Metropolitan Bank & Trust Bundle

Can Metrobank Maintain Its Stellar Growth Trajectory?

From its inception in 1962, Metropolitan Bank & Trust Company (Metrobank) has evolved into a financial powerhouse, now the second-largest private universal bank in the Philippines. This journey, marked by strategic expansions and a commitment to innovation, has positioned Metrobank at the forefront of the Philippine Banking industry. But what does the future hold for this financial institution?

This analysis delves into Metrobank's Metropolitan Bank & Trust SWOT Analysis, exploring its Growth Strategy and future prospects within the dynamic Philippine Banking landscape. We'll examine Metrobank's strategic initiatives, market share analysis, and expansion plans to understand how it aims to navigate challenges and capitalize on opportunities. Discover the key drivers behind Metrobank's success and what investors can expect from this leading player in the financial sector.

How Is Metropolitan Bank & Trust Expanding Its Reach?

Metrobank is actively pursuing several expansion initiatives to drive future growth, focusing on both market penetration and product diversification. The bank's strategic repositioning involves a pivot towards higher-margin businesses, specifically corporate, commercial, and SME lending, as well as specialist mortgages. This shift is evident in the significant growth of new loan originations in these segments.

The bank's commitment to supporting local businesses is further highlighted by its focus on corporate, commercial, and SME lending. In terms of geographical expansion, Metrobank plans to open new 'stores' (branches) in 2025, demonstrating a commitment to its physical presence as a key source of new lending and deposits. These actions aim to reduce excess liquidity and cost of deposits, allowing the bank to focus on higher-yielding assets.

Metrobank's strategic initiatives are designed to enhance its market position and drive sustainable growth within the Philippine Banking industry. For more insights into the ownership structure and key stakeholders, you can explore Owners & Shareholders of Metropolitan Bank & Trust.

Metrobank is focusing on both market penetration and product diversification to achieve its Growth Strategy. This involves expanding its reach within existing markets and introducing new products and services to cater to a broader customer base. The strategy aims to strengthen Metrobank's competitive position and increase its market share.

The bank is strategically repositioning itself towards higher-margin businesses. This includes a focus on corporate, commercial, and SME lending, as well as specialist mortgages. This shift is designed to improve profitability and optimize the bank's financial performance, aligning with its long-term growth objectives.

Metrobank plans to open new branches in key locations to expand its physical presence. This expansion is a key part of its strategy to increase lending and deposit-taking capabilities. The opening of new branches is a testament to the bank's commitment to serving a wider customer base and supporting local businesses.

Metrobank is strategically optimizing its balance sheet to reduce excess liquidity and costs. This involves selling certain portfolios, such as prime residential mortgages and unsecured personal loans, to focus on higher-yielding assets. The goal is to enhance the bank's financial efficiency and profitability.

Corporate and commercial new lending increased by 71% during 2024, demonstrating strong growth in this segment. The credit-approved pipeline for corporate, commercial, and SME lending for 2025 is already greater than 50% of the total lending in 2024, indicating significant momentum. Metrobank's expansion plans include opening three new branches in 2025.

- Metrobank's focus on corporate, commercial, and SME lending is a key driver of its Growth Strategy.

- The bank's geographical expansion aims to increase its physical presence and reach new customers.

- Balance sheet optimization is crucial for improving financial efficiency and profitability.

- These initiatives are designed to enhance Metrobank's market position and drive sustainable growth.

