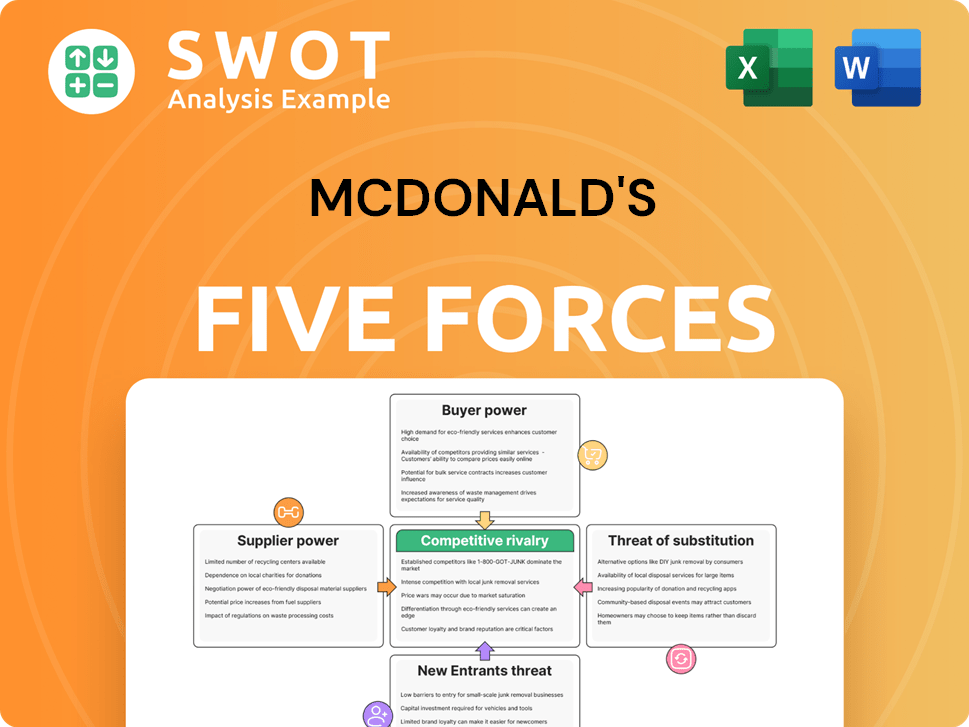

McDonald's Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of McDonald's Company?

- What is Competitive Landscape of McDonald's Company?

- What is Growth Strategy and Future Prospects of McDonald's Company?

- How Does McDonald's Company Work?

- What is Sales and Marketing Strategy of McDonald's Company?

- What is Brief History of McDonald's Company?

- What is Customer Demographics and Target Market of McDonald's Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.