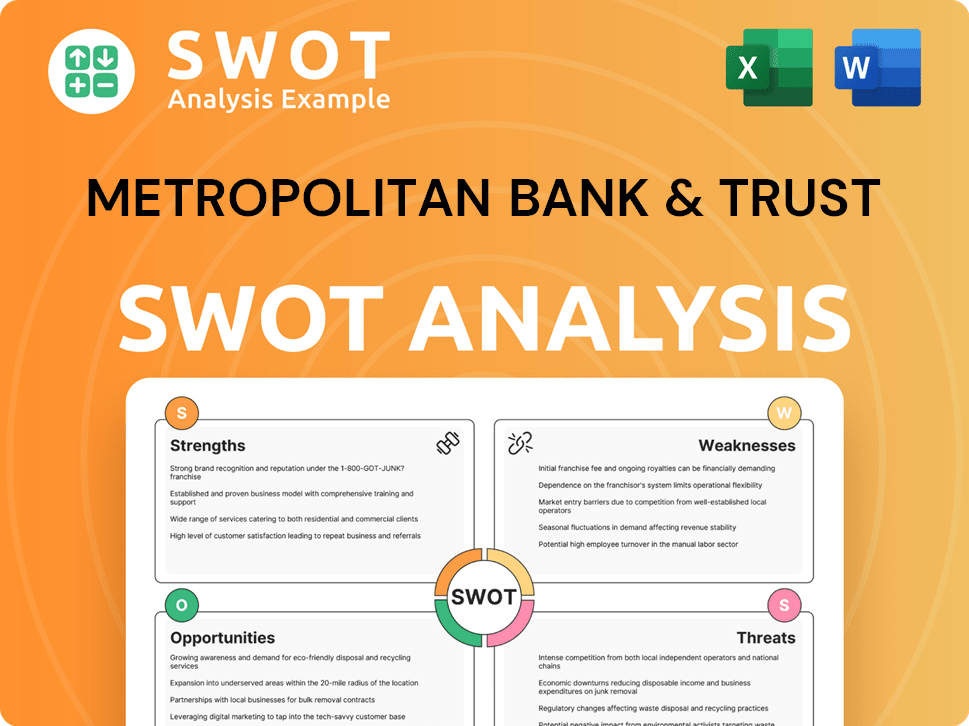

Metropolitan Bank & Trust SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Metropolitan Bank & Trust Invest in Innovation?

Metrobank is significantly investing in technology and innovation to drive its Growth Strategy and improve service delivery. The bank's commitment to digital transformation is evident through substantial capital expenditures allocated for IT enhancements. This strategic focus aims to boost operational efficiency and enhance customer experience within the Philippine Banking sector.

The bank leverages data analytics and AI to understand customer needs better and provide personalized financial solutions. Collaborations with technology partners like Infosys are central to this strategy, focusing on digitizing operations and integrating AI capabilities. These efforts are designed to deliver a more consistent and improved customer experience, aligning with the evolving demands of the Banking Industry.

Metrobank's initiatives, such as the 'Magic Makers' program, foster collaboration with startups to implement new technologies. These programs seek innovative solutions to improve customer experience, optimize systems, and promote sustainable banking practices. These efforts are contributing to the bank's overall Growth prospects.

For 2025, Metrobank has allocated up to PHP 5 billion for capital expenditure. Approximately 70% of this budget is dedicated to information technology enhancements, highlighting a strong focus on digital transformation.

Announced in September 2024, the collaboration with Infosys aims to enhance IT functions. This partnership is designed to digitize business operations, improve automation, and embed AI capabilities using Infosys Topaz.

The second iteration of the 'Magic Makers' program launched in 2024. This program focuses on collaborating with startups to implement new technologies to improve customer experience and optimize systems.

Metrobank has adopted co-browsing technology, a digital blueprint for data insights, and an advanced voice assistant. Early 2024 saw a 140% increase in approved business loans compared to the previous year, indicating the positive impact of digital efforts.

The bank aims to deliver a simpler and more consistent customer experience through its digital transformation initiatives. This includes personalized financial solutions and improved operational efficiency.

Innovation efforts focus on improving customer experience, optimizing systems and data, and promoting sustainable banking. These initiatives are central to Metrobank's strategic goals.

The bank's strategic investments in technology and innovation are designed to improve its competitive position. These investments, along with other strategic initiatives, are detailed further in an article about the Target Market of Metropolitan Bank & Trust.

Metrobank's digital transformation strategy includes several key technological advancements and strategic partnerships. These initiatives are designed to enhance customer service, improve operational efficiency, and drive sustainable growth.

- Data Analytics and AI: Leveraging data analytics and AI to understand customer needs and provide personalized financial solutions.

- Infosys Collaboration: Partnering with Infosys to enhance IT functions, digitize business operations, and embed AI capabilities.

- 'Magic Makers' Program: Collaborating with startups to implement new technologies and innovative solutions.

- Co-browsing Technology: Implementing co-browsing technology to improve customer support and experience.

- Digital Blueprint for Data Insights: Developing a digital blueprint for data insights to enhance decision-making.

- Advanced Voice Assistant: Developing an advanced voice assistant to improve customer service and accessibility.

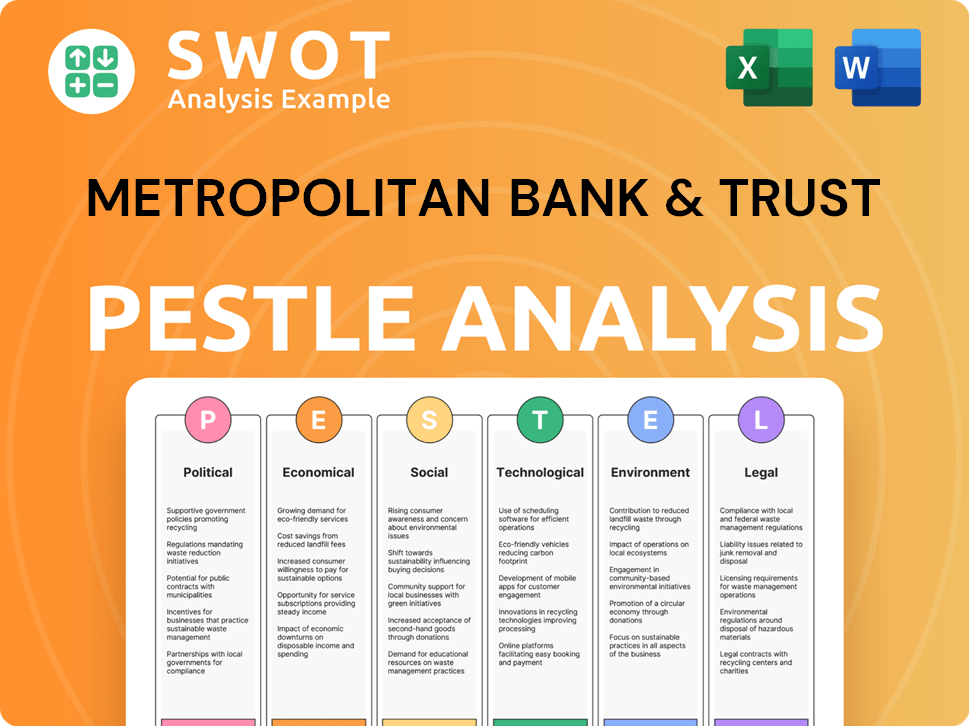

Metropolitan Bank & Trust PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Metropolitan Bank & Trust’s Growth Forecast?

In 2024, Metropolitan Bank & Trust, or Metrobank, demonstrated strong financial performance, achieving a record net income. This success was fueled by robust asset expansion and improved asset quality, reflecting the bank's effective growth strategy within the Philippine Banking industry. The bank's ability to maintain and improve its financial metrics showcases its resilience and strategic focus in a dynamic market.

Metrobank's financial health continued into 2025, with a solid start to the year. The first quarter of 2025 showed continued growth in net income, driven by significant increases in gross loans across various segments. This positive trend highlights the bank's ongoing efforts to expand its market presence and serve its customer base effectively. The bank's strategic initiatives continue to drive its growth prospects.

Despite global uncertainties, Metrobank maintains a positive outlook, supported by strong capitalization and a healthy portfolio. The bank's proactive approach to risk management, as evidenced by its low non-performing loan (NPL) ratio and high NPL coverage, provides a solid foundation for sustainable growth. Metrobank's strategic initiatives are designed to navigate challenges and capitalize on opportunities within the Banking Industry, ensuring long-term value creation.

Metrobank's net income reached PHP 48.1 billion in 2024, a 14.0% increase year-on-year. Return on equity improved to 13.0% from 12.5% in 2023. The bank declared a total cash dividend of PHP 5.00 per share, including a special cash dividend of PHP 2.00.

Net income for Q1 2025 was PHP 12.3 billion, a 2.5% increase year-over-year. Gross loans grew by 16.1%, with auto loans up 21.4% and gross credit card receivables up 17.9%. Net interest income reached PHP 29.4 billion.

The NPL ratio eased to 1.4% in 2024, with an NPL cover of 163.5%. In Q1 2025, the NPL ratio was 1.6%, with a coverage ratio of 150.9%. Total consolidated assets expanded by 9.1% year-on-year to PHP 3.48 trillion at the end of March 2025.

Metrobank issued £250 million AT1 securities in Q1 2025. This strategic move optimized its capital framework and provided flexibility for growth, resulting in a pro forma improvement in Tier 1 capital ratio to 17.5%.

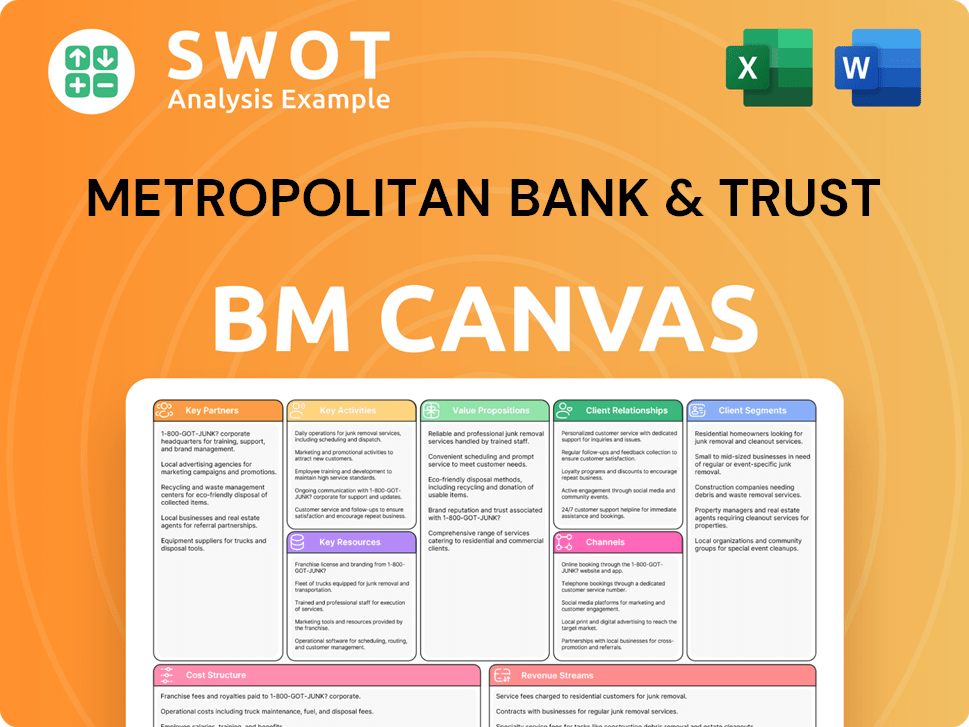

Metropolitan Bank & Trust Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Metropolitan Bank & Trust’s Growth?

The growth strategy of Metrobank and its future prospects are subject to several potential risks and obstacles. These challenges span macroeconomic factors, regulatory changes, and operational hurdles, all of which could influence the financial institution's performance. Understanding these risks is crucial for assessing Metrobank's long-term growth potential within the Philippine banking sector.

Macroeconomic fluctuations, such as shifts in GDP growth, interest rates, and employment levels, directly impact the bank's loan growth, profit margins, and asset quality. Regulatory changes, including the implementation of Basel 3.1, demand continuous adaptation and compliance efforts. Operational challenges, such as cost management and optimizing the funding model, also play a significant role in shaping Metrobank's strategic trajectory.

The bank's loan book expansion, while indicative of growth, also brings about increased provisions for bad loans. Furthermore, external factors like the state of the real estate market in China could impact consumer confidence and domestic demand, indirectly affecting Metrobank's operating environment.

Economic downturns or slowdowns can reduce loan demand and increase the risk of defaults. Interest rate volatility affects net interest margins. Geopolitical instability and potential trade friction could impact the overall economic outlook, affecting Metrobank's performance.

Compliance with new regulations, such as Basel 3.1, requires significant investments and adjustments. The regulators' firm approach to misconduct and customer outcomes demands robust risk management. Historical instances of regulatory scrutiny faced by similar institutions highlight the importance of compliance.

Managing costs effectively, especially with a physical branch network, is critical for profitability. Maintaining cost discipline while investing in digital transformation can be challenging. Optimizing the funding model to ensure stable and cost-effective sources of funds is also important.

A growing loan book can lead to increased provisions for bad loans, as seen with the 362% increase to PHP 2.6 billion in Q1 2025. Monitoring the Non-Performing Loan (NPL) ratio is crucial to assess asset quality. Economic shocks or sector-specific issues could worsen credit quality.

A worsening real estate market in China could impact consumer confidence and domestic demand, affecting the broader economic environment. Global economic slowdowns or crises can reduce international trade and investment, impacting the Philippine banking sector. Changes in global commodity prices can affect various industries and their ability to repay loans.

Competition from both traditional banks and fintech companies can erode market share and margins. The need to invest in technology and innovation to remain competitive puts pressure on costs. Attracting and retaining talent in a competitive job market is also essential.

Metrobank is preparing for the introduction of Basel 3.1, which will bring changes to capital requirements. This will involve significant investment in systems and processes. The bank must ensure compliance to avoid regulatory penalties and maintain financial stability.

The bank has made progress in cost reduction, with £50 million in annualized savings achieved by H1 2024 and a target of £80 million by year-end. Maintaining cost discipline is crucial for improving profitability. Streamlining operations and leveraging technology are key to managing costs effectively.

The expansion of the loan book has resulted in provisions for bad loans ballooning by 362% to PHP 2.6 billion in Q1 2025. Continuous monitoring of asset quality is essential to mitigate credit risks. The NPL ratio, although currently low, needs careful management to prevent future losses.

A worsening real estate market in China could affect consumer confidence and domestic demand. Global economic conditions and geopolitical risks can impact the Banking Industry. These external factors can indirectly affect Metrobank's performance and financial stability.

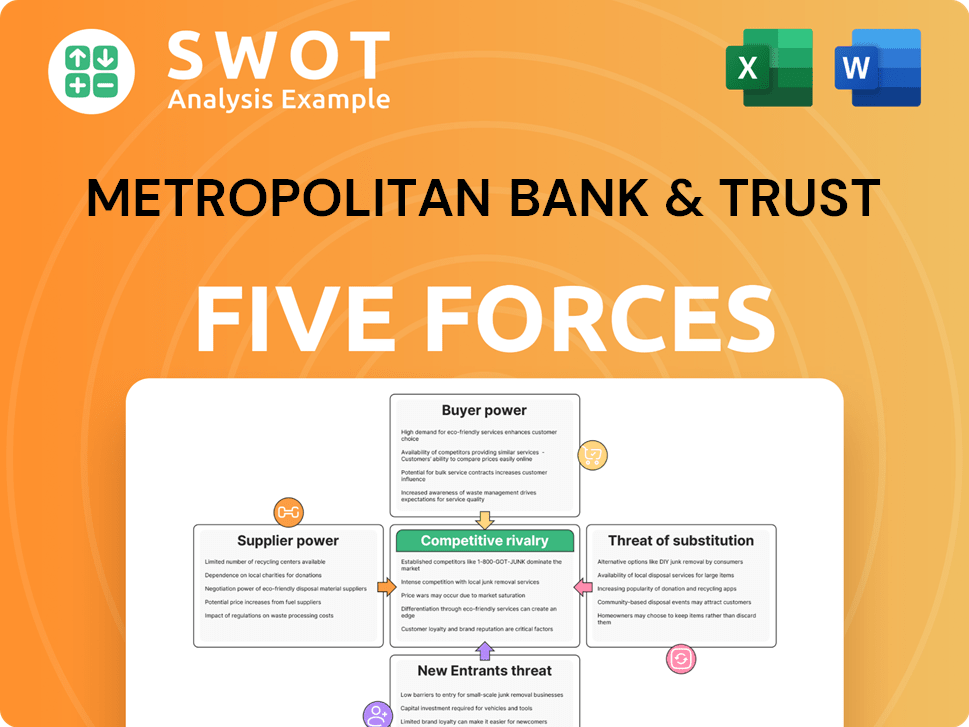

Metropolitan Bank & Trust Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Metropolitan Bank & Trust Company?

- What is Competitive Landscape of Metropolitan Bank & Trust Company?

- How Does Metropolitan Bank & Trust Company Work?

- What is Sales and Marketing Strategy of Metropolitan Bank & Trust Company?

- What is Brief History of Metropolitan Bank & Trust Company?

- Who Owns Metropolitan Bank & Trust Company?

- What is Customer Demographics and Target Market of Metropolitan Bank & Trust Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